A Profit Model for Spread Trading with an Application to Energy Futures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Specialty Strategies

RCM Alternatives: AlternaRCt M ve s Whitepaper Specialty Strategies 318 W Adams St 10th FL | Chicago, IL 60606 | 855-726-0060 www.rcmalternatives.com | [email protected] RCM Alternatives: Specialty Strategies RCM It’s fairly common for “trend following” and “managed futures” to be used interchangeably. But there are many more strategies out there beyond the standard approach – a variety of approaches that we call Specialty Strategies. Specialty strategies include short-term, options, and spread traders. Short-Term Systematic Traders The cousin to the multi-market systematic trend is the trading equivalent of an arms race that most follower, the short-term systematic program will also money managers want to stay as far away from as look to latch onto a “trend” in an effort to make a possible. profit. The difference here has to do with timeframe, and how that impacts their trend identification, What types of shorter-term traders can we length of trade, and performance during volatile expect to invest with? First, there are day trading times. Unlike longer-term trend followers, short-term strategies. A day trading system is defined by a systematic traders may believe an hours-long move is single characteristic: that it will NOT hold a position enough to represent a trend, allowing them to take overnight, with all positions covered by the end of advantage of market moves that are much shorter in the trading day. This appeals to many investors who duration. One man’s noise is another’s treasure in the don’t like the prospect of something happening in minds of short term traders. -

A Study on Advantages of Separate Trade Book for Bull Call Spreads and Bear Put Spreads

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 11-20 www.iosrjournals.org A Study on Advantages of Separate Trade book for Bull Call Spreads and Bear Put Spreads. Chirag Babulal Shah PhD (Pursuing), M.M.S., B.B.A., D.B.M., P.G.D.F.T., D.M.T.T. Assistant Professor at Indian Education Society’s Management College and Research Centre. Abstract: Derivatives are revolutionary instruments and have changed the way one looks at the financial world. Derivatives were introduced as a hedging tool. However, as the understanding of the intricacies of these instruments has evolved, it has become more of a speculative tool. The biggest advantage of Derivative instruments is the leverage it provides. The other benefit, which is not available in the spot market, is the ability to short the underlying, for more than a day. Thus it is now easy to take advantage of the downtrend. However, the small retail participants have not had a good overall experience of trading in derivatives and the public at large is still bereft of the advantages of derivatives. This has led to a phobia for derivatives among the small retail market participants, and they prefer to stick to the old methods of investing. The three main reasons identified are lack of knowledge, the margining methods and the quantity of the lot size. The brokers have also misled their clients and that has led to catastrophic results. The retail participation in the derivatives markets has dropped down dramatically. But, are these derivative instruments and especially options, so bad? The answer is NO. -

Affidavit of Stewart Mayhew

Affidavit of Stewart Mayhew I. Qualifications 1. I am a Principal at Cornerstone Research, an economic and financial consulting firm, where I have been working since 2010. At Cornerstone Research, I have conducted statistical and economic analysis for a variety of matters, including cases related to securities litigation, financial institutions, regulatory enforcement investigations, market manipulation, insider trading, and economic studies of securities market regulations. 2. Prior to working at Cornerstone Research, I worked at the U.S. Securities and Exchange Commission (“SEC” or “Commission”) as Deputy Chief Economist (2008-2010), Assistant Chief Economist (2004-2008), and Visiting Academic Scholar (2002-2004). From 2004 to 2008, I headed a group that was responsible for providing economic analysis and support for the Division of Trading and Markets (formerly known as the Division of Market Regulation), the Division of Investment Management, and the Office of Compliance Inspections and Examinations. Among my responsibilities were to analyze SEC rule proposals relating to market structure for the trading of stocks, bonds, options, and other products, and to perform analysis in connection with compliance examinations to assess whether exchanges, dealers, and brokers were complying with existing rules. I also assisted the Division of Enforcement on numerous investigations and enforcement actions, including matters involving market manipulation. 3. I have taught doctoral level, masters level, and undergraduate level classes in finance as Assistant Professor in the Finance Group at the Krannert School of Management, Purdue University (1996-1999), as Assistant Professor in the Department of Banking and Finance at the Terry College of Business, University of Georgia (2000-2004), and as a Lecturer at the Robert H. -

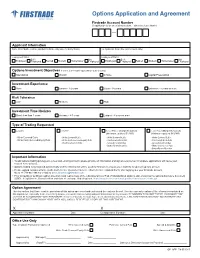

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD). -

My Top 5 Rules for Successful Debit Spread Trading Trade with Lower Cost and Create More Consistency in Your Options Portfolio

My Top 5 Rules for Successful Debit Spread Trading Trade with Lower Cost and Create More Consistency in Your Options Portfolio Price Headley, CFA, CMT TABLE OF CONTENTS: How Debit Spreads Give You Growth AND Income Potential Rule #1. Buy In-The-Money and Sell At or Out-Of-The-Money Rule #2. Sell More Time Premium Than You Buy Rule #3. Profit Taking in Pieces Increases Win Percentage Rule #4. Don’t Be Greedy – Favor Early Profit Taking Rule #5. Trade in Pairs How Debit Spreads Give You Growth AND Income Potential If you’ve ever bought an option before, you know that one of the challenges of trading a time-limited asset is paying a “time premium” and overcoming the loss of time. And yet as a trader, I still see plenty of opportunities to take advantage of trends on various time frames, from quick moves over a few days to “swing trading” moves over several weeks. So how can you actually place time on your side in the options game? It’s not by just selling options, as that can be profitable, but many traders have seen how a small number of trades can cause you lots of trouble in option selling if a stock or market moves sharply against you. The answer that meets nicely in the middle – profiting from the growth potential of catching a piece of an existing trend, while lowering your total cost per contract and paying no net time in your options – is Debit Spreads. You may have heard them called Vertical Spreads, or Bull Call Spreads or Bear Put Spreads. -

Futures Spreads Product Guide

FUTURES SPREADS PRODUCT GUIDE 1 PRODUCT INTRODUCTION Saxo Bank offers clients online trading in Fu- priced based on an estimated volume for their tures Spreads from the main Exchange around first month. When trading Futures Spread as it the world starting with Globex and rolling-out involves two legs, the clients will be charged two gradually to Europe and APAC exchanges. legs. Futures Spreads are tradable from the award- Commissions for Futures spread are the same as winning downloadable SaxoTrader, web-based for Futures Contract. From 0 to 5,000 lots per WebTrader, SaxoTrader for iPhone, Android and month they are visible on the Saxobank.com. iPad. Above 5,000 lots per month the client can ex- pect bespoke pricing. Saxo Bank supports Limit and Market orders on Futures Spreads, Stop orders are not supported. Saxo Bank Futures Spread Unique Sell- The initial margins listed in Online contracts ing Points specification are the collateral per contract that clients must have in their account to open a po- • Roll over the next front month very easily sition. • Trade Futures Spread Strategies on agricul- With the introduction of Risk Based Portfolio tural products, oil and energies, base metals, Margin on Futures Spread positions, Saxo Bank precious metals, bonds, currencies, short- will be able to apply lower margins on spread term interest rates, live stocks, softs and positions, while maintaining sufficient margin stock indices from one trading platform and levels reflecting the actual risk on the client’s po- enjoy margin benefits. sitions more closely. • Free access to Globex real-time market data Clients must maintain the Maintenance Mar- for Saxo bank’s customers gins listed per Futures Spread contract in their account at all times. -

Intelligent Cash Flow and Investment Decisions

SUCCESS STOCK MARKET G INCOME GENERATING STRATEGIES Intelligent Cash Flow and Investment Decisions Written by Mike Coval SUCCESSSTOCKMARKET .COM Stock Market Income Training Incometrader.com 6338 Presidential Court #204 Fort Myers, FL 33919 Phone 239.603.6137 • Fax 813.884.5666 If your educational course came with live webinar training, you will be given access to your login procedures at your live event. Webinar Website: Webinar Username: Webinar Password: Webinar Time: Your 4 “Cash Flow” course videos are in DVD format to ensure compatibility with both PC and Mac. Copyright © 2013 SuccessStockMarket.com. All rights Reserved. Terms of use apply. Disclaimer Success Resources USA, The Success Stock Market Income Manual, and the Success Stock Market website are information services for investors and traders, and are not a recommendation to buy or sell securities, nor an offer to buy or sell securities. The principals, employees of, as well as those who provide contracted services for Success Resources USA are neither stockbrokers nor investment advisors, and are not acting in any way to influence the purchase of any security. The information provided is obtained from sources deemed reliable, but is not guaranteed as to its accuracy or completeness. It is possible at this, or some subsequent date, the principals, employees of, as well as those who provide contracted services for Success Resources USA may own, buy, or sell securities presented. The principals, employees of, as well as those who provide contracted services for Success Resources USA are not liable for any losses or damages, monetary or otherwise, that result from the content of The Success Stock Market income Manual and the Success Stock Market website. -

Order: Bank of America, N.A

UNITED STATES OF AMERICA Before the COMMODITY FUTURES TRADING COMMISSION ) In the Matter of: ) ) Bank of America, N.A., ) CFTC Docket No. 18 -34 ) Respondent. ) ) ) ) ORDER INSTITUTING PROCEEDINGS PURSUANT TO SECTION 6(c) AND 6(d) OF THE COMMODITY EXCHANGE ACT, MAKING FINDINGS, AND IMPOSING REMEDIAL SANCTIONS I. The Commodity Futures Trading Commission (“Commission”) has reason to believe that Bank of America, N.A. (“Bank of America,” the “Bank,” or “Respondent”) violated the Commodity Exchange Act (the “Act” or “CEA”) and Commission Regulations (“Regulations”). Therefore, the Commission deems it appropriate and in the public interest that public administrative proceedings be, and hereby are, instituted to determine whether Respondent engaged in the violations set forth herein, and to determine whether any order shall be issued imposing remedial sanctions. II. In anticipation of the institution of an administrative proceeding, Respondent has submitted an Offer of Settlement (“Offer”), which the Commission has determined to accept. Without admitting or denying the findings or conclusions herein, Respondent consents to the entry and acknowledges service of this Order Instituting Proceedings Pursuant to Section 6(c) and 6(d) of the Commodity Exchange Act, Making Findings, and Imposing Remedial Sanctions (“Order”).1 1 Respondent consents to the entry of this Order and to the use of these findings in this proceeding and in any other proceeding brought by the Commission or to which the Commission is a party; provided, however, that Respondent does not consent to the use of the Offer, or the findings or conclusions in this Order, as the sole basis for any other proceeding brought by the Commission, other than in a proceeding in bankruptcy or to enforce the terms of this Order. -

How to Make Money in Soybeans – July/November Spread Trade

How to Make Money in Soybeans – July/November Spread Trade How to Make Money in Soybeans Traders are always on the lookout for new ways to protect themselves against market volatility and uncertainty. In such circumstances, spread trading is a very common approach to trading that is widely employed in the futures markets. Spread trading, as the name implies is trading or speculating on the price difference in a futures’ contract for two separate months. Most commonly a spread is known as the difference between the bid and ask price. A calendar spread is somewhat similar, but it is the difference between the front month and the deferred month contract’s prices. Spread trading is said to offer limited risks because traders often focus on the two contract months within the same asset. Spread trading has become so popular that CME Group has started to offer calendar spread contracts on options in select markets. Some of the most commonly used futures markets where spread trading is employed are agricultural markets which include corn, wheat, soybeans. The reason why the agricultural markets form the most popular assets is because of the seasonality in the grains or agricultural markets. The chart below shows the seasonality in the soybean markets. Soybean seasonal chart – 30 years (Source – seasonalcharts.com) Because these markets typically go through the cycle of planting and harvesting, calendar spreads offers traders a great way to exploit the seasonality in the agriculture and grains markets. For example you could trade the soybeans July – November contracts simultaneously (buying one and selling the other) which is known as the calendar spread trade. -

Eot-Course-Manual.Pdf

Tyler Chianelli’s EASYOPTIONTRADING by OPTION TRADING COACH PART 1 - THE FOUNDATION FOR TRADING SUCCESS A SIMPLE SYSTEM FOR TRADING OPTIONS WORKS IN UP, DOWN, AND SIDEWAYS MARKETS PART 1.1 - BASIC FUNDAMENTALS OF TRADING It is Important to Trade with the Trend Trade ‘Fundamentally Strong’ Companies Buy Stocks that Pay Dividends Go Long Shares in Bull Markets Sell Short Shares in Bear Markets Always Buy Shares with a Limit Order Have an Exit Strategy for Each Trade You Make Copyright © 2015 Option Trading Coach, LLC. All Rights Reserved. Terms of Use Apply. PART 1.1 - BASIC FUNDAMENTALS OF TRADING Market Capitalization: The total dollar value of a company. Earnings Per Share: The amount of money a company makes on a per share basis. Profit Margin: Measures how much the company keeps out of every dollar that comes in and is calculated by taking the net profit divided by total sales. P/E Ratio: This is calculated by dividing the stock price by earnings per share. Earnings Growth: The rate of growth for a company. PEG Ratio: Calculates the company value using earnings growth. Price/Book: A ratio that compares the market value to the book value. Current Ratio: Shows if a company can pay short-term debt obligations. Return on Assets: Shows how profitable a company is with it’s total assets. Beta: Measures the volatility or risk of a company. Total Cash Per Share: A ratio that determines if there is a likely change in earnings per share by dividing the free cash flow by the total number of outstanding shares. -

Credit Suisse Basis Points

18 February 2010 Fixed Income Research http://www.credit-suisse.com/researchandanalytics Credit Suisse Basis Points US Interest Rate Strategy Contributors A Guide to the Front-End and Basis Swap Markets Carl Lantz +1 212 538 5081 [email protected] Michael Chang +1 212 325 1962 [email protected] Sonam Leki Dorji +1 212 325 5584 [email protected] ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE IN THE DISCLOSURE APPENDIX. FOR OTHER IMPORTANT DISCLOSURES, PLEASE REFER TO https://firesearchdisclosure.credit-suisse.com. 18 February 2010 Credit Suisse Basis Points 2 18 February 2010 Introduction 5 The Basics 7 London Interbank Offered Rate (LIBOR) 7 Federal Funds Market 9 Forward Rate Agreements (FRAs) 11 Overview 11 FRAs used to hedge floating-rate notes 14 FRAs used to express a view on falling LIBOR Rates 15 Overnight Index Swaps 17 Overview 17 Using OIS to restructure bank liabilities 18 Using OIS to hedge repo funding rates 19 Using OIS to take directional views on T-Bill/OIS spreads 20 Using OIS to anticipate the outcome of FOMC meetings 21 Using OIS to hedge one leg of total return swaps 21 FRA-OIS Spread 23 Overview 23 Using FRA/OIS as a hedge for general bank credit quality 24 Using FRA/OIS to express directional view on credit spreads 24 Using FRA/OIS to hedge swap spreads generically 25 LIBOR/LIBOR Basis Swaps 27 Overview 27 LIBOR/LIBOR basis as a hedge for interest rate uncertainty 28 Using LIBOR/LIBOR basis to express a view on bank credit 29 Using 6s3s basis swaps to match bank assets -

Market Liquidity — Theory and Empirical Evidence

NBER WORKING PAPER SERIES MARKET LIQUIDITY — THEORY AND EMPIRICAL EVIDENCE Dimitri Vayanos Jiang Wang Working Paper 18251 http://www.nber.org/papers/w18251 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 July 2012 Forthcoming in the Handbook of the Economics of Finance, edited by George Constantinides, Milton Harris, and Rene Stulz. We thank Bruno Biais, Joost Driessen, Denis Gromb, Terrence Hendershott and Ronnie Sadka for very helpful comments. Financial support from the Paul Woolley Centre at the LSE is gratefully acknowledged. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2012 by Dimitri Vayanos and Jiang Wang. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Market Liquidity — Theory and Empirical Evidence Dimitri Vayanos and Jiang Wang NBER Working Paper No. 18251 July 2012 JEL No. D42,D53,D82,D83,G01,G11,G12,G14 ABSTRACT In this paper we survey the theoretical and empirical literature on market liquidity. We organize both literatures around three basic questions: (a) how to measure illiquidity, (b) how illiquidity relates to underlying market imperfections and other asset characteristics, and (c) how illiquidity affects expected asset returns. Using a unified model from Vayanos and Wang (2010), we survey theoretical work on six main imperfections: participation costs, transaction costs, asymmetric information, imperfect competition, funding constraints, and search---and for each imperfection we address the three basic questions within that model.