990-PF and Its Instructions Is at Www

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Theater Events: Body Image at Play in Clockwise's 'Impenetrable'

dailyherald.com http://www.dailyherald.com/article/20141010/entlife/141019986/ Theater events: Body image at play in Clockwise's 'Impenetrable' Barbara Vitello Body image A spa billboard showing a gorgeous, bikini-clad woman with arrows pointing to her imperfections and how they could be improved provokes outrage in a Chicago suburb in "Impenetrable" by Mia McCullough. Judy Blue directs Clockwise Theatre's production of the 2012 play about body image and perception and how this advertisement affects men and women in the community. Opens at 8 p.m. Friday, Oct. 10, at 221 N. Genesee St., Waukegan. $12, $20. See clockwisetheatre.org. A sneak peek The Actors Gymnasium offers a glimpse of new works as part of its Circus in Progress series showcasing circus arts. Featured artists include Striding Lion dance theater along with trapeze artist Camille Swift and Akemi Berry on silks. Next up is "A Circus Night's Dream," written and directed by The House Theatre's Chris Mathews. 4:30 and 7:30 p.m. Saturday, Oct. 11, at the Noyes Cultural Arts Center, 927 Noyes St., Evanston. $15. (847) 328-2795 or actorsgymnasium.org. Devil has his 'Day' Signal Ensemble Theatre opens its season with the world premiere of "Devil's Day Off" by Jon Steinhagen ("Blizzard '67," "Dating Walter Dante"). Set during a record-breaking heat wave that is accompanied by massive power outages, "Devil's Day Off" chronicles the fear, humor and heroism of the event through multiple vignettes. Co-artistic director Ronan Mara directs the premiere, which features 13 actors playing 100 characters. -

STATEMENT of PRINCIPLE No One Should Be Forced to Choose

STATEMENT OF PRINCIPLE No one should be forced to choose between her personal safety and dignity, and her job. But too often in the theater community this is exactly the choice that women must make. Sexual discrimination and harassment and gender-based violence often occur in the intimate and physical context of a theater production. Victims of such conduct face a stark choice between continuing to work in close collaboration with their abuser and quitting the show. Few can afford to give up a job and lose not only income, but also the opportunity for career advancement. There is a sense in the community that it is not necessarily in a victim’s best interest to report abuse because of fear that the response will be insufficient and open her up to retribution. In addition, many instances of abuse happen outside of the physical boundaries of a theater. No theater, union or guild currently takes responsible for handling such cases. However, the two people involved will most likely have to work together the next day or in another production, and the victims are left to deal with the aftermath by themselves. In the face of these realities, victims often choose silence and the abuse is allowed to continue. It is time for the theater community to break its own silence on harassment and abuse and formally address the problem. The reality is that those who behave abusively are generally in positions of power. Artistic directors hold the power to employ, playwrights have hiring approval; removing a director mid-rehearsal puts an entire production in doubt; losing a celebrity from the cast hurts ticket sales. -

Financial Technology Sector Summary

Financial Technology Sector Summary July 30, 2014 Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access -

Showtime 2004

FOR IMMEDIATE RELEASE Contact: Cathy Taylor, Cathy Taylor Public Relations (773) 564-9564; [email protected] Ben Thiem, Director of Member Services, League of Chicago Theatres (312) 554-9800; [email protected] SUMMER 2019 THEATER HIGHLIGHTS Chicago, IL – Celebrating 2019 as the Year of Chicago Theatre, Chicago will continue to produce some of the most exciting work in the country this summer. Offerings from the city’s more than 250 producing theaters feature everything from the latest musicals to highly anticipated world premieres. For a comprehensive list of Chicago productions including a Summer Theatre Guide, visit the League of Chicago website, ChicagoPlays.com. Half-price tickets are available at HotTix.org or at the two Hot Tix half- price ticket locations: across from the Chicago Cultural Center at Expo72 (72 E. Randolph) and Block Thirty Seven, Shops at 108 N. State. Hot Tix offers half-price tickets for the current week and some performances in advance. “As we approach the halfway point of the Year of Chicago Theatre, I encourage every Chicagoan and visitor to attend a production by one of our 250 theater companies. This summer, there is a wide range of offerings, including an impressive number of musicals and world premieres. Simply, there is something for everyone,” notes Deb Clapp, Executive Director of the League of Chicago Theatres. The following is a selection of notable work playing in Chicago throughout the summer: New works and adaptations include: Lookingglass Theatre presents a new adaptation of Mary Shelley’s Frankenstein. Mary Shelley’s unsettling story crackles to life as Victor Frankenstein must contend with his unholy creation. -

Explore Our Virtual Program

20|21 MICHAEL WEBER JEANNIE LUKOW Artistic Director Executive Director presents Featuring ANTHONY COURSER, PAM CHERMANSKY, CROSBY SANDOVAL, JAY TORRENCE, LEAH URZENDOWSKI & RYAN WALTERS Written by JAY TORRENCE Direction by HALENA KAYS This production was filmed during Porchlight Music Theatre’s premiere with The Ruffians at the Ruth Page Center for the Arts, December 13 - 27, 2019. Understudies for 2019 Production Nellie Reed: KAITLYN ANDREWS Henry Gilfoil/Eddie Foy: DAVE HONIGMAN Fancy Clown: JAY TORRENCE Faerie Queen/Robert Murray: RAWSON VINT Choreography by LEAH URZENDOWSKI Additional 2019 Choreography by ARIEL ETANA TRIUNFO Lighting Design MAGGIE FULLILOVE-NUGENT Original Scenic & Costume Design LIZZIE BRACKEN Scenic Design JEFF KMIEC Costume Design BILL MOREY Sound Design MIKE TUTAJ Associate Sound Design ROBERT HORNBOSTEL Original Properties Design MAGGIE FULLILOVE-NUGENT & LIZZIE BRACKEN Properties Master CAITLIN McCARTHY Original Associate Properties Design ARCHER CURRY Technical Direction BEK LAMBRECHT Production Stage Management JUSTINE B. PALMISANO Production Management SAM MORYOUSSEF & ALEX RHYAN Video Production MARTY HIGGENBOTHAM/THE STAGE CHANNEL The following artists significantly contributed to this performance and the play’s creation: Lizzie Bracken (set design, costume design, prop design), Dan Broberg (set design), Maggie Fullilove-Nugent (lighting design), Leah Urzendowski (choreography) & Mike Tutaj (sound design). The original 2011 cast included Anthony Courser, Dean Evans, Molly Plunk, Jay Torrence, Leah Urzendowski & Ryan Walters This performance runs 100 minutes without intermission. Please be aware this play contains flashing lights and some moments that may trigger an adverse reaction with sudden loud noises and sounds of violence. Porchlight Music Theatre acknowledges the generosity of Allstate, the Bayless Family Foundation, DCASE Chicago, the Gaylord and Dorothy Donnelley Foundation, James P. -

Joe Henderson: a Biographical Study of His Life and Career Joel Geoffrey Harris

University of Northern Colorado Scholarship & Creative Works @ Digital UNC Dissertations Student Research 12-5-2016 Joe Henderson: A Biographical Study of His Life and Career Joel Geoffrey Harris Follow this and additional works at: http://digscholarship.unco.edu/dissertations © 2016 JOEL GEOFFREY HARRIS ALL RIGHTS RESERVED UNIVERSITY OF NORTHERN COLORADO Greeley, Colorado The Graduate School JOE HENDERSON: A BIOGRAPHICAL STUDY OF HIS LIFE AND CAREER A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Arts Joel Geoffrey Harris College of Performing and Visual Arts School of Music Jazz Studies December 2016 This Dissertation by: Joel Geoffrey Harris Entitled: Joe Henderson: A Biographical Study of His Life and Career has been approved as meeting the requirement for the Degree of Doctor of Arts in the College of Performing and Visual Arts in the School of Music, Program of Jazz Studies Accepted by the Doctoral Committee __________________________________________________ H. David Caffey, M.M., Research Advisor __________________________________________________ Jim White, M.M., Committee Member __________________________________________________ Socrates Garcia, D.A., Committee Member __________________________________________________ Stephen Luttmann, M.L.S., M.A., Faculty Representative Date of Dissertation Defense ________________________________________ Accepted by the Graduate School _______________________________________________________ Linda L. Black, Ed.D. Associate Provost and Dean Graduate School and International Admissions ABSTRACT Harris, Joel. Joe Henderson: A Biographical Study of His Life and Career. Published Doctor of Arts dissertation, University of Northern Colorado, December 2016. This study provides an overview of the life and career of Joe Henderson, who was a unique presence within the jazz musical landscape. It provides detailed biographical information, as well as discographical information and the appropriate context for Henderson’s two-hundred sixty-seven recordings. -

Newly Cataloged Items in the Music Library December 2016 - January 2017

Newly Cataloged Items In the Music Library December 2016 - January 2017 Author Title Publisher Performers Item Enum Call Number 26 Italian songs and arias : an authoritative Alfred Pub. Co., On CD: Joan Thompson, MUSIC. edition based on authentic sources / John piano. MCD1619.T976 P3 Glenn Paton, editor. 1991 Med.High 53 masterpieces for alto sax and piano : Belwin, MUSIC. M268.S33 educational, recreational / arranged by F54 1943 Walter Schad. Alfred's Group Piano Book 2 w/ CD-rom Alfred's Group Piano for Adults w/CD Rom Cavaliers DVD Classics to moderns in the intermediate Consolidated Music MUSIC. M21 .A35 C42 grades / compiled and edited by Denes Publishers, 1962 Agay. Cowboys and Indies: Epic History of the Record Industry Dynamic Marching and Movement Vol I- DVD Dynamic Music in the Mix -DVD Dynamic Music vol 1 From the 50 Yard Line- DVD Introduction to music therapy research / Barcelona Publishers, MUSIC. ML3920 edited by Barbara L. Wheeler and .M874 2016 Kathleen M. Murphy. Introduction to music therapy research / Barcelona Publishers, MUSIC. ML3920 edited by Barbara L. Wheeler, Kathleen M. .M8741 2016 Murphy. Judas Maccabaeus: an oratorio / the music G. Schirmer, MUSIC. M2003.H14 by G.F. Handel ; words by Thos. Morrell. J73 K3 1939 Leadership Success -DVD/cdrom Rare choral masterpieces / compiled and Hall & McCreary, MUSIC. M2060.B37 edited by Parke S. Barnard. R3 1951 Tuesday, February 07, 2017 Page 1 of 15 Author Title Publisher Performers Item Enum Call Number Showcase of Bands 2013 MUSIC.RECITAL. MCD1 .W5726 2013 Feb.23 Teaching Music performance band Grade 4 vol 1 Teaching Music Performance band Grades 2-3 Teaching Music through Performance in Beginning Band Teaching Music through Performance in Beginning Band CD Grade 1 Triosonate : catalogue raisonné der G. -

Jeff Hughson Collection

http://oac.cdlib.org/findaid/ark:/13030/c8gt5v7h No online items Guide to the Jeff Hughson collection Devon Miller Center for Sacramento History 551 Sequoia Pacific Blvd. Sacramento, California 95811-0229 Phone: (916) 808-7072 Fax: (916) 264-7582 Email: [email protected] URL: http://www.centerforsacramentohistory.org/ © 2013 Center for Sacramento History. All rights reserved. Guide to the Jeff Hughson MS 67 1 collection Guide to the Jeff Hughson collection Collection number: MS 67 Center for Sacramento History Sacramento, CA Processed by: Devon Miller Date Completed: 2020-02-26 Encoded by: Devon Miller © 2013 Center for Sacramento History. All rights reserved. Descriptive Summary Title: Jeff Hughson collection Dates: 1952-2009 Collection number: MS 67 Creator: Hughson, Jeff (1950 - ) Collection Size: 2 linear feet(2 boxes) Repository: Center for Sacramento History Sacramento, California 95811-0229 Abstract: Jeff Hughson was born in Sacramento in 1950 and graduated from Sacramento High School in 1968 and shortly thereafter joined the staff of KZAP, Sacramento’s first freeform rock music radio station. This collection contains biographical information on Jeff Hughson on the form of one DVD and several news articles, and periodicals, radio playlists, concert flyers, promotional material, sound recordings and VHS tapes collected by Hughson and documenting the musical scene in Sacramento from the 1960s to the 1980s. Physical location: 30:I:01 Languages: Languages represented in the collection: English Access Collection is open for research use. Publication Rights All requests to publish or quote from private manuscripts held by the Center for Sacramento History (CSH) must be submitted in writing to the archivist. -

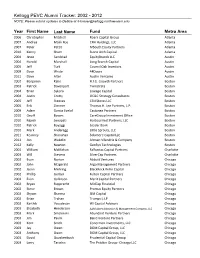

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

To Lead and Inspire Philanthropic Efforts That Measurably Improve the Quality of Life and the Prosperity of Our Region

2008 ANNUAL REPORT To lead and inspire philanthropic efforts that measurably improve the quality of life and the prosperity of our region. OUR VALUES Five values define our promise to the individuals and communities we serve: INTEGRITY Our responsibility, first and foremost, is to uphold the public trust placed in us and to ensure that we emulate the highest ethical standards, honor our commitments, remain objective and transparent and respect all of our stakeholders. STEWARDSHIP & SERVICE We endeavor to provide the highest level of service and due diligence to our donors and grant recipients and to safeguard donor intent in perpetuity. DIVERSITY & INCLUSION Our strength is found in our differences and we strive to integrate diversity in all that we do. COLLABORATION We value the transformative power of partnerships based on mutual interests, trust and respect and we work in concert with those who are similarly dedicated to improving our community. INNOVATION We seek and stimulate new approaches to address what matters most to the people and we serve, as well as support, others who do likewise in our shared commitment to improve metropolitan Chicago. OUR VISION The Chicago Community Trust is committed to: • Maximizing our community and donor impact through strategic grant making and bold leadership; • Accelerating our asset growth by attracting new donors and creating a closer relationship with existing donors; • Delivering operational excellence to our donors, grant recipients and staff members. In 2008, The Chicago Community Trust addressed the foreclosure crisis by spearheading an action plan with over 100 experts from 70 nonprofit, private and public organizations. -

Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 Report Produced on 9th October 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

The Brief Mergermarket’S Weekly Private Equity Round-Up

The Brief mergermarket’s Weekly Private Equity Round-Up 4 December 2009 | Issue 41 Editorial 1 The Noticeboard 2 Private Equity Opportunities 3 Deals of the Week 9 Pipeline 16 Statistics 19 League & Activity Tables 22 Top Deals 31 Investor Profile: Blackstone Group Holdings LLC 34 Notes & Contacts 36 The Week That Was..... The last seven days: private equity in review Over the past seven days, global private equity deal Mongolia-based Gobi Coal and Energy from En+ Group making was steady but somewhat unspectacular with for US$25m. Although the value of the deal falls firmly 15 transactions coming to the market, worth a collective in the lower end of the market, it is the largest private US$2.57bn. The top deal of the week was seen in Italy equity-related deal announced in Mongolia this decade. where Bridgepoint Capital and AXA Private Equity moved to acquire the gaming business of Snai, the company Deal flow over the second half of 2009 has certainly engaged in the design, construction and provision of suggested that private equity houses are becoming technology and services in the gambling industry, for a increasingly willing to return to the market after the total consideration of US$898m. global financial crisis. However, this week there was a sharp reminder to the asset class that the effects of The deal could prove to be an astute investment by the the economic downturn will be felt for some time yet buyout houses with Italy’s gaming market the second with beleaguered buyout firm Candover announcing largest in Europe and tipped to see annual growth of that it has agreed with investors to terminate the €3bn around 4-6% over the next five years.