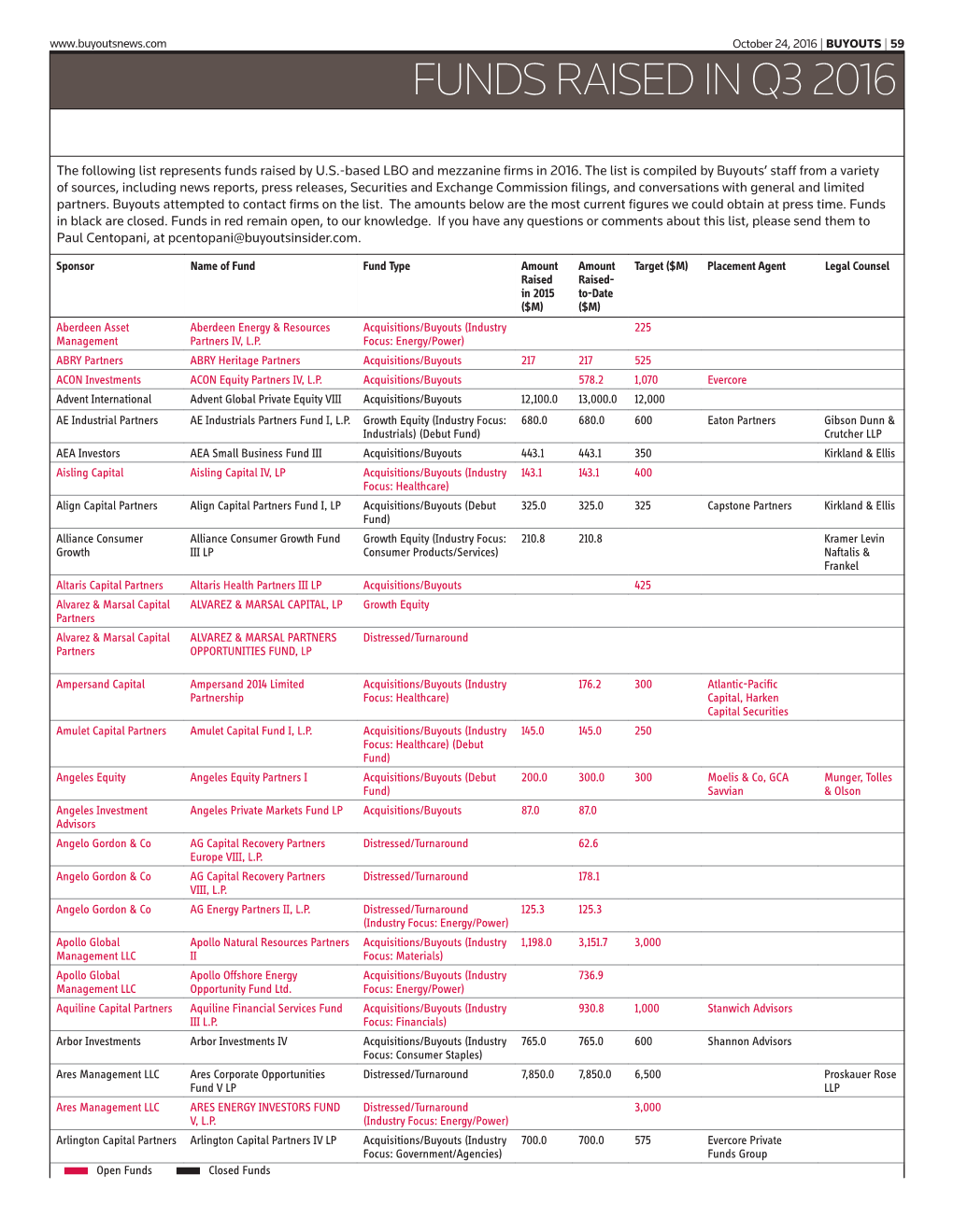

Funds Raised in Q3 2016 Funds Raised in Q3 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TRS Contracted Investment Managers

TRS INVESTMENT RELATIONSHIPS AS OF DECEMBER 2020 Global Public Equity (Global Income continued) Acadian Asset Management NXT Capital Management AQR Capital Management Oaktree Capital Management Arrowstreet Capital Pacific Investment Management Company Axiom International Investors Pemberton Capital Advisors Dimensional Fund Advisors PGIM Emerald Advisers Proterra Investment Partners Grandeur Peak Global Advisors Riverstone Credit Partners JP Morgan Asset Management Solar Capital Partners LSV Asset Management Taplin, Canida & Habacht/BMO Northern Trust Investments Taurus Funds Management RhumbLine Advisers TCW Asset Management Company Strategic Global Advisors TerraCotta T. Rowe Price Associates Varde Partners Wasatch Advisors Real Assets Transition Managers Barings Real Estate Advisers The Blackstone Group Citigroup Global Markets Brookfield Asset Management Loop Capital The Carlyle Group Macquarie Capital CB Richard Ellis Northern Trust Investments Dyal Capital Penserra Exeter Property Group Fortress Investment Group Global Income Gaw Capital Partners AllianceBernstein Heitman Real Estate Investment Management Apollo Global Management INVESCO Real Estate Beach Point Capital Management LaSalle Investment Management Blantyre Capital Ltd. Lion Industrial Trust Cerberus Capital Management Lone Star Dignari Capital Partners LPC Realty Advisors Dolan McEniry Capital Management Macquarie Group Limited DoubleLine Capital Madison International Realty Edelweiss Niam Franklin Advisers Oak Street Real Estate Capital Garcia Hamilton & Associates -

Themiddlemarket.Comt M

OCTOBER 2017 GO GO BIG SMALL OR GO HOME Private equity investors are heading to the lower middle market and the 350,000 companies that populate it TheMiddleMarket.comT m 0C1_MAJ100117 1 9/1/2017 11:40:00 AM B:8.125” T:7.875” S:7.375” Your clients’ wealth has multiplied. B:10.75” T:10.5” So has their S:10” need for advice. We know, because we know you well. Knowing clients well gives us the insight to help with their wealth— and their lives. Together, with your expertise and ours, we’ll help your clients before, during and after the sale of their business. Find out how strong relationships lead to 95% client satisfaction. 844-208-7863 | bnymellonwealth.com | @BNYMellonWealth Source: 2016 Client Satisfaction Survey. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2017 The Bank of New York Mellon Corporation. All rights reserved. 002_MAJ1017 2 8/30/2017 5:39:07 PM WGMT “ADVICE” AD - SIZE A 33/34/65/5 PUB: MERGERS & ACQUISITIONS Filename: 724476-5_J0176_WGMT_Advice_Size_A_V3R.indd CLIENT: BNY MELLON PRODUCT: Print Ad Agency Job Number: J0176 Cradle Job Number: 724476-5 JOB#: J0176 SPACE: 4C Proof #: 3, release Path: EG-PLUS-NY:Volumes:EG-PLUS-NY:EGPlus_Departments:Print:A‚ÄîF:TBWA:BNY_ Created: 8-3-2017 12:00 PM BLEED: 8.125” x 10.75” MELLON:724476-5_J0176_WGMT_ Advice_Size_A_Ad:MECHANICALS:724476-5_J0176_WGMT_Advice_Size_A_V3R.indd Saved: 8-3-2017 2:15 PM TRIM: 7.875” x 10.5” Operators: april_relucio / Daniel-Rivera Printed: 8-3-2017 2:15 PM SAFETY: 7.375” -

Private Equity Review

the Private Equity Review Private Private Equity Review Eighth Edition Editor Stephen L Ritchie Eighth Edition Eighth lawreviews © 2019 Law Business Research Ltd Private Equity Review Eighth Edition Reproduced with permission from Law Business Research Ltd This article was first published in June 2019 For further information please contact [email protected] Editor Stephen L Ritchie lawreviews © 2019 Law Business Research Ltd PUBLISHER Tom Barnes SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGER Joel Woods SENIOR ACCOUNT MANAGERS Pere Aspinall, Jack Bagnall ACCOUNT MANAGERS Olivia Budd, Katie Hodgetts, Reece Whelan PRODUCT MARKETING EXECUTIVE Rebecca Mogridge RESEARCH LEAD Kieran Hansen EDITORIAL COORDINATOR Tommy Lawson HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Robbie Kelly SUBEDITOR Charlotte Stretch CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2019 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained herein. Although the information provided is accurate as at April 2019, be advised that this -

ANNUAL REVIEW 2017 Land of the Giants Cycle-Tested Credit Expertise Extensive Market Coverage Comprehensive Solutions Relative Value Focus

ANNUAL REVIEW 2017 Land of the giants Cycle-Tested Credit Expertise Extensive Market Coverage Comprehensive Solutions Relative Value Focus Ares Management is honored to be recognized as Lender of the Year in North America for the fourth consecutive year as well as Lender of the Year in Europe Lender of the year in Europe Ares Management, L.P. (NYSE: ARES) is a leading global alternative asset manager with approximately $106 billion of AUM1 and offices throughout the United States, Europe, Asia and Australia. With more than $70 billion in AUM1 and approximately 235 investment professionals, the Ares Credit Group is one of the largest global alternative credit managers across the non-investment grade credit universe. Ares is also one of the largest direct lenders to the U.S. and European middle markets, operating out of twelve office locations in both geographies. Note: As of December 31, 2017. The performance, awards/ratings noted herein may relate only to selected funds/strategies and may not be representative of any client’s given experience and should not be viewed as indicative of Ares’ past performance or its funds’ future performance. 1. AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and a registered investment adviser. learn more at: www.aresmgmt.com | www.arescapitalcorp.com The battle of the brands the US market on page 80, advisor Hamilton TOBY MITCHENALL Lane said it had received a record number EDITOR'S of private placement memoranda in 2017 – ISSN 1474–8800 LETTER MARCH 2018 around 800 – and that this, combined with Senior Editor, Private Equity faster fundraising processes, has made it dif- Toby Mitchenall, Tel: +44 207 566 5447 [email protected] ficult to some investors to make considered Special Projects Editor decisions. -

Trs Investment Relationships As of June 2020

TRS INVESTMENT RELATIONSHIPS AS OF JUNE 2020 Global Public Equity (Global Income continued) Acadian Asset Management Oaktree Capital Management AQR Capital Management Pacific Investment Management Company Arrowstreet Capital Pemberton Capital Advisors Axiom International Investors PGIM Dimensional Fund Advisors Proterra Investment Partners Emerald Advisers Riverstone Credit Partners Grandeur Peak Global Advisors Solar Capital Partners JP Morgan Asset Management Taplin, Canida & Habacht/BMO LSV Asset Management Taurus Funds Management Northern Trust Investments TCW Asset Management Company RhumbLine Advisers Varde Partners Strategic Global Advisors T. Rowe Price Associates Real Assets Wasatch Advisors Barings Real Estate Advisers The Blackstone Group Transition Managers Brookfield Asset Management The Carlyle Group Citigroup Global Markets CB Richard Ellis Loop Capital Dyal Capital Macquarie Capital Exeter Property Group Northern Trust Investments Fortress Investment Group Penserra Gaw Capital Partners Heitman Real Estate Investment Management Global Income INVESCO Real Estate AllianceBernstein LaSalle Investment Management Apollo Global Management Lion Industrial Trust Beach Point Capital Management Lone Star Cerberus Capital Management LPC Realty Advisors Dolan McEniry Capital Management Macquarie Group Limited DoubleLine Capital Madison International Realty Edelweiss Niam Franklin Advisers Oak Street Real Estate Capital Garcia Hamilton & Associates Principal Real Estate Investors Hayfin Capital Management Proterra Investment Partners -

Financial Technology Sector Summary

Financial Technology Sector Summary July 30, 2014 Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access -

Probitas Partners 2021 Institutional Investors Private Equity Survey December 2020 Table of Contents

Probitas Partners 2021 Institutional Investors Private Equity Survey December 2020 Table of Contents Topic Page . Survey Highlights 2 . Background and Appetite 3 . Sectors of Interest 9 . Geographies of Interest 18 . Middle-Market Buyouts 25 . Venture Capital 28 . Niche Sectors 31 . Structural Issues 38 . Investor Fears 43 . Summary 46 Confidential and Trade Secret © 2020 Probitas Partners 1 Survey Highlights – and The Pandemic . The Pandemic has had a roller coaster impact on institutional investors during 2020 as the normal market environment of January plunged into volatility and uncertainty in March and April followed by a slow rebound in public market and private market valuations . By late October prices for many firms returned to January levels as various stimulus plans mitigated certain economic impacts and progress in developing vaccines gave hope for a return to “normal” sometime in 2021 . Probitas’ latest annual survey was taken over the first two weeks of November after the markets had recovered significantly from the depths of April – and the results of a survey done in April would have been very different from what we are showing now . In private equity, investors are still heavily focused on U.S. and European Middle- Market Buyouts and U.S. Growth Capital, though interest in Asian private equity has increased from this time last year . In the second and third quarter of 2020 there was sharply increased interest in secondaries and distressed private equity – but at this point, many investors seem to have already made their bets in these sectors and are waiting for their commitments to be invested before committing too much more to these sectors . -

Download the 2020 Report

MBA Careers 2020 Employment Summary CLASS OF 2021 INTERNSHIPS CLASS OF 2020 FULL-TIME NUMBER PERCENTAGE NUMBER PERCENTAGE TOTAL NUMBER OF STUDENTS 852 904 Students Seeking Employment 775 91.0% 681 75.3% Reporting Job Offers 774 99.9 637 93.5 Reporting Job Acceptances 771 99.5 624 91.6 Students Not Seeking Employment 48 5.3 159 17.6 Company-Sponsored (Returning to Company) 3 111 Self-Employed/Starting Own Business 24 28 Postponed Job Search/Continuing Education 1 17 Personal Reasons/Other 20 3 Students Not Responding to Survey 33 3.6 64 7.1 Data current as of September 14, 2020, and it is collected and reported according to MBA Career Services and Employer Alliance standards. Compensation CLASS OF 2021 INTERNSHIPS CLASS OF 2020 FULL-TIME by Industry (MONTHLY) (ANNUAL) PERCENT ACCEPTS MEDIAN SALARY PERCENT ACCEPTS MEDIAN SALARY ALL INDUSTRIES $9,200 $150,000 Consulting 16.4% $13,500 24.5% $165,000 Consumer Products 2.8 8,333 2.4 122,500 Energy 1.3 7,667 0.2 — Financial Services 36.0 10,416 36.2 150,000 Hedge Funds/Other Investments 3.3 10,000 3.2 150,000 Insurance & Diversified Services 2.3 9,666 1.4 125,000 Investment Banking/Brokerage 10.7 12,500 12.2 150,000 Investment Management 4.6 10,721 4.5 150,000 Private Equity/Buyouts/Other 8.0 10,000 11.9 170,000 Venture Capital 7.1 6,000 3.0 171,500 FinTech 1.5 5,000 2.1 140,000 Future Mobility 0.4 — — — Health Care 7.4 7,954 6.7 140,000 Legal & Professional Services 1.2 12,917 1.8 190,000 Manufacturing 2.3 7,800 0.8 — Media, Entertainment & Sports 1.3 5,170 1.3 150,000 Real Estate 2.1 7,210 2.9 120,000 Retail 5.2 6,150 3.2 140,000 Social Impact 5.3 4,480 1.8 89,250 Technology 16.9 8,666 16.2 139,345 Travel & Hospitality 0.1 — — — Median base salary for one year only. -

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please Submit Updates to Debbie at [email protected]

Kellogg PEVC Alumni Tracker: 2002 - 2012 NOTE: Please submit updates to Debbie at [email protected] Year First Name Last Name Fund Metro Area 2006 Christopher Mitchell Roark Capital Group Atlanta 2007 Andrea Malik Roe CRH Holdings, LLC Atlanta 2007 Peter Pettit MSouth Equity Partners Atlanta 2010 Kenny Shum Stone Arch Capital Atlanta 2004 Jesse Sandstad EquityBrands LLC Austin 2004 Harold Marshall Long Branch Capital Austin 2005 Jeff Turk Council Oak Investors Austin 2009 Dave Wride 44Doors Austin 2011 Dave Alter Austin Ventures Austin 2002 Benjamin Kahn H.I.G. Growth Partners Boston 2003 Patrick Davenport Twinstrata Boston 2004 Brian Sykora Lineage Capital Boston 2004 Justin Crotty OC&C Strategy Consultants Boston 2005 Jeff Steeves CSN Stores LLC Boston 2005 Erik Zimmer Thomas H. Lee Partners, L.P. Boston 2009 Adam Garcia Evelof Castanea Partners Boston 2010 Geoff Bowes CareGroup Investment Office Boston 2010 Rajesh Senapati HarbourVest Partners, LLC Boston 2010 Patrick Boyaggi Leader Bank Boston 2010 Mark Anderegg Little Sprouts, LLC Boston 2011 Kearney Shanahan Solamere Capital LLC Boston 2012 Jon Wakelin Altman Vilandrie & Company Boston 2012 Kelly Newton GenSyn Technologies Boston 2003 William McMahan Falfurrias Capital Partners Charlotte 2003 Will Stevens SilverCap Partners Charlotte 2002 Evan Norton Abbott Ventures Chicago 2002 John Fitzgerald Argo Management Partners Chicago 2002 Jason Mehring BlackRock Kelso Capital Chicago 2002 Phillip Gerber Fulton Capital Partners Chicago 2002 Evan Gallinson Merit Capital Partners -

Private Equity Benchmark Report

Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 alternative assets. intelligent data. Preqin Private Equity Benchmarks: All Private Equity Benchmark Report As of 31st March 2014 Report Produced on 9th October 2014 This publication is not included in the CLA Licence so you must not copy any portion of it without the permission of the publisher. All rights reserved. The entire contents of the report are the Copyright of Preqin Ltd. No part of this publication or any information contained in it may be copied, transmitted by any electronic means, or stored in any electronic or other data storage medium, or printed or published in any document, report or publication, without the express prior written approval of Preqin Ltd. The information presented in the report is for information purposes only and does not constitute and should not be construed as a solicitation or other offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction, or as advice of any nature whatsoever. If the reader seeks advice rather than information then he should seek an independent fi nancial advisor and hereby agrees that he will not hold Preqin Ltd. responsible in law or equity for any decisions of whatever nature the reader makes or refrains from making following its use of the report. While reasonable efforts have been used to obtain information from sources that are believed to be accurate, and to confi rm the accuracy of such information wherever possible, Preqin Ltd. Does not make any representation or warranty that the information or opinions contained in the report are accurate, reliable, up-to-date or complete. -

The Brief Mergermarket’S Weekly Private Equity Round-Up

The Brief mergermarket’s Weekly Private Equity Round-Up 4 December 2009 | Issue 41 Editorial 1 The Noticeboard 2 Private Equity Opportunities 3 Deals of the Week 9 Pipeline 16 Statistics 19 League & Activity Tables 22 Top Deals 31 Investor Profile: Blackstone Group Holdings LLC 34 Notes & Contacts 36 The Week That Was..... The last seven days: private equity in review Over the past seven days, global private equity deal Mongolia-based Gobi Coal and Energy from En+ Group making was steady but somewhat unspectacular with for US$25m. Although the value of the deal falls firmly 15 transactions coming to the market, worth a collective in the lower end of the market, it is the largest private US$2.57bn. The top deal of the week was seen in Italy equity-related deal announced in Mongolia this decade. where Bridgepoint Capital and AXA Private Equity moved to acquire the gaming business of Snai, the company Deal flow over the second half of 2009 has certainly engaged in the design, construction and provision of suggested that private equity houses are becoming technology and services in the gambling industry, for a increasingly willing to return to the market after the total consideration of US$898m. global financial crisis. However, this week there was a sharp reminder to the asset class that the effects of The deal could prove to be an astute investment by the the economic downturn will be felt for some time yet buyout houses with Italy’s gaming market the second with beleaguered buyout firm Candover announcing largest in Europe and tipped to see annual growth of that it has agreed with investors to terminate the €3bn around 4-6% over the next five years. -

Private Equity Forecast & Desk Book

Private Equity Forecast & Desk Book 2014 On an ongoing basis, Probitas Partners offers research and investment tools for the alternative investment market to aids its institutional investor and general partner clients. Probitas Partners compiles data from various trade and other sources and then vets and enhances that data via its team’s broad knowledge of the market. probity ¯¯˘ n. [from Latin probitas: good, proper, honest.] adherence to the highest principles, ideals and character. Probitas Partners is pleased to present its Private Equity Forecast & Desk Book 2014. The purpose of this paper is to offer our forward view of likely trends for 2014 and beyond based on our review of 2013 and our ongoing dialog with (and surveys of) the global institutional investor marketplace. The paper starts with our forecast for this year, then presents a summary review of the dominant trends that shaped 2013 and the details behind those trends. We encourage you to obtain copies of our research reports, surveys, and desk books from our firm’s library at: www.probitaspartners.com/alternative_investments_publications/ Contents Private Equity Outlook .............................................................. 2 Private Equity Fundraising ....................................................... 4 Deal Volume and Capital Overhang ....................................... 7 The Buyout Market: Investor Focus and Concerns ............... 9 U.S. Venture Capital ................................................................ 13 Distressed Private Equity .......................................................