Interim Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Billboarding Billboards Are Short Sponsor Messages (5 Sec) Before Or After a Programme Or Commercial Break

Billboarding Billboards are short sponsor messages (5 sec) before or after a programme or commercial break. Billboarding helps you benefit from the connection with viewers, the surroundings, and the popularity of the programme. Because of its high attention value and cost-efficiency, billboarding is an effective way of increasing brand awareness, as well as being highly suitable for product introductions or increasing sales. You can purchase billboarding from us based on content or based on GRPs. With a Content package or a Managed GRP package, you yourself decide on the content that suits your campaign. If you choose a Target Audience package based on GRP objectives, your target audience will be reached on an attractive range of appropriate channels. If you wish to purchase to the best-possible cost-efficiency, then opt for Fill boarding. The TV spot commercial policy applies to all our Billboard packages, except the Premium Package. See the purchase system diagram for the calculation of fees. CONTENT FEE/PRODUCT INDEX MINIMUM PERIOD/GRPS CLASSIFICATION Billboard Fixed fee for the agreed Minimum period 1 week Claim well-known and familiar titles like De Premium Package* number of billboards Klok, RTL Weer, RTL Boulevard, Jinek, Married At First Sight, Weet Ik Veel, Chantals Beauty Camper and films and series (we add popular programmes to the range every month) Billboard Managed 83 15 Managed according to content on all full GRP Package* audit RTL channels (except RTL Crime and RTL Lounge), The Walt Disney Company, ViacomCBS, and Discovery Benelux (except Eurosport). TARGET AUDIENCE PRODUCT INDEX MIN GRPS CLASSIFICATION Billboard Target 78 10 All full audit RTL channels (except RTL Crime Audience Package and RTL Lounge) and a selection of the Plus* appropriate full audit The Walt Disney Company, ViacomCBS, and Discovery Benelux channels (except Eurosport). -

Television Advertising Insights

Lockdown Highlight Tous en cuisine, M6 (France) Foreword We are delighted to present you this 27th edition of trends and to the forecasts for the years to come. TV Key Facts. All this information and more can be found on our This edition collates insights and statistics from dedi cated TV Key Facts platform www.tvkeyfacts.com. experts throughout the global Total Video industry. Use the link below to start your journey into the In this unprecedented year, we have experienced media advertising landscape. more than ever how creative, unitive, and resilient Enjoy! / TV can be. We are particularly thankful to all participants and major industry players who agreed to share their vision of media and advertising’s future especially Editors-in-chief & Communications. during these chaotic times. Carine Jean-Jean Alongside this magazine, you get exclusive access to Coraline Sainte-Beuve our database that covers 26 countries worldwide. This country-by-country analysis comprises insights for both television and digital, which details both domestic and international channels on numerous platforms. Over the course of the magazine, we hope to inform you about the pandemic’s impact on the market, where the market is heading, media’s social and environmental responsibility and all the latest innovations. Allow us to be your guide to this year’s ACCESS OUR EXCLUSIVE DATABASE ON WWW.TVKEYFACTS.COM WITH YOUR PERSONAL ACTIVATION CODE 26 countries covered. Television & Digital insights: consumption, content, adspend. Australia, Austria, Belgium, Brazil, Canada, China, Croatia, Denmark, France, Finland, Germany, Hungary, India, Italy, Ireland, Japan, Luxembourg, The Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, UK and the US. -

Aanvullende Voorwaarden Unlimited & Entertainment

Aanvullende voorwaarden Unlimited & Entertainment 1. Algemeen 2.2 Om gebruik te maken van de diensten van Netflix en 1.1 Deze Aanvullende Voorwaarden Unlimited & Entertainment Videoland als onderdeel van het U&E abonnement dien je zijn van toepassing op het abonnement Go Unlimited data zelf een nieuw account aan te maken bij Partners en + bellen – Entertainment, hierna te noemen “U&E”. U&E is de nieuwe danwel een bestaand Partner account te koppelen een variant van de Go abonnementen van T-Mobile en bestaat aan U&E volgens de procedure die op de T-Mobile website uit de diensten genoemd in je Overeenkomst inclusief: staat vermeld dan wel via de procedures van haar Partners n Netflix Standaard + Videoland Plus (“Entertainment”). die worden gecommuniceerd via e-mail en/of SMS. 1.2 Met U&E biedt T-Mobile je de mogelijkheid om Entertainment 2.3 T-Mobile behoudt zich het recht voor om deze Aanvullende welke geleverd wordt door de bedrijven Netflix International Voorwaarden eenzijdig te wijzigen of aan te vullen. T-Mobile B.V. (hierna te noemen: “Netflix”) en Videoland B.V. (hierna zal je hier dan tijdig over informeren. Voorts behoudt te noemen: “Videoland”) (en gezamenlijk hierna te noemen: T-Mobile zich het recht voor om U&E op enig moment in de “Partners”) toegang tot te verkrijgen en betaal je een bedrag toekomst te mogen wijzigen indien haar samenwerking/ voor U&E waar Entertainment zit inbegrepen, middels je overeenkomst met een of beide Entertainment Partners voor T-Mobile factuur. Met Entertainment heb je onbeperkt de afname van Entertainment eindigt. -

Full-Year Results 2020

FULL-YEAR RESULTS 2020 ENTERTAIN. INFORM. ENGAGE. KEY FIGURES +18.01 % SDAX +8.77 % MDAX SHARE PERFORMANCE 1 January 2020 to 31 December 2020 in per cent INDEX = 100 -7.65 % SXMP -9.37 % RTL GROUP -1.11 % PROSIEBENSAT1 RTL Group share price development for January to December 2020 based on the Frankfurt Stock Exchange (Xetra) against MDAX/SDAX, Euro Stoxx 600 Media and ProSiebenSat1 RTL GROUP REVENUE SPLIT 8.5 % OTHER 17.5 % DIGITAL 43.8 % TV ADVERTISING 20.0 % CONTENT 6.7 % 3.5 % PLATFORM REVENUE RADIO ADVERTISING RTL Group’s revenue is well diversified, with 43.8 per cent from TV advertising, 20.0 per cent from content, 17.5 per cent from digital activities, 6.7 per cent from platform revenue, 3.5 per cent from radio advertising, and 8.5 per cent from other revenue. 2 RTL Group Full-year results 2020 REVENUE 2016 – 2020 (€ million) ADJUSTED EBITA 2016 – 2020 (€ million) 20 6,017 20 853 19 6,651 19 1,156 18 6,505 18 1,171 17 6,373 17 1,248 16 6,237 16 1,205 PROFIT FOR THE YEAR 2016 – 2020 (€ million) EQUITY 2016 – 2020 (€ million) 20 625 20 4,353 19 864 19 3,825 18 785 18 3,553 17 837 17 3,432 16 816 16 3,552 MARKET CAPITALISATION* 2016 – 2020 (€ billion) TOTAL DIVIDEND/DIVIDEND YIELD PER SHARE 2016 – 2020 (€ ) (%) 20 6.2 20 3.00 8.9 19 6.8 19 NIL* – 18 7.2 18 4.00** 6.3 17 10.4 17 4.00*** 5.9 16 10.7 16 4.00**** 5.4 *As of 31 December *On 2 April 2020, RTL Group’s Board of Directors decided to withdraw its earlier proposal of a € 4.00 per share dividend in respect of the fiscal year 2019, due to the coronavirus outbreak ** Including -

Edition 2016 Entertain. Inform. Engage

EDITION 2016 FULL YEAR RESULTS ENTERTAIN. INFORM. ENGAGE. KEY FIGURES SHARE PRICE PERFORMANCE 01/01/2016 – 31/12/2016 + 6.8 % MDAX INDEX = 100 – 7.6 % EURO STOXX 600 MEDIA – 9.5 % RTL GROUP – 21.7 % PROSIEBENSAT1 RTL Group share price development for January to December 2016 based on the Frankfurt Stock Exchange (Xetra) against MDAX, Euro Stoxx 600 Media and ProSiebenSat1 11.5 % OTHER 10.7 % DIGITAL 48.0 % 21.2 % TV ADVERTISING CONTENT 4.5 % PLATFORM REVENUE 4.1 % RADIO ADVERTISING RTL Group Revenue Split In 2016, TV advertising accounted for 48.0 per cent of RTL Group’s total revenue, making the Group one of the most diversified groups when it comes to revenue. Content represented 21.2 per cent of the total, while greater exposure to fast-growing digital revenue streams and higher margin platform revenue will further improve the mix. 2 RTL Group Full-year results 2016 Key figures REVENUE 2012 – 2016 (€ million) EBITA 2012 – 2016 (€ million) 16 6,237 16 1,205 15 6,029 15 1,167 14 5,808 14 1,144* 13 5,824* 13 1,148** 12 5,998 12 1,078 * Restated for IFRS 11 * Restated for changes in purchase price allocation ** Restated for IFRS 11 NET PROFIT ATTRIBUTABLE TO RTL GROUP SHAREHOLDERS 2012 – 2016 (€ million) EQUITY 2012 – 2016 (€ million) 16 720 16 3,552 15 789 15 3,409 14 652* 14 3,275* 13 870 13 3,593 12 597 12 4,858 * Restated for changes in purchase price allocation * Restated for changes in purchase price allocation TOTAL DIVIDEND/ MARKET CAPITALISATION* 2012 – 2016 (€ billion) DIVIDEND YIELD PER SHARE 2012 – 2016 (€ ) (%) 16 10.7 16 -

F Ul L Ye Ar R Es Ults 2 01 9

FULL YEAR RESULTS 2019 ENTERTAIN. INFORM. ENGAGE. KEY FIGURES SHARE PERFORMANCE (1 January 2019 to 31 December 2019) +31.15 % MDAX +16.41 % SXMP –5.82 % RTL GROUP INDEX = 100 –10.55 % PROSIEBENSAT1 RTL Group share price development for January to December 2019 based on the Frankfurt Stock Exchange (Xetra) against MDAX, Euro Stoxx 600 Media and ProSiebenSat1 Fremantle’s America’s Got Talent: The Champions is a prime-time hit on NBC. 2 RTL Group Full-year results 2019 REVENUE 2015 – 2019 (€ million) EBITA 2015 – 2019 (€ million) 19 6,651 19 1,139 18 6,505 18 1,171 17 6,373 17 1,248 16 6,237 16 1,205 15 6,029 15 1,167 PROFIT FOR THE YEAR 2015 – 2019 (€ million) EQUITY 2015 – 2019 (€ million) 19 864 19 3,825 18 785 18 3,553 17 837 17 3,432 16 816 16 3,552 15 863 15 3,409 MARKET CAPITALISATION* 2015 – 2019 (€ billion) TOTAL DIVIDEND / DIVIDEND YIELD PER SHARE 2015 – 2019 (€) (%) 19 6.8 19 4.00 8.7 18 7.2 18 4.00* 6.3 17 10.4 17 4.00** 5.9 16 10.7 16 4.00*** 5.4 15 11.9 15 4.00**** 4.9 *As of 31 December * Including an interim dividend of € 1.00 per share, paid in September 2018 ** Including an interim dividend of € 1.00 per share, paid in September 2017 *** Including an interim dividend of € 1.00 per share, paid in September 2016 **** Including an extraordinary interim dividend of € 1.00 per share, paid in September 2015 CASH CONVERSION RATE* 2015 – 2019 (%) PLATFORM REVENUE* 2015 – 2019 (€ million) 19 105 19 368 18 90 18 343 17 104 17 319 16 97 16 281 15 87 15 248 *Calculated as operating pre-tax free cash flow as a percentage of EBITA * Revenue generated across all distribution platforms (cable, satellite, IPTV) including subscription and re-transmission fees 3 RTL Group Full-year results 2019 “ WE ARE BOOSTING OUR STREAMING SERVICES AND GLOBAL CONTENT BUSINESSES” “Driven by the strong performances of our three largest business units, RTL Group achieved all financial goals in 2019: revenue grew on an underlying basis by 3.2 per cent, EBITA remained broadly stable despite higher investments, and Group profit was up by 10 per cent. -

Liste Des Programmes Luxembourgeois

Services de télévision sur antenne soumis au contrôle de l’ALIA Dernière mise à jour : mars 2021 Services radiodiffusés à rayonnement international Nom du service Fournisseur de service RTL TVi RTL Belux s.a. & cie s.e.c.s. Club RTL 43, boulevard Pierre Frieden L-1543 Luxembourg Plug RTL RTL 4 Teleshop 4 RTL 5 Teleshop 5 RTL 7 Teleshop 7 RTL 8 Teleshop 8 RTL Telekids CLT-Ufa s.a. RTL Lounge 43, boulevard Pierre Frieden L-1543 Luxembourg RTL Crime RTL Z Film+ RTL II RTL+ RTL Gold Sorozat Musika TV Cool Page 1 sur 19 Service radiodiffusé visant le public résidant Nom du service Fournisseur de service RTL Télé Lëtzebuerg CLT-Ufa s.a. 43, boulevard Pierre Frieden 2ten RTL Télé Lëtzebuerg L-1543 Luxembourg Services luxembourgeois par satellite Nom du service Fournisseur de service Nordliicht a.s.b.l. Nordliicht 22, route de Diekirch L-9381 Moestroff Uelzechtkanal a.s.b.l. c/o Lycée de garçons Esch Uelzechtkanal 71, rue du Fossé L-4123 Esch/Alzette Dok TV s.a. .dok den oppene kanal 36, rue de Kopstal L-8284 Kehlen Luxembourg Movie Production a.s.b.l. Kanal 3 5, rue des Jardins L-7325 Heisdorf Osmose Media s.a. Euro D 177, rue de Luxembourg L-8077 Bertrange Luxe.TV (HD) (version anglaise) Luxe.TV (HD) (version française) Opuntia s.a. Luxe.TV Luxembourg (UHD 4K) 45, rue Siggy vu Lëtzebuerg (version anglaise) L-1933 Luxembourg Luxe TV Luxembourg (UHD 4K) (version française) Goto Luxe.TV (SD) (version anglaise) N 1 (version croate) N 1 (version bosnienne) Adria News s.à r.l. -

Groupe M6 Is Opening up Bedrock's Capital to Rtl

GROUPE M6 IS OPENING UP BEDROCK’S CAPITAL TO RTL GROUP TO CREATE THE EUROPEAN LEADER IN STREAMING TECHNOLOGY The growth in video consumption across all screens and on demand (AVOD and SVOD) represents a genuine opportunity to strengthen the power of TV channels and brands. These new usage patterns are based on cutting-edge technologies that require substantial investment, but which become strategic assets for the companies that control them. Since 2008, Groupe M6 has been anticipating the need for and significance of these technologies for its business and has been developing in-house expertise around its catch-up television platform M6 Replay, and from 2013, around its streaming service 6play. This technology unit, now called Bedrock and led by Jonas Engwall, has more than 200 employees and has developed a technology platform which is currently used by 6Play, RTL Belgium, RTL Hungary and RTL Croatia. From June 2020, this platform will also be used by the Salto SVOD service which is being launched by the groups TF1, France Télévisions and M6. RTL Nederland will also use this technology for the next version of its catch-up and SVOD services, RTL XL and Videoland. Bedrock aims to license its technology platform to further European broadcasters, also outside RTL Group. With the aim of continuing its development and pooling investments on a European scale, Groupe M6 is opening up Bedrock’s capital, enabling RTL Group to acquire a 50% stake. With this transaction, Groupe M6 and RTL Group aim to create a European leader in streaming technology. Bedrock’s capital may further be opened up to other shareholders. -

S1867 16071609 0

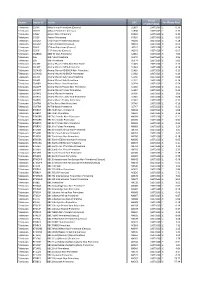

Period Domain Station ID Station UDC Per Minute Rate (YYMMYYMM) Television CSTHIT 4Music Non-Primetime (Census) S1867 16071609 £ 0.36 Television CSTHIT 4Music Primetime (Census) S1868 16071609 £ 0.72 Television C4SEV 4seven Non-Primetime F0029 16071608 £ 0.30 Television C4SEV 4seven Primetime F0030 16071608 £ 0.60 Television CS5USA 5 USA Non-Primetime (Census) H0010 16071608 £ 0.28 Television CS5USA 5 USA Primetime (Census) H0011 16071608 £ 0.56 Television CS5LIF 5* Non-Primetime (Census) H0012 16071608 £ 0.34 Television CS5LIF 5* Primetime (Census) H0013 16071608 £ 0.67 Television CSABNN ABN TV Non-Primetime S2013 16071608 £ 7.05 Television 106 alibi Non-Primetime S0373 16071608 £ 2.52 Television 106 alibi Primetime S0374 16071608 £ 5.03 Television CSEAPE Animal Planet EMEA Non-Primetime S1445 16071608 £ 0.10 Television CSEAPE Animal Planet EMEA Primetime S1444 16071608 £ 0.19 Television CSDAHD Animal Planet HD EMEA Non-Primetime S1483 16071608 £ 0.10 Television CSDAHD Animal Planet HD EMEA Primetime S1482 16071608 £ 0.19 Television CSEAPI Animal Planet Italy Non-Primetime S1530 16071608 £ 0.08 Television CSEAPI Animal Planet Italy Primetime S1531 16071608 £ 0.16 Television CSANPL Animal Planet Non-Primetime S0399 16071608 £ 0.54 Television CSDAPP Animal Planet Poland Non-Primetime S1556 16071608 £ 0.11 Television CSDAPP Animal Planet Poland Primetime S1557 16071608 £ 0.22 Television CSANPL Animal Planet Primetime S0400 16071608 £ 1.09 Television CSAPTU Animal Planet Turkey Non-Primetime S1946 16071608 £ 0.08 Television CSAPTU Animal -

Interim Results H1/2019 28 August 2019

INTERIM RESULTS H1/2019 28 AUGUST 2019 28 AUGUST 2019 1 AGENDA HALF-YEAR 2019 GROUP OPERATIONAL STRATEGY & HIGHLIGHTS FINANCIALS HIGHLIGHTS OUTLOOK 2019 Highlights NEW LEADERSHIP STRUCTURE New Group Management Committee of RTL Group Thomas Rabe Elmar Heggen Björn Bauer Chief Executive Officer, RTL Group Deputy Chief Executive Officer and Chief Financial Officer, RTL Group Chief Operating Officer, RTL Group Jennifer Mullin Bernd Reichart Nicolas de Tavernost Chief Executive Officer, Chief Executive Officer, Chief Executive Officer, Fremantle Mediengruppe RTL Deutschland Groupe M6 3 Highlights RTL GROUP CONTINUES TO DELIVER ON ITS TOTAL VIDEO STRATEGY… 1 Leading market positions, high profitability – key for current investment cycle in the media industry Fast growth in VOD and content BROADCAST 2 as subscriber growth continues and content strategy pays off 3 New alliances and partnerships to actively shape the future of the European Total Video industry TOTAL VIDEO STRATEGY 4 Highlights …ACHIEVING ITS HIGHEST EVER FIRST-HALF REVENUE +4.2% Revenue: €3,173m BROADCAST -1.8% -1.0pp EBITA: €538m Margin: 17.0% Profit for +21.0% the period: €443m 5 Highlights HIGHLY DIVERSIFIED – DYNAMIC DIGITAL REVENUE GROWTH RTL Group H1 2019 revenue split Digital revenue split TV advertising In € million 44.3% MPNs: €153m +9.3% +21.0% 513 VOD1: €122m +27.1% Content MPNs 20.9% VOD €3.2bn Content: €104m +89.1% 424 (Fremantle) Content Other 2 9.0% Digital Ad-tech Ad-tech : €83m +18.6% 16.2% Other Other: 4.0% H1 2018 H1 2019 €51m (20.3)% Radio 14% 16% advertising 5.6% % of total revenue Platform revenue 6 Notes: 1. -

Full-Year Results 2020

FULL-YEAR RESULTS 2020 ENTERTAIN. INFORM. ENGAGE. KEY FIGURES +18.01 % SDAX +8.77 % MDAX SHARE PERFORMANCE 1 January 2020 to 31 December 2020 in per cent INDEX = 100 -7.65 % SXMP -9.37 % RTL GROUP -1.11 % PROSIEBENSAT1 RTL Group share price development for January to December 2020 based on the Frankfurt Stock Exchange (Xetra) against MDAX/SDAX, Euro Stoxx 600 Media and ProSiebenSat1 RTL GROUP REVENUE SPLIT 8.5 % OTHER 17.5 % DIGITAL 43.8 % TV ADVERTISING 20.0 % CONTENT 6.7 % 3.5 % PLATFORM REVENUE RADIO ADVERTISING RTL Group’s revenue is well diversified, with 43.8 per cent from TV advertising, 20.0 per cent from content, 17.5 per cent from digital activities, 6.7 per cent from platform revenue, 3.5 per cent from radio advertising, and 8.5 per cent from other revenue. 2 RTL Group Full-year results 2020 REVENUE 2016 – 2020 (€ million) ADJUSTED EBITA 2016 – 2020 (€ million) 20 6,017 20 853 19 6,651 19 1,156 18 6,505 18 1,171 17 6,373 17 1,248 16 6,237 16 1,205 PROFIT FOR THE YEAR 2016 – 2020 (€ million) EQUITY 2016 – 2020 (€ million) 20 625 20 4,353 19 864 19 3,825 18 785 18 3,553 17 837 17 3,432 16 816 16 3,552 MARKET CAPITALISATION* 2016 – 2020 (€ billion) TOTAL DIVIDEND/DIVIDEND YIELD PER SHARE 2016 – 2020 (€ ) (%) 20 6.2 20 3.00 8.9 19 6.8 19 NIL* – 18 7.2 18 4.00** 6.3 17 10.4 17 4.00*** 5.9 16 10.7 16 4.00**** 5.4 *As of 31 December *On 2 April 2020, RTL Group’s Board of Directors decided to withdraw its earlier proposal of a € 4.00 per share dividend in respect of the fiscal year 2019, due to the coronavirus outbreak ** Including -

Goncalves Et Al

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Gonçalves, Vânia; Evens, Tom; Alves, Artur Pimenta; Ballon, Pieter Conference Paper Power and control strategies in online video services 25th European Regional Conference of the International Telecommunications Society (ITS): "Disruptive Innovation in the ICT Industries: Challenges for European Policy and Business" , Brussels, Belgium, 22nd-25th June, 2014 Provided in Cooperation with: International Telecommunications Society (ITS) Suggested Citation: Gonçalves, Vânia; Evens, Tom; Alves, Artur Pimenta; Ballon, Pieter (2014) : Power and control strategies in online video services, 25th European Regional Conference of the International Telecommunications Society (ITS): "Disruptive Innovation in the ICT Industries: Challenges for European Policy and Business" , Brussels, Belgium, 22nd-25th June, 2014, International Telecommunications Society (ITS), Calgary This Version is available at: http://hdl.handle.net/10419/101438 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte.