Initiatives in Each Business (PDF, 478KB)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

West Japan Railway Group Integrated Report 2019 —Report on Our Value for Society—

Continuity Progress Making Our Vision into Reality West Japan Railway Group Integrated Report 2019 —Report on Our Value for Society— West Japan Railway Company Contents 2 On the publication of “JR-West Group Integrated Report 2019” 3 Values held by the JR-West Group Our Starting Point 5 The derailment accident on the Fukuchiyama Line 11 Recovering from heavy rain damage through cooperation and think-and-act initiatives 13 Business activities of JR-West Group 15 The president’s message 17 The value we seek to provide through the non-railway business —Messages from group company Presidents Strategy of 21 Steps toward our vision 21 JR-West Group Medium-Term Management Plan 2022: approach & overview Value Creation 23 Toward long-term sustainable growth for Our Vision 25 Progress on Groupwide strategies—example initiatives 27 Promoting our technology vision 29 Special Three-Way Discussion The challenge of evolving in the railway/transportation field in an era of innovation 33 Fiscal 2019 performance in priority CSR fields and fiscal 2020 plans for priority initiatives 37 Safety 47 Customer satisfaction 51 Coexistence with communities A Foundation 55 Human resources/motivation Supporting 59 Human rights Value Creation 61 Global environment 67 Risk management 71 Corporate governance 73 Special Three-Way Discussion The role of the Board of Directors in achieving sustainable growth and enhancing corporate value 77 Initiatives in each business 81 Consolidated 10-year financial summary Data 83 Financial statements 87 Recognizing and responding to risks and opportunities 88 Data related to human resources and motivation (non-consolidated) Corporate profile (as of March 31, 2019) Scope As a rule, JR-West Group (including some Company name West Japan Railway Company initiatives at the non-consolidated level). -

2009 Annual Report

WEST JAPAN RAILWAY COMPANY RAILWAY JAPAN WEST Annual Report 2009 Ensuring Safety, Delivering Growth Annual Report 2009 WEST JAPAN RAILWAY COMPANY WEST JAPAN RAILWAY COMPANY Printed in Japan West Japan Railway Company (JR-West) is one of the six passenger railway transport companies formed by the split-up and privatization of Japanese National Railways (JNR) in 1987. Its mainstay railway business operates a network of lines with a total route length of approximately 5,000 kilometers, extending through 18 prefectures that account for around one-fifth of Japan’s land area. Railway systems in Japan evolved as a natural consequence of the cities that formed through the accumulation of people in the limited number of plains throughout the country. Joined like links in a chain, the geographical distribution of these cities has created a solid demand base that accounts for one-fourth of all passenger volume in Japan. While railway operations remain the core of its business, JR-West also aims to make the most of the assets that are part of its network of stations and railways to develop its retail, real estate, and hotel businesses. Corporate Philosophy 1 We, being conscious of our responsibility for protecting 4 We, together with our Group companies, will consistently the truly precious lives of our customers, and incessantly improve our service quality by enhancing technology and acting on the basis of safety first, will build a railway that expertise through daily efforts and practices. assures our customers of its safety and reliability. 5 We, deepening mutual understanding and respecting each 2 We, with a central focus on railway business, will fulfill the individual, will strive to create a company at which employ- expectations of our customers, shareholders, employees, ees find job satisfaction and in which they take pride. -

METROS/U-BAHN Worldwide

METROS DER WELT/METROS OF THE WORLD STAND:31.12.2020/STATUS:31.12.2020 ّ :جمهورية مرص العرب ّية/ÄGYPTEN/EGYPT/DSCHUMHŪRIYYAT MISR AL-ʿARABIYYA :القاهرة/CAIRO/AL QAHIRAH ( حلوان)HELWAN-( المرج الجديد)LINE 1:NEW EL-MARG 25.12.2020 https://www.youtube.com/watch?v=jmr5zRlqvHY DAR EL-SALAM-SAAD ZAGHLOUL 11:29 (RECHTES SEITENFENSTER/RIGHT WINDOW!) Altamas Mahmud 06.11.2020 https://www.youtube.com/watch?v=P6xG3hZccyg EL-DEMERDASH-SADAT (LINKES SEITENFENSTER/LEFT WINDOW!) 12:29 Mahmoud Bassam ( المنيب)EL MONIB-( ش ربا)LINE 2:SHUBRA 24.11.2017 https://www.youtube.com/watch?v=-UCJA6bVKQ8 GIZA-FAYSAL (LINKES SEITENFENSTER/LEFT WINDOW!) 02:05 Bassem Nagm ( عتابا)ATTABA-( عدىل منصور)LINE 3:ADLY MANSOUR 21.08.2020 https://www.youtube.com/watch?v=t7m5Z9g39ro EL NOZHA-ADLY MANSOUR (FENSTERBLICKE/WINDOW VIEWS!) 03:49 Hesham Mohamed ALGERIEN/ALGERIA/AL-DSCHUMHŪRĪYA AL-DSCHAZĀ'IRĪYA AD-DĪMŪGRĀTĪYA ASCH- َ /TAGDUDA TAZZAYRIT TAMAGDAYT TAỴERFANT/ الجمهورية الجزائرية الديمقراطيةالشعبية/SCHA'BĪYA ⵜⴰⴳⴷⵓⴷⴰ ⵜⴰⵣⵣⴰⵢⵔⵉⵜ ⵜⴰⵎⴰⴳⴷⴰⵢⵜ ⵜⴰⵖⴻⵔⴼⴰⵏⵜ : /DZAYER TAMANEỴT/ دزاير/DZAYER/مدينة الجزائر/ALGIER/ALGIERS/MADĪNAT AL DSCHAZĀ'IR ⴷⵣⴰⵢⴻⵔ ⵜⴰⵎⴰⵏⴻⵖⵜ PLACE DE MARTYRS-( ع ني نعجة)AÏN NAÂDJA/( مركز الحراش)LINE:EL HARRACH CENTRE ( مكان دي مارت بز) 1 ARGENTINIEN/ARGENTINA/REPÚBLICA ARGENTINA: BUENOS AIRES: LINE:LINEA A:PLACA DE MAYO-SAN PEDRITO(SUBTE) 20.02.2011 https://www.youtube.com/watch?v=jfUmJPEcBd4 PIEDRAS-PLAZA DE MAYO 02:47 Joselitonotion 13.05.2020 https://www.youtube.com/watch?v=4lJAhBo6YlY RIO DE JANEIRO-PUAN 07:27 Así es BUENOS AIRES 4K 04.12.2014 https://www.youtube.com/watch?v=PoUNwMT2DoI -

Higashiōsaka

Coordinates: 34°40′46″N 135°36′03″E Higashiōsaka 東大阪市 Higashiōsaka ( Higashiōsaka-shi, literally "East Higashiōsaka Osaka City") is a city located in Osaka Prefecture, Japan. The 東大阪市 city is known as one of the industrial cities of Japan and "the rugby football town". Core city As of October 1, 2016, the city has an estimated population of 500,463 and a population density of 8,100 persons per km². The total area is 61.81 km². Contents History Transportation Rail Nagase River in Higashiōsaka Roads Economy Politics Elections Education Flag Emblem Sister cities See also References External links History The city was founded on February 1, 1967 , by a merger of three cities, Fuse (布施), Kawachi (河内) and Hiraoka (枚岡), in eastern Osaka Prefecture. Transportation Rail West Japan Railway Company Katamachi Line (Gakkentoshi Line) Tokuan Station - Kōnoikeshinden Station Osaka Higashi Line - Takaida-Chūō Station - JR Location of Higashiōsaka in Osaka Prefecture Kawachi-Eiwa Station - JR Shuntokumichi Station - JR Nagase Station Kintetsu Railway Nara Line Fuse Station - Kawachi-Eiwa Station - Kawachi-Kosaka Station - Yaenosato Station - Wakae- Iwata Station - Kawachi-Hanazono Station - Higashi- Hanazono Station - Hyōtan-yama Station - Hiraoka Station - Nukata Station - Ishikiri Station Osaka Line Fuse Station - Shuntokumichi Station - Nagase Station - Mito Station Keihanna Line (Nagata Station) - Aramoto Station - Yoshita Station - Shin-Ishikiri Station Osaka Municipal Subway Chūō Line Takaida Station - Nagata Station Higashiōsaka Roads Expressways -

Transportation Operations

Business Strategy and Operating Results Transportation Operations Railway Revenues Other Conventional Lines Shinkansen Shinkansen 13.0% 51.1% Number of Passengers Years ended March 31 83million (Millions of passengers) 100 Kansai Urban Area (Kyoto-Osaka-Kobe Area) 83 83 85 69 67 35.9% 64 70 65 55 JR-West’s transportation operations segment consists of railway operations and small-scale 40 2013 2014 2015 2016 2017 bus and ferry services. Its core railway opera- tions encompass 18 prefectures in the western half of Japan’s main island of Honshu and the northern tip of Kyushu, covering a total service area of approximately 104,000 km2. The service Kansai Urban Area area has a population of approximately 43 million people, equivalent to around 33% of the population of Japan. The railway network Number of Passengers Years ended March 31 comprises a total of 1,200 railway stations, with an operating route length of 5,008.7 km, almost 20% of the total passenger railway 1,519million length in Japan. This network includes the Shinkansen (Sanyo Shinkansen and Hokuriku (Millions of passengers) Shinkansen), a high-speed intercity railway 1,600 1,511 1,519 line; the Kansai Urban Area, serving the 1,488 1,475 1,500 1,451 Kyoto–Osaka–Kobe metropolitan area; and other conventional railway lines (other than 1,400 those operated by the Kyoto, Osaka, and 1,300 Kobe branches). 1,200 1,100 2013 2014 2015 2016 2017 18 WEST JAPAN RAILWAY COMPANY Shinkansen Service Area Hokuriku Shinkansen Shinkansen Under construction Joetsumyoko Share of Passenger Market—Shinkansen -

11. Development in Kansai Urban Area (PDF, 156KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING CONTENTS BUSINESS DATA OTHER Fact Sheets 2019 OVERVIEW ENVIRONMENT 11 Business Development in Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA (As of March 2019) DEVELOPMENT in OSAKA LOOP LINE AREA JR Kyoto Line Osaka Higashi Line Tanikawa Umekoji-Kyotonishi (northern part) New station Shin-Osaka Hanaten – Shin-Osaka Opened in March 2019 Yamashina Kusatsu Relocate a portion of a Opened in March 2019 Ibaraki Station branch line of the Tokaido Kyoto Line underground and improvement and Kyoto development inside JR Kobe Line open a new station Railway Osaka Spring 2023 Opened in April 2018 Museum Hanaten Opened in Kyobashi Gakkentoshi Line April 2016 Himeji Maya New station Opened in Shin-Osaka Nara Line Nishikujo March 2016 Double track JR Tozai Line Kakogawa II stage JR Soujiji Spring 2023 Naniwasuji Line Shin-Kobe New station Yumeshima Umekita (Osaka) underground Kyobashi Opened in (Candidate site for station – JR Namba Higashi-Himeji Sannomiya March 2018 World Expo 2025 and Spring 2031 New station an integrated resort) Opened in Amagasaki Nara JR-Namba March 2016 Kobe Nishi-Akashi Osaka Tennoji Kizurikamikita Osaka New station Oji Higashi Line Opened in (southern part) March 2018 Takada Tennoji Yamatoji Line Kansai-airport Kyuhoji : JR-West related MAJOR PROJECTS facilities HOTEL • Naniwasuji Line • Relocate a portion of a branch line of • Osaka Higashi Line construction project VISCHIO OSAKA the Tokaido Line underground and by GRANVIA Project overview open a new station Project overview · Total cost: Approx. 330.0 billion yen · Total cost: Approx. 120.0 billion yen Project overview · length: Approx. -

Nekomap-2013-E.Pdf

Kita-Senri For Takarazuka For Saito-Nishi N Mino-o(箕面) Senri-Chuo Handai-Byoin-mae Takarazuka Line Ikeda M08 Hankyu Senri Line Bampaku-KinenKoen Kyuko Line Kita-Osak Osaka Monorail For Takarazuka HankyuHotarugaike Mino Line Yamada Hankyu Itami Line Ibaraki For Kyoto Itami Ishibashi Toyonaka M09 Kyoto Line Hankyu T Osaka Airport M10 Ryokuchi-Koen Hankyu Kyoto Line Ibaraki-Shi Itami M11 Esaka a Kandai-Mae akar Minami- For For Shin-Kobe Osaka Int'l Airport a M12 Higashimikuni Ibaraki Kawaramachi /Himeji zuka Lin Shin- Suita Itakano For Mikuni Higashi- Kami-Shinjo I 11 Sannomiya Hankyu Kobe Line Kanzakigawa e Osaka新大阪 Yodogawa M13 Shimo-Shinjo I 12 For Kyoto Tsukaguchi Tsukaguchi Sanyo Shinkansen Line Nishinakajima- Tokaido Shinkansen Line Minamigat西中島南方a I 13 Amagasaki Tsukamoto Awaji Moriguchi M14 Sozenji Taishibashi- Juso Minamikata Imaichi I 14 T12 T11 Dainichi For Sannomiya Kobe Line Kunijima T13 Moriguchi Kadoma T Amagasaki Daimotsu Hanshin Mainozai Line Line Nakatsu Tenjimbashisuji -Shi -Shi M15 Nakatsu 6-chome T14 For Hanshin Namba Line Umeda Nakazakicho Miyakojima For Sannomiya Osaka T18 Sanjo 大阪 T19 K11 T17 T16 T15 Ebie Kadoma N27 Fukushima UmedaM16 Ogimachi Temma I 15 -Minami 梅田 T20 Yodogawa Noda Umeda K12 O Sekime-Seiiku Higashi- sa I 17 I 16 Tsurumi- Umeda ka Ryokuchi N26 Nodahanshin S11 Shin- Y11 Nishi- Lo Sakuranomiya Sekime Fukushima Umeda op Dempo Minami- L Noda in S12 Morimachi e in Line N25 Tamagawa T21 Noe Maishima Kitashinchi K13 Osakatemmangu Kyobashi Sports Island N24 Naniwabashi Osakajokitazume N22 I 18 Yumesaki Line -

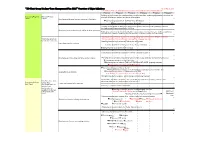

JR-West Group Medium-Term Management Plan 2022 Major

“JR-West Group Medium-Term Management Plan 2022” Overview of Major Initiatives As of May 8, 2019 Red letters: Additions after the announcement of the medium-term management plan FY2019.3 FY2020.3 FY2021.3 FY2022.3 FY2023.3 FY2024.3~ Building tourism routes that combine railways and cruise ships, operating sightseeing trains that link Increasing Regional Setouchi Palette strategic Shinkansen stations and tourist destinations Value Project Developing wide-area tourism routes as a foundation ▼Commencing operation of the Hello Kitty Shinkansen ▼Enhancing strategic stations (Onomichi) Drawing on the appeal of distinctive regional food and souvenirs to develop strategic stations, developing appealing accommodation facilities Developing content that has the ability to draw customers Developing commercial products that feature regional appeal and opening sales routes, establishing and publicizing content combining new perspectives on regional events and attractions Opening an official Twitter account for train operating-status information (English, traditional Hospitality initiatives Chinese, simplified Chinese, Korean), opening Thai-language web site for inbound customers Installing Western-style toilets on 700-series rolling stock Improving reception systems Installing free Wi-Fi in Shinkansen trains (Sanyo/Hokuriku) Enabling Internet reservations from overseas Considering/implementing campaigns to attract overseas tourists in Developing and improving wide-area tourism routes Providing diverse products (expanding regional airport usage products -

11. Railway-Related Projects in the Kansai Urban Area (PDF, 113KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING STRATEGY BUSINESS DATA OTHER Fact Sheets 2021 OVERVIEW ENVIRONMENT 11 Business Railway-related projects in the Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA (As of March 2021) Travel time from Osaka to Kansai Airport Tanikawa Umekoji-Kyotonishi New station Access Method Travel Time Opened in March 2019 Kusatsu Yamashina Kansai - Airport Rapid Current 64 min.*1 Ibaraki Station Service from Osaka Relocate a portion of a branch New station between improvement and After opening line of the Tokaido Line Himeji and Agaho Kyoto Kyoto “Haruka” from development inside Railway of underground 44 min.*2 underground and Umekita Kyoto opening in Spring 2026 Opened in April 2018 underground station Museum station (Osaka) Underground Station Opened in *1 March 2017 timetable basis April 2016 (Planned for Spring 2023) *2 After opening of Naniwasuji Line Tokaido Shinkansen Himeji Maya New station Timetable is under consideration Shin-Kobe Opened in Shin-Osaka Nara Line March 2016 Double track Sanyo Shinkansen Shin- Kakogawa II stage Osaka JR Soujiji Spring 2023 Kobe Shin-Kobe New station Opened in Kyobashi Higashi-Himeji Sannomiya March 2018 Amagasaki New station Transport access Opened in Amagasaki Nara March 2016 Kobe under consideration Osaka Hanaten Nishi-Akashi Osaka Tennoji Sakurajima Kyobashi Oji Naniwasuji Line Yumeshima Osaka Higashi Line Takada (The site of World Expo Nishikujo (Planned for Access to eastern part All segments open 2025 and candidate site Spring 2031) from March 2019 for an integrated resort) of Osaka and Nara JR-Namba Kansai-airport Tennoji Nara Kansai-airport Access to Kansai Airport MAJOR PROJECTS Kyuhoji • Naniwasuji Line • Relocate a portion of a branch line of the Tokaido Line underground and Hineno Project overview open a new station · Total cost: Approx. -

(Translation) to Our Shareholders: Firstly, We Should Like to Extend

(Translation) To Our Shareholders: Firstly, we should like to extend our heartfelt gratitude for your continued support of our business operations. We also offer our heartfelt condolences to all the victims of the Kumamoto Earthquake, which struck in April 2016, along with our sincere wishes for the earliest recovery. West Japan Railway Group very seriously takes its responsibility for the train accident on the Fukuchiyama Line we caused on April 25, 2005 and the gravity of its consequences, and all officers and employees are making a group-wide effort to establish a safe, secure and trusted rail service. To continue to take the accident seriously and build a safer railway system, I, as well as all other officers and employees, am determined to make greater efforts in conducting day-to-day operations. In March 2013, we formulated a "JR-West Group Medium-Term Management Plan 2017" and its central core "Safety Think-and-Act Plan 2017", which have continued to place "Three Pillars of Management", comprising "measures to have ourselves accepted as acting with the best intentions by the victims of the train accident", "measures to enhance safety" and "furthering of reform", as our high-priority issues for management and have since exerted our efforts to implement, as the Priority Strategies, the "Three Basic Strategies" and the "Four Business Strategies". In April 2015, as a review of the last two years, and based on the changes in the business environment, we updated the "JR-West Group Medium-Term Management Plan 2017" and made revisions and additions to the measures to be implemented to achieve our objectives. -

Opening of New Lines Nippori-Toneri Liner

Photostory Opening of New Lines Nippori-Toneri Liner Minumadai-shinsuikoen Toneri Toneri-koen Yazaike Nishiaraidaishi-nishi Kohoku Koya Toden Arakawa Line Ogi-ohashi Adachi-odai Keihin-Tohoku Line Kumanomae Yamanote Line Akado-shogakkomae Tokyo Metro Chiyoda Line Ikebukuro Keisei Line Nishi-nippori Joban Line Nippori Ueno Akihabara Tokyo The Nippori-Toneri Liner is an automated guideway shinsuikoen to Nippori to 20 minutes compared to the transit (AGT) system that entered service on 30 March 1-hour bus journey. 2008 and is operated by the Transportation Bureau of A green zone that includes Kohoku Hokubu the Tokyo Metropolitan Government. The 9.7-km line Greenway Park, Tokyo Metropolitan Toneri Park, and connects Nippori Station in Tokyo’s Arakawa Ward with Minumadai-shinsui Park extends alongside the line and Minumadai-shinsuikoen Station via Nishiaraidaishi-nishi shopping districts, temples, and other sites are located and other stations. The decision to construct the line was nearby. made in 1985 to alleviate the shortage of public transport Arakawa Ward and other organizations are in Arakawa and Adachi wards in northeast Tokyo; redeveloping the area around Nippori Station in construction started in 1997. Transport convenience in anticipation of possible increased passenger flows the area has been greatly improved by the opening, following the opening. which shortens the travel time from Minumadai- Japan Railway & Transport Review No. 50 • Sep 2008 2 Photostory Exterior (above) and interior (below) views of Nippori-Toneri Liner (Bureau of Transportation, Tokyo Metropolitan Government) 3 Japan Railway & Transport Review No. 50 • Sep 2008 Photostory Opening of New Lines Tokyo Metro Fukutoshin Line Wakoshi Chikatetsu-narimasu Tobu Tojo Line Chikatetsu-akatsuka Heiwadai Hikawadai Fukutoshin Line train (Tokyo Metro. -

11. Development in Kansai Urban Area (PDF, 209KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING CONTENTS BUSINESS DATA OTHER Fact Sheets 2017 OVERVIEW ENVIRONMENT 11 Business Development in Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA *New station names are provisional. (As of May 2017) MAJOR PROJECTS Tanikawa JR Shichijyo* • Relocate a portion of a branch line of • Osaka Higashi Line construction project New station the Tokaido Line underground and Spring 2019 Yamashina open a new station Project overview Ibaraki Station Kyoto · Total cost: Approx. 120.0 billion yen improvement and Kyoto Project overview development inside (excl. opening of new stations) Railway · Total cost: approx. 69.0 billion yen station Spring 2018 Museum · length: Approx. 20.3 km · Length: approx. 2.4 km Opened in · No. of stations: 14 (incl. existing stations) April 2016 · New station plan: underground station with Himeji Maya New station two unattached platforms and four train lines Project leaders Opened in Shin-Osaka Nara Line · Construction: Osaka Soto-Kanjo Railway Co., Ltd. Project leaders March 2016 Double track · Operations: West Japan Railway Company Kakogawa Spring 2023 · Construction: City of Osaka, West Japan Railway Company Project timeline Shin-Kobe JR Soujiji* New station · Operations: West Japan Railway Company Jun. 1999 Construction started on southern part Higashi-Himeji Kyobashi Spring 2018 (Hanaten-Kyuhoji) Sannomiya Project timeline New station Nov. 2007 Construction started on northern part Opened in Nara Nov. 2015 Construction started Kobe Amagasaki (Shin Osaka-Hanaten) March 2016