The New Installment Payment Landscape 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wolfefintechforum DAY 1 AGENDA

#WolfeFinTechForum DAY 1 AGENDA - TUESDAY, MARCH 9, 2021 Opening Remarks 7:50-8:00am ET Wolfe Research – Darrin Peller, Managing Director, Payments, Processors, and IT Services Shift4 Payments 8:00-8:35am ET Jared Isaacman - CEO Fiserv 8:40-9:15am ET Frank Bisignano – President & CEO JP Morgan Chase 9:20-9:55am ET Max Neukirchen – CEO of Merchant Services Mastercard 10:00-10:35am ET Sachin Mehra - CFO B2B Payments: Living Through an Inflection Billtrust – Mark Shifke, CFO Discover Financial Services 10:40-11:15am ET MineralTree – Chris Sands, CFO John Greene – EVP & CFO Repay Holdings Corporation – Jake Moore, EVP Corporate Development & Strategy Fidelity National Information Services 11:20-11:55am ET Gary Norcross – President & CEO Woody Woodall - CFO PayPal 12:00-12:40pm ET Dan Schulman - CEO 12:40-1:00pm ET BREAK Square 1:00-1:35pm ET Amrita Ahuja - CFO Jack Henry & Associates, Inc. 1:40-2:15pm ET David Foss – President & CEO Synchrony 2:20-2:55pm ET Brian Wenzel, Sr – EVP & CFO Paychex, Inc. 3:00-3:35pm ET Efrain Rivera – Sr. VP, CFO & Treasurer Walker & Dunlop 3:40-4:15pm ET Willy Walker - CEO Cross-Border B2B: Still So Hard to Reach 4:20-4:55pm ET Credorax - Benny Nachman, Founder & Chairman of the Board Tipalti Inc. - Sarah D. Spoja, CFO COMPANIES HOSTING 1X1s ONLY – MARCH 9 Cielo S/A - Daniel Henrique de Sousa Diniz, Head of IR Coro Global Inc - David Dorr, Co-Founder & Mark Goode, CEO Finix Payments - Emanuel Pleitez, Head of Business Development FleetCor Technologies - Jim Eglseder, SVP, IR Global Blue Far Peak Acquisition Corporation - Thomas Farley, Chairman & CEO of Far Peak Acquisition Corporation Houlihan Lokey, Inc. -

Emerging Payments Trends

E M E R G I N G T R E N D S I N P A Y M E N T S I N N O V A T I O N M A5Y 2 0 2 0 real-time product and consumer insight on all competitors and new entrants Contact us at: pi-360@thefuturistgroup. com SECURITY INNOVATION CONSUMERS WANT Map every security feature on the market and 2 0 % identify innovation that drives product engagement r i s e i n f r a u d by consumer segment (e.g., GenZ, Millennials, 1 S T Q U A R T E R O F 2 0 2 0 Subprime, Prime, etc.). Virtual card #'s, biometrics, dynamic cvv, monitoring, alerts, protection insurance, etc. Mastercard | Visa | Apple | C apital One | Discover | Oberthur + more NEW PATH TO PROFITABILITY See shifting consumer needs and opportunity for 3 0 % driving long-term, profitable usage. D R O P I N Preferred reward constructs (tiered vs. flat etc.) C R E D I T S P E N D SWOT vs. competitors and their products a P R I L 2 0 2 0 Consumer data & insight on every innovative benefit deployed in response to COVID All Banks + Amazon| Instacart | Netflix| Zoom | DoorDash| SoFi + more FUTURE OF CONTACTLESS 4 0 % Understand near-term and longer-term i n c r e a s e i n opportunity for contactless communication & c o n t a c t l e S S innovation. Consumer insight data on every form a P R I L 2 0 2 0 of contactless including card plastic, mobile app, wearables, biometric, and connected car All Banks + Tappy | Fitbit | Apple | Samsung | Biohax | Connected Cars + more RISE OF DEBIT CARD REWARDS 2 . -

Global Payments 2020-30 a Quantium Shift in the Next Decade Australia's Challenge

McLean Roche Consulting Group Global Payments 2020-30 A quantium shift in the next decade Australia’s challenge – to keep up 1 Submission To RBA Payments Boards – Future of Payments – January 2020 McLean Roche Consulting Group AUSTRALIA’S PAYMENT CHALLENGE Australian payments will see more change in the next 10 years than the last 40 years combined. Australia has an expensive US/Anglo legacy based retail payments system which will be challenge by new technology, new data uses, new players and the need to protect consumer rights and data. Consumer retail payments total $975.7 billion in 2019 and will reach $3.2 trillion by 2030. A faster rate of expansion will occur in SME and Corporate payments. Payments are a very high volume, low margin business with even the smallest changes in revenues or margins delivering significant changes in actual dollars. Regulators around the globe will be challenged by forces of change and this requires all regulators and politicians to be aware of the scale of change and ensure the regulatory frame work changes and evolves quickly. 4 MYTHS DOMINATE THE NARRATIVE 1. CASH WILL DISAPPEAR – many including regulators keep predicting the death of cash. While bank notes may disappear, various forms of cash now dominate retail payments in Australia combining to total 71% share. 2. CREDIT CARDS DOMINATE LENDING – consumer credit cards are in decline having peaked 8 years ago. All the leading indicators are falling – average balance, average spend, revolve rate and number of cards. Corporate and Commercial cards are the only growth story. 3. DIGITAL PAYMENTS ARE THE FUTURE – many payment products use the ‘digital’ tag for marketing ‘glint’ however the reality is all payment products using Visa, MasterCard, Amex or eftpos payment networks are not digital. -

August M&A Newsletter

Our August Report on M&A in the FinTech, Data and Analytics Industry 3 Keys To Successful Tech M&A: Our August Report On M&A Values And Trends In Fintech, Data, And Analytics 01 © Copyright Marlin & Associates Holding LLC 2021 Our August Report on M&A in the FinTech, Data and Analytics Industry 3 Keys To Successful Tech M&A: Our August Report On M&A Values And Trends In Fintech, Data, And Analytics Dear Clients and Friends: Our latest report on the M&A values among the 11 sectors of the FinTech, Data and Analytics world that we follow is HERE. In case you haven’t noticed, after a very brief COVID pause, tech M&A is hot again. According to Refinitiv, last year the value of worldwide M&A deals was around $634 billion. We exceed that in the first half of 2021 - and we’re still going strong. That’s good for us. Further, about a quarter of those deals are in our sweet spot: tech, data, and analytics. The drive for tech M&A should not be surprising. We live in a world in which companies must grow to survive. And growth requires vision, innovation, talented people, hard work and time. The demands on leaders can be exhausting. M&A can accelerate tech product and geographic expansion, facilitate gains in market share and improve profitability. But success is not automatic. According to a recent Harvard Business Review report, 70% - 90% of M&A transactions fail to deliver on forecast results. That’s a lot. It’s not for lack of trying. -

View Final Mid-Year Conference Attendee List

MAG 2021 Mid-Year Conference Registraton Roster Sponsored by This list is not to be distributed or reproduced outside the MAG. Registrations as of 2/23/2021 COMPANY FIRST NAME LAST NAME TITLE [24]7.ai Ian Bain VP Corporate Communications [24]7.ai Michelle Gregory Senior Vice President of Data Science [24]7.ai Lisa Matherly VP, Marketing [24]7.ai Renee Ramsarran Marketing Manager [24]7.ai Matt Sato CIO [24]7.ai John Wanamaker Chief Revenue Officer 14 West/The Agora Companies Elizabeth Cammack Assistant Manager 14 West/The Agora Companies Nicole Deludos Sr. Manager, Global Payments 14 West/The Agora Companies Sam Hintz Senior Fraud Specialist 14 West/The Agora Companies Brendan Smith Payments Support Specialist 7-Eleven, Inc. Peter Jessiman Payment Acceptance & ATM Manager 7-Eleven, Inc. Josephine Mbanga-Hakata IT Project Manager 7-Eleven, Inc. Michael Silver Digital Payments - Credit Card Fraud Data Analyst 7-Eleven, Inc. Josephine Sitole Senior Manager, Accounting 7-Eleven, Inc. Veena Vadvadgi Sr Manager 7-Eleven, Inc. Anahi Wray Senior Category Manager Aaron's, LLC Bill Harrison Director Treasury Management Aaron's, LLC Max Ivanov Product Manager Aaron's, LLC Ashley Lee Manager of Software Engineering Aaron's, LLC Paul Raymond Product Manager Accel and STAR Networks David Munno Vice President, Business Development ACI Worldwide Dan Coates Solution Evangelist - Omni-Commerce ACI Worldwide Bryan Croteau Director, Merchant Solutions ACI Worldwide Russ Green Sr. New Business Developer ACI Worldwide James Harrison Sales Development ACI Worldwide Brad Kireta Sr. New Business Developer ACI Worldwide Tommy McDeermond Sr. New Business Developer ACI Worldwide Mike Pitura Sr. -

Top 150 Merchant Acquirers Worldwide Companies from 45 Countries Generated 342.2 Billion Purchase Transactions

ISSUE 1183 SEPTEMBER 2020 ARTICLES IN THIS ISSUE p5 Top 150 Merchant Acquirers p12 Acquiring-as-a-Service Worldwide Platform from FSS p7 Top 100 U.S. Mastercard and p13 Point of Sale Terminal Visa Issuers at Midyear Manufacturers — Part 2 p10 Buy Now, Pay Later Funding p14 Top General Purpose Deals in 2020 Credit Card Issuers in the United States at Midyear p11 PayNearMe Payment Processing TRANSACTIONS (BIL.) IN 2019 Top 150 Merchant Acquirers Worldwide Companies from 45 countries generated 342.2 billion purchase transactions. The six companies listed below accounted for 41% or 141.8 billion of those transactions. Read full article on page 5 FIS (WORLDPAY) 36.72 JPMORGAN CHASE 29.41 SBERBANK 20.61 FISERV 20.36 (FIRST DATA) BANK OF 18.56 AMERICA 16.19 GLOBAL PAYMENTS FOR 50 YEARS, THE LEADING PUBLICATION COVERING PAYMENT SYSTEMS WORLDWIDE CONTENTS COVER STORY Top 150 Merchant Acquirers Outstandings for the top 10 Worldwide Acquirers headquartered in 45 countries included 32 in the U.S. issuers of Mastercard and U.S., 10 in Turkey, 7 in France, Russia, and Iran, and 5 in Brazil Visa credit cards totaled and Japan. p5 $569 bil. as of June 30, 2020, down 9.8% from June 30, 2019 Top 100 U.S. Issuers of Visa and Mastercard Credit Cards at Midyear Rankings are based on outstandings as of June 30, 2020 and on purchase volume for January 1 through June 30, 2020. Acquiring-as-a-Service Platform p7 from FSS Embark is a cloud-based managed service accessed through a single connection and integration. -

Payments Insights. Opinions. Volume 21

Venture capital transaction overview Q3 2020 02 #payments VC tracker Venture capital Date Volume Funding Target Market Round Investor(s) Segment Description announced (US$m) (US$m) 1 01–07–20 Curv United States A 23.00 29.50 Commerz Ventures Alternative Develops a cloud-based wallet for payment storing and protecting digital assets. systems 2 01–07–20 Point Up Inc. United States A 10.5 12.70 Valar Ventures Issuing Provides card issuing and digital lending services for consumers. 3 01–07–20 Weifang Smart China B 2.84 2.84 Payment Designs and manufactures payment Yoke Network Mainland acceptance processing equipment for oil Technology Co., devices + stations. Ltd. Software 4 01–07–20 Creator Cash United Seed 4.00 4.00 Artis Capital Other Offers a suite of financial services, States Management, such as savings accounts, debit cards, L.P. and more to social media creators. 5 05–07–20 Spotii DMCC United Arab Seed – – Daman Alternative Develops a payment platform that Emirates Investments payment enables customers to make online PSC systems purchases and make payment in four equal installments. 6 06–07–20 Pair Finance Germany Venture 2.26 7.57 Other Provides digital debt collection services. 7 06–07–20 PAYFAZZ Indonesia B 53.00 127.10 B Capital Group, Alternative Owns and operates an online Insignia Ventures payment payment wallet. Partners systems 8 07–07–20 Thyngs United N/D 0.20 1.30 Payment Develops contactless payment Kingdom acceptance technology that connects buyers, devices + sellers, and brands. Software 9 07–07–20 Verestro Poland N/D – 1.00 Mastercard Alternative Offers payment solutions, which (formerly Upaid) payment includes digital wallet, NFC systems contactless payments, P2P transfers, QR payment, card management, and payment services. -

UX Report for Sezzle: Competitive Analysis

UX Report for Sezzle: Competitive Analysis Team 16: 4U Authors: Alexa YoonSeon Yi, April Shin, Jesi Zhang, Sunny Kim March 12, 2019 Word count: 2975 Table of Contents Table of Contents 1 Executive Summary 2 Introduction 2 Methodology 3 Direct Competitors Partial Competitors Parallel Competitors Indirect Competitors Findings 6 Direct Comparison: Klarna, Afterpay, Quadpay Partial Comparison: Bread, Affirm, Zip-pay Parallel: Samsung Pay, Apple Pay Parallel: Alipay Indirect: Credit/Debit Cards Recommendations 9 Discussion 12 Conclusion 12 Appendices 13 Appendix A - Competitive Matrix Appendix B - Functionality Comparison Chart Appendix C - Account Setup - Afterpay Appendix D - Account Setup - QuadPay Appendix E - Initial Account Setup - Klarna Appendix F - Future Payment Tracking - Klarna, Quadpay, Afterpay Appendix G - Apple Pay Wallet — Walgreen and Salads Up 1 Executive Summary This report focuses on the methods used to evaluate the competitors of Sezzle, as well as our findings and recommendations. In order to properly evaluate the competitors, we grouped them by functional similarities and placed them into four categories: direct competitors, partial competitors, parallel comparisons, and indirect competitors. By having all competitors in each category, we developed 19 criterias by which to evaluate these services based on values found in our user research. We drew a table that clearly compares the functionality of competitors and Sezzle. Based on our findings, we further developed a competitive matrix to better understand the core differences between Sezzle and the competitors, and ultimately found the opportunity areas including key findings and recommendations. We found that each competitor has experienced growth in their businesses by focusing on the target population and strategically partnering with merchants according to core needs of target users. -

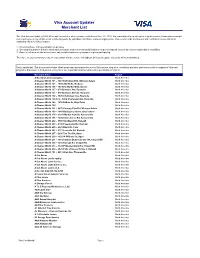

Visa Account Updater Merchant List

Visa Account Updater Merchant List The Visa Account Updater (VAU) Merchant List includes all merchants enrolled as of June 30, 2020. It is consolidated in an attempt to relay the most relevant and meaningful merchant name as merchants enroll at differing levels: by subsidiary, franchise, or parent organization. Visa recommends that issuers and merchants not use this list in marketing efforts for VAU because: 1. We do not have 100% penetration on all sides. 2. We cannot guarantee that the information exchange between the financial institution and merchant will occur in time for the cardholder’s next billing. 3. Some merchants on this list may have only certain divisions or geographic regions participating. Therefore, we do not want to create an expectation that the service will address all account update issues for all merchants listed. Visa Confidential: This document contains Visa's proprietary information for use by Visa issuers, acquirers, merchants and their processors solely in support of Visa card programs. Disclosure to third parties or any other use is prohibited without prior written permission of Visa Inc. Merchant Name Region A Buckley Landscaping Inc. North America A Cleaner World 106 – 3481 Robinhood Rd, Winston-Salem North America A Cleaner World 107 – 1009 2Nd St Ne, Hickory North America A Cleaner World 108 – 130 New Market Blvd, Boone North America A Cleaner World 127 – 679 Brandon Ave, Roanoke North America A Cleaner World 127 – 679 Brandon Avenue, Roanoke North America A Cleaner World 128 – 3806 Challenger Ave, Roanoke -

PYMNTS Connected Economy Ebook

WHAT’S NEXT IN PAYMENTS: CONNECTED 46 TOP PAYMENT EXECUTIVES JUNE 2021 WHAT’S NEXT IN PAYMENTS: CONNECTED TABLE OF CONTENTS 08 a&o Hotels and Hostels 66 FIS 122 Mars 188 Pollinate International Oliver Winter, CEO Bruce Lowthers, President, Jason Thomstatter, Herman Spruit, CEO Banking and Merchant Solutions Head of Digital Commerce 12 Airbnb 194 QED Investments Sam Shrauger, Global Head of Payments, 70 Flourish 128 Mastercard Mike Packer, Partner Chairman and CEO Airbnb Payments Emmalyn Shaw, Managing Partner Ron Shultz, EVP 198 Sesame Care 18 AT&T 76 Forward 132 NCR David Goldhill, Founder and CEO Jason Inskeep, Director of 5G Center Robert Sebastian, Co-founder Doug Brown, SVP and GM, Digital Banking of Excellence 204 Sezzle 82 HomeLight 138 Neruo-ID Charlie Youakim, CEO 22 Brighterion Drew Uher, Founder and CEO Jack Alton, CEO Sudhir Jha, SVP and Head 210 Shake Shack 86 i2c 144 New Enterprise Associates Steph So, Head of Digital Experience 28 Car IQ Jim McCarthy, President Liza Landsman, General Partner Sterling Pratz, CEO 216 Soul Machines 92 Ingo Money 150 Northwestern Mutual Greg Cross, Co-founder and CEO 34 CellPoint Drew Edwards, CEO Souheil Badran, EVP and COO Kristian Gjerding, CEO 222 Stand Up NY 96 Johnson & Johnson 154 NuORDER Dani Zoldan, Owner 38 Chipotle Sarfraz Nawaz, Head of Digital Transformation, Heath Wells, Co-founder and Co-CEO Scott Boatwright, Chief Restaurant Officer Supply Chain 228 sticky.io 160 OppFi Brian Bogosian, CEO 44 Circle 102 Joor Jared Kaplan, CEO Jeremy Allaire, CEO Kristin Savilia, CEO 232 The Yes 164 Paidy Julie Bornstein, CEO 50 Dick’s Sporting Goods 106 JPMC Russell Cummer, J.P. -

Payments. Insights. Opinions

#payments insights. opinions. Is going cashless inevitable? How the world’s financial leaders see the end of cash And how will the disappearance of notes and coins change our With digital payments increasing their share of the global payments mix by about 10% each year, the topic was the subject of much discussion — and debate — at this lives beyond how we pay for year’s Sibos conference, held in London in September. EY polled Sibos attendees, things? We asked the world’s who included financial leaders, technology specialists and regulators, to get a deeper banking and regulatory leaders sense of the issues behind the transition to cashless. What are the biggest benefits for their insights. to a digital economy — and the greatest barriers to its adoption? And critically, as the potential disappearance of physical currency looms, how can we ensure that this fundamental change is undertaken safely and fairly, while delivering the greatest economic and societal benefit? Continued on page 3 Volume 25 03 How the world’s financial leaders see the end of cash Is going cashless inevitable? And how will the disappearance of notes and coins change our lives beyond how we pay for things? We asked the world’s banking and regulatory leaders for their insights. 05 Riding the waves of the European merchant acquiring consolidation As three waves of M&A activity continue to reshape the European payments market, how should players respond? New evidence from EY’s extensive payments database helps track trends in consolidation and explore the way forward. Editorial Welcome to the last issue of #payments for 2019 — a year that has seen huge change within our dynamic sector. -

Afterpay (ASX: APT) an Investment Case Study by Hayden Capital November 2020

Afterpay (ASX: APT) An Investment Case Study By Hayden Capital November 2020 Hayden Capital 1345 Avenue of the Americas, 33rd Floor New York, NY. 10105 Office: (646) 883-8805 Mobile: (513) 304-3313 Email: [email protected] Disclaimer These materials shall not constitute an offer to sell or the solicitation of an offer to buy any securities, or interests in any fund or account managed by Hayden Capital LLC (“Hayden Capital”) or any of its affiliates. Such an offer to sell or solicitation of an offer to buy will only be made pursuant to definitive subscription documents between a fund and an investor. Hayden Capital may have positions in any securities mentioned in this report. Following publication of the report, Hayden Capital may transact in the securities of the company covered herein, including selling or buying the securities. All content in this publication represents the opinions of Hayden Capital. Hayden Capital has obtained all information referenced from sources they believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hayden Capital makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. All expressions of opinion are subject to change without notice, and Hayden Capital does not undertake to update or supplement this report or any information contained herein. This report is not a recommendation to purchase the securities of any company. The fees and expenses charged in connection with the investment may be higher than the fees and expenses of other investment alternatives and may offset profits.