Spread Trading a Whole New Way to Trade by Trader, Author and Educator Joe Ross

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Profit Model for Spread Trading with an Application to Energy Futures

A profit model for spread trading with an application to energy futures by Takashi Kanamura, Svetlozar T. Rachev, Frank J. Fabozzi No. 27 | MAY 2011 WORKING PAPER SERIES IN ECONOMICS KIT – University of the State of Baden-Wuerttemberg and National Laboratory of the Helmholtz Association econpapers.wiwi.kit.edu Impressum Karlsruher Institut für Technologie (KIT) Fakultät für Wirtschaftswissenschaften Institut für Wirtschaftspolitik und Wirtschaftsforschung (IWW) Institut für Wirtschaftstheorie und Statistik (ETS) Schlossbezirk 12 76131 Karlsruhe KIT – Universität des Landes Baden-Württemberg und nationales Forschungszentrum in der Helmholtz-Gemeinschaft Working Paper Series in Economics No. 27, May 2011 ISSN 2190-9806 econpapers.wiwi.kit.edu A Profit Model for Spread Trading with an Application to Energy Futures Takashi Kanamura J-POWER Svetlozar T. Rachev¤ Chair of Econometrics, Statistics and Mathematical Finance, School of Economics and Business Engineering University of Karlsruhe and KIT, Department of Statistics and Applied Probability University of California, Santa Barbara and Chief-Scientist, FinAnalytica INC Frank J. Fabozzi Yale School of Management October 19, 2009 ABSTRACT This paper proposes a profit model for spread trading by focusing on the stochastic move- ment of the price spread and its first hitting time probability density. The model is general in that it can be used for any financial instrument. The advantage of the model is that the profit from the trades can be easily calculated if the first hitting time probability density of the stochastic process is given. We then modify the profit model for a particular market, the energy futures market. It is shown that energy futures spreads are modeled by using a mean- reverting process. -

Sales Representatives Manual 2020

Sales Representatives Manual Volume 4 2020 Volume 4 Table of Contents Chapter 1 Overview of Derivatives Transactions ………… 1 Chapter 2 Products of Derivatives Transactions ……………99 Derivatives Transactions and Chapter 3 Articles of Association and ……………… 165 Various Rules of the Association Exercise (Class-1 Examination) ……………………………………… 173 Chapter 1 Overview of Derivatives Transactions Introduction ∙∙∙∙∙∙∙∙ 3 Section 1. Fundamentals of Derivatives Transactions ∙∙∙∙∙∙∙∙ 10 1.1 What Are Derivatives Transactions? ∙∙∙∙∙∙∙∙ 10 Section 2. Futures Transactions ∙∙∙∙∙∙∙∙ 10 2.1 What Are Futures Transactions? ∙∙∙∙∙∙∙∙ 10 2.2 Futures Price Formation ∙∙∙∙∙∙∙∙ 14 2.3 How to Use Futures Transactions ∙∙∙∙∙∙∙∙ 17 Section 3. Forward Transactions ∙∙∙∙∙∙∙∙ 24 3.1 What Are Forward Transactions? ∙∙∙∙∙∙∙∙ 24 Section 4. Option Transactions ∙∙∙∙∙∙∙∙ 25 4.1 What Are Options Transactions? ∙∙∙∙∙∙∙∙ 25 4.2 Options’ Price Formation ∙∙∙∙∙∙∙∙ 32 4.3 Characteristics of Options Premiums ∙∙∙∙∙∙∙∙ 36 4.4 Sensitivity of Premiums to the Respective Factors ∙∙∙∙∙∙∙∙ 38 4.5 How to Use Options ∙∙∙∙∙∙∙∙ 46 4.6 Option Pricing Theory ∙∙∙∙∙∙∙∙ 57 Section 5. Swap Transactions ∙∙∙∙∙∙∙∙ 63 5.1 What Are Swap Transactions? ∙∙∙∙∙∙∙∙ 63 Section 6. Risks in Derivatives Transactions ∙∙∙∙∙∙∙∙ 72 Conclusion ∙∙∙∙∙∙∙∙ 82 Introduction Introduction 1. History of Derivatives Transactions Chapter 1 The term “derivatives” is used for financial instruments that “derive” from financial assets, meaning those that have securities such as shares or bonds as their underlying assets or financial transactions that use a reference indicator such as interest rates or exchange rates. Today the term “derivative” is used widely throughout society and not just on the financial markets. Although there has been criticism that they amplify financial risks and have a harmful impact on the Chapter 2 economy, derivatives are an indispensable requirement in supporting finance in the present age, and have become accepted as the leading edge of financial innovation. -

Specialty Strategies

RCM Alternatives: AlternaRCt M ve s Whitepaper Specialty Strategies 318 W Adams St 10th FL | Chicago, IL 60606 | 855-726-0060 www.rcmalternatives.com | [email protected] RCM Alternatives: Specialty Strategies RCM It’s fairly common for “trend following” and “managed futures” to be used interchangeably. But there are many more strategies out there beyond the standard approach – a variety of approaches that we call Specialty Strategies. Specialty strategies include short-term, options, and spread traders. Short-Term Systematic Traders The cousin to the multi-market systematic trend is the trading equivalent of an arms race that most follower, the short-term systematic program will also money managers want to stay as far away from as look to latch onto a “trend” in an effort to make a possible. profit. The difference here has to do with timeframe, and how that impacts their trend identification, What types of shorter-term traders can we length of trade, and performance during volatile expect to invest with? First, there are day trading times. Unlike longer-term trend followers, short-term strategies. A day trading system is defined by a systematic traders may believe an hours-long move is single characteristic: that it will NOT hold a position enough to represent a trend, allowing them to take overnight, with all positions covered by the end of advantage of market moves that are much shorter in the trading day. This appeals to many investors who duration. One man’s noise is another’s treasure in the don’t like the prospect of something happening in minds of short term traders. -

A Study on Advantages of Separate Trade Book for Bull Call Spreads and Bear Put Spreads

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 11-20 www.iosrjournals.org A Study on Advantages of Separate Trade book for Bull Call Spreads and Bear Put Spreads. Chirag Babulal Shah PhD (Pursuing), M.M.S., B.B.A., D.B.M., P.G.D.F.T., D.M.T.T. Assistant Professor at Indian Education Society’s Management College and Research Centre. Abstract: Derivatives are revolutionary instruments and have changed the way one looks at the financial world. Derivatives were introduced as a hedging tool. However, as the understanding of the intricacies of these instruments has evolved, it has become more of a speculative tool. The biggest advantage of Derivative instruments is the leverage it provides. The other benefit, which is not available in the spot market, is the ability to short the underlying, for more than a day. Thus it is now easy to take advantage of the downtrend. However, the small retail participants have not had a good overall experience of trading in derivatives and the public at large is still bereft of the advantages of derivatives. This has led to a phobia for derivatives among the small retail market participants, and they prefer to stick to the old methods of investing. The three main reasons identified are lack of knowledge, the margining methods and the quantity of the lot size. The brokers have also misled their clients and that has led to catastrophic results. The retail participation in the derivatives markets has dropped down dramatically. But, are these derivative instruments and especially options, so bad? The answer is NO. -

A Glossary of Securities and Financial Terms

A Glossary of Securities and Financial Terms (English to Traditional Chinese) 9-times Restriction Rule 九倍限制規則 24-spread rule 24 個價位規則 1 A AAAC see Academic and Accreditation Advisory Committee【SFC】 ABS see asset-backed securities ACCA see Association of Chartered Certified Accountants, The ACG see Asia-Pacific Central Securities Depository Group ACIHK see ACI-The Financial Markets of Hong Kong ADB see Asian Development Bank ADR see American depositary receipt AFTA see ASEAN Free Trade Area AGM see annual general meeting AIB see Audit Investigation Board AIM see Alternative Investment Market【UK】 AIMR see Association for Investment Management and Research AMCHAM see American Chamber of Commerce AMEX see American Stock Exchange AMS see Automatic Order Matching and Execution System AMS/2 see Automatic Order Matching and Execution System / Second Generation AMS/3 see Automatic Order Matching and Execution System / Third Generation ANNA see Association of National Numbering Agencies AOI see All Ordinaries Index AOSEF see Asian and Oceanian Stock Exchanges Federation APEC see Asia Pacific Economic Cooperation API see Application Programming Interface APRC see Asia Pacific Regional Committee of IOSCO ARM see adjustable rate mortgage ASAC see Asian Securities' Analysts Council ASC see Accounting Society of China 2 ASEAN see Association of South-East Asian Nations ASIC see Australian Securities and Investments Commission AST system see automated screen trading system ASX see Australian Stock Exchange ATI see Account Transfer Instruction ABF Hong -

Affidavit of Stewart Mayhew

Affidavit of Stewart Mayhew I. Qualifications 1. I am a Principal at Cornerstone Research, an economic and financial consulting firm, where I have been working since 2010. At Cornerstone Research, I have conducted statistical and economic analysis for a variety of matters, including cases related to securities litigation, financial institutions, regulatory enforcement investigations, market manipulation, insider trading, and economic studies of securities market regulations. 2. Prior to working at Cornerstone Research, I worked at the U.S. Securities and Exchange Commission (“SEC” or “Commission”) as Deputy Chief Economist (2008-2010), Assistant Chief Economist (2004-2008), and Visiting Academic Scholar (2002-2004). From 2004 to 2008, I headed a group that was responsible for providing economic analysis and support for the Division of Trading and Markets (formerly known as the Division of Market Regulation), the Division of Investment Management, and the Office of Compliance Inspections and Examinations. Among my responsibilities were to analyze SEC rule proposals relating to market structure for the trading of stocks, bonds, options, and other products, and to perform analysis in connection with compliance examinations to assess whether exchanges, dealers, and brokers were complying with existing rules. I also assisted the Division of Enforcement on numerous investigations and enforcement actions, including matters involving market manipulation. 3. I have taught doctoral level, masters level, and undergraduate level classes in finance as Assistant Professor in the Finance Group at the Krannert School of Management, Purdue University (1996-1999), as Assistant Professor in the Department of Banking and Finance at the Terry College of Business, University of Georgia (2000-2004), and as a Lecturer at the Robert H. -

Table of Contents

Trading Spreads and Seasonals Chapter 1 What Is a “Spread?” If you already know what a spread is, you may be tempted to skip this initial chapter. However, I advise against it. Besides being presented for those who know, it is presented here for those who are not sure, and also for those who know that they know that they don’t know. I have been amazed at the number of traders who show up at my seminars who do not know what a spread is. Additionally, they do not know its numerous purposes or its many uses. A Spread is... For purposes of this book, a spread is defined as the sale of one or more futures contracts and the purchase of one or more offsetting futures contracts. You can turn that around and state that a spread is the purchase of one or more futures contracts and the sale of one or more offsetting futures contracts. A spread is also created when a trader owns (is long) the physical vehicle and offsets by selling (going short) futures. However, this course will not cover the long physicals, short futures types of spreads. Furthermore, for purposes of this course, a spread is defined as the purchase and sale of one or more offsetting futures contracts normally recognized as a spread by the futures exchanges. This explicitly excludes those exotic spreads that are put forth by some vendors but are nothing more than computer generated coincidences which will not be treated as spreads by the exchanges. Such exotic spreads as long Trading Spreads and Seasonals Bond futures and short Bean Oil futures may show up as reliable computer generated spreads, but they are not recognized as such by the exchanges, and are in the same category with believing the annual performance of the US stock market is somehow related to the outcome of a sporting event. -

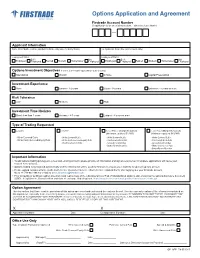

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD). -

My Top 5 Rules for Successful Debit Spread Trading Trade with Lower Cost and Create More Consistency in Your Options Portfolio

My Top 5 Rules for Successful Debit Spread Trading Trade with Lower Cost and Create More Consistency in Your Options Portfolio Price Headley, CFA, CMT TABLE OF CONTENTS: How Debit Spreads Give You Growth AND Income Potential Rule #1. Buy In-The-Money and Sell At or Out-Of-The-Money Rule #2. Sell More Time Premium Than You Buy Rule #3. Profit Taking in Pieces Increases Win Percentage Rule #4. Don’t Be Greedy – Favor Early Profit Taking Rule #5. Trade in Pairs How Debit Spreads Give You Growth AND Income Potential If you’ve ever bought an option before, you know that one of the challenges of trading a time-limited asset is paying a “time premium” and overcoming the loss of time. And yet as a trader, I still see plenty of opportunities to take advantage of trends on various time frames, from quick moves over a few days to “swing trading” moves over several weeks. So how can you actually place time on your side in the options game? It’s not by just selling options, as that can be profitable, but many traders have seen how a small number of trades can cause you lots of trouble in option selling if a stock or market moves sharply against you. The answer that meets nicely in the middle – profiting from the growth potential of catching a piece of an existing trend, while lowering your total cost per contract and paying no net time in your options – is Debit Spreads. You may have heard them called Vertical Spreads, or Bull Call Spreads or Bear Put Spreads. -

INTRODUCTION to COTTON FUTURES Blake K

INTRODUCTION TO COTTON FUTURES Blake K. Bennett Extension Economist/Management Texas Cooperative Extension, The Texas A&M University System Introduction For well over a century, industry representatives have joined traders and investors in the New York Board of Trade futures markets to engage in price discovery, price risk transfer and price distribution of cotton. In fact, the first cotton futures market contracts were traded in New York in 1870. From that time, the cotton futures market has grown in use, but still provides the same services it did when trading began. For the novice, futures market trading may seem chaotic. However there is a reason for every movement, gesture, and even the color of jacket the traders wear on the trading floor. All these elements come together to provide the world a centralized location where demand and supply forces are taken into consideration and market prices are determined for commodities. Having the ability to take advantage of futures market contracts as a means of shifting price risk is a valuable tool for producers. While trading futures market contracts may be a relatively easy task to undertake, understanding the fundamental concept behind how these contracts are used from a price risk management standpoint is essential before trading begins. This booklet will assist cotton producers interested in gaining or furthering their knowledge in terms of using futures contracts to hedge cotton price risk. Who Are The Market Participants? Any one person, group of persons, or firm can trade futures contracts. Generally futures market participants fall into two categories. These categories are hedgers and speculators. -

Notes & Comments

NOTES & COMMENTS THE TAX-STRADDLE CASES The use of commodity futures "straddle" or "spread" transactions to reduce tax burdens is a time-honored practice.' Because of their in- creased popularity over the past decade, tax straddles have recently re- ceived a great deal of attention from the Treasury Department2 and from Congress.3 The Treasury Department has issued revenue rulings disapproving of the practice 4 and has challenged thousands of tax re- turns in which taxpayers offset losses generated by straddle transactions against other income. 5 In the first case to reach trial, Smith v. Commis- sioner,6 the United States Tax Court denied the straddle losses claimed by the taxpayers because the taxpayers lacked the requisite profit mo- 1. 12 TAX NOTES 209, 209 (1981) (testimony of Secretary of the Treasury Donald T. Regan at his confirmation hearing before the Senate Finance Committee (Jan. 6, 1981)). 2. See IRS, EXAMINATION TAX SHELTERS HANDBOOK, reprinted in Silver Prices and the Adequacy ofFederalActions in the Marketplace,1978-80. HearingsBefore the Subcomm. on Com- merce, Consumer and Monetary Affairs of the House Comm on Government Operations, 96th Cong., 2d Sess. 368-69 (1980) (hereinafter cited as Silver Prices); Lewis, The Treasury'r Latest Attack on Tax Shelters, I1 TAX NOTES 723, 723 (1980). 3. See Economic Recovery Tax Act of 1981, Pub. L. No. 97-34, §§ 501-509, 95 Stat. 172. This statute dramatically alters the tax treatment of commodity futures transactions by prospec- tively eliminating the claimed losses from tax straddles. Section 503 of the Act requires unrealized gains and losses in open futures positions to be valued by referral to their market prices on the last day of the tax year and to adjust taxable income accordingly. -

Yield Curve Spreads Are Mean Reverting

PRICING AND CHARTING YIELD CURVE SPREADS A guide to trading US and Au bond futures KEIRAN HORTH & GUY BOWER Contents 1. Basic Definitions 2. Using DV01s 3. Calculating Hedge Ratios 4. Directional Spreading Versus Hedging 5. Changing Slope of the Yield Curve 6. Factors Affecting the Shape of the Yield Curve 7. Charting Your Spread 8. Filtering Data 9. Alternate Method of Charting a Spread 10. Varying the Spread Ratio 11. Trading the Spread 12. When is a Spread Not a Spread 13. Some Spreading Research Ideas 14. Contract Specs and Trading Information Disclaimer Trading involves high risks, with potential for profits as well as substantial losses and is not suitable for all persons. No information in this document or related material should be considered advice or any kind. Propex suggest you seek advice from an independent investment professional as to the suitability of trading for your personal needs. Propex Derivatives Pty Ltd. Level 4, 299 Elizabeth Street, Sydney NSW 2000. Propex Derivatives Pty Ltd (Propex) is a Proprietary Full Participant of the Sydney Futures Exchange. © Propex Derivatives. Horth & Bower Introduction OK, let’s talk relative value. Spread trading is all about relative value. Spread trading is all about understanding how two (or more) markets relate to each other and recognising when there is opportunity based on current levels or a view on the future. Here we are going to look at some interest rate spreads, how to price them and how to chart them. For the newcomer, it is easy to get prices and yields mixed up given their inverse relationship.