Media Baltics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automatinę Kanalų Paiešką“

Dėl techninių aplinkybių keisis skaitmeninės Teo televizijos kanalų tinklelis. Pokyčiai vyks dviem etapais – 2016 m. gegužės 1 d. ir 2016 m. liepos 1 d. Pokyčiai didesnės TV signalo aprėpties zonoje Pokyčiai mažesnės TV signalo aprėpties zonoje (iki 40-ies TV kanalų) (iki 30-ies TV kanalų) Nauji kanalai nuo 2016 05 01 Naujas kanalas nuo 2016 05 01 Viasat Nature, Setanta Sports, TNT. Viasat Nature, TNT. Išjungiami kanalai nuo 2016 05 01: CNN, Discovery Science, Išjungiami kanalai nuo 2016 05 01: Animal Planet, Animal Planet, Discovery World, Eurosport2, TLC. Sony Turbo, Sony Channel, TLC. Išjungiami kanalai nuo 2016 07 01: RTL. Išjungiami kanalai nuo 2016 07 01: Cartoon Network, Dožd, BBC World News, VH1, RTL. Galutinis kanalų sąrašas po pakeitimų Galutinis kanalų sąrašas po pakeitimų LRT Televizija Viasat Nature LRT Televizija Eurosport LRT Kultūra Sony Turbo LRT Kultūra Sport1 TV3 Sony Channel TV3 KidZone TV TV8 FOX TV8 Playboy TV TV6 FOX Life TV6 Travel Channel LNK Balticum Auksinis LNK TNT Info TV Eurosport Info TV Liuks! Sport1 Liuks! TV1 Setanta Sports TV1 BTV Nickelodeon BTV Lietuvos rytas TV KidZone TV Lietuvos rytas TV BBC World News Cartoon Network Pervyj Baltiskij Kanal Euronews Playboy TV TVCi Pervyj Baltiskij Kanal Travel Channel Discovery Channel TVCi MTV National Geographic Channel Dožd TVP Polonia Viasat Nature Discovery Channel VH1 Europe Balticum Auksinis National Geographic Channel TNT FOX Nauji kanalai Viasat Nature – aukštos kokybės geriausios Setanta Sports – kanalas siūlo daugiau nei 80 TNT - tai pramoginis TV kanalas, garsėjantis dokumentinės laidos ir filmai apie gamtą ir futbolo, ledo ritulio, teniso, golfo ir kitų sporto pripažintais humoro projektais (kaip „Comedy gyvūnų pasaulį visuose egzotiškuose Žemės šakų tiesioginių transliacijų per mėnesį (ka- Club“), laidomis ir TV serialais su garsiais rusų kampeliuose. -

Is There Life After the Crisis?

is There Life afTer The crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe is There Life afTer The crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe Sources of information: Lursoft – database on companies Lithuanian Company Register ORBIS – database of companies, ownership and financial data worldwide. Data harvesters: Rudīte Spakovska, Aija Krūtaine, Mikk Salu, Mantas Dubauskas Authors: Rudīte Spakovska, Sanita Jemberga, Aija Krūtaine, Inga Spriņģe Special thanks to Anders Alexanderson, Uldis Brūns, Ārons Eglītis For re-publishing written permission shall be obtained prior to publishing. © The Centre for Media Studies at SSE Riga © The Baltic Center for Investigative Journalism Re:Baltica Riga, 2014 Is There Life After The Crisis? Analysis Of The Baltic Media’s Finances And Audiences (2008-2014) Contents How Baltic Media Experts View the Sector ...............................................................................................................4 Introduction: Media After Crisis ..................................................................................................................................7 Main Conclusions ............................................................................................................................................................8 Changes In Turnover of Leading Baltic Media, 2013 vs 2008 ................................................................................9 -

Atlyginimas Už Retransliavimą Kabelinių 4 Operatorių Tinklus Yra Didžiausias Per Visus AVAKA 2 Veiklos Metus

2017 METŲ APŽVALGA IR SKAIČIAI Audiovizualinių kūrinių retransliavimas KABELINIŲ OPERATORIŲ TINKLAIS 1. ATLYGINIMO PASKIRSTYMO PRINCIPAI Džiugina ir tai, jog AVAKA surenka vis didesnį atlyginimą Audiovizualinių kūrinių Retransliavimo kabelinių atstovaujamiems teisių turėtojams. Lyginant 2016 m. ir operatorių tinklais paskirstymas teisių turėtojams yra 2017 m., surinkimas augo daugiau negu 3 %. atliekamas vadovaujantis LR Autorių teisių ir gretutinių teisių įstatymo nuostatomis ir AVAKA Atlyginimo, surinkto audiovizualinių kūrinių autoriams ir gamintojams (prodiuseriams) už audiovizualinių kūrinių retransliavimą, paskirstymo taisyklių (toliau – Paskirstymo taisyklės) nuostatomis. Atlyginimas teisių turėtojams, išskyrus atlyginimą muzikinių klipų teisių turėtojams (žiūrėti 3 punktą), apskaičiuojamas remiantis: 2017 m. 2016 m. AUDIOVIZUALIO RETRANSLIUOJAMŲ KŪRINIO TRUKMĘ KANALŲ ŽIŪRIMUMĄ pav. Surinkto atlyginimo pokytis 2016-2017 m. b. PASKIRSTYTO, BET NEIŠMOKĖTO ATLYGINIMO UŽ AUDIOVIZUALINIO ANKSTESNIUS LAIKOTARPIUS. Pagal AVAKA KŪRINIO AUDIOVIZUALINIO Paskirstymo taisykles neišmokėtas atlyginimas teisių RETRANSLIAVIMO KŪRINIO ŽANRĄ turėtojams yra saugomas 3 metus. AVAKA imasi visų LAIKĄ būtinų priemonių identifikuojant audiovizualinių kūrinių teisių turėtoją, nustatant jo tapatybę. Pasibaigus 3 metų laikotarpiui, neišmokėtos sumos pridedamos 2. SKIRSTOMAS ATLYGINIMAS prie einamųjų metų paskirstymo sumos ir yra perskirstomos. AVAKA atstovaujamiems Lietuvos teisių turėtojams paskirstytas retransliavimo atlyginimas už 2017 m., Atsižvelgiant -

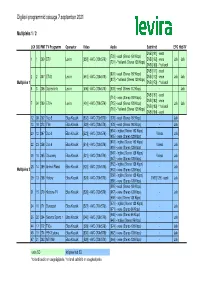

Levira DTT Programmid 09.08.21.Xlsx

Digilevi programmid seisuga 7.september 2021 Multipleks 1 / 2 LCN SID PMT TV Programm Operaator Video Audio Subtiitrid EPG HbbTV DVB [161] - eesti [730] - eesti (Stereo 192 Kbps) 1 1 290 ETV Levira [550] - AVC (720x576i) DVB [162] - vene Jah Jah [731] - *hollandi (Stereo 128 Kbps) DVB [163] - *hollandi DVB [171] - eesti [806] - eesti (Stereo 192 Kbps) 2 2 307 ETV2 Levira [561] - AVC (720x576i) DVB [172] - vene Jah Jah [807] - *hollandi (Stereo 128 Kbps) Multipleks 1 DVB [173] - *hollandi 6 3 206 Digilevi info Levira [506] - AVC (720x576i) [603] - eesti (Stereo 112 Kbps) - - Jah DVB [181] - eesti [714] - vene (Stereo 192 Kbps) DVB [182] - vene 7 34 209 ETV+ Levira [401] - AVC (720x576i) [715] - eesti (Stereo 128 Kbps) Jah Jah DVB [183] -* hollandi [716] - *hollandi (Stereo 128 Kbps) DVB [184] - eesti 12 38 202 Duo 5 Elisa Klassik [502] - AVC (720x576i) [605] - eesti (Stereo 192 Kbps) - Jah 13 18 273 TV6 Elisa Klassik [529] - AVC (720x576i) [678] - eesti (Stereo 192 Kbps) - Jah [654] - inglise (Stereo 192 Kbps) 20 12 267 Duo 3 Elisa Klassik [523] - AVC (720x576i) Videos Jah [655] - vene (Stereo 128 Kbps) [618] - inglise (Stereo 192 Kbps) 22 23 258 Duo 6 Elisa Klassik [514] - AVC (720x576i) Videos Jah [619] - vene (Stereo 128 Kbps) [646] - inglise (Stereo 128 Kbps) 26 10 265 Discovery Elisa Klassik [521] - AVC (720x576i) Videos Jah [647] - vene (Stereo 128 Kbps) [662] - inglise (Stereo 128 Kbps) 28 14 269 Animal Planet Elisa Klassik [525] - AVC (720x576i) - Jah Multipleks 2 [663] - vene (Stereo 128 Kbps) [658] - inglise (Stereo 128 Kbps) -

2020 Annual Report

Radio and Television Commission of Lithuania RADIO AND TELEVISION COMMISSION OF LITHUANIA 2020 ANNUAL REPORT 17 March 2021 No ND-1 Vilnius 1 CONTENTS CHAIRMAN’S MESSAGE ................................................................................................................ 3 MISSION AND OBJECTIVES .......................................................................................................... 5 MEMBERSHIP AND ADMINISTRATION ...................................................................................... 5 LICENSING OF BROADCASTING ACTIVITIES AND RE-BROADCAST CONTENT AND REGULATION OF UNLICENSED ACTIVITIES ............................................................................ 6 THE LEGISLATIVE PROCESS AND ENFORCEMENT .............................................................. 30 ECONOMIC OPERATOR OVERSIGHT AND CONTENT MONITORING ................................ 33 COPYRIGHT PROTECTION ON THE INTERNET ...................................................................... 41 STAFF PARTICIPATION IN TRAINING AND INTERNATIONAL COOPERATION EFFORTS ........................................................................................................................................................... 42 COMPETITION OF THE BEST IN RADIO AND TELEVISION PRAGIEDRULIAI ................... 43 PUBLICITY WORK BY THE RTCL .............................................................................................. 46 PRIORITIES FOR 2021 ................................................................................................................... -

Multiple Documents

Alex Morgan et al v. United States Soccer Federation, Inc., Docket No. 2_19-cv-01717 (C.D. Cal. Mar 08, 2019), Court Docket Multiple Documents Part Description 1 3 pages 2 Memorandum Defendant's Memorandum of Points and Authorities in Support of i 3 Exhibit Defendant's Statement of Uncontroverted Facts and Conclusions of La 4 Declaration Gulati Declaration 5 Exhibit 1 to Gulati Declaration - Britanica World Cup 6 Exhibit 2 - to Gulati Declaration - 2010 MWC Television Audience Report 7 Exhibit 3 to Gulati Declaration - 2014 MWC Television Audience Report Alex Morgan et al v. United States Soccer Federation, Inc., Docket No. 2_19-cv-01717 (C.D. Cal. Mar 08, 2019), Court Docket 8 Exhibit 4 to Gulati Declaration - 2018 MWC Television Audience Report 9 Exhibit 5 to Gulati Declaration - 2011 WWC TElevision Audience Report 10 Exhibit 6 to Gulati Declaration - 2015 WWC Television Audience Report 11 Exhibit 7 to Gulati Declaration - 2019 WWC Television Audience Report 12 Exhibit 8 to Gulati Declaration - 2010 Prize Money Memorandum 13 Exhibit 9 to Gulati Declaration - 2011 Prize Money Memorandum 14 Exhibit 10 to Gulati Declaration - 2014 Prize Money Memorandum 15 Exhibit 11 to Gulati Declaration - 2015 Prize Money Memorandum 16 Exhibit 12 to Gulati Declaration - 2019 Prize Money Memorandum 17 Exhibit 13 to Gulati Declaration - 3-19-13 MOU 18 Exhibit 14 to Gulati Declaration - 11-1-12 WNTPA Proposal 19 Exhibit 15 to Gulati Declaration - 12-4-12 Gleason Email Financial Proposal 20 Exhibit 15a to Gulati Declaration - 12-3-12 USSF Proposed financial Terms 21 Exhibit 16 to Gulati Declaration - Gleason 2005-2011 Revenue 22 Declaration Tom King Declaration 23 Exhibit 1 to King Declaration - Men's CBA 24 Exhibit 2 to King Declaration - Stolzenbach to Levinstein Email 25 Exhibit 3 to King Declaration - 2005 WNT CBA Alex Morgan et al v. -

Vartotojų Informavimo Planas 2021 M

VARTOTOJŲ INFORMAVIMO APIE ELEKTROS ENERGIJOS RINKOS LIBERALIZAVIMĄ IR JO PROCESĄ PLANAS 2021 m. NUMATOMI KONKURENCINGOS ELEKTROS ENERGIJOS RINKOS SUKŪRIMO ETAPAI 2020-2023 m. Apie 793 tūkst.* II ETAPAS vartotojų ESO pateikia antro etapo Iki šios datos buitinių klientų elektros tiekėją duomenis (kurie pasirenka namų Visuomenės neišreiškė ūkiai, suvartojantys informavimo nesutikimo) >1000 kWh/metus kampanija elektros tiekėjams III ETAPAS 2021.04.05 2021.09.01 2022.12.10 2020.05-12 2021.07 2021.12.10 2023.01.01 II ETAPAS III ETAPAS Iki šios datos Visuomeninis tiekėjas Iki šios datos Įvykdytas 1-asis elektros tiekėją informuoja į pirmąjį elektros tiekėją liberalizavimo pasirenka namų etapą pateksiančius pasirenka visi etapas. ūkiai, suvartojantys buitinius klientus (747 likę namų ūkiai PASIRINKO 97% 1000>5000 tūkst.) apie elektros kWh/metus energijos tiekimo Apie 747 tūkst.* visuomenine kaina vartotojų nutraukimą. PALANKUMO VERTINIMAS Kodėl galimybę pasirinkti elektros energijos tiekėją iš keleto tiekėjų vertinate palankiai? Šaltinis: Visuomenės nuomonės tyrimas dėl elektros energijos rinkos liberalizavimo, 2020 12, UAB „Norstat“ Tyrimo duomenimis apie 98 proc. Lietuvos gyventojų girdėjo apie tai, kad gali rinktis elektros tiekėją savo namams; Tyrimo duomenimis 74 proc. apklaustųjų žino arba girdėjo apie informacinę svetainę Pasirinkitetiekeja.lt; 53% teigia trūkstantys daugiau informacijos apie tiekėjo pasirinkimo procesą. KOMUNIKACIJOS KELIAS ŽINOMUMAS SUSIDOMĖJIMAS VEIKSMAS AIŠKIOS NAUDOS: LAISVĖ RINKTIS, AIŠKUMAS: INFORMAVIMAS / EDUKAVIMAS naudų ir patarimų komunikavimas. asmens duomenų sauga, Visuomenėje suformuoti vykstančio Gerosios patirtys. Daugiau pasirinkimo proceso pokyčio žinomumą. Informuoti klientus ir akcentų: kas, kada ir kaip keisis. komunikavimas, skatinimas suteikti kuo daugiau informacijos apie nelikti garantiniame tiekime. pokytį, jo tikslus, naudą, eigą. Aiški ir paprasta, asmeniškai į žmogų nukreipta komunikacija. -

Generational Use of News Media in Estonia

Generational Use of News Media in Estonia Contemporary media research highlights the importance of empirically analysing the relationships between media and age; changing user patterns over the life course; and generational experiences within media discourse beyond the widely-hyped buzz terms such as the ‘digital natives’, ‘Google generation’, etc. The Generational Use doctoral thesis seeks to define the ‘repertoires’ of news media that different generations use to obtain topical information and create of News Media their ‘media space’. The thesis contributes to the development of in Estonia a framework within which to analyse generational features in news audiences by putting the main focus on the cultural view of generations. This perspective was first introduced by Karl Mannheim in 1928. Departing from his legacy, generations can be better conceived of as social formations that are built on self- identification, rather than equally distributed cohorts. With the purpose of discussing the emergence of various ‘audiencing’ patterns from the perspectives of age, life course and generational identity, the thesis centres on Estonia – a post-Soviet Baltic state – as an empirical example of a transforming society with a dynamic media landscape that is witnessing the expanding impact of new media and a shift to digitisation, which should have consequences for the process of ‘generationing’. The thesis is based on data from nationally representative cross- section surveys on media use and media attitudes (conducted 2002–2012). In addition to that focus group discussions are used to map similarities and differences between five generation cohorts born 1932–1997 with regard to the access and use of established news media, thematic preferences and spatial orientations of Signe Opermann Signe Opermann media use, and a discursive approach to news formats. -

150 Russia's Information Policy in Lithuania: the Spread of Soft Power Or Information Geopolitics? by Nerijus Maliukevicius* L

Volume 9, 2007 Baltic Security & Defence Review Russia’s Information Policy in Lithuania: The Spread of Soft Power or Information Geopolitics? By Nerijus Maliukevicius Lithuania joined the European Union and NATO in 2004, thus attaining its vital political goals. However the merger of the Lithuanian information environment, in terms of culture and values, with the Western information environment still lacks clarity and stability. The results of electronic media (TV) monitoring (conducted by the author in 2005- 2007) reveal a significant increase of Russia’s impact on the content of Lithuanian media products. Significant segments of Lithuanian society receive popular information as well as news about the world and the post-Soviet region through Russian TV networks (Civil Society Institute (CSI) – Vilmorus poll, 2006). The same study shows that many Lithuanians still have a feeling of nostalgia for the “soviet times”. This might lead us to think that Russian information policies are successful in this particular post-Soviet country. However, the CSI-Vilmorus poll reveals just the opposite: in Lithuania, Russia is considered to be the most hostile country (CSI, 2006). This article focuses on the above mentioned paradox: the competitive advantage Russia has for its information policies in the Lithuanian information environment and, at the same time, an entirely negative image the Lithuanian public has formed about modern Russia. This dilemma tempts us to find a reasoned explanation. The article contends that the main reason behind this paradox is the strategy used by Russia in pursuing its information policy. The said strategy rests on the principles of resonance communication and on the theory and practice of information geopolitics – a strategy which fundamentally contradicts the current soft power principles so popular in international politics. -

Must-Carry Rules, and Access to Free-DTT

Access to TV platforms: must-carry rules, and access to free-DTT European Audiovisual Observatory for the European Commission - DG COMM Deirdre Kevin and Agnes Schneeberger European Audiovisual Observatory December 2015 1 | Page Table of Contents Introduction and context of study 7 Executive Summary 9 1 Must-carry 14 1.1 Universal Services Directive 14 1.2 Platforms referred to in must-carry rules 16 1.3 Must-carry channels and services 19 1.4 Other content access rules 28 1.5 Issues of cost in relation to must-carry 30 2 Digital Terrestrial Television 34 2.1 DTT licensing and obstacles to access 34 2.2 Public service broadcasters MUXs 37 2.3 Must-carry rules and digital terrestrial television 37 2.4 DTT across Europe 38 2.5 Channels on Free DTT services 45 Recent legal developments 50 Country Reports 52 3 AL - ALBANIA 53 3.1 Must-carry rules 53 3.2 Other access rules 54 3.3 DTT networks and platform operators 54 3.4 Summary and conclusion 54 4 AT – AUSTRIA 55 4.1 Must-carry rules 55 4.2 Other access rules 58 4.3 Access to free DTT 59 4.4 Conclusion and summary 60 5 BA – BOSNIA AND HERZEGOVINA 61 5.1 Must-carry rules 61 5.2 Other access rules 62 5.3 DTT development 62 5.4 Summary and conclusion 62 6 BE – BELGIUM 63 6.1 Must-carry rules 63 6.2 Other access rules 70 6.3 Access to free DTT 72 6.4 Conclusion and summary 73 7 BG – BULGARIA 75 2 | Page 7.1 Must-carry rules 75 7.2 Must offer 75 7.3 Access to free DTT 76 7.4 Summary and conclusion 76 8 CH – SWITZERLAND 77 8.1 Must-carry rules 77 8.2 Other access rules 79 8.3 Access to free DTT -

Packages & Channel Lineup

™ ™ ENTERTAINMENT CHOICE ULTIMATE PREMIER PACKAGES & CHANNEL LINEUP ESNE3 456 • • • • Effective 6/17/21 ESPN 206 • • • • ESPN College Extra2 (c only) (Games only) 788-798 • ESPN2 209 • • • • • ENTERTAINMENT • ULTIMATE ESPNEWS 207 • • • • CHOICE™ • PREMIER™ ESPNU 208 • • • EWTN 370 • • • • FLIX® 556 • FM2 (c only) 386 • • Food Network 231 • • • • ™ ™ Fox Business Network 359 • • • • Fox News Channel 360 • • • • ENTERTAINMENT CHOICE ULTIMATE PREMIER FOX Sports 1 219 • • • • A Wealth of Entertainment 387 • • • FOX Sports 2 618 • • A&E 265 • • • • Free Speech TV3 348 • • • • ACC Network 612 • • • Freeform 311 • • • • AccuWeather 361 • • • • Fuse 339 • • • ActionMAX2 (c only) 519 • FX 248 • • • • AMC 254 • • • • FX Movie 258 • • American Heroes Channel 287 • • FXX 259 • • • • Animal Planet 282 • • • • fyi, 266 • • ASPiRE2 (HD only) 381 • • Galavisión 404 • • • • AXS TV2 (HD only) 340 • • • • GEB America3 363 • • • • BabyFirst TV3 293 • • • • GOD TV3 365 • • • • BBC America 264 • • • • Golf Channel 218 • • 2 c BBC World News ( only) 346 • • Great American Country (GAC) 326 • • BET 329 • • • • GSN 233 • • • BET HER 330 • • Hallmark Channel 312 • • • • BET West HD2 (c only) 329-1 2 • • • • Hallmark Movies & Mysteries (c only) 565 • • Big Ten Network 610 2 • • • HBO Comedy HD (c only) 506 • 2 Black News Channel (c only) 342 • • • • HBO East 501 • Bloomberg TV 353 • • • • HBO Family East 507 • Boomerang 298 • • • • HBO Family West 508 • Bravo 237 • • • • HBO Latino3 511 • BYUtv 374 • • • • HBO Signature 503 • C-SPAN2 351 • • • • HBO West 504 • -

VYTAUTO DIDŽIOJO UNIVERSITETAS Erika

VYTAUTO DIDŽIOJO UNIVERSITETAS POLITIKOS MOKSLŲ IR DIPLOMATIJOS FAKULTETAS VIEŠOSIOS KOMUNIKACIJOS KATEDRA Erika Vyšniauskaitė DIDŽIAUSIĄ TV RINKOS DALĮ LIETUVOJE TURINČIŲ KANALŲ (TV3, LNK, BTV, LTV) TENDENCIJOS 2001 – 2011 METAIS Magistro baigiamasis darbas Žurnalistikos ir medijų analizės studijų programa, valstybinis kodas 62609S105 Žurnalistikos studijų kryptis Vadovas (-ė)_____________________ _________ __________ (Moksl. laipsnis, vardas, pavardė) (Parašas) (Data) Apginta ___________________ __________ __________ (Fakulteto/studijų instituto dekanas/direktorius) (Parašas) (Data) Kaunas, 2012 TURINYS PAGRINDINIŲ SĄVOKŲ ŽODYNAS IR SANTRUMPOS PAVEIKSLŲ IR LENTELIŲ SĄRAŠAS SANTRAUKA SUMMARY ĮVADAS...............................................................................................................................................8 I. TELEVIZIJOS VAIDMUO XX – XXI AMŽIŲ SANDŪROJE..............................................14 1.1. Masinės informacijos priemonės. Teoriniai požiūriai.......................................................14 1.2. Šiuolaikinės televizijos tendencijos.....................................................................................16 1.2.1. Televizijos globalėjimas...................................................................................................20 1.2.2. Komercializacija, vesternizacija, tabloidizacija televizijoje............................................24 1.2.3. Postmodernizmo apraiškos televizijoje............................................................................30