Statement of Preliminary Issues – 17 August 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Disclosure of Contracts

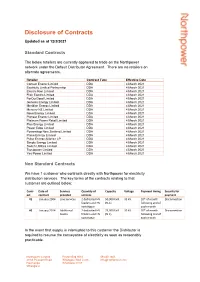

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

FY20 Full Year Results Presentation 20 August 2020

FY20 Full Year Results Presentation 20 August 2020 Marc England – CHIEF EXECUTIVE OFFICER Chris Jewell – CHIEF FINANCIAL OFFICER GENESIS ENERGY LIMITED AGENDA 1 Year in Review 2 Financial Performance and Guidance 3 Strategy Update and Outlook 4 Supplementary Information Genesis Energy Limited FY20 Full Year Result Presentation 2. 1. Year in Review GENESIS ENERGY LIMITED Results at a glance 1 EBITDAF m Retail $ ➢ Genesis’ residential gross customer churn down 3.5 ppt to 24.1% and net churn down 1.6 ppt to 14.8% ➢ Continued Retail momentum - netbacks up in all fuels, Electricity up 7%, Gas up 10% and LPG up 10% ➢ Customers choosing to purchase more than 1 fuel grew to over 121,000, up 3% NPAT m $ ➢ Over 77% of customers now choosing to interact digitally ➢ Launch of new customer Care Package for those most vulnerable post-COVID-19 Final dividend Wholesale cps ➢ 2nd lowest January to June North Island inflow sequence in 95 years, hydro generation down 20% to 491 GWh . Gross ➢ Thermal generation up 12%, fuel portfolio costs up 20% yield of ➢ Average FY20 thermal fuel cost up 7% but has commenced a decline and is down 3% on HY20 to $79/MWh % ➢ Our adaptive flexible generation and fuels portfolio defended low hydrology and high fuel cost impacts ➢ Tekapo upgrades successfully completed and its intake gate capital project reached the half-way point As at 18 August 2020 Operating expenses Kupe down $1m m $ ➢ Field production down 10% due to planned November 30-day outage and February perforation project Finance ➢ Well perforation project completed successfully. -

THE GENESIS ENERGY SHARE OFFER PROSPECTUS DATED 13 MARCH 2014 Important Information

THE GENESIS ENERGY THE SHARE OFFER GENESIS ENERGY PROSPECTUS DATED 13 MARCH 2014 DATED PROSPECTUS SHARE OFFER INITIAL PUBLIC OFFERING OF ORDINARY SHARES IN GENESIS ENERGY LIMITED PROSPECTUS DATED 13 MARCH 2014 we’re in it for you IMPORTANT INFORMATION IMPORTANT NOTICE —the signed consent of the Auditor to the audit report Genesis Energy, their respective offi cers, the directors This document (“Prospectus”) relates to the Off er by appearing in this Prospectus; of Genesis Energy or any other person referred to in this the Crown of ordinary shares in Genesis Energy Limited. —the signed consent of Ernst & Young Transaction Prospectus with respect to the achievement of the results A description of the Off er and the Shares is set out in Advisory Services Limited to the investigating set out in any such statement, or that the underlying Section 7.1 Details of the Off er. accountant’s report appearing in this Prospectus; assumptions used will in fact be realised. —the signed consent of Beca Limited to the This document is a prospectus for the purposes of the independent engineer’s report appearing in SUPPLEMENTARY DISCLOSURE AND Securities Act and the Securities Regulations and is this Prospectus; WITHDRAWAL RIGHT prepared as at, and dated, 13 March 2014. —the signed consent of Gaff ney, Cline & Associates If any signifi cant adverse developments occur This Prospectus is an important document and should be (Consultants) Pte Limited to the independent expert’s prior to the Allotment Date, the Crown and Genesis read carefully before deciding whether or not to invest in report appearing in this Prospectus; Energy may advise investors of those developments Genesis Energy. -

Genesis Energy Limited (GNE) – Hedge Contract Agreed with Meridian Energy

MARKET RELEASE Date: 8 July 2014 Release: Immediate Genesis Energy Limited (GNE) – hedge contract agreed with Meridian Energy Genesis Energy has signed a “swaption” electricity hedge contract to provide dry year cover for Meridian Energy for four years from 1 January 2015. The 150MW swaption follows on from the existing 200MW swaption between Genesis Energy and Meridian Energy which expires in October 2014. The new four-year agreement has a provision to terminate after the first two years in the event Meridian’s contract with NZ Aluminium Smelters sees a reduction in volume. The structure of the new agreement allows for 100MW to be available year round, with an additional 50MW available from 1 April to 30 October in each year of the contract. Genesis Energy’s prospective financial information (PFI) was prepared on the assumption that the existing 200MW swaption would not be replaced with a similar instrument. The new agreement is therefore expected to have a positive impact on Genesis Energy’s FY2015 PFI. Genesis Energy’s Chief Executive, Albert Brantley, said the agreement provides a useful independent revenue stream and enables enhanced economic utilisation of its diverse portfolio of hydro and thermal power generation located in both the North and South Islands of New Zealand. ENDS For media enquiries, please contact: Richard Gordon Public Affairs Manager Genesis Energy P: 09 951 9280 M: 021 681 305 For investor relations enquiries, please contact: Rodney Deacon Investor Relations Manager Genesis Energy P: 09 571 4970 M: 021 631 074 About Genesis Energy Genesis Energy (NZX: GNE) is a diversified New Zealand energy company. -

Contracts Disclosure 2019 9/07/2019 1 2

Disclosure of Contracts relevant to Northpower’s Electricity Lines Business Updated 9 July 2019 This disclosure is made in accordance with clauses 2.4.9 to 2.4.17 of the Electricity Distribution Information Disclosure Determination 2012 (EDIDD 2012) published by the Commerce Commission which requires Northpower to publicly disclose “Prescribed Terms & Conditions” of Northpower’s standard and non- standard contracts relating to the supply of Electricity Lines Services. Contracts with Electricity Retailers Northpower’s contractual arrangement for the provision of Lines Services to most end-use consumers connected to the Northpower network is on an interposed basis. The electricity retailers are “interposed” between Northpower and the end-use consumers, meaning that Northpower has contracts with the electricity retailers and the electricity retailers have individual contracts with the end-use consumers. Table 1 following lists the electricity retailers who have contracts with Northpower for line services to supply consumers on the Northpower network and, for completeness, some additional details. Table 1: Electricity Retailers who have contracts with Northpower for line services (Listed in alphabetical order) Retailer Services provided Basis of contract Contract date Body Corporate Power Lines services Model Use of System July 2018 Limited Agreement 2012 Contact Energy Limited Lines services Model Use of System January 2008 Agreement 2005 Ecotricity Limited Lines services Model Use of System September 2015 Agreement 2005 Electric Kiwi Limited -

GENESIS ENERGY Annual Report 2017 CONTENTS

GENESIS ENERGY annual report 2017 CONTENTS Genesis – putting control in 2017 in your hands. 2 Chair and CEO joint letter 5 Strategy dashboard 8 Four key projects 10 For our customers 14 Generation for New Zealand 18 For our community and environment 20 Caring for our people 22 Your executive team 26 Your Board of directors At Genesis our purpose is to 28 Governance reimagine energy to put control highlights in our customers’ hands. We will 30 Financial deliver this through new products, statements new services and new ways of 32 Independent RESIDENTIAL CUSTOMER engaging with energy. Auditor’s report 70 Our objective is to give customers Rachel Foster Corporate the convenience, control and To learn more about her governance and experience with Genesis go to disclosures comfort they want in their lives. yearinreview.genesisenergy.co.nz 74 1 GENESIS IN 2017 acquisitions – here are 1 AT A GLANCE $ the highlights. kupe production FY17 9.3 PJ m renewable generation FY17 FY17 EBITDAF 3,154 GWh $ BUSINESS CUSTOMER m FY16 335m Zhen Hua Yang Fruitworld, Greenlane Auckland $ customers linked since joining in m May 2017 net profit after tax FY16 $184m digital interactions total dividend cps FY16 16.4c $ 820 92 employees schools in across eight the Schoolgen b locations programme revenue FY16 $2b products per $ $ customer 47m 48m capital spending FY17 tax payable3 %total shareholders total customers2 $ return 599 225m Whio (Blue Duck) successful issue pairs increased of hybrid bonds from 533 in 2015 to investors 25% electricity market share 38% gas market share 19% LPG market share 1 Before working capital and accounting wash-up adjustments. -

The GENESIS Energy Share Offer Investment Statement Dated 13 March 2014 the GENESIS Energy Share Offer

THE GENESIS ENERGY THE GENESIS ENERGY THE SHARE OFFER GENESIS ENERGY INVESTMENT STATEMENT DATED 13 MARCH 2014 DATED STATEMENT INVESTMENT SHARE OFFER INITIAL PUBLIC OFFERING OF ORDINARY SHARES IN GENESIS ENERGY LIMITED INVESTMENT STATEMENT DATED 13 MARCH 2014 we’re in it for you IMPORTANT INFORMATION (THE INFORMATION IN THIS SECTION IS REQUIRED Securities Act and Securities Regulations, as modifi ed Given these uncertainties, you are cautioned not to UNDER THE SECURITIES ACT 1978.) by the Securities Act (Genesis Energy Limited Crown place undue reliance on any forward looking statements share off er) Exemption Notice 2014. There is a registered contained in this Investment Statement. Under no Investment decisions are very important. They often have prospectus containing an off er of securities to which this circumstances should you regard the inclusion of forward long-term consequences. Read all documents carefully. Investment Statement relates. looking statements as a representation or warranty by Ask questions. Seek advice before committing yourself. This Investment Statement is an important document and the Crown, Genesis Energy, their respective offi cers, the In addition to the information in this document, important should be read carefully before deciding whether or not directors of Genesis Energy or any other person referred information can be found in the current registered to invest in Genesis Energy. to in this Investment Statement with respect to the achievement of the results set out in any such statement, prospectus for the investment. You are entitled to No one is authorised by the directors of Genesis Energy or that the underlying assumptions used will in fact a copy of that prospectus on request. -

New Zealand Energy Data File 2012

12 2011 Calendar Year Edition The New Zealand Energy Data File is an annual publication that provides comprehensive statistics and supporting information on New Zealand’s energy supply, demand and prices. New Zealand Energy Data File New Zealand Energy Data File 2012 Prepared by: Important Acknowledgements Energy Information and Modelling Group The New Zealand Energy Data File focuses The authors are grateful to the individuals, on commercial energy – energy forms that companies and organisations that provided Energy and Communications Branch are usually produced and sold as fuel. information and gave generously of their Ministry of Economic Development Other forms of energy, such as photovoltaic time to assist with the work reported here. PO Box 1473, Wellington 6140 generation, are not included because there New Zealand Authorship is insuffi cient reliable data. Email: [email protected] This publication was prepared by the Energy Use of this New Zealand Energy Data File Information and Modelling Group of the publication in paper or electronic form © Crown Copyright 2012 Ministry of Economic Development. Principal implies acceptance of the conditions of its contributors were Thomas Elliot, Bryan Field, ISSN 1177-6676 Paperback release, which are that if the information is Paul Hunt, Brian Moore, Michael Smith and ISSN 1177-6684 Online version made available to others: Samuel Thornton. The authors are grateful to • its source must be acknowledged as New Zealand Petroleum and Minerals for Ministry of Economic Development 2012 their assistance with reserves information or by reference to the publication title and Base Two for publication layout. and date; and Thank you to KiwiRail for supplying the • no charge is made other than to recover photograph of the Matangi electric train the direct costs of dissemination. -

King Country Energy Limited 2015 Independent Advisers Report

King Country Energy Limited Independent Adviser’s Report In Respect of the Full Takeover Offer by King Country Energy Holdings Limited November 2015 Statement of Independence Simmons Corporate Finance Limited confirms that it: has no conflict of interest that could affect its ability to provide an unbiased report has no direct or indirect pecuniary or other interest in the proposed transaction considered in this report, including any success or contingency fee or remuneration, other than to receive the cash fee for providing this report. Simmons Corporate Finance Limited has satisfied the Takeovers Panel, on the basis of the material provided to the Takeovers Panel, that it is independent under the Takeovers Code for the purposes of preparing this Independent Adviser’s Report. www.simmonscf.co.nz Index Section Page 1. Introduction ........................................................................................................................ 1 2. Evaluation of the Merits of the Trustpower Offer ...............................................................5 3. Overview of the Electricity Industry ..................................................................................17 4. Profile of King Country Energy ........................................................................................25 5. Profile of Trustpower ........................................................................................................38 7. Sources of Information, Reliance on Information, Disclaimer and Indemnity ................. -

Shelf Prospectus

GEL UTILITY FUNDING SPV PLC RC 1527166 (A SPECIAL PURPOSE VEHICLE INCORPORATED AS A PUBLIC LIMITED LIABILITY IN THE FEDERAL REPUBLIC OF NIGERIA) N50,000,000,000 MEDIUM TERM NOTE PROGRAMME Banker, Stockbroker, Accountant, Solicitor or Solicitor Accountant, Stockbroker, Banker, SHELF PROSPECTUS This Shelf Prospectus and the Bonds which it offers have been registered by the Securities & Exchange Commission (the “SEC” or the “Commission”). It is a civil wrong and a criminal offence under the Investments and Securities Act (No. 29) 2007 (the “ISA” or the “Act”) to issue a Prospectus which contains false or misleading information. Clearance and registration of this Shelf Prospectus and the Bonds which can be issued under the Programme do not relieve the parties of any liability arising under the Act for false and misleading statements contained herein or for any omission of a material fact. Investors are advised to note that liability for false or misleading statements or acts made in connection with the Prospectus is provided in Sections 85 and 86 of the ISA. This Shelf Prospectus has been issued in compliance with Part IX of the Act, the Rules and Regulations of the Commission and the listing requirements of the Nigerian Stock Exchange (the “NSE”) and FMDQ OTC Securities Exchange PLC (“FMDQ”) and contains particulars which are in compliance with the requirements of the Commission for the purpose of giving information with regard to the ₦50,000,000,000.00 Medium Term Note (the “Programme”). The maximum aggregate nominal amount of all Bonds issued from time to time and outstanding under the Programme shall not exceed ₦50,000,000,000.00 over the three (3) years that this Shelf Prospectus, including any amendments thereto, remains valid. -

Genesis Energy Limited (GNE) – Annual Shareholder Meeting

MARKET RELEASE Date: 3 October 2016 Genesis Energy Limited (GNE) – Annual Shareholder Meeting Genesis Energy advises that the following attached documents will be sent to Genesis Energy shareholders today: The Notice of Annual Shareholder Meeting 2016; The Proxy Voting Form for the Annual Shareholder Meeting 2016. An electronic copy of these documents will also be available on the Genesis Energy website at www.genesisenergy.co.nz/annual-shareholder-meeting Genesis Energy’s Annual Shareholder Meeting, will be held on Wednesday 19 October 2016, commencing at 10.00 am (NZST), in the Level 4 Lounge, South Stand, Eden Park, Reimers Avenue, Auckland, New Zealand. For more information visit our website on www.genesisenergy.co.nz ENDS For media enquiries, please contact: Richard Gordon Public Affairs Manager Genesis Energy P: 09 951 9280 M: 021 681 305 For investor relations enquiries, please contact: Rodney Deacon Group Manager Strategy and Investor Relations Genesis Energy P: 09 571 4970 M: 021 631 074 About Genesis Energy Genesis Energy (NZX: GNE) is a diversified New Zealand energy company. It sells electricity, reticulated natural gas and LPG through its retail brands of Genesis Energy and Energy Online. It is New Zealand’s largest energy retailer with around 645,000 customer accounts. The Company generates electricity from a diverse portfolio of thermal and renewable generation assets located in different parts of the country. Genesis Energy also has a 31% interest in the Kupe Joint Venture, which owns the Kupe Oil and Gas Field offshore of Taranaki, New Zealand. Genesis Energy had revenue of $NZ2bn during the 12 months ended 30 June 2016. -

Stakeholder Feedback Received on Our September 2018 Delivery Pricing Consultation and Discussion Paper

Stakeholder feedback received on our September 2018 Delivery pricing consultation and discussion paper Published 23 October 2018 Introduction This document brings together all of the feedback we received on our September 2018 consultation and discussion paper. It is ordered by the name of the party, as follows: Electric Kiwi Flick Genesis Energy Meridian Energy Powershop Further responses were received from Contact Energy and Powershop and marked as confidential, and are not presented here. 9 October 2018 Orion New Zealand Limited By email: [email protected] Dear Bruce Thank you for the opportunity to comment on the Orion pricing consultation paper for 2019/20. As we are a residential-based business, our comments are in relation to residential pricing only. Rather than commenting on each specific question, we provide our general views below. As you may be aware, Electric Kiwi provides a free hour of off-peak power to customers each day. This provides a sharp price signal for customers to shift consumption to off-peak periods of the day. This, in part, smooths out some of the network peaks as customers have the incentive to use non- essential electricity at off-peak times (e.g. the dishwasher, washing machine etc). As such, this has positive benefits for the distribution network as a whole. We have seen in practice that, because the customer knows they can save money at a predictable time, customers are keen to actively shift their load. Therefore, if there is a predictable price signal, customers will actively respond. We do not agree that the network-peak based pricing structure is achieving its intended purpose.