A Case Study of Small and Medium Forest Enterprise Development in Zhejiang Province

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ningbo Facts

World Bank Public Disclosure Authorized Climate Resilient Ningbo Project Local Resilience Action Plan 213730-00 Final | June 2011 Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized 213730-00 | Draft 1 | 16 June 2011 110630_FINAL REPORT.DOCX World Bank Climate Resilient Ningbo Project Local Resilience Action Plan Contents Page 1 Executive Summary 4 2 Introduction 10 3 Urban Resilience Methodology 13 3.1 Overview 13 3.2 Approach 14 3.3 Hazard Assessment 14 3.4 City Vulnerability Assessment 15 3.5 Spatial Assessment 17 3.6 Stakeholder Engagement 17 3.7 Local Resilience Action Plan 18 4 Ningbo Hazard Assessment 19 4.1 Hazard Map 19 4.2 Temperature 21 4.3 Precipitation 27 4.4 Droughts 31 4.5 Heat Waves 32 4.6 Tropical Cyclones 33 4.7 Floods 35 4.8 Sea Level Rise 37 4.9 Ningbo Hazard Analysis Summary 42 5 Ningbo Vulnerability Assessment 45 5.1 People 45 5.2 Infrastructure 55 5.3 Economy 69 5.4 Environment 75 5.5 Government 80 6 Gap Analysis 87 6.1 Overview 87 6.2 Natural Disaster Inventory 87 6.3 Policy and Program Inventory 89 6.4 Summary 96 7 Recommendations 97 7.1 Overview 97 7.2 People 103 7.3 Infrastructure 106 213730-00 | Draft 1 | 16 June 2011 110630_FINAL REPORT.DOCX World Bank Climate Resilient Ningbo Project Local Resilience Action Plan 7.4 Economy 112 7.5 Environment 115 7.6 Government 118 7.7 Prioritized Recommendations 122 8 Conclusions 126 213730-00 | Draft 1 | 16 June 2011 110630_FINAL REPORT.DOCX World Bank Climate Resilient Ningbo Project Local Resilience Action Plan List of Tables Table -

Risk Factors for Carbapenem-Resistant Pseudomonas Aeruginosa, Zhejiang Province, China

Article DOI: https://doi.org/10.3201/eid2510.181699 Risk Factors for Carbapenem-Resistant Pseudomonas aeruginosa, Zhejiang Province, China Appendix Appendix Table. Surveillance for carbapenem-resistant Pseudomonas aeruginosa in hospitals, Zhejiang Province, China, 2015– 2017* Years Hospitals by city Level† Strain identification method‡ excluded§ Hangzhou First 17 People's Liberation Army Hospital 3A VITEK 2 Compact Hangzhou Red Cross Hospital 3A VITEK 2 Compact Hangzhou First People’s Hospital 3A MALDI-TOF MS Hangzhou Children's Hospital 3A VITEK 2 Compact Hangzhou Hospital of Chinese Traditional Hospital 3A Phoenix 100, VITEK 2 Compact Hangzhou Cancer Hospital 3A VITEK 2 Compact Xixi Hospital of Hangzhou 3A VITEK 2 Compact Sir Run Run Shaw Hospital, School of Medicine, Zhejiang University 3A MALDI-TOF MS The Children's Hospital of Zhejiang University School of Medicine 3A MALDI-TOF MS Women's Hospital, School of Medicine, Zhejiang University 3A VITEK 2 Compact The First Affiliated Hospital of Medical School of Zhejiang University 3A MALDI-TOF MS The Second Affiliated Hospital of Zhejiang University School of 3A MALDI-TOF MS Medicine Hangzhou Second People’s Hospital 3A MALDI-TOF MS Zhejiang People's Armed Police Corps Hospital, Hangzhou 3A Phoenix 100 Xinhua Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Provincial People's Hospital 3A MALDI-TOF MS Zhejiang Provincial Hospital of Traditional Chinese Medicine 3A MALDI-TOF MS Tongde Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Hospital 3A MALDI-TOF MS Zhejiang Cancer -

Analysis of Character Convergence of Jiangnan Ancient Towns Lei Yunyao , Zhang Qiongfang

International Forum on Management, Education and Information Technology Application (IFMEITA 2016) Analysis of Character Convergence of Jiangnan Ancient Towns Lei Yunyao1, a, Zhang Qiongfang 1,b 1 Wuchang Shouyi University, Wuhan 430064 China [email protected], b [email protected] Key Words:Jiangnan Ancient Towns; Character convergence; Analysis Abstract:This article illustrates the representation of character convergence of Jiangnan Ancient Towns. It analyzes the formation mechanism of character convergence to build the whole image of these ancient towns with Zhouzhuang as a prototype. Based on Tourism Geography Theory and Regional Linkage Theory, it puts forward the fact that the character convergence can be beneficial to building a whole tourism image and to enhancing people’s awareness of ancient heritage. But some problems caused by the convergence will also be presented, such as the identical tourism development model, the backward infrastructure and the destruction of original ecology. Introduction With Taihu Lake as the center, the region of Jiangnan, the south of the lower reaches of the Yangtze River, is scattered all over by many historic ancient towns. These towns have a long history and deep cultural deposit. They are densely occupied and economically developed. They form a national transport network combined with inland waterway. These towns have witnessed a long-term economic prosperity in the south of the lower reaches of the Yangtze River and are now generally called “Jiangnan Ancient Towns”. Since 1980s, under the wave of reform, opening up and modernization construction, experience-based tourism and leisure tourism of these towns have achieved great development. Under the influence of “China's First Water Town” Zhouzhuang, some other similar towns like Tongli, Luzhi, Xitang, Nanxun, Wuzhen all choose to follow suit. -

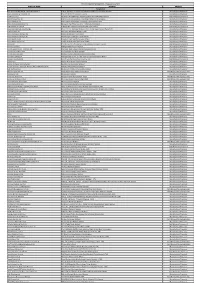

Factory List to Demonstrate Our Pledge to Transparency

ASOS is committed to Fashion With Integrity and as such we have decided to publish our factory list to demonstrate our pledge to transparency. This factory list will be refreshed every three months to ensure that as we go through mapping it is continually up to date. This factory list does not include factories inherited from acquisitions made in February 2021. We are working hard to consolidate this supply base, and look forward to including these additional factories in our factory list once this is complete. Please see our public statement for our approach to the Topshop, Topman, Miss Selfridge and HIIT supply chains https://www.asosplc.com/~/media/Files/A/Asos-V2/reports-and- presentations/2021/asos-approach-to-the-topshop-topman-miss-selfridge-and-hiit- supply-chains.pdf Please direct any queries to [email protected] More information can be found in our ASOS Modern Slavery statement https://www.asosplc.com/~/media/Files/A/Asos- V2/ASOS%20Modern%20Slavery%20Statement%202020-21.pdf 31st May 2021 Number of Female Factory Name Address Line Country Department Male Workers Workers Workers 2010 Istanbul Tekstil San Ve Namik Kemal Mahallesi, Adile Nasit Bulvari 151, Sokak No. 161, B Turkey Apparel 150-300 53% 47% Dis Tic Ltd Sti Blok Kat1, Esenyurt, Istanbul, 34520 20th Workshop of Hong Floor 3, Building 16, Gold Bi Industrial, Yellow Tan Management Guang Yang Vacuum China Accessories 0-150 52% 48% District, Shenzhen, Guangdong, 518128 Technology Co., Ltd. (Nasihai) 359 Limited (Daisytex) 1 Ivan Rilski Street, Koynare, Pleven, 5986 -

A Survey of Marine Coastal Litters Around Zhoushan Island, China and Their Impacts

Journal of Marine Science and Engineering Article A Survey of Marine Coastal Litters around Zhoushan Island, China and Their Impacts Xuehua Ma 1, Yi Zhou 1, Luyi Yang 1 and Jianfeng Tong 1,2,3,* 1 College of Marine Science, Shanghai Ocean University, Shanghai 201306, China; [email protected] (X.M.); [email protected] (Y.Z.); [email protected] (L.Y.) 2 National Engineering Research Center for Oceanic Fisheries, Shanghai 201306, China 3 Experimental Teaching Demonstration Center for Marine Science and Technology, Shanghai Ocean University, Shanghai 201306, China * Correspondence: [email protected] Abstract: Rapid development of the economy increased marine litter around Zhoushan Island. Social- ecological scenario studies can help to develop strategies to adapt to such change. To investigate the present situation of marine litter pollution, a stratified random sampling (StRS) method was applied to survey the distribution of marine coastal litters around Zhoushan Island. A univariate analysis of variance was conducted to access the amount of litter in different landforms that include mudflats, artificial and rocky beaches. In addition, two questionnaires were designed for local fishermen and tourists to provide social scenarios. The results showed that the distribution of litter in different landforms was significantly different, while the distribution of litter in different sampling points had no significant difference. The StRS survey showed to be a valuable method for giving a relative overview of beach litter around Zhoushan Island with less effort in a future survey. The questionnaire feedbacks helped to understand the source of marine litter and showed the impact on the local environment and economy. -

The Superfamily Calopterygoidea in South China: Taxonomy and Distribution. Progress Report for 2009 Surveys Zhang Haomiao* *PH D

International Dragonfly Fund - Report 26 (2010): 1-36 1 The Superfamily Calopterygoidea in South China: taxonomy and distribution. Progress Report for 2009 surveys Zhang Haomiao* *PH D student at the Department of Entomology, College of Natural Resources and Environment, South China Agricultural University, Guangzhou 510642, China. Email: [email protected] Introduction Three families in the superfamily Calopterygoidea occur in China, viz. the Calo- pterygidae, Chlorocyphidae and Euphaeidae. They include numerous species that are distributed widely across South China, mainly in streams and upland running waters at moderate altitudes. To date, our knowledge of Chinese spe- cies has remained inadequate: the taxonomy of some genera is unresolved and no attempt has been made to map the distribution of the various species and genera. This project is therefore aimed at providing taxonomic (including on larval morphology), biological, and distributional information on the super- family in South China. In 2009, two series of surveys were conducted to Southwest China-Guizhou and Yunnan Provinces. The two provinces are characterized by karst limestone arranged in steep hills and intermontane basins. The climate is warm and the weather is frequently cloudy and rainy all year. This area is usually regarded as one of biodiversity “hotspot” in China (Xu & Wilkes, 2004). Many interesting species are recorded, the checklist and photos of these sur- veys are reported here. And the progress of the research on the superfamily Calopterygoidea is appended. Methods Odonata were recorded by the specimens collected and identified from pho- tographs. The working team includes only four people, the surveys to South- west China were completed by the author and the photographer, Mr. -

Tonatory Patterns in Taizhou Wu Tones

TONATORY PATTERNS IN TAIZHOU WU TONES Phil Rose Emeritus Faculty, Australian National University [email protected] ABSTRACT 台州 subgroup of Wu to which Huángyán belongs. The issue has significance within descriptive Recordings of speakers of the Táizhou subgroup of tonetics, tonatory typology and historical linguistics. Wu Chinese are used to acoustically document an Wu dialects – at least the conservative varieties – interaction between tone and phonation first attested show a wide range of tonatory behaviour [11]. One in 1928. One or two of their typically seven or eight finds breathy or ventricular phonation in groups of tones are shown to have what sounds like a mid- tones characterising natural tonal classes of Rhyme glottal-stop, thus demonstrating a new importance for phonotactics and Wu’s complex tone pattern in Wu tonatory typology. Possibly reflecting sandhi. One also finds a single tone characterised by gradual loss, larygealisation appears restricted to the a different non-modal phonation type [12]; or even north and north-west, and is absent in Huángyán two different non-modal phonation types in two dialect where it was first described. A perturbatory tones. However, the Huangyan-type tonation seems model of the larygealisation is tested in an to involve a new variation, with the same phonation experiment determining how much of the complete type in two different tones from the same historical tonal F0 contour can be restored from a few tonal category, thus prompting speculation that it centiseconds of modal F0 at Rhyme onset and offset. developed before the tonal split. The results are used both to acoustically quantify laryngealised tonal F0, with its problematic jitter and 2. -

Climate Research 57:123

Vol. 57: 123–132, 2013 CLIMATE RESEARCH Published August 20 doi: 10.3354/cr01174 Clim Res Extreme sea ice events in the Chinese marginal seas during the past 2000 years Jie Fei1,2,*, Zhong-Ping Lai2,3, David D. Zhang4, Hong-Ming He5 1Institute of Chinese Historical Geography, Fudan University, Shanghai 200433, PR China 2State Key Laboratory of Cryospheric Sciences (CAREERI), Chinese Academy of Sciences, Lanzhou 730000, PR China 3Qinghai Institute of Salt Lakes, Chinese Academy of Sciences, Xining 810008, PR China 4Department of Geography, The University of Hong Kong, Hong Kong SAR 5Institute of Soil and Water Conservation, Chinese Academy of Sciences & Ministry of Water Resources, Yangling District 712100, PR China ABSTRACT: We used Chinese historical literature to examine extreme records of sea ice events in the Chinese marginal seas during the past 2000 yr. We identified a total of 6 sea ice events that occurred in the sea areas to the south of 35° N. These extreme events occurred in the winters of AD 821/822, 903/904, 1453/1454, 1493/1494, 1654/1655 and 1670/1671. According to the histori- cal records, the southern limit of sea ice in the Chinese marginal seas should be in Hangzhou Bay (30−31° N), and most probably near Haiyan County in Zhejiang Province (30.5° N). The sea ice events of 1453/1454 and 1654/1655 were synchronous with the freezing events of Taihu Lake, and the sea ice event of 1670/1671 was synchronous with the freezing event of the lower reaches of the Yangtze River. However, none of the sea ice events was synchronous with the abnormally early freezing dates of Suwa Lake in Japan or the extreme freezing events of Venice Lagoon in Italy. -

Shop Direct Factory List Dec 18

Factory Factory Address Country Sector FTE No. workers % Male % Female ESSENTIAL CLOTHING LTD Akulichala, Sakashhor, Maddha Para, Kaliakor, Gazipur, Bangladesh BANGLADESH Garments 669 55% 45% NANTONG AIKE GARMENTS COMPANY LTD Group 14, Huanchi Village, Jiangan Town, Rugao City, Jaingsu Province, China CHINA Garments 159 22% 78% DEEKAY KNITWEARS LTD SF No. 229, Karaipudhur, Arulpuram, Palladam Road, Tirupur, 641605, Tamil Nadu, India INDIA Garments 129 57% 43% HD4U No. 8, Yijiang Road, Lianhang Economic Development Zone, Haining CHINA Home Textiles 98 45% 55% AIRSPRUNG BEDS LTD Canal Road, Canal Road Industrial Estate, Trowbridge, Wiltshire, BA14 8RQ, United Kingdom UK Furniture 398 83% 17% ASIAN LEATHERS LIMITED Asian House, E. M. Bypass, Kasba, Kolkata, 700017, India INDIA Accessories 978 77% 23% AMAN KNITTINGS LIMITED Nazimnagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 1708 60% 30% V K FASHION LTD formerly STYLEWISE LTD Unit 5, 99 Bridge Road, Leicester, LE5 3LD, United Kingdom UK Garments 51 43% 57% AMAN GRAPHIC & DESIGN LTD. Najim Nagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 3260 40% 60% WENZHOU SUNRISE INDUSTRIAL CO., LTD. Floor 2, 1 Building Qiangqiang Group, Shanghui Industrial Zone, Louqiao Street, Ouhai, Wenzhou, Zhejiang Province, China CHINA Accessories 716 58% 42% AMAZING EXPORTS CORPORATION - UNIT I Sf No. 105, Valayankadu, P. Vadugapal Ayam Post, Dharapuram Road, Palladam, 541664, India INDIA Garments 490 53% 47% ANDRA JEWELS LTD 7 Clive Avenue, Hastings, East Sussex, TN35 5LD, United Kingdom UK Accessories 68 CAVENDISH UPHOLSTERY LIMITED Mayfield Mill, Briercliffe Road, Chorley Lancashire PR6 0DA, United Kingdom UK Furniture 33 66% 34% FUZHOU BEST ART & CRAFTS CO., LTD No. 3 Building, Lifu Plastic, Nanshanyang Industrial Zone, Baisha Town, Minhou, Fuzhou, China CHINA Homewares 44 41% 59% HUAHONG HOLDING GROUP No. -

The LEGO Jiaxing Factory the LEGO JIAXING FACTORY the LEGO JIAXING FACTORY Our Innovating Introduction Commitment for Children

The LEGO Jiaxing Factory THE LEGO JIAXING FACTORY THE LEGO JIAXING FACTORY Our Innovating Introduction commitment for children The LEGO Group is a privately held, family-owned company with headquarters We are committed to emphasising play as a LEGO® play experiences enable learning in Billund (Denmark) and main offices in Enfield (USA), London (UK), Shanghai significant contributor to children’s development. through play by encouraging children to reason (China), and Singapore. Founded in 1932 by Ole Kirk Kristiansen, and based on Play has a profound impact on children’s social, systematically and think creatively. The LEGO the iconic LEGO® brick, it is one of the world’s leading manufacturers of emotional and cognitive skills. This is why all LEGO® System in Play is universally appealing and has creative play materials. play experiences are based on the underlying unlimited possibilities. It encourages children philosophy of learning and development through around the world to engage in fun and creative play play. It is also why we remain focused on providing and allows them to build anything they can imagine. fun and engaging play materials of the highest quality and safety to children. All LEGO products are developed in Denmark by more than 250 designers that represent 35 different Children’s best interests and well-being have always nationalities. While our designers have solid insight been at the very core of our values: Imagination into children’s play patterns and interests, our most – Creativity – Fun – Learning – Caring – Quality. valuable insight comes from children themselves. Our core values are important to us not only We include children in concept and product testing because they define who we are as a company and phases as an integrated part of our product what we stand for, but also because they guide us innovation cycle. -

Chapter 2 Beijing's Internal and External Challenges

CHAPTER 2 BEIJING’S INTERNAL AND EXTERNAL CHALLENGES Key Findings • The Chinese Communist Party (CCP) is facing internal and external challenges as it attempts to maintain power at home and increase its influence abroad. China’s leadership is acutely aware of these challenges and is making a concerted effort to overcome them. • The CCP perceives Western values and democracy as weaken- ing the ideological commitment to China’s socialist system of Party cadres and the broader populace, which the Party views as a fundamental threat to its rule. General Secretary Xi Jin- ping has attempted to restore the CCP’s belief in its founding values to further consolidate control over nearly all of China’s government, economy, and society. His personal ascendancy within the CCP is in contrast to the previous consensus-based model established by his predecessors. Meanwhile, his signature anticorruption campaign has contributed to bureaucratic confu- sion and paralysis while failing to resolve the endemic corrup- tion plaguing China’s governing system. • China’s current economic challenges include slowing econom- ic growth, a struggling private sector, rising debt levels, and a rapidly-aging population. Beijing’s deleveraging campaign has been a major drag on growth and disproportionately affects the private sector. Rather than attempt to energize China’s econo- my through market reforms, the policy emphasis under General Secretary Xi has shifted markedly toward state control. • Beijing views its dependence on foreign intellectual property as undermining its ambition to become a global power and a threat to its technological independence. China has accelerated its efforts to develop advanced technologies to move up the eco- nomic value chain and reduce its dependence on foreign tech- nology, which it views as both a critical economic and security vulnerability. -

TIER2 SITE NAME ADDRESS PROCESS M Ns Garments Printing & Embroidery

TIER 2 MANUFACTURING SITES - Produced July 2021 TIER2 SITE NAME ADDRESS PROCESS Bangladesh Mns Garments Printing & Embroidery (Unit 2) House 305 Road 34 Hazirpukur Choydana National University Gazipur Manufacturer/Processor (A&E) American & Efird (Bd) Ltd Plot 659 & 660 93 Islampur Gazipur Manufacturer/Processor A G Dresses Ltd Ag Tower Plot 09 Block C Tongi Industrial Area Himardighi Gazipur Next Branded Component Abanti Colour Tex Ltd Plot S A 646 Shashongaon Enayetnagar Fatullah Narayanganj Manufacturer/Processor Aboni Knitwear Ltd Plot 169 171 Tetulzhora Hemayetpur Savar Dhaka 1340 Manufacturer/Processor Afrah Washing Industries Ltd Maizpara Taxi Track Area Pan - 4 Patenga Chottogram Manufacturer/Processor AKM Knit Wear Limited Holding No 14 Gedda Cornopara Ulail Savar Dhaka Next Branded Component Aleya Embroidery & Aleya Design Hose 40 Plot 808 Iqbal Bhaban Dhour Nishat Nagar Turag Dhaka 1230 Manufacturer/Processor Alim Knit (Bd) Ltd Nayapara Kashimpur Gazipur 1750 Manufacturer/Processor Aman Fashions & Designs Ltd Nalam Mirzanagar Asulia Savar Manufacturer/Processor Aman Graphics & Design Ltd Nazimnagar Hemayetpur Savar Dhaka Manufacturer/Processor Aman Sweaters Ltd Rajaghat Road Rajfulbaria Savar Dhaka Manufacturer/Processor Aman Winter Wears Ltd Singair Road Hemayetpur Savar Dhaka Manufacturer/Processor Amann Bd Plot No Rs 2497-98 Tapirbari Tengra Mawna Shreepur Gazipur Next Branded Component Amantex Limited Boiragirchala Sreepur Gazipur Manufacturer/Processor Ananta Apparels Ltd - Adamjee Epz Plot 246 - 249 Adamjee Epz Narayanganj