Sinopec Zhenhai Refining & Chemical Company Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Development Zone Directory Shanghai, Jiangsu, Zhejiang 2020

Development Zone Directory Shanghai, Jiangsu, Zhejiang 2020 Contents Introduction 4 Shanghai 6 Jiangsu 11 Zhejiang 22 Others 32 Imprint Address Publisher: SwissCham China SwissCham Shanghai Administrator: SwissCham Shanghai Carlton Building, 11th Floor, Room1138, 21 Project execution, editorial and Huanghe Road, Shanghai, 200003. P. R. translations: Nini Qi (lead), Eric Ma China Project direction: Peter Bachmann 中国上海市黄河路21号鸿祥大厦1138室 邮编: 200003 Tel: 021 5368 1248 Copyright 2020 SwissCham China Web: https://www.swisscham.org/shanghai/ 2 Development Zone Directory 2020 Dear Readers, A lot has changed since we published our first edition of the Development Zone Directory back in 2017. But China remains one of the top investment hotspots in the world, despite ongoing trade and other disputes the country faces. While it is true that companies and countries are relocating or building up additional supply chains to lessen their dependence on China, it is also a fact that no other country has the industrial capacity, growing middle class and growth potential. The Chinese market attracts the most foreign direct investment and it well may do so for many years to come, given the large untapped markets in the central and western part of the country. Earlier this year, Premier Li Keqiang mentioned that there are 600 million Chinese citizens living with RMB 1,000 of monthly disposable income. While this may sounds surprising, it also shows the potential that Chinese inner regions have for the future. Investing in China and selling to the Chinese consumers is something that makes sense for companies from around the world. The development zones listed in this directory are here to support and help foreign investors to deal with the unique challenges in the Chinese market. -

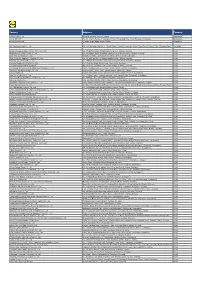

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Spatial Distribution Pattern of Minshuku in the Urban Agglomeration of Yangtze River Delta

The Frontiers of Society, Science and Technology ISSN 2616-7433 Vol. 3, Issue 1: 23-35, DOI: 10.25236/FSST.2021.030106 Spatial Distribution Pattern of Minshuku in the Urban Agglomeration of Yangtze River Delta Yuxin Chen, Yuegang Chen Shanghai University, Shanghai 200444, China Abstract: The city cluster in Yangtze River Delta is the core area of China's modernization and economic development. The industry of Bed and Breakfast (B&B) in this area is relatively developed, and the distribution and spatial pattern of Minshuku will also get much attention. Earlier literature tried more to explore the influence of individual characteristics of Minshuku (such as the design style of Minshuku, etc.) on Minshuku. However, the development of Minshuku has a cluster effect, and the distribution of domestic B&Bs is very unbalanced. Analyzing the differences in the distribution of Minshuku and their causes can help the development of the backward areas and maintain the advantages of the developed areas in the industry of Minshuku. This article finds that the distribution of Minshuku is clustered in certain areas by presenting the overall spatial distribution of Minshuku and cultural attractions in Yangtze River Delta and the respective distribution of 27 cities. For example, Minshuku in the central and eastern parts of Yangtze River Delta are more concentrated, so are the scenic spots in these areas. There are also several concentrated Minshuku areas in other parts of Yangtze River Delta, but the number is significantly less than that of the central and eastern regions. Keywords: Minshuku, Yangtze River Delta, Spatial distribution, Concentrated distribution 1. -

Identification and Nitrogen Fixation Effects of Symbiotic Frankia Isolated from Casuarina Spp

African Journal of Biotechnology Vol. 11(17), pp. 4022-4029, 28 February, 2012 Available online at http://www.academicjournals.org/AJB DOI: 10.5897/AJB11.3970 ISSN 1684–5315 © 2012 Academic Journals Full Length Research Paper Identification and nitrogen fixation effects of symbiotic Frankia isolated from Casuarina spp. in Zhejiang, China Xin Zhang1*, Aihua Shen2, Qiuqin Wang1 and Youwu Chen2 1College of Forestry and Biotechnology, Zhejiang Agricultural and Forestry University, Lin’an, 311300, China. 2Zhejiang Forestry Academy, Hangzhou, 310023, China. Accepted 3 February, 2012 Fourteen symbiotic isolates were obtained from root nodules of Casuarina equisetifolia and Casuarina cunninghamiana in Zhejiang, China. All isolates exhibited typical Frankia morphological characteristics, including filamentous hyphae, vesicles, and multilocular sporangia borne terminally or in an intercalary position. Combined with 16S rDNA sequence alignment results, all isolates were identified as Frankia spp. 4 isolates belonged to the physical Group A, 7 to Group B, and 3 to Group AB. The strains demonstrated varied nitrogenase activities, with the ZCN192 strain being the highest (2.897 μmol·mg-1h-1) and ZCN199 the lowest (0.056 μmol·mg-1h-1). After in vivo inoculation, all strains significantly increased seedling height, basal diameter, and dry biomass of Casuarina spp. Generally, strains with higher nitrogenase activities exhibited more effective nitrogen fixation in vivo. Keywords: Casuarina spp., Frankia, identification, nitrogen fixation effect. INTRODUCTION Coastal shelter forests are crucial components of the are essential not only to the construction of shelter ecological construction and natural disaster prevention forests but also to that of timber forests (Baker and system of China. Zhejiang Province, located in the Mullin, 1992; Lechevalier, 1994). -

Styrolution Press Release

PRESS RELEASE FOR IMMEDIATE RELEASE Singapore – December 18, 2020 INEOS STYROLUTION HOSTS GROUNDBREAKING CEREMONY FOR ITS NEW 600KT ABS PLANT IN NINGBO, CHINA • Additional resources for the world’s biggest ABS market • Improved service offering for customers • Investment reflects commitment to the company’s Triple Shift growth strategy INEOS Styrolution, the global leader in styrenics, today announced its ground- breaking ceremony for its new 600kt ABS (acrylonitrile butadiene styrene) plant located in Ningbo, China. The development of the new site is part of INEOS Styrolution’s larger expansion plans into China, following an earlier acquisition of two polystyrene production sites in Ningbo and Foshan. INEOS Styrolution APAC Pte Ltd., 111 Somerset Road, #14 – 16 to 21 TripleOne Somerset, Singapore 238164 Phone +65 6933 8350, Fax +65 6933 8355, [email protected], www.ineos-styrolution.com 1 / 3 The location of the new site was selected because of its extensive access to feedstock supply options and excellent supply chain connection to customers. The new site is expected to be operational by 2023. The ground-breaking ceremony was hosted by Meizhu Fang, INEOS Styrolution APAC Project Director. Attendees included local government and business leaders, engineering and construction representatives, and several project service providers/partners. “First, we want to thank the Ningbo Municipal Government, Zhenhai District Government, Sinopec Zhenhai Refining & Chemical Co., Ltd.,Ningbo Zhoushan Port Group, State Grid Ningbo Power Supply Company and Ningbo Petrochemical Economic and Technological Development Zone administrative committee for providing their very strong support as we embark on this exciting project for our company,” said Steve Harrington, CEO INEOS Styrolution. -

World Bank Document

ENVIRONMENT ASSESSMENT REPORT Public Disclosure Authorized FOR THE SECOND PHASE OF BEILUNGANG THERMAL POWER PLANT PROJECT i~~~~~~~~~~-it Public Disclosure Authorized Vo L MARCH, 1993 Public Disclosure Authorized ZHEJIANG PROVINCIAL ENVIRONMENTAL PROTECTION SCIENTIFIC RESEARCH INSTITUTE AND EAST CHINA ELECTRICAL POWER DESIGN INSTITUTE Public Disclosure Authorized 'I, Contents J. Introduction 1X. Basis and Principles in the Assessment 2.1 Aims of the Assessment 2.2 The Foundation of the Assessment 2.3 China's Policy and Regulations regarding Environment Assessment 2.4 Standards of the Assessment 2.5 Scope of Assessment 2.6 The Emphasis of Assessment and Major Projection Objects II. Introductionto the Construction 3.1 Project Background 3.2 Project Scale 3.3 Project Site Selection 3.4 Introductionto Phase I Project 3.5 Electricity Production Process Flow 3.6 Fuel 3.7 Water Sources and Consumption 3.8 Occupied Area and Staffing of the BTPP IV. Introduction to Local Environment 4.1 The Overall Plan of Ningbo City and the Geographic Location of the Project 4.2 Natural Environment 4.3 The Local Social Environment 4.4 Pollution Sources Around the BTPP V. The Present Conditions of the Quality of Regional Environment 5.1 The Present Conditions of the Quality of Atmospheric Environment 5.2 The Present Conditions of the Quality of Sea Water Environment 5.3 An Investigationof the Present Cultivation Conditions of the Marine Life, Fishery Resources and Shoal Algae in the Sea Area 5.4 The Present Conditions of the Quality of Noisy Environment. VI. Major Pollution Source & Potential Environmental Problems 6.1 Analysis of Major Pollution Sources 6.2 Potential Environment Problems VII. -

Chinese Producers and Exporters of Walk-Behind Snow Throwers

Chinese Producers and Exporters of Walk-Behind Snow Throwers 1. Zhejiang Dobest Power Tools Co., T: 86-573-8383-5888 Ltd. F: 86-573-8383-5577 No.9 Huacheng west road,Chengxi New E: [email protected] zone,Yongkang 321300, Zhejiang, China W: http://www.yattool.com/ T: 86-579-89286290 E: [email protected] 7. Zhejiang KC Mechanical & Electrical W: http://www.zjdobest.com/ Co. No.866 East HuaXi Road, 2. Zhejiang Zhouli Industrial Co., Ltd GuShan,YongKang,ZheJiang,China Jinyan Mountain Industry Function Area T: 86-579-87512207 Quanxi,Wuyi,321210 Zhejiang,China E: [email protected] T: 86-579-8798 W: http://www.ykcst.com/ E: [email protected] W: http://chinazhouyi.cn 8. Yongkang Great Power Import and Export Co. Ltd. 3. Century Distribution Systems NO.22 BUILDING,GAOCHUAN 8/F, North Bund Business Center HUAYUAN,JIANGNAN 1050 Dongdaming Road, STREET,YONGKANG JINHAU Hongkou District CITY,ZHEJIANG ZHEJIANG Shanghai 20082, China PROVINCE T: 86-21-5118-3888 F: 86-21-3105-6140 9. Ningbo Vertak Mechanical & W: https://www.cds-net.com/global- Electrical Ltd. offices/ #288 Guangming Road, Zhuangshi Zhenhai District, Ningbo, China 4. Sumec Hardware and Tools Co., Ltd. T: 86-13566024458 No.1, Xinghuo Road, E: [email protected] Nanjing Hi-Tech Zone, W: Nanjing, China https://www.vertak.com/contact/contact. T: 86-25-5863-8000 html F: 86-25-8563-8018 W: www.sumecpower.com 10. Hong Kong Sunrise Trading, Ltd. Rm 3b 5/F Far East 5. Positec (Macao Commercial Office) Consortium Bldg 121 Rm A 8/F, Des Voeux Rd The Macau Sq., Central District, Hong Kong 47 Avenida Do Infan D. -

SUPPLIER LIST AUGUST 2019 Cotton on Group - Supplier List 2

SUPPLIER LIST AUGUST 2019 Cotton On Group - Supplier List _2 COUNTRY FACTORY NAME SUPPLIER ADDRESS STAGE TOTAL % OF % OF % OF TEMP WORKERS FEMALE MIGRANT WORKER WORKERS WORKER CHINA NINGBO FORTUNE INTERNATIONAL TRADE CO LTD RM 805-8078 728 LANE SONGJIANG EAST ROAD SUP YINZHOU NINGBO, ZHEJIANG CHINA NINGBO QIANZHEN CLOTHES CO LTD OUCHI VILLAGE CMT 104 64% 75% 6% GULIN TOWN, HAISHU DISTRICT NINGBO, ZHEJIANG CHINA XIANGSHAN YUFA KNITTING LTD NO.35 ZHENYIN RD, JUEXI STREET CMT 57 60% 88% 12% XIANGSHAN COUNTY NINGBO CITY, ZHEJIANG CHINA SUNROSE INTERNATIONAL CO LTD ROOM 22/2 227 JINMEI BUILDING NO 58 LANE 136 SUP SHUNDE ROAD, HAISHU DISTRICT NINGBO, ZHEJIANG CHINA NINGBO HAISHU WANQIANYAO TEXTILE CO LTD NO 197 SAN SAN ROAD CMT 26 62% 85% 0% WANGCHAN INDUSTRIAL ZONE NINGBO, ZHEJIANG CHINA ZHUJI JUNHANG SOCKS FACTORY DAMO VILLAGE LUXI NEW VILLAGE CMT 73 38% 66% 0% ZHUJI CITY ZHEJIANG CHINA SKYLEAD INDUSTRY CO LIMITED LAIMEI INDUSTRIAL PARK SUP CHENGHAI DISTRICT, SHANTOU CITY GUANGDONG CHINA CHUANGXIANG TOYS LIMITED LAIMEI INDUSTRIAL PARK CMT 49 33% 90% 0% CHENGHAI DISTRICT SHANTOU, GUANGDONG CHINA NINGBO ODESUN STATIONERY & GIFT CO LTD TONGJIA VILLAGE, PANHUO INDUSTRIAL ZONE SUP YINZHOU DISTRICT NINGBO CITY, ZHEJIANG CHINA NINGBO ODESUN STATIONERY & GIFT CO LTD TONGJIA VILLAGE, PANHUO INDUSTRIAL ZONE CMT YINZHOU DISTRICT NINGBO CITY, ZHEJIANG CHINA NINGBO WORTH INTERNATIONAL TRADE CO LTD RM. 1902 BUILDING B, CROWN WORLD TRADE PLAZA SUP NO. 1 LANE 28 BAIZHANG EAST ROAD NINGBO ZHEJIANG CHINA NINGHAI YUEMING METAL PRODUCT CO LTD NO. 5 HONGTA ROAD -

Spatial Variation of Regional Sustainable Development and Its Relationship to the Allocation of Science and Technology Resources

Sustainability 2014, 6, 6400-6417; doi:10.3390/su6096400 OPEN ACCESS sustainability ISSN 2071-1050 www.mdpi.com/journal/sustainability Article Spatial Variation of Regional Sustainable Development and its Relationship to the Allocation of Science and Technology Resources Jian Wu 1,*, Guangdong Wu 2,†, Qing Zhou 3,† and Mi Li 4,† 1 School of Management, Hangzhou Dianzi University, Xiasha, Jianggan District, Hangzhou 310018, China 2 School of Tourism and Urban Management, Jiangxi University of Finance and Economics, Nanchang 330013, China; E-Mail: [email protected] 3 School of Economics and Management, Beijing University of Technology, Beijing 100022, China; E-Mail: [email protected] 4 College of Electro-mechanics Engineering, Jiaxing University, Jiaxing 314000, China; E-Mail: [email protected] † These authors contributed equally to this work. * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel./Fax: +86-571-8691-9072. Received: 27 May 2014; in revised form: 14 August 2014 / Accepted: 26 August 2014 / Published: 15 September 2014 Abstract: With the increasing of labor salaries, the RMB exchange rate, resource product prices and requirements of environmental protection, inexpensive labor and land are no longer the decisive factor of regional competitiveness. From this perspective, China needs to shift from the extensive development mode to the sustainable development mode. Science and technology resources rational allocation is one of the key issues in sustainable development. Based on the counties (districts) data of Zhejiang Province in China, this paper portrays the spatial variation of regional sustainable development level of this area. This paper finds that counties tend to cluster in groups with the same sustainable development level, and this agglomeration trend has been enforced during the past several years. -

Chinese Producers and Exporters of Walk-Behind Snow Throwers

Chinese ProducersBarcode:4104620-04 and Exporters A-570-141 of INV Walk-Behind - Investigation Snow - Throwers 1. Zhejiang Dobest Power Tools Co., T: 86-573-8383-5888 Ltd. F: 86-573-8383-5577 No.9 Huacheng west road,Chengxi New E: [email protected] zone,Yongkang 321300, Zhejiang, China W: http://www.yattool.com/ T: 86-579-89286290 E: [email protected] 7. Zhejiang KC Mechanical & Electrical W: http://www.zjdobest.com/ Co. No.866 East HuaXi Road, 2. Zhejiang Zhouli Industrial Co., Ltd GuShan,YongKang,ZheJiang,China Jinyan Mountain Industry Function Area T: 86-579-87512207 Quanxi,Wuyi,321210 Zhejiang,China E: [email protected] T: 86-579-8798 W: http://www.ykcst.com/ E: [email protected] W: http://chinazhouyi.cn 8. Yongkang Great Power Import and Export Co. Ltd. 3. Century Distribution Systems NO.22 BUILDING,GAOCHUAN 8/F, North Bund Business Center HUAYUAN,JIANGNAN 1050 Dongdaming Road, STREET,YONGKANG JINHAU Hongkou District CITY,ZHEJIANG ZHEJIANG Shanghai 20082, China PROVINCE T: 86-21-5118-3888 F: 86-21-3105-6140 9. Ningbo Vertak Mechanical & W: https://www.cds-net.com/global- Electrical Ltd. offices/ #288 Guangming Road, Zhuangshi Zhenhai District, Ningbo, China 4. Sumec Hardware and Tools Co., Ltd. T: 86-13566024458 No.1, Xinghuo Road, E: [email protected] Nanjing Hi-Tech Zone, W: Nanjing, China https://www.vertak.com/contact/contact. T: 86-25-5863-8000 html F: 86-25-8563-8018 W: www.sumecpower.com 10. Hong Kong Sunrise Trading, Ltd. Rm 3b 5/F Far East 5. Positec (Macao Commercial Office) Consortium Bldg 121 Rm A 8/F, Des Voeux Rd The Macau Sq., Central District, Hong Kong 47 Avenida Do Infan D. -

Assessment on Island Ecological Vulnerability to Tourism Application to Zhoushan, China

Ecological Indicators 113 (2020) 106247 Contents lists available at ScienceDirect Ecological Indicators journal homepage: www.elsevier.com/locate/ecolind Nouveauté or Cliché? Assessment on island ecological vulnerability to Tourism: Application to Zhoushan, China T ⁎ Xin Maa,b, , Martin de Jongc,d,e, Baiqing Suna, Xin Baoa a School of Management, Harbin Institute of Technology, 92 West Dazhi Street, Nan Gang District, Harbin 150001, China b School of Languages and Literature, Harbin Institute of Technology, 2 Wenhuaxi Road, Weihai 264209, China c Erasmus School of Law, Erasmus University Rotterdam, 3062 PA Rotterdam, The Netherlands d Rotterdam School of Management, Erasmus University Rotterdam, 3062 PA Rotterdam, The Netherlands e School of International Relations and Public Affairs, Fudan University, Shanghai 200433, China ARTICLE INFO ABSTRACT Keywords: In comparison with coastal zones, islands are even more vulnerable to anthropogenic disturbance, especially to Island ecological vulnerability (IEV) tourism and tourism-induced activities. Despite a great number of studies on either island tourism or island Island tourism vulnerability reviewed in this paper, knowledge and practice of the impact from tourism upon island ecological Coupling coordination degree modeling vulnerability (IEV) still needs to be expanded. In this contribution, the IEV of four administrative regions in (CCDM) Zhoushan, China is assessed between 2012 and 2017 based on an “exposure (E)-sensitivity (S)-adaptive capacity Zhoushan (A)” framework and by means of coupling -

Pitchbook A4US Template

0707 InterimInterim PresentationPresentation September 2007 (Stock code: 3900.HK) 0 Contents Business Overview Results Highlight Outlook 1 Business Overview 2 Leading property developer in China Total land bank reached 15,385,000 * sqm (as at 31 August 2007) Qingdao 16% Beijing 4% No. of projects 1 No. of projects 2 Site area(’000 sqm) 1,247 Site area(’000 sqm) 571 Aggregate GFA(’000 sqm) 2,437 Aggregate GFA(’000 sqm 680 Hangzhou 29% 6% Shanghai No. of projects 15 No. of projects 5 Site area(’000 sqm) 2,851 ( ) Site area ’000 sqm 1,296 Aggregate GFA(’000 sqm) 4,507 Aggregate GFA(’000 sqm) 979 Zhejiang 32% Other cities 13% (excluding Hangzhou) No. of projects 11 No. of projects 19 Site area(’000 sqm) 2,580 Site area(’000 sqm) 3,517 Aggregate GFA(’000 sqm) 1,941 Aggregate GFA(’000 sqm) 4,840 * Including subsidiaries and associates 3 Based in China’s wealthiest and fastest growing regions Yangtze River Delta* Zhejiang Guangdong (including Hangzhou & other cities in Zhejiang Province Province Province) GDP per capita (RMB) 31,684 27,923 33,110 Population (million) 50 93 143 Contribution of GDP by local private 71.5% 40.04% NA enterprises Source: CEIC 2006 * Yangtze River Metropolitan Area comprising Shanghai, Nanjing, Zhenjiang, Yangzhou, Suzhou, Changzhou, Wuxi, Nantong, Taizhou (in Jiangsu), Jiaxing, Huzhou, Ningbo, Shaoxing, Zhoushan, Taizhou (in Zhejiang) 4 Leading developer in Zhejiang A local private property developer in Shanghai Hangzhou established in 1995, successfully Greentown Greentown Hangzhou Zhoushan launched 49 mid/high-end