Kimco's 2020 Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Future Looks Bright

The Future Looks Bright Main Line companies look to schools to build workforce of tomorrow “Trekkies” Take Flight Inside Lower Merion High School’s international service trips Look Inside What’s happening at top Main Line private schools? Dining & Shopping l Schools & Colleges l Cultural Attractions Local Entertainment & Activities l Health & Medical The Main Line Chamber of Commerce Look inside for The Main Line Chamber of Commerce directory West Laurel Hill One Call To One Place - For Everything We plan for just about every event in life except for the one certainty. Contact us to get started. Pre-Planning available for: M Cemetery Property & Merchandise 610.668.9900 M Funeral Arrangements www.WestLaurelHill.com M Cremation Arrangements 225 Belmont Ave M Jewish & Green Services Bala Cynwyd, PA M Monument Design William A. Sickel, F.D., Supervisor, West Laurel Hill Funeral Home, Inc. 2 • Guide to the Main Line 2017/2018 mainlinemedianews.com mainlinemedianews.com Guide to the Main Line 2017/2018 • 3 Welcome to the Table of Contents Departments WE KNOW KITCHENS. Business/Financial Services ............................. 46 Let us help you find the right ingredients. Main Line Dining. .............................................................. 64 Shopping .......................................................... 73 Education ......................................................... 81 Senior Services. ................................................ 93 Health and Wellness -

Ardmore Crossing

Proposal for the Ardmore Transit Center Submitted by: Strategic Realty Investments September 19, 2007 RDMORE Pennsylvania aughan and autter A V BUILDERS September 18, 2007 Bruce D. Reed, President Township of Lower Merion Table of Contents Board of Commissioners Project Approach 75 East Lancaster Avenue Ardmore, Pennsylvania 19003 Our Team RE: Ardmore Transit Center and Business District Revitalization Strategic Realty Investment Dear President Reed: Looney Ricks Kiss Architects, Inc. We would like to applaud all of the commissioners and township staff for all of their hard work that was very evident in the preparation of this request for proposals – Ardmore Transit Traffic Planning and Design, Inc. Center and Business District Revitalization. As evidenced by the recent historical summary chronicling William Penn’s vision for Lower Merion that was recently circulated to your residents, we are extremely fortunate for the many historical influences that have help shape this wonderful community and township. We believe, as responsible stewards that it is critical to respect these past influences and build upon the positive elements that have attracted some many to this area. It is our belief that the revitalization of Ardmore will and should occur in a thoughtful, planned and deliberate manner. This will undoubtedly result from further direction and input from the commissioners, township staff along with the many stakeholders that will be impacted. We have provided some initial thoughts and comments that we hope will form the basis for further dialogue. Initially our plan and vision has focused on the area immediately surrounding the commuter rail station and the pedestrian and vehicular access to and from this area. -

Investor Presentation Fourth Quarter 2020

INVESTOR PRESENTATION FOURTH QUARTER 2020 Embry Village – Atlanta, GA SAFE HARBOR The statements in this presentation, including targets and assumptions, state the Company’s and management’s hopes, intentions, beliefs, expectations or projections of the future and are forward-looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from current expectations include the key assumptions contained within this presentation, general economic conditions, local real estate conditions, increases in interest rates, foreign currency exchange rates, increases in operating costs, real estate taxes and pandemics or other health crises, such as coronavirus disease 2019 (COVID- 19). Additional information concerning factors that could cause actual results to differ materially from those forward-looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s Annual Report on Form 10-K. Copies of each filing may be obtained from http://investors.kimcorealty.com/ or the SEC. Cover: Lincoln Square, Philadelphia, PA Suburban Square, Ardmore, PA KIMCO REALTY SNAPSHOT 400 93.9% Baa1/BBB+ 92%/91% # of Properties Operating Portfolio Moody’s / Q4/Jan. Base Occupancy S&P Ratings Rent Collections* $ 70M SQFT 77.6% $679/SF $2.3B Total Gross Leasable % of ABR from Grocery AVG Grocery Total Liquidity Area (GLA) Anchored Centers Sales/SF As of 12/31/2020 -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Macy's, Inc. Outlines Cost Efficiency Initiatives and Lists Store Locations to Be Closed

January 6, 2016 Macy’s, Inc. Outlines Cost Efficiency Initiatives and Lists Store Locations to Be Closed CINCINNATI--(BUSINESS WIRE)-- Macy’s, Inc. (NYSE:M) today announced a series of cost-efficiency and process improvement measures to be implemented beginning in early 2016 that will reduce SG&A expense by approximately $400 million while still investing in growth strategies, particularly in omnichannel capabilities at Macy’s and Bloomingdale’s. The actions represent progress toward the company’s previously stated goal of re-attaining over time an EBITDA rate as a percent of sales of 14 percent. (Editor’s Note: Macy’s, Inc. this afternoon also issued a separate news release announcing sales results for the November/December 2015 period and updating guidance.) “In light of our disappointing 2015 sales and earnings performance, we are making adjustments to become more efficient and productive in our operations. Moreover, we believe we can operate more effectively with an organization that is flatter and more agile so we can pursue growth and regain market share in our core Macy’s and Bloomingdale’s omnichannel businesses faster and with more intensity. We will continue to invest in strategic initiatives that anticipate emerging customer needs and create shareholder value,” said Terry J. Lundgren, chairman and chief executive officer of Macy’s, Inc. “The cost efficiencies represent more than two-thirds of our goal of annual SG&A expense reduction of $500 million, net of growth initiatives, from previously planned levels by 2018. In some cases, there will be short-term pain as we tighten our belt and realign our resources. -

Exhibit C Page 1 of 14 1 Before the Conditional Use Hearing Officer

Exhibit C Page 1 of 14 Before the Conditional Use Hearing Officer Lower Merion Township, Montgomery County Pennsylvania Application CU 3747C RECOMMENDATIONS FOR FINDINGS OF FACT, CONCLUSIONS OF LAW AND ORDER This conditional use application was filed by Kimco Realty, LLC seeking approval to deviate from architectural and design standards of the Mixed-Use Special Transportation District pursuant to Code §155-87.25. A Conditional Use Hearing was held on December 17, 2015 before the Conditional Use Hearing Officer.1 1. The Applicant is Kimco Realty, LLC by its representative Geoff Glazer (“Applicant”). The Applicant is represented by Jamie Jun, Esq. of Fromhold, Jaffe & Adams. The record owner is Amerishop Suburban LP. 2. The Property is comprised of four separate lots: 0 Montgomery Ave., 42 St. James Place, 75 St. James Place and 100 Coulter Ave. (collectively referred to as “the Property”). Two formerly private roads traverse the property: St. James Place and Parking Plaza; as well as one public street: Coulter Avenue. Although it was originally designed as a private road, Parking Plaza was subsequently restricted to pedestrian access only. 3. The Property is bound by the following: North: Montgomery Avenue; East: Sibley Avenue containing residential and office uses; South: SEPTA/Amtrak Paoli Thorndale regional rail line; West: Anderson Avenue. 4. The Property is the site of “Suburban Square,” considered to be one of the earliest retail shopping centers in this country. It has been improved with several Class II Historic resources listed on the Township’s Historic Resource Inventory. Suburban Square was designed 1 The Conditional Use Hearing Officer is authorized to conduct the hearing pursuant to Code §155-141.2.A.5. -

General Background

The Pennsylvania State University The Graduate School College of Earth and Mineral Sciences RESTRUCTURING DEPARTMENT STORE GEOGRAPHIES: THE LEGACIES OF EXPANSION AND CONSOLIDATION IN PHILADELPHIA’S JOHN WANAMAKER AND STRAWBRIDGE & CLOTHIER, 1860-1960 A Thesis in Geography by Wesley J Stroh © 2008 Wesley J Stroh Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Science August 2008 The thesis of Wesley J. Stroh was reviewed and approved* by the following: Deryck W. Holdsworth Professor of Geography Thesis Adviser Roger M. Downs Professor of Geography Karl Zimmerer Professor of Geography Head of the Department of Geography *Signatures are on file in the Graduate School. ABSTRACT RESTRUCTURING DEPARTMENT STORE GEOGRAPHIES: THE LEGACIES OF EXPANSION AND CONSOLIDATION IN PHILADELPHIA’S JOHN WANAMAKER AND STRAWBRIDGE & CLOTHIER, 1860-1960 Consolidation in the retail sector continues to restructure the department store, and the legacies of earlier forms of the department store laid the foundation for this consolidation. Using John Wanamaker’s and Strawbridge & Clothier, antecedents of Macy’s stores in Philadelphia, I undertake a case study of the development, through expansion and consolidation, which led to a homogenized department store retail market in the Philadelphia region. I employ archival materials, biographies and histories, and annual reports to document and characterize the development and restructuring Philadelphia’s department stores during three distinct phases: early expansions, the first consolidations into national corporations, and expansion through branch stores and into suburban shopping malls. In closing, I characterize the processes and structural legacies which department stores inherited by the latter half of the 20th century, as these legacies are foundational to national-scale retail homogenization. -

TOWNSHIP of LOWER MERION Building and Planning Committee

TOWNSHIP OF LOWER MERION BUILDING AND PLANNING Wednesday, October 14, 2020 COMMITTEE 6:45 PM (Approximately) Chairperson: Joshua L. Grimes,Todd M. Sinai Vice Chairperson: Sean P. Whalen AGENDA 1. AUTHORIZATION TO RELEASE FUNDS IN ESCROW 2. DECISION ON APPEAL OF ORDER TO REMOVE BAMBOO - 1125 W. Montgomery Avenue, Bryn Mawr, Ward 6 3. CERTIFIED LOCAL GOVERNMENT (CLG) GRANT - Belmont Hills Community Center Feasibility Study 4. WAIVER OF LAND DEVELOPMENT PLAN - 42 St. James Place, Suburban Square, Ardmore, Ward 5, LD# W-20-001. 5. PRELIMINARY LAND DEVELOPMENT PLAN - 27 W. City Avenue, Bala Cynwyd, Ward 9, LD# 3853 6. SECOND STAGE PLAN – 424 Devereux Drive, Villanova, Ward 6, LD# 3222L5 7. REQUEST TO AMEND A CONDITION OF APPROVAL - 250 Haverford Road, Wynnewood, Penn Wynne Elementary School 8. HISTORICAL COMMISSION - 601 North Ithan Avenue, Bryn Mawr, Beaumont, Class 2, 2020-R-26 9. HISTORICAL COMMISSION - 541 Oriole Lane, Villanova, Briar Crest, Class 2, 2020-R- 23 10. HISTORICAL COMMISSION - 1333 Youngsford Road, Gladwyne, Class 1, 2020-R-24 11. HISTORICAL COMMISSION - 50 Lapsley Lane, Merion Station, Barnes Foundation, Class 1, 2020-R-25 12. CERTIFICATE OF APPROPRIATENESS - 414 Berkley Road, Haverford, Haverford Station Historic District, 20-18 13. CERTIFICATE OF APPROPRIATENESS - 607 Loves Lane, Wynnewood, English Village Historic District, 20-17 1 2 AGENDA ITEM INFORMATION ITEM: AUTHORIZATION TO RELEASE FUNDS IN ESCROW Consider for recommendation to the Board of Commissioners approval the release of funds held in escrow as Improvement Guarantees in accordance with §135-5 of the Township Code for the following: Haverford Square Development 379-385 W, Lancaster Avenue Escrow Release No. -

Investor Presentation First Quarter 2015 SAFE HARBOR

Investor Presentation First Quarter 2015 SAFE HARBOR The statements in this presentation, including targets and assumptions, state the Company’s and management’s hopes, intentions, beliefs, expectations or projections of the future and are forward-looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from current expectations include the key assumptions contained within this presentation, general economic conditions, local real estate conditions, increases in interest rates, foreign currency exchange rates, increases in operating costs and real estate taxes. Additional information concerning factors that could cause actual results to differ materially from those forward-looking statements is contained from time to time in the Company’s SEC filings. Copies of each filing may be obtained from the Company or the SEC. Crossroads Plaza | Cary, NC 2 COMPANY SNAPSHOT Owner and Operator of Largest Publicly Traded Portfolio of Neighborhood & Community Shopping Centers in North America History Started in 1958 | IPO that initiated Modern REIT Era NYSE listed (1991) | S&P 500 Index (2006) Dividend $0.96 annually, ~4.0% yield (based on 06/01/15 closing price) Retail Portfolio 745 properties totaling 108M sf Footprint 39 States, Puerto Rico, Canada, Mexico and Chile Occupancy(1) Current: 95.7% | All-time high: 96.3% (12/31/07) Credit Rating Investment Grade: BBB+ Baa1 BBB+ S&P Moody’s Fitch -

Market Analysis Report 2017

2017 Market Analysis Report for Downtown Ardmore Market Study Conducted by Ardmore Initiative 56 E. Lancaster Ave. Ardmore, PA 19003 610 645 0540 Marie Suvansin Executive Director Funded in part by a grant from the PA Department of Community and Economic Development October 2017 1 Table of Contents Section 1 Project Purpose and Methodology 4 Previous Plan and Progress: Ardmore Retail Strategy 2006 5 Current Demographic Trends and Profile 6 Psychographic Profile 15 Consumer Expenditures 17 Sales Void Analysis 19 Business Mix 21 Findings and Recommendations 22 Section 2 Appendix A: Demographic Data for Driving Trade Area 25 Appendix B: Demographic Data for Walking Trade Area 27 Appendix C: Demographic Data for Zip Code 19003 (Ardmore) 29 Credits 31 2 Section 1 Project Purpose and Methodology Previous Plan and Progress: Ardmore Retail Strategy 2006 Current Demographic Trends and Profile Psychographic Profile Consumer Expenditures Sales Void Analysis Business Mix Findings and Recommendations 3 Project Purpose and Methodology In spring 2016, the Ardmore Initiative received an $18,363 grant from the Pennsylvania Department of Community and Economic Development to conduct a Market Study and Strategic Plan for the Ardmore Business District. The Ardmore Initiative conducted the Market Study in-house, and, through a competitive RFP process, enlisted Heritage Consulting Inc. to complete the Strategic Plan, as well as advise on the Market Study. Managed by the Ardmore Initiative, the Ardmore Business District is a historic commercial corridor situated in the Main Line, the affluent western suburbs of Philadelphia. Ardmore is unique in that its residential community is the most socioeconomically and ethnically diverse in the Main Line. -

The Changing Design of Shopping Places

The Changing Design of Shopping Places From the palatial department SHOPPING IS an interaction between a marketing strategy and the store to the no-frills power design of the shopping place. The envi- ronment is an integral part of the retail center, design plays a key role equation, as important as the way that goods are marketed. Sometimes changes in retailing environments. in shopping are driven by environmental innovations, sometimes by innovations in strategy, and sometimes innovations occur in both realms at once. The only constant is change, for retailing, more than other sector of commercial real estate, is particu- larly susceptible to fashion. Whatever attracts consumers one year may repel them the next. WITOLD RYBCZYNSKI 34 ZELL/LURIE REAL ESTATE CENTER ARCADES AND GALLERIES the glass roofs meant that shops usually sold expensive goods, and most arcades For centuries, the design of shops was rel- were located in fashionable districts such as atively static. Shops were small, usually Piccadilly. A number of arcades were built owner-operated, and though the shop- in American cities such as Philadelphia, window is a venerable device, displays of New York, Cleveland, and Providence. goods inside the shop were minimal. In The grandest arcades, such as those in many cases, manufacturing occurred in a Berlin, Moscow, and Naples, were referred back room. Since the shopkeeper generally to as galleries. The Galleria Vittorio owned the building, in which he also lived, Emanuele II in Milan, built in 1865–67, a shoemaker’s shop or a bakery combined has an extremely tall and ornate interior, retail, workshop, and residential. -

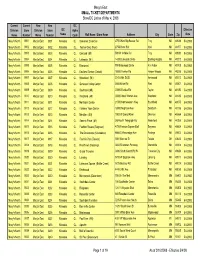

Macy's East SMALL TICKET DEPARTMENTS Store/DC List As of May 4, 2008 Page 1 of 19 As of 3/10/2008

Macy's East SMALL TICKET DEPARTMENTS Store/DC List as of May 4, 2008 Current Current New New DC Division Store Division Store DC Alpha Effective Name Number Name Number Name Code Mall Name / Store Name Address City State Zip Date Macy's North 0001 Macy's East 0301 Minooka CL Somerset Collection 2750 West Big Beaver Rd Troy MI 48084 5/4/2008 Macy's North 0002 Macy's East 0302 Minooka CL Twelve Oaks (Novi) 27550 Novi Rd Novi MI 48377 5/4/2008 Macy's North 0003 Macy's East 0303 Minooka CL Oakland (MI) 500 W 14 Mile Rd Troy MI 48083 5/4/2008 Macy's North 0004 Macy's East 0304 Minooka CL Lakeside (MI) 14200 Lakeside Circle Sterling Heights MI 48313 5/4/2008 Macy's North 0005 Macy's East 0305 Minooka CL Briarwood 700 Briarwood Circle Ann Arbor MI 48108 5/4/2008 Macy's North 0006 Macy's East 0306 Minooka CL Eastland Center (Detroit) 18000 Vernier Rd Harper Woods MI 48225 5/4/2008 Macy's North 0007 Macy's East 0307 Minooka CL Woodland (MI) 3165 28th St SE Kentwood MI 49512 5/4/2008 Macy's North 0008 Macy's East 0308 Minooka CL Genesee Valley Center 4600 Miller Rd Flint MI 48507 5/4/2008 Macy's North 0009 Macy's East 0309 Minooka CL Southland (MI) 23000 Eureka Rd Taylor MI 48180 5/4/2008 Macy's North 0010 Macy's East 0310 Minooka CL Westland (MI) 35000 West Warren Ave Westland MI 48185 5/4/2008 Macy's North 0011 Macy's East 0311 Minooka CL Northland Center 21500 Northwestern Hwy Southfield MI 48075 5/4/2008 Macy's North 0012 Macy's East 0312 Minooka CL Fairlane Town Center 18900 Mighican Ave Dearborn MI 48126 5/4/2008 Macy's North 0013 Macy's