2018 Annual Report & Sustainability Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Günlük Bülten S&P 500 Brent Petrol USD Endeks %0.36 -%0.75 %0.17

Türkiye | Piyasalar 26 Ocak 2021 Salı Günlük Bülten S&P 500 Brent Petrol USD Endeks %0.36 -%0.75 %0.17 Ekonomik Veriler Açıklanacak Veriler Saat Piyasa Yorumu: İngiltere İşsizlik Oranı 10:00 Amerika Tüketici Güveni 18:00 TSİ Bu sabah BIST100’de aşağı yönlü bir açılış bekliyoruz. Küresel piyasalardaki negatif seyir devam ederken, hisse senetlerinde satışların Hisse Senedi Piyasası devam ettiğini görüyoruz. Zayıf bankacılık ve havacılık hisse senetlerinin performansı endekse karşı genel duyarlılığı etkiliyor. 50,000 1,580 48,000 1,570 Bu sabah negatif açılış ve sonrasında 1510 – 1550 arasında işlem 46,000 1,560 aktivitesi bekliyoruz. 44,000 1,550 42,000 1,540 40,000 1,530 38,000 1,520 Bugünün Haberleri: 36,000 1,510 34,000 1,500 15-Oca 18-Oca 19-Oca 20-Oca 21-Oca 22-Oca 25-Oca Piyasa Gelişmesi İşlem Hacmi, TRY mln BIST 100 . Reel kesim güveninde düşüş Bono Piyasası . Ocak ayı - Kapasite Kullanım Oranı 60.0 13.6 13.5 50.0 Hisse Senetleri 13.5 40.0 13.4 13.4 . ARCLK; 4Ç20 sonuçları beklentilerin oldukça üzerinde geldi / 30.0 13.3 20.0 13.3 olumlu 13.2 10.0 13.2 0.0 13.1 . PETKM; Etilen-nafta spread’i yeniden 650 USD'ye yöneldi / olumlu 15-Oca 18-Oca 19-Oca 20-Oca 21-Oca 22-Oca 25-Oca . GUBRF; 2020 yılı faaliyetleri hakkında bilgilendirme / pozitif İşlem Hacmi, TRY mln Türkiye 2030 Endeksler, para piyasaları ve emtia . BAGFS; %200 bedelli sermaye artırımı / nötr Kapanış Önceki 1 Gün 1 Ay Yıl Baş. BIST100 1,540 1,542 -0.1% 8.0% 4.3% . -

1 Ocak 2021 Itibariyle Şirketlerin Katilim Endeksi

1 OCAK 2021 İTİBARİYLE ŞİRKETLERİN KATILIM ENDEKSİ KRİTERLERİNE UYGUNLUK DURUMU & ARINDIRMA ORANLARI Faaliyet alanı, grubu ve pazarı uygun olmayan şirketlerin finansal kriterleri hesaplanmamaktadır. Faizli krediler / (piyasa değeri ya da aktif toplamdan büyük olanı) < %33 kriterini geçemeyen şirketlerin diğer finansal kriterleri hesaplanmamaktadır. Faiz Getirili Nakit/(piyasa değeri ya da aktif toplamdan büyük olanı)<%33 kriterini geçemeyen şirketlerin diğer finansal kriterleri hesaplanmamaktadır. Toplam Faizli Uygunsuz Krediler / Piyasa (Nakit+Menkul Uygun Olmayan Sıra Hisse Kodu Hisse Adı Gerekçe Değeri veya Aktif (< Kıymet)/Piyasa Değeri Faaliyetlerden Gelir / %33) veya Aktif (<%33) Toplam Gelir (< %5) 1 BIMAS Bim Mağazalar Uygun 0,0% 0,0% 0,2% 2 EREGL Ereğli Demir Çelik Uygun 14,4% 25,3% 2,7% 3 ASELS Aselsan Uygun 9,6% 5,5% 1,5% 4 THYAO Türk Hava Yolları Uygun 18,3% 4,6% 4,3% 5 CCOLA Coca Cola İçecek Uygun 29,5% 18,4% 1,8% 6 GUBRF Gübre Fabrik. Uygun 22,7% 11,5% 0,3% 7 BERA Bera Holding Uygun 26,3% 0,0% 0,5% 8 TKFEN Tekfen Holding Uygun 14,0% 15,6% 1,2% 9 OYAKC Oyak Çimento Uygun 9,7% 6,2% -22,6% 10 PGSUS Pegasus Uygun 7,5% 12,4% 2,6% 11 EGEEN Ege Endüstri Uygun 4,3% 22,0% 2,1% 12 TTRAK Türk Traktör Uygun 30,7% 32,9% 2,3% 13 MAVI Mavi Giyim Uygun 30,2% 22,6% 1,5% 14 LOGO Logo Yazılım Uygun 7,6% 7,9% 2,8% 15 KARTN Kartonsan Uygun 0,0% 7,4% 1,8% 16 SELEC Selçuk Ecza Deposu Uygun 0,6% 10,6% 0,7% 17 ISDMR İskenderun Demir Çelik Uygun 4,9% 0,2% 1,3% 18 RTALB RTA Laboratuvarları Uygun 1,5% 0,1% 2,8% 19 CEMAS Çemaş Döküm Uygun 0,3% 17,9% -

2016 Annual Report & Sustainability Report

2016 ANNUAL REPORT & SUSTAINABILITY REPORT BOYNER RETAIL AND TEXTILE INVESTMENTS BOYNER RETAIL AND TEXTILE INVESTMENTS www.boynerperakende.com www.boynergrup.com 2 2016 ANNUAL REPORT & SUSTAINABILITY REPORT 3 CONTENTS 05 10 29 69 106 121 137 FROM THE MANAGEMENT BOYNER GROUP BOYNER RETAIL AND SUSTAINABILITY CORPORATE AGENDA FOR THE INDEPENDENT TEXTILE INVESTMENTS REPORT GOVERNANCE ORDINARY GENERAL AUDITOR’S REPORT ON 06 12 CO. INC. and PRINCIPLES ASSEMBLY MEETING ANNUAL REPORT Message from the CEO and Our History 71 ITS COMPANIES COMPLIANCE REPORT FOR 2016 Chairman of the Board Sustainability 141 14 30 Management and our 117 122 INDEPENDENT 09 Our 2016 Awards Partnership Structure Stakeholders RISK MANAGEMENT AND Resumes and AUDITOR’S REPORT Members of the Board of 15 INTERNAL AUDIT Statements of & FINANCIAL Directors 33 73 Our Values Independent Members STATEMENTS Boyner Büyük Our Working Ecosystem 118 for Ordinary General 16 Mağazacılık A.Ş. DONATIONS AND GRANTS 83 Assembly Meeting for Our Working 43 Anti-Corruption 118 2016 Environment Beymen Mağazacılık CAPITAL MARKET 84 130 18 A.Ş. INSTRUMENTS ISSUED Our Environmental Dividend Distribution Our Strategies and IN 2016 51 Awareness Proposal and Statement Projects in 2016 AY Marka Mağazacılık 119 for 2016 - WEPUBLIC 90 A.Ş. LEGAL DISCLOSURES - Hopi Our Value Chain 132 - All Line Retail 61 Remuneration Policy 95 Altınyıldız Tekstil ve for Board Members and Our Contribution to Konfeksiyon A.Ş. Senior Executives Society 136 Dividend Distribution Policy FROM THE MANAGEMENT 05 6 2016 ANNUAL REPORT & SUSTAINABILITY REPORT 7 By making a very important investment in 2016, we enabled Boyner not be restricted and purchases will be realized with nominal value. -

Hisse Senedi Veri Bankasi

Günlük Haftalık Aylık 3 Aylık 12 Aylık Yılbaşına Göre 22.04.2021 21.04.2021 15.04.2021 22.03.2021 22.01.2021 22.04.2020 31.12.2020 22 Nisan 2021 HİSSE SENEDİ VERİ BANKASI ENDEKSLER KAPANIŞ P E R F O R M A N S TL US $ Günlük (TL) 1 Hafta (TL/US$) 1 Ay (TL/US$) 3 Ay (TL/US$) YBB (TL/US$) 1 Yıl (TL/US$) BIST-100 1,345.2 162.7 %1.10 -%4.4 -%6.9 -%2.5 -%6.8 -%12.8 -%22.0 -%8.9 -%18.3 %37.0 %15.5 BIST-30 1,412.7 170.8 %1.12 -%3.6 -%6.1 -%1.4 -%5.8 -%14.4 -%23.4 -%13.7 -%22.5 %22.0 %2.8 Mali 1,253.1 151.5 %0.82 -%6.3 -%8.7 -%9.5 -%13.5 -%23.0 -%31.1 -%19.9 -%28.2 %18.2 -%0.4 Sanayi 2,475.9 299.4 %1.65 -%5.3 -%7.7 %0.4 -%4.0 -%3.1 -%13.3 %5.8 -%5.1 %99.0 %67.8 Hizmetler 1,082.1 130.9 %1.35 -%5.5 -%7.9 -%2.5 -%6.8 -%12.7 -%21.9 -%9.3 -%18.6 %28.2 %8.0 Banka 1,086.5 131.4 %0.85 -%4.1 -%6.6 -%9.9 -%13.9 -%28.3 -%35.8 -%30.3 -%37.4 -%9.0 -%23.3 XU100_Getiri 2,350.8 284.3 %1.10 -%4.44 -%6.9 -%0.7 -%5.1 -%11.2 -%20.5 -%7.0 -%16.6 %40.8 %18.7 PİY. -

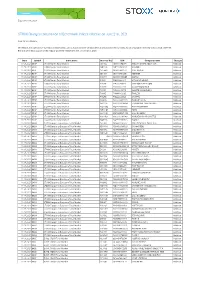

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

Günlük Bülten S&P 500 Brent Petrol USD Endeks -%0.29 %0.38 %0.49

Türkiye | Piyasalar 20 Mayıs 2021 Perşembe Günlük Bülten S&P 500 Brent Petrol USD Endeks -%0.29 %0.38 %0.49 Ekonomik Veriler Açıklanacak Veriler Saat Piyasa Yorumu: - - TSİ Bu sabah BIST100’de yatay/negatif yönlü bir açılış bekliyoruz. Hisse Senedi Piyasası Geçtiğimiz günlerde bankacılık hisse senetlerinde güçlü performans olduğu gözlemlenirken bazı sanayi hisselerinden bankacılık hisselerine 35,000 1,470 geçişlerin önümüzdeki günlerde devam edeceğini tahmin ediyoruz. 30,000 1,460 25,000 Bu sabah yatay/negatif açılış ve sonrasında 1450 – 1470 arasında işlem 1,450 20,000 aktivitesi bekliyoruz. 1,440 15,000 1,430 10,000 5,000 1,420 Bugünün Haberleri: 0 1,410 06-May 07-May 10-May 11-May 12-May 17-May 18-May İşlem Hacmi, TRY mln BIST 100 Ekonomik Veriler . Saat 15:30 – Amerika, İşsizlik haklarından yararlanma başvuruları Bono Piyasası . Saat 15:30 – Amerika, Philadelphia Fed istihdam (May) 60.0 18.3 50.0 18.2 18.2 . Saat 17:30 – Türkiye, Merkezi hükümet borç stoku (Nis) 40.0 18.1 30.0 18.1 20.0 18.0 10.0 18.0 0.0 17.9 06-May 07-May 10-May 11-May 12-May 17-May 18-May İşlem Hacmi, TRY mln Türkiye 2030 Endeksler, para piyasaları ve emtia Kapanış Önceki 1 Gün 1 Ay Yıl Baş. BIST100 1,460 1,454 0.4% 6.0% -1.2% İşlem Hacmi, TL mln 24,080 21,610 11.4% 3.4% -34.1% Turkey 2030 (13.11.2030) 18.17% 18.23% -6 bps 20 bps 526 bps Turkey 2030 6.31% 6.26% 5 bps 2 bps 94 bps TCMB karışık fonlama mlyt 19.00% 19.00% 0 bps 0 bps 197 bps USD/TRY 8.41 8.36 0.7% 3.9% 13.1% EUR/TRY 10.25 10.21 0.3% 5.1% 12.9% Sepet (50/50) 9.33 9.29 0.5% 4.5% 13.0% DOW 33,896 34,061 -0.5% -0.5% 10.7% S&P500 4,116 4,128 -0.3% -1.1% 9.6% FTSE 6,950 7,034 -1.2% -0.7% 7.6% MSCI EM 1,328 1,333 -0.4% -1.6% 2.8% MSCI EE 178.69 181.25 -1.4% 6.3% 9.8% Shanghai SE Comp 3,511 3,529 -0.5% 1.0% 1.1% Nikkei 28,044 28,407 -1.3% -5.5% 2.2% Petrol (Brent) 66.92 66.66 0.4% 30.0% 30.0% Altın 1,870 1,869 0.0% 5.5% -1.5% En Çok Yükselen & Düşenler Hisse Kodu Son Kapanış Gün Değ. -

STOXX EASTERN EUROPE 300 Selection List

STOXX EASTERN EUROPE 300 Last Updated: 20210802 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) RU0009024277 B59SNS8 LKOH.MM EV020 LUKOIL RU RUB Large 50.2 1 1 RU0007661625 B59L4L7 GAZP.MM EV019 GAZPROM RU RUB Large 39.4 2 2 RU0009029540 4767981 SBER.MM EV023 SBERBANK RU RUB Large 36.3 3 3 RU000A0DKVS5 B59HPK1 NVTK.MM B058LB NOVATEK RU RUB Large 35.3 4 4 RU0007288411 B5B1TX2 GMKN.MM EV022 MMC NORILSK NICKEL RU RUB Large 20 5 5 RU0008926258 B5BHQP1 SNGS.MM EV014 SURGUTNEFTEGAS RU RUB Large 13.4 6 6 HU0000061726 7320154 OTPB.BU 732015 OTP BANK HU HUF Large 10.8 7 7 RU0009033591 B59BXN2 TATN.MM EV015 TATNEFT RU RUB Large 8.7 8 8 RU000A0J2Q06 B59SS16 ROSN.MM EV021 ROSNEFT RU RUB Large 7.8 9 9 PLPKO0000016 B03NGS5 PKO.WA B03NGS PKO BANK PL PLN Large 7.3 10 10 RU000A0JKQU8 B59GLW2 MGNT.MM EV050 MAGNIT RU RUB Large 6.3 11 11 RU000A0JP7J7 B59Q6G1 PIKK.MM EV007 PIK SHB RU RUB Large 5.9 12 14 PLKGHM000017 5263251 KGH.WA 526325 KGHM PL PLN Large 5.8 13 12 LU2237380790 BMBQDF6 ALEP.WA PL00OY ALLEGRO.EU PL PLN Large 5.6 14 13 RU000A0JNAA8 B57R0L9 PLZL.MM EV010 POLYUS RU RUB Large 5.2 15 16 PLPKN0000018 5810066 PKN.WA 581006 PKNORLEN PL PLN Large 5 16 15 PLPZU0000011 B63DG21 PZU.WA PL001B PZU GROUP PL PLN Large 4.7 17 18 RU0007252813 B6QPBP2 ALRS.MM RU501R ALROSA RU RUB Large 4.6 18 17 RU0009046510 B5B9C59 CHMF.MM EV013 SEVERSTAL RU RUB Large 4 19 21 CZ0005112300 5624030 CEZP.PR 562403 CEZ CZ CZK Large 3.8 20 19 RU0009046452 B59FPC7 NLMK.MM EV009 NLMK RU RUB Large 3.7 21 25 PLPEKAO00016 5473113 -

Koç Holding 2020 Faaliyet Raporu İçindekiler

Koç Holding 2020 Faaliyet Raporu İçindekiler Sunuş Toplumsal Yatırımlar 01 Kurucumuz 124 Kurumsal Marka Projeleri ve Sponsorluk 02 Özetle Koç Holding ve Koç Topluluğu 125 Vehbi Koç Vakfı Genel Kurul Kurumsal Yönetim 06 Olağan Genel Kurul Gündemi 131 Hukuki Açıklamalar 07 Yönetim Kurulu’nun Yıllık Faaliyet Raporu’na İlişkin 134 Kurumsal Yönetim İlkelerine Uyum Beyanı Bağımsız Denetim Raporu 136 Sürdürülebilirlik İlkelerine Uyum Beyanı 08 Şeref Başkanı’ndan Mesaj 138 Kurumsal Yönetim İle İlgili Açıklamalar 10 Yönetim Kurulu Başkanı’nın Değerlendirmesi 142 2020 Yönetim Kurulu Yapısı 12 Yönetim Kurulu Raporu 143 Organizasyon Şeması 18 Bağımsız Denetçi Raporu (Görüş) 144 Yönetim Kurulu Özgeçmişleri 19 Konsolide Bilanço / Konsolide Gelir Tablosu 148 Üst Yönetim Özgeçmişleri 20 2020 Yönetim Kurulu 150 Risk Yönetimi 22 Kâr Dağıtım Politikası 151 İç Kontrol Sistemi ve İç Denetim 22 Kâr Dağıtım Teklifi 152 Finansal Tablolar Sorumluluk Beyanı 23 Kâr Dağıtım Tablosu 153 Faaliyet Raporu Sorumluluk Beyanı 24 Esas Sözleşme Değişiklikleri 26 2021 Yönetim Kurulu Üye Adayları Finansal Tablolar ve Bağımsız Denetim Raporu 27 Ücret Politikası 155 Konsolide Finansal Tablolar ve Bağımsız Denetçi Raporu Koç Topluluğu 272 Koç Holding A.Ş. Vergi Usul Kanununa Göre 28 CEO’nun Değerlendirmesi Düzenlenmiş Bilanço ve Gelir Tablosu 30 Üst Yönetim 32 Tarihçe Diğer Bilgilendirmeler 34 Koç Topluluğu’nda Pandemi Süreci Yönetimi 276 Genel Kurul Bilgilendirme Dokümanı 40 2020 Ödüller ve Başarılar 282 Bağımsızlık Beyanları 42 Pay Sahipleri ve Yatırımcı İlişkileri 286 Kurumsal Yönetim İlkelerine Uyum Raporu ve 43 İnsan Kaynakları Bilgi Formu 47 Sürdürülebilirlik 300 Sürdürülebilirlik İlkelerine Uyum ile İlgili Açıklamalar 61 Uyum Programı Hakkında Endeks 62 Koç Dijital Dönüşüm Programı 304 Kimlik 64 Araştırma Geliştirme 66 Koç İnovasyon Programı 67 Fikri Haklar Sektörler ve Şirketler 70 Enerji 82 Otomotiv 96 Dayanıklı Tüketim 104 Finans 112 Diğer Sektörler Koç Holding 2020 Faaliyet Raporu Genel Kurul Kurucumuz Devletim ve ülkem var oldukça ben de varım. -

Hisse Senedi Veri Bankasi

Günlük Haftalık Aylık 3 Aylık 12 Aylık Yılbaşına Göre 4.12.2020 3.12.2020 27.11.2020 4.11.2020 4.09.2020 4.12.2019 31.12.2019 04 Aralık 2020 HİSSE SENEDİ VERİ BANKASI ENDEKSLER KAPANIŞ P E R F O R M A N S TL US $ Günlük (TL) 1 Hafta (TL/US$) 1 Ay (TL/US$) 3 Ay (TL/US$) YBB (TL/US$) 1 Yıl (TL/US$) BIST-100 1,330.9 171.1 %0.00 %0.2 %0.4 %14.0 %23.9 %22.5 %16.7 %16.3 -%11.2 %23.6 -%8.9 BIST-30 1,470.4 189.0 -%0.19 -%0.5 -%0.3 %14.8 %24.8 %20.2 %14.5 %5.9 -%19.1 %11.6 -%17.7 Mali 1,427.1 183.4 -%0.30 -%0.2 %0.1 %17.2 %27.3 %26.8 %20.9 %5.6 -%19.4 %12.0 -%17.4 Sanayi 2,069.5 266.0 %0.73 %0.8 %1.0 %14.7 %24.7 %33.0 %26.7 %48.7 %13.6 %60.5 %18.3 Hizmetler 1,133.8 145.7 -%0.49 %1.8 %2.0 %8.5 %17.9 %13.7 %8.4 %29.9 -%0.8 %37.3 %1.2 Banka 1,430.7 183.9 -%1.25 -%3.0 -%2.8 %21.5 %32.0 %29.3 %23.2 -%10.7 -%31.8 -%5.0 -%30.0 XU100_Getiri 2,278.7 292.9 %0.00 %0.28 %0.5 %14.1 %24.0 %22.7 %16.9 %17.9 -%10.0 %25.3 -%7.6 PİY. -

The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market

Munich Personal RePEc Archive The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market Turel, Asli 2010 Online at https://mpra.ub.uni-muenchen.de/29800/ MPRA Paper No. 29800, posted 28 Mar 2011 09:00 UTC Middle Eastern Finance and Economics ISSN: 1450-2889 Issue 8 (2010) © EuroJournals Publishing, Inc. 2010 http://www.eurojournals.com/MEFE.htm The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market Asli Turel Istanbul University, School of Business, , Avcılar, Istanbul, Turkey E-mail: [email protected] Tel: +90-212-4737070-18394 Abstract The development of the internet as a global medium has significantly impacted financial reporting environment of the companies. Recently, companies have started reporting their financial results and other information relating to business on their web pages. The internet offers the facility to provide all interested groups with information to make well-informed, timely investment decision thus reducing the information advantages of institutional investors and information intermediaries. This study examines the level of internet financial reporting in Turkey. Furthermore, it tries to find out whether there is an expectation gap in internet financial reporting. In this study, “expectation gap” refers to the difference between (1) what financial statement users perceive important in decision making process to be and (2) what companies actually disclose or present in their web pages. Our findings indicate that an expectation gap exists; financial statement users have higher expectations for various facets than what companies actually report in the areas such as; reports of analysts, phone number to investor relations, segmental reporting, financial data in processable format, and summary of financial data. -

Democratic Transitions and Implicit Power: an Econometric Approach

Democratic Transitions and Implicit Power: An Econometric Approach Gokce Goktepe (NYU) Shanker Satyanath (NYU) Abstract Recent works of political economy have emphasized the importance of distinguishing between transfers of explicit and implicit power over economic decision making in democratic transitions. Scholars have so far provided interesting anecdotal evidence supporting their claims of potential divergence between transfers of explicit and implicit power. This raises the question of whether it is possible to econometrically identify when a transfer of explicit power has not also been accompanied by a transfer of implicit power. This paper offers a straightforward and easily replicable approach to addressing this question using the tools of financial econometrics. We apply this approach here to a major country where considerable uncertainty remains over the military’s implicit role in economic decision making long after an explicit transfer of power to elected leaders, namely Turkey. Our findings indicate a significant gap between the explicit and implicit aspects of Turkey’s democratic transition, adding support to scholars’ claims about the importance of distinguishing between these aspects of transitions. 1. Introduction- When has a democratic transition truly occurred? Standard measures of democracy consider the presence of free elections and/or turnover in government as adequate to identify the emergence of a democracy. However, these are only explicit aspects of a democratic transition. Several scholars, ranging from O’Donnell (1994) to Acemoglu and Robinson (2008), have expressed concerns that countries that have made the transition to free elections and turnover in office may still be implicitly undemocratic in that elements of the previous authoritarian regime continue to exercise substantial behind the scenes (implicit) influence over economic decision making. -

The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market

MPRA Munich Personal RePEc Archive The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market Turel, Asli 2010 Online at http://mpra.ub.uni-muenchen.de/29800/ MPRA Paper No. 29800, posted 23. March 2011 / 14:06 Middle Eastern Finance and Economics ISSN: 1450-2889 Issue 8 (2010) © EuroJournals Publishing, Inc. 2010 http://www.eurojournals.com/MEFE.htm The Expectation Gap in Internet Financial Reporting: Evidence from an Emerging Capital Market Asli Turel Istanbul University, School of Business, , Avcılar, Istanbul, Turkey E-mail: [email protected] Tel: +90-212-4737070-18394 Abstract The development of the internet as a global medium has significantly impacted financial reporting environment of the companies. Recently, companies have started reporting their financial results and other information relating to business on their web pages. The internet offers the facility to provide all interested groups with information to make well-informed, timely investment decision thus reducing the information advantages of institutional investors and information intermediaries. This study examines the level of internet financial reporting in Turkey. Furthermore, it tries to find out whether there is an expectation gap in internet financial reporting. In this study, “expectation gap” refers to the difference between (1) what financial statement users perceive important in decision making process to be and (2) what companies actually disclose or present in their web pages. Our findings indicate that an expectation gap exists; financial statement users have higher expectations for various facets than what companies actually report in the areas such as; reports of analysts, phone number to investor relations, segmental reporting, financial data in processable format, and summary of financial data.