Case 1:09-Cv-01656-RMC Document 54 Filed 11/22/10 Page 1 of 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

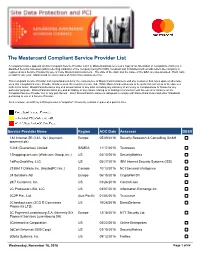

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Testimony of Jamie Dimon Chairman and CEO, Jpmorgan Chase & Co

Testimony of Jamie Dimon Chairman and CEO, JPMorgan Chase & Co. Before the Financial Crisis Inquiry Commission January 13, 2010 Chairman Angelides, Vice-Chairman Thomas, and Members of the Commission, my name is Jamie Dimon, and I am Chairman and Chief Executive Officer of JPMorgan Chase & Co. I appreciate the invitation to appear before you today. The charge of this Commission, to examine the causes of the financial crisis and the collapse of major financial institutions, is of paramount importance, and it will not be easy. The causes of the crisis and its implications are numerous and complex. If we are to learn from this crisis moving forward, we must be brutally honest about the causes and develop an understanding of them that is realistic, and is not – as we are too often tempted – overly simplistic. The FCIC’s contribution to this debate is critical as policymakers seek to modernize our financial regulatory structure, and I hope my participation will further the Commission’s mission. The Commission has asked me to address a number of topics related to how our business performed during the crisis, as well as changes implemented as a result of the crisis. Some of these matters are addressed at greater length in our last two annual reports, which I am attaching to this testimony. While the last year and a half was one of the most challenging periods in our company’s history, it was also one of our most remarkable. Throughout the financial crisis, JPMorgan Chase never posted a quarterly loss, served as a safe haven for depositors, worked closely with the federal government, and remained an active lender to consumers, small and large businesses, government entities and not-for-profit organizations. -

Analysis of Jamie Dimon: Impact of Leadership and Culture at J.P. Morgan Chase & Co

University of New Hampshire University of New Hampshire Scholars' Repository Honors Theses and Capstones Student Scholarship Spring 2020 Analysis of Jamie Dimon: Impact of Leadership and Culture at J.P. Morgan Chase & Co. Abigail Elisabeth Chapman University of New Hampshire, Durham Follow this and additional works at: https://scholars.unh.edu/honors Part of the Business Administration, Management, and Operations Commons, and the Corporate Finance Commons Recommended Citation Chapman, Abigail Elisabeth, "Analysis of Jamie Dimon: Impact of Leadership and Culture at J.P. Morgan Chase & Co." (2020). Honors Theses and Capstones. 509. https://scholars.unh.edu/honors/509 This Senior Honors Thesis is brought to you for free and open access by the Student Scholarship at University of New Hampshire Scholars' Repository. It has been accepted for inclusion in Honors Theses and Capstones by an authorized administrator of University of New Hampshire Scholars' Repository. For more information, please contact [email protected]. University of New Hampshire Spring 2020 Analysis of Jamie Dimon: Impact of Leadership and Culture at J.P. Morgan Chase & Co. Abigail E. Chapman University of New Hampshire, Durham, [email protected] Peter T. Paul College Honor’s Thesis Analysis of Jamie Dimon: Impact of Leadership and Culture at J.P. Morgan Chase Abigail Chapman Advisor: Professor Richard Kilbride University of New Hampshire 2 Table of Contents Introduction ……………………………………………………………………………………………………………………………. 4 Leadership Study ……………………………………………………………………………………………………………………. -

Conditional Approval #312 May 1999

Comptroller of the Currency Administrator of National Banks Washington, DC 20219 Conditional Approval #312 May 1999 DECISION OF THE OFFICE OF THE COMPTROLLER OF THE CURRENCY ON THE APPLICATION TO CHARTER NEXTBANK, NATIONAL ASSOCIATION, SAN FRANCISCO, CALIFORNIA MAY 8, 1999 I. DESCRIPTION OF THE PROPOSAL On December 10, 1998, NextCard, Inc., San Francisco, California (“NCI”), filed an application with the Office of the Comptroller of the Currency (OCC) to charter a new national credit card bank as specified in the Competitive Equality Banking Act of 1987, as amended (CEBA). The proposed bank will be headquartered in San Francisco, California, and will be titled NextBank, National Association (“Bank”).1 The Bank has applied to the Federal Deposit Insurance Corporation (FDIC) for deposit insurance and will apply to become a member of the Federal Reserve System. The Bank has also filed an operating subsidiary application with the OCC to own and operate NextCard Funding Corp. (“NFC”), a Delaware corporation that is currently wholly-owned by NCI. The applications have been supplemented from time to time with additional or amended information. No comments were received from the public regarding these applications. NCI, formerly called Internet Access Financial Corporation, launched the NextCard VISA card in December 1997. The product, which NCI calls the First True Internet VISA, is marketed to consumers exclusively through its Web site, www.nextcard.com. The NextCard can be used for both online and offline purchases and offers several product and service enhancements specifically designed for the Internet-enabled consumer. These include a customized application process, Internet-based account management, and online shopping enhancements. -

Jpmorgan Chase: out of Control

March 12, 2013 Joshua Rosner 646/652-6207 [email protected] JPMorgan Chase: Out of Control In this report we will focus on the risk management and internal control environment at JPMorgan Chase, a bank whose balance sheet is almost one-ninth the size of the United States economy. JPMorgan's financial filings, its "Task Force" investigation of losses in the CIO's office and its recent history of significant regulatory failures demonstrate that shareholders are continuing to be called upon to pay for the firm's inability to ensure an acceptable control environment. There are real risks of further regulatory or legislative changes to required leverage and capital ratios, and that the FDIC’s “single point of entry” approach to the orderly liquidation authority may result in new long-term debt issuance requirements at the holding company. Furthermore, other business risks appear under-appreciated, such as those associated with interest-rate risk management and also the collateral management of derivatives. While these fundamental issues deserve attention, they are not areas of focus in this report but will be addressed in a forthcoming report that considers the fundamental financial realities of “fortress JPM”. The failures we highlight are not exhaustive but should nonetheless serve to demonstrate the ongoing strains in managing a firm the size of JPMorgan and the benefits that would accrue to shareholders from better oversight and a business plan more focused on core operations. We have intentionally chosen not to detail all of the many private or public actions settled or outstanding (which have driven almost $16 billion in litigation expenses since 2009) or, other than the multistate settlement and foreclosure review settlement, the agreed to or unresolved costs of actions related to mortgage putback demands, including those of institutional investors, insurers, the GSEs, FHA, or the costs of foreclosure-related actions. -

List of Merchants 4

Merchant Name Date Registered Merchant Name Date Registered Merchant Name Date Registered 9001575*ARUBA SPA 05/02/2018 9013807*HBC SRL 05/02/2018 9017439*FRATELLI CARLI SO 05/02/2018 9001605*AGENZIA LAMPO SRL 05/02/2018 9013943*CASA EDITRICE LIB 05/02/2018 9017440*FRATELLI CARLI SO 05/02/2018 9003338*ARUBA SPA 05/02/2018 9014076*MAILUP SPA 05/02/2018 9017441*FRATELLI CARLI SO 05/02/2018 9003369*ARUBA SPA 05/02/2018 9014276*CCS ITALIA ONLUS 05/02/2018 9017442*FRATELLI CARLI SO 05/02/2018 9003946*GIUNTI EDITORE SP 05/02/2018 9014368*EDITORIALE IL FAT 05/02/2018 9017574*PULCRANET SRL 05/02/2018 9004061*FREDDY SPA 05/02/2018 9014569*SAVE THE CHILDREN 05/02/2018 9017575*PULCRANET SRL 05/02/2018 9004904*ARUBA SPA 05/02/2018 9014616*OXFAM ITALIA 05/02/2018 9017576*PULCRANET SRL 05/02/2018 9004949*ELEMEDIA SPA 05/02/2018 9014762*AMNESTY INTERNATI 05/02/2018 9017577*PULCRANET SRL 05/02/2018 9004972*ARUBA SPA 05/02/2018 9014949*LIS FINANZIARIA S 05/02/2018 9017578*PULCRANET SRL 05/02/2018 9005242*INTERSOS ASSOCIAZ 05/02/2018 9015096*FRATELLI CARLI SO 05/02/2018 9017676*PIERONI ROBERTO 05/02/2018 9005281*MESSAGENET SPA 05/02/2018 9015228*MEDIA SHOPPING SP 05/02/2018 9017907*ESITE SOCIETA A R 05/02/2018 9005607*EASY NOLO SPA 05/02/2018 9015229*SILVIO BARELLO 05/02/2018 9017955*LAV LEGA ANTIVIVI 05/02/2018 9006680*PERIODICI SAN PAO 05/02/2018 9015245*ASSURANT SERVICES 05/02/2018 9018029*MEDIA ON SRL 05/02/2018 9007043*INTERNET BOOKSHOP 05/02/2018 9015286*S.O.F.I.A. -

Registros De Entidades 2017

REGISTROS DE ENTIDADES 2017 SITUACION A 31 DE DICIEMBRE DE 2017 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ........................................................................................................ 9 ORDENADO POR CODIGO B.E. ......................................................................................................... 11 BANCOS ORDENADO ALFABETICAMENTE ...................................................................................................... 15 ORDENADO POR CODIGO B.E. ......................................................................................................... 17 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE ...................................................................................................... 27 ORDENADO POR CODIGO B.E. ......................................................................................................... 29 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 33 ORDENADO POR CODIGO B.E. ......................................................................................................... 35 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 47 ORDENADO POR CODIGO B.E. ......................................................................................................... 49 ESTABLECIMIENTOS FINANCIEROS DE CREDITO -

JP Morgan Chase Sofya Frantslikh Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 3-14-2005 Mergers and Acquisitions, Featured Case Study: JP Morgan Chase Sofya Frantslikh Pace University Follow this and additional works at: http://digitalcommons.pace.edu/honorscollege_theses Part of the Corporate Finance Commons Recommended Citation Frantslikh, Sofya, "Mergers and Acquisitions, Featured Case Study: JP Morgan Chase" (2005). Honors College Theses. Paper 7. http://digitalcommons.pace.edu/honorscollege_theses/7 This Article is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Thesis Mergers and Acquisitions Featured Case Study: JP Morgan Chase By: Sofya Frantslikh 1 Dedicated to: My grandmother, who made it her life time calling to educate people and in this way, make their world better, and especially mine. 2 Table of Contents 1) Abstract . .p.4 2) Introduction . .p.5 3) Mergers and Acquisitions Overview . p.6 4) Case In Point: JP Morgan Chase . .p.24 5) Conclusion . .p.40 6) Appendix (graphs, stats, etc.) . .p.43 7) References . .p.71 8) Annual Reports for 2002, 2003 of JP Morgan Chase* *The annual reports can be found at http://www.shareholder.com/jpmorganchase/annual.cfm) 3 Abstract Mergers and acquisitions have become the most frequently used methods of growth for companies in the twenty first century. They present a company with a potentially larger market share and open it u p to a more diversified market. A merger is considered to be successful, if it increases the acquiring firm’s value; m ost mergers have actually been known to benefit both competition and consumers by allowing firms to operate more efficiently. -

JP Morgan Investment Management Inc. | Client Relationship Summary

J.P. MORGAN INVESTMENT MANAGEMENT INC. JULY 9, 2021 Client Relationship Summary The best relationships are built on trust and transparency. That’s why, at J.P. Morgan Investment Management Inc. (“JPMIM”, “our”, “we”, or “us”), we want you to fully understand the ways you can invest with us. This Form CRS gives you important information about our wrap fee programs, short-term fixed income and private equity separately managed accounts (“SMAs”). We are registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment advisory services and fees differ, and it is important for retail investors (“you”) to understand the differences. Free and simple tools are available for you to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. WHAT INVESTMENT SERVICES AND ADVICE CAN YOU PROVIDE ME? We have minimum account requirements, and for Private Equity SMAs, Wrap Fee and Other Similar Managed Account Programs clients must generally satisfy certain investor sophistication requirements. We offer investment advisory services to retail investors through SMAs More detailed information about our services is available at available within wrap fee and other similar managed account programs. www.jpmorgan.com/form-crs-adv. These programs are offered by certain financial institutions, including our affiliates ("Sponsors"). Depending on the SMA strategy, these accounts invest in individual securities (such as stocks and bonds), exchange-traded funds CONVERSATION STARTERS (“ETFs”) and/or mutual funds. Throughout this Client Relationship Summary we’ve included When we act as your discretionary investment manager, you give us “Conversation Starters.” These are questions that the SEC thinks you authority to make investment and trading decisions for your account without should consider asking your financial professional. -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

PEI June2020 PEI300.Pdf

Cover story 20 Private Equity International • June 2020 Cover story Better capitalised than ever Page 22 The Top 10 over the decade Page 24 A decade that changed PE Page 27 LPs share dealmaking burden Page 28 Testing the value creation story Page 30 Investing responsibly Page 32 The state of private credit Page 34 Industry sweet spots Page 36 A liquid asset class Page 38 The PEI 300 by the numbers Page 40 June 2020 • Private Equity International 21 Cover story An industry better capitalised than ever With almost $2trn raised between them in the last five years, this year’s PEI 300 are armed and ready for the post-coronavirus rebuild, writes Isobel Markham nnual fundraising mega-funds ahead of the competition. crisis it’s better to be backed by a pri- figures go some way And Blackstone isn’t the only firm to vate equity firm, particularly and to towards painting a up the ante. The top 10 is around $30 the extent that it is able and prepared picture of just how billion larger than last year’s, the top to support these companies, which of much capital is in the 50 has broken the $1 trillion mark for course we are,” he says. hands of private equi- the first time, and the entire PEI 300 “The businesses that we own at Aty managers, but the ebbs and flows of has amassed $1.988 trillion. That’s the Blackstone that are directly affected the fundraising cycle often leave that same as Italy’s GDP. Firms now need by the pandemic, [such as] Merlin, picture incomplete. -

Chicago Fed Letter: Understanding the New World Order of Private

ESSAYS ON ISSUES THE FEDERAL RESERVE BANK OCTOBER 2010 OF CHICAGO NUMBER 279a ChicagoFedLetter Understanding the new world order of private equity by William Mark, lead examiner, Supervision and Regulation, and head, Private Equity Merchant Banking Knowledge Center, and Steven VanBever, lead supervision analyst, Supervision and Regulation The Federal Reserve System’s Private Equity Merchant Banking Knowledge Center, formed at the Chicago Fed in 2000 after the passage of the Gramm–Leach–Bliley Act, sponsors an annual conference on new industry developments. This article summarizes the tenth annual conference, The New World Order of Private Equity, held on July 21–22, 2010. Tokickofftheconference,1Carl lossofcompetitivenessoverthelong Tannenbaum,FederalReserveBank termfortheU.S.andotherdeveloped ofChicago,reflectedbrieflyonthe economiesrelativetoChinaandother decadesincethepassageoftheGramm– emergingcountries.Hutchinsciteda Leach–BlileyAct.Theseyearssawexten- numberofnegativeindicatorsintheU.S., sivefinancialinnovation,alongwiththe suchasrisinghealthcareandenergy removalofregulatorybarriersthat costs,thetradedeficit,governmental traditionallyseparatedtheactivities budgetdeficits,lossofleadershipintech- ofcommercialandinvestmentbanks. nologicalinnovation,laggingeducational Thefinancialcrisispromptedareeval- systems,andpoliticalpolarization. By a number of measures, uationofmanyviewsthathadbeen the state of private equity widelyheld,culminatinginPresident State of the industry has improved since the worst ObamasigningtheDodd–FrankWall ApanelledbyMarkO’Hare,Preqin of the financial crisis, but StreetReformandConsumerProtection Ltd.,exploredtheevolvingroleofpri- ActonJuly21,2010(bycoincidence, vateequity(PE)intheeconomyand many features of the asset thefirstdayoftheconference). ininvestorportfolios.ItfeaturedPaul class have been altered.