Hisse Senedi Veri Bankasi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Günlük Bülten S&P 500 Brent Petrol USD Endeks %0.36 -%0.75 %0.17

Türkiye | Piyasalar 26 Ocak 2021 Salı Günlük Bülten S&P 500 Brent Petrol USD Endeks %0.36 -%0.75 %0.17 Ekonomik Veriler Açıklanacak Veriler Saat Piyasa Yorumu: İngiltere İşsizlik Oranı 10:00 Amerika Tüketici Güveni 18:00 TSİ Bu sabah BIST100’de aşağı yönlü bir açılış bekliyoruz. Küresel piyasalardaki negatif seyir devam ederken, hisse senetlerinde satışların Hisse Senedi Piyasası devam ettiğini görüyoruz. Zayıf bankacılık ve havacılık hisse senetlerinin performansı endekse karşı genel duyarlılığı etkiliyor. 50,000 1,580 48,000 1,570 Bu sabah negatif açılış ve sonrasında 1510 – 1550 arasında işlem 46,000 1,560 aktivitesi bekliyoruz. 44,000 1,550 42,000 1,540 40,000 1,530 38,000 1,520 Bugünün Haberleri: 36,000 1,510 34,000 1,500 15-Oca 18-Oca 19-Oca 20-Oca 21-Oca 22-Oca 25-Oca Piyasa Gelişmesi İşlem Hacmi, TRY mln BIST 100 . Reel kesim güveninde düşüş Bono Piyasası . Ocak ayı - Kapasite Kullanım Oranı 60.0 13.6 13.5 50.0 Hisse Senetleri 13.5 40.0 13.4 13.4 . ARCLK; 4Ç20 sonuçları beklentilerin oldukça üzerinde geldi / 30.0 13.3 20.0 13.3 olumlu 13.2 10.0 13.2 0.0 13.1 . PETKM; Etilen-nafta spread’i yeniden 650 USD'ye yöneldi / olumlu 15-Oca 18-Oca 19-Oca 20-Oca 21-Oca 22-Oca 25-Oca . GUBRF; 2020 yılı faaliyetleri hakkında bilgilendirme / pozitif İşlem Hacmi, TRY mln Türkiye 2030 Endeksler, para piyasaları ve emtia . BAGFS; %200 bedelli sermaye artırımı / nötr Kapanış Önceki 1 Gün 1 Ay Yıl Baş. BIST100 1,540 1,542 -0.1% 8.0% 4.3% . -

1 Ocak 2021 Itibariyle Şirketlerin Katilim Endeksi

1 OCAK 2021 İTİBARİYLE ŞİRKETLERİN KATILIM ENDEKSİ KRİTERLERİNE UYGUNLUK DURUMU & ARINDIRMA ORANLARI Faaliyet alanı, grubu ve pazarı uygun olmayan şirketlerin finansal kriterleri hesaplanmamaktadır. Faizli krediler / (piyasa değeri ya da aktif toplamdan büyük olanı) < %33 kriterini geçemeyen şirketlerin diğer finansal kriterleri hesaplanmamaktadır. Faiz Getirili Nakit/(piyasa değeri ya da aktif toplamdan büyük olanı)<%33 kriterini geçemeyen şirketlerin diğer finansal kriterleri hesaplanmamaktadır. Toplam Faizli Uygunsuz Krediler / Piyasa (Nakit+Menkul Uygun Olmayan Sıra Hisse Kodu Hisse Adı Gerekçe Değeri veya Aktif (< Kıymet)/Piyasa Değeri Faaliyetlerden Gelir / %33) veya Aktif (<%33) Toplam Gelir (< %5) 1 BIMAS Bim Mağazalar Uygun 0,0% 0,0% 0,2% 2 EREGL Ereğli Demir Çelik Uygun 14,4% 25,3% 2,7% 3 ASELS Aselsan Uygun 9,6% 5,5% 1,5% 4 THYAO Türk Hava Yolları Uygun 18,3% 4,6% 4,3% 5 CCOLA Coca Cola İçecek Uygun 29,5% 18,4% 1,8% 6 GUBRF Gübre Fabrik. Uygun 22,7% 11,5% 0,3% 7 BERA Bera Holding Uygun 26,3% 0,0% 0,5% 8 TKFEN Tekfen Holding Uygun 14,0% 15,6% 1,2% 9 OYAKC Oyak Çimento Uygun 9,7% 6,2% -22,6% 10 PGSUS Pegasus Uygun 7,5% 12,4% 2,6% 11 EGEEN Ege Endüstri Uygun 4,3% 22,0% 2,1% 12 TTRAK Türk Traktör Uygun 30,7% 32,9% 2,3% 13 MAVI Mavi Giyim Uygun 30,2% 22,6% 1,5% 14 LOGO Logo Yazılım Uygun 7,6% 7,9% 2,8% 15 KARTN Kartonsan Uygun 0,0% 7,4% 1,8% 16 SELEC Selçuk Ecza Deposu Uygun 0,6% 10,6% 0,7% 17 ISDMR İskenderun Demir Çelik Uygun 4,9% 0,2% 1,3% 18 RTALB RTA Laboratuvarları Uygun 1,5% 0,1% 2,8% 19 CEMAS Çemaş Döküm Uygun 0,3% 17,9% -

Strong Foundations Healthy Performance

STRONG FOUNDATIONS HEALTHY PERFORMANCE 2019 ANNUAL REPORT 2019 ANNUAL REPORT CONTENTS Anadolu Isuzu continues its Introduction 2 CORPORATE PROFILE operations in line with its growth 4 2019 FINANCIAL AND OPERATIONAL HIGHLIGHTS 6 HIGHLIGHTS IN 2019 strategy without interruption with 12 MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS the market diversity its product 14 MESSAGE FROM THE PRESIDENT OF THE AUTOMOTIVE GROUP 16 MESSAGE FROM THE GENERAL MANAGER portfolio provides, its marketing 20 ANADOLU ISUZU FROM PAST TO PRESENT 22 SHAREHOLDERS OF ANADOLU ISUZU competencies and the support of 26 ANADOLU ISUZU’S PRODUCT PORTFOLIO its shareholders in the light of its 42 THE ECONOMY IN TURKEY AND THE WORLD 43 OVERVIEW OF THE SECTOR strengthening financial structure. In 2019 Tuğrul Arıkan 46 IN SUMMARY General Manager 47 EXPORT ACTIVITIES 53 MARKETING AND DEALER NETWORK DEVELOPMENT ACTIVITIES 55 AFTER-SALES SERVICES 56 SUPPLY CHAIN AT ANADOLU ISUZU 58 R&D AT ANADOLU ISUZU 62 PRODUCTION 64 ANADOLU ISUZU AND THE ENVIRONMENT 67 INDUSTRY 4.0 AND DIGITALIZATION PROJECTS 69 IM GLOBAL LEADER COMPANY 71 ENERGY PERFORMANCE OF ANADOLU ISUZU 72 HUMAN RESOURCES 78 OHS/EMPLOYEE SAFETY 79 SOCIAL AWARENESS PROJECTS AT ANADOLU ISUZU Corporate Governance 82 BOARD OF DIRECTORS 87 SENIOR MANAGEMENT 90 ORGANIZATION CHART 92 INDEPENDENT AUDIT REPORT 94 OTHER INFORMATION ABOUT ACTIVITIES 102 2019 AFFILIATE REPORT 103 CORPORATE GOVERNANCE Financial Information 125 CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD 31 DECEMBER 2019 AND INDEPENDENT AUDITOR’S REPORT FOR -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Eurozone Equity ETF (EURZ) Xtrackers International Real Estate ETF (HAUZ) Xtrackers Japan JPX-Nikkei 400 Equity ETF (JPN) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Eurozone Equity ETF ......................................................... 4 Xtrackers International Real Estate ETF .................................................. 6 Xtrackers Japan JPX-Nikkei 400 Equity ETF .............................................. 8 Fees and Expenses ....................................................................... 10 Schedules of Investments Xtrackers Eurozone Equity ETF ......................................................... 11 Xtrackers International Real Estate ETF .................................................. 16 Xtrackers Japan JPX-Nikkei 400 Equity ETF .............................................. 25 Statements of Assets and Liabilities ........................................................ 30 Statements of Operations ................................................................. 31 Statements of Changes in Net Assets ....................................................... 32 Financial Highlights ...................................................................... 34 Notes to Financial Statements ............................................................. 36 Report -

BORUSAN MANNESMANN BORU SANAYİ Ve TİCARET A.Ş. Ve

BORUSAN MANNESMANN BORU SANAYİ ve TİCARET A.Ş. ve BAĞLI ORTAKLIKLAR 1 Ocak – 30 Haziran 2021 Yönetim Kurulu Faaliyet Raporu Güney Bağımsız Denetim ve SMMM A.Ş. Tel: +90 212 315 3000 Maslak Mah. Eski Büyükdere Cad. Fax: +90 212 230 8291 Orjin Maslak İş Merkezi No: 27 ey.com Kat: 2-3-4 Daire: 54-57-59 Ticaret Sicil No : 479920 34485 Sarıyer Mersis No: 0-4350-3032-6000017 İstanbul - Türkiye ARA DÖNEM FAALİYET RAPORU UYGUNLUĞU HAKKINDA SINIRLI DENETİM RAPORU Borusan Mannesmann Boru Sanayi ve Ticaret Anonim Şirketi Yönetim Kurulu’na Borusan Mannesmann Boru Sanayi ve Ticaret Anonim Şirketi’nin (“Şirket”) ile bağlı ortaklıklarının (“Grup”) 30 Haziran 2021 tarihi itibarıyla hazırlanan ara dönem faaliyet raporunda yer alan finansal bilgilerin, sınırlı denetimden geçmiş ara dönem özet konsolide finansal tablolar ile tutarlı olup olmadığının incelemesini yapmakla görevlendirilmiş bulunuyoruz. Rapor konusu ara dönem faaliyet raporu, Grup yönetiminin sorumluluğundadır. Sınırlı denetim yapan kuruluş olarak üzerimize düşen sorumluluk, ara dönem faaliyet raporunda yer alan finansal bilgilerin, sınırlı denetimden geçmiş ve 17 Ağustos 2021 tarihli sınırlı denetim raporuna konu olan ara dönem özet konsolide finansal tablolar ve açıklayıcı notlar ile tutarlı olup olmadığına ilişkin ulaşılan sonucun açıklanmasıdır. Yaptığımız sınırlı denetim, Sınırlı Bağımsız Denetim Standardı (SBDS) 2410 "Ara Dönem Finansal Bilgilerin, İşletmenin Yıllık Finansal Tablolarının Bağımsız Denetimini Yürüten Denetçi Tarafından Sınırlı Bağımsız Denetimi"ne uygun olarak yürütülmüştür. Ara dönem finansal bilgilere ilişkin sınırlı denetim, başta finans ve muhasebe konularından sorumlu kişiler olmak üzere ilgili kişilerin sorgulanması ve analitik prosedürler ile diğer sınırlı denetim prosedürlerinin uygulanmasından oluşur. Ara dönem finansal bilgilerin sınırlı denetiminin kapsamı; Bağımsız Denetim Standartlarına uygun olarak yapılan ve amacı finansal tablolar hakkında bir görüş bildirmek olan bağımsız denetimin kapsamına kıyasla önemli ölçüde dardır. -

Main Heading Goes Here

Karsan Turkey / equity / automotive Turnaround story begins in 2015 May 21, 2014 Turning into an OEM producer from contract auto manufacturer. Karsan has been MARKET OUTPERFORMER producing commercial vehicles for the world’s leading brands such as Peugeot, Renault (initiated) and Hyundai through its flexible manufacturing facilities. However, it has been suffering KARSN.IS KARSN TI from being a contract manufacturer as the profitability is very low for contract manufacturers. Eventually, Karsan has decided to become an OEM producer, producing Stock Data its own products rather than being a contract manufacturer, and taken some steps (such Current Price (TL) 1.16 as; Hyundai deal, expiry of PSA and Renault agreements, enrichment of product mix 12M Target Price (TL) 1.60 with own brands and establishing a JV with Chinese producer) to improve its profitability Upside potential 38% and balance sheet, which will start paying off in 2015. Current Mcap (TLmn) 534 Hyundai deal to ignite turnaround. Karsan signed an agreement with Hyundai Motor Free Float (FF) 34.35% Company (HMC) for the production of more than 200k light commercial vehicles FF. Mcap (TLmn) 183 between 2014-2021. According to our calculation, Karsan will generate more than TL1bn Foreign Share in FF 3.26% Report priced as of May 20, 2014 revenue from (protected by take-or pay clause) Hyundai vehicle sales in 2015 (2014E top-line: TL537mn), totaling c.TL15.7bn between 2014-2021. Relative Performance to BIST-100 Strong growth in P&L is on the way. Deriving strength from Hyundai project, 1m 3m 6m 12m profitable BredaMenarinibus sales and upcoming new product launches, we expect the 10% 5% 8% 31% company to post substantial growth in P&L as we expect revenues, EBITDA and net Avg. -

2016 Annual Report & Sustainability Report

2016 ANNUAL REPORT & SUSTAINABILITY REPORT BOYNER RETAIL AND TEXTILE INVESTMENTS BOYNER RETAIL AND TEXTILE INVESTMENTS www.boynerperakende.com www.boynergrup.com 2 2016 ANNUAL REPORT & SUSTAINABILITY REPORT 3 CONTENTS 05 10 29 69 106 121 137 FROM THE MANAGEMENT BOYNER GROUP BOYNER RETAIL AND SUSTAINABILITY CORPORATE AGENDA FOR THE INDEPENDENT TEXTILE INVESTMENTS REPORT GOVERNANCE ORDINARY GENERAL AUDITOR’S REPORT ON 06 12 CO. INC. and PRINCIPLES ASSEMBLY MEETING ANNUAL REPORT Message from the CEO and Our History 71 ITS COMPANIES COMPLIANCE REPORT FOR 2016 Chairman of the Board Sustainability 141 14 30 Management and our 117 122 INDEPENDENT 09 Our 2016 Awards Partnership Structure Stakeholders RISK MANAGEMENT AND Resumes and AUDITOR’S REPORT Members of the Board of 15 INTERNAL AUDIT Statements of & FINANCIAL Directors 33 73 Our Values Independent Members STATEMENTS Boyner Büyük Our Working Ecosystem 118 for Ordinary General 16 Mağazacılık A.Ş. DONATIONS AND GRANTS 83 Assembly Meeting for Our Working 43 Anti-Corruption 118 2016 Environment Beymen Mağazacılık CAPITAL MARKET 84 130 18 A.Ş. INSTRUMENTS ISSUED Our Environmental Dividend Distribution Our Strategies and IN 2016 51 Awareness Proposal and Statement Projects in 2016 AY Marka Mağazacılık 119 for 2016 - WEPUBLIC 90 A.Ş. LEGAL DISCLOSURES - Hopi Our Value Chain 132 - All Line Retail 61 Remuneration Policy 95 Altınyıldız Tekstil ve for Board Members and Our Contribution to Konfeksiyon A.Ş. Senior Executives Society 136 Dividend Distribution Policy FROM THE MANAGEMENT 05 6 2016 ANNUAL REPORT & SUSTAINABILITY REPORT 7 By making a very important investment in 2016, we enabled Boyner not be restricted and purchases will be realized with nominal value. -

Piyasa Verileri Tablosu TL/USD 7,9379 BIST 100 1.191 Hisse Endeks H.A.O

Tarih 23.10.20 Piyasa Verileri Tablosu TL/USD 7,9379 BIST 100 1.191 Hisse Endeks H.A.O. Kapanış Hisse Piyasa Değeri Piyasa Değeri Net Kar (TL)Net Kar Piyasa Göstergeleri Finansal Göstergeler (%; Yıllık) Getiri (%) Hisse Kodları (%) (TL) Adeti (TL mn) ($) 2018/12 2019/12 2019/06 2020/06 Değişim F/K PD/DD FD/FAVÖK FD/Satış Net Borç (TL) N.Kar Marjı FAVÖK Marjı Haftalık Aylık Yıllık Senetleri XU100 1.190,63 852.502.567.240 107.396.486.129 90.844.166.923 89.380.650.239 38.884.330.823 33.545.146.448 -13,7% 10,50 1,05 7,69 1,09 347.924.398.803 -0,18 7,98 19,32 BIST 100 Endeksi XU030 1.305,37 529.496.538.707 66.704.863.844 71.604.053.222 65.401.296.171 28.413.768.763 24.904.765.476 -12,3% 8,18 0,85 6,94 0,98 272.654.371.376 -0,79 5,98 5,67 BIST 30 Endeksi XUTUM 1.378,00 1.494.188.085.477 188.234.682.407 92.528.745.523 92.292.214.725 39.455.655.563 33.734.912.461 -14,5% 16,76 1,65 8,15 1,03 424.911.738.102 -0,18 9,71 35,10 BIST TÜM Endeksi DAYANIKLI TÜKETİM SEKTÖRÜ 32.381.175.025 4.079.312.542 1.850.293.457 1.853.440.020 799.052.835 1.619.543.088 102,7% 9,30 1,64 5,80 0,72 12.032.860.943 6,2% 13,0% -1,16 7,40 54,65 Beyaz Eşya 26.282.579.945 3.311.024.319 1.479.140.457 1.529.393.020 763.574.835 1.019.452.088 33,5% 10,15 1,72 6,36 0,74 6.085.333.943 7,3% 11,4% -1,33 7,80 37,79 ARCLK 30 25 28,22 675.728.205 19.069.049.945 2.402.278.933 851.756.000 924.833.000 444.484.000 662.357.000 49,0% 9,91 1,50 6,11 0,68 5.366.926.000 5,4% 11,1% 2,84 21,53 51,48 Arçelik IHEVA 60 2,06 350.500.000 722.030.000 90.959.826 6.828.981 42.860.897 6.181.709 7.578.984 22,6% 16,31 1,87 17,76 2,65 -2.161.992 16,3% 16,1% -5,50 -5,94 24,10 İhlas Ev Aletleri SILVR 45 4,50 45.000.000 202.500.000 25.510.525 -2.005.524 -6.372.877 -4.279.874 -1.203.896 71,9% a.d. -

1H 2010 Results Announcement

1H 2010 Results Announcement OTOKAR REPORTS 1H 2010 RESULTS In this report we submit 1H 2010 figures to compare with 1H 2009 figures. 1H 2010 & 1H 2009 financial results published in this press release are prepared according to International Financial Reporting Standards. Highlights of 1H 2010 • Otokar generated USD 110.4 million domestic revenues in 1H 2010, 69% greater than the 1H 2009. Otokar’s 1H 2010 total revenues were USD 127.1 million. As a result of this, the share of the domestic revenues in total revenues reached to 87%, whereas it was 53% and 69% in 1H 2009 and FY 2009 respectively. A similar situation is encountered in comprise of sales in terms of defensive, commercial and other revenues. The portion of commercial products in total revenues was 47% in 1H 2010, whereas it was 31% in 1H 2009. • In the 1H 2010, Otokar vastly increased its sales and production units. Otokar’s production and sale units in 1H 2010 were 1.364 and 1.434, 47% and 65% greater than 1H 2009 respectively. • The planned dividend payment that was agreed at the General Assembly for the year 2009 is TL.20.4 million was paid on Mar 24, 2010. Overview OTOKAR 1H 2010 1H 2009 USD Based IFRS USD USD Change P/L Statement Highlights (thousands) (thousands) Net Sales 127.120 124.879 2% Cost of Sales (109.041) (85.252) 28% Gross Profit 18.078 39.627 -54% Operating Expenses (19.224) (21.957) -12% Operating Profit -1.145 17.670 -106% Income/(loss) before minorities & taxes -6.003 7.578 -179% Taxation 4.207 -275 -1630% Net Profit -1.796 7.303 -125% EBITDA 2.796 20.255 -86% 1 1H 2010 Results 1H 2010 Results Announcement Net Sales Otokar increased its total revenues concurrently with the launches of its new products. -

Hisse Senedi Veri Bankasi

Günlük Haftalık Aylık 3 Aylık 12 Aylık Yılbaşına Göre 22.04.2021 21.04.2021 15.04.2021 22.03.2021 22.01.2021 22.04.2020 31.12.2020 22 Nisan 2021 HİSSE SENEDİ VERİ BANKASI ENDEKSLER KAPANIŞ P E R F O R M A N S TL US $ Günlük (TL) 1 Hafta (TL/US$) 1 Ay (TL/US$) 3 Ay (TL/US$) YBB (TL/US$) 1 Yıl (TL/US$) BIST-100 1,345.2 162.7 %1.10 -%4.4 -%6.9 -%2.5 -%6.8 -%12.8 -%22.0 -%8.9 -%18.3 %37.0 %15.5 BIST-30 1,412.7 170.8 %1.12 -%3.6 -%6.1 -%1.4 -%5.8 -%14.4 -%23.4 -%13.7 -%22.5 %22.0 %2.8 Mali 1,253.1 151.5 %0.82 -%6.3 -%8.7 -%9.5 -%13.5 -%23.0 -%31.1 -%19.9 -%28.2 %18.2 -%0.4 Sanayi 2,475.9 299.4 %1.65 -%5.3 -%7.7 %0.4 -%4.0 -%3.1 -%13.3 %5.8 -%5.1 %99.0 %67.8 Hizmetler 1,082.1 130.9 %1.35 -%5.5 -%7.9 -%2.5 -%6.8 -%12.7 -%21.9 -%9.3 -%18.6 %28.2 %8.0 Banka 1,086.5 131.4 %0.85 -%4.1 -%6.6 -%9.9 -%13.9 -%28.3 -%35.8 -%30.3 -%37.4 -%9.0 -%23.3 XU100_Getiri 2,350.8 284.3 %1.10 -%4.44 -%6.9 -%0.7 -%5.1 -%11.2 -%20.5 -%7.0 -%16.6 %40.8 %18.7 PİY. -

Truck Market 2024 Sustainable Growth in Global Markets Editorial Welcome to the Deloitte 2014 Truck Study

Truck Market 2024 Sustainable Growth in Global Markets Editorial Welcome to the Deloitte 2014 Truck Study Dear Reader, Welcome to the Deloitte 2014 Truck Study. 1 Growth is back on the agenda. While the industry environment remains challenging, the key question is how premium commercial vehicle OEMs can grow profitably and sustainably in a 2 global setting. 3 This year we present a truly international outlook, prepared by the Deloitte Global Commercial 4 Vehicle Team. After speaking with a selection of European OEM senior executives from around the world, we prepared this innovative study. It combines industry and Deloitte expert 5 insight with a wide array of data. Our experts draw on first-hand knowledge of both country 6 Christopher Nürk Michael A. Maier and industry-specific challenges. We hope you will find this report useful in developing your future business strategy. To the 7 many executives who took the time to respond to our survey, thank you for your time and valuable input. We look forward to continuing this important strategic conversation with you. Using this report In each chapter you will find: • A summary of the key messages and insights of the chapter and an overview of the survey responses regarding each topic Christopher Nürk Michael A. Maier • Detailed materials supporting our findings Partner Automotive Director Strategy & Operations and explaining the impacts for the OEMs © 2014 Deloitte Consulting GmbH Table of Contents The global truck market outlook is optimistic Yet, slow growth in key markets will increase competition while growth is shifting 1. Executive Summary to new geographies 2. -

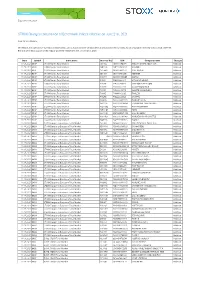

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU.