China Has Changed Its Policy to Further Open up Its Automotive Market That Will Benefit Foreign Luxury Vehicle Automakers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021

4/19/2021 No.1325 All-New Electric SUV AIRTREK Teased at Auto Shanghai 2021 Tokyo, April 19, 2021 – MITSUBISHI MOTORS CORPORATION (MMC) announced that GAC Mitsubishi Motors Co., Ltd. (GMMC)1, MMC’s vehicle production and sales joint venture in China, today teased the all-new electric SUV AIRTREK at Auto Shanghai 20212. 1. A joint venture between Guangzhou Automobile Group Co., Ltd. (GAC), Mitsubishi Corporation and MMC. 2. Officially called The 19th Shanghai International Automobile Industry Exhibition. April 19 and 20 are Press Days, and April 21 to 23 are Trade Days. The show is open to the public from April 24 to 28. The exhibition is held at the National Exhibition and Convention Center (Shanghai). The all-new AIRTREK is based on the concept of an “e-cruising SUV” founded on three keywords: “Electric (electric vehicle),” “Expanding (expanding life’s pleasures with a car)” and “Expressive (expressing the uniqueness of MITSUBISHI MOTORS).” It generates an image of advanced sophistication fit for an EV while incorporating MMC’s consistent design identity, represented by its Dynamic Shield front design concept, and is styled to express the powerful performance expected of a Mitsubishi vehicle. “We have developed the AIRTREK as an SUV that enables customers to enjoy limitless adventures,” said John Signoriello, executive officer, responsible for global marketing and sales, MMC. “Designed exclusively for the Chinese market, the all-new AIRTREK will be launched by the end of this year as the fourth model of MITSUBISHI MOTORS’ lineup in China. With the addition of this electric vehicle, we aim to contribute to creating a sustainable mobility society.” # # # -1- . -

Groupe Renault Sets Its New Strategy for China

PRESS RELEASE Groupe Renault sets its new Strategy for China • Groupe Renault will focus in China on light commercial vehicles (LCV) and electric vehicles (EV). • Groupe Renault will transfer its shares in Dongfeng Renault Automotive Company Ltd (DRAC) to Dongfeng Motor Corporation. DRAC will stop its Renault brand-related activities. • LCV business is operated through Renault Brilliance Jinbei Automotive Co., Ltd. (RBJAC), leveraging Jinbei legacy with Renault know-how. • EV business will be developed through the two existing joint ventures: eGT New Energy Automotive Co., Ltd (eGT) and Jiangxi Jiangling Group Electric Vehicle Co. Ltd (JMEV). Boulogne-Billancourt, April 14th, 2020 - Groupe Renault unveiled today its new strategy for the Chinese Market, building on two of its key pillars: Electric Vehicles (EV) and Light Commercial Vehicles (LCV). Within this new strategy, Groupe Renault activities in China will be driven as follow: About Chinese ICE Passenger Car Market Regarding ICE passenger car, Groupe Renault has entered into a preliminary agreement with Dongfeng Motor Corporation under which Renault transfers its shares to Dongfeng. DRAC will stop its Renault brand-related activities. Renault will continue to provide high quality aftersales service for its 300,000 customers through Renault dealers but also through Alliance synergies. Further development for Renault brand passenger cars will be detailed later within future new mid-term-plan Renault. Furthermore, Renault and Dongfeng will continue to cooperate with Nissan on new generation engines like components supply to DRAC and diesel license to Dongfeng Automobile Co., Ltd. Renault and Dongfeng will also engage in innovative cooperation in the field of intelligent connected vehicles. -

Understanding Auto Fincos

Global Research 18 March 2019 Fundamental Analytics Equities Behind the numbers: Autos Global Valuation, Modelling & Accounting Geoff Robinson, CA FCA Analyst [email protected] +44-20-7567 1706 Julian Radlinger, CFA Analyst [email protected] +44-20-7568 1171 Renier Swanepoel Analyst [email protected] +44-20-7568 9025 Patrick Hummel, CFA Analyst [email protected] +41-44-239 79 23 Guy Weyns, PhD Analyst We launch the second of our series of collaborative sector analyses … [email protected] The Fundamental Analytics team has teamed up with the UBS Global Auto Sector team +65-6495 3507 (17 analysts across six regions) to deliver the second in its series of collaborative reports Paul Gong (see the first one on pharmaceuticals here). This report focuses on all things Autos. It is Analyst written to (1) provide investors new to Autos with an exhaustive overview of everything [email protected] that's relevant to understand the sector from an industry and company perspective, (2) +852-2971 7868 help new and seasoned investors alike frame their financial statement and earnings Colin Langan, CFA quality analysis, and (3) provide a guide to the most commonly used accounting Analyst practices and pitfalls specific to the sector, how to spot them, interpret and adjust for [email protected] +1-212-713 9949 them. This report is the go-to Global Auto sector hand-book for equity investors. Kohei Takahashi … including a detailed global sector run-through … Analyst Our report starts with a ~50-page sector primer written on the basis of the combined [email protected] expertise and wealth of resources of the UBS Global Auto Sector team. -

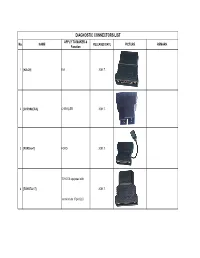

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013 Dongfeng Motor (489.HK) Automobile Sector 10 January 2013 Research Idea: Moving Up the Gears Target Price HK$15.00 We rate Dongfeng Motor (DFG) a Buy with 12-month target price of 12m Rating Buy HK$15.00. Its sales have dropped since Q3 2012 amid Sino-Japan tensions, 16% upside but we expect a recovery to pre-protest levels in Q1 2013 and growth to DFG – Price Chart (HK$) persist backed by a strong brand lineup. As one of the nation’s leading 22 Bull, HK$20.90 20 automakers, DFG is a good proxy for a secular sector growth story. 18 16 Base, HK$15.00 Three reasons to Buy: 14 12 10 . Sino-Japanese tensions have eased. DF Honda’s sales rebounded to 8 pre-protest levels while DF Nissan’s rebounded to 80% of pre-protest 6 Bear, HK$6.40 Jan12 May12 Sep12 Jan13 May13 Sep13 Jan14 levels in December, well above expectations. Consumer concerns about damage to vehicles should be offset by Sino-Japan auto JVs Price (HK$) 12.96 guaranteeing to repair damage caused during the recent unrest. We Mkt cap – HK$m (US$m) 112,354 (14,494) expect DFG’s sales volume growth to rebound from down 0.8% to +11% in FY13. Free float – % (H-share) 100.00 3M avg. t/o– HK$m (US$m) 299.5 (38.6) . Strong brand lineup can facilitate market-share gains. DFG has Major shareholder (%) three JVs and a comprehensive range of well-received models, which should help minimize sales fluctuations. -

2016 Annual Report

東風汽車集團股份有限公司 DONGFENG MOTOR GROUP COMPANY LIMITED Stock Code: 489 2016 Annual Report * For identification purposes only Contents Corporate Profile 2 Chairman’s Statement 3 Report of Directors 7 Management Discussion and Analysis 42 Profiles of Directors, Supervisors and Senior Management 51 Report of the Supervisory Committee 59 Corporate Governance Report 61 Independent Auditor’s Report 84 Consolidated Income Statement 91 Consolidated Statement of Comprehensive Income 92 Consolidated Statement of Financial Position 93 Consolidated Statement of Changes in Equity 95 Consolidated Statement of Cash Flows 97 Notes to the Financial Statements 100 Five Year Financial Summary 189 Corporate Information 191 Notice of Annual General Meeting and Relating Information 192 Definitions 208 Corporate Profile Dongfeng Peugeot Citroën Sales Co., Ltd. Dongfeng Peugeot Citroën Auto Finance Co., Ltd. Dongfeng (Wuhan) Engineering Consulting Co., Ltd. Dongfeng Motor Investment (Shanghai) Co., Ltd. Dongfeng Off-road Vehicle Co., Ltd. Dongfeng Motor Co., Ltd. Dongfeng Nissan Auto Finance Co., Ltd. China Dongfeng Motor Industry Import & Export Co., Ltd. Limited Dongfeng Motor Finance Co.,Ltd. Dongfeng Getrag Automobile Transmission Co., Ltd. Dongfeng Renault Automobile Co., Ltd. Dongfeng Liu Zhou Motor Co., Ltd. Dongvo (Hangzhou) Truck Co., Ltd. Honda Motor (China ) Investment Co.,Ltd. Motor Group Company Dongfeng Honda Auto Parts Co., Ltd. ), the predecessor of Dongfeng Motor Corporation and the parent of the the parent of Corporation and of Dongfeng Motor the predecessor ), Dongfeng Honda Engine Co., Ltd. Dongfeng Honda Automobile Co., Ltd. Dongfeng Dongfeng Peugeot Citroën Automobile Co., Ltd. Dongfeng Commercial Vehicle Co., Ltd. Dongfeng Electrical Vehicle Co., Ltd. 第二汽車製造廠 Dongfeng Special Purpose Commercial Vehicle Co., Ltd. -

Annual Report

ai158746681363_GAC AR2019 Cover_man 29.8mm.pdf 1 21/4/2020 下午7:00 Important Notice 1. The Board, supervisory committee and the directors, supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. 2. All directors of the Company have attended meeting of the Board. 3. PricewaterhouseCoopers issued an unqualified auditors’ report for the Company. 4. Zeng Qinghong, the person in charge of the Company, Feng Xingya, the general manager, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Accounting Chief), represent that they warrant the truthfulness and completeness of the financial statements contained in this annual report. 5. The proposal for profit distribution or conversion of capital reserve into shares for the reporting period as considered by the Board The Board proposed payment of final cash dividend of RMB1.5 per 10 shares (tax inclusive). Together with the cash dividend of RMB0.5 per 10 shares (including tax) paid during the interim period, the ratio of total cash dividend payment for the year to net profit attributable to the shareholders’ equity of listed company for the year would be approximately 30.95%. 6. Risks relating to forward-looking statements The forward-looking statements contained in this annual report regarding the Company’s future plans and development strategies do not constitute any substantive commitment to investors and investors are reminded of investment risks. -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2020 together with the comparative figures of the corresponding period ended 31 December 2019. The result has been reviewed by the Audit Committee and the Board of the Company. - 1 - CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2020 2019 RMB’000 RMB’000 Revenue 3 63,156,985 59,704,322 Cost of sales (60,860,992) (57,181,363) Gross profit 2,295,993 2,522,959 Selling and distribution costs (3,641,480) (4,553,402) Administrative expenses (3,850,327) (3,589,516) Net impairment losses on financial assets (55,110) (53,831) Interest income 304,233 290,694 Other gains – net 4 1,379,690 2,620,340 Operating loss (3,567,001) (2,762,756) Interest income 127,551 171,565 Finance costs 5 (439,567) (516,481) Share of profit of joint ventures and associates 6 9,570,978 9,399,343 Profit before income tax 5,691,961 6,291,671 Income tax credit 7 355,990 -

Feasibility Study and Strategy Analysis of Low

E3S Web of Conferences 275, 02011 (2021) https://doi.org/10.1051/e3sconf/202127502011 EILCD 2021 Feasibility study and strategy analysis of low-carbon operation of large-scale sports events under the green development model: an example of building a "racing city" in Wuhan Yi Ke1,* 1School of Physical Education and Equestrian, Wuhan Business University, Wuhan, China Abstract. China emphasizes the need to establish a new development concept of innovation, coordination, green, openness and sharing, and to promote green and low-carbon transformation. Hubei Province is also accelerating the promotion of green and low-carbon development and continuously improving its sustainable development capacity. Wuhan, as the capital of Hubei province, is the city of car-making and the future city of racing. This paper mainly uses the literature method and fieldwork method to conduct the study and the author believes that under the green development model, through the low-carbon event operation means, the large-scale auto event will become a unique auto event brand IP, which will help expand the influence of the city, promote the low-carbon development of auto industry and sports industry, and lead the public to actively embrace the low-carbon and green lifestyle. 1 Introduction Table 1. Basic information of major passenger car enterprises In the general debate of the 75th session of the UN in Wuhan General Assembly, President Xi Jinping clearly Production and sales No. Passenger car OEMs proposed that "China will increase its national volume in 2020 contribution, adopt more vigorous policies and measures, strive to peak CO2 emissions by 2030, and strive to 1 Dongfeng Honda 850307 units achieve carbon neutrality by 2060, emphasizing that all 2 SAIC-GM Wuhan 482178 units countries should promote green and low-carbon Dongfeng Peugeot 3 50,267 units transformation to build a community of human destiny. -

Motorcycles, All Ter- Rain Vehicles (Atvs), Outboard Motors, and Other Products

ANNUAL REPORT 2010 99999-E2062-210 Printed in Japan Profile Suzuki Motor Corporation designs and manufactures passenger cars, commercial vehicles, motorcycles, all ter- rain vehicles (ATVs), outboard motors, and other products. The company continuously and vigorously promotes technical cooperation through numerous joint ventures overseas, and its main production facilities are currently located in 23 countries and regions overseas. The established network enables Suzuki to operate as a global organization serving 196 countries and regions. Suzuki Motor Corporation was first established as Suzuki Loom Manufacturing Co. in March 1920. Suzuki then entered the motorcycle business with the introduction of “Power Free” motorized bicycle in 1952, and entered the automobile business in 1955 with the introduction of “Suzulight” mini car. Suzuki is committed to use its amassed technological expertise and all other available resources to help raise the quality of human life in society by promoting corporate growth through manufacture and supply of socially demanded products. Head Office & Takatsuka Plant Headquarters, Engineering center and Motorcycle engines assembling plant Contents Profile ___________________________________________________________________ 1 A Message From The Management ________________________________________ 2 Financial Highlights ______________________________________________________ 4 Year In Review ___________________________________________________________ 5 Automobiles ___________________________________________________________ -

2005-Global Partnerships Final Poster.Qxd 8/17/2005 3:54 PM Page 1

2005-global partnerships final poster.qxd 8/17/2005 3:54 PM Page 1 SPONSORED BY GGuuiiddee ttoo gglloobbaall aauuttoommoottiivvee ppaarrttnneerrsshhiippss FULL OWNERSHIP EQUITY STAKES VEHICLE ASSEMBLY ALLIANCES TECHNICAL/PARTS ALLIANCES BMW AG Owned by: Joint venture: Contract assembly: •DaimlerChrysler - gasoline engines - Brazil •Mini •Quandt family - 46.6% •BMW Brilliance •Magna Steyr, Austria •Land Rover - diesel engines - UK •Rolls-Royce Motor Cars Ltd. •Other shareholders - 53.4% Automotive Co., China •PSA/Peugeot-Citroen - gasoline engines - France & UK •Tritec Motors, Brazil •Toyota -diesel engines DAIMLERCHRYSLER AG Owns: Owned by: Joint venture: Contract assembly: •BMW - gasoline engines - Brazil •Chrysler group •McLaren Group - 40% •Deutsche Bank - 6.9% •Beijing Benz-DaimlerChrysler •Karmann, Germany •GM - hybrid drive system •Mercedes-Benz •Mitsubishi - 12.8% •Kuwait Investments - 7.2% Automotive, China •Magna Steyr, Austria •Hyundai/Mitsubishi - 4-cylinder engines (Mercedes-Benz owns 100% of Maybach and Smart) •Mitsubishi Fuso - 65% •Other shareholders - 85.9% •Fujian Motor Industry Group, China DONGFENG MOTOR CORP. Owns: Owned by: Joint venture: •Dongfeng Yueda Kia Dongfeng Motor Corp. •Dongfeng Liuzhou Motor Co. Ltd. •Dongfeng Automobile Co. - •Chinese central government - •Dongfeng Honda Automobile Co., China 70% 100% Automobile (Wuhan), China •Zhengzhou Nissan •Dongfeng Motor Co., China Automobile Co., China •Dongfeng Peugeot Citroen Automobile Co., China FIAT S.P.A. Owns: Owned by: Joint venture: Contract assembly: •General Motors - powertrains - Poland •Fiat Auto S.p.A. •Ferrari - 50% •Agnelli family - 22% •Nanjing Fiat - China •Pininfarina, Italy •Suzuki - diesel engines - India (Fiat Auto owns 100% of Alfa Romeo, Fiat and Lancia) •Other shareholders - 78% •SEVEL - Italy, France •Suzuki, Hungary •Maserati S.p.A. •Tofas - Turkey •Nissan, South Africa •Iveo Fiat - Brazil •Mekong Corp., Vietnam FIRST AUTOMOBILE WORKS GROUP Owns: Owned by: Joint venture: •FAW-Volkswagen First Automobile (FAW) •FAW Car Co. -

Takata Allocation Schedule V3 (01.30.2018).Xlsx

2:16-cr-20810-GCS-EAS Doc # 60-2 Filed 02/01/18 Pg 1 of 3 Pg ID 514 EXHIBIT B 2:16-cr-20810-GCS-EAS Doc # 60-2 Filed 02/01/18 Pg 2 of 3 Pg ID 515 Takata Corp OEM Allocation % Initial Consenting OEM Inflator shipping volume Initial Consenting OEM Roll‐up Units in thousands Joining OEM Non‐Consenting OEM Shipments ALL OEM Initial Consenting OEM Total PSAN Total PSAN ALL OEM # Short Name Formal Name Head office OEM Category Relationship Inflators % of total Inflators ALLOCATION % 1 Honda Honda Japan Initial Consenting OEM Honda 53,397 14.8215192% 53,419 14.8277907% 2CHAC Honda Automobile (China) Co., Ltd. China Initial Consenting OEM Roll‐up Honda Chinese JV 23 0.0062715% ‐ ‐ 3GHAC GAC Honda Automobile Co., Ltd. China Joining OEM Honda Chinese JV 3,682 1.0220562% 3,682 1.0220562% 4WDHAC Dongfeng Honda Automobile Co., Ltd. China Joining OEM Honda Chinese JV 4,323 1.2000105% 4,323 1.2000105% 5 Toyota Toyota Japan Initial Consenting OEM Toyota 44,018 12.2181997% 48,881 13.5681391% 6 NUMMI New United Motor Manufacturing, Inc. US Initial Consenting OEM Roll‐up Toyota 1,922 0.5335676% ‐ ‐ 7Daihatsu Daihatsu Motor Co., Ltd. Japan Initial Consenting OEM Roll‐up Toyota owned (100% owned) 2,908 0.8072901% ‐ ‐ 8HINO Hino Motors, Ltd. Japan Initial Consenting OEM Roll‐up Toyota affiliate 33 0.0090817% ‐ ‐ 9GTMC GAC Toyota Motor Co., Ltd. China Joining OEM Toyota Chinese JV 602 0.1671380% 602 0.1671380% 10 TFTM Tianjin FAW Toyota Motor Co., Ltd. China Joining OEM Toyota Chinese JV 3,069 0.8517936% 3,069 0.8517936% 11 SFTMCF Changchun Fengyue Company of Sichuan FAW Toyota Motor Co., Ltd.