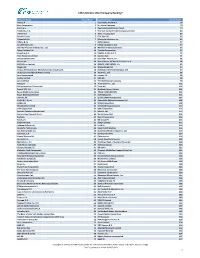

Exkluderade Bolag Per Q4 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL RE·PORT 2013 Astra Resources Plc (CN: 0762(218) and Controlled Entities Financial Report for the Period Ended on 30 June 2013

Astra Resources ANNUAL RE·PORT 2013 Astra Resources PlC (CN: 0762(218) and Controlled Entities Financial Report for the Period Ended on 30 June 2013 CONTENTS MESSAGE FROM ASTRA'S CEO , , 3 MESSAGE FROM ASTRA'S MANAGING DIRECTOR , 4 THE ASTRA WAY ...........................•..... , ,.., , , , , 5 OUR V1SION •.••••••.••.•.•.,•.•.••••..•..••.••••.•.•.•..,..•.•.•,..•.•.•.•••••,.••.•.•,........•....••..•.•....•....•.•..••.•.....•••••••.• ,.••.•.•••.•.•••....,.••...•..••..•.•...•..• ,.••.••.•........•....•.••••.................••.• 5 OUR MISSION •....................•................................................................•.............•................................•.....•.•.••.•.......•.•.•.•..•.••.•....•.•.• ,•.....•....•...•.•...•....•.•.• ,.•..•.. 5 OUR GOALS AND VALUES .•.•••••.•,.•••••.•,.••.•.••••....••.•....••....•.•..•.•...•••••.••.•.•...•.•....••.••••..• ,....•.••...•. ,•••••..•,.•.•..•..........•.•................••.................•..................•........ 5 HIGHLIGHTS & PRIORITIES 6 2013 HI GHLrGHTS ............................................•.............•..•.••..................•...........•...•..............•.............•..•.••.••.•.• ,•.•••,...•..•••••.••••.•••.,.•.•.•.•.•.••..•....••.••.••.•.•.••.• 6 2014 PRIORlTIES ,..,.....•.••.•..••.••••.•.•...••..•.••.•.••.•....•.••.....•.••.•.....••.• ,.•,.•,..••.•.........•.•.••.•.......•..••.••..•.•......•.••.•.•.••••..•.....•.•..•.••.•••••••........•.......•...............•.••.•... 8 BUSINESS STRATEGY ..........................................................................................................................•........ -

Corporate Rating Component Scores North America Q4 2020

Corporate Rating Component Scores North America Q4 2020 FALSE NA Corporate Rating Component Scores Oct. 31, 2020 Corporate Rating Component Scores North America Methodology," which is the criteria we use for rating corporate industrial companies and utilities. We list the scores for the 2308 public ratings in NA that are within the scope of our corporate methodology, accompanied by charts that show the distribution of aggregated scores. We believe that the list and charts enhance benchmarking across industries and rating levels for all market participants. We disclose these scores in line with the information we provide in our rating research publications, such as research updates and full analyses. By releasing all scores for public corporate ratings in NA, S&P Global Ratings confirms its commitment to deliver greater transparency and insight into the ratings process and simplify access for all market participants. Ratings are organized alphabetically by industry sector. The scores reflect the building blocks of the corporate ratings framework (see chart 1). Modifiers and components related to our group rating methodology or government-related entity methodology are indicated only where they have a positive or negative effect on the rating. The report reflects corporate credit ratings and scores as of Oct. 31, 2020. This document will not be updated for future rating actions or score revisions. To keep it concise, the list only discloses scores for the main rated entity of larger corporate groups. We omit certain entities such as subsidiaries or holding companies where the ratings are linked to those on their parent companies. In this report, we highlight changes since Jan. -

The Mineral Industry of Chile in 1998

THE MINERAL INDUSTRY OF CHILE By Pablo Velasco In 1998, Chile continued to be the top producer and exporter negotiate a trade agreement in the medium term. Chile shared of copper in terms of volume and value, producing 30.8% of the the U.S. interest in negotiating a comprehensive trade world's mined copper. Chile was recognized by the world agreement between the two countries. This is because the mining community as being the single most active mining United States was Chile’s most important single trading partner country in terms of new development and investment; of the and source of foreign investment. In 1995, Chile began total $5.04 billion in foreign investment, about 32% was in negotiations to joint the North American Free Trade mining. Direct foreign investment in Chilean mining rose to Agreement (NAFTA). Those talks have been stalled because of $1.6 billion in 1997. political factors in the United States. The U.S. administration Copper remained the country’s most important export planned to introduce legislation in Congress, which, if product, accounting for about 36% of export earnings in the approved, would allow negotiations related to Chilean first 9 months of 1998. Chile was also one of the world's accession to NAFTA or to a bilateral trade agreement with the significant producers and exporters of potassium nitrate and United States. sodium nitrate and ranked second after Japan in world A key feature of the government of Chile’s development production of iodine. Chile ranked first in lithium, second in strategy was a welcoming attitude towards foreign investors, rhenium, and third in molybdenum. -

World Investment Report 2007: Transnational Corporations, Extractive Industries and Development

EMBARGO The contents of this Report must not be quoted or summarized in the press, on radio, or on television, before 16 October 2007 - 17:00 hours GMT UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT WORLD INVESTMENT 2007 REPORT d Transnational Corporations, WExtractive Industriesorl and Development t Investment Repor UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT WORLD INVESTMENT 2007 REPORT Transnational Corporations, Extractive Industries and Development UNITED NATIONS New York and Geneva, 2007 New York and Geneva, 2007 ii World Investment Report 2007: Transnational Corporations, Extractive Industries and Development NOTE As the focal point in the United Nations system for investment and technology, and building on 30 years of experience in these areas, UNCTAD, through DITE, promotes understanding of key issues, particularly matters related to foreign direct investment and transfer of technology. DITE also assists developing countries in attracting and benefiting from FDI and in building their productive capacities and international competitiveness. The emphasis is on an integrated policy approach to investment, technological capacity building and enterprise development. The terms country/economy as used in this Report also refer, as appropriate, to territories or areas; the designations employed and the presentation of the material do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. In addition, the designations of country groups are intended solely for statistical or analytical convenience and do not necessarily express a judgement about the stage of development reached by a particular country or area in the development process. -

UNITED CHURCH of CHRIST, INC. SCHEDULE of INVESTMENTS March 31, 2021 Unaudited - for Information Purposes Only

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS March 31, 2021 Unaudited - for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 32,253,645 $ 32,253,645 Synthetic Guaranteed Investment Contracts Liquidity Strategy 22,775,770 22,775,770 Total Return Strategy 113,816,896 113,816,896 TOTAL STABLE VALUE INVESTMENTS $ 168,846,312 $ 168,846,312 SHORT-TERM INVESTMENTS Short-term Investments $ 99,844,082 $ 99,844,082 TOTAL SHORT-TERM INVESTMENTS $ 99,844,082 $ 99,844,082 FIXED-INCOME INVESTMENTS Bonds $ 1,100,460,107 $ 1,102,627,965 Bond funds 127,197,863 136,853,018 Asset-backed & Mortgage-backed Securities 252,260,633 255,492,647 TOTAL FIXED-INCOME INVESTMENTS $ 1,479,918,603 $ 1,494,973,630 EQUITY INVESTMENTS Common stocks and equivalents $ 948,021,079 $ 1,367,282,966 Equity funds 295,450,197 366,566,153 TOTAL EQUITY INVESTMENTS $ 1,243,471,276 $ 1,733,849,120 OTHER INVESTMENTS Hedge funds $ 92,035,561 $ 122,358,507 Real assets 107,927,936 98,977,251 Participation in the United Church Funds, Inc. 34,869,973 45,987,425 TOTAL OTHER INVESTMENTS $ 234,833,470 $ 267,323,183 TOTAL INVESTMENTS $ 3,226,913,743 $ 3,764,836,327 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 32,253,645 $ 32,253,645 TOTAL SHORT-TERM INVESTMENT $ 32,253,645 $ 32,253,645 SYNTHETIC GUARANTEED INVESTMENT CONTRACTS- LIQUIDITY STRATEGY: Asset-Backed Securities 801,908 AEP Texas Inc. -

Uitsluitingenlijst

UITSLUITINGENLIJST Scildon sluit voor de door haar intern beheerde portefeuilles aandelen en leningen uit, uitgegeven door bedrijven vermeld in de onderstaande tabellen: ELECTRICITEITS-, MIJNBOUW-, Agnico Eagle Mines Ltd Tahoe Resources Inc OLIE- EN GASINDUSTRIE African Rainbow Minerals Ltd Cia Siderurgica Nacional SA Norsk Hydro ASA Usinas Siderurgicas de Minas Gerais SA Lundin Gold Inc Gold Fields Ltd Acacia Mining PLC NGEx Resources Inc Anglo American Platinum Ltd MMC Norilsk Nickel PJSC Fosun International Ltd Sibanye Gold Ltd Fortescue Metals Group Ltd Zijin Mining Group Co Ltd Aurubis AG Hindalco Industries Ltd Wheaton Precious Metals Corp. OZ Minerals Ltd voestalpine AG Franco-Nevada Corp Alcoa Corporation South32 Ltd Korea Zinc Co Ltd Constellium NV Eldorado Gold Corp Jiangxi Copper Co Ltd Outokumpu OYJ Antofagasta PLC Nordic Mines AB APERAM SA Industrias Penoles SAB de CV Maruichi Steel Tube Ltd Boliden AB Alrosa PJSC Afarak Group OYJ Anglo American PLC Bekaert SA Enagas SA Newmont Mining Corp China Steel Corp ERG SpA Kinross Gold Corp Lucara Diamond Corp Snam SpA Vedanta Resources PLC Sumitomo Metal Mining Co Ltd TOTAL SA Hindustan Zinc Ltd Nucor Corp Neste Oyj Arconic Inc Gränges AB Cairn Energy PLC Umicore SA Daido Steel Co Ltd MOL Hungarian Oil & Gas PLC Goldcorp Inc Tenaris SA Galp Energia SGPS SA SSAB AB Cia de Minas Buenaventura SAA Nederlandse Gasunie NV Kumba Iron Ore Ltd Hitachi Metals Ltd Eni SpA Lonmin PLC JSW Steel Ltd Statoil ASA Vedanta Ltd JFE Holdings Inc OMV AG Barrick Gold Corp Salzgitter AG PTT Exploration -

Coal Ownership

Coal Ownership (MW) July 2017 - Includes units 30 MW and larger Announced + Pre-permit Cancelled Company Announced Pre-permit Permitted + Permitted Construction Shelved 2010-2017 Operating Retired 24 Hour Company 0 0 500 500 0 0 0 0 0 A Brown Company 0 0 0 0 135 0 0 135 0 A1 Group 0 0 0 0 0 150 0 0 0 A2A 375 0 0 375 0 0 0 796 160 Aalborg Forsyning 0 0 0 0 0 0 0 716 0 Aarti Steels 0 0 0 0 0 0 0 90 0 Abhijeet Group 0 0 0 0 0 0 8,955 244 0 ABL Co. Ltd. 0 112 0 112 0 0 0 0 0 Aboitiz Group 0 0 200 200 755 344 0 500 0 ACB (India) Limited 0 0 0 0 0 1,200 1,200 1,330 0 ACC Limited 0 0 0 0 0 0 0 30 0 Accord Energy 0 0 0 0 0 360 0 0 0 Aci Energy 0 0 0 0 0 0 0 0 36 ACWA Power 3,850 300 720 4,870 1,200 300 0 0 0 Adani Group 600 3,200 3,200 7,000 0 2,920 6,300 10,440 0 Adaro 300 100 0 400 633 0 0 60 0 Adhunik Group 0 0 0 0 0 0 5,820 570 0 Aditya Birla Group 0 0 0 0 0 0 0 3,173 0 AEI (Ashmore Energy International) 0 0 0 0 0 0 0 300 0 AES 0 168 0 168 168 150 6,780 9,963 4,655 Africa Power House 0 0 330 330 0 0 0 0 0 African Energy Resources 900 0 300 1,200 0 850 0 0 0 AGL Energy 0 0 0 0 0 0 2,000 5,194 0 Agrofert 0 0 0 0 0 0 0 46 0 Air Products & Chemicals 0 0 0 0 0 0 0 0 60 Akfen Group 0 0 0 0 0 0 1,900 0 0 Akkan Enerji A.ş. -

Premier Natural Resources Practice “They Go to Great Lengths to Understand Your Industry, Business and Specific Objectives

Premier Natural Resources Practice “They go to great lengths to understand your industry, business and specific objectives . so the advice you get it is fit for purpose. It’s not cookie cutter, and as a client that is extremely valuable.” CLIENT QUOTED IN CHAMBERS UK 2014 NATURAL RESOURCES “Sullivan is our firm of choice – they are terrific, time after time. The work is of a very high quality, and they understand our commercial intentions as well as the legal issues.” CLIENT QUOTED IN CHAMBERS USA 2013 “Sullivan & Cromwell has ‘very thorough knowledge of the industry’.” Client Quoted In LEGAL 500 UK, 2014 Projects, Energy and Natural Resources: Oil & Gas Premier Natural Resources Practice &C has served the needs of extractive industry clients Our multi-disciplinary approach ensures that clients benefit from our industry experience in each of our Sfor over a century. Lawyers in our Natural Resources practice areas, from advising junior resource companies, private equity and commodities traders to some of the Group have advised on many of the most transformative world’s largest energy and mining companies and their financiers. Our core practice areas and the natural and complex transactions in both the oil and gas and resources industries we serve include: mining and minerals industries. Our experience extends OUR GLOBAL Mergers & Acquisitions and Joint Ventures PRACTICE AREAS across the natural resources sector and is global in scope, Project Development & Finance from Argentina to Zimbabwe. Capital Markets, Leveraged Finance & Lending Private Equity Restructuring Commodities, Futures & Derivatives Tax Sanctions and Trade Disputes and Investigations OUR INDUSTRIES Oil and Gas — Upstream — Pipelines — LNG — Downstream Mining and Metals 2 3 Oil and Gas &C has significant and varied experience advising clients S&C’s standing in the industry is reflected in the number of major companies it has represented, both directly and in Sin the oil and gas sector. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

CSR-S Monitor Company Standings

CSR-S Monitor 2012 Company Ranking* Company Name Overall Rank Company Name Overall Rank VALE S.A. 1 Koninklijke Ahold N.V. 79 Sony Corporation 2 H.J. Heinz Company 79 Enel S.p.A. 3 Puma AG Rudolf Dassler Sport 79 Telefonica, S.A. 4 The Siam Cement Public Company Limited 83 L'Oreal S.A. 5 Mars, Incorporated 84 Alcatel Lucent 5 GDF Suez SA 85 Vattenfall A.B. 7 Motorola Solutions, Inc. 85 Tiffany & Co. 7 3M Company 87 LG Electronics, Inc. 9 Intesa Sanpaolo S.p.A. 87 Hon Hai Precision Industry Co., Ltd. 10 Northern Trust Corporation 87 Fibria Celulose S.A. 10 Toshiba Corporation 87 Ecopetrol S.A. 12 CEMEX, S.A.B. de C.V. 91 Teck Resources Limited 13 Danisco A/S 91 GlaxoSmithKline Plc 14 Schneider Electric S.A. 91 Xstrata plc 14 Banca Monte dei Paschi di Siena S.p.A. 94 BHP Billiton Limited 16 BANCO SANTANDER, S.A. 95 Diageo plc 16 Wienerberger AG 95 Taiwan Semiconductor Manufacturing Company Ltd. 18 Sumitomo Chemical Company, Ltd. 97 De Beers Consolidated Mines Limited 19 AEON Co., Ltd. 98 Acer Incorporated 20 Lonmin Plc 98 Fujitsu Limited 21 UBS AG 98 ArcelorMittal 22 The Walt Disney Company 98 Aviva plc 23 Asahi Glass Co., Ltd. 102 British American Tobacco plc 23 Linde AG 102 Repsol YPF, S.A. 23 Nedbank Group Limited 102 Exxon Mobil Corporation 26 TELUS CORPORATION 102 Bayer Aktiengesellschaft 27 Xcel Energy Inc. 102 Daimler AG 27 QUALCOMM Incorporated 107 Pirelli & C. S.p.A. 29 Koninklijke Philips Electronics N.V. -

Eligible Company List - Updated 2/1/2018

Eligible Company List - Updated 2/1/2018 S10009 3 Dimensional Services Rochester Hills, MI Supplier Employees Only S65830 3BL Media LLC North Hampton, MA Supplier Employees Only S69510 3D Systems Rock Hill, SC Supplier Employees Only S65364 3IS Inc Novi, MI Supplier Employees Only S70521 3R Manufacturing Company Goodell, MI Supplier Employees Only S61313 7th Sense LP Bingham Farms, MI Supplier Employees Only D18911 84 Lumber Company Eighty Four, PA DCC Employees Only S42897 A & S Industrial Coating Co Inc Warren, MI Supplier Employees Only S73205 A and D Technology Inc Ann Arbor, MI Supplier Employees Only S57425 A G Manufacturing Harbour Beach, MI Supplier Employees Only S01250 A G Simpson (USA) Inc Sterling Heights, MI Supplier Employees Only F02130 A G Wassenaar Denver, CO Fleet Employees Only S80904 A J Rose Manufacturing Avon, OH Supplier Employees Only S19787 A OK Precision Prototype Inc Warren, MI Supplier Employees Only S62637 A Raymond Tinnerman Automotive Inc Rochester Hills, MI Supplier Employees Only S82162 A Schulman Inc Fairlawn, OH Supplier Employees Only S78336 A T Kearney Inc Chicago, IL Supplier Employees Only D80005 A&E Television Networks New York, NY DCC Employees Only S64720 A.P. Plasman Inc. Fort Payne, AL Supplier Employees Only S36205 AAA National Office (Only EMPLOYEES Eligible) Heathrow, FL Supplier Employees Only S31320 AAF McQuay Inc Louisville, KY Supplier Employees Only S14541 Aarell Process Controls Group Troy, MI Supplier Employees Only F05894 ABB Inc Cary, NC Fleet Employees Only S10035 Abbott Ball Co -

Chile Mining 2021 Chile Mining 2021

CHILE MINING 2021 CHILE MINING 2021 Political Overview - Production - Exploration - ESG Equipment & Technology - Engineering & Consulting - Services Dear Reader, Welcome to our Chile Mining 2021 publication, where we dive deep into the chal- lenges, opportunities and competitiveness of the Chilean mining industry, as well as ongoing trends and debates on automation, digitalization, the copper cycle, the future of lithium and potential for gold. Our Chile Mining report of 2020 highlighted the battle the country fought with the social unrest and how the industry was impacted. Chile was hopeful at the beginning of 2020 to start the year on a clean slate. However, the world witnessed the Covid-19 pandemic unravel, plunging global economies into recessions and triggering trillion- dollar stimulus plans. Fortunately, the Chilean mining industry has shown remarkable resilience and perse- verance, as it withstood the external pressures well compared to other leading copper producers. This was facilitated by the industry’s early trial at remote work in Octo- ber 2019 and the boom in commodity prices that pushed base and precious metals to record-highs that gave hope to the global mining sector. The pandemic has also significantly accelerated technology adoption across the entire supply chain as companies adopted remote working techniques. However, there were challenges as supply chains were disrupted due to lockdowns and social distancing measures. The pandemic aside, the industry in Chile is fighting some of the same battles we see every year with water scarcity, rising energy costs and decreasing total factor produc- tivity. This year we are witnessing significant investments in R&D by equipment and service providers to address these challenges.