Westfield Group Annual Financial Report 31 December 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

All About Ping! All About Ping! E Work Aims To

all about Ping! all about ping! e work aims to Ping! is managed and delivered by Table Tennis England in partnership with local Follow us online: Facebook: www.facebook.co.uk/pingengland Twi er: @Ping_Croydon Website: www.pingcroydon.co.uk Play On Ping! doesn’t end in August. There are loads of places where you can keep on playing. Check out our website to help you connect with other Ping! f ans and to find places to play-on in your area by visi ng www.pingcroydon.co.uk/#playon Thank you for helPing! UK Table Tennis, Chris Challinger, Sing London, Sport England, White Label, Matthews Yard, the Croydon Steering Group, and all our table hosts, table minders and volunteers. 150255 all about PING! Croydon Ping! 22 JUNE – 21 August 2015 all about ping! 8 WEEKS e work aims to 15 TABLES Ping! is managed and delivered by Table Tennis England in partnership with local BATS & BALLS Follow us online: PROVIDED. Facebook: www.facebook.co.uk/pingengland Twi er: @Ping_Croydon Website: www.pingcroydon.co.uk HAVE A Play On Ping! doesn’t end in August. There are loads of places where you can keep on playing. BALL! Check out our website to help you connect with other Ping! f ans and to find places to play-on in your area by visi ng www.pingcroydon.co.uk/#playon Thank you for helPing! UK Table Tennis, Chris Challinger, Sing London, Sport England, White Label, Matthews Yard, the Croydon Steering Group, and all our table hosts, table minders and volunteers. k .co.u CROYDON .ping www PING! PONG random acts of ping! pong Ping! Launch Ping! at the platform Ping! Croydon launches on 22nd June Getting into the swing of Ping!? Fancy your (12:00-14:00) at the Whitgift Centre. -

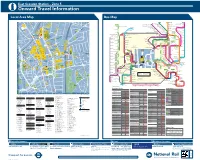

Local Area Map Bus Map

East Croydon Station – Zone 5 i Onward Travel Information Local Area Map Bus Map FREEMASONS 1 1 2 D PLACE Barrington Lodge 1 197 Lower Sydenham 2 194 119 367 LOWER ADDISCOMBE ROAD Nursing Home7 10 152 LENNARD ROAD A O N E Bell Green/Sainsbury’s N T C L O S 1 PA CHATFIELD ROAD 56 O 5 Peckham Bus Station Bromley North 54 Church of 17 2 BRI 35 DG Croydon R E the Nazarene ROW 2 1 410 Health Services PLACE Peckham Rye Lower Sydenham 2 43 LAMBERT’S Tramlink 3 D BROMLEY Bromley 33 90 Bell Green R O A St. Mary’s Catholic 6 Crystal Palace D A CRYSTAL Dulwich Library Town Hall Lidl High School O A L P H A R O A D Tramlink 4 R Parade MONTAGUE S S SYDENHAM ROAD O R 60 Wimbledon L 2 C Horniman Museum 51 46 Bromley O E D 64 Crystal Palace R O A W I N D N P 159 PALACE L SYDENHAM Scotts Lane South N R A C E WIMBLEDON U for National Sports Centre B 5 17 O D W Forest Hill Shortlands Grove TAVISTOCK ROAD ChCCheherherryerryrry Orchard Road D O A 3 Thornton Heath O St. Mary’s Maberley Road Sydenham R PARSON’S MEAD St. Mary’s RC 58 N W E L L E S L E Y LESLIE GROVE Catholic Church 69 High Street Sydenham Shortlands D interchange GROVE Newlands Park L Junior School LI E Harris City Academy 43 E LES 135 R I Croydon Kirkdale Bromley Road F 2 Montessori Dundonald Road 198 20 K O 7 Land Registry Office A Day Nursery Oakwood Avenue PLACE O 22 Sylvan Road 134 Lawrie Park Road A Trafalgar House Hayes Lane G R O V E Cantley Gardens D S Penge East Beckenham West Croydon 81 Thornton Heath JACKSON’ 131 PLACE L E S L I E O A D Methodist Church 1 D R Penge West W 120 K 13 St. -

RGS-IBG and AGI Response to Mayor Draft Transport Strategy

Consultation Response Mayor of London draft Transport Strategy Mayor of London/ Greater London Authority Consultation Date: 29 September 2017 Introduction The Royal Geographical Society (with the Institute of British Geographers) is the UK's learned society and professional body for geography, founded in 1830. We are dedicated to the development and promotion of geographical knowledge, together with its application to the challenges facing society and the environment. The Association for Geographic Information (AGI) is the membership organisation for the UK geospatial industry. The AGI exists to promote the knowledge and use of Geographic Information for the betterment of governance, commerce and the citizen. The AGI represent the interests of the UK's Geographic Information industry; a wide-ranging group of public and private sector organisations, suppliers of geographic information/ geospatial software, hardware, data and services, consultants, academics and interested individuals. The RGS-IBG and the AGI are responding jointly to this consultation to further a shared vision and mission to ensure that geography and geographic information is recognised as an important enabler to the world of big data that surrounds us in the digital economy, and is used more widely across the public, private and third sectors. Our submission has been developed in consultation with the RGS Transport Geography, Economic Geography, Geographies of Health and Wellbeing, Planning and Environmental and Urban Geography Research Groups and with AGI London and the AGI Environmental, Asset Management and Land and Property Special Interest Groups. We welcome this opportunity to provide our views on the draft Transport Strategy. Key Message Geography is a key determinant of transport and transport networks, therefore using robust locational intelligence can enable smarter and more efficient transport networks, infrastructure and services to be delivered. -

21,134 Sq Ft

21,134 SQ FT RARE URBAN WAREHOUSE UNIT UNDERGOING FULL REFURBISHMENT UNIT 4 AVAILABLE TO OCCUPY JUNE 2021 IN PRIME LONDON LOCATION SEGRO.com/ParkCanningTown WELL-PLACED FOR ACCESS TO PORTS CITY OF LONDON CANARY WHARF Unit 4 at SEGRO Park Canning Town provides 21,134 sq ft (1,963 sq m) of A12/A102 rare urban warehouse space in one of London’s most premium and well- connected city logistics parks. A406 NORTH CIRCULAR RD Here’s why a variety of businesses have already set up shop and called SEGRO Park Canning Town home: UNIT 4 A13 An enviable location in the heart Within walking distance of three Zone A406 NORTH CIRCULAR RD and bustle of East London 2/3 tube stations, making it an ideal location for workers on the estate A key location for London centric M25 J30 customers, SEGRO Park Canning With convenient links to London Town’s proximity to Canary Wharf Gateway and Tilbury Port, SEGRO Park and beyond makes it ideal for serving Canning Town provides direct access CANNING TOWN STATION a London market to the city’s large shipping network. STAR LANE STATION CLOSE PROXIMITY TO THE CITY IN THE HEART OF EAST LONDON BOREHAMWOOD ENFIELD WATFORD BARNET Unit 4 is undergoing a complete M1 A1 STAPLEFORD M11 ABBOTTS 4 refurbishment which will enhance A10 M25 2 NORTHWOOD EDGWARE employee wellbeing, exceed sustainability WOODFORD F U LLY standards and introduce new tech REFURBISHED 4 HARROW A12 innovations and solutions to create 1 A1 ROMFORD 1 a more holistic working environment. WEMBLEY HOLLOWAY STRATFORD A40 DAGENHAM A10 BARKING HAYES GREENFORD A13 -

Travel Tips United Kingdom

Travel Tips United Kingdom City Guide London London is the largest city in the United Kingdom and a leader in global finance, fashion, commerce and education. It has a population of 8.17 million people and is located in south-eastern part of Great Britain and lies along the banks of the River Thames. London dates back 2 millennia to Roman times when it was a northern outpost of the Roman Empire. Airports London has two major international airports, and the city is easily reached from both of them. Heathrow (LHR) Heathrow located 15 miles west of London and there are a wide variety of transportation options to bring you to the city center. The Underground is the cheapest option with a one way ticket costing at most £6 (US$9.5). It takes close to an hour to reach most destinations within central London. The Heathrow Express train is the fastest option and will bring you to Paddington station in between 15 and 20 min. It costs £34 (US$53) for a return ticket. If your destination is not in the Paddington area, the Underground may end up taking less time overall. Various bus companies operate to and from London, and prices usually average about £12 (US$19) for a return ticket. There are several coaches that operate to outlying areas such as Oxford if London is not your final destination. There is a taxi queue in front of the arrivals gate, and private “Mini-Cabs” can be ordered ahead of time. It usually costs between £50-100 (US$75-$155). -

Seele Project Map London

projects in london Current and completed seele-projects, you may visit in and around London. Madame Toussauds 01 36 37 41 Royal Albert Hall 39 40 42 Victoria & Albert Museum 13 British Museum 12 Buckingham Palace 38 Houses of Parliament 11 27 31 34 16 07 08 02 21 46 23 14 Westminster Abbey 17 26 28 22 06 09 18 15 19 25 29 32 London Eye 03 20 24 St Paul's Cathedral 33 43 30 44 Imperial War Museum 05 Tower of London 35 45 04 10 projects in london Current and completed seele-projects, you may visit in and around London. 01 Hendon Quadrangle (university) 10 Wimbledon No. 1 Court (tennis stadium) 19 Unilever House (office building) 28 19 – 31 Moorgate (office building) 36 intu Watford (shopping centre) 45 Cutty Sark (museum) steel-and-glass roof, lift enclosure, post-and-beam construction, atrium, glass fibre construction, unitised façade made out of steel-and-glass gridshell roof steel-and-glass enclosure of the gallery and staircase balustrades balustrades, door systems glazed west façade, roofing stone, glass and aluminium www.watford-shopping.co.uk hull www.mdx.ac.uk www.wimbledon.com www.unilever.com reception open to the public Watford High Street (Train) www.rmg.co.uk/cutty-sark Hendon Central Wimbledon Park reception open to the public Moorgate / Bank 210 Queen St, Watford Cutty Sark The Burroughs Church Rd, Wimbledon City Thameslink 19 – 31 Moorgate King William Walk / Greenwich se-austria / 2005 se-austria / 2019 seele GmbH / 2007 100 Victoria Embankment se-austria / 2002 se-austria / 2018 se-austria / 2012 02 Westfield (shopping -

The Bay Area-Silicon Valley and Australia an Expanding Trans-Pacific Partnership

The Bay Area-Silicon Valley and Australia An Expanding Trans-Pacific Partnership December 2020 Acknowledgments This report was developed in partnership with the Odette Hampton, Trade and Investment Commissioner American Chamber of Commerce in Australia, with and Deputy Consul General, Australian Trade and support from Cisco, Google, Lendlease, Salesforce, Investment Commission (Austrade) Telstra, University of Technology Sydney, and Wipro. Joe Hockey, Founding Partner and President, Bondi Development of the project was led by Sean Randolph, Partners, Australian Ambassador to the US, 2016–2020 Senior Director at the Bay Area Council Economic Institute. Neils Erich, a consultant to the Institute, Vikas Jain, Asia-Pacific Business Head for Engineering, was co-author. The Institute wishes to thank April Construction and Mining, Wipro Palmerlee, Chief Executive Officer of the American Claire Johnston, Managing Director, Google Chamber of Commerce in Australia, for her support Development Ventures, Lendlease throughout this effort and the following individuals for Joe Kaesshaefer, Trade and Investment Commissioner– their valuable input: USA, Department of Industry, New South Wales Jeff Bleich, Chief Legal Officer, Cruise, US Ambassador Michael Kapel, Trade and Investment Commissioner to to Australia 2009–2013 the Americas in San Francisco, Government of Victoria Michael Blumenstein, Associate Dean, Research Damian Kassabgi, Executive Vice President, Public Strategy and Management, Faculty of Engineering Policy and Communications, Afterpay and -

Whitgift CPO Inspector's Report

CPO Report to the Secretary of State for Communities and Local Government by Paul Griffiths BSc(Hons) BArch IHBC an Inspector appointed by the Secretary of State for Communities and Local Government Date: 13 July 2015 The Town and Country Planning Act 1990 The Local Government (Miscellaneous Provisions) Act 1976 The Acquisition of Land Act 1981 The London Borough of Croydon (Whitgift Centre and Surrounding Land bounded by and including parts of Poplar Walk, Wellesley Road, George Street and North End) Compulsory Purchase Order 2014 Inquiry opened on 3 February 2015 Accompanied Inspection was carried out on 3 February 2015 The London Borough of Croydon (Whitgift Centre and Surrounding Land bounded by and including parts of Poplar Walk, Wellesley Road, George Street and North End) Compulsory Purchase Order 2014 File Ref: NPCU/CPO/L5240/73807 CPO Report NPCU/CPO/L5240/73807 File Ref: NPCU/CPO/L5240/73807 The London Borough of Croydon (Whitgift Centre and Surrounding Land bounded by and including parts of Poplar Walk, Wellesley Road, George Street and North End) Compulsory Purchase Order 2014 The Compulsory Purchase Order was made under section 226(1)(a) and 226(3)(a) of the Town and Country Planning Act 1990, Section 13 of the Local Government (Miscellaneous Provisions) Act 1976, and the Acquisition of Land Act 1981, by the London Borough of Croydon, on 15 April 2014. The purposes of the Order are (a) facilitating the carrying out of development, redevelopment or improvement on or in relation to the land comprising the demolition of existing -

2020 Tax Return Guide

2020 Tax Return Guide Westfield Newmarket, NZ — Scentre Group Limited ABN 66 001 671 496 Scentre Management Limited ABN 41 001 670 579 AFS Licence 230329 as responsible entity of Scentre Group Trust 1 ABN 55 191 750 378 ARSN 090 849 746 RE1 Limited ABN 80 145 743 862 AFS Licence 380202 as responsible entity of Scentre Group Trust 2 ABN 66 744 282 872 ARSN 146 934 536 RE2 Limited ABN 41 145 744 065 AFS Licence 380203 as responsible entity of Scentre Group Trust 3 ABN 11 517 229 138 ARSN 146 934 652 This document does not constitute financial product or investment advice, and, in particular, it is not intended to influence you in making a decision in relation to financial products including Scentre Group Stapled Securities. You should obtain professional advice before taking any action in relation to this document, for example from your accountant, taxation or other professional adviser. About this Guide This 2020 Tax Return Guide (“Guide”) has been prepared to assist Australian resident individual securityholders to complete their 2020 Australian income tax return. This Guide provides general information Section 1 Important Information for only. Accordingly, this Guide should not be relied upon as taxation Australian Resident Individual advice. Each securityholder’s particular circumstances are different and we recommend you contact your accountant, taxation or other Securityholders Completing professional adviser for specific advice. a 2020 Tax Return This Tax Return Guide has two sections: General information - Scentre Group Scentre Group is a stapled group that comprises the following four Section 1 Provides information to assist entities: Australian resident individual - Scentre Group Limited (“SGL”) securityholders complete - Scentre Group Trust 1 (“SGT1”) their 2020 Australian income - Scentre Group Trust 2 (“SGT2”) tax return. -

Savills.Co.Uk/Retail Shaping Retail

Central London Retail savills.co.uk/retail Shaping Retail. Contents The Team 3 The Savills Approach 4 London 6 Crossrail 7 Track Record: Oxford Street 8 Track Record: Bond Street 10 Track Record: Old Spitalfields Market 12 Case Study: Nike Women’s Store 13 Track Record: APM Monaco 14 Case Study: Itsu 15 Bond Street 17 Dover Street and Albemarle Street 19 Mount Street and South Audley Street 21 South Molton Street 23 Conduit Street and Bruton Street 25 Regent Street 27 Oxford Street East 29 Oxford Street West 31 Marylebone High Street 33 Covent Garden: Neal Street 35 Covent Garden: Long Acre 37 Covent Garden: Seven Dials 39 Soho 41 King’s Road 43 Kensington High Street 45 Knightsbridge 47 Sloane Street and Sloane Square 49 South Kensington 51 Westbourne Grove 53 Spitalfields 55 Westfield Stratford 57 Westfield London 59 One Stop Shop 60 The Team Agency Lease Consultancy Anthony Selwyn Laura Salisbury-Jones Alan Spencer [email protected] [email protected] [email protected] +44 (0) 20 7758 3880 +44 (0) 20 7409 8830 +44 (0) 20 7758 3876 Peter Thomas Tiffany Luckett Paul Endicott [email protected] [email protected] [email protected] +44 (0) 20 7734 3443 +44 (0) 20 7758 3878 +44 (0) 20 7758 3879 Sam Foyle Benjamin Ashe Kristian Kendall [email protected] [email protected] [email protected] +44 (0) 20 7409 8171 +44 (0) 20 7758 3889 +44 (0) 20 7758 3881 Sarah Goldman James Fairley Daniel Aboud [email protected] [email protected] [email protected] +44 (0) 20 7758 3875 +44 (0) 20 7758 3877 +44 (0) 20 7758 3895 Oliver Green Claire Lakie [email protected] [email protected] +44 (0) 20 7758 3899 +44 (0) 20 7758 3896 Lance Marton Research [email protected] +44 (0) 20 7758 3884 Marie Hickey [email protected] +44 (0) 20 3320 8288 For general enquiries: [email protected] 3 The Savills Approach Savills Central London Retail team is recognised as a market leader within the sector and we have extensive experience in Central London, leasing and asset management and Landlord & Tenant matters. -

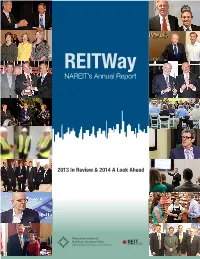

2014 PRINT NAREIT Annual Report Layout 1

REITWay NAREIT’s Annual Report 2013 In Review & 2014 A Look Ahead National Association of Real Estate Investment Trusts® REITs: Building Dividends & Diversification® 2014 REITWay NAREIT’s Annual Report 2 To Our Members The past year was active for NAREIT as we Stock Exchange-Listed took the REIT story to all of our industry’s REIT Capital Offerings, 2013 audiences. This 2014 issue of REITWay: IPOs NAREIT’S Annual Report re-caps some of what Secured and we accomplished on the REIT industry’s behalf Unsecured Debt $5.71 billion during the year. $30.74 billion Policy & Politics Secondary Total: In the Policy and Politics area, we began the Equity year with a highly effective Washington $40.51 billion $76.96 billion Leadership Forum. Our industry’s leaders climbed Capitol Hill to provide legislators and their staffs with a better understanding of the REIT investment proposition, including its history, the REITs in today’s mortgage finance marketplace, to the impact of important functions REITs play in investment portfolios, their rising interest rates on REIT total returns. We also continued to channeling of capital to the real estate industry, and their role upgrade and expand our REIT.com online platform and our other creating jobs and economic growth. digital properties. Over the course of the year, our Policy & Politics team provided Additionally, we conducted a full schedule of successful constructive input to the ongoing discussion on tax reform, conference events for our members, including our major including input to the House Ways and Means Committee and investor conferences, REITWeek and REITWorld. -

London Borough of Croydon

LONDON BOROUGH OF CROYDON THE LONDON BOROUGH OF CROYDON (WHITGIFT CENTRE AND SURROUNDING LAND BOUNDED BY AND INCLUDING PARTS OF POPLAR WALK, WELLESLEY ROAD, GEORGE STREET AND NORTH END) COMPULSORY PURCHASE ORDER 2014 SECTION 226(1)(a) AND 226(3)(a) OF THE TOWN AND COUNTRY PLANNING ACT 1990 AND SECTION 13 THE LOCAL GOVERNMENT (MISCELLANEOUS PROVISIONS) ACT 1976 AND THE ACQUISITION OF LAND ACT 1981 STATEMENT OF REASONS OF THE LONDON BOROUGH OF CROYDON FOR MAKING THE COMPULSORY PURCHASE ORDER TABLE OF CONTENTS Page 1 INTRODUCTION 1 2 THE ENABLING POWERS FOR THE CPO 2 3 BACKGROUND 3 4 DESCRIPTION OF THE ORDER LAND, LOCATION AND NEW RIGHTS 6 5 CROYDON LIMITED PARTNERSHIP 12 6 DESCRIPTION OF THE SCHEME 14 7 THE COUNCIL'S PURPOSE AND JUSTIFICATION IN MAKING THE ORDER 19 8 STATUS OF ORDER LAND AND THE EXTENT TO WHICH THE SCHEME FITS WITH PLANNING FRAMEWORK 31 9 WELL-BEING OBJECTIVES AND THE COUNCIL'S SUSTAINABLE COMMUNITY STRATEGY 39 10 SPECIAL CONSIDERATIONS AFFECTING THE ORDER LAND 41 11 HUMAN RIGHTS CONSIDERATIONS 41 12 EQUALITY ACT 2010 43 13 OTHER RELEVANT INFORMATION 45 15 INQUIRY PROCEDURE RULES 46 16 DOCUMENTS TO BE REFERRED TO OR PUT IN EVIDENCE IN THE EVENT OF AN INQUIRY 46 1. INTRODUCTION 1.1 On 7 April 2014 the London Borough of Croydon (the "Council") resolved to make the London Borough of Croydon (Whitgift Centre and surrounding land bounded by and including parts of Poplar Walk, Wellesley Road, George Street and North End) Compulsory Purchase Order 2014 (the "Order"). The Order has been made under section 226(1)(a) of the Town