2020 ANNUAL REPORT Financial Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mine 2019 Resourcing the Future

Mine 2019 Resourcing the future www.pwc.com/mine Shifting expectations Welcome to our annual review of futures markets, not present markets. And Copper and battery metals, which stand to global trends in the mining industry, when investors and other stakeholders gain as the energy mix moves away from as represented by the Top 40 mining look at the future of the mining industry, combustion engines to electricity including companies by market capitalisation. it is clear they have concerns about the renewable energy, are receiving the bulk industry’s perception on vital issues such of capital investment. (However, as coal Judged by traditional metrics, things are as safety, the environment, technology and contributes 38% to global electricity looking good for the world’s top miners. consumer engagement. generation, it remains an important part In 2018, the world’s 40 largest miners of the basket and continues to receive consolidated the stellar performance In spite of the strong operating substantial capital investment and of 2017. As a group, they increased performance, both investors and transaction focus.) production, boosted cash fl ow, paid down consumers seem to be down on the brand debt, and provided returns to shareholders of mining. They question whether the Mining companies are also streamlining at near record highs. And there was still industry can responsibly create sustainable their operating portfolio by disposing of cash left to increase capital expenditure value for all stakeholders. Discrete events, non-core assets and optimising project for the fi rst time in fi ve years. All while such as safety or environmental incidents, portfolios in line with long-term strategies. -

Mosaic Stockholders Report 2013 Transition Period Financial Highlights

MOSAIC STOCKHOLDERS REPORT 2013 TRANSITION PERIOD FINANCIAL HIGHLIGHTS NET SALES AND OPERATING EARNINGS DILUTED EARNINGS PER SHARE CAPITAL EXPENDITURES AND Fiscal Year / $ In Billions Fiscal Year / $ Per Share CASH FLOW FROM OPERATIONS Fiscal Year / $ In Billions $12 $6 $3 $10 $5 $2.5 $8 $4 $2 $6 $3 $1.5 $4 $2 $1 $0.5 $2 $1 $0 $0 $0 FY2010 FY2011 FY2012 FY2013 TP2013 FY2010 FY2011 FY2012 FY2013 TP2013 FY2010 FY2011 FY2012 FY2013 TP2013 Net Sales Operating Earnings Sustaining Opportunity Expansion Cash Flow from Operations FINANCIAL OVERVIEW In Millions (except per share amounts) FY2010 FY2011 FY2012 FY2013 TP2013 Net Sales $6,759.1 $9,937.8 11,107.8 $9,974.1 $4,765.9 Gross Margin 1,693.3 3,121.8 3,085.0 2,760.2 828.3 Operating Earnings 1,270.8 2,664.2 2,611.1 2,209.6 416.9 Net Earnings 827.1 2,514.6 1,930.2 1,888.7 340.0 Diluted Net Earnings Per Share 1.85 5.62 4.42 4.42 0.80 Cash and Cash Equivalents 2,523.0 3,906.4 3,811.0 3,697.1 5,293.1 Total Assets 12,707.7 15,786.9 16,690.4 18,086.0 19,554.0 Total Long-term Debt 1,260.8 809.3 1,010.5 1,010.5 3,009.3 Total Equity 8,748.4 11,661.9 11,999.4 13,442.9 11,320.6 Net Cash Provided by Operating Activities 1,356.0 2,426.7 2,705.8 1,887.5 889.4 Capital Expenditures 910.6 1,263.2 1,639.3 1,588.3 800.0 Dividends Per Share on Common Stock 1.50 0.20 0.28 1.00 0.50 *TP = Transition Period from June 1, 2013, through December 31, 2013 The Mosaic Company Transition Period from June 1, 2013, through December 31, 2013 Financial Table of Contents Page Management’s Discussion and Analysis of Financial Condition and Results of Operations .................. -

EXHIBITOR PROSPECTUS Minexpo INTERNATIONAL® Is the World’S Largest and Most Comprehensive Global Mining Event

ALL THE RESOURCES YOU NEED SPONSORED BY EXHIBITOR PROSPECTUS MINExpo INTERNATIONAL® is the world’s largest and most comprehensive global mining event. In just three days—and in one place—you’ll meet thousands of people in mining with the buying power and influence to purchase the equipment, products and services you bring to the show. Nothing beats the in-person experiences, meetings and networking that will take place in September 2021. OUR COMMITMENT TO YOUR SAFETY Your health and safety is our top priority. We are committed to following the guidance of the CDC, state and local authorities as well as the Las Vegas Convention Center, a Global Biorisk Advisory Council Star facility. Below are a few of the safety protocols you can expect at MINExpo®: REMOVE THIS PAGE • Easily-accessible hand-washing and/or sanitizing systems • Strict enforcement of mask and social distancing mandates • Rigorous employee training to uphold preventative measures and reporting functions FROM EXPORTED PDF • Effective use of approved disinfectants and delivery systems • Rapid response protocols for skilled health and safety professionals For more information or to reserve your booth, visit www.minexpo.com. BUYERS ARE READY Ready To Buy The numbers don’t lie: With $7.3 million spent at MINExpo on average, attendees are ready to purchase. You can drill into the figures any way you want—every segment of the mining industry is at the show. This is a rare opportunity for manufacturers and suppliers to reach thousands of domestic and international buyers with the purchasing power and motivation to make buying decisions on-site. -

VALE S.A. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on April 29, 2010 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: December 31, 2009 Commission file number: 001-15030 VALE S.A. (Exact name of Registrant as specified in its charter) Federative Republic of Brazil (Jurisdiction of incorporation or organization) Fabio de Oliveira Barbosa, Chief Financial Officer fax: +55 21 3814 8820 Avenida Graça Aranha, No. 26 20030-900 Rio de Janeiro, RJ, Brazil (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Which Registered Preferred class A shares of Vale, no par value per share New York Stock Exchange* American Depositary Shares (evidenced by American Depositary Receipts), each representing New York Stock Exchange one preferred class A share of Vale Common shares of Vale, no par value per share New York Stock Exchange* American Depositary Shares (evidenced by American Depositary Receipts), each representing New York Stock Exchange one common share of Vale 5.50% Guaranteed Notes due 2010, Series RIO, issued by Vale Capital New York Stock Exchange 5.50% Guaranteed Notes due 2010, Series RIO P, issued by Vale Capital New York Stock Exchange 6.75% Guaranteed Notes due 2012, Series VALE, issued by Vale Capital II New York Stock Exchange 6.75% Guaranteed Notes due 2012, Series VALE.P, issued -

A Focus on MINING 2 Aon | a Focus on Mining a Testimonial to Our Value

A focus on MINING 2 Aon | A focus on mining A testimonial to our value Our 30 year partnership with Aon is integral to the success of our risk management process. Aon has advised us through several major acquisitions and offers innovative solutions to address the risks our multi-national mining business presents. Aon has provided valued guidance in presenting and resolving several challenging claims through the years. In support of an improved claim handling experience, Aon streamlined our global placement by reducing the number of participants on the program and limiting the claims agreement parties to our long standing quota share underwriters. Carrie Robinson, Freeport-McMoRan Inc Aon | A focus on mining 3 4 Aon | A focus on mining Expand your opportunities and minimise risk Across all geographies, mining companies are enjoying a resurgence in commodity prices on the back of tightening supply and strengthening demand. This environment has led to some marginal mines coming out of care and maintenance and the revival of a series of mining infrastructure plans and feasibility studies for greenfield developments together with some substantial upgrades to existing operations. The complexity and demands put on mining operations therefore means that their insurance and risk management programs need to be exceptionally effective to reduce the cost of risk and help satisfy a variety of regulatory requirements. Aon’s Mining Team supports organisations in Australia and around the world, helping them optimise risk-taking and risk management activities. We have significant project development, exploration and operational site expertise, which we combine with a desire to understand the complexities of our clients’ activities. -

Cohen & Steers Real Assets Fund

Cohen & Steers Real Assets Fund As of 06/30/2021 Current % of Total Security Name Sector Market Value Market Value Gold 100 Oz Futr Oct21 Commodities $7,980,750.00 3.33 % Wti Crude Future Sep21 Commodities $6,985,920.00 2.92 % Spdr Gold Minishares Trust Gold $6,853,812.00 2.86 % Natural Gas Futr Sep21 Commodities $6,486,960.00 2.71 % Corn Future Sep21 Commodities $6,082,387.50 2.54 % Low Su Gasoil G Sep21 Commodities $4,378,175.00 1.83 % Soybean Future Nov21 Commodities $4,336,900.00 1.81 % Ny Harb Ulsd Fut Sep21 Commodities $4,206,001.80 1.76 % Gasoline Rbob Fut Sep21 Commodities $4,202,226.00 1.75 % Public Storage Global Real Estate Securities $4,174,779.96 1.74 % Brent Crude Futr Sep21 Commodities $4,029,480.00 1.68 % American Tower Corporation Global Listed Infrastructure $3,952,148.20 1.65 % Soybean Oil Futr Dec21 Commodities $3,916,224.00 1.63 % Copper Future Dec21 Commodities $3,640,975.00 1.52 % Lme Pri Alum Futr Dec21 Commodities $3,015,600.00 1.26 % Enbridge Inc. Global Listed Infrastructure $3,007,747.76 1.26 % Silver Future Sep21 Commodities $2,881,340.00 1.20 % I Shares Gold Trust Gold $2,644,549.50 1.10 % UDR Inc. Global Real Estate Securities $2,314,647.86 0.97 % Live Cattle Futr Aug21 Commodities $2,307,230.00 0.96 % Wti Crude Future Nov21 Commodities $2,268,480.00 0.95 % Vinci SA Global Listed Infrastructure $2,238,898.03 0.93 % Coffee 'C' Future Sep21 Commodities $2,216,531.25 0.93 % HEALTHPEAK PROPERTIES INC Global Real Estate Securities $2,074,266.61 0.87 % Vonovia SE Global Real Estate Securities $2,032,827.97 0.85 % Prologis Inc. -

Value Creation in Mining 2019: Return to Strategy

Value Creation in Mining 2019 Return to Strategy Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not-for-profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with offices in more than 90 cities in 50 countries. For more information, please visit bcg.com. Value Creation in Mining 2019 RETURN TO STRATEGY GUSTAVO NIEPONICE THOMAS VOGT ALEXANDER KOCH January 2019 | Boston Consulting Group CONTENTS 3 EXECUTIVE SUMMARY 6 THE ROAD TO RECOVERY 10 FOLLOWING THE MONEY: CASH FLOW AND CAPITAL SPENDING 17 MOVING FORWARD: THE CRITICAL DECISIONS 23 APPENDIX 26 FOR FURTHER READING 27 NOTE TO THE READER 2 | Return to Strategy EXECUTIVE SUMMARY fter a deep five-year slide, the mining industry began to recover Ain 2016, aided by substantial increases in commodity prices. Yet by mid-2018, the rebound began to encounter significant headwinds. • In 2016 and 2017, the median total shareholder return (TSR) of the 63 leading mining companies in our study was 41% and 23%, respectively. This, after the industry had turned in the lowest medi- an TSR of any industry sector from 2011 through 2015. • In 2017 and 2018, revenues and margins grew simultaneously for the first time in seven years. -

The Mosaic Company: MOS

St. John’s University Undergraduate Student Managed Investment Fund Presents: The Mosaic Company: MOS Analysts: Danielle Connelly ([email protected]) Ross M. Fox ([email protected]) Stephen Gilroy ([email protected]) Bryan Kotliar ([email protected]) Share Data: Price (5/12/08): $126.99 P/E (5/12/08): 37.13 Shares Outstanding: 443.6M Forward P/E: 19.97 Market Capitalization: 56.4B Diluted EPS, 2007: 0.95 Beta (adj.): 1.126 Diluted EPS, 2008(E): 3.42 52 Week High: 143.32 Diluted EPS, 2009(E): 6.36 52 Week Low: 29.08 Mosaic 2 Executive Summary After a thorough analysis of The Mosaic Company, we are recommending the purchase of 100 shares of common stock at the current market price. Mosaic is the world’s largest fertilizer mining company (or the leading producer of crop nutrients) operating in seven different countries worldwide. They are vertically integrated and carry their operations through all the stages of fertilizer development. The company has rapidly been improving its free cash flows since being founded in 2005. It is quickly moving towards and investment grade rating by Standard & Poor’s. According to Mosaic’s conference call after releasing third quarter fiscal year 2008 earnings, two of the company’s main goals in the near term are to issue dividends and buyback shares. It was rated the #1 performing Fortune 500 company for 2007-2008. Our proposed purchase of 100 shares will equate to 1.00% of the SMIF’s equity holdings and 0.75% of the total SMIF Portfolio. Currently the SMIF only holds two equities in the materials sector including an exchange traded fund. -

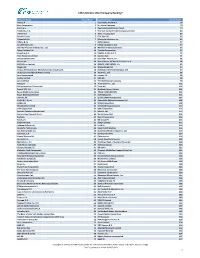

CSR-S Monitor Company Standings

CSR-S Monitor 2012 Company Ranking* Company Name Overall Rank Company Name Overall Rank VALE S.A. 1 Koninklijke Ahold N.V. 79 Sony Corporation 2 H.J. Heinz Company 79 Enel S.p.A. 3 Puma AG Rudolf Dassler Sport 79 Telefonica, S.A. 4 The Siam Cement Public Company Limited 83 L'Oreal S.A. 5 Mars, Incorporated 84 Alcatel Lucent 5 GDF Suez SA 85 Vattenfall A.B. 7 Motorola Solutions, Inc. 85 Tiffany & Co. 7 3M Company 87 LG Electronics, Inc. 9 Intesa Sanpaolo S.p.A. 87 Hon Hai Precision Industry Co., Ltd. 10 Northern Trust Corporation 87 Fibria Celulose S.A. 10 Toshiba Corporation 87 Ecopetrol S.A. 12 CEMEX, S.A.B. de C.V. 91 Teck Resources Limited 13 Danisco A/S 91 GlaxoSmithKline Plc 14 Schneider Electric S.A. 91 Xstrata plc 14 Banca Monte dei Paschi di Siena S.p.A. 94 BHP Billiton Limited 16 BANCO SANTANDER, S.A. 95 Diageo plc 16 Wienerberger AG 95 Taiwan Semiconductor Manufacturing Company Ltd. 18 Sumitomo Chemical Company, Ltd. 97 De Beers Consolidated Mines Limited 19 AEON Co., Ltd. 98 Acer Incorporated 20 Lonmin Plc 98 Fujitsu Limited 21 UBS AG 98 ArcelorMittal 22 The Walt Disney Company 98 Aviva plc 23 Asahi Glass Co., Ltd. 102 British American Tobacco plc 23 Linde AG 102 Repsol YPF, S.A. 23 Nedbank Group Limited 102 Exxon Mobil Corporation 26 TELUS CORPORATION 102 Bayer Aktiengesellschaft 27 Xcel Energy Inc. 102 Daimler AG 27 QUALCOMM Incorporated 107 Pirelli & C. S.p.A. 29 Koninklijke Philips Electronics N.V. -

2017 Annual Report

2017 Annual Report 2017 Annual Report (January 1, 2017—December 31, 2017) Contents SMA STRATEGIC PLAN 2 CHAIR’S MESSAGE 3 PRESIDENT’S MESSAGE 4 SECTION REPORTS Exploration 6 Industrial Minerals 9 Metallic Minerals 10 Potash 11 Uranium 13 COMMITTEE REPORTS Environment 18 Geotechnical 22 Human Resources 23 Public Awareness 24 Safety 28 Finance/Taxation 33 APPENDIX I PERFORMANCE REPORTING 34 APPENDIX II SMA BOARD & MEMBER COMPANIES 39 APPENDIX III FINANCIAL STATEMENTS 40 2 SMA Strategic Plan 2017 - 2021 Goal 1: Advance Safety and Environmental Stewardship Goal 2: Enhance Public Awareness and Support Goal 3: Inform Regulatory and Policy Frameworks Goal 4: Cultivate a Diverse, Inclusive and Talented/Skilled Workforce Goal 5: Advance Indigenous Participation Goal 6: Enhance Capacity and Efficiency of Saskatchewan Mining Supply Chain Sector Goal 7: Organizational Effectiveness Mission Statement: Advance a safe, sustainable and globally competitive exploration and mining industry in Saskatchewan that benefits all residents of the province. 3 Chair ’s Message Jessica Theriault Director, Environmental Affairs, Potash Business Unit, The Mosaic Company 2017 marked the first year of the reconfigured governance i. The G & N Committee, chaired by Vice-Chair, Tammy Van Lambalgen, met structure of the SMA Board of Directors (BOD), comprised of once this year to develop the Nominating Committee Report for the BOD and 16 engaged Board Members, proportionally representing the provide oversight to the annual general meeting (AGM) preparations. 5 sections -

Microessentials: What It Took – and Why It Worked

MicroEssentials: What it Took – and Why it Worked Corrine Ricard SVP – Commercial, The Mosaic Company Forward Looking Statements This document contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our proposed acquisition of the global phosphate and potash operations of Vale S.A. ("Vale") conducted through Vale Fertilizantes S.A. (the "Transaction") and the anticipated benefits and synergies of the proposed Transaction, other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company's management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the possibility that the closing of the proposed Transaction may be delayed or may not occur, including delays or risks arising from any inability of Vale to achieve certain specified regulatory and operational milestones, and the ability to satisfy any of the other closing conditions; our ability to secure financing, or financing on satisfactory terms and in amounts sufficient to fund the cash portion of the purchase price without the need for additional funds from other liquidity sources; difficulties with realization of the benefits of the proposed Transaction, including the risks that the acquired business may not -

Marketable Phosphate Rock--Crop Year 2004

Mineral Industry Surveys For information, contact: Stephen M. Jasinski, Phosphate Rock Commodity Specialist Hoa P. Phamdang (Data) U.S. Geological Survey Telephone: (703) 648-7965 983 National Center Fax: (703) 648-7975 Reston, VA 20192 E-mail: [email protected] Telephone: (703) 648-7711, Fax: (703) 648-7757 E-mail: [email protected] Internet: http://minerals.usgs.gov/minerals MARKETABLE PHOSPHATE ROCK—CROP YEAR 2004 U.S. production of marketable phosphate rock increased The two largest phosphate rock producers in the United slightly to 36.1 million metric tons (Mt) in Crop Year 2004 States, IMC Global Inc. and Cargill Crop Nutrition, announced (July 1, 2003-June 30, 2004) compared with 35.6 Mt in Crop plans to merge in February 2004. The new company, which will Year 2003 according to the U.S. Geological Survey (USGS). be known as The Mosaic Company, will become the second Data for this report were collected through monthly and largest fertilizer company in the world, in terms of sales, after semiannual canvasses of U.S. phosphate rock producers. All Yara International ASA of Norway. Mosaic would control 55% companies that produced phosphate rock in the United States of domestic phosphate rock production capacity and about 57% during the period participated in the voluntary surveys, of U.S. phosphoric acid (P2O5 content) production capacity. representing 100% of the production, sold or used, and value Worldwide, it would have 13% of phosphate rock capacity and data shown in the tables. Trade data were provided by the U.S. 14.4% of phosphoric acid capacity (Green Markets, 2004).