Audit Report on the Accounts of Union Councils District Karachi Audit Year 2013-14

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEF Assisted Schools (SAS)

Sindh Education Foundation, Govt. of Sindh SEF Assisted Schools (SAS) PRIMARY SCHOOLS (659) S. No. School Code Village Union Council Taluka District Operator Contact No. 1 NEWSAS204 Umer Chang 3 Badin Badin SHUMAILA ANJUM MEMON 0333-7349268 2 NEWSAS179 Sharif Abad Thari Matli Badin HAPE DEVELOPMENT & WELFARE ASSOCIATION 0300-2632131 3 NEWSAS178 Yasir Abad Thari Matli Badin HAPE DEVELOPMENT & WELFARE ASSOCIATION 0300-2632131 4 NEWSAS205 Haji Ramzan Khokhar UC-I MATLI Matli Badin ZEESHAN ABBASI 0300-3001894 5 NEWSAS177 Khan Wah Rajo Khanani Talhar Badin HAPE DEVELOPMENT & WELFARE ASSOCIATION 0300-2632131 6 NEWSAS206 Saboo Thebo SAEED PUR Talhar Badin ZEESHAN ABBASI 0300-3001894 7 NEWSAS175 Ahmedani Goth Khalifa Qasim Tando Bago Badin GREEN CRESCENT TRUST (GCT) 0304-2229329 8 NEWSAS176 Shadi Large Khoski Tando Bago Badin GREEN CRESCENT TRUST (GCT) 0304-2229329 9 NEWSAS349 Wapda Colony JOHI Johi Dadu KIFAYAT HUSSAIN JAMALI 0306-8590931 10 NEWSAS350 Mureed Dero Pat Gul Mohammad Johi Dadu Manzoor Ali Laghari 0334-2203478 11 NEWSAS215 Mureed Dero Mastoi Pat Gul Muhammad Johi Dadu TRANSFORMATION AND REFLECTION FOR RURAL DEVELOPMENT (TRD) 0334-0455333 12 NEWSAS212 Nabu Birahmani Pat Gul Muhammad Johi Dadu TRANSFORMATION & REFLECTION FOR RURAL DEVELOPMENT (TRD) 0334-0455333 13 NEWSAS216 Phullu Qambrani Pat Gul Muhammad Johi Dadu TRANSFORMATION AND REFLECTION FOR RURAL DEVELOPMENT (TRD) 0334-0455333 14 NEWSAS214 Shah Dan Pat Gul Muhammad Johi Dadu TRANSFORMATION AND REFLECTION FOR RURAL DEVELOPMENT (TRD) 0334-0455333 15 RBCS002 MOHAMMAD HASSAN RODNANI -

Migration and Small Towns in Pakistan

Working Paper Series on Rural-Urban Interactions and Livelihood Strategies WORKING PAPER 15 Migration and small towns in Pakistan Arif Hasan with Mansoor Raza June 2009 ABOUT THE AUTHORS Arif Hasan is an architect/planner in private practice in Karachi, dealing with urban planning and development issues in general, and in Asia and Pakistan in particular. He has been involved with the Orangi Pilot Project (OPP) since 1982 and is a founding member of the Urban Resource Centre (URC) in Karachi, whose chairman he has been since its inception in 1989. He is currently on the board of several international journals and research organizations, including the Bangkok-based Asian Coalition for Housing Rights, and is a visiting fellow at the International Institute for Environment and Development (IIED), UK. He is also a member of the India Committee of Honour for the International Network for Traditional Building, Architecture and Urbanism. He has been a consultant and advisor to many local and foreign CBOs, national and international NGOs, and bilateral and multilateral donor agencies. He has taught at Pakistani and European universities, served on juries of international architectural and development competitions, and is the author of a number of books on development and planning in Asian cities in general and Karachi in particular. He has also received a number of awards for his work, which spans many countries. Address: Hasan & Associates, Architects and Planning Consultants, 37-D, Mohammad Ali Society, Karachi – 75350, Pakistan; e-mail: [email protected]; [email protected]. Mansoor Raza is Deputy Director Disaster Management for the Church World Service – Pakistan/Afghanistan. -

Drivers of Climate Change Vulnerability at Different Scales in Karachi

Drivers of climate change vulnerability at different scales in Karachi Arif Hasan, Arif Pervaiz and Mansoor Raza Working Paper Urban; Climate change Keywords: January 2017 Karachi, Urban, Climate, Adaptation, Vulnerability About the authors Acknowledgements Arif Hasan is an architect/planner in private practice in Karachi, A number of people have contributed to this report. Arif Pervaiz dealing with urban planning and development issues in general played a major role in drafting it and carried out much of the and in Asia and Pakistan in particular. He has been involved research work. Mansoor Raza was responsible for putting with the Orangi Pilot Project (OPP) since 1981. He is also a together the profiles of the four settlements and for carrying founding member of the Urban Resource Centre (URC) in out the interviews and discussions with the local communities. Karachi and has been its chair since its inception in 1989. He was assisted by two young architects, Yohib Ahmed and He has written widely on housing and urban issues in Asia, Nimra Niazi, who mapped and photographed the settlements. including several books published by Oxford University Press Sohail Javaid organised and tabulated the community surveys, and several papers published in Environment and Urbanization. which were carried out by Nur-ulAmin, Nawab Ali, Tarranum He has been a consultant and advisor to many local and foreign Naz and Fahimida Naz. Masood Alam, Director of KMC, Prof. community-based organisations, national and international Noman Ahmed at NED University and Roland D’Sauza of the NGOs, and bilateral and multilateral donor agencies; NGO Shehri willingly shared their views and insights about e-mail: [email protected]. -

Malir-Karachi

Malir-Karachi 475 476 477 478 479 480 Travelling Stationary Inclass Co- Library Allowance (School Sub Total Furniture S.No District Teshil Union Council School ID School Name Level Gender Material and Curricular Sport Total Budget Laboratory (School Specific (80% Other) 20% supplies Activities Specific Budget) 1 Malir Karachi Gadap Town NA 408180381 GBLSS - HUSSAIN BLAOUCH Middle Boys 14,324 2,865 8,594 5,729 2,865 11,459 45,836 11,459 57,295 2 Malir Karachi Gadap Town NA 408180436 GBELS - HAJI IBRAHIM BALOUCH Elementary Mixed 24,559 4,912 19,647 4,912 4,912 19,647 78,588 19,647 98,236 3 Malir Karachi Gadap Town 1-Murad Memon Goth (Malir) 408180426 GBELS - HASHIM KHASKHELI Elementary Boys 42,250 8,450 33,800 8,450 8,450 33,800 135,202 33,800 169,002 4 Malir Karachi Gadap Town 1-Murad Memon Goth (Malir) 408180434 GBELS - MURAD MEMON NO.3 OLD Elementary Mixed 35,865 7,173 28,692 7,173 7,173 28,692 114,769 28,692 143,461 5 Malir Karachi Gadap Town 1-Murad Memon Goth (Malir) 408180435 GBELS - MURAD MEMON NO.3 NEW Elementary Mixed 24,882 4,976 19,906 4,976 4,976 19,906 79,622 19,906 99,528 6 Malir Karachi Gadap Town 2-Darsano Channo 408180073 GBELS - AL-HAJ DUR MUHAMMAD BALOCH Elementary Boys 36,374 7,275 21,824 14,550 7,275 29,099 116,397 29,099 145,496 7 Malir Karachi Gadap Town 2-Darsano Channo 408180428 GBELS - MURAD MEMON NO.1 Elementary Mixed 33,116 6,623 26,493 6,623 6,623 26,493 105,971 26,493 132,464 8 Malir Karachi Gadap Town 3-Gujhro 408180441 GBELS - SIRAHMED VILLAGE Elementary Mixed 38,725 7,745 30,980 7,745 7,745 30,980 123,919 -

Central-Karachi

Central-Karachi 475 476 477 478 479 480 Travelling Stationary Inclass Co- Library Allowance (School Sub Total Furniture S.No District Teshil Union Council School ID School Name Level Gender Material and Curricular Sport Total Budget Laboratory (School Specific (80% Other) 20% supplies Activities Specific Budget) 1 Central Karachi New Karachi Town 1-Kalyana 408130186 GBELS - Elementary Elementary Boys 20,253 4,051 16,202 4,051 4,051 16,202 64,808 16,202 81,010 2 Central Karachi New Karachi Town 4-Ghodhra 408130163 GBLSS - 11-G NEW KARACHI Middle Boys 24,147 4,829 19,318 4,829 4,829 19,318 77,271 19,318 96,589 3 Central Karachi New Karachi Town 4-Ghodhra 408130167 GBLSS - MEHDI Middle Boys 11,758 2,352 9,406 2,352 2,352 9,406 37,625 9,406 47,031 4 Central Karachi New Karachi Town 4-Ghodhra 408130176 GBELS - MATHODIST Elementary Boys 20,492 4,098 12,295 8,197 4,098 16,394 65,576 16,394 81,970 5 Central Karachi New Karachi Town 6-Hakim Ahsan 408130205 GBELS - PIXY DALE 2 Registred as a Seconda Elementary Girls 61,338 12,268 49,070 12,268 12,268 49,070 196,281 49,070 245,351 6 Central Karachi New Karachi Town 9-Khameeso Goth 408130174 GBLSS - KHAMISO GOTH Middle Mixed 6,962 1,392 5,569 1,392 1,392 5,569 22,278 5,569 27,847 7 Central Karachi New Karachi Town 10-Mustafa Colony 408130160 GBLSS - FARZANA Middle Boys 11,678 2,336 9,342 2,336 2,336 9,342 37,369 9,342 46,711 8 Central Karachi New Karachi Town 10-Mustafa Colony 408130166 GBLSS - 5/J Middle Boys 28,064 5,613 16,838 11,226 5,613 22,451 89,804 22,451 112,256 9 Central Karachi New Karachi -

Hblbankbranches.Pdf

CITY WISE LIST OF HBL BRANCHES DESIGNATED FOR DHA CITY COLLECTION KARACHI 1 Dhoraji Colony Branch 1069 2 Yousuf Plaza Branch 1115 3 Nazimabad Commercial Area Branch 1117 4 Shahra-e-Pakistan Branch 1118 5 Hasan Square Branch 1178 6 Malir cantt. Branch 1217 7 P.E.C.H.S. Commercial Centre Branch 1220 8 Abdullah Haroon Road Branch 1403 9 Gulshan Block 5 Branch 1549 10 Korangi No. 2 Branch 1642 11 Shahra-e-Jahangir Branch 1679 12 Ghaffar Goth Branch 1757 13 Abul Hassan Isphani 2214 14 Gujjar Chowk - Manzoor Colony Branch 2289 15 Landhi Industrial Area Branch 0019 16 Liaquatabad Branch 0020 17 Nazimabad Branch 0024 18 Nursery Branch 0027 19 P.A.F. Shahra-e-Faisal Branch 0028 20 Paposhnagar Branch 0053 21 Azizabad Branch 0063 22 Jinnah Terminal Branch 0064 23 Mehran - Malir Halt Branch 0300 24 Orangi Town Branch 0369 25 Muslim Town Branch 0400 26 Sir Syed Road Branch 0490 27 Barkat-e-Hyderi Branch 0502 28 Bahadurabad Branch 0526 29 Korangi No. 5 Branch 0550 30 Shaheed-e-Millat Branch 0599 31 Ibrahim Hyderi Branch 0622 32 Gulistan-e-Jouhar Branch 0857 33 Dastagir Colony Branch 0878 34 University Road Branch 0879 35 Mahmoodabad Branch 0891 36 Karsaz Branch 0896 37 Annexe Branch 0047 38 Baddar Commercial Branch 1155 39 Clifton Branch 0056 40 D.H.A. Branch 0541 41 Elphinstone Street Branch 0044 42 High Court Branch 0606 43 Hotel Mehran Branch 1059 44 Iddgah Branch 0008 45 J.P.M.C. Branch 0065 46 Jacoblines Branch 1089 47 Jodia Bazar Branch 0692 48 K.M.C. -

Misuse of Licit Trade for Opiate Trafficking in Western and Central

MISUSE OF LICIT TRADE FOR OPIATE TRAFFICKING IN WESTERN AND CENTRAL ASIA MISUSE OF LICIT TRADE FOR OPIATE Vienna International Centre, PO Box 500, 1400 Vienna, Austria Tel: +(43) (1) 26060-0, Fax: +(43) (1) 26060-5866, www.unodc.org MISUSE OF LICIT TRADE FOR OPIATE TRAFFICKING IN WESTERN AND CENTRAL ASIA A Threat Assessment A Threat Assessment United Nations publication printed in Slovenia October 2012 MISUSE OF LICIT TRADE FOR OPIATE TRAFFICKING IN WESTERN AND CENTRAL ASIA Acknowledgements This report was prepared by the UNODC Afghan Opiate Trade Project of the Studies and Threat Analysis Section (STAS), Division for Policy Analysis and Public Affairs (DPA), within the framework of UNODC Trends Monitoring and Analysis Programme and with the collaboration of the UNODC Country Office in Afghanistan and in Pakistan and the UNODC Regional Office for Central Asia. UNODC is grateful to the national and international institutions that shared their knowledge and data with the report team including, in particular, the Afghan Border Police, the Counter Narcotics Police of Afghanistan, the Ministry of Counter Narcotics of Afghanistan, the customs offices of Afghanistan and Pakistan, the World Customs Office, the Central Asian Regional Information and Coordination Centre, the Customs Service of Tajikistan, the Drug Control Agency of Tajikistan and the State Service on Drug Control of Kyrgyzstan. Report Team Research and report preparation: Hakan Demirbüken (Programme management officer, Afghan Opiate Trade Project, STAS) Natascha Eichinger (Consultant) Platon Nozadze (Consultant) Hayder Mili (Research expert, Afghan Opiate Trade Project, STAS) Yekaterina Spassova (National research officer, Afghan Opiate Trade Project) Hamid Azizi (National research officer, Afghan Opiate Trade Project) Shaukat Ullah Khan (National research officer, Afghan Opiate Trade Project) A. -

Sindh Coast: a Marvel of Nature

Disclaimer: This ‘Sindh Coast: A marvel of nature – An Ecotourism Guidebook’ was made possible with support from the American people delivered through the United States Agency for International Development (USAID). The contents are the responsibility of IUCN Pakistan and do not necessarily reflect the opinion of USAID or the U.S. Government. Published by IUCN Pakistan Copyright © 2017 International Union for Conservation of Nature. Citation is encouraged. Reproduction and/or translation of this publication for educational or other non-commercial purposes is authorised without prior written permission from IUCN Pakistan, provided the source is fully acknowledged. Reproduction of this publication for resale or other commercial purposes is prohibited without prior written permission from IUCN Pakistan. Author Nadir Ali Shah Co-Author and Technical Review Naveed Ali Soomro Review and Editing Ruxshin Dinshaw, IUCN Pakistan Danish Rashdi, IUCN Pakistan Photographs IUCN, Zahoor Salmi Naveed Ali Soomro, IUCN Pakistan Designe Azhar Saeed, IUCN Pakistan Printed VM Printer (Pvt.) Ltd. Table of Contents Chapter-1: Overview of Ecotourism and Chapter-4: Ecotourism at Cape Monze ....... 18 Sindh Coast .................................................... 02 4.1 Overview of Cape Monze ........................ 18 1.1 Understanding ecotourism...................... 02 4.2 Accessibility and key ecotourism 1.2 Key principles of ecotourism................... 03 destinations ............................................. 18 1.3 Main concepts in ecotourism ................. -

FRPM Ramzanii.Cdr

Ramzan Issue ir Electio a n F N 28 Commodities Register & e t w e e o r r k 2% Price Increase while F 13 Commodities Register FAFEN 4% Price Decrease r r A Report Based on Prices of 52 Consumer Commodities Collected at Designated o Retail Outlets in 172 Towns of 119 Districts across Pakistan in August 2011 o t t i i The price of 28 commodities including meat, sweeteners, kitchen fuels and milk registered an average increase of 2% while the average price of 13 commodities including some condiments and pulses, over-the-counter available n medicines and poultry products decreased by 4% in the mid of Ramazan (18th August 2011) as compared to the prices n of these commodities in the almost the beginning of this holy month (6th August 2011). o Despite an increase in the prices of a higher number of the observed commodities, the overall impact of the price o increase turned out to be lower than the price decrease indicating a slight increase in the prices of 28 commodities while a comparatively sizeable decrease in the other 13 commodities in comparison. The commodities that registered a price increase include banana (7%), plain chapatti (5%), black gram (4%), sugar M (45), Liquid Petroleum Gas (LPG) (2%), mutton (1%) and yoghurt (1%) while commodities that registered a decrease M in their prices include tomato (14%), apple golden (10%), Disprin (5%), chicken live (3%), garlic (2%) and potato (2%). FAFEN usually collects the prices of the observed consumer commodities on the 10th of every motnh. -

34Pwd36-186.Pdf

GOVERNMENT OF PAKISTAN PAKISTAN PUBLIC WORKS DEPARTMENT ***** NO.EE/KCCD-III/(SAP-2020-2021)/AB/458 Dated, Karachi: 02nd June, 2021. INVITATION TO BID Sealed tenders are invited from the contractors registered with Pakistan Engineering Council / Pak PWD under relevant Category & field of specialization, on percentage rates basis on Pak PWD Schedule of Rates 2012, who possess valid renewal with Pakistan Engineering Council / Pak PWD for 2020-21. Tender documents can be received from the office of the undersigned during office hours on any working day upto 17th June 2021 with written request on letter accompanied with attested copy of CNIC, Income Tax Registration Certificate as active taxpayer (filer) and copy of valid registration of Pakistan Engineering Council / Pak PWD under relevant category. Tenders will be issued to the proprietor of the Firm / Company or their legally authorized representatives having registered power of attorney (duly attested). The tenders in sealed cover should be dropped in the tender box kept in the office of undersigned on 18th June 2021 upto 12:00 noon. The respective tenders will be opened on the same day at 12:30 p.m., in the presence of contractors or their authorized representatives, having registered power of attorney. Other terms and conditions can be seen in the office of the undersigned during office hours on any working day. TERMS & CONDITIONS 1) No tender will be sold / issued on the date of opening of tenders and in case of public holiday, the receipt and opening of tenders will be the next working day. 2) No tender will be issued / received through post, telegraph or e-mail. -

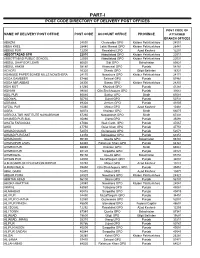

Part-I: Post Code Directory of Delivery Post Offices

PART-I POST CODE DIRECTORY OF DELIVERY POST OFFICES POST CODE OF NAME OF DELIVERY POST OFFICE POST CODE ACCOUNT OFFICE PROVINCE ATTACHED BRANCH OFFICES ABAZAI 24550 Charsadda GPO Khyber Pakhtunkhwa 24551 ABBA KHEL 28440 Lakki Marwat GPO Khyber Pakhtunkhwa 28441 ABBAS PUR 12200 Rawalakot GPO Azad Kashmir 12201 ABBOTTABAD GPO 22010 Abbottabad GPO Khyber Pakhtunkhwa 22011 ABBOTTABAD PUBLIC SCHOOL 22030 Abbottabad GPO Khyber Pakhtunkhwa 22031 ABDUL GHAFOOR LEHRI 80820 Sibi GPO Balochistan 80821 ABDUL HAKIM 58180 Khanewal GPO Punjab 58181 ACHORI 16320 Skardu GPO Gilgit Baltistan 16321 ADAMJEE PAPER BOARD MILLS NOWSHERA 24170 Nowshera GPO Khyber Pakhtunkhwa 24171 ADDA GAMBEER 57460 Sahiwal GPO Punjab 57461 ADDA MIR ABBAS 28300 Bannu GPO Khyber Pakhtunkhwa 28301 ADHI KOT 41260 Khushab GPO Punjab 41261 ADHIAN 39060 Qila Sheikhupura GPO Punjab 39061 ADIL PUR 65080 Sukkur GPO Sindh 65081 ADOWAL 50730 Gujrat GPO Punjab 50731 ADRANA 49304 Jhelum GPO Punjab 49305 AFZAL PUR 10360 Mirpur GPO Azad Kashmir 10361 AGRA 66074 Khairpur GPO Sindh 66075 AGRICULTUR INSTITUTE NAWABSHAH 67230 Nawabshah GPO Sindh 67231 AHAMED PUR SIAL 35090 Jhang GPO Punjab 35091 AHATA FAROOQIA 47066 Wah Cantt. GPO Punjab 47067 AHDI 47750 Gujar Khan GPO Punjab 47751 AHMAD NAGAR 52070 Gujranwala GPO Punjab 52071 AHMAD PUR EAST 63350 Bahawalpur GPO Punjab 63351 AHMADOON 96100 Quetta GPO Balochistan 96101 AHMADPUR LAMA 64380 Rahimyar Khan GPO Punjab 64381 AHMED PUR 66040 Khairpur GPO Sindh 66041 AHMED PUR 40120 Sargodha GPO Punjab 40121 AHMEDWAL 95150 Quetta GPO Balochistan 95151 -

(Rfp) for Front End Collection and Disposal of Municipal Solid Waste for Zone Central (Dmc Central Area) Karachi Sindh - Pakistan

REQUEST FOR PROPOSAL (RFP) FOR FRONT END COLLECTION AND DISPOSAL OF MUNICIPAL SOLID WASTE FOR ZONE CENTRAL (DMC CENTRAL AREA) KARACHI SINDH - PAKISTAN. Executive Director (Operation-I) Sindh Solid Waste Management Board (SSWMB) Govt. of Sindh SSWMB - NIT-17 Sindh Solid Waste Management Board Table of Content Section-I Clause# Page# 1.1 Purpose of Request for Proposal 8 1.2 Scope of Work/Assignment 8 1.3 Brief Description of DMC Central 8 1.4 MAP of DMC Central 9 1.5 Definition & Interpretation 10 1.6 Abbreviation 10 1.7 Section of RFP/Bidding Documents 11 1.8 Procuring Agency Right to cancel any or all proposals/tenders 11 Section-II Instructions to Contractors/Bidders Clause# Page# 2.1 Information related to procuring agency 13 2.2 Language of proposal and correspondence 13 2.3 Method of Procurement 13 2.4 Period of Contract 13 2.5 Pre-proposal Meeting 13 2.6 Clarification and modifications of Bidding Document 13 2.7 Visit of the area of Service 13 2.8 Utilization of Existing Work Force on SWM of DMC Central 14 2.9 Utilization of Existing Solid Waste Collection & Transportation Vehicle of 16 DMC Central. 2.10 Utilization of Existing Facilities i.e. Workshop, Offices of DMC Central 17 2.11 Amendment through Addendums 17 2.12 Cancelation of Tender before Tender Time 17 2.13 Proposal Preparation Cost/Cost of bidding 17 2.14 Bid submitted by a Joint Venture/Consortium 17 2.15 Place, date, time and manner of submission of Tender/Bid Document 18 2.16 Currency Unit of Offers and Payments 21 2.17 Conditional and Partial Offers 22 2.18 Alternative