Ameriprise Financial Executive Position in Relation to Positions in the Sources of Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ethics Agreement in Order to Avoid Any Financial Conflict

Date: 7 .-e-•15 Iett..% 1--4 17 MEMORANDUM FOR THE RECORD SUBJECT: Ethics Agreement In order to avoid any financial conflict of interest in violation of 18 U.S.C. § 208(a) or the appearance of a financial conflict of interest as defined in the Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. § 2635.502, and to adhere to the Ethics Pledge instituted by Executive Order 13770 issued on January 28, 2017, and entitled "Ethics Commitments by Executive Branch Appointees" (the Ethics Pledge), I am issuing the following statement. I understand that as an appointee I must sign the Ethics Pledge and that I will be bound by the requirements and restrictions therein even if not specifically mentioned in this or any other ethics agreement. Before beginning my covered Federal position, I resigned from my non-Federal positions with the Association of State and Territorial Health Officials (ASTHO) and the State of Georgia on July 6, 2017. Pursuant to the Ethics Pledge, I will not, for a period of two years from the date of my appointment to my covered Federal position, participate in an official capacity in any particular matter involving specific parties that is directly and substantially related to ASTHO, unless an exception applies or I am granted a waiver. I understand that this provision in the Ethics Pledge does not apply to state government entities, including the State of Georgia. Even when the two-year restriction of the Ethics Pledge does not apply, under 5 C.F.R. § 2635.502, I will not, for a period of one year from the date of my resignation from ASTHO and the State of Georgia, participate in any particular matter involving specific parties in which ASTHO or the State of Georgia is a party or represents a party, unless I am first authorized to participate, pursuant to 5 C.F.R. -

2021 Responsible Business Report

Ameriprise Financial Responsible Business Report Spring 2021 Ameriprise Financial, Inc. Table of Contents A Message From Our Chairman and CEO .................................2 Environmental Steward .......................................................................... 25 Executive Summary.......................................................................................3 Community Impact......................................................................................27 Recognized as an Industry Leader ..................................................4 Appendix – Ameriprise and Our Global Reach .................. 30 Financial Strength and Stability ........................................................5 Appendix – Diversified Business Underpinned by a Strong Financial Foundation ................................................. 31 Values-Driven Firm ..........................................................................................6 Appendix – Diversified Business with Multiple Stakeholders ............................................................................. 32 Responsible Investor .................................................................................17 Appendix .............................................................................................................. 33 Governance ....................................................................................................... 22 1 Dear fellow stakeholders, 2020 was a year of significant and unforeseen Again in 2020, Ameriprise received -

Fund Holdings As of 6/30/2021 Massmutual Balanced Fund Invesco Prior to 5/1/2021, the Fund Name Was Massmutual Premier Balanced Fund

Fund Holdings As of 6/30/2021 MassMutual Balanced Fund Invesco Prior to 5/1/2021, the Fund name was MassMutual Premier Balanced Fund. Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting % Amount Value Apple Inc AAPL 037833100 3.91 48,433 6,633,384 Microsoft Corp MSFT 594918104 3.45 21,552 5,838,437 USTREAS T-Bill Auction Ave 3 Mon 1.69 2,862,977 JPMorgan Chase & Co JPM 46625H100 1.56 16,948 2,636,092 Verizon Communications Inc VZ 92343V104 1.45 43,768 2,452,321 The Home Depot Inc HD 437076102 1.42 7,556 2,409,533 Intel Corp INTC 458140100 1.29 38,961 2,187,271 Procter & Gamble Co PG 742718109 1.04 13,105 1,768,258 Cisco Systems Inc CSCO 17275R102 1.03 32,830 1,739,990 UnitedHealth Group Inc UNH 91324P102 1.00 4,215 1,687,855 Comcast Corp Class A CMCSA 20030N101 0.94 28,021 1,597,757 AT&T Inc T 00206R102 0.91 53,587 1,542,234 Oracle Corp ORCL 68389X105 0.83 18,031 1,403,533 Deere & Co DE 244199105 0.76 3,635 1,282,101 Accenture PLC Class A ACN G1151C101 0.74 4,237 1,249,025 Johnson Controls International PLC JCI G51502105 0.74 18,185 1,248,037 Visa Inc Class A V 92826C839 0.71 5,152 1,204,641 Texas Instruments Inc TXN 882508104 0.70 6,128 1,178,414 Costco Wholesale Corp COST 22160K105 0.67 2,850 1,127,660 Bank of America Corp BAC 060505104 0.64 26,192 1,079,896 Broadcom Inc AVGO 11135F101 0.63 2,223 1,060,015 Abbott Laboratories ABT 002824100 0.57 8,348 967,784 Target Corp TGT 87612E106 0.56 3,949 954,631 Honeywell International Inc HON 438516106 0.56 4,324 948,469 Goldman Sachs Group Inc GS 38141G104 0.53 2,374 901,004 -

PEOPLE SERVING PEOPLE 2016 Annual Report 2016 Was a Year of Significant Growth for People Serving People

“Spending time with the kids here re-charges me. Their positivity, humor, and resiliency brings light to my week, and fills me with a sense of hope.” – Cora, Volunteer Tutor PEOPLE SERVING PEOPLE 2016 Annual Report 2016 was a year of significant growth for People Serving People. People Serving RYAN STRACK Recognizing the trauma our guests have experienced and Minneapolis Public Schools the lasting impact it has on physical and emotional health, we People, Inc. undertook an initiative to become trauma-informed throughout ANDREA TURNER our operations and service delivery. An organizational self- DREW FESLER, CHAIR General Mills assessment, professional development trainings, and staff-led ECMC Group work groups have helped us identify and implement changes to make People Serving People a more supportive, healing space JOSEPHINE PUFPAFF, People Serving People for both guests and staff. VICE CHAIR Corporation for Charities, Inc. This year we also designed and completed construction on a Supportive Housing new external initiative, the Center of Excellence, opening in GUY BECKER, CHAIR 2017. This initiative expands our physical presence to two sites and marks a shift in our service population to include STEFANI TYGAR BARNES Kristopher James Company children and families at-risk of experiencing homelessness. In Wells Fargo Insurance, Inc. CHRISTOPHER CLARK, addition to direct care services, the Center will feature research, development, and training to improve the field of family JESSE BERGLANDK VICE CHAIR resilience and trauma-informed education and service. Northwestern Mutual Xcel Energy Our shelter’s Early Childhood Development Program received LATOYA BURRELL ELIZABETH HINZ national accreditation in September 2016 by the National North Central University Formerly at Minneapolis Public Early Childhood Program Accreditation. -

Madonna Now President's Report 2012-2013

MADONNA NOW The Magazine of Madonna University PRESIDENT’S REPORT 2012 & 2013 LIVING OUR VALUES On campus, in our community and around the world Thank You to our Generous Sponsors of the 2012 Be Polish for a Night IRA Charitable Rollover Extended Scholarship Dinner and Auction A great way to give to Madonna! If you’re 70 ½ or over, you can make a Diamond Sponsors – $5,000 GoldCorp Inc. tax free gift from your IRA: MJ Diamonds • Direct a qualified distribution (up to $100,000) directly to Madonna Platinum Sponsor – $2,500 • This counts toward your required minimum distribution Felician Sisters of North America • You’ll pay no federal income tax on the distribution Lorraine Ozog • Your gift makes an immediate impact at Madonna Gold Sponsor – $1,000 Comerica Contact us to discuss programs and initiatives DAK Solutions you might want to support. Doc’s Sports Retreat Dean Adkins, Director of Gift Planning Dunkin Donuts/BP Friends of Representative Lesia Liss 734-432-5856 • [email protected] Laurel Manor Miller Canfield Polish National Alliance Lodge 53 Linda Dzwigalski-Long Daniel and Karen Longeway Ray Okonski and Suzanne Sloat SHOW YOUR Leonard C. Suchyta MADONNA PRIDE! Rev. Msgr. Anthony M. Tocco Leave your mark at Madonna with a CBS 62 Detroit/CW50 Legacy Brick in the Path of the Madonna Silver Sponsor – $500 or get an Alumni Spirit Tassel Catholic Vantage Financial Marywood Nursing Center Bricks with your personalized Schakolad Chocolate Factory message are $150 for an 8x8 with SmithGroupJJR Stern Brothers & Co. M logo, and $75 for a 4x8. Spirit Tassels are only $20.13 Bronze Sponsor – $250 Paul and Debbie DeNapoli E & L Construction FOCUS Facility Consulting Services Inc Dr. -

Businesses That Match Employee Donations

Minnesota Businesses that Match Employee Donations CORPORATION NAME CITY OF HEADQUARTERS 3M Company St. Paul Allianz Life Insurance Company of North America Minneapolis Ameriprise Financial Minneapolis Andersen Corporation Bayport Apogee Enterprises, Inc. Minneapolis Best Buy Co., Inc. Richfield Blue Cross and Blue Shield of Minnesota Eagan Buffalo Wild Wings Inc. Minneapolis Cargill, Incorporated Wayzata Carlson Holdings, Inc. Minnetonka Ceridian Corporation Minneapolis CHS Inc. Inver Grove Heights Compeer Financial Mankato Deluxe Corporation Shoreview Donaldson Company, Inc. Minneapolis Dorsey and Whitney LLP Minneapolis Ecolab Inc. St. Paul Edina Realty, Inc. Brainerd Federated Mutual Insurance Company Owatonna First National Bank Bemidji Bemidji General Mills, Inc. Minneapolis Graco Inc. Minneapolis H.B. Fuller Company St. Paul Homecrest Industries, Inc. Wadena Hormel Foods Corporation Austin Hutchinson Technology Incorporated Hutchinson International Dairy Queen, Inc. Minneapolis Jostens, Inc. Minneapolis Land O'Lakes, Inc. Arden Hills Larkin, Hoffman, Daly & Lindgren, Ltd. Minneapolis M. A. Mortenson Company Minneapolis Medtronic, Inc. Minneapolis Minnesota Power, Inc. Duluth Minnesota Timberwolves Basketball Limited Partnership Minneapolis Minnesota Twins Baseball Club Minneapolis Minnesota Vikings Football Club, LLC Eagan Minnesota Wild Hockey Club, LP St. Paul Opus Corporation Minnetonka Pentair, Inc. Minneapolis Polaris Industries, Inc. Medina Post Consumer Brands LLC Lakeville Rahr Malting Co. Shakopee Denotes this company also donates for employee volunteer hours 9/13/18 Minnesota Businesses that Match Employee Donations RBC Wealth Management Minneapolis Red Wing Shoe Company, Inc. Red Wing Reell Precision Manufacturing Corporation St. Paul Regis Corporation Minneapolis Riverway Co. Bloomington Robins Kaplan L.L.P. Minneapolis Schoeneckers, Inc Edina Schwan's Company Marshall Securian Financial Group, Inc. St. Paul Security State Bank Hibbing Sit Investment Associates, Inc. -

2020 Annual Report Donor List

alsmn.org 2020 Annual Report Donor List This list recognizes donations of $500 or $100,000+ more that were given within Jon Andresen our fiscal year of February 1, John & Margie Wiehoff Foundation 2019 - January 31st, 2020. We truly appreciate your support $25,000-$99,000 of our mission, and every effort has been made to ensure the Anonymous Donor accuracy of this list. If your Ron & Ramona Beggs name has been inadvertently Boulay, Heutmaker, Zibell, PLLP omitted or listed inaccurately, Cargill, Inc. please accept our apologies Karen Conrath+ and contact our office at Corinne J. Dietrich Fund 1-888-672-0484 Lurinda Davis+ Jennifer Erickson+ Jan French+ Jody Grossman+ $10,000-$24,999 Rebecca & Jody Hams+ Joan Berg+ Jill Lekatz+ Blue Cross Blue Shield of Minnesota Amsoil, Inc. Sue Northey+ Benjamin & Amy Brachio Ranae Perry+ Butzow Family Foundation Larry & Kristi Waite C.H. Robinson Worldwide, Inc. Diane Ware+ Michael Conner+ Peilan Yang+ EMC Corporation James Brumbaugh+ Lee & Peggy Frederickson+ Roxanne Gleason Curt Glesmann Foundation James Griffiths+ Pam Haas+ Paul Haubenschild+ Starla & Patrick Inman+ Chester & Bobbi Jacobsen+ Eli Judah+ + Denotes donation 1 of equipment alsmn.org 2020 Annual Report Donor List $10,000-$24,999 Continued Carlton Kittleson, Jr. $5,000-$9,999 Anonymous Donor Vicki Kleeberger Barbara Ahlberg+ Kolar AutoWorld Clay Ahrens & Jana Johnson Gerald Krech+ American Family Mutual Insurance Nick Ladas+ Ameriprise Financial Karri LaFond+ Amsoil, Inc. Joyce Leyh+ Avera Health Mainline Information Systems Blake Begnaud+ -

Opportunities Targeted to the People You Want to Meet and the Visibility to Grow Your Brand

Opportunities targeted to the people you want to meet and the visibility to grow your brand. • • • • • • • • • • 3M Company Electromed Inc. MGC Diagnostics Corporation Spectrum Brands Holdings, Inc. ASK LLP A. O. Smith Corporation EMC Insurance Group Inc. MOCON, Inc. SS&C Technologies Holdings, Inc. Ballard Spahr, LLP (Lindquist & Vennum) Allete Inc. EnteroMedics Inc. Moody's (formerly Advent Software) BlackRock, Inc. Alliant Energy Corporation Evolving Systems, Inc. Mosaic Co. St. Jude Medical, Inc. Bloomberg L.P. Ameriprise Financial, Inc. Famous Dave’s of America MTS Systems Corporation Stamps.com Inc. BNY Mellon Brand Advantage Group Apogee Enterprises, Inc. Fastenal Company Multiband Corp. Steelcase Broadridge Financial Solutions, Inc. Arctic Cat Inc. FBL Financial Group, Inc. Navarre Stratasys, Ltd. Business Wire Sunshine Heart Inc Associated Bank FHLBanks Office of Finance New Jersey Resources Corporation CFA Institute SUPERVALU Inc. AstraZeneca plc FICO Northern Oil & Gas, Inc. Curran & Connors AxoGen, Inc. First Business NorthWestern Energy Corp SurModics, Inc. Deluxe Corporation Bemis Company, Inc. Financial Services, Inc. NVE Corporation Target Corporation Drexel Hamilton, LLC Best Buy, Co., Inc. FLUX Power Holdings, Inc. OneBeacon Insurance Group TCF Financial Corporation EQS Group Bio-Techne Corporation G&K Services, Inc. Orion Engineered Carbons S.A. Tennant Company FactSet Research Systems Inc. Black Hills Corp. General Mills, Inc. Oshkosh Corporation Tetraphase Pharmaceuticals, Inc. Federal Reserve Bank of Minneapolis Boston Scientific Corporation Graco, Inc. OSI Systems, Inc. The Toro Company Inspired Investment Leadership: Objective Measure Conference Buffalo Wild Wings, Inc. H.B. Fuller Company Otter Tail Corporation Tile Shop Holdings Inc Intrinsic Research Systems Inc. C.H. Robinson Worldwide, Inc. Heartland Financial USA, Inc. -

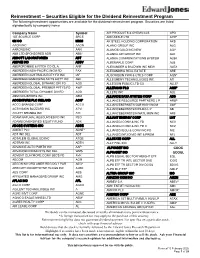

Word Template for Creating Internal Use Only Pdfs in Portrait Mode

Reinvestment – Securities Eligible for the Dividend Reinvestment Program The following investment opportunities are available for the dividend reinvestment program. Securities are listed alphabetically by company name Company Name Symbol AIR PRODUCTS & CHEMICALS APD 1ST SOURCE CORP SRCE AIRCASTLE LTD AYR* 3M CO MMM AK STEEL HOLDING CORPORATION AKS AAON INC AAON ALAMO GROUP INC ALG AARONS INC AAN ALAMOS GOLD INC NEW AGI* ABB LTD SPONSORED ADR ABB* ALASKA AIR GROUP INC ALK ABBOTT LABORATORIES ABT ALASKA COMMUNICATIONS SYSTEM ALSK ABBVIE INC ABBV ALBEMARLE CORP ALB ABERCROMBIE & FITCH CO CL A ANF ALEXANDER & BALDWIN INC NEW ALEX ABERDEEN ASIA-PACIFIC INCM FD FAX ALEXANDRIA REAL ESTATE ARE ABERDEEN AUSTRALIA EQTY FD INC IAF ALGONQUIN PWR & UTILS CORP AQN* ABERDEEN EMERGING MKTS EQTY INC AEF ALLEGHENY TECHNOLOGIES INC ATI ABERDEEN GLOBAL DYNAMIC DIV FD AGD ALLEGION PUBLIC LTD CO ALLE* ABERDEEN GLOBAL PREMIER PPTYS FD AWP ALLERGAN PLC AGN* ABERDEEN TOTAL DYNAMIC DIV FD AOD ALLETE INC ALE ABM INDUSTRIES INC ABM ALLIANCE DATA SYSTEM CORP ADS ACCENTURE PLC IRELAND ACN* ALLIANCE RESOURCE PARTNERS L P ARLP ACCO BRANDS CORP ACCO ALLIANCEBERNSTN GLB HIGH INCM AWF ACTIVISION BLIZZARD INC ATVI ALLIANCEBERNSTEIN HLDG L P AB ACUITY BRANDS INC AYI ALLIANCEBERNSTEIN NATL MUN INC AFB ADAM NATURAL RESOURCES FD INC PEO ALLIANT ENERGY CORP LNT ADAMS DIVERSIFIED EQUITY FUND ADX ALLIANZGI CONV & INC FD NCV ADOBE SYSTEMS INC ADBE ALLIANZGI CONV & INC FD II NCZ ADIENT PLC ADNT* ALLIANZGI EQU & CONV INC FD NIE ADT INC DEL ADT ALLIANZGI NFJ DIVID INT & PREM NFJ ADTALEM -

View Annual Report

Annual Report 2018 Ameriprise Financial Consolidated Highlights (In millions, except per share amounts and as noted) GAAP 2018 2017 2016 Adjusted Operating1, 2 2018 2017 2016 Net revenues $12,835 $12,132 $11,800 Net revenues $12,694 $11,993 $11,639 Net income Net revenues attributable to $2,098 $1,480 $1,313 excluding Tax Act $12,694 $12,044 $11,639 Ameriprise Financial impacts3 Earnings per diluted Earnings $2,135 $1,603 $1,426 share attributable to $14.20 $9.44 $7.81 Ameriprise Financial Earnings excluding 3 $2,135 $1,923 $1,426 common shareholders Tax Act impacts Earnings per diluted Return on equity $14.45 $10.23 $8.48 excluding accumulated share 36.0% 24.8% 20.4% other comprehensive income, net of tax Earnings per diluted share excluding $14.45 $12.27 $8.48 3 Shareholders’ equity $5,588 $5,995 $6,289 Tax Act impacts Shareholders’ equity Return on excluding accumulated equity excluding $5,879 $5,766 $6,089 other comprehensive accumulated other 36.6% 26.9% 22.2% income, net of tax comprehensive income, net of tax 2018 2017 2016 Return on equity excluding Assets under accumulated other 36.6% 32.3% 22.2% management and comprehensive $823 $897 $787 administration income, net of tax, (in billions) and Tax Act impacts3 Weighted average common shares 147.7 156.7 168.2 outstanding — diluted Cash dividends paid $3.53 $3.24 $2.92 per common share Common stock shares 11.3 9.9 17.6 repurchased 1 his Annual Report to Shareholders contains certain nonGAAP financial measures that management believes best reect the underlying performance of our operations. -

Ameriprise Financial 2-2021

Ameriprise Financial February 2021 Forward-looking statements The forward-looking statements in this presentation reflect management’s expectations about future events, plans and performance. These forward-looking statements and the many assumptions upon which they are based involve risks and uncertainties. A list of factors that could cause actual results to be materially different from those expressed or implied by any of these forward-looking statements is detailed under the headings “Forward-Looking Statements” and “Risk Factors”, and elsewhere, in our Annual Report on Form 10-K for the year ended December 31, 2019 and elsewhere in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020. These forward-looking statements speak only as of today's date and we undertake no obligation to update publicly or revise them for any reason. For information about Ameriprise Financial, please refer to the Fourth Quarter 2020 Statistical Supplement available at ir.ameriprise.com. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures that our management feels best reflect the underlying performance of our operations. Reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measure have been provided along with the presentation. 2 A diversified and differentiated financial services leader with a record of outperformance – well-positioned to capture future growth 3 Ameriprise – diversified and fully integrated Advice & Wealth Management Industry-leading wealth manager with Strong investment differentiated advice Important solutions performance; value proposition meeting clients’ client-focused approach evolving needs $1.1T Nearly tripled ~90% free cash $16B+ returned $1.9B 36% adjusted in AUM/A EPS since 20121 flow generation to shareholders excess capital operating ROE, since 2012 ex. -

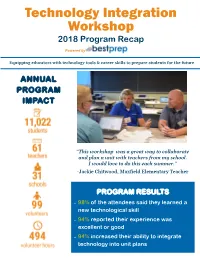

Technology Integration Workshop 2018 Program Recap

Technology Integration Workshop 2018 Program Recap Powered by Equipping educators with technology tools & career skills to prepare students for the future ANNUAL PROGRAM IMPACT “This workshop was a great way to collaborate and plan a unit with teachers from my school. I would love to do this each summer.” -Jackie Chitwood, Maxfield Elementary Teacher PROGRAM RESULTS • 98% of the attendees said they learned a new technological skill • 94% reported their experience was excellent or good • 94% increased their ability to integrate technology into unit plans Technology Integration Workshop The Technology Integration Workshop is a four-day professional development opportunity for educators to enhance their curriculum by utilizing technology tools in the classroom. Participants attended breakout sessions and a job shadow with a business professional. Schools Represented TECHNOLOGY INTEGRATION SPECIALISTS Academy of Whole Learning, Minnetonka Central High School, St. Paul Paul Anderson, Buffalo High School Como Park Senior High School, St. Paul Brenda Diekman, Buffalo High School Highwood Hills Elementary, St. Paul Angie Kalthoff, St. Cloud School District International Community School of Abidjan, Africa Jackson Elementary, St. Paul Jen Legatt, Hopkins North Jr. High School JJ Hill Montessori, St. Paul Rhonda Mechels, St. Paul Public Schools Lincoln Elementary, Owatonna Luverne Elementary School, Luverne Luverne High School, Luverne Luverne Middle, Luverne Luverne Public School District, Luverne Maxfield Elementary School, St. Paul McKinley Elementary, Owatonna Medford Secondary School, Medford Owatonna ALC 9-12, Owatonna Owatonna Middle School, Owatonna Owatonna Public School District, Owatonna Owatonna Senior High School, Owatonna Perpich Center for Arts Education, Golden Valley A breakout speaker discusses how to Rockford Elementary Arts Magnet School, Rockford integrate Virtual Reality Rockford High School, Rockford Rogers High School, Rogers Ronald M.