2019 Welcome

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Equity and Corporate Governance: Retrospect and Prospect

353 Corporate Governance: An International Review, 2009, 17(3): 353–375 Private Equity and Corporate Governance: Retrospect and Prospect Mike Wright*, Kevin Amess, Charlie Weir and Sourafel Girma ABSTRACT Manuscript Type: Review Research Question/Issue: We assess the corporate governance role and the impact of private equity. Research Findings/Results: Private equity firms are heterogeneous in their characteristics and activities. Nevertheless, a corporate governance structure with private equity involvement provides incentives to reduce agency and free cash flow problems. Additionally, private equity enhances the efficacy of the market for corporate control. Private equity investment is associated with performance gains, with such gains not simply being a result of transfers from other stakeholders. In the short term, the benefits appear clear to outgoing owners and to the new owners and management while in the longer term the benefits are less clear. While non-financial stakeholders argue that other stakeholders suffer in the short and long term, the evidence to support this view is at best mixed. Theoretical Implications: By reviewing a comprehensive selection of theoretical and empirical papers published in refereed academic journals in finance, economics, entrepreneurship, and management as well as publicly available working papers and private equity industry studies, we develop a more complete understanding of private equity investment. Agency theory has shortcomings when applied to the broad sweep of private equity-backed buyout types, as in some cases pre-ownership change agency problems were likely low (e.g., family firms), in some cases the exploitation of growth opportunities owes more to the entrepreneurial behavior of managers than to improved incentives, and in some institu- tional contexts outside Anglo-Saxon countries traditional agency issues are different and stakeholder interests are more important. -

Annual Report 2019 Contents

Annual Report 2019 Contents 4 Foreword 93 Report of the Supervisory Board 6 Executive Board 102 Consolidated Financial Statements 103 Consolidated Statement of 8 The Axel Springer share Financial Position 10 Combined Management Report 105 Consolidated Income Statement 106 Consolidated Statement of 13 Fundamentals of the Axel Springer Group Comprehensive Income 24 Economic Report 107 Consolidated Statement of 44 Economic Position of Axel Springer SE Cash Flows 48 Report on risks and opportunities 108 Consolidated Statement of Changes in Equity 60 Forecast Report 109 Consolidated Segment Report 71 Disclosures and explanatory report on the Executive Board pursuant to takeover law 110 Notes to the Consolidated Financial Statements 77 Corporate Governance Report 180 Responsibility Statement 181 Independent Auditor’s Report 187 Boards 2 Group Key Figures in € millions Change yoy 2019 2018 Group Revenues – 2.2 % 3,112.1 3,180.7 Digital revenue share1) 73.3 % 70.6 % 2) EBITDA, adjusted – 14.5 % 630.6 737.9 EBITDA margin, adjusted2) 20.3 % 23.2 % 2) EBIT, adjusted – 21.5 % 414.5 527.9 EBIT margin, adjusted 2) 13.3 % 16.6 % Net income – 35.4 % 134.6 208.4 2) Net income, adjusted – 21.5 % 263.7 335.7 Segments Revenues Classifieds Media 0.1 % 1,213.8 1,212.5 News Media – 4.4 % 1,430.9 1,496.2 Marketing Media 0.8 % 421.5 418.3 Services/Holding – 14.4 % 46.0 53.7 EBITDA, adjusted2) Classifieds Media – 3.8 % 468.4 487.2 News Media – 39.3 % 138.5 228.2 Marketing Media 20.3 % 107.8 89.6 Services/Holding − – 84.1 – 67.0 EBIT, adjusted2) Classifieds Media – 7.1 % 377.9 406.7 News Media – 54.4 % 72.1 158.2 Marketing Media 26.1 % 83.3 66.0 Services/Holding − – 118.6 – 103.0 Liquidity and financial position 2) Free cash flow (FCF) – 38.1 % 214.6 346.9 2) 3) FCF excl. -

Financial Technology Sector Summary

Financial Technology Sector Summary July 30, 2014 Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access -

The Determinants of Bankruptcies Post LBO, Master Thesis, Jonas

The Determinants of Bankruptcies post LBO - A study of North American post LBO bankruptcies 1980-2006 Jonas Granström ♠ Pär Warnström ♣ Master’s Thesis in Finance Stockholm School of Economics This thesis aims to shed light upon the determinants of default amongst leveraged buy out targets. We study 519 North American bankruptcies of leveraged buyout transactions and examine specific characteristics of the private equity sponsor, the target firms and the economic climate at the time of the transaction. We study three main areas, private equity firm characteristics, target firm characteristics and economic climate. We find that young firms are more likely to face bankruptcy and that increasing profitability of the industry the target is active within at the time of the buyout have negative correlation with bankruptcy. Moreover, we find that deals made in boom periods as proxied by periods of low US-yield spread are more likely to default. Keywords: Private Equity, Buyouts, Financial Distress Tutor: Associate Professor Per Strömberg Date: Location: Stockholm School of Economics Discussants: Acknowledgements: We would like to thank Per Strömberg for his valuable support and advice throughout the process of writing this paper. ♠ [email protected] ♣ [email protected] 0 Contents 1. Introduction .......................................................................................................................... 2 2.Theoretical framework ......................................................................................................... -

The Current State of Lbos

Bachelor Thesis Economics and Business Faculty of Economics and Business Academic year: 2019 – 2020 The Current State of LBOs Specialization: Finance Student Name: Duricu Vlad Marco George Student Number: 11838418 Supervisor: Florencio Lopez de Silanes Molina 1 Statement of Originality This document is written by Student Vlad Marco George Duricu who declares to take full responsibility for this document's contents. I declare that the text and the work presented in this document are original and that no sources other than those mentioned in the text and its references have been used in creating it. The Faculty of Economics and Business is responsible solely for the supervision of completion of the work, not for the contents. Abstract This paper investigates if trends in the private equity industry and leveraged buyouts established by Stromberg (2007) prior to financial crisis still hold for the last decade. The focus of the research is on three categories sub-deals, regions and industries. It is also investigates what are the common characteristics of an attractive target for a leveraged buyout. The outcome regarding the common trends are different compared the period before the financial crisis. The main reason could be the change in the investor’s behavior (mainly PE). On the other hand, the characteristics of an attractive target for an LBO are in line with the literature. This illustrates that the behavior of the investors only changed in terms of non-financial factors. 2 Table of Contents 1. Introduction ............................................................................................................................................ -

Attendee Bios

ATTENDEE BIOS Ejim Peter Achi, Shareholder, Greenberg Traurig Ejim Achi represents private equity sponsors in connection with buyouts, mergers, acquisitions, divestitures, joint ventures, restructurings and other investments spanning a wide range of industries and sectors, with particular emphasis on technology, healthcare, industrials, consumer packaged goods, hospitality and infrastructure. Rukaiyah Adams, Chief Investment Officer, Meyer Memorial Trust Rukaiyah Adams is the chief investment officer at Meyer Memorial Trust, one of the largest charitable foundations in the Pacific Northwest. She is responsible for leading all investment activities to ensure the long-term financial strength of the organization. Throughout her tenure as chief investment officer, Adams has delivered top quartile performance; and beginning in 2017, her team hit its stride delivering an 18.6% annual return, which placed her in the top 5% of foundation and endowment CIOs. Under the leadership of Adams, Meyer increased assets managed by diverse managers by more than threefold, to 40% of all assets under management, and women managers by tenfold, to 25% of AUM, proving that hiring diverse managers is not a concessionary practice. Before joining Meyer, Adams ran the $6.5 billion capital markets fund at The Standard, a publicly traded company. At The Standard, she oversaw six trading desks that included several bond strategies, preferred equities, derivatives and other risk mitigation strategies. Adams is the chair of the prestigious Oregon Investment Council, the board that manages approximately $100 billion of public pension and other assets for the state of Oregon. During her tenure as chair, the Oregon state pension fund has been the top-performing public pension fund in the U.S. -

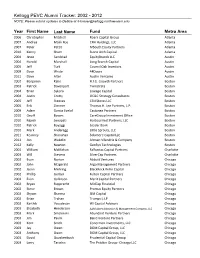

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 Report Produced on 9th October 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

The Brief Mergermarket’S Weekly Private Equity Round-Up

The Brief mergermarket’s Weekly Private Equity Round-Up 4 December 2009 | Issue 41 Editorial 1 The Noticeboard 2 Private Equity Opportunities 3 Deals of the Week 9 Pipeline 16 Statistics 19 League & Activity Tables 22 Top Deals 31 Investor Profile: Blackstone Group Holdings LLC 34 Notes & Contacts 36 The Week That Was..... The last seven days: private equity in review Over the past seven days, global private equity deal Mongolia-based Gobi Coal and Energy from En+ Group making was steady but somewhat unspectacular with for US$25m. Although the value of the deal falls firmly 15 transactions coming to the market, worth a collective in the lower end of the market, it is the largest private US$2.57bn. The top deal of the week was seen in Italy equity-related deal announced in Mongolia this decade. where Bridgepoint Capital and AXA Private Equity moved to acquire the gaming business of Snai, the company Deal flow over the second half of 2009 has certainly engaged in the design, construction and provision of suggested that private equity houses are becoming technology and services in the gambling industry, for a increasingly willing to return to the market after the total consideration of US$898m. global financial crisis. However, this week there was a sharp reminder to the asset class that the effects of The deal could prove to be an astute investment by the the economic downturn will be felt for some time yet buyout houses with Italy’s gaming market the second with beleaguered buyout firm Candover announcing largest in Europe and tipped to see annual growth of that it has agreed with investors to terminate the €3bn around 4-6% over the next five years. -

990-PF and Its Instructions Is at Www

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491314002224 Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947 (a)(1) Trust Treated as Private Foundation 0- Do not enter Social Security numbers on this form as it may be made public . By law, the 2013 IRS cannot redact the information on the form. Department of the Treasury 0- Information about Form 990-PF and its instructions is at www. irs.gov /form990pf . Internal Revenue Service For calendar year 2013 , or tax year beginning 01-01-2013 , and ending 12-31-2013 Name of foundation A Employer identification number John D and Catherine T MacArthur Foundation Consolidated 23-7093598 Number and street ( or P 0 box number if mail is not delivered to street address ) Room / suite 6 ieiepnone number ( see instructions) 140 South Dearborn Street No 1200 (312) 726-8000 City or town, state or province , country, and ZIP or foreign postal code C If exemption application is pending, check here F Chicago, IL 606035285 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations , check here F r-Final return r'Amended return 2. Foreign organizations meeting the 85% test, r Address change r'Name change check here and attach computation E If private foundation status was terminated H Check type of organization Section 501( c)(3) exempt private foundation und er section 507 ( b )( 1 )( A ), c hec k here F_ Section 4947 (a)(1) nonexempt charitable trust r'Other taxable private foundation I Fair market value of all assets at end J Accounting method F Cash F Accrual F If the foundation is in a 60-month termination of year (from Part II, col. -

Prestationsutveckling Hos Private Equity-Ägda Bolag

Prestationsutveckling hos Private Equity-ägda bolag Patrick Nurmio Handledare: Eva Liljeblom Institutionen för finansiell ekonomi och statistik Svenska handelshögskolan Helsingfors 2017 i SVENSKA HANDELSHÖGSKOLAN Institution: Arbetets art: Avhandling Institutionen för finansiell ekonomi och statistik Författare och Studerandenummer: Datum: 30.07.2017 Patrick Nurmio, 111660 Avhandlingen rubrik: Prestationsutveckling hos Private Equity-ägda bolag Sammandrag: Denna magisteravhandling studerar prestationsutvecklingen hos 84 stycken europeiska Private Equity-ägda bolag under ägarskapsperioden. Tidsperioden för Private Equity- ägarskapsperioderna sträcker sig från 1998 till 2017 och omfattar således olika konjunkturlägen. En stor del av den tidigare forskningen är begränsad till den amerikanska marknaden och de nyare tidsperioderna som undersökts är till största del före finanskrisen. Således bidrar denna magisteravhandling med resultat på en lägre utforskad marknad samt en nyare tidsperiod. Den operativa prestationsutvecklingen i målföretagen undersöks i relation till jämförelsegruppen mellan entry- och exit-tidpunkterna av det belånade uppköpet (eng. Leveraged Buyout). Jämförelsegrupperna består totalt av 1680 bolag matchade enligt NACE- industribeteckningar och utgör därmed 20 stycken per målföretag. Mer specifikt granskas den justerade förändringen i lönsamheten, omsättningstillväxten, effektiviteten och antalet anställda hos målföretagen. Av dessa är den genomsnittliga årliga omsättningstillväxten på fem procent och effektivitetsutvecklingen mätt som omsättning/anställda på 27 procent och EBITDA/anställd på 13,4 procent i medianvärde signifikanta. Utöver detta studeras även determinanter för den operativa prestationen mätt som lönsamhet. Determinanterna är anställningsförändringen, effektivitetsutvecklingen, skuldsättningen och Private Equity- sponsorns hemland. Av dessa bidrar en procents ökning i antalet anställda med 4,9 procents ökning i EBITDA-marginalen och en procents ökning i EBITDA/anställd med en 3,5 procents ökning i EBITDA marginalen. -

Financial Technology Sector Summary

Financial Technology Sector Summary May 7, 2014 Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access Service . Late Stage Private through . Broad Network Including