Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consumers Energy

Table of Contents CMS ENERGY CONSUMERS ENERGY 2020 COMBINED PROXY STATEMENT Table of Contents CMS ENERGY CORPORATION CONSUMERS ENERGY COMPANY NOTICE OF ANNUAL MEETINGS OF SHAREHOLDERS To Shareholders of CMS Energy Corporation and Consumers Energy Company: The CMS Energy Corporation (‘‘CMS’’) Annual Meeting of Shareholders and the Consumers Energy Company (‘‘Consumers’’) Annual Meeting of Shareholders (collectively ‘‘Annual Meeting’’) will be held concurrently on Friday, May 1, 2020, at 10:00 a.m., Eastern Daylight Saving Time, at the corporate headquarters, One Energy Plaza, Jackson, Michigan 49201 for the purpose of considering the following matters: Board of Directors For Both CMS and Consumers Shareholders: Recommendation Elect the Director Nominees Named in this Proxy Statement to the Board of FOR EACH Directors Approve, on an Advisory Basis, Executive Compensation FOR Ratify the Appointment of Independent Registered Public Accounting Firm FOR Approve the 2020 Performance Incentive Stock Plan FOR Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement Board of Directors For CMS Shareholders Only: Recommendation Vote on a Shareholder Proposal Relating to Political Contributions AGAINST Disclosure, if Properly Presented All shareholders of record at the close of business on March 3, 2020, are entitled to receive notice of and vote at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you can vote prior to the meeting by telephone, Internet, proxy card or voting instruction form. We encourage you to exercise your right to vote. All shares of Consumers common stock held by CMS (99.6% of the voting shares of Consumers) will be voted for the proposed Director nominees, thus assuring their election as Directors of Consumers, as well as for the other recommendations of the Consumers’ Board of Directors. -

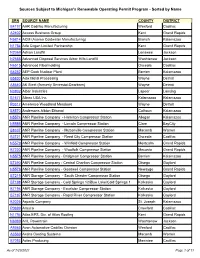

Sources Subject to Michigan's Renewable Operating Permit Program - Sorted by Name

Sources Subject to Michigan's Renewable Operating Permit Program - Sorted by Name SRN SOURCE NAME COUNTY DISTRICT B4197 AAR Cadillac Manufacturing Wexford Cadillac A2402 Access Business Group Kent Grand Rapids N5814 ACM (Asama Coldwater Manufacturing) Branch Kalamazoo N1784 Ada Cogen Limited Partnership Kent Grand Rapids N2369 Adrian Landfill Lenawee Jackson N2688 Advanced Disposal Services Arbor Hills Landfill Washtenaw Jackson N6515 Advanced Fibermolding Osceola Cadillac B4252 AEP Cook Nuclear Plant Berrien Kalamazoo B5830 Ajax Metal Processing Wayne Detroit A8640 AK Steel (formerly Severstal-Dearborn) Wayne Detroit N0802 Albar Industries Lapeer Lansing B1677 Allnex USA Inc. Kalamazoo Kalamazoo P0317 Ameresco Woodland Meadows Wayne Detroit B8570 Andersons Albion Ethanol Calhoun Kalamazoo N5574 ANR Pipeline Company - Hamilton Compressor Station Allegan Kalamazoo N5586 ANR Pipeline Company - Lincoln Compressor Station Clare BayCity B8337 ANR Pipeline Company - Muttonville Compressor Station Macomb Warren B3721 ANR Pipeline Company - Reed City Compressor Station Osceola Cadillac N5578 ANR Pipeline Company - Winfield Compressor Station Montcalm Grand Rapids B7220 ANR Pipeline Company - Woolfolk Compressor Station Mecosta Grand Rapids N5575 ANR Pipeline Company - Bridgman Compressor Station Berrien Kalamazoo B7390 ANR Pipeline Company - Central Charlton Compressor Station Otsego Gaylord N5576 ANR Pipeline Company - Goodwell Compressor Station Newaygo Grand Rapids B7219 ANR Storage Company - South Chester Compressor Station Otsego Gaylord -

Annual Report

Table of Contents CMS ENERGY & C ONSUME RS ENERGY ANNUAL REPORT 2019 Table of Contents Dear Shareowners: I’m proud to report that we delivered another year of strong financial performance in 2019, marking 17 years of meeting our adjusted earnings guidance. As we reflect on a successful year of world class performance delivering hometown service, I’m proud to share our top achievements with you, as measured by our triple bottom line of People, Planet and Profit. PEOPLE ─ Serving our customers, communities and co-workers. Highlights include: • Achieved 1st Quartile Employee Engagement • Named the #1 Michigan Company for Diversity 2019 by Forbes® Magazine for the third year in a row • Ranked 2nd in the state (40th of 113 companies globally) in the Military Times Best for Vets: Employers 2019 • Ranked in the Top 50 Best Employers for Diversity 2020 by Forbes® Magazine • Won the Association for Talent Development (ATD) 2019 BEST Award (# 3 in the world) • Received the 2019 Women’s Resource Network’s Pillar Award • Ranked #1 overall in the Midwest Large Segment for the 2019 Gas Residential Customer Satisfaction Study, JD Power & Associates • Partnered with Project Search and Jackson Intermediate School District to launch our 2nd cohort of interns to provide meaningful work experiences to young adults with disabilities PLANET ─ Going above and beyond environmental regulations to leave our planet better than we found it. Highlights include: • Settled our 20-year Clean Energy Plan with broad coalition of support • Cross Winds® Energy Park Phase -

S T a T E O F M I C H I G

S T A T E O F M I C H I G A N BEFORE THE MICHIGAN PUBLIC SERVICE COMMISSION * * * * * In the matter on the Commission’s own motion ) to implement the provisions of 2013 PA 95. ) Case No. U-17377 ) At the July 9, 2015 meeting of the Michigan Public Service Commission in Lansing, Michigan. PRESENT: Hon. John D. Quackenbush, Chairman Hon. Greg R. White, Commissioner Hon. Sally Talberg, Commissioner ORDER AND NOTICE OF OPPORTUNITY TO COMMENT 2013 PA 95 (Act 95), MCL 460.9t, created the Low-Income Energy Assistance Fund (LIEAF) within the State Treasury. Section 9t(5) of Act 95 provides that money from the LIEAF shall be expended by the Department of Health and Human Services as provided in the Michigan Energy Assistance Act, 2012 PA 615. Act 95 provides that the Commission, after an opportunity to comment, may annually approve a low-income energy assistance funding factor no later than July 31 of each year for the subsequent fiscal year. Section 9t(10)(B) of Act 95 provides that the funding factor is a nonbypassable surcharge to be added to each retail billing meter (but no more than one residential meter per residential site), payable monthly by every customer receiving retail distribution service from an electric utility, municipally-owned electric utility, or cooperative electric utility, regardless of the identity of the customer’s electric generation supplier. The funding factor shall be the same across all customer classes, shall appear as a separate line item on each customer’s bill, and shall not exceed $1. -

Rate Book for Natural Gas Service

M.P.S.C. No. 3 - Gas Original Sheet No. A-1.00 Consumers Energy Company (To reformat Rate Book) CONSUMERS ENERGY COMPANY RATE BOOK FOR NATURAL GAS SERVICE These Standard Rules and Regulations and Rate Schedules contained herein have been adopted by the Company to govern its relations with customers and have been approved by the Michigan Public Service Commission as an integral part of its Rate Book for Natural Gas Service. Copies of the Company's Rate Book for Natural Gas Service are available on Consumers Energy Company's website at the following website address, https://www.consumersenergy.com/-/media/CE/Documents/rates/gas-rate-book.ashx or at the Michigan Public Service Commission's website at the following website address, https://www.michigan.gov/documents/mpsc/consumers2cur_575658_7.pdf. Territory This Rate Book for Natural Gas Service applies to the entire territory served with Natural Gas by the Company. THIS RATE BOOK SUPERSEDES AND CANCELS RATE BOOK M.P.S.C. No. 2 - Gas Issued December 13, 2019 by Patti Poppe, President and Chief Executive Officer, Jackson, Michigan M.P.S.C. No. 3 – Gas Second Revised Sheet No. A-2.00 Consumers Energy Company Cancels First Revised Sheet No. A-2.00 (To update links) INDEX SECTION A Sheet No. Title Page A-1.00 Index A-2.00 Table of Contents - Checklist A-7.00 Gas Service or Franchise Area A-11.00 Territory Served A-12.00 Technical Terms and Abbreviations A-24.00 Supplemental Utility Service Charges A-26.00 SECTION B ADMINISTRATIVE RULES INDEX https://www.michigan.gov/mpsc/0,9535,7-395-93309_93437_93467---,00.html B1. -

Policies to Overcome Barriers for Renewable Energy Distributed Generation: a Case Study of Utility Structure and Regulatory Regimes in Michigan

Michigan Technological University Digital Commons @ Michigan Tech Department of Social Sciences Publications Department of Social Sciences 2-20-2019 Policies to overcome barriers for renewable energy distributed generation: A Case study of utility structure and regulatory regimes in Michigan Emily Prehoda Michigan Technological University Joshua M. Pearce Michigan Technological University Chelsea Schelly Michigan Technological University Follow this and additional works at: https://digitalcommons.mtu.edu/social-sciences-fp Part of the Energy Policy Commons, and the Environmental Policy Commons Recommended Citation Prehoda, E., Pearce, J. M., & Schelly, C. (2019). Policies to overcome barriers for renewable energy distributed generation: A Case study of utility structure and regulatory regimes in Michigan. Energies, 12(4). http://dx.doi.org/10.3390/en12040674 Retrieved from: https://digitalcommons.mtu.edu/social-sciences-fp/164 Follow this and additional works at: https://digitalcommons.mtu.edu/social-sciences-fp Part of the Energy Policy Commons, and the Environmental Policy Commons energies Review Policies to Overcome Barriers for Renewable Energy Distributed Generation: A Case Study of Utility Structure and Regulatory Regimes in Michigan Emily Prehoda 1, Joshua M. Pearce 2,3,* and Chelsea Schelly 1 1 Department of Social Sciences, Michigan Technological University, Houghton, MI 49931, USA; [email protected] (E.P.); [email protected] (C.S.) 2 Department of Material Science & Engineering and Department of Electrical & Computer Engineering, Michigan Technological University, Houghton, MI 49931, USA 3 Department of Electronics and Nanoengineering, School of Electrical Engineering, Aalto University, FI-00076 Espoo, Finland * Correspondence: [email protected] or joshua.pearce@aalto.fi Received: 9 January 2019; Accepted: 14 February 2019; Published: 20 February 2019 Abstract: Because of its environmental damage and now often being the most expensive source for electricity production, coal use is declining throughout the United States. -

Get Closer to Nature Enjoy Michigan’S Rivers and Natural Woodlands

GET CLOSER TO NATURE ENJOY MICHIGAN’S RIVERS AND NATURAL WOODLANDS. A LITTLE WILD, A LOT WONDERFUL CONSUMERS ENERGY GET CLOSER TO NATURE • 1 GET CLOSER TO NATURE A LITTLE WILD, A LOT WONDERFUL xperience the best nature has to offer. Whether it’s a leisurely bike ride or hike through miles Eof pine forests with hardly another human passerby. Built and operated by Consumers Rogers Hydro Energy since the early 1900s, the 12,000 acres of land and water at our 13 hydro- electric dams offer many recreational opportunities: Au Sable River Mio • Fishing or camping. Alcona • Picnicking and swimming. Manistee River Cooke • Canoeing and seeing a deer take a Hodenpyl PAGE Foote PAGE drink at the edge of the water. Five Channels • Catching sight of a bald eagle soaring Tippy 6 Loud high above its nest or a family of 4 trumpeter swans gliding silently across Muskegon River the water. Hardy • Viewing Michigan’s fall foilage along Rogers PAGE the brilliantly colorful landscape. Croton Consumers Energy works with town- 8 ship, county, state and federal govern- ment officials, plus many volunteer Grand River PAGE organizations and private businesses to provide access to the clear water and Webber cool forests. 10 So grab the family, hop in the car and Kalamazoo River enjoy Michigan’s rivers and natural Allegan PAGE woodlands today. (Calkins Bridge) Let your family experience something a 10 little wild, but a lot wonderful. YOUR SAFETY IS A PRIORITY. See page 15 for tips. CONSUMERS ENERGY GET CLOSER TO NATURE • 3 MANISTEE RIVER Known locally as the “Big Manistee,” so as not to be confused with its smaller southern neighbor, the Little Manistee River, the Manistee River stretches about 170 miles from its headwaters near Alba to Manistee Lake and then Lake Michigan. -

Consumers Energy Cms Energy

TABLE OF CONTENTS CMS ENERGY CONS UMERS ENERGY 2021 COMBINED PROXY STATEMENT TABLE OF CONTENTS CMS ENERGY CORPORATION CONSUMERS ENERGY COMPANY NOTICE OF VIRTUAL ANNUAL MEETINGS OF SHAREHOLDERS To Shareholders of CMS Energy Corporation and Consumers Energy Company: The CMS Energy Corporation (‘‘CMS’’) Virtual Annual Meeting of Shareholders and the Consumers Energy Company (‘‘Consumers’’) Virtual Annual Meeting of Shareholders (collectively ‘‘Annual Meeting’’) will be held concurrently on Friday, May 7, 2021, at 10:00 a.m., Eastern Daylight Saving Time. There will be no physical location for shareholders to attend. Shareholders may only participate online by logging in at www.virtualshareholdermeeting.com/CMS2021 for CMS shareholders and www.virtualshareholdermeeting.com/CMSPB2021 for Consumers Shareholders. ITEMS OF BUSINESS: Board of Directors For Both CMS and Consumers Shareholders: Recommendation Elect the Director Nominees Named in this Proxy Statement to the Board of FOR EACH Directors Approve, on an Advisory Basis, Executive Compensation FOR Ratify the Appointment of Independent Registered Public Accounting Firm FOR Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement Board of Directors For CMS Shareholders Only: Recommendation Vote on a Shareholder Proposal Relating to Greenwashing Audit, if AGAINST Properly Presented All shareholders of record at the close of business on March 9, 2021, are entitled to receive notice of and vote at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you can vote prior to the meeting by telephone, Internet, proxy card or voting instruction form. We encourage you to exercise your right to vote. All shares of Consumers common stock held by CMS (99.6% of the voting shares of Consumers) will be voted for the proposed Director nominees, thus assuring their election as Directors of Consumers, as well as for the other recommendations of the Consumers’ Board of Directors. -

Consumers Energy AUG 7 2014 Waiver App.Pdf

20140807-5167 FERC PDF (Unofficial) 8/7/2014 4:47:30 PM UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULATORY COMMISSION ) Consumers Energy Company, ) Docket No. EL14-____-000 ) CONSUMERS ENERGY COMPANY’S REQUEST FOR WAIVER 20140807-5167 FERC PDF (Unofficial) 8/7/2014 4:47:30 PM TABLE OF CONTENTS Page I. EXECUTIVE SUMMARY .................................................................................................2 II. DESCRIPTION AND BENEFITS OF ALTERNATIVE PROPOSALS ............................3 1. Planned Outage ........................................................................................................3 2. Waiver of Must-Offer and Requirements to Purchase Replacement ZRCs ..................................................................................................3 3. Replacement ZRCs for Period in Question Only .....................................................4 4. Financial Payment ....................................................................................................4 III. ISSUE AND PROPOSED SOLUTIONS ...........................................................................4 A. The Classic Seven ...................................................................................................4 B. The 6.5 Week Disconnect .......................................................................................5 C. Consumers Energy Cannot Continue to Operate the Classic Seven on Coal Beyond April 16, 2016 ...............................................................................6 D. -

Serving Michigan. That's Our Promise

SERVING MICHIGAN. THAT’S OUR PROMISE. 2014 ACCOUNTABILITY REPORT SERVING MICHIGAN. THAT’S OUR PROMISE. 2014 ACCOUNTABILITY REPORT Ludington Pumped Electric Service Territory Storage Lake Winds Energy Park Karn/Weadock Cross Winds Energy Park Cobb Gas and Electric Service Territory Campbell Zeeland Gas Service Territory Jackson Headquarters Whiting TABLE OF CONTENTS 1. Message from John Russell: Consumers Energy Works to Serve You 2. Just the Facts 4. Consumers Energy in Your Community 8. Meeting Michigan’s Future Energy Needs 10. Our Balanced Energy Approach 12. Sustainability – Making Our Mark 14. Quality – Keeping Our Promises Every Day 16. Striving to Be Best in Class KEY PERFORMANCE INDICATORS: 17. Safety 18. Customer Service 19. Reliability 20. Rates 21. Controlling Costs 22. Workforce 23. Environment 24. Corporate Giving CONSUMERS ENERGY WORKS TO SERVE YOU Each day, Consumers Energy employees are focused on delivering value to the customers and communities we serve. he reasons we come to work each day are This report details our efforts to meet Michigan’s to serve our customers and to care for the energy needs. Inside, you’ll learn more about our communities where they live and work. company’s historical commitment to serving the First and foremost, that means safely sup- state; how the unique challenges of our industry Tplying the reliable, affordable energy needed to power influence our strategy; and how we’re doing in per- businesses and warm and light homes. But it also means formance areas that are key to delivering value operating sustainably and behaving as a solid corpo- to our customers. rate citizen by committing our financial resources and I hope you’ll discover more about Consumers Energy, leveraging the time and develop appreciation for the long-term nature of our We’re leveraging our financial talents of our employees to business and see a clear picture of the performance resources, as well as the time improve the quality of life we’re working hard to improve each day. -

Reporter 2012 Hydro Reporter • 3

HYr e p Do rRt erO 2 0 12 CONTENTS Flood of 1986 Challenged Cooke Dam Tours Employees and Machines Featured During Centennial Celebration 4 Cooling Outflow Water wenty- five years ago, as Consumers Croton Hydro Temperatures in 2011 5 Energy celebrated the 100th anniver- Tsary of its 1886 founding, a two-day Foote Dam Tailwater storm of epic proportions tested its Mus- Access Being Readied kegon River dams and the people of west for Reconstruction 6 Michigan like no weather event has, before or since. By the time it was over, west Mich- Hardy Pond Trail igan was swamped with more than a foot Development and a half of rain, at least six people died, 89 Effort Delayed 7 more were injured and public and private property suffered millions in damages. The Trumpeter Swans of storm posed a real threat to the integrity of the Au Sable Valley 8 Rogers, Hardy and Croton dams. Had they Mio Dam Tailwater Fishing failed, the scope of the disaster unquestion- Access Improvements 9 ably would have been much worse. The week of Sept. 7, 1986 started out as As dawn approached on Improving Fish Habitat 10 routine as any for the Muskegon River dam Thursday, flow passage operations and maintenance staff. Periodic unit inspections were getting under way had to increase at all three for Croton unit 1 and 2 and Hardy Pond plants as rising pond levels had been lowered one foot to decrease the chances that it would need to pass flows need to be controlled. through the spill gates at Croton while the two units were out. -

Rate Book for Electric Service

M.P.S.C. No. 14 – Electric Original Sheet No. A-1.00 Consumers Energy Company (To reformat Rate Book) CONSUMERS ENERGY COMPANY RATE BOOK FOR ELECTRIC SERVICE These Standard Rules and Regulations and Rate Schedules contained herein have been adopted by the Company to govern its relations with customers and have been approved by the Michigan Public Service Commission as an integral part of its Rate Book for Electric Service. Copies of the Company's Rate Book for Electric Service are available on Consumers Energy Company's website at the following website address, https://www.consumersenergy.com/-/media/CE/Documents/rates/electric-rate-book.pdf or at the Michigan Public Service Commission's website at the following website address, https://www.michigan.gov/mpsc/0,9535,7-395- 93308_93325_93423_93501_93508_94515-504646--,00.html Territory This Rate Book for Electric Service applies to the entire territory served with Electricity by the Company. THIS RATE BOOK SUPERSEDES AND CANCELS RATE BOOK M.P.S.C. No. 13 - Electric Issued December 13, 2019 by Patti Poppe, President and Chief Executive Officer, Jackson, Michigan M.P.S.C. No. 14 – Electric Third Revised Sheet No. A-2.00 Consumers Energy Company Cancels Second Revised Sheet No. A-2.00 (To update links) INDEX SECTION A Sheet No. Title Page A-1.00 Index A-2.00 Table of Contents - Checklist A-7.00 Electric Service or Franchise Area A-12.00 Territory Served A-13.00 Technical Terms and Abbreviations A-26.00 SECTION B ADMINISTRATIVE RULES INDEX https://www.michigan.gov/mpsc/0,9535,7-395-93309_93437_93467---,00.html B1.