Attending Firms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Technology Sector Summary

Financial Technology Sector Summary July 30, 2014 Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access -

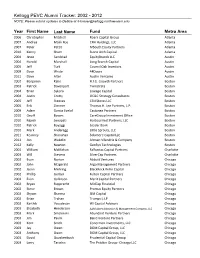

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 Report Produced on 9th October 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

The Brief Mergermarket’S Weekly Private Equity Round-Up

The Brief mergermarket’s Weekly Private Equity Round-Up 4 December 2009 | Issue 41 Editorial 1 The Noticeboard 2 Private Equity Opportunities 3 Deals of the Week 9 Pipeline 16 Statistics 19 League & Activity Tables 22 Top Deals 31 Investor Profile: Blackstone Group Holdings LLC 34 Notes & Contacts 36 The Week That Was..... The last seven days: private equity in review Over the past seven days, global private equity deal Mongolia-based Gobi Coal and Energy from En+ Group making was steady but somewhat unspectacular with for US$25m. Although the value of the deal falls firmly 15 transactions coming to the market, worth a collective in the lower end of the market, it is the largest private US$2.57bn. The top deal of the week was seen in Italy equity-related deal announced in Mongolia this decade. where Bridgepoint Capital and AXA Private Equity moved to acquire the gaming business of Snai, the company Deal flow over the second half of 2009 has certainly engaged in the design, construction and provision of suggested that private equity houses are becoming technology and services in the gambling industry, for a increasingly willing to return to the market after the total consideration of US$898m. global financial crisis. However, this week there was a sharp reminder to the asset class that the effects of The deal could prove to be an astute investment by the the economic downturn will be felt for some time yet buyout houses with Italy’s gaming market the second with beleaguered buyout firm Candover announcing largest in Europe and tipped to see annual growth of that it has agreed with investors to terminate the €3bn around 4-6% over the next five years. -

990-PF and Its Instructions Is at Www

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491314002224 Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947 (a)(1) Trust Treated as Private Foundation 0- Do not enter Social Security numbers on this form as it may be made public . By law, the 2013 IRS cannot redact the information on the form. Department of the Treasury 0- Information about Form 990-PF and its instructions is at www. irs.gov /form990pf . Internal Revenue Service For calendar year 2013 , or tax year beginning 01-01-2013 , and ending 12-31-2013 Name of foundation A Employer identification number John D and Catherine T MacArthur Foundation Consolidated 23-7093598 Number and street ( or P 0 box number if mail is not delivered to street address ) Room / suite 6 ieiepnone number ( see instructions) 140 South Dearborn Street No 1200 (312) 726-8000 City or town, state or province , country, and ZIP or foreign postal code C If exemption application is pending, check here F Chicago, IL 606035285 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations , check here F r-Final return r'Amended return 2. Foreign organizations meeting the 85% test, r Address change r'Name change check here and attach computation E If private foundation status was terminated H Check type of organization Section 501( c)(3) exempt private foundation und er section 507 ( b )( 1 )( A ), c hec k here F_ Section 4947 (a)(1) nonexempt charitable trust r'Other taxable private foundation I Fair market value of all assets at end J Accounting method F Cash F Accrual F If the foundation is in a 60-month termination of year (from Part II, col. -

Financial Technology Sector Summary

Financial Technology Sector Summary May 7, 2014 Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access Service . Late Stage Private through . Broad Network Including -

2019 Welcome

Panel Sessions Panel 2019 Welcome 12TH ANNUAL ALTERNATIVEALTERNATIVE INVESTMENTSINVESTMENTS CONFERENCECONFERENCE presented by POSITIONING PORTFOLIOS FOR THE LATE-STAGE CYCLE ENVIRONMENT HOSTED BY THE INSTITUTE FOR PRIVATE CAPITAL AND THE UNC KENAN-FLAGLER PRIVATE EQUITY CLUB www.uncaic.com March 28th The Carolina Inn THE UNIVERSITY OF NORTH CAROLINA AT CHAPEL HILL 11 2 Welcome 3-4 Conference Agenda 5 Sponsors 6-7 Keynote Speakers 8-29 Panel Sessions & Roundtable Discussions 30 Kenan Investment Management Fellowship 31 UNC Kenan-Flagler Private Equity Club table of contents table 32 UNC Kenan-Flagler Private Equity Fund 34 The Institute for Private Capital On behalf of the Institute for Private Capital and the Private Equity Club at UNC Kenan-Flagler, we welcome you to the 12th Annual Alternative Investments Conference. We are pleased to present a highly-regarded group of keynote speakers and panelists from leading investment firms and organizations who will share their insights on current issues and topics in the alternative investments industry. We appreciate the generous support of our sponsors and alumni who have continued to make this annual event a success. We thank you for joining us and look forward to a successful event. Sincerely, THE INSTITUTE FOR PRIVATE CAPITAL THE PRIVATE EQUITY CLUB UNC Kenan-Flagler UNC ALTERNATIVE INVESTMENTS CONFERENCE UNC ALTERNATIVE 2 CONFERENCE AGENDA thursday, MARCH 28 TIME LOCATION EVENT Conference agenda 9:00 – 9:45 AM COLONNADE CHECK IN & BREAKFAST 9:45 – 10:00 AM HILL BALLROOM WELCOME Prof. Greg -

The 2008 Preqin Private Equity Performance Monitor - Sample Pages

Sample Pages The 2008 Preqin Private Equity Performance Monitor - Sample Pages © 2008 Private Equity Intelligence Ltd 1 Sample Pages A Guide to the Performance of Private Equity Fund Managers © 2008 Private Equity Intelligence Ltd 2 Sample Pages Contents 1. Executive Summary 7 Fund of Funds 41 - DPI, RVPI and TVPI 2. Methodology 13 - Median Net IRR and Quartile Ranking - Fund Selection Performance 3. Overall Performance of Private Equity 19 - Relationship between Successor and Predecessor Fund - Fund Universe Mezzanine 45 - DPI, RVPI and TVPI - DPI, RVPI and TVPI - Median IRRs, Money Weighted IRRs and Pooled IRRs - Median Net IRR and Quartile Ranking - Performance by Geographic Region - Quartile Ranking by Fund Number - Relationship between Predecessor and Successor Fund Quartile Real Estate 49 - Experience Effect - DPI, RVPI and TVPI - Median Net IRR and Quartile Ranking 4. Performance by Fund Type 29 - Relationship between Successor and Predecessor Fund Buyout 31 Secondaries 53 - DPI, RVPI and TVPI - DPI, RVPI and TVPI - Median Net IRR and Quartile Ranking - Median IRR - Median, Weighted and Pooled IRRs Venture 55 - North American vs. European Buyout Funds - DPI, RVPI and TVPI - Large and Mega Buyout Funds - Median Net IRR and Quartile Ranking - Buyout Cash Flow Analysis - Median, Weighted and Pooled IRRs - Buyout Net Cash Flow by Vintage Year - Performance of Early Stage Funds - Performance at Different Points in Time - Performance of Industry Focused Funds - Relationship between Successor and Predecessor Fund Quartile - Venture Cash Flow Analysis Distressed Debt & Special Situations 39 - Venture Cash Flow by Vintage - DPI, RVPI and TVPI - Performance at Different Points in Time - Median IRR - Relationship between Successor and Predecessor Fund Quartile © 2008 Private Equity Intelligence Ltd 3 Sample Pages 5. -

Lawrence M. Braun

Lawrence M. Braun Partner T: +1.213.617.4184 333 South Hope Street C: +1.213.999.0444 Forty-Third Floor F: +1.213.443.2814 Los Angeles, CA 90071 [email protected] Larry Braun is the former Leader of the firm’s Corporate Practice Group. In addition to his law degree, Larry holds an M.B.A. in Finance from the Kellogg School at Northwestern University and has attained the New Jersey C.P.A. Certificate Requirements. He was previously a managing director of the largest private investment banking firm on the west coast. Larry is resident in the firm’s Los Angeles office, where he represents public and private companies in the areas of mergers and acquisitions, corporate finance, securities and general business. Areas of Practice Larry is an advisor to clients ranging from family-owned businesses to multi-national corporations in many diverse industries such as high-tech and computers, healthcare, consumer goods, aerospace and defense and grocery and food service. His principal areas of practice consist of general corporate law, corporate finance and securities law, mergers and acquisition transactions, contractual matters (including licensing and distribution arrangements), healthcare transactions and general business counseling. Honors ■ Leading Dealmakers in America List, Lawdragon, 2021 ■ Southern California Super Lawyer, Super Lawyers, 2007-2021 ■ The Los Angeles 500 - The Most Influential People in Los Angeles, Los Angeles Business Journal, 2016-2017 ■ Trailblazer - Mergers and Acquisitions and Antitrust, National Law Journal, -

Q2 2013 Preqin Private Equity Benchmarks: Buyout Benchmark Report

Preqin Private Equity Benchmarks: Buyout Benchmark Report As of 30th June 2013 alternative assets. intelligent data. Preqin Private Equity Benchmarks: Buyout Benchmark Report As of 30th June 2013 Report Produced on 12th March 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2011 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 30th June 2011 Report Produced on 27th January 2012 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

Health Care Deals in the Wake of the Affordable Care Act

HEALTH CARE DEALS IN THE WAKE OF THE AFFORDABLE CARE ACT HOW PRIVATE EQUITY IS BENEFITING PRIVATE EQUITY FIRMS AND INVESTORS ARE WASTING NO TIME SEEKING WAYS TO PROFIT FROM THIS BURGEONING MARKET. WeiserMazars LLP is an independent member firm of Mazars Group. HE PATIENT PROTECTION AND Private Equity Deals in Healthcare Sector AFFORDABLE CARE ACT OF 2010 (ACA) HAS LED TO A TRANSFOR- Year Deals Capital MATION IN THE HEALTHCARE Invested TINDUSTRY. As of April 1, 2014, more than 7 million previously uninsured Americans have signed up for 2012 934 $108B healthcare through the ACA. Private equity firms and investors are wasting no time seeking ways to profit from 2013 1090 $123B this burgeoning market. In fact, private equity spending on healthcare has continued to increase since 2012, according Q1 2014 202 $43B to Pitchbook Data. If spending keeps pace with first quarter Source: Pitchbook Data 2014, the healthcare industry is set to see a record of almost $175 billion of private equity capital poured into it. their money strategically and they need more insight into which insurance plans best fulfill their particular needs. “This is the most comprehensive shift in the healthcare This shift isn’t lost on private equity firms, which are delivery model since Medicare was adopted in the 1960s. eagerly investing in technology that helps consumers make It’s no surprise that investors want to take part in this transparent decisions and take advantage of the fact that rebirth,” says Joseph Ibrahim, Principal with The Riverside they now have purchasing power over their insurance. Company.