Television Advertising Insights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seguimiento De Accesibilidad a La

SEGUIMIENTO DE ACCESIBILIDAD A LA TDT Informe de la CMT sobre accesibilidad de los contenidos televisivos Informe Económico Sectorial 2012 Comisión del Mercado de las Telecomunicaciones CMT Seguimiento de accesibilidad a la TDT ÍNDICE I. INTRODUCCIÓN ......................................................................................................................................................................................................................................................................... 4 Origen de los datos ....................................................................................................................................................................................................................................................................... 4 Operadores y canales incluidos en el informe ......................................................................................................................................................................................... 4 Porcentajes y valores de los servicios de accesibilidad en la programación de los canales según la LGCA 7/2010 ................................................................................................................................................... 5 Canales de programación de nueva emisión .............................................................................................................................................................................................. 6 Información solicitada a los -

Sheila Simmenes.Pdf (1.637Mb)

Distant Music An autoethnographic study of global songwriting in the digital age. SHEILA SIMMENES SUPERVISOR Michael Rauhut University of Agder, 2020 Faculty of Fine Arts Department of Popular music 2 Abstract This thesis aims to explore the path to music creation and shed a light on how we may maneuver songwriting and music production in the digital age. As a songwriter in 2020, my work varies from being in the same physical room using digital communication with collaborators from different cultures and sometimes even without ever meeting face to face with the person I'm making music with. In this thesis I explore some of the opportunities and challenges of this process and shine a light on tendencies and trends in the field. As an autoethnographic research project, this thesis offers an insight into the songwriting process and continuous development of techniques by myself as a songwriter in the digital age, working both commercially and artistically with international partners across the world. The thesis will aim to supplement knowledge on current working methods in songwriting and will hopefully shine a light on how one may improve as a songwriter and topliner in the international market. We will explore the tools and possibilities available to us, while also reflecting upon what challenges and complications one may encounter as a songwriter in the digital age. 3 4 Acknowledgements I wish to express my gratitude to my supervisor Michael Rauhut for his insight, expertise and continued support during this work; associate professor Per Elias Drabløs for his kind advice and feedback; and to my artistic supervisor Bjørn Ole Rasch for his enthusiasm and knowledge in the field of world music and international collaborations. -

Hybrid & Electric Vehicles

A CRC Press FREEBOOK Hybrid & Electric Vehicles TABLE OF CONTENTS 0 Introduction 1 • Introduction to Electric Vehicles from 0 Electric and Plug-in Hybrid Vehicle Networks: Optimization and Control 2 • Electric Machines from Electric and 0 Hybrid Vehicles: Design Fundamentals, Second Edition 3 • Fundamentals of Conventional 0 Vehicles and Powertrains from Advanced Electric Drive Vehicles 0 4 • Hybrid Energy Storage Systems from Advanced Electric Drive Vehicles 5 • Solar Powered Charging Stations from 0 Solar Powered Charging Infrastructure for Electric Vehicles: A Sustainable Development 6. Internal Combustion Engines from 0 Modern Electric, Hybrid Electric, and Fuel Cell Vehicles, Third Edition Solar Powered Charging Infrastructure for Electric Vehicles VISIT WWW.CRCPRESS.COM TO BROWSE FULL RANGE OF ELECTRICAL ENGINEERING TITLES Introduction In response to increasing demand for low-carbon technologies, we educate in hybrid and fully electric vehicle development from CRC Press. These books show students and professionals alike how electrical and mechanical engineers must work together to complete an alternative vehicle system. It empowers them to carry on state-of-the-art research and development in automotive engineering in order to meet today?s needs of clean, efficient, and sustainable vehicles! 4 Q INTRODUCTION TO ELECTRIC VEHICLES This chapter is excerpted from Electrical and Plug-in Hybrid Vehicle Networl<s: Optimization and Control by Emanuele Crisostomi, Robert Shorten, Sonja StGdli & Fabian Wirth © 2018 Taylor & Francis Group. All rights reserved. 0 Learn more 1 Introduction to Electric Vehicles 1.1 Introduction Growing concerns over the limited supply of fossil-based fuels are motivating intense activity in the search for alternative road transportation propulsion systems. -

Download The

Press release Cannes, October 16th, 2018 A SUCCESSFUL PARTNERSHIP 909 Productions (A Lagardère Studios’ company) and RMC Découverte partnered with Discovery to adapt Naked and Afraid in France. The very first adaptation of the US format worldwide made great ratings on RMC Découverte’s prime time slot. After 6 weeks of broadcast, over 8 million people have watched the show. Over this first season, the series reached an average of 512 000 viewers and 2.4% market share. An increase of 43% compared to the average of the slot last season. Frédéric JOLY, 909 Productions’ CEO: « I am very happy about this collaboration with Discovery and RMC. NAKED AND AFRAID is an amazing and strong format and I believe we succeeded in adapting the format in respect to its basics but also RMC’s expectations ». Saevar LEMKE, Vice President International Program Sales EMEA & APAC: « This is the first international adaptation of NAKED AND AFRAID and we could not be more pleased with the outcome of our partnership with 909 Productions and RMC Découverte. The rating success is the result of the great work, expertise and care that has gone into the adaptation of this wonderful format ». Guenaëlle TROLY, RMC Découverte, RMC Story CEO: « Our excellent collaboration with 909 Productions and Discovery has contributed to the success of the French adaptation “Retour à l’Instinct Primaire”. This program has unquestionably found its public on our channel and fits perfectly with RMC Découverte’s editorial policy ». Naked and Afraid, is originally produced by Renegade 83 for Discovery Channel and distributed by Discovery International. -

14Annual Report Contents

14Annual Report Contents 4 Foreword 78 Report of the Supervisory Board 6 Executive Board 86 Consolidated Financial Statements 87 Responsibility Statement 8 The Axel Springer share 88 Auditor’s Report 89 Consolidated Statement of Financial Position 10 Combined Management Report 91 Consolidated Statement of 12 Fundamentals of the Axel Springer Group Comprehensive Income 22 Economic report 92 Consolidated Statement of Cash Flows 41 Economic position of Axel Springer SE 93 Consolidated Statement of Changes in Equity 44 Events after the reporting date 94 Consolidated Segment Report 45 Report on risks and opportunities 95 Notes to the Consolidated 56 Forecast report Financial Statements 61 Disclosures and explanatory report of the Executive Board pursuant to takeover law 158 Boards 65 Corporate Governance Report Group Key Figures Continuing operations in € millions Change yoy 2014 2013 2012 Group Total revenues 8.4 % 3,037.9 2,801.4 2,737.3 Digital media revenues share 53.2 % 47.5 % 42.4 % 1) EBITDA 11.6 % 507.1 454.3 498.8 1) EBITDA margin 16.7 % 16.2 % 18.2 % 2) Digital media EBITDA share 72.1 % 62.0 % 49.4 % 3) EBIT 9.7 % 394.6 359.7 413.6 Consolidated net income 31.9 % 235.7 178.6 190.7 3) Consolidated net income, adjusted 9.3 % 251.2 229.8 258.6 Segments Revenues Paid Models 2.6 % 1,561.4 1,521.5 1,582.9 Marketing Models 10.8 % 794.1 716.5 662.8 Classified Ad Models 27.2 % 512.0 402.6 330.2 Services/Holding 6.1 % 170.5 160.8 161.4 EBITDA1) Paid Models – 2.4 % 244.2 250.1 301.8 Marketing Models 6.0 % 109.7 103.4 98.1 Classified Ad Models -

SA4RGA04KN/12 Philips Leitor MP3 Com Fullsound™

Philips GoGEAR Leitor MP3 com FullSound™ Raga 4 GB* SA4RGA04KN Dê cor ao seu mundo com um som fascinante Pequeno, divertido e colorido Pequeno e divertido, o leitor MP3 GoGEAR Raga SA4RGA04KN da Philips com FullSound dá vida aos seus favoritos. O Philips Songbird assegura uma descoberta infindável de músicas e uma sincronização fácil, enquanto o FastCharge permite carregamentos rápidos. Excelente qualidade de som • FullSound™ para dar vida à sua música MP3 Complementa a sua vida • Acabamento macio e suave para conforto e fácil manuseamento • Visor a cores para navegação intuitiva e agradável • Desfrute de até 15 horas de reprodução de música Fácil e intuitivo • Philips Songbird: um programa simples para descobrir, reproduzir, sincronizar • LikeMusic para listas de reprodução de músicas que combinam na perfeição • Carregamento rápido de 6 minutos para 60 minutos de reprodução • Vista de pastas para organizar e visualizar os ficheiros multimédia como faz no seu computador Leitor MP3 com FullSound™ SA4RGA04KN/12 Raga 4 GB* Destaques Acabamento macio e suave LikeMusic sua bateria de iões de lítio para solucionar o Acabamento macio e suave para conforto e seu problema rapidamente… e manter a fácil manuseamento música a tocar. Visor a cores Vista de pastas Visor a cores para navegação intuitiva e agradável Reprodução de música até 15 horas A função LikeMusic permite-lhe ouvir mais música do seu estilo preferido – com apenas um clique! Não necessita de organizar a sua biblioteca de música, nem de aguardar um golpe de sorte ao acaso. A função LikeMusic é A vista da pasta é uma vista de directório um algoritmo patenteado da Philips que analisa opcional do leitor GoGear, que permite ver músicas na sua biblioteca para identificar todos os ficheiros no seu leitor como se se características de música semelhantes. -

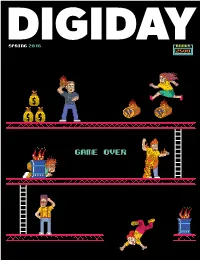

Game Over Spring 2018

SPRING 2018 BONUS 2600 GAME OVER SPRING 2018 06 11 26 43 51 TABLE OF CONTENTS 04 Editor’s Note 29 Jon Slade Feels Optimistic About Publishing’s Future HOT TAKES 31 Q&A With Turner’s John Martin 33 Media’s Master Mechanics 05 How Publishers Beg for Direct 37 Shadow Organizations Force Change Connections Media and Marketing Translator What’s In & Out for 2018 MARKETING 06 How Paywall Publishers Stop Churn AI by the Numbers 39 Q&A With e.l.f. Beauty’s Tarang Amin Influencer Dictionary 41 CVS’ Norman de Greve Rethinks Transparency 07 Facebook Irks Media 43 Consulting Firms Threaten Ad Agencies and Marketing Companies TheThe intersection modernization of finance, of money money 45 Richemont Explores E-Commerce and commerce 09 Blockchain’s Media and in China and technology Marketing Applications 47 How Brands Use WeChat 49 Alibaba Counters Counterfeits MEDIA 51 Ad Schools Evolve 53 Russell Westbrook’s Fashion Influence 11 Issues Shaping the New World 55 Amazon’s Private-Label Anatomy of a Brand Failure 12 Business Grows 13 Oral History of Facebook Beacon 15 Q&A With BuzzFeed’s Jonah Peretti ETC. 17 Media Pushes Back Against the Duopoly 19 The Rise of Athlete-Driven Media 57 Office Hours WithJulie Alvin 21 Q&A With Hearst Magazines’ Joanna Coles 59 Jeff Staple’s Guide to Tokyo 23 Quartz Expands Into India 61 A Day in the Life of Fashion Stylist 26 GDPR Misconceptions Micaela Erlanger 27 Q&A With NBCUniversal’s 65 Final Word tearsheet.co Linda Yaccarino TABLE OF CONTENTS | DIGIDAY 02 FOUNDER AND CEO NICK FRIESE EDITORIAL TEARSHEET CLIENT CUSTOM -

Television Academy Awards

2021 Primetime Emmy® Awards Ballot Outstanding Music Composition For A Series (Original Dramatic Score) The Alienist: Angel Of Darkness Belly Of The Beast After the horrific murder of a Lying-In Hospital employee, the team are now hot on the heels of the murderer. Sara enlists the help of Joanna to tail their prime suspect. Sara, Kreizler and Moore try and put the pieces together. Bobby Krlic, Composer All Creatures Great And Small (MASTERPIECE) Episode 1 James Herriot interviews for a job with harried Yorkshire veterinarian Siegfried Farnon. His first day is full of surprises. Alexandra Harwood, Composer American Dad! 300 It’s the 300th episode of American Dad! The Smiths reminisce about the funniest thing that has ever happened to them in order to complete the application for a TV gameshow. Walter Murphy, Composer American Dad! The Last Ride Of The Dodge City Rambler The Smiths take the Dodge City Rambler train to visit Francine’s Aunt Karen in Dodge City, Kansas. Joel McNeely, Composer American Gods Conscience Of The King Despite his past following him to Lakeside, Shadow makes himself at home and builds relationships with the town’s residents. Laura and Salim continue to hunt for Wednesday, who attempts one final gambit to win over Demeter. Andrew Lockington, Composer Archer Best Friends Archer is head over heels for his new valet, Aleister. Will Archer do Aleister’s recommended rehabilitation exercises or just eat himself to death? JG Thirwell, Composer Away Go As the mission launches, Emma finds her mettle as commander tested by an onboard accident, a divided crew and a family emergency back on Earth. -

TV Listings Aug21-28

SATURDAY EVENING AUGUST 21, 2021 B’CAST SPECTRUM 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 12 AM 12:30 1 AM 2 2Stand Up to Cancer (N) NCIS: New Orleans ’ 48 Hours ’ CBS 2 News at 10PM Retire NCIS ’ NCIS: New Orleans ’ 4 83 Stand Up to Cancer (N) America’s Got Talent “Quarterfinals 1” ’ News (:29) Saturday Night Live ’ Grace Paid Prog. ThisMinute 5 5Stand Up to Cancer (N) America’s Got Talent “Quarterfinals 1” ’ News (:29) Saturday Night Live ’ 1st Look In Touch Hollywood 6 6Stand Up to Cancer (N) Hell’s Kitchen ’ FOX 6 News at 9 (N) News (:35) Game of Talents (:35) TMZ ’ (:35) Extra (N) ’ 7 7Stand Up to Cancer (N) Shark Tank ’ The Good Doctor ’ News at 10pm Castle ’ Castle ’ Paid Prog. 9 9MLS Soccer Chicago Fire FC at Orlando City SC. Weekend News WGN News GN Sports Two Men Two Men Mom ’ Mom ’ Mom ’ 9.2 986 Hazel Hazel Jeannie Jeannie Bewitched Bewitched That Girl That Girl McHale McHale Burns Burns Benny 10 10 Lawrence Welk’s TV Great Performances ’ This Land Is Your Land (My Music) Bee Gees: One Night Only ’ Agatha and Murders 11 Father Brown ’ Shakespeare Death in Paradise ’ Professor T Unforgotten Rick Steves: The Alps ’ 12 12 Stand Up to Cancer (N) Shark Tank ’ The Good Doctor ’ News Big 12 Sp Entertainment Tonight (12:05) Nightwatch ’ Forensic 18 18 FamFeud FamFeud Goldbergs Goldbergs Polka! Polka! Polka! Last Man Last Man King King Funny You Funny You Skin Care 24 24 High School Football Ring of Honor Wrestling World Poker Tour Game Time World 414 Video Spotlight Music 26 WNBA Basketball: Lynx at Sky Family Guy Burgers Burgers Burgers Family Guy Family Guy Jokers Jokers ThisMinute 32 13 Stand Up to Cancer (N) Hell’s Kitchen ’ News Flannery Game of Talents ’ Bensinger TMZ (N) ’ PiYo Wor. -

Quick Guide to the Eurovision Song Contest 2018

The 100% Unofficial Quick Guide to the Eurovision Song Contest 2018 O Guia Rápido 100% Não-Oficial do Eurovision Song Contest 2018 for Commentators Broadcasters Media & Fans Compiled by Lisa-Jayne Lewis & Samantha Ross Compilado por Lisa-Jayne Lewis e Samantha Ross with Eleanor Chalkley & Rachel Humphrey 2018 Host City: Lisbon Since the Neolithic period, people have been making their homes where the Tagus meets the Atlantic. The sheltered harbour conditions have made Lisbon a major port for two millennia, and as a result of the maritime exploits of the Age of Discoveries Lisbon became the centre of an imperial Portugal. Modern Lisbon is a diverse, exciting, creative city where the ancient and modern mix, and adventure hides around every corner. 2018 Venue: The Altice Arena Sitting like a beautiful UFO on the banks of the River Tagus, the Altice Arena has hosted events as diverse as technology forum Web Summit, the 2002 World Fencing Championships and Kylie Minogue’s Portuguese debut concert. With a maximum capacity of 20000 people and an innovative wooden internal structure intended to invoke the form of Portuguese carrack, the arena was constructed specially for Expo ‘98 and very well served by the Lisbon public transport system. 2018 Hosts: Sílvia Alberto, Filomena Cautela, Catarina Furtado, Daniela Ruah Sílvia Alberto is a graduate of both Lisbon Film and Theatre School and RTP’s Clube Disney. She has hosted Portugal’s edition of Dancing With The Stars and since 2008 has been the face of Festival da Cançao. Filomena Cautela is the funniest person on Portuguese TV. -

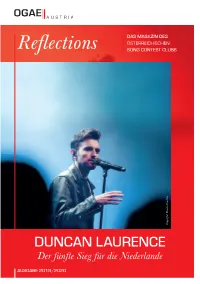

Reflections 3 Reflections

3 Refl ections DAS MAGAZIN DES ÖSTERREICHISCHEN Refl ections SONG CONTEST CLUBS AUSGABE 2019/2020 AUSGABE | TAUSEND FENSTER Der tschechische Sänger Karel Gott („Und samkeit in der großen Stadt beim Eurovision diese Biene, die ich meine, die heißt Maja …“) Song Contest 1968 in der Royal Albert Hall wurde vor allem durch seine vom böhmischen mit nur 2 Punkten den bescheidenen drei- SONG CONTEST CLUBS Timbre gekennzeichneten, deutschsprachigen zehnten Platz, fi ndet aber bis heute großen Schlager in den 1970er und 1980er Jahren zum Anklang innerhalb der ESC-Fangemeinde. Liebling der Freunde eingängiger U-Musik. Neben der deutschen Version, nahm Karel Copyright: Martin Krachler Ganz zu Beginn seiner Karriere wurde er Gott noch eine tschechische Version und zwei ÖSTERREICHISCHEN vom Österreichischen Rundfunk eingela- englische Versionen auf. den, die Alpenrepublik mit der Udo Jürgens- Hier seht ihr die spanische Ausgabe von „Tau- DUNCAN LAURENCE Komposition „Tausend Fenster“ zu vertreten. send Fenster“, das dort auf Deutsch veröff ent- Zwar erreichte der Schlager über die Ein- licht wurde. MAGAZINDAS DES Der fünfte Sieg für die Niederlande DIE LETZTE SEITE | ections Refl AUSGABE 2019/2020 2 Refl ections 4 Refl ections 99 Refl ections 6 Refl ections IMPRESSUM MARKUS TRITREMMEL MICHAEL STANGL Clubleitung, Generalversammlung, Organisation Clubtreff en, Newsletter, Vorstandssitzung, Newsletter, Tickets Eurovision Song Contest Inlandskorrespondenz, Audioarchiv [email protected] Fichtestraße 77/18 | 8020 Graz MARTIN HUBER [email protected] -

LES CHAÎNES TV by Dans Votre Offre Box Très Haut Débit Ou Box 4K De SFR

LES CHAÎNES TV BY Dans votre offre box Très Haut Débit ou box 4K de SFR TNT NATIONALE INFORMATION MUSIQUE EN LANGUE FRANÇAISE NOTRE SÉLÉCTION POUR VOUS TÉLÉ-ACHAT SPORT INFORMATION INTERNATIONALE MULTIPLEX SPORT & ÉCONOMIQUE EN VF CINÉMA ADULTE SÉRIES ET DIVERTISSEMENT DÉCOUVERTE & STYLE DE VIE RÉGIONALES ET LOCALES SERVICE JEUNESSE INFORMATION INTERNATIONALE CHAÎNES GÉNÉRALISTES NOUVELLE GÉNÉRATION MONDE 0 Mosaïque 34 SFR Sport 3 73 TV Breizh 1 TF1 35 SFR Sport 4K 74 TV5 Monde 2 France 2 36 SFR Sport 5 89 Canal info 3 France 3 37 BFM Sport 95 BFM TV 4 Canal+ en clair 38 BFM Paris 96 BFM Sport 5 France 5 39 Discovery Channel 97 BFM Business 6 M6 40 Discovery Science 98 BFM Paris 7 Arte 42 Discovery ID 99 CNews 8 C8 43 My Cuisine 100 LCI 9 W9 46 BFM Business 101 Franceinfo: 10 TMC 47 Euronews 102 LCP-AN 11 NT1 48 France 24 103 LCP- AN 24/24 12 NRJ12 49 i24 News 104 Public Senat 24/24 13 LCP-AN 50 13ème RUE 105 La chaîne météo 14 France 4 51 Syfy 110 SFR Sport 1 15 BFM TV 52 E! Entertainment 111 SFR Sport 2 16 CNews 53 Discovery ID 112 SFR Sport 3 17 CStar 55 My Cuisine 113 SFR Sport 4K 18 Gulli 56 MTV 114 SFR Sport 5 19 France Ô 57 MCM 115 beIN SPORTS 1 20 HD1 58 AB 1 116 beIN SPORTS 2 21 La chaîne L’Équipe 59 Série Club 117 beIN SPORTS 3 22 6ter 60 Game One 118 Canal+ Sport 23 Numéro 23 61 Game One +1 119 Equidia Live 24 RMC Découverte 62 Vivolta 120 Equidia Life 25 Chérie 25 63 J-One 121 OM TV 26 LCI 64 BET 122 OL TV 27 Franceinfo: 66 Netflix 123 Girondins TV 31 Altice Studio 70 Paris Première 124 Motorsport TV 32 SFR Sport 1 71 Téva 125 AB Moteurs 33 SFR Sport 2 72 RTL 9 126 Golf Channel 127 La chaîne L’Équipe 190 Luxe TV 264 TRACE TOCA 129 BFM Sport 191 Fashion TV 265 TRACE TROPICAL 130 Trace Sport Stars 192 Men’s Up 266 TRACE GOSPEL 139 Barker SFR Play VOD illim.