FACTSHEET – September 03, 2021 Prime Mobile Payments Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

Wolfefintechforum DAY 1 AGENDA

#WolfeFinTechForum DAY 1 AGENDA - TUESDAY, MARCH 9, 2021 Opening Remarks 7:50-8:00am ET Wolfe Research – Darrin Peller, Managing Director, Payments, Processors, and IT Services Shift4 Payments 8:00-8:35am ET Jared Isaacman - CEO Fiserv 8:40-9:15am ET Frank Bisignano – President & CEO JP Morgan Chase 9:20-9:55am ET Max Neukirchen – CEO of Merchant Services Mastercard 10:00-10:35am ET Sachin Mehra - CFO B2B Payments: Living Through an Inflection Billtrust – Mark Shifke, CFO Discover Financial Services 10:40-11:15am ET MineralTree – Chris Sands, CFO John Greene – EVP & CFO Repay Holdings Corporation – Jake Moore, EVP Corporate Development & Strategy Fidelity National Information Services 11:20-11:55am ET Gary Norcross – President & CEO Woody Woodall - CFO PayPal 12:00-12:40pm ET Dan Schulman - CEO 12:40-1:00pm ET BREAK Square 1:00-1:35pm ET Amrita Ahuja - CFO Jack Henry & Associates, Inc. 1:40-2:15pm ET David Foss – President & CEO Synchrony 2:20-2:55pm ET Brian Wenzel, Sr – EVP & CFO Paychex, Inc. 3:00-3:35pm ET Efrain Rivera – Sr. VP, CFO & Treasurer Walker & Dunlop 3:40-4:15pm ET Willy Walker - CEO Cross-Border B2B: Still So Hard to Reach 4:20-4:55pm ET Credorax - Benny Nachman, Founder & Chairman of the Board Tipalti Inc. - Sarah D. Spoja, CFO COMPANIES HOSTING 1X1s ONLY – MARCH 9 Cielo S/A - Daniel Henrique de Sousa Diniz, Head of IR Coro Global Inc - David Dorr, Co-Founder & Mark Goode, CEO Finix Payments - Emanuel Pleitez, Head of Business Development FleetCor Technologies - Jim Eglseder, SVP, IR Global Blue Far Peak Acquisition Corporation - Thomas Farley, Chairman & CEO of Far Peak Acquisition Corporation Houlihan Lokey, Inc. -

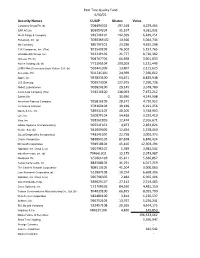

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

Emerging Payments Trends

E M E R G I N G T R E N D S I N P A Y M E N T S I N N O V A T I O N M A5Y 2 0 2 0 real-time product and consumer insight on all competitors and new entrants Contact us at: pi-360@thefuturistgroup. com SECURITY INNOVATION CONSUMERS WANT Map every security feature on the market and 2 0 % identify innovation that drives product engagement r i s e i n f r a u d by consumer segment (e.g., GenZ, Millennials, 1 S T Q U A R T E R O F 2 0 2 0 Subprime, Prime, etc.). Virtual card #'s, biometrics, dynamic cvv, monitoring, alerts, protection insurance, etc. Mastercard | Visa | Apple | C apital One | Discover | Oberthur + more NEW PATH TO PROFITABILITY See shifting consumer needs and opportunity for 3 0 % driving long-term, profitable usage. D R O P I N Preferred reward constructs (tiered vs. flat etc.) C R E D I T S P E N D SWOT vs. competitors and their products a P R I L 2 0 2 0 Consumer data & insight on every innovative benefit deployed in response to COVID All Banks + Amazon| Instacart | Netflix| Zoom | DoorDash| SoFi + more FUTURE OF CONTACTLESS 4 0 % Understand near-term and longer-term i n c r e a s e i n opportunity for contactless communication & c o n t a c t l e S S innovation. Consumer insight data on every form a P R I L 2 0 2 0 of contactless including card plastic, mobile app, wearables, biometric, and connected car All Banks + Tappy | Fitbit | Apple | Samsung | Biohax | Connected Cars + more RISE OF DEBIT CARD REWARDS 2 . -

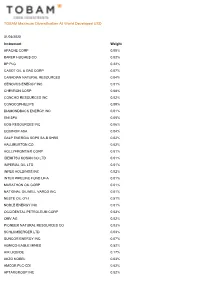

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight APACHE CORP 0.00% BAKER HUGHES CO 0.02% BP PLC 0.22% CABOT OIL & GAS CORP 0.07% CANADIAN NATURAL RESOURCES 0.04% CENOVUS ENERGY INC 0.01% CHEVRON CORP 0.08% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.09% DIAMONDBACK ENERGY INC 0.01% ENI SPA 0.05% EOG RESOURCES INC 0.06% EQUINOR ASA 0.04% GALP ENERGIA SGPS SA-B SHRS 0.02% HALLIBURTON CO 0.02% HOLLYFRONTIER CORP 0.01% IDEMITSU KOSAN CO LTD 0.01% IMPERIAL OIL LTD 0.01% INPEX HOLDINGS INC 0.02% INTER PIPELINE FUND LP-A 0.01% MARATHON OIL CORP 0.01% NATIONAL OILWELL VARCO INC 0.01% NESTE OIL OYJ 0.51% NOBLE ENERGY INC 0.01% OCCIDENTAL PETROLEUM CORP 0.03% OMV AG 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.03% SUNCOR ENERGY INC 0.07% AGNICO-EAGLE MINES 0.52% AIR LIQUIDE 0.17% AKZO NOBEL 0.03% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight AVON RESOURCES LTD 0.20% BALL CORP 0.06% CCL INDUSTRIES INC - CL B 0.01% CHR HANSEN HOLDING A/S 0.05% CLARIANT AG-REG 0.01% CORTEVA INC 0.04% CRODA INTERNATIONAL PLC 0.02% EMS-CHEMIE HOLDING AG-REG 0.01% FIRST QUANTUM MINERALS LTD 0.01% FORTESCUE METALS GROUP LTD 0.04% FRANCO-NEVADA CORP 1.01% GIVAUDAN-REG 0.07% INTL FLAVORS & FRAGRANCES 0.04% JAMES HARDIE INDUSTRIES-CDI 0.01% KANSAI PAINT CO LTD 0.01% KIRKLAND LAKE GOLD LTD 0.31% LINDE PLC 0.03% MARTIN MARIETTA MATERIALS 0.03% MOSAIC CO/THE 0.01% NEWCREST MINING LTD 0.60% NEWMONT CORP 1.89% NIPPON PAINT CO LTD 0.03% NORTHERN STAR RESOURCES -

VISA Europe AIS Certified Service Providers

Visa Europe Account Information Security (AIS) List of PCI DSS validated service providers Effective 08 September 2010 __________________________________________________ The companies listed below successfully completed an assessment based on the Payment Card Industry Data Security Standard (PCI DSS). 1 The validation date is when the service provider was last validated. PCI DSS assessments are valid for one year, with the next annual report due one year from the validation date. Reports that are 1 to 60 days late are noted in orange, and reports that are 61 to 90 days late are noted in red. Entities with reports over 90 days past due are removed from the list. It is the member’s responsibility to use compliant service providers and to follow up with service providers if there are any questions about their validation status. 2 Service provider Services covered by Validation date Assessor Website review 1&1 Internet AG Internet payment 31 May 2010 SRC Security www.ipayment.de processing Research & Consulting Payment gateway GmbH Payment processing a1m GmbH Payment gateway 31 October 2009 USD.de AG www.a1m.biz Internet payment processing Payment processing A6IT Limited Payment gateway 30 April 2010 Kyte Consultants Ltd www.A6IT.com Abtran Payment processing 31 July 2010 Rits Information www.abtran.com Security Accelya UK Clearing and Settlement 31 December 2009 Trustwave www.accelya.com ADB-UTVECKLING AB Payment gateway 30 November 2009 Europoint Networking WWW.ADBUTVECKLING.SE AB Adeptra Fraud Prevention 30 November 2009 Protiviti Inc. www.adeptra.com Debt Collection Card Activation Adflex Payment Processing 31 March 2010 Evolution LTD www.adflex.co.uk Payment Gateway/Switch Clearing & settlement 1 A PCI DSS assessment only represents a ‘snapshot’ of the security in place at the time of the review, and does not guarantee that those security controls remain in place after the review is complete. -

Moving Forward. Driving Results. Euronet Worldwide Annual Report 2004 Report Annual Worldwide Euronet

MOVING FORWARD. DRIVING RESULTS. EURONET WORLDWIDE ANNUAL REPORT 2004 REPORT ANNUAL WORLDWIDE EURONET EURONET WORLDWIDE ANNUAL REPORT 2004 The Transaction Highway At Euronet Worldwide, Inc. secure electronic financial transactions are the driving force of our business. Our mission is to bring electronic payment convenience to millions who have not had it before. Every day, our operations centers in six countries connect consumers, banks, retailers and mobile operators around the world, and we process millions of transactions a day over this transaction highway. We are the world's largest processor of prepaid transactions, supporting more than 175,000 point-of-sale (POS) terminals at small and major retailers around the world. We operate the largest pan-European automated teller machine (ATM) network across 14 countries and the largest shared ATM network in India. Our comprehensive software powers not only our own international processing centers, but it also supports more than 46 million transactions per month for integrated ATM, POS, telephone, Internet and mobile banking solutions for our customers in more than 60 countries. Glossary ATM – Automated Teller Machine EMEA - Europe, Middle East and Africa An unattended electronic machine in a public Euronet has an EMEA regional business unit in place that dispenses cash and bank account the EFT Processing Segment. information when a personal coded card is EPS - Earnings per Share used. A company's profit divided by each fully-diluted Contents EBITDA - Earnings before interest, taxes, share of common stock. depreciation and amortization 3...Letter to Our Shareholders E-top-up – Electronic top up EBITDA is the result of operating profit plus The ability to add airtime to a prepaid mobile 5...2004 Company Highlights depreciation and amortization. -

Schedule of Investments November 30, 2020 (Unaudited)

GOLDMAN SACHS EQUAL WEIGHT U.S. LARGE CAP EQUITY ETF Schedule of Investments November 30, 2020 (Unaudited) Shares Description Value Shares Description Value Common Stocks – 99.8% Common Stocks – (continued) Communication Services – 5.3% Consumer Discretionary – (continued) 10,210 Activision Blizzard, Inc. $ 811,491 11,013 D.R. Horton, Inc. $ 820,468 462 Alphabet, Inc., Class A* 810,533 20,791 DraftKings, Inc., Class A*(a) 1,088,617 462 Alphabet, Inc., Class C* 813,462 16,903 eBay, Inc. 852,418 28,271 Altice USA, Inc., Class A* 958,952 5,977 Etsy, Inc.* 960,504 29,863 AT&T, Inc. 858,561 8,123 Expedia Group, Inc. 1,011,232 434 Cable One, Inc. 859,611 104,432 Ford Motor Co. 948,243 92,741 CenturyLink, Inc. 969,143 7,293 Garmin Ltd. 851,531 1,275 Charter Communications, Inc., Class A* 831,287 22,939 General Motors Co. 1,005,646 18,388 Comcast Corp., Class A 923,813 8,360 Genuine Parts Co. 822,373 6,474 Electronic Arts, Inc.* 827,053 9,720 Hasbro, Inc. 904,252 2,847 Facebook, Inc., Class A* 788,534 8,497 Hilton Worldwide Holdings, Inc. 880,544 6,248 IAC/InterActiveCorp* 887,153 2,853 Home Depot, Inc. (The) 791,451 5,448 Liberty Broadband Corp., Class C* 857,243 15,994 Las Vegas Sands Corp. 891,026 6,389 Match Group, Inc.* 889,413 10,319 Lennar Corp., Class A 782,799 1,623 Netflix, Inc.* 796,406 4,798 Lowe’s Cos., Inc. 747,624 17,002 Omnicom Group, Inc. -

Presentation 27 May 2010

PayPoint plc Preliminary Results Presentation 27 May 2010 Strictly private and confidential Agenda • Highlights & Strategy • Operational Review • Financial Review • Summary and Outlook • Q&A 2 Highlights & Strategy Dominic Taylor Chief Executive 3 Established and developing business streams Established business streams: – Generate the group’s profits and cash flows – Provide unique retail/internet proposition to clients – Strongly differentiated to clients and retailers – With significant barriers to entry Developing business streams: – In large markets that have strong growth potential, with opportunities to accelerate growth – Core to PayPoint’s strategy to broaden payment capability and extend differentiation – Leverage established business streams – On clear path to profitability – Diversify risk across a broader and more balanced business 4 PayPoint highlights • Established business streams delivered to plan: – Over 650 net additions to UK retail network, reinforcing our value to retailers – Strong growth in retail services (transactions 23% up) – 22% transaction growth in internet payments – New value added services • Investment in developing business streams: – 3,400 Collect+ sites; 13 clients with many more interested – 900 new Romanian bill-pay sites – Six-fold increase in bill pay transactions in Romania – PayByPhone acquisition opens new geographies and capability • Large growth markets for developing businesses 5 Camelot What is proposed? Our position: • Camelot seeking to enter our UK • Robust response, underpinned by retail -

Fintech Monthly Market Update | July 2021

Fintech Monthly Market Update JULY 2021 EDITION Leading Independent Advisory Firm Houlihan Lokey is the trusted advisor to more top decision-makers than any other independent global investment bank. Corporate Finance Financial Restructuring Financial and Valuation Advisory 2020 M&A Advisory Rankings 2020 Global Distressed Debt & Bankruptcy 2001 to 2020 Global M&A Fairness All U.S. Transactions Restructuring Rankings Advisory Rankings Advisor Deals Advisor Deals Advisor Deals 1,500+ 1 Houlihan Lokey 210 1 Houlihan Lokey 106 1 Houlihan Lokey 956 2 JP Morgan 876 Employees 2 Goldman Sachs & Co 172 2 PJT Partners Inc 63 3 JP Morgan 132 3 Lazard 50 3 Duff & Phelps 802 4 Evercore Partners 126 4 Rothschild & Co 46 4 Morgan Stanley 599 23 5 Morgan Stanley 123 5 Moelis & Co 39 5 BofA Securities Inc 542 Refinitiv (formerly known as Thomson Reuters). Announced Locations Source: Refinitiv (formerly known as Thomson Reuters) Source: Refinitiv (formerly known as Thomson Reuters) or completed transactions. No. 1 U.S. M&A Advisor No. 1 Global Restructuring Advisor No. 1 Global M&A Fairness Opinion Advisor Over the Past 20 Years ~25% Top 5 Global M&A Advisor 1,400+ Transactions Completed Valued Employee-Owned at More Than $3.0 Trillion Collectively 1,000+ Annual Valuation Engagements Leading Capital Markets Advisor >$6 Billion Market Cap North America Europe and Middle East Asia-Pacific Atlanta Miami Amsterdam Madrid Beijing Sydney >$1 Billion Boston Minneapolis Dubai Milan Hong Kong Tokyo Annual Revenue Chicago New York Frankfurt Paris Singapore Dallas -

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

Global Payments 2020-30 a Quantium Shift in the Next Decade Australia's Challenge

McLean Roche Consulting Group Global Payments 2020-30 A quantium shift in the next decade Australia’s challenge – to keep up 1 Submission To RBA Payments Boards – Future of Payments – January 2020 McLean Roche Consulting Group AUSTRALIA’S PAYMENT CHALLENGE Australian payments will see more change in the next 10 years than the last 40 years combined. Australia has an expensive US/Anglo legacy based retail payments system which will be challenge by new technology, new data uses, new players and the need to protect consumer rights and data. Consumer retail payments total $975.7 billion in 2019 and will reach $3.2 trillion by 2030. A faster rate of expansion will occur in SME and Corporate payments. Payments are a very high volume, low margin business with even the smallest changes in revenues or margins delivering significant changes in actual dollars. Regulators around the globe will be challenged by forces of change and this requires all regulators and politicians to be aware of the scale of change and ensure the regulatory frame work changes and evolves quickly. 4 MYTHS DOMINATE THE NARRATIVE 1. CASH WILL DISAPPEAR – many including regulators keep predicting the death of cash. While bank notes may disappear, various forms of cash now dominate retail payments in Australia combining to total 71% share. 2. CREDIT CARDS DOMINATE LENDING – consumer credit cards are in decline having peaked 8 years ago. All the leading indicators are falling – average balance, average spend, revolve rate and number of cards. Corporate and Commercial cards are the only growth story. 3. DIGITAL PAYMENTS ARE THE FUTURE – many payment products use the ‘digital’ tag for marketing ‘glint’ however the reality is all payment products using Visa, MasterCard, Amex or eftpos payment networks are not digital.