The Mineral Industry of Turkey in 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27 Yurt içinde bugün TCMB faiz kararı takip edilecek Haftalık Getiriler (%) 1,5 1,2 ● TCMB’nin politika faizini sabit tutması bekleniyor 1,0 0,7 0,4 ● ABD’de yıllık enflasyon, %5,4 düzeyinde yatay seyretti 0,5 ● ABD Senatosu, 3,5 trilyon $’lık harcama paketini onayladı 0,0 -0,5 Küresel çapta, ABD'de tüketici fiyatları temmuz ayında aylık bazda -1,0 %0,5 artış gösterdi. Haziran ayında aylık enflasyon %0,9 -1,5 -1,5 düzeyinde gerçekleşmiş idi. Bu temmuz ayı gerçekleşmesi ile, yıllık -2,0 -1,7 enflasyon da %5,4 düzeyinde yatay seyretti. Yıllık çekirdek enflasyon Dolar/TL Euro/TL Gram Altın BIST-100 Gösterge Tahvil ise, %4,5'ten %4,3'e geriledi. ABD‘de özellikle enflasyon ve işgücü piyasasına yönelik veriler, Fed'in varlık alımlarında azaltıma Veriler (Bugün) Önceki Beklenti başlayabileceği tarih açısından kritik öneme sahip. TCMB Faiz Kararı (%) 19,0 19,0 Euro Bölgesi Sanayi Bölgesi ABD Senatosu, Başkan Biden'ın ekonomik reform takviminde -1,0 0,2 (Haziran, aylık % değişim, m.a.) bulunan 3,5 trilyon $ tutarındaki bütçe taslağına 50'ye karşı 49 oy ile onay verdi. Tasarının, ABD hükümetinin sosyal ve çevresel konulara yönelik daha fazla harcama yapmasına imkan tanıyacağı Yatırımcı Takvimi için tıklayınız belirtiliyor. Küresel çapta günlük vaka sayıları 7 günlük ortalamalar Devlet Tahvili Getirileri bazında artış eğilimini sürdürürken, ABD'de ve Avrupa'da, aşı (%) 11/08 10/08 2020 olmayanlara yönelik kısmi zorlayıcı tedbirler yürürlüğe giriyor. -

En-Isbank2009.Pdf

Contents Presentation 1 İşbank at the onset of 2010 2 Turkey’s Bank 4 İşbank since 1924 5 İşbank’s Vision, Objectives, and Strategy 6 Pioneering Activities 7 İşbank’s Financial Indicators and Shareholder Structure 8 Chairman’s Message 12 CEO’s Message 18 İşbank’s transformation journey: Customer Centric Transformation (MOD) 20 The Economic Outlook in 2009 26 İşbank in 2009 49 Subsidiaries 54 Corporate Social Responsibility at İşbank 60 Annual Report Compliance Opinion Management and Corporate Governance at İşbank 62 Board of Directors & Auditors 64 Executive Committee 66 Organization Chart 68 Managers of Internal Systems 68 Information About the Meetings of the Board of Directors 69 İşbank Committees 71 Human Resources Functions at İşbank 72 Information on the Transactions Carried out with İşbank’s Risk Group 72 Activities for which Support Services are Received in Accordance with the Regulation on Procurement of Support Services for Banks and Authorization of Organizations Providing this Service 73 İşbank’s Dividend Distribution Policy 74 Agenda of the Annual General Meeting 75 Report of the Board of Directors 76 Auditors’ Report 77 Dividend Distribution Proposal 78 Corporate Governance Principles Compliance Report Financial Information and Assessment on Risk Management 89 Audit Committee’s Assessments on the Operation of Internal Control, Internal Audit and Risk Management Systems, and Their Activities in the Reported Period 91 Independent Auditors’ Report 92 Unconsolidated Financial Statements 102 Financial Highlights and Key Ratios -

Mineral Exploration: What, Where • and Why in Turkey

by Mining & Earth Sciences Magazine 01 September 2011 | Vol 1 | Number 1 | www.madencilik-turkiye.com • Mineral Exploration: What, Where and Why in Turkey • Turkey: Europe’s Largest Gold Producer • Mining Sector In The World and In Turkey contents Mining Turkey is published biannually by Mayeb Madencilik ve Yer Bilimleri Basım Yayın Dağıtım Ltd. 2...... FROM THE EDITOR 1042. Cd. 1335. Sk. Vadi Köşk Apt. No: 6/8 A. Öveçler / ANKARA / TURKEY Tel : +90 (312) 482 18 60 4...... NEWS Fax : +90 (312) 482 18 61 [email protected] www.madencilik-turkiye.com 12...... MINERAL EXPLORATION: WHAT, WHERE AND General Coordinator Onur Aydın WHY IN TURKEY by Özcan Yiğit [email protected] Editor - International Relations O. Çağım Tuğ 20...... FLSMIDTH company profile [email protected] News Ceren Kılıç 21...... CHESSER RESOURCES company profile [email protected] Graphic Design M. Anıl Tuğ 22...... TURKEY: EUROPE’S LARGEST GOLD PRODUCER [email protected] Merve Mallı [email protected] by Muhterem Köse Web Technologies Bilgin B. Yılmaz [email protected] 26...... MAXWELL GEOSERVICES company profile Legal Adviser Av. Evrim İnal [email protected] 28...... MINING SECTOR IN THE WORLD AND IN Academical Advisers Assoc. Prof. C. Okay Aksoy Assoc. Prof. Ali Sarıışık TURKEY by MSBK Assoc. Prof. Erol Kaya Assoc. Prof. Hakan Başarır Assoc. Prof. M. Emin Candansayar 32...... MINING COMPANIES IN TURKEY’S TOP 500 Assoc. Prof. Talip Güngör Assist. Prof. Melih Geniş Assist. Prof. Melih Iphar INDUSTRIAL ENTERPRISES OF 2010 Assist. Prof. Nuray Demirel Advertising Sales by Madencilik Türkiye Magazine [email protected] Annual Subscription Enquiries [email protected] Advertisers index 01 September 2011 1 Editor www.madencilik-turkiye.com 1979 to 2011. -

Discussion and Evaluation of Mining and Environment Laws of Turkey with Regard to Eu Legislation

DISCUSSION AND EVALUATION OF MINING AND ENVIRONMENT LAWS OF TURKEY WITH REGARD TO EU LEGISLATION A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY ŞÜKRÜ ŞAFAK IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN MINING ENGINEERING SEPTEMBER 2006 1 Approval of the Graduate School of Natural and Applied Sciences Prof. Dr. Canan Özgen Director I certify that this thesis satisfies all the requirements as a thesis for the degree of Master of Science Prof. Dr. Ümit Atalay Head of Department This is to certify that we have read this thesis and that in our opinion it is fully adequate, in scope and quality, as a thesis for the degree of Master of Science. Assoc. Prof. Dr. Aydın Bilgin Supervisor Examining Committee Members Prof. Dr. Tevfik Güyagüler (METU, MINE) Assoc. Prof. Dr. Aydın Bilgin (METU, MINE) Prof. Dr. Naci Bölükba şı (METU, MINE) Prof. Dr. Ali İhsan Arol (METU, MINE) Assist. Prof. Dr. M. Ali Hindistan (HÜ, MINE) 1 I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last Name: Şükrü, ŞAFAK Signature : iii ABSTRACT DISCUSSION AND EVALUATION OF MINING AND ENVIRONMENT LAWS OF TURKEY WITH REGARD TO EU LEGISLATION ŞAFAK, Şükrü M.S., Department of Mining Engineering Supervisor : Assoc. Prof. Dr. Aydın Bilgin September 2006, 140 pages Turkey is trying to become a member of the European Union. -

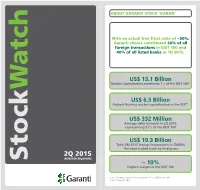

2Q 2015, Representing 21% of the BIST 100

ABOUT GARANTI STOCK ‘GARAN’ With an actual free float ratio of ~50%, Garanti shares constituted 20% of all foreign transactions in BIST 100 and 40% of all listed banks in 1H 2015. US$ 13.1 Billion Market Capitalization constitutes 7% of the BIST 100* Watch US$ 6.5 Billion Highest floating market capitalization in the BIST* US$ 332 Million Average daily turnover in 2Q 2015, representing 21% of the BIST 100 US$ 19.3 Billion Total 6M 2015 foreign transactions in GARAN The most traded stock by foreigners 2Q 2015 INVESTOR RELATIONS Stock ~ 10% Highest weight in the BIST 100 Note: Currency conversion is based on US$/TL CBRT ask rate. * As of June 30, 2015 GARANTI FINANCIAL HIGHLIGHTS Garanti Market Shares* Jun-15 QoQ ∆ In the first half of 2015, Garanti Total Performing Loans 11.8% reached consolidated total TL Loans 10.8% asset of US$ 99.9 billion and FC Loans 14.1% Credit Cards - Issuing (Cumulative) 19.1% consolidated net profit of Credit Cards - Acquiring (Cumulative) 20.4% US$ 777.7 million. Consumer Loans** 14.0% Total Customer Deposits 11.4% TL Customer Deposits 9.3% FC Customer Deposits 14.1% SELECTED FINANCIALS* Customer Demand Deposits 13.5% Mutual Funds 11.0% Total Assets Total Performing Loans * Figures are based on bank-only financials for fair comparison with sector. Sector US$ 99.9 Billion US$ 60.0 Billion figures are based on BRSA weekly data for commercial banks only. ** Including consumer credit cards and other Total Deposits Shareholders’ Equity Garanti with Numbers* US$ 54.7 Billion US$ 10.5 Billion Dec-14 Mar-15 Jun-15 -

Etimine USA Inc. AB Etiproducts O.Y

Etimine USA, Inc. Borate and Boron Product Usage in the Oil and Gas Industry Borate mineral ores such as Ulexite and Colemanite, as well as refined borates and boron products, are important additives found in many formulations used in petroleum, natural gas and shale gas well operations in order to maximize yields and improve performance. When using guar gums, for example, the crosslinking action of borate’s B2O3 content gives drilling fluids the viscosity needed at less expense than simply using more guar gum to achieve the same viscosity. Ulexite’s delayed solubility means viscosity increase is delayed. When mixed just before using, it is easier to pump drilling fluids at a well head’s entry. Furthermore, borate’s pH sensitivity means drillers can easily reverse the crosslinking via buffers, making the fluid much easier to pump back to the surface once the job is done. Eti Maden and Etimine USA offer borate and boron product grades designed for oil and gas industry applications, including especially fine particle sizes that reduce filter clogging. Depending on the situation and type of application—such as drilling muds, well stimulation or fracking— borate and boron products are selected alongside other chemical components in order to modify a formulation’s viscosity, pH, thermal stability, lubricity and/or flow rate. Among the more popular borate products for use in oil and gas exploration, drilling and well completion, mineral ores Colemanite and Ulexite are the subject of numerous patents in the energy industry. Formulators and users are strongly encouraged to evaluate the current and pending patents to assess their ability to operate without infringing on protected intellectual property. -

Istanbul Jewelry School Spreads to the World Behold the Jewels, from the Ancient Lands, Where Civilisations Flourished, Gifts Crafted by the Artisanship of Ages

YOUR COMPLIMENTARY COPY BRIEFING Turkey aims to export $190B in 2020 INDEPT Turkish Jewelry all over the Word INTERVIEW Deva CEO TheTurkish Philipp Haas PerspectiveFEBRUARY 2020 ISSUE 79 ECONOMY I BUSINESS I FOREIGN TRADE I ANALYSIS Istanbul Jewelry School Spreads to the World Behold the jewels, from the ancient lands, where civilisations flourished, gifts crafted by the artisanship of ages. It is the historical and cultural heritage that these rare accesories bear, that makes you feel special when you touch, put them on or wear them, rather than their monetary value. The Turkish Perspective TheTurkish Perspective Contents FEBRUARY 2020 ISSUE 79 Snow Globe of the World: 42Turkey Mckinsey: Artificial Intelligence The Power Symbol Turkey’s innovation ecosystem 14 to create 3.1 million jobs in 28 of Turkey: Jewelry 46 grows above the EU average Turkey 2019 exports reach to record Kamar: Our exports totaled 7.2 16 level of 180.5 billion dollars 30 billion dollars in 2019 THY awarded as Turkey’s A Master of Murassa: 20 top service exporter 35 Hrac Aslanyan Franchise sector to create an FDI Spotlight in Turkey Turkey’s Car Introduced 48 ecosystem of 50 billion dollars 22 38 in 2020 Foreign investors generated 64 Turkey eyes 120 billion USD Gastronomical reflection of 26 percent of Turkish M&A market 40 from tourism 54 Turkish Culture deal volume Mediterranean Cuisine FEBRUARY 2020 ISSUE 79 3 TheTurkish Perspective FEBRUARY 2020 ISSUE 79 THE TURKISH PERSPECTIVE RENEWED Management Publisher On Behalf Of Turkish Exporters Assembly Chairman Of The Turkish Exporters Assembly The Turkish Perspective continues publishing İsmail GÜLLE Strategic Partner with its renewed content in 2020. -

World Flame Retardants

INDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS CLICK TO VIEW Table of Contents 2 List of Tables & Charts 3 Study Overview 5 Sample Text, Table & Chart 6 Sample Profile, Table & Forecast 7 Order Form & Corporate Use License 8 photo: Universal Carbon Fibers About Freedonia, Custom Research, Related Studies, 9 World Flame Retardants Industry Study with Forecasts for 2016 & 2021 Study #2987 | February 2013 | $6100 | 336 pages The Freedonia Group 767 Beta Drive www.freedoniagroup.com Cleveland, OH • 44143-2326 • USA Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 E-mail: [email protected] Study #2987 February 2013 World Flame Retardants $6100 336 Pages Industry Study with Forecasts for 2016 & 2021 Table of Contents EXECUTIVE SUMMARY Flame Retardant Demand .......................95 Industry Restructuring ........................ 256 United States ......................................97 Competitive Strategies ........................ 258 MARKET ENVIRONMENT Canada ............................................. 104 Product Differentiation & Mexico ............................................. 110 Market Segmentation ..................... 259 General ................................................4 Research & Development .................. 260 Global Economic Overview .......................5 WESTERN EUROPE Cooperative Agreements ................... 261 Recent Historical Trends .......................5 Marketing & Distribution ..................... 264 World Economic Outlook .......................7 -

Turkish Outbound M&A Review 2014-2015

Turkish Outbound M&A Review 2014-2015 May 2016 2 Foreword Despite volatile financial markets and local political tension in the last two years, Turkish companies were keen on expanding their global footprint via acquisitions in new geographies. Although the number of deals was lower as compared to the previous periods, the deal volume was remarkable. Turkish corporates’ appetite to expand in global markets translated into a record-breaking level in 2014 in terms of deal value, especially through a couple of mega deals; and last year Turkish investors remained eager but cautious in investing abroad, due to the ascending political uncertainty and weakened financial performance of the companies. Looking ahead, cross border acquisitions of Turkish companies will increase at a strong pace as part of their operational strategies towards becoming regional players and benefiting from the growth potential in the new markets. On behalf of our corporate finance team in Deloitte Turkey, we are delighted to share our Turkish Outbound M&A Review, featuring our analyses regarding the cross-border investments of Turkish corporates over the past two years. Başak Vardar Financial Advisory Leader Partner Turkish Outbound M&A Review 2014-2015 1 Basis of Presentation Transaction data presented in this report are based on information that is readily available in the public domain and include transactions with closing procedures still ongoing at the year end. This study does not include capital market transactions or intra-group share transfers but covers real estate acquisitions, infrastructure projects and concessions. We do not accept any responsibility as to the accuracy or completeness of the data or as to whether all transactions listed herein will necessarily close. -

The Mineral Industry of Turkey in 2016

2016 Minerals Yearbook TURKEY [ADVANCE RELEASE] U.S. Department of the Interior January 2020 U.S. Geological Survey The Mineral Industry of Turkey By Sinan Hastorun Turkey’s mineral industry produced primarily metals and decreases for illite, 72%; refined copper (secondary) and nickel industrial minerals; mineral fuel production consisted mainly (mine production, Ni content), 50% each; bentonite, 44%; of coal and refined petroleum products. In 2016, Turkey was refined copper (primary), 36%; manganese (mine production, the world’s leading producer of boron, accounting for 74% Mn content), 35%; kaolin and nitrogen, 32% each; diatomite, of world production (excluding that of the United States), 29%; bituminous coal and crushed stone, 28% each; chromite pumice and pumicite (39%), and feldspar (23%). It was also the (mine production), 27%; dolomite, 18%; leonardite, 16%; salt, 2d-ranked producer of magnesium compounds (10% excluding 15%; gold (mine production, Au content), 14%; silica, 13%; and U.S. production), 3d-ranked producer of perlite (19%) and lead (mine production, Pb content) and talc, 12% each (table 1; bentonite (17%), 4th-ranked producer of chromite ore (9%), Maden İşleri Genel Müdürlüğü, 2018b). 5th-ranked producer of antimony (3%) and cement (2%), 7th-ranked producer of kaolin (5%), 8th-ranked producer of raw Structure of the Mineral Industry steel (2%), and 10th-ranked producer of barite (2%) (table 1; Turkey’s industrial minerals and metals production was World Steel Association, 2017, p. 9; Bennett, 2018; Bray, 2018; undertaken mainly by privately owned companies. The Crangle, 2018a, b; Fenton, 2018; Klochko, 2018; McRae, 2018; Government’s involvement in the mineral industry was Singerling, 2018; Tanner, 2018; van Oss, 2018; West, 2018). -

Political Economy of Conflict: Evidence from Turkey

Markets, Conflict, and Incumbent Tenure: Evidence From Turkey's Kurdish Insurgency Emine Deniz ∗ February 3, 2020 ∗Harris School of Publicy Policy, The University of Chicago ([email protected]). I am grateful to Shanker Satyanath for his unwavering support throughout this project. I would like to thank Micha¨elAklin, Eric Arias, Antonella Bandiera, Kara Ross Camarena, Maria Carreri, Oeindrila Dube, Anna Getmansky, Michael Gilligan, Luis Martinez, Erzen Oncel,¨ Pablo Querebin, Cyrus Sami, Edoardo Teso, and Austin Wright for helpful discussions and insightful comments. The author thanks the discussants and seminar participants at the Workshop on the Political Economy of Turkey at LSE, Ozye˘ginUniversity,¨ Sabancı University and Bo˘gazi¸ciUniversity. Finally, Deniz Akku¸sand the analysts at the Kare Investment and Securities, Inc., were very generous with their time and resources providing the financial markets data. Alyssa Eldridge provided incredible editorial assistance.All errors belong to the author. Abstract Unexpected outbreaks of civil conflict may either strengthen or weaken the like- lihood of an incumbent remaining in office. In the absence of an actual turnover in office, or immediate public opinion surveys, scholars of conflict are at a loss to tell whether such episodes of conflict strengthen or weaken an incumbent's hold on power. In this paper, I address this question with a novel approach: studying the stock market performances of the firms inside and outside of the incumbent's network to infer the effect of an exogenous conflict episode on the incumbent's survival probability. I hypothesize that the abnormal returns of firms connected with the incumbent provide valuable information about the incumbent's hold on power: positive abnormal returns indicate stronger incumbent power, while neg- ative abnormal returns indicate weaker incumbent power. -

In-Depth Energy Efficiency Policy Review of the REPUBLIC of TURKEY

In-Depth Energy Efficiency Policy Review of THE REPUBLIC OF TURKEY ENERGY CHARTER SECRETATIAT 2014 In-Depth Energy Efficiency Policy Review of THE REPUBLIC OF TURKEY ENERGY CHARTER SECRETATIAT 2014 Information contained in this work has been obtained from sources believed to be reliable. However, neither the Energy Charter Secretariat nor its authors guarantee the accuracy or completeness of any information published herein, and neither the Energy Charter Secretariat nor its authors shall be responsible for any losses or damages arising from the use of this information or from any errors or omissions therein. This work is published with the understanding that the Energy Charter Secretariat and its authors are supplying the information, but are not attempting to render legal or other professional services. © Energy Charter Secretariat, 2014 Boulevard de la Woluwe, 56 B-1200 Brussels, Belgium ISBN 978-905948-149-7 (English PDF) ISBN 978-905948-148-0 (English Paperback), Dépôt number: D/2014/7850/2 Reproduction of this work, save where otherwise stated, is authorised, provided the source is acknowledged. All rights otherwise reserved. Cover and layout design: Diana Spotinova for Spotinov print Ltd. Printed by Spotinov print Ltd. Photo on the cover: Maiden’s Tower, Istanbul. Source: Ministry of Energy and Natural Resources of Turkey. Introduction Turkey ratified the Energy Charter Treaty (ECT) and the Protocol on Energy Efficiency and Related Environmental Aspects (PEEREA) on 5 April 2001. By ratifying PEEREA, countries commit themselves to formulating and implementing policies for improving energy efficiency (EE) and reducing the negative environmental impacts of the energy cycle (Art. 5). The guiding principle of PEEREA is that contracting parties shall cooperate and, as appropriate, assist each other in developing and implementing EE policies, laws and regulations (Art.