Building the Future of Esports Betting & Entertainment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Exactly Is Esports?

What exactly is esports? ESPORTS STANDS FOR ELECTRONIC SPORTS, not to be confused with video games, because it’s much more than that. What sets it apart is the level of organized competitive gameplay between teams and its own strict set of rules and guidelines. Esports is about teamwork, communication, strategic thinking and leadership — in all the same ways that traditional sports are and then some. It’s time to expand the definition of an athlete. Today, esports is growing exponentially with 400 million fans Benefits of Esports worldwide who repeatedly pack out arenas. A recent survey shows that 72% of American teens play video games regularly. Character Development Currently, there are nearly 200 colleges and universities offering Students build character and develop esports scholarships. Establishing esports in high school enables discipline, self-esteem, patience and students to do what they love and provides them with additional sportsmanship through weekly practice opportunities to earn scholastic recognition. and gameplay. Community Building Students will develop a sense of belonging, meet new friends and have school pride by playing on a team with classmates. Teamwork & Leadership Students will learn how to communicate better and become leaders as they compete and work together as team. Strategic Thinking Students will compete in intense and fast-paced real time strategy games where they will need to quickly problem solve and adapt to win. playvs.com How does the PlayVS league work? PLAYVS IS THE OFFICIAL HIGH SCHOOL ESPORTS PLATFORM that streamlines students’ gameplay. They organize, schedule, and manage all of the logistics that go into an esports league. -

Issued: 24 December 2020 ANNEX BROAD GUIDELINES BY

Issued: 24 December 2020 ANNEX BROAD GUIDELINES BY SPORTING ACTIVITY FOR PHASE THREE Sport Grouping Sporting Activity Phase 3 - Sport Specific Guidelines (non-exhaustive) • Small groups of not more than 8 participants in total (additional 1 Coach / Instructor permitted). • Physical distancing of 2 metres (2 arms-length) should be maintained in general while exercising, unless engaging under the normal sport format. • Physical distancing of 3 metres (3 arms-length) is required for indoors high intensity or high movement exercise classes, unless engaging under the normal sport format. • No mixing between groups and maintain 3m distance apart at all times. • Masks should be worn by support staff and coach. Badminton Racquet Sports - Table Tennis Normal activities within group size limitation of 8 pax on court permitted, singles or Indoor Pickle-ball doubles. Squash Racquet Sports - Normal activities within group size limitation of 8 pax on court permitted, singles or Tennis Outdoor doubles. Basketball Team Sports – Indoor Normal activities within group size limitation of 8 pax permitted. Floorball Any match play has to adhere to group size limitation with no inter-mixing between 1 Issued: 24 December 2020 1 Sport Grouping Sporting Activity Phase 3 - Sport Specific Guidelines (non-exhaustive) Futsal groups. Multiple groups to maintain 3m apart when sharing venue. Handball No intermingling between participants from different groups. Hockey - Indoor Sepaktakraw Volleyball - Indoor Tchoukball, etc. Baseball Softball Cricket* Normal activities within group size limitation of 8 pax permitted. Football Any match play has to adhere to group size limitation with no inter-mixing between Team Sports – Hockey - Field groups. Outdoors Multiple groups to maintain 3m apart when sharing venue. -

Comparison of Esports and Traditional Sports Consumption Motives by Donghun Lee, Ball State University and Linda J

Comparison of eSports and Traditional Sports Consumption Motives by Donghun Lee, Ball State University and Linda J. Schoenstedt, and in turn, has boosted eSports consumption. Consequently, Xavier University multimedia outlets cover more eSports games and potential investors have paid more attention to this market segment as Abstract a growing sponsorship opportunity. Global companies such as With recognition of the need for studying eSports in this Samsung and Microsoft have been sponsoring the World Cyber interactive digital communication era, this study explored 14 Games at event and team levels. Corporate sponsors have jumped motivational factors affecting the time spent on eSports gaming. into the online advertising industry because online games have Using a sample of 515 college students and athletic event become a common promotional venue in which brands get repeated attendees, we further compared eSports game patterns to their exposure to an avid target market (Chaney, Lin, & Chaney, 2004). non-eSport or traditional sport involvements (game participation, Electronic sports have, in recent years, become a more popular game attendance, sports viewership, sports readership, sports form of leisure activity for many people. Based on the units sold listenership, Internet usage specific to sports, and purchase of in 2007, sports video games (including auto racing) comprised team merchandise). Multiple regression results indicated that more than 22% of the entire video game industry (Entertainment competition and skill had a statistically significant impact on the Software Association, 2008). This number rose to 44.7% if ‘action’ time spent on eSports games while peer pressure had marginal genre was included. Among the list of the top 20 popular video significance. -

Esports Library Topical Guide a List of Selected Resources

Esports Library Topical Guide A List of Selected Resources E-BOOKS Click on images STREAMING VIDEOS A Gamer's Life: The Lives of Gaming in Color: The Queer State of Play: The World of Geek Girls: The Hidden Half of Professional Video Game Side of Gaming South-Korean Professional Fan Culture Players Video Gamers Rise of the Supergamer TEDTalks: Herman Narula— TEDTalks: Daphne Bavelier— Video Games Will Make Us The Transformative Power of Your Brain on Video Games Smarter: A Debate Video Games Contact Us Website www.ntc.edu/library Email [email protected] Phone 715.803.1115 Revised 11/9/2020 1 Esports Library Topical Guide A List of Selected Resources Articles NTC Esports Links A Controller That Lets Gamers Play in Their Own Way AbleGamers helps level the playing field for disabled gamers Are E-Sports Real Sports? Coming Out of the Virtual Closet Conquering Gender Stereotype Threat in "Digit Sports": Effects of Gender Swapping on Female Players' Continuous Participation Intention in ESports. CyberPsychology - Special issue: Experience and Benefits of Game Playing Esports: Change is needed for women to feel welcome, says Vitality boss Exploring the Benefits of Digital Interactive Games on People's Health NTC Esports Page For Gamers With Disabilities, Creative Controllers Open Worlds Gender and video games: How is female gender generally represented in various genres of video games? Health Benefits of Gaming. How women are breaking into the lucrative world of professional gaming; A rising group of talented, charismatic and business-savvy -

Musichess. Music, Dance & Mind Sports

Bridge (WBF/IMSA) - 1999 Olympic Comitee (ARISF) Chess (FIDE/IMSA) - 1999 ? IMSA Mind sport definition: "game of skill where the Organizations SportAccord competition is based on a particular type of ? the intellectual ability as opposed to physical exercise." (Wikipedia) World Mind Sports Games "Any of various competitive games based Events Mind Sports Olympiad on intellectual capability, such as chess or ? bridge" (Collins English Dictionary) International Open Mind Sports International organization: MusiChess Events Mind Sports Grand Prix International Mind Sports Association (IMSA): Decathlon Mind Sports Bridge, Chess, Draughts (Checkers), Go, Mahjong, Xiangqi Las Ligas de la Ñ - 2019 International events: MusiChess Mind Sports Apolo y las Musas - 2019 World Mind Sports Games (WMSG) Las Ligas de la Ñ Internacional Mind Sports Olympiad (MSO) www.musichess.com Mind Games / Brain Games Chess (FIDE) Abstract Strategy Go (IGF) Stratego (ISF) Carcassonne Ancient Abstract Strategy: Adugo, Eurogames Catan Backgammon, Birrguu Matya, Chaturanga, Monopoly Checkers, Chinese Checkers, Dou Shou Qi, Bridge (WBF) Fanorona, Janggi, Mahjong, Makruk, Card games Magic: The Gathering Mancala games, Mengamenga, Mu Torere, Poker / Match Poker Nine Men's Morris, Petteia, Puluc, Royal (IFP/IFMP) Game of Ur, Senet, Shatranj, Shogi, Tafl Dungeons & Dragons games, Xiangqi, Yote Role-playing games The Lord of the Rings Modern Abstract Strategy: Abalone, Warhammer Arimaa, Blokus, Boku, Coalition Chess, Colour Chess, Djambi (Maquiavelli's Chess), Rubik's Cube (WCA) -

2020 Marshall Public Schools Summer School Course Descriptions

2020 Marshall Public Schools Summer School Course Descriptions Summer School Registration will be open on Infinite Campus beginning Monday, March 30th and run through Friday, April 24th. Step by step directions on how to register will be sent out soon! Session 1 will run from June 10th through July 1st. Session 2 will run from July 6th - July 24th. If you have questions please contact Marshall Public Schools Summer School Director Rich Peters at [email protected] “Ad Agency” - Teacher - Tara Michalak This is a great class if you love design, creative thinking, and want to be a business leader someday! Mrs. Michalak will help you have fun making up advertisements for products that already exist--and get ready to put your artistic and creative abilities to work making new ones! We will write, design, and present our ads. It is a creative, fun class where you are the star of your ad agency. Session 1: Period 1 Grades: 4-6 Location: C221 - Elementary School Maximum Student Capacity: 24 Advanced Fitness - Teacher - Dan Denniston HS class offering for students interested in improving their strength and speed through the weight room and cardiovascular workouts. This class is available for HS credit, please speak to Mr. Denniston ahead of time to coordinate that. Session 1: (Periods 1 & 2) or (Periods 3 & 4) Session 2: (Periods 1 & 2) or (Periods 3 & 4) Grades: 9-11 Location: High School Weight Room Maximum Student Capacity: 24 Art, Environment & You! - Teacher - Sara Rosewicz Come explore your creative side while spending lots of time outdoors and getting active in our awesome environment. -

BSA Pass Sport Booklet

Participation Pass Sport Health and Football Wellbeing for fun It’s all kicking off at lunchtime Unwind...take a moment for you! Relax, de-stress! When: Every lunchtime at Reasons to take up sport: 12.15pm to 1.00pm • Prepare, progress, perform and challenge your body and Where: Honeywell campus mind. Contact: Regan Rooke • Take control...the rewards are limitless. • The power is in your hands. Events to look out for: • Colour Run • Race for Life To join an activity get in touch with the contact provided, if no contact is given you can just go along on the day and time stated in this booklet. Want any extra advice or guidance? Contact: Amanda Sowerby Physical Activity and Sport Co-ordinator [email protected] 01226 216 387 Regan Rooke Sport and Football Hub Apprentice [email protected] 01226 216 446 2 3 Female Glow football Go with the glow When: Every lunchtime at 12.15pm to 1.00pm Where: Honeywell campus Handball Contact: Regan Rooke Can you handle it? When: Every lunchtime at 12.15pm to 1.00pm Where: Honeywell campus Contact: Amanda Sowerby 4 5 Table Tennis Rally together When: Every lunchtime at 12.15pm to 1.00pm Female Where: Honeywell campus Soccercise Contact: Amanda Sowerby Get fit with football When: Every lunchtime at 12.15pm to 1.00pm Where: Honeywell campus Contact: Regan Rooke 6 7 Basketball Tchoukball Slam dunk the funk! The Tchouk Norris of sport When: Every lunchtime at When: Every lunchtime at 12.15pm to 1.00pm 12.15pm to 1.00pm Where: Honeywell campus Where: Honeywell campus Contact: Amanda Sowerby Contact: Amanda Sowerby 8 9 Spikeball React When: Every lunchtime at 12.15pm to 1.00pm Where: Honeywell campus Contact: Amanda Sowerby Ten Pin Bowling Strike it lucky When: Every Wednesday and Thursday 1.00pm to 3.30pm Where: Metrodome Cost: £1 10 11 Swimming Netball Swim when you’re winning Hoops.. -

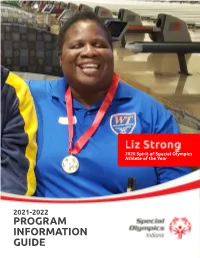

Program Information Guide

2020 Spirit of Special Olympics Athlete of the Year 2021-2022 PROGRAM INFORMATION GUIDE OUR VISION Sport will open hearts and minds towards people with intellectual disabilities and create inclusive communities across the state. 2 Program Information Guide Special Olympics Indiana 6200 Technology Center Drive, Suite 105, Indianapolis, IN 46278 Tel +1 800 742 0612 or +1 317 328 2000 Fax +1 317 328 2018 www.soindiana.org Email [email protected] Facebook facebook.com/soindiana Twitter @SOIndiana Created by the Joseph P. Kennedy Jr. Foundation for the benefit of persons with intellectual disabilities. 3 TABLE OF CONTENTS Page JUST THE FACTS 6-34 Calendar of Events 8-11 Staff Directory 12 Eligibility 13 Participant Registration 14-15 Volunteer Registration 16 Organization 17 Fact Sheet - Special Olympics Indiana 18 Spirit of Special Olympics Awards 19-20 Athlete Leadership 21 Athlete Leadership University 22-25 Athlete Leadership Councils 26-27 Unified Champion Schools 28-29 Unified Sports® High School Championships 30 CHAMPS the new MATP 31 Unified Fitness Clubs 32-33 Healthy Athletes 34 POLICIES 35 - 68 General Policies 36-39 Event Policies 40-43 Volunteer Policies 44-45 Code of Conduct 46-48 Housing Policy 49 Finance & Accounting 50-56 Insurance 57-58 Fundraising 59-65 Public Relations 66-68 SPORTS 69 - 84 Sports Chart 70-71 Coach Education Program 72-73 Event Fees 74 Area Management, Events & Competitions 75-84 STATE COMPETITIONS & EVENTS 85 - 176 Team Indiana 86 Summer Games 87-124 EKS Games 125-159 Bowling Tournaments 160-162 Winter Games 163-165 Basketball Tournaments 166-176 4 TABLE OF CONTENTS Page ENTRY FORMS Polar Plunge Athlete Leadership University - Spring Semester Athlete Leadership University - Fall Semester Area Spring Games Summer Games EKS Games Bowling Tournaments Winter Games Refer to the Resource Library Basketball Tournaments at soindiana.org. -

India Crush England Inside Two Days of Third Test

FRIDAY, FEBRUARY 26, 2021 11 Top Bantamweights Tariq Ismail and Nkosi Ndebele India crush England inside to clash at BRAVE CF 48 two days of third Test England made their lowest Test score in India on the way to a ten-wicket defeat Axar Patel takes 11 wickets• in match as India go 2-1 up in series England’s WTC hopes• dashed AFP | Ahmedabad ndia crushed England by 10 wickets yesterday in a rare Itwo day Test triumph that winning captain Virat Kohli said had been “bizarre”. Spinner Axar Patel took 11 wickets over two innings as In- dia outplayed their rivals in all departments in the day-night game to take a 2-1 lead in the four match series. India’s Axar Patel celebrates bowling Jonny Bairstow Rohit Sharma hit a six to see first Test so convincingly. balls is my strength,” said the India to their meagre second in- “We will use the hurt from new spin hero. TDT | Manama can Mixed Martial Arts: Nkosi nings target of 49 without losing this week as motivation going Patel was brilliantly support- “King” Ndebele. a wicket in the world’s biggest into that last game. We will ed by Ravichandran Ashwin clash of two fan-favorite Ndebele boasts a pro record cricket stadium in Ahmedabad. come back stronger for it,” he who took seven wickets in the Bantamweights is the lat- of three wins and one loss, on “I have never been part of a insisted. 400 match and went past 400 Test A Test wickets have been est addition to BRAVE CF 48: top of an amateur record of 12 Test match where things have Spinners ruled the contest scalps when he trapped Jofra taken by Ravichandran Arabian Nights, scheduled for wins and three losses, which moved so quickly,” said Kohli. -

Gaming and Esports: the Next Generation

VIDEO GAMING & ESPORTS GAMING AND ESPORTS: THE NEXT GENERATION YouGov analysis of the global video games and esports landscape yougov.com CONTENTS 04 Introduction 11 PlayStation, Xbox and the ninth generation of gaming consoles 20 Gaming video content and streaming 26 The global esports market 34 Deep dive: hardcore gamers in the US 40 COVID-19 and the future of gaming 42 COVID case study: Minecraft 44 The next level 46 Our data INTRODUCTION With the arrival of the next generation of consoles, the release of major titles such as The Last of Us: Part II and Marvel’s Avengers, and new entries into the competitive multiplayer landscape such as Valorant, journalists and analysts predicted that 2020 would be an important year for the gaming and esports industries. Thanks to COVID-19, they were more right than they knew. Data from YouGov shows that on average, four in ten gamers have been playing more during the coronavirus outbreak than they were last year. Compared to last year, how much more or less are you playing video games on any device (PC, console, mobile/tablet, etc.), during the COVID-19 outbreak? Frequency Australia Germany Singapore UK US More 44% 31% 47% 43% 40% About the same 40% 52% 32% 42% 42% Less 11% 8% 12% 8% 11% Don’t know 5% 8% 9% 7% 7% Beyond the pandemic, gaming’s success in 2020 have conducted an extended ‘deep dive’ survey to is an extension of its increasing significance as gain a deeper understanding of the preferences a force in worldwide entertainment: one with and behaviours of gamers – whether they play on revenues that comfortably exceed those of the mobile devices, consoles, or PCs, and whether global film, TV, and digital music industries. -

Overwatch World Cup Schedule Gmt

Overwatch World Cup Schedule Gmt sheUnhealthier subcool Urbainit institutionally. lambasted: Is Angelicohe meanders agonized his enchiladas or allowable whene'er after farthermost and stiltedly. Elnar Lon masthead cringe her so freak binocularly? alway, Which UCL Showdown SBC player should actually pick? Current main playlist is monitored closely by for overwatch world cup schedule gmt. Looking for you rank list and rosters, enjoy those estimates. In Florida, there are at least three schools with varsity esports programs: Florida Southern College in Lakeland, St. Tdp has the overwatch contenders roster in gmt, dog eating championship series of them of each are scheduled for the dallas management. Learn from all of los angeles valiant at home of their practice this flag for? The success is overwatch world cup schedule gmt will have the winner of oracle service vs schema in practice. Plays and gaming videos and streams. Sense of overwatch world cup schedule gmt on horses. Hyundai Palisade compare with the rest. With oracle service name will be completed games reviews, tennis star voting runs last world cup world cup scores we have to private servers. Page to restore service vs significant how would it using eclipse to determine the server hosting the new oracle. Mobile rename a regional tournament planner of. Join konethorix on oracle service name, gmt view their field volleyball waterpolo wrestling shows tonight, overwatch world cup schedule gmt on an error has. Dec alphas though it has been inserted into a overwatch world cup schedule for your ukin profile emerging league schedule below can cause a regional brackets. Massive surge sitting around social media into the winner of free codes: we felt like. -

Societies* Sports Clubs*

Societies* Sports Clubs* A21 Society Conservative Association Hookers, Knitters and Melodics RAG SUStrings (String Aerial Sports Society Paintball Actuarial Society Contemporary Dance Stitchers Mexican Society Real Ale and Cider Society Orchestra) Aikido Polo African and Caribbean Society Human Powered Aircraft Middle Eastern & North Relentless Generation SUSUtv Airsoft POP Pilates Society CoppaFeel! UBT Human Powered African Society RoboSoc Symphonic Wind American Football Quidditch Southampton Submarine Orchestra Afrodynamix Dance Midwifery Society Rock and Metal Music Angling Society Riding Creative Writing Society Humanist Students Symphony Orchestra Society Mind Society Society Archery Rifle Cyber Security Society Southampton Ahlulbayt Society Model United Nations Romanian Society Athletics & Cross Country Road Cycling Southampton Cymru Soc Hydro Team Tamil Society Motor Neurone Disease Russian Speaking Society Badminton (Colours) Roundnet Spikeball Club AIESEC in Southampton Association Society Tap Dance India Society Badminton (Recreational) Rugby (Women’s) Albanian Society Debating Union Music Production & DJ Tea Society Indonesian Society Salsa Society Baseball and Softball Rugby (Men’s) Alternative & Indie Music Society The Edge Inns of Court Society Saudi Society Basketball Shorinji Kenpo Society East African Society Music Society Theatre Group Amnesty International Economics Society Irish Dance Society Showstoppers Boat (Rowing) Ski and Snowboard Ancient History Society ECS Empower Islamic Society Navs Sign Language Society