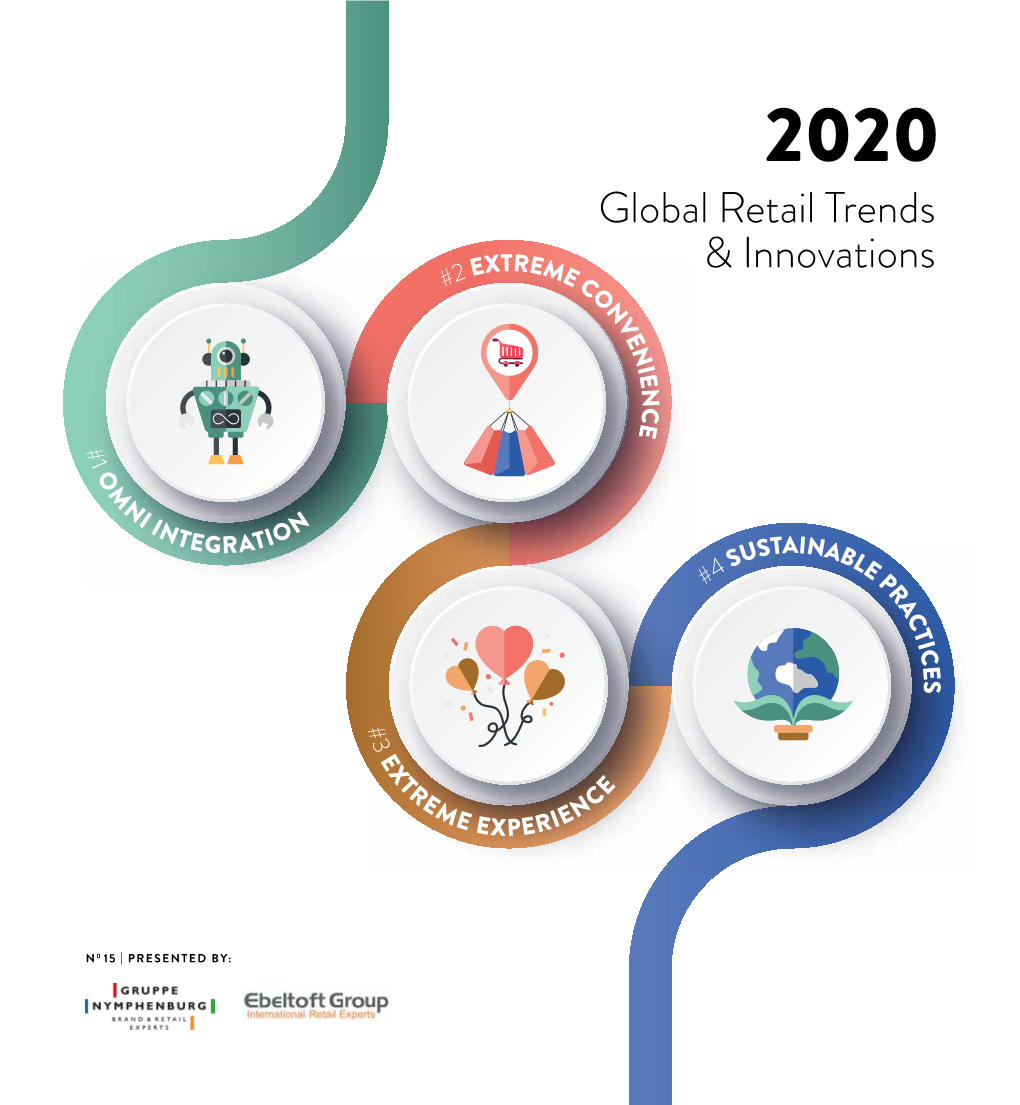

Global Retail Trends & Innovations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Closeby Deborah Patton

OPINIONATED • OUTSPOKEN • UNBIASED THE FALL 2015 GLOBAL REPORTS FROM BRAZIL, CUBA, ITALY AND MEXICO PAGES 17,18,23,32,42 MILLENNIALS: TALKING LUXURY AND THE WORKPLACE OF THE FUTURE PAGES 8, 40 COSTCOHOLICS 75 MILLION ADDICTS AND COUNTING PAGE 3 / 1 TOC Featured Contributors: RANDY BURT VISHWA CHANDRA NADIA SHOURABOURA Randy Burt is a Partner in the Consumer Goods Vishwa Chandra is a Partner in Dr. Nadia Shouraboura is a retail and Retail Practice at A.T. Kearney, a global A.T. Kearney's Consumer Goods and revolutionary. She holds a Ph.D. in strategy and management consulting firm. Retail Practice, where he partners Mathematics from Princeton University, He has over 16 years of experience in consumer with food, mass, drug and value has extensive retail and technology products and Food Retailing with focus on retail retailers to drive merchandising experience, and was former head of strategy, Fresh and Center Store merchandising, effectiveness and supply chain Supply Chain and Fulfillment Technolo- ecommerce, and supply chain. He also spent efficiency. He is also a leader in the gies for Amazon.com. Nadia also served five years at the Nielsen Company in a variety firm's Consumer institute, where he on Jeff Bezos's senior leadership team, of market research and data operations roles. leads primary research on the ever which was responsible for overall He is a regular speaker and author on online evolving consumer landscape and direction and operations of Amazon. grocery and other food retail topics. its implications for retailers. CEO, EDITORIAL -

Amazon Case Study

Last updated: August 2002 Amazon.com Case Update Amazon.com Inc. (stock: AMZN) is undoubtedly the poster child for Internet retail businesses. It is the No. 1 Internet retailer of books, music, DVDs and videos, and has 26 million active customers in more than 220 countries as of first quarter 2002. In 2001, Interbrand's annual World's Most Valuable Brands survey ranked Amazon.com as the 76th most valuable brand in the world, ahead of Burger King and Shell, among others. According to MMXI Europe Audience Ratings Report, the Amazon.co.uk, Amazon.de and parent Amazon.com site are the top three online retail sites in Europe, based on reach. Amazon's founder and chairman, Jeff Bezos, was Time magazine's "Man of the Year" in 1999. Amazon.com has evolved from an online bookseller to a general merchant, and today is the largest online retailer. It claims that it has “the Earth’s biggest selection” of products in categories such as books, music, DVDs, videos, toys, electronics, software, video games, lawn and patio, kitchen and home improvement. The company has also created Web-based marketplaces, including Amazon Marketplace, Amazon.com Auctions and zShops, where businesses or individuals can sell virtually anything. The Amazon.com family of websites also includes Internet Movie Database (www.imdb.com), a comprehensive source of information on more than 300,000 movies and entertainment programs and 1 million cast and crew members dating from 1892 to the present. Amazon Anywhere (www.amazon.com/anywhere) marks the company's entrance into mobile e-commerce. -

Inventaire Au 31 12 2010-1

Inventaire commercial au 31 décembre 2010 Code Postal Commune Activité Enseigne Adresse Surface totale 69550 AMPLEPUIS Meubles SIMONET 7 rue de l'Egalité 400 69550 AMPLEPUIS Equipt-foyer-sauf-luminaires B&B-MILLE-ET-UNE-IDEES CHEMIN DE LA GAIETE 700 69550 AMPLEPUIS Supermarché ED CHEMIN DE LA GAIETE 681 69550 AMPLEPUIS Supermarché CARREFOUR-MARKET IMPASSE EDOUARD BRANLY 1800 69550 AMPLEPUIS Supermarché CARREFOUR-MARKET pres de la cloche 1800 69550 AMPLEPUIS Supermarché INTERMARCHE ROUTE DE ROANNE 1200 69550 AMPLEPUIS Fleurs-jardinerie GAMM-VERT RUE BRANLY 1125 69550 AMPLEPUIS Electroménager-Hifi-TV MOOS-ELECTROMENAGER ZI EDOUARD BRANLY 379 69550 AMPLEPUIS Vente-auto-neuves-occasions LEPINE ZI LA GAIETE 1900 69550 AMPLEPUIS Textiles LINGERIE-DES-FLANDRES ZONE COMMERCIALE LA GAIETE 500 69420 AMPUIS Meubles PANORAMA RN 86 1100 69480 ANSE Supermarché LEADER-PRICE AVENUE DE LA 1ERE ARMEE 480 69480 ANSE Meubles VANNERIE-CALADOISE LA LOGERE 350 69480 ANSE Vte-carav-autocarav-remorques SPORT-PLEIN-AIR RTE NATIONALE 3070 69480 ANSE Mag-non-spéc-non-alim CETRAM RTE NATIONALE 6 850 69480 ANSE Fleurs-jardinerie JARDILAND ZAC DE LA FONTAINE 5600 69480 ANSE Supermarché CARREFOUR-MARKET Zac Pré aux Moutons 1870 69210 ARBRESLE Bricolage-avec-jardinerie L'ARBRESL'LOISIRS 2 RUE EMILE FOURNIER 658 69210 ARBRESLE Habillement DEFI-MODE 243 route de Sain Bel 1400 69210 ARBRESLE Equipt-foyer-sauf-luminaires GIFI 243 route de Sain Bel 1400 69210 ARBRESLE Equipt-foyer-sauf-luminaires PLAISIR-D'OFFRIR 264,RTE DE SAIN-BEL 400 69210 ARBRESLE Bricolage-sans-jardinerie -

Datecdec Situation Du Projet Projet Decis Cdec Recours

'$7(&'(& 6,78$7,21 352-(7 '(&,6 5(&2856 '$7(&1(& '(&,6 &1(& '8352-(7 &'(& Extension de 3200 m² la surface de vente du magasin BRIE COMTE ROBERT – ZAC du LEROY MERLIN à BRIE COMTE ROBERT Tuboeuf -ZAC du Tuboeuf, rue de la Butte au Berger- selon la DXWRULVDWLRQ répartition suivante : PðH[WpULHXUV (par le libre accès de la clientèle dans la cour de matériaux agrandie de 323 m²) et PðSRXUOHPDJDVLQ (la surface couverte passera de 5800 m² à 6200 m², la surface extérieure sera de 2800 m² , la surface de show room de 195 m² est inchangée ) La surface de vente globale passera donc de 5995 à 9195 m² (SA LEROY MERLIN France) PROVINS , 15-17 avenue du Extension de 651 m² la surface de vente du magasin Maréchal de Lattre de Tassigny INTERMARCHE (2499 m² après extension) DXWRULVDWLRQ (SA PROVINS DISTRIBUTION (PRODIS) ) PROVINS -3, avenue de la Voulzie Extension de de 300 m² la surface de vente (1000 m² (partie de l’ex local BUT) après extension) du magasin d’équipement de la personne à l’enseigne DEFI MODE DXWRULVDWLRQ (SA JMP EXPANSION) MAREUIL LES MEAUX, lieudit Création d’un ensemble de trois magasins d’une surface de la Hayette, 79, rue des Montaubans vente totale de 1880 m² comprenant un magasin à (ancien site JARDILAND) l’enseigne MAXI TOYS (jeux et jouets) de 800 m², un DXWRULVDWLRQ magasin à l’enseigne AUBERT (puériculture et layette) de 550 m² et un magasin à l’enseigne CASA (arts de la table et décoration) de 530 m² (Sarl PAGESTIM) '$7(&'(& 6,78$7,21 352-(7 '(&,6 5(&2856 '$7(&1(& '(&,6 &1(& '8352-(7 &'(& extension de 290 m² la surface de vente (1440 m² après DAMMARIE LES LYS extension) du magasin de meubles FLY –Rue A. -

E-Commerce and Its Impact on Competition Policy and Law in Singapore

E-commerce and its impact on competition policy and law in Singapore A DotEcon study for the Competition Commission of Singapore Final Report – October 2015 DotEcon Ltd 17 Welbeck Street London W1G 9XJ www.dotecon.com Content Content 1 Introduction ................................................................................................................. 1 2 E-commerce activity in Singapore ............................................................................... 4 2.1 An introduction to e-commerce ........................................................................... 4 2.2 E-commerce adoption in Singapore ................................................................... 17 3 E-commerce and competition .................................................................................... 38 3.1 What changes with e-commerce? ...................................................................... 38 3.2 The impact of e-commerce on market boundaries ............................................. 59 3.3 The impact of e-commerce on market structure and competition ...................... 65 3.4 Vertical restraints ............................................................................................... 77 4 Implications of e-commerce for competition policy in Singapore .............................. 83 4.1 Defining a relevant market ................................................................................. 84 4.2 Assessing market power ................................................................................... -

Le Renouvellement Du Parc D'entrepôt En Ile-De-France

Le renouvellement du parc d’entrepôts en Ile-de-France Rapport final de l’étude Avertissement Le rapport final ainsi que le rapport de synthèse de l'étude sont le résultat d'un travail exploratoire. Les auteurs s'y sont engagés sous leur propre responsabilité et les avis émis ne sauraient engager la DRIEA. On reste convaincu qu'ils apportent à ceux qui préparent l'avenir de la région des connaissances utiles à tous, même si les avis exprimés n'engagent évidemment que leurs auteurs. Crédits photos : © DRIEA - Jean-Marie Gobry, Daniel Guiho Le renouvellement du parc d’entrepôts en Ile-de-France SAMARCANDE TLT - SCET – pour la DRIEA Cette étude a été réalisée par Samarcande sous la direction de Philippe DUONG, avec : Eric DEROCHE, SCET Didier BERNATEAU, SCET Frédéric MEYNARD, SCET Charlotte JACQUOT, SCET Christophe RENARD, SAMARCANDE Renaud KOURLAND, SAMARCANDE Introduction 2 Le renouvellement du parc d’entrepôts en Ile-de-France SAMARCANDE TLT - SCET – pour la DRIEA Introduction................................................................................ 6 1. La démographie du parc immobilier logistique francilien ....... 8 1.1. La dynamique de construction d’entrepôts entre 1975 et 2010 ................ 8 1.2. Les principales évolutions du parc d’entrepôts ........................................ 11 1.3. La part des 8 secteurs logistiques franciliens .......................................... 17 1.4. Une estimation du par médian d’entreposage ......................................... 19 1.5. Reconfiguration des espaces logistiques -

Deloitte Studie

Global Powers of Retailing 2018 Transformative change, reinvigorated commerce Contents Top 250 quick statistics 4 Retail trends: Transformative change, reinvigorated commerce 5 Retailing through the lens of young consumers 8 A retrospective: Then and now 10 Global economic outlook 12 Top 10 highlights 16 Global Powers of Retailing Top 250 18 Geographic analysis 26 Product sector analysis 30 New entrants 33 Fastest 50 34 Study methodology and data sources 39 Endnotes 43 Contacts 47 Global Powers of Retailing identifies the 250 largest retailers around the world based on publicly available data for FY2016 (fiscal years ended through June 2017), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook and looks at the 50 fastest-growing retailers and new entrants to the Top 250. This year’s report will focus on the theme of “Transformative change, reinvigorated commerce”, which looks at the latest retail trends and the future of retailing through the lens of young consumers. To mark this 21st edition, there will be a retrospective which looks at how the Top 250 has changed over the last 15 years. 3 Top 250 quick statistics, FY2016 5 year retail Composite revenue growth US$4.4 net profit margin (Compound annual growth rate CAGR trillion 3.2% from FY2011-2016) Aggregate retail revenue 4.8% of Top 250 Minimum retail Top 250 US$17.6 revenue required to be retailers with foreign billion among Top 250 operations Average size US$3.6 66.8% of Top 250 (retail revenue) billion Composite year-over-year retail 3.3% 22.5% 10 revenue growth Composite Share of Top 250 Average number return on assets aggregate retail revenue of countries with 4.1% from foreign retail operations operations per company Source: Deloitte Touche Tohmatsu Limited. -

Brick Ang Click

A Project Report On Competitive advantage of online selling By brick and click company Submitted in partial fulfillment of the requirement for the award of Two year full time, Masters in Business Administration. Submitted To Submitted By PRIYANKA GARG INTRODUCTION BRICKS-AND-CLICK Bricks-and-clicks is a business model by which a company integrates both offline (bricks) and online (clicks) presences. It is also known as click-and-mortar or clicks-and-bricks, as well as bricks, clicks and flips, flips referring to cataloes. For example, an electronics store may allow the user to order online, but pick up their order immediately at a local store, which the user finds using locator software. Conversely, a furniture store may have displays at a local store from which a customer can order an item electronically for delivery. The bricks and clicks model has typically been used by traditional retailers who have extensive logistics and supply chains. Part of the reason for its success is that it is far easier for a traditional retailer to establish an online presence than it is for a start-up company to employ a successful pure "dot com" strategy, or for an online retailer to establish a traditional presence (including a strong brand). The success of the model in many sectors has destroyed the credibility of analysts who argued that the Internet would render traditional retailers obsolete through disintermediation. Advantages of the Bricks and Clicks model Click and mortar firms have the advantage in areas of existing products and services. In these cases there are major advantages in retaining ties to a physical company. -

Rush Hour by Meenal Mistry NEW YORK — Among Civilians, It’S a Little-Known Fact, but Fashion Folk Are Actually a Hardy Bunch

FRANCES HITS FLA./2 WHAT THE LADIES ARE BUYING/4 Global Edition WWWomen’s Wear Daily • DTUESDAYThe Retailers’TUESDAY Daily Newspaper • September 7, 2004 • $2.00 Ready-to-Wear/Textiles Rush Hour By Meenal Mistry NEW YORK — Among civilians, it’s a little-known fact, but fashion folk are actually a hardy bunch. They are the practical sort who will let little stand in their way, especially when it comes to creating the potential 15- minute moment of glory that is the fashion show. That said, in preparing for this spring season, designers had two additional obstacles to accompany all the usual last-minute Carolina Herrera shares mayhem: an early start to fashion week, which will begin a a laugh with mere two days after Labor Day, and the Republican design director Herve Pierre National Convention, held right in the Garment District. Braillard. See Down, Page 6 PHOTO BY THOMASPHOTO BY IANNACCONE 2 WWD/GLOBAL, SEPTEMBER 2004 WWW.WWD.COM WWDTUESDAY Fla. Retail Endures Frances Ready-to-Wear/Textiles PLANTATION, Fla. — Retail sorting through the destruction Group’s 27 Florida malls had GENERAL stores in Florida, after losing caused by hurricane Charley closed by Friday afternoon, said Now that the Republicans have left town, Seventh Avenue designers spent more than three shopping days when Frances began. Punta Les Morris, corporate spokesman. 1 the weekend getting ready for fashion week, which begins on Wednesday. due to hurricane Frances during Gorda and Port Charlotte Hurricane warnings were Having been pounded by hurricane Frances, Florida retailers, many closed the traditionally important seemed to take the brunt of lifted in Miami-Dade county by Labor Day sales weekend, began Charley’s wrath. -

Amazon Vs Walmart Battle

Spring 2019 Volume 12 Issue 2 Insights to Accelerate International Expansion Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors” Sell to 96 Countries Amazon vs. Walmart Battle: Looking for qualified international distributors? Export Solutions’ leading Land, Air, and Overseas distributor database supplies information on more than 8,300 distributors in 96 countries. The database features filters that allow you to screen distributors by categories such as Confectionery, Natural Food, Beverage, or Made in the USA (or Italy, UK, or Germany). New! Export Solutions’ retailer database now tracks 2,250 retailers in 96 countries. Free samples at www.exportsolutions.com. In This Issue Page 1 Amazon vs. Walmart Battle: Land, Air, and Overseas The marriage of clicks with bricks defines 2019 Government Intervention the omni-channel battle for consumer Retail is a core industry and Page 2 spending. During a forty day period in governments are scrambling to legislate Who is Bill Doyle? 2018, Walmart telegraphed their multi- the playing field before local retailers front game plan. Walmart announced the become casualties. The UK Page 3 sale (merger) of its £23 billion pound Competition and Markets Authority ASDA UK unit to rival Sainsbury, effectively squashed the ASDA- Tactical Exports vs. International followed quickly with a transaction to Sainsbury merger citing a “substantial Brand Building divest 80 percent of their Brasilian lessening of competition at both a operation to Advent International. national and local level.” Walmart and Page 4 Sandwiched in between the deals, Amazon face greater challenges in the Twelve Tips: Walmart tendered a $16 billion offer for robust Indian e-commerce market. -

Trigger Factors in Brick and Click Shopping

Intangible Capital IC, 2019 – 15(1): 57-71 – Online ISSN: 1697-9818 – Print ISSN: 2014-3214 https://doi.org/10.3926/ic.1364 Trigger factors in brick and click shopping Mage Marmol1 , Vicenc Fernandez2 1Euncet Business School (Universitat Politècnica de Catalunya • BarcelonaTech) (Spain) 2Universitat Politècnica de Catalunya • BarcelonaTech (Spain) [email protected], [email protected] Received September, 2018 Accepted April, 2019 Abstract Purpose: The goal of this research is to describe the customer’s purchase path in different shopping channels and to identify which are the trigger factors that motivate the choice of every shopping channel. The description of the factors that motivate this seamless experience across all channels will provide brands with knowledge about how to improve their strategic approach to engagement, belonging and retention of customers. Design/methodology: This paper builds propositions about the trigger factors for shopping channel choice based on thirty reports from the main consultancy companies made during the last five years and coded regarding the main topics highlighted in the literature. Findings: The findings of this study indicate that there are common trigger factors for every shopping channel and for every stage of the purchase path. Research limitations/implications: The data are from different countries, segments and products although they show common patterns. Originality/value: To date, little research in a complete vision of the shopping paths has been done. The definition of the different paths and the trigger factors associated to each one is unique and will help further research in this area. Keywords: Omnichannel, multichannel, Purchase process, Customer experience, Purchase intention, Webrooming, showrooming, m-commerce, Bricks and clicks, Brick-and-mortar Jel Codes: M3 To cite this article: Marmol, M., & Fernandez, V. -

ENQUÊTE SUR LE COMMERCE ASIATIQUE AUX OLYMPIADES Quartier Des Olympiades – Diagnostic Urbain

ATELIER PARISIEN D’URBANISME - 17, BD MORLAND – 75004 PARIS – TÉL : 0142712814 – FAX : 0142762405 – http://www.apur.org ENQUÊTE SUR LE COMMERCE ASIATIQUE AUX OLYMPIADES Quartier des Olympiades – Diagnostic urbain Mars 2003 RÉSUMÉ En 2002, 65% des commerces de détail (sur les 328 recensés) du quartier Olympiades/Villa d'Este sont asiatiques. Par ailleurs, l'ancienne gare des Gobelins, recouverte par la dalle des Olympiades, abrite un marché de demi-gros dédié essentiellement aux produits asiatiques. Par l'importance qu'il a pris depuis vingt ans, jusqu’à devenir une des destinations touristiques de Paris, le commerce asiatique des Olympiades constitue un enjeu pour la définition d'une stratégie d'intervention dans ce secteur clas- sé comme site prioritaire du « Grand projet de renouvellement urbain » de la couronne de Paris. On entend par « commerce asiatique », un commerce tenu par une personne de nationalité ou d'o- rigine asiatique, dont la clientèle et les produits vendus sont majoritairement d'origine asiatique, dont l’enseigne est rédigée dans une langue d'Asie. Objet et méthode. La présente étude décrit le fonctionnement et le rayonnement du commerce asiatique dans le sud du 13e arrondissement, et ses incidences sur la vie urbaine locale. L'analyse s'appuie sur l'exploitation de fichiers sur le commerce (BDCom), sur l'activité (Sirene), sur la population et l'emploi (recensements de la population), ainsi que sur des enquêtes de terrains : relevés, questionnaires, entretiens. Les enquêtes et leurs exploitations ainsi que la cartographie ont été réalisées par des étudiants du DESS de l'Institut Français d'Urbanisme (Paris 8).