W&C Standard Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Macro Report Comparative Study of Electoral Systems Module 4: Macro Report September 10, 2012

Comparative Study of Electoral Systems 1 Module 4: Macro Report Comparative Study of Electoral Systems Module 4: Macro Report September 10, 2012 Country: Serbia Date of Election: May 6, 2012 (Parliamentary and first round presidential); May 20, 2012 - second round presidential Prepared by: Bojan Todosijević Date of Preparation: 05. 08. 2013. NOTES TO COLLABORATORS: ° The information provided in this report contributes to an important part of the CSES project. The information may be filled out by yourself, or by an expert or experts of your choice. Your efforts in providing these data are greatly appreciated! Any supplementary documents that you can provide (e.g., electoral legislation, party manifestos, electoral commission reports, media reports) are also appreciated, and may be made available on the CSES website. ° Answers should be as of the date of the election being studied. ° Where brackets [ ] appear, collaborators should answer by placing an “X” within the appropriate bracket or brackets. For example: [X] ° If more space is needed to answer any question, please lengthen the document as necessary. Data Pertinent to the Election at which the Module was Administered 1a. Type of Election [ ] Parliamentary/Legislative [X] Parliamentary/Legislative and Presidential [ ] Presidential [ ] Other; please specify: __________ 1b. If the type of election in Question 1a included Parliamentary/Legislative, was the election for the Upper House, Lower House, or both? [ X] Upper House [ ] Lower House [ ] Both [ ] Other; please specify: __________ Comparative Study of Electoral Systems 2 Module 4: Macro Report 2a. What was the party of the president prior to the most recent election, regardless of whether the election was presidential? Democratic Party (Demokratska stranka, DS) 2b. -

Participation of Older Persons in Political And

International Forum on the Rights of Older Persons 26‐28 March 2012 Mexico City PARTICIPATIONPARTICIPATION OFOF OLDEROLDER PERSONSPERSONS ININ POLITICALPOLITICAL ANDAND PUBLICPUBLIC LIFELIFE AlexandreAlexandre SidorenkoSidorenko ©Alexandre Sidorenko, 2012 Plan of Presentation 1. Introduction. Political orientation and political participation of older persons 2. Organizations of (with) older persons: Civil society organizations; NGOs; Labour Unions; Political parties 3. Participation in decision making: Coordinating bodies; Consultative bodies 4. Political and public participation in the international policy frameworks on ageing 5. Political and public participation in national policy actions on ageing (instrumental review) 6. Conclusion ©Alexandre Sidorenko, 2012 1. Political Orientation and Political Participation of Older Persons PoliticalPolitical orientationorientation:: ‐the content, intensity, and stability of the attachments individuals have to political objects. PoliticalPolitical participationparticipation:: ‐ the ways in which individuals attempt to influence or take part in governmental activity. 1. Political Orientation and Political Participation of Older Persons PoliticalPolitical OrientationOrientation 9 Political Interest –expressed interest in political affairs 9 Attitudes toward Self, Politics, and Political Institutions – sense ofOlder efficacy persons (worth) in arepolitics. more notable for their 9 Politicalsimilarities Values andto otherPolitical age Ideology groups –more than fundamental their differencesorientations; -

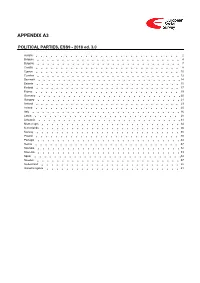

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

List of Participants Liste Des Participants

LIST OF PARTICIPANTS LISTE DES PARTICIPANTS 142nd IPU Assembly and Related Meetings (virtual) 24 to 27 May 2021 - 2 - Mr./M. Duarte Pacheco President of the Inter-Parliamentary Union Président de l'Union interparlementaire Mr./M. Martin Chungong Secretary General of the Inter-Parliamentary Union Secrétaire général de l'Union interparlementaire - 3 - I. MEMBERS - MEMBRES AFGHANISTAN RAHMANI, Mir Rahman (Mr.) Speaker of the House of the People Leader of the delegation EZEDYAR, Mohammad Alam (Mr.) Deputy Speaker of the House of Elders KAROKHAIL, Shinkai (Ms.) Member of the House of the People ATTIQ, Ramin (Mr.) Member of the House of the People REZAIE, Shahgul (Ms.) Member of the House of the People ISHCHY, Baktash (Mr.) Member of the House of the People BALOOCH, Mohammad Nadir (Mr.) Member of the House of Elders HASHIMI, S. Safiullah (Mr.) Member of the House of Elders ARYUBI, Abdul Qader (Mr.) Secretary General, House of the People Member of the ASGP NASARY, Abdul Muqtader (Mr.) Secretary General, House of Elders Member of the ASGP HASSAS, Pamir (Mr.) Acting Director of Relations to IPU Secretary to the delegation ALGERIA - ALGERIE GOUDJIL, Salah (M.) Président du Conseil de la Nation Président du Groupe, Chef de la délégation BOUZEKRI, Hamid (M.) Vice-Président du Conseil de la Nation (RND) BENBADIS, Fawzia (Mme) Membre du Conseil de la Nation Comité sur les questions relatives au Moyen-Orient KHARCHI, Ahmed (M.) Membre du Conseil de la Nation (FLN) DADA, Mohamed Drissi (M.) Secrétaire Général, Conseil de la Nation Secrétaire général -

Chronicle of Parliamentary Elections 2008 Elections Parliamentary of Chronicle Chronicle of Parliamentary Elections Volume 42

Couverture_Ang:Mise en page 1 22.04.09 17:27 Page1 Print ISSN: 1994-0963 Electronic ISSN: 1994-098X INTER-PARLIAMENTARY UNION CHRONICLE OF PARLIAMENTARY ELECTIONS 2008 CHRONICLE OF PARLIAMENTARY ELECTIONS VOLUME 42 Published annually in English and French since 1967, the Chronicle of Parliamen tary Elections reports on all national legislative elections held throughout the world during a given year. It includes information on the electoral system, the background and outcome of each election as well as statistics on the results, distribution of votes and distribution of seats according to political group, sex and age. The information contained in the Chronicle can also be found in the IPU’s database on national parliaments, PARLINE. PARLINE is accessible on the IPU web site (http://www.ipu.org) and is continually updated. Inter-Parliamentary Union VOLUME 42 5, chemin du Pommier Case postale 330 CH-1218 Le Grand-Saconnex Geneva – Switzerland Tel.: +41 22 919 41 50 Fax: +41 22 919 41 60 2008 E-mail: [email protected] Internet: http://www.ipu.org 2008 Chronicle of Parliamentary Elections VOLUME 42 1 January - 31 December 2008 © Inter-Parliamentary Union 2009 Print ISSN: 1994-0963 Electronic ISSN: 1994-098X Photo credits Front cover: Photo AFP/Pascal Pavani Back cover: Photo AFP/Tugela Ridley Inter-Parliamentary Union Office of the Permanent Observer of 5, chemin du Pommier the IPU to the United Nations Case postale 330 220 East 42nd Street CH-1218 Le Grand-Saconnex Suite 3002 Geneva — Switzerland New York, N.Y. 10017 USA Tel.: + 41 22 919 -

Local Elections in Serbia (6 May 2012)

The Congress of Local and Regional Authorities Chamber of Local Authorities 23rd PLENARY SESSION CPL(23)3 26 September 2012 Local elections in Serbia (6 May 2012) Rapporteur: Nigel MERMAGEN, United Kingdom (L, ILDG1) Draft resolution (for vote) ......................................................................................................................... 2 Draft recommendation (for vote) ............................................................................................................. 3 Explanatory memorandum ...................................................................................................................... 4 Summary The Congress appointed a delegation to observe the first round of the local elections in the Republic of Serbia (Serbia) on 6 May 2012. With the exception of some incidents, the delegation stated that the elections were conducted in an overall calm and orderly manner in, mostly, well-organised polling stations. The Congress also referred to improvements in the legal framework and the electoral system of Serbia (a new allocation system for mandates and the abolition of the so-called blank resignations of candidates) which had positive effects on the identification of local leadership. However, the organisation of three elections – at presidential, parliamentary and municipal/local level – on the same day has meant that local elections were largely overshadowed by the national vote. Matters of concern from a Congress perspective remain the infringement of the secrecy of the vote, the -

Manifesto Project Dataset List of Political Parties

Manifesto Project Dataset List of Political Parties [email protected] Website: https://manifesto-project.wzb.eu/ Version 2020a from July 22, 2020 Manifesto Project Dataset - List of Political Parties Version 2020a 1 Coverage of the Dataset including Party Splits and Merges The following list documents the parties that were coded at a specific election. The list includes the name of the party or alliance in the original language and in English, the party/alliance abbreviation as well as the corresponding party identification number. In the case of an alliance, it also documents the member parties it comprises. Within the list of alliance members, parties are represented only by their id and abbreviation if they are also part of the general party list. If the composition of an alliance has changed between elections this change is reported as well. Furthermore, the list records renames of parties and alliances. It shows whether a party has split from another party or a number of parties has merged and indicates the name (and if existing the id) of this split or merger parties. In the past there have been a few cases where an alliance manifesto was coded instead of a party manifesto but without assigning the alliance a new party id. Instead, the alliance manifesto appeared under the party id of the main party within that alliance. In such cases the list displays the information for which election an alliance manifesto was coded as well as the name and members of this alliance. 2 Albania ID Covering Abbrev Parties No. Elections -

List of Political Parties

Manifesto Project Dataset Political Parties in the Manifesto Project Dataset [email protected] Website: https://manifesto-project.wzb.eu/ Version 2015a from May 22, 2015 Manifesto Project Dataset Political Parties in the Manifesto Project Dataset Version 2015a 1 Coverage of the Dataset including Party Splits and Merges The following list documents the parties that were coded at a specific election. The list includes the party’s or alliance’s name in the original language and in English, the party/alliance abbreviation as well as the corresponding party identification number. In case of an alliance, it also documents the member parties. Within the list of alliance members, parties are represented only by their id and abbreviation if they are also part of the general party list by themselves. If the composition of an alliance changed between different elections, this change is covered as well. Furthermore, the list records renames of parties and alliances. It shows whether a party was a split from another party or a merger of a number of other parties and indicates the name (and if existing the id) of this split or merger parties. In the past there have been a few cases where an alliance manifesto was coded instead of a party manifesto but without assigning the alliance a new party id. Instead, the alliance manifesto appeared under the party id of the main party within that alliance. In such cases the list displays the information for which election an alliance manifesto was coded as well as the name and members of this alliance. 1.1 Albania ID Covering Abbrev Parties No. -

Public Funding and Party Survival in Eastern Europe

Get a Subsidy or Perish! Public Funding and Party Survival in Eastern Europe Fernando Casal Bértoa & Maria Spirova Department of Political Science Leiden University f.casal.Bé[email protected] [email protected] The Legal Regulation of Political Parties Working Paper 29 February 2013 © The author(s), 2013 This working paper series is supported by the Economic and Social Research Council (ESRC research grant RES-061-25-0080) and the European Research Council (ERC starting grant 205660). To cite this paper : Fernando Casal Bértoa and Maria Spirova (2013). ‘Get a Subsidy or Perish! Public Funding and Party Survival in Eastern Europe’, Working Paper Series on the Legal Regulation of Political Parties, No. 29. To link to this paper : http://www.partylaw.leidenuniv.nl/uploads/wp2913.pdf This paper may be used for research, teaching and private study purposes. Any substantial or systematic reproduction, re-distribution, re-selling, loan or sub-licensing, systematic supply or distribution in any form to anyone is expressly forbidden. ISSN: 2211-1034 The Legal Regulation of Political Parties, working paper 29/13 Introduction 1 Much has been written about the state financing of political parties, its characteristics and its consequences for party behavior. Research has centered heavily on the effects party financing has had on issues of corruption, accountability, and transparency, and for the most part has focused on the regulation of private financing (Roper 2002, 2003; Protsyk 2002; Nassmacher 2004; Pinto-Duschinsky 2002, Smilov and Toplak, 2007). Similarly, studies have investigated the effects high dependence on public financing has had on the development of organizational structures and the internal shifts of power within individual parties (van Biezen 2003, 177–200). -

Final Report, Early Parliamentary Elections, OSCE

Office for Democratic Institutions and Human Rights REPUBLIC OF SERBIA EARLY PARLIAMENTARY ELECTIONS 24 April 2016 OSCE/ODIHR Limited Election Observation Mission Final Report Warsaw 29 July 2016 TABLE OF CONTENTS I. EXECUTIVE SUMMARY ........................................................................................ 1 II. INTRODUCTION AND ACKNOWLEDGEMENTS ............................................. 3 III. BACKGROUND ......................................................................................................... 4 IV. LEGAL FRAMEWORK AND ELECTORAL SYSTEM ...................................... 4 V. ELECTION ADMINISTRATION ............................................................................ 5 VI. VOTER REGISTRATION ........................................................................................ 6 VII. CANDIDATE REGISTRATION .............................................................................. 7 VIII. CAMPAIGN ENVIRONMENT ................................................................................ 9 IX. CAMPAIGN FINANCE ........................................................................................... 11 X. MEDIA ...................................................................................................................... 12 A. MEDIA ENVIRONMENT ................................................................................................ 12 B. LEGAL AND REGULATORY FRAMEWORK ................................................................... 13 C. OSCE/ODIHR LEOM MEDIA MONITORING -

The Emergence of Pensioners' Parties in Contemporary Europe

The emergence of pensioners’ parties in contemporary Europe Chapter 12 in Joerg Chet Tremmel (ed.) Young Generation Under Pressure? The Financial Situation and the “Rush Hour” of the Cohorts 1970-1985 in a Generational Comparison. Berlin: Springer Verlag, 2010, pp. 225-244. Dr Seán Hanley Senior Lecturer in Politics School of Slavonic and East European Studies UCL Gower St London WC1E 6BT [email protected] tel + 00 44 207 679 8818 1 The emergence of pensioners’ parties in contemporary Europe Introduction Party politics in contemporary Europe often exhibit marked generational biases. Older voters are both more to turn out to vote to support political parties at elections and to be members of political parties (Goerres 2009). Conversely, younger votes are increasingly disinclined to participate in formal party-electoral politics leading to concern over the ‘greying’ of party democracy and of socio-political organizations (Henn, Weinstein and Wring 2002; Phelps 2006; Goerres 2009; Robertson 2009). Certain (types of) party are disproportionately supported by older age groups. Indeed, in certain cases – as with the members of the British Conservative Party during 1990s (Whitely, Syed and Richardson 1994) or the electorate of the Czech Republic’s Communist Party (Hanley 2001), older age cohorts can find themselves in the majority, significantly affecting the way such parties understand, prioritize and respond to issues of the day and often tending to narrow their political appeal over time. However, the possibility that population ageing and the growing salience of issues relating to ageing societies might generate pressures for the emergence of new parties has been largely overlooked. -

Manifesto Project Dataset List of Political Parties

Manifesto Project Dataset List of Political Parties [email protected] Website: https://manifesto-project.wzb.eu/ Version 2019a from August 21, 2019 Manifesto Project Dataset - List of Political Parties Version 2019a 1 Coverage of the Dataset including Party Splits and Merges The following list documents the parties that were coded at a specific election. The list includes the name of the party or alliance in the original language and in English, the party/alliance abbreviation as well as the corresponding party identification number. In the case of an alliance, it also documents the member parties it comprises. Within the list of alliance members, parties are represented only by their id and abbreviation if they are also part of the general party list. If the composition of an alliance has changed between elections this change is reported as well. Furthermore, the list records renames of parties and alliances. It shows whether a party has split from another party or a number of parties has merged and indicates the name (and if existing the id) of this split or merger parties. In the past there have been a few cases where an alliance manifesto was coded instead of a party manifesto but without assigning the alliance a new party id. Instead, the alliance manifesto appeared under the party id of the main party within that alliance. In such cases the list displays the information for which election an alliance manifesto was coded as well as the name and members of this alliance. 2 Albania ID Covering Abbrev Parties No. Elections