Pitchbook A4US Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Risk Factors for Carbapenem-Resistant Pseudomonas Aeruginosa, Zhejiang Province, China

Article DOI: https://doi.org/10.3201/eid2510.181699 Risk Factors for Carbapenem-Resistant Pseudomonas aeruginosa, Zhejiang Province, China Appendix Appendix Table. Surveillance for carbapenem-resistant Pseudomonas aeruginosa in hospitals, Zhejiang Province, China, 2015– 2017* Years Hospitals by city Level† Strain identification method‡ excluded§ Hangzhou First 17 People's Liberation Army Hospital 3A VITEK 2 Compact Hangzhou Red Cross Hospital 3A VITEK 2 Compact Hangzhou First People’s Hospital 3A MALDI-TOF MS Hangzhou Children's Hospital 3A VITEK 2 Compact Hangzhou Hospital of Chinese Traditional Hospital 3A Phoenix 100, VITEK 2 Compact Hangzhou Cancer Hospital 3A VITEK 2 Compact Xixi Hospital of Hangzhou 3A VITEK 2 Compact Sir Run Run Shaw Hospital, School of Medicine, Zhejiang University 3A MALDI-TOF MS The Children's Hospital of Zhejiang University School of Medicine 3A MALDI-TOF MS Women's Hospital, School of Medicine, Zhejiang University 3A VITEK 2 Compact The First Affiliated Hospital of Medical School of Zhejiang University 3A MALDI-TOF MS The Second Affiliated Hospital of Zhejiang University School of 3A MALDI-TOF MS Medicine Hangzhou Second People’s Hospital 3A MALDI-TOF MS Zhejiang People's Armed Police Corps Hospital, Hangzhou 3A Phoenix 100 Xinhua Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Provincial People's Hospital 3A MALDI-TOF MS Zhejiang Provincial Hospital of Traditional Chinese Medicine 3A MALDI-TOF MS Tongde Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Hospital 3A MALDI-TOF MS Zhejiang Cancer -

Domestic and International Challenges for the Textile Industry in Shaoxing (Zhejiang)

Special feature China perspectives Domestic and International Challenges for the Textile Industry in Shaoxing (Zhejiang) SHI LU ABSTRACT: This article recounts the transformations that have taken place in the textile industry in Shaoxing, Zhejiang Province, over the course of the past 30 years. It reveals the importance of the local setup and the links that have built up between companies, mar - kets, and the state and its departments. It also exposes the difficulties experienced by companies as they try to adapt to their changing environment, whether in terms of opportunities offered by the domestic or international markets, or new regulations. KEYWORDS: textile industry, clusters, developmental state, governance, market. Introduction markets increased, the cost of labour rose, and new environmental require - ments were imposed. This contribution looks back over the transformations he developmental state concept was developed by Chalmers Johnson and the ways in which companies have adapted to these changes in the in the early 1980s to describe the role of the state in the economic case of the textile industry in Zhejiang Province and, more particularly, in successes enjoyed by Japan, which he considered to have been un - the city of Shaoxing. T (1) derestimated. It was subsequently used to refer to the ability of economic In 2013, 15% of companies in Zhejiang Province were operating in the bureaucracies to guide development in South Korea and Taiwan, channelling textile and clothing industries, making it one of China’s main centres for private investment towards growth sectors and allowing these economies manufacturing textile products at that time. (4) The city of Shaoxing, a for - to benefit from a comparative advantage in international competition. -

![Directors and Parties Involved in the [Redacted]](https://docslib.b-cdn.net/cover/7098/directors-and-parties-involved-in-the-redacted-577098.webp)

Directors and Parties Involved in the [Redacted]

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT DIRECTORS AND PARTIES INVOLVED IN THE [REDACTED] DIRECTORS Name Address Nationality Executive Directors Mr. Hua Bingru (華丙如) 7-6, Building 7 Chinese Jinchongfu Lanting Community Yuhang Economic Development Zone Hangzhou City, Zhejiang Province the PRC Mr. Wang Shijian (王詩劍) Room 2101, Unit 2, Building 4 Chinese Zanchengtanfu, Xinyan Road Meiyan Community Donghu Street, Yuhang District Hangzhou City, Zhejiang Province the PRC Mr. Wang Weiping (汪衛平) Room 802, Unit 3, Building 6 Chinese Junlin Tianxia City Community Shidai Community Nanyuan Street, Yuhang District Hangzhou City, Zhejiang Province the PRC Mr. Dong Zhenguo (董振國) Paiwu 39-2 Chinese Jindu Xiagong Community Maoshan Community Donghu Street, Yuhang District Hangzhou City, Zhejiang Province the PRC Mr. Xu Shijian (徐石尖) Room 702, Unit 2, Building 7 Chinese Mingshiyuan Community Renmin Dadao Baozhangqiao Community Nanyuan Street, Yuhang District Hangzhou City, Zhejiang Province the PRC –80– THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT DIRECTORS AND PARTIES INVOLVED IN THE [REDACTED] Name Address Nationality Non-executive Directors Ms. Hua Hui (華慧) Room 101, Unit 1, Building 25 Chinese Beizhuyuan, Xiagong Huayuan 156 Beisha West Road Maoshan Community Linping Street, Yuhang District Hangzhou City, Zhejiang Province the PRC Independent non-executive Directors Mr. Yu Kefei (俞可飛) Room 1201, Unit 1, Building 5 Chinese Binjiang Huadu No. -

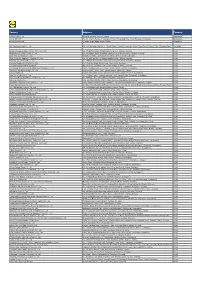

Development Zone Directory Shanghai, Jiangsu, Zhejiang 2020

Development Zone Directory Shanghai, Jiangsu, Zhejiang 2020 Contents Introduction 4 Shanghai 6 Jiangsu 11 Zhejiang 22 Others 32 Imprint Address Publisher: SwissCham China SwissCham Shanghai Administrator: SwissCham Shanghai Carlton Building, 11th Floor, Room1138, 21 Project execution, editorial and Huanghe Road, Shanghai, 200003. P. R. translations: Nini Qi (lead), Eric Ma China Project direction: Peter Bachmann 中国上海市黄河路21号鸿祥大厦1138室 邮编: 200003 Tel: 021 5368 1248 Copyright 2020 SwissCham China Web: https://www.swisscham.org/shanghai/ 2 Development Zone Directory 2020 Dear Readers, A lot has changed since we published our first edition of the Development Zone Directory back in 2017. But China remains one of the top investment hotspots in the world, despite ongoing trade and other disputes the country faces. While it is true that companies and countries are relocating or building up additional supply chains to lessen their dependence on China, it is also a fact that no other country has the industrial capacity, growing middle class and growth potential. The Chinese market attracts the most foreign direct investment and it well may do so for many years to come, given the large untapped markets in the central and western part of the country. Earlier this year, Premier Li Keqiang mentioned that there are 600 million Chinese citizens living with RMB 1,000 of monthly disposable income. While this may sounds surprising, it also shows the potential that Chinese inner regions have for the future. Investing in China and selling to the Chinese consumers is something that makes sense for companies from around the world. The development zones listed in this directory are here to support and help foreign investors to deal with the unique challenges in the Chinese market. -

Identifying the Financing Pattern Problems

日本建築学会計画系論文集 第84巻 第756号,323-331, 2019年2月 【カテゴリーⅠ】 J. Archit. Plann., AIJ, Vol. 84 No. 756, 323-331, Feb., 2019 DOI http://doi.org/10.3130/aija.84.323 IDENTIFYINGIDENTIFYING THE THE FINANCING FINANCING PATTERN PATTERN PROBLEMS PROBLEMS OF DILAPIDATED OF DILAPIDATED URBAN URBANHOUSING HOUSING RENEWAL RENEWAL SYSTEM SYSTEM IN ZHEJIANG, IN ZHEJIANG, CHINA: CHINA: CASECASE STUDY STUDY OF OF JINSHOUJINSHOU PROJECTPROJECT IN IN ZHOUSHAN ZHOUSHAN 中国浙江の危房改造システムの資金面の問題点:舟山の「金寿新村」プロジェクトを対象に୰ᅜύỤࡢ༴ᡣᨵ㐀ࢩࢫࢸ࣒ࡢ㈨㔠㠃ࡢၥ㢟Ⅼ ⯚ᒣࡢࠕ㔠ᑑ᪂ᮧࠖࣉࣟࢪ࢙ࢡࢺࢆᑐ㇟ *1 *2 LiLi GUAN GUAN* and and Takashi Takashi ARIGA ARIGA** ⟶ࠉࠉ⌮㸪᭷㈡ࠉ㝯管 理,有 賀 隆 A dualistic system of private urban housing renewal consisting of marketized “Old City Renewal” and government voluntary “Dilapidated Urban Housing Renewal” has been established in China since 2015. Focusing on the latter '8+5PRGHWKLVVWXG\DLPVWRLGHQWLI\LWVSUREOHPVIURPWKHSHUVSHFWLYHRIÀQDQFLQJSDWWHUQ-LQVKRX3URMHFWLQ =KRXVKDQLVVHOHFWHGDVDUHSUHVHQWDWLYHFDVHWRFODULI\WKH'8+5PRGHLQ=KHMLDQJ3URYLQFH7KURXJKDQDO\]LQJWKH VWDWLVWLFVRISURMHFWIXQGLQJWKLVSDSHUDUJXHVWKDWWKH'8+5PRGHFRPSOHWHO\UHOLHVRQSXEOLFIXQGLQJDQGLVKDUGWR tackle the increasing number of dilapidated housing. Keywords: Dilapidated Urban Housing Renewal, Old City Renovation, Financing pattern, China ༴ᡣᨵ㐀㸪ᪧᇛᨵ㐀㸪㈨㔠ࡢὶࢀ㸪୰ᅜ 1. Introduction structure has been seriously damaged or the load-bearing 1.1. Research background component is in danger and may at any time lose the stability Evolution of Chinese urban housing system and load-bearing capacity.*4) Recent years, frequent collapse The Chinese social -

Barcode:3844251-01 A-570-112 INV - Investigation

Barcode:3844251-01 A-570-112 INV - Investigation - PRODUCERS AND EXPORTERS FROM THE PRC Producer/Exporter Name Mailing Address A-Jax International Co., Ltd. 43th Fei Yue Road, Zhongshan City, Guandong Province, China Anhui Amigo Imp.&Exp. Co., Ltd. Private Economic Zone, Chaohu, 238000, Anhui, China Anhui Sunshine Stationery Co., Ltd. 17th Floor, Anhui International Business Center, 162, Jinzhai Road, Hefei, Anhui, China Anping Ying Hang Yuan Metal Wire Mesh Co., Ltd. No. 268 of Xutuan Industry District of Anping County, Hebei Province, 053600, China APEX MFG. CO., LTD. 68, Kuang-Chen Road, Tali District, Taichung City, 41278, Taiwan Beijing Kang Jie Kong 9-2 Nanfaxin Sector, Shunping Rd, Shunyi District, Beijing, 101316, China Changzhou Kya Fasteners Co., Ltd. Room 606, 3rd Building, Rongsheng Manhattan Piaza, Hengshan Road, Xinbei District, Changzhou City, Jiangsu, China Changzhou Kya Trading Co., Ltd. Room 606, 3rd Building, Rongsheng Manhattan Piaza, Hengshan Road, Xinbei District, Changzhou City, Jiangsu, China China Staple #8 Shu Hai Dao, New District, Economic Development Zone, Jinghai, Tianjin Chongqing Lishun Fujie Trading Co., Ltd. 2-63, G Zone, Perpetual Motor Market, No. 96, Torch Avenue, Erlang Technology New City, Jiulongpo District, Chongqing, China Chongqing Liyufujie Trading Co., Ltd. No. 2-63, Electrical Market, Torch Road, Jiulongpo District, Chongqing 400000, China Dongyang Nail Manufacturer Co.,Ltd. Floor-2, Jiaotong Building, Ruian, Wenzhou, Zhejiang, China Fastco (Shanghai) Trading Co., Ltd. Tong Da Chuang Ye, Tian -

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Spatial Distribution Pattern of Minshuku in the Urban Agglomeration of Yangtze River Delta

The Frontiers of Society, Science and Technology ISSN 2616-7433 Vol. 3, Issue 1: 23-35, DOI: 10.25236/FSST.2021.030106 Spatial Distribution Pattern of Minshuku in the Urban Agglomeration of Yangtze River Delta Yuxin Chen, Yuegang Chen Shanghai University, Shanghai 200444, China Abstract: The city cluster in Yangtze River Delta is the core area of China's modernization and economic development. The industry of Bed and Breakfast (B&B) in this area is relatively developed, and the distribution and spatial pattern of Minshuku will also get much attention. Earlier literature tried more to explore the influence of individual characteristics of Minshuku (such as the design style of Minshuku, etc.) on Minshuku. However, the development of Minshuku has a cluster effect, and the distribution of domestic B&Bs is very unbalanced. Analyzing the differences in the distribution of Minshuku and their causes can help the development of the backward areas and maintain the advantages of the developed areas in the industry of Minshuku. This article finds that the distribution of Minshuku is clustered in certain areas by presenting the overall spatial distribution of Minshuku and cultural attractions in Yangtze River Delta and the respective distribution of 27 cities. For example, Minshuku in the central and eastern parts of Yangtze River Delta are more concentrated, so are the scenic spots in these areas. There are also several concentrated Minshuku areas in other parts of Yangtze River Delta, but the number is significantly less than that of the central and eastern regions. Keywords: Minshuku, Yangtze River Delta, Spatial distribution, Concentrated distribution 1. -

Identification and Nitrogen Fixation Effects of Symbiotic Frankia Isolated from Casuarina Spp

African Journal of Biotechnology Vol. 11(17), pp. 4022-4029, 28 February, 2012 Available online at http://www.academicjournals.org/AJB DOI: 10.5897/AJB11.3970 ISSN 1684–5315 © 2012 Academic Journals Full Length Research Paper Identification and nitrogen fixation effects of symbiotic Frankia isolated from Casuarina spp. in Zhejiang, China Xin Zhang1*, Aihua Shen2, Qiuqin Wang1 and Youwu Chen2 1College of Forestry and Biotechnology, Zhejiang Agricultural and Forestry University, Lin’an, 311300, China. 2Zhejiang Forestry Academy, Hangzhou, 310023, China. Accepted 3 February, 2012 Fourteen symbiotic isolates were obtained from root nodules of Casuarina equisetifolia and Casuarina cunninghamiana in Zhejiang, China. All isolates exhibited typical Frankia morphological characteristics, including filamentous hyphae, vesicles, and multilocular sporangia borne terminally or in an intercalary position. Combined with 16S rDNA sequence alignment results, all isolates were identified as Frankia spp. 4 isolates belonged to the physical Group A, 7 to Group B, and 3 to Group AB. The strains demonstrated varied nitrogenase activities, with the ZCN192 strain being the highest (2.897 μmol·mg-1h-1) and ZCN199 the lowest (0.056 μmol·mg-1h-1). After in vivo inoculation, all strains significantly increased seedling height, basal diameter, and dry biomass of Casuarina spp. Generally, strains with higher nitrogenase activities exhibited more effective nitrogen fixation in vivo. Keywords: Casuarina spp., Frankia, identification, nitrogen fixation effect. INTRODUCTION Coastal shelter forests are crucial components of the are essential not only to the construction of shelter ecological construction and natural disaster prevention forests but also to that of timber forests (Baker and system of China. Zhejiang Province, located in the Mullin, 1992; Lechevalier, 1994). -

Styrolution Press Release

PRESS RELEASE FOR IMMEDIATE RELEASE Singapore – December 18, 2020 INEOS STYROLUTION HOSTS GROUNDBREAKING CEREMONY FOR ITS NEW 600KT ABS PLANT IN NINGBO, CHINA • Additional resources for the world’s biggest ABS market • Improved service offering for customers • Investment reflects commitment to the company’s Triple Shift growth strategy INEOS Styrolution, the global leader in styrenics, today announced its ground- breaking ceremony for its new 600kt ABS (acrylonitrile butadiene styrene) plant located in Ningbo, China. The development of the new site is part of INEOS Styrolution’s larger expansion plans into China, following an earlier acquisition of two polystyrene production sites in Ningbo and Foshan. INEOS Styrolution APAC Pte Ltd., 111 Somerset Road, #14 – 16 to 21 TripleOne Somerset, Singapore 238164 Phone +65 6933 8350, Fax +65 6933 8355, [email protected], www.ineos-styrolution.com 1 / 3 The location of the new site was selected because of its extensive access to feedstock supply options and excellent supply chain connection to customers. The new site is expected to be operational by 2023. The ground-breaking ceremony was hosted by Meizhu Fang, INEOS Styrolution APAC Project Director. Attendees included local government and business leaders, engineering and construction representatives, and several project service providers/partners. “First, we want to thank the Ningbo Municipal Government, Zhenhai District Government, Sinopec Zhenhai Refining & Chemical Co., Ltd.,Ningbo Zhoushan Port Group, State Grid Ningbo Power Supply Company and Ningbo Petrochemical Economic and Technological Development Zone administrative committee for providing their very strong support as we embark on this exciting project for our company,” said Steve Harrington, CEO INEOS Styrolution. -

The Phonology of Shaoxing Chinese

The Phonology of Shaoxing Chinese Published by LOT phone: +31 30 253 6006 Trans 10 fax: +31 30 253 6000 3512 JK Utrecht e-mail: [email protected] The Netherlands http://wwwlot.let.uu.nl Cover illustration: A mural painting of Emperor Gou Jian of the Yue Kingdom (497-465 B.C.) (present-day Shaoxing). The photo was taken by Xiaonan Zhang in Shaoxing. ISBN 90-76864-90-X NUR 632 Copyright © 2006 by Jisheng Zhang. All rights reserved. The Phonology of Shaoxing Chinese PROEFSCHRIFT ter verkrijging van de graad van Doctor aan de Universiteit Leiden, op gezag van de Rector Magnificus Dr. D.D. Breimer, hoogleraar in de faculteit der Wiskunde en Natuurwetenschappen en die der Geneeskunde, volgens besluit van het College voor Promoties te verdedigen op dinsdag 31 januari 2006 klokke 15.15 uur door JISHENG ZHANG geboren te Shaoxing, China in 1955 Promotiecommissie promotor: prof. dr. V.J.J.P. van Heuven co-promotor: dr. J.M. van de Weijer referent: prof. dr. M. Yip (University College London) overige leden: prof. dr. C.J. Ewen dr. M. van Oostendorp (Meertens Instituut) dr. N.S.H. Smith (University of Amsterdam) Dedicated to my mother who gave me my life and brought me up on this ancient land –– Shaoxing. Contents Acknowledgements ...................................................................................... xi 1 Background............................................................................................1 1.1 Introduction ...............................................................................................1 1.2 Methodology -

World Bank Document

ENVIRONMENT ASSESSMENT REPORT Public Disclosure Authorized FOR THE SECOND PHASE OF BEILUNGANG THERMAL POWER PLANT PROJECT i~~~~~~~~~~-it Public Disclosure Authorized Vo L MARCH, 1993 Public Disclosure Authorized ZHEJIANG PROVINCIAL ENVIRONMENTAL PROTECTION SCIENTIFIC RESEARCH INSTITUTE AND EAST CHINA ELECTRICAL POWER DESIGN INSTITUTE Public Disclosure Authorized 'I, Contents J. Introduction 1X. Basis and Principles in the Assessment 2.1 Aims of the Assessment 2.2 The Foundation of the Assessment 2.3 China's Policy and Regulations regarding Environment Assessment 2.4 Standards of the Assessment 2.5 Scope of Assessment 2.6 The Emphasis of Assessment and Major Projection Objects II. Introductionto the Construction 3.1 Project Background 3.2 Project Scale 3.3 Project Site Selection 3.4 Introductionto Phase I Project 3.5 Electricity Production Process Flow 3.6 Fuel 3.7 Water Sources and Consumption 3.8 Occupied Area and Staffing of the BTPP IV. Introduction to Local Environment 4.1 The Overall Plan of Ningbo City and the Geographic Location of the Project 4.2 Natural Environment 4.3 The Local Social Environment 4.4 Pollution Sources Around the BTPP V. The Present Conditions of the Quality of Regional Environment 5.1 The Present Conditions of the Quality of Atmospheric Environment 5.2 The Present Conditions of the Quality of Sea Water Environment 5.3 An Investigationof the Present Cultivation Conditions of the Marine Life, Fishery Resources and Shoal Algae in the Sea Area 5.4 The Present Conditions of the Quality of Noisy Environment. VI. Major Pollution Source & Potential Environmental Problems 6.1 Analysis of Major Pollution Sources 6.2 Potential Environment Problems VII.