Deloitte Studie

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Markets Day 2016 Disclaimer and Notes

Capital Markets Day 2016 Disclaimer and Notes By accessing this presentation you agree to the following restrictions: This document and the presentation to which is relates is intended for information only, does not constitute a prospectus or similar document and should not be treated as investment advice. It is not intended and should not be construed as an offer for sale, or as a solicitation of an offer to purchase or subscribe to, any securities in any jurisdiction. Neither this presentation nor anything contained therein shall form the basis of, or be relied upon in connection with, any commitment or contract whatsoever. This presentation may not, at any time, be reproduced, distributed or published (in whole or in part) without prior written consent of CECONOMY AG (“CECONOMY”). Historical financial or operative information contained in this presentation, if not taken or derived from our accounting records or our management reporting or unless otherwise stated, is taken or derived from the unaudited combined financial statements of CECONOMY for the respective period and not from the consolidated financial statements of the METRO Group. The combined financial statements of CECONOMY have not been audited and may also deviate substantially from (segmental or other) information in the consolidated financial statements of the METRO Group and, thus, may not be fully comparable to such financial statements. In addition, the historical financial and operative information included in this presentation does not necessarily fully reflect changes that will occur when we, the prospective CECONOMY business, operate as a separate company. Accordingly, such information is not necessarily indicative for the future consolidated results of operations, financial position or cash flows of the prospective CECONOMY business on a stand-alone basis. -

Report Name:Retail Foods Bulgaria

Voluntary Report – Voluntary - Public Distribution Date: March 20,2020 Report Number: BU2020-0011 Report Name: Retail Foods Bulgaria Country: Bulgaria Post: Sofia Report Category: Retail Foods Prepared By: Alexander Todorov Approved By: Jonn Slette Report Highlights: Consistent growth in Bulgaria’s food and beverage retail market is driven by increased consumer confidence, declining unemployment, and growing incomes. The total number of retail outlets in Bulgaria in 2019 was 41,306. Modern retail food and beverage sales in 2019 grew by nearly five percent over 2018, and accounted for 55 percent of total food retail in value terms. U.S. exports with strong sales potential in Bulgaria’s food and beverage retail sector are distilled spirits, tree nuts, dried fruits, wine, snacks and cereals, beef meat, fish and seafood, sauces, spices, and pulses. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Market Fact Sheet: Bulgaria Executive Summary Since 2016, annual Bulgarian GDP growth has Food Retail Industry been over three percent. Exports generate Bulgarian food retail sales reached $6.85 billion in almost 49 percent of Bulgaria’s GDP and are a pillar 2019. Modern retail sales accounted for of the economy. EU Member States are Bulgaria’s $3.77 billion (55 percent) and $3.08 billion in primary trading partners, although there is wide traditional channel. Total retail outlets were 41,306. variation in the balances of trade. In 2019, Bulgaria Food and beverage retail grew in 2019 on improved had a trade deficit in goods of about €1.72 billion consumer confidence and a better labor market. -

SPAR International Annual Review 2018

SPAR International Annual Review 2018 2018 Overview sales 246 105 DISTRIBUTION CENTRES RETAIL & WHOLESALE 48countries PARTNERS €35.8 billion new STORES 2 13,112 m 335 stores 7.4 5.4% MILLION in RETAIL growth SALES AREA m² €4,809 13.5 AVERAGE MILLION ANNUAL SALES SPAR 568 COLLEAGUES per m² AVERAGE CUSTOMERS STORE SIZE PER DAY 350,000 Managing Director’s Report “ SPAR is unique. Our strong network of SPAR Partners across four continents means that we operate in a truly global marketplace whilst being firmly rooted in the local communities we serve.” Tobias Wasmuht, Managing Director, SPAR International Third year of strong and our partners by enhancing the competitiveness, productivity and profitability of our retail and wholesale consistent growth partners worldwide. With the launch of SPAR in four new countries, The strength of our international network allows SPAR combined with a growth of 335 new stores and a to leverage global benefits whilst simultaneously sales increase of 5.4% to €35.8 billion, 2018 has been integrating ourselves in the local communities we another exceptionally strong year for SPAR. serve. This strong network of SPAR Partners and their supply chains across four continents gives SPAR The third year of our five-year SPAR ‘Better Together’ competitive advantages in an increasingly global strategy delivered again for the organisation, our marketplace. partners and our customers. Launched in 2016, the strategy represents SPAR’s core ethos of uniting SPAR’s strong growth and expansion has been driven together the global scale and resources of the SPAR by the responsiveness of our retailers in placing the network so that all shall benefit. -

Champion Brands to My Wife, Mercy the ‘Made in Germany’ Champion Brands Nation Branding, Innovation and World Export Leadership

The ‘Made in Germany’ Champion Brands To my wife, Mercy The ‘Made in Germany’ Champion Brands Nation Branding, Innovation and World Export Leadership UGESH A. JOSEPH First published 2013 by Gower Publishing Published 2016 by Routledge 2 Park Square, Milton Park, Abingdon, Oxon OX14 4RN 711 Third Avenue, New York, NY 10017, USA Routledge is an imprint of the Taylor & Francis Group, an informa business Copyright © Ugesh A. Joseph 2013 Ugesh A. Joseph has asserted his right under the Copyright, Designs and Patents Act, 1988, to be identified as the author of this work. Gower Applied Business Research Our programme provides leaders, practitioners, scholars and researchers with thought provoking, cutting edge books that combine conceptual insights, interdisciplinary rigour and practical relevance in key areas of business and management. All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. Notice: Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation without intent to infringe. British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library. The Library of Congress has cataloged the printed edition as follows: Joseph, Ugesh A. The ‘Made in Germany’ champion brands: nation branding, innovation and world export leadership / by Ugesh A. Joseph. pages cm Includes bibliographical references and index. ISBN 978-1-4094-6646-8 (hardback: alk. -

An N U Al R Ep O R T 2018 Annual Report

ANNUAL REPORT 2018 ANNUAL REPORT The Annual Report in English is a translation of the French Document de référence provided for information purposes. This translation is qualified in its entirety by reference to the Document de référence. The Annual Report is available on the Company’s website www.vivendi.com II –— VIVENDI –— ANNUAL REPORT 2018 –— –— VIVENDI –— ANNUAL REPORT 2018 –— 01 Content QUESTIONS FOR YANNICK BOLLORÉ AND ARNAUD DE PUYFONTAINE 02 PROFILE OF THE GROUP — STRATEGY AND VALUE CREATION — BUSINESSES, FINANCIAL COMMUNICATION, TAX POLICY AND REGULATORY ENVIRONMENT — NON-FINANCIAL PERFORMANCE 04 1. Profile of the Group 06 1 2. Strategy and Value Creation 12 3. Businesses – Financial Communication – Tax Policy and Regulatory Environment 24 4. Non-financial Performance 48 RISK FACTORS — INTERNAL CONTROL AND RISK MANAGEMENT — COMPLIANCE POLICY 96 1. Risk Factors 98 2. Internal Control and Risk Management 102 2 3. Compliance Policy 108 CORPORATE GOVERNANCE OF VIVENDI — COMPENSATION OF CORPORATE OFFICERS OF VIVENDI — GENERAL INFORMATION ABOUT THE COMPANY 112 1. Corporate Governance of Vivendi 114 2. Compensation of Corporate Officers of Vivendi 150 3 3. General Information about the Company 184 FINANCIAL REPORT — STATUTORY AUDITORS’ REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS — CONSOLIDATED FINANCIAL STATEMENTS — STATUTORY AUDITORS’ REPORT ON THE FINANCIAL STATEMENTS — STATUTORY FINANCIAL STATEMENTS 196 Key Consolidated Financial Data for the last five years 198 4 I – 2018 Financial Report 199 II – Appendix to the Financial Report 222 III – Audited Consolidated Financial Statements for the year ended December 31, 2018 223 IV – 2018 Statutory Financial Statements 319 RECENT EVENTS — OUTLOOK 358 1. Recent Events 360 5 2. Outlook 361 RESPONSIBILITY FOR AUDITING THE FINANCIAL STATEMENTS 362 1. -

QUEST Integration

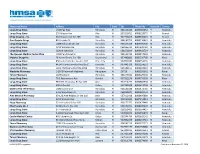

Pharmacy Name Address City State Zip Phone No Hours24 County Longs Drug Store 1330 Pali Hwy Honolulu Hi 968132230 8085365542 Y Honolulu Longs Drug Store 555 Kilauea Ave Hilo Hi 967203011 8089359075 Y Hawaii Shiigi Drug Co., Inc. 333 Kilauea Ave Ste 109 Hilo Hi 967203013 8089350001 N Hawaii Don Quijote Drugs 801 Kaheka St Honolulu Hi 968143725 8089736661 N Honolulu Longs Drug Store 1088 Bishop St Ste 113 Honolulu Hi 968133109 8085365706 N Honolulu Longs Drug Store 4211 Waialae Ave Honolulu Hi 968165319 8087320782 N Honolulu Longs Drug Store 1620 N School St Honolulu Hi 968171844 8088410724 Y Honolulu The Queens Medical Center Phcy 1301 Punchbowl St Honolulu Hi 968132402 8085474238 Y Honolulu Molokai Drugs Inc 28 Kamoi Street Ste 100 Kaunakakai Hi 967480000 8085535790 N Maui Longs Drug Store 850 Kamehameha Hwy Ste 107 Pearl City Hi 967822682 8084554555 Y Honolulu Longs Drug Store 46-047 Kamehameha Hwy Ste C Kaneohe Hi 967443736 8082354551 Y Honolulu Longs Drug Store 1450 Ala Moana Blvd Ste 2004 Honolulu Hi 968144671 8089494010 N Honolulu Westside Pharmacy 1-3845 Kaumualii Highway Hanapepe Hi 96716 8083355342 N Kauai Times Pharmacy 1425 Liliha St Honolulu Hi 968173522 8085225078 N Honolulu Longs Drug Store 70 E Kaahumanu Ave Kahului Hi 967322176 8088770068 N Maui Longs Drug Store 98-1005 Moanalua Rd Spc 400 Aiea Hi 967014775 8084880958 N Honolulu Longs Drug Store 609 Kailua Rd Kailua Hi 967342839 8082619794 N Honolulu Queens Pob I Pharmacy 1380 Lusitana St Honolulu Hi 968132449 8085474745 N Honolulu Longs Drug Store 2750 Woodlawn Dr Honolulu Hi 968221841 8089882151 N Honolulu Aiea Medical Pharmacy 99-128 Aiea Heights Dr Ste 103 Aiea Hi 967013916 8088405680 N Honolulu Longs Drug Store 3221 Waialae Ave Honolulu Hi 968165842 8087352811 Y Honolulu Plaza Pharmacy 321 N Kuakini St Ste 105 Honolulu Hi 968172375 8085479440 N Honolulu Pharmacare No. -

Rubric 5-13, Paragraph 2(B)

CBUS.0002.0001.0065 Rubric 5-13, Paragraph 2(b) Table A: Shareholding of United Super in Unlisted Entities Shareholdings Number of shares held NSW Ports Pty Limited 545 (5%) Concession Investment Holding LLC 2.9 (3%) Utilities of Australia Pty Ltd 1 (2%) ISPT Pty Ltd 1 (4%) Frontier Advisors Pty Ltd 124 (31%) Industry Super Holdings Pty Ltd 150,941,198 (18%) Members Equity Bank Pty Ltd 2,085,878 (19%) CBUS.0002.0001.0066 2 Table B: Shareholding of United Super in Listed Entities as at 31 May 2018 Holdings Inst. Type SEOOL Asset Name Holdings Date 31/05/2018 Equity Security 6215035 COMMONWEALTH BANK OF AUSTRAUA 8,861,462 31/05/2018 Equity Security 6144690 BHP BIL UTON LTD 17,897,041 31/05/2018 Equity Security 6076146 WESTPAC BANKING CORP 19,557,658 31/05/2018 Equity Security 6065586 AUSTRAUA & NEW ZEALAND BANKING GRP LTD 16,273,481 31/05/2018 Equity Security 6185495 CSL LTD 2,364,963 31/05/2018 Equity Security B28YTC2 MACQUARIE GROUP LTD 2,975,477 31/05/2018 Equity Security 6624608 NATIONALAUSTRAUA BAN K LTD 12,088,937 31/05/2018 Equity Security 6981239 WOOLWORTHS GROUP LTD 8,970,427 31/05/2018 Equity Security 6979728 WOODSIDE PETROLEUM LTD 7,288,335 31/05/2018 Equity Security 6214861 ORIGIN ENERGY LTD 22,887,663 31/05/2018 Equity Security 6220103 RIO TINTO LIMITED 2,610,105 31/05/2018 Equity Security 6948836 WESFARMERS LTD 4,532,369 31/05/2018 Equity Security 2000019 AMAZON .COM INC 84,107 31/05/2018 Equity Security B7TL820 FACEBOOK INC 631,954 31/05/2018 Equity Security B61JC67 TREASURY WINE ESTATES LTD 9,220,720 31/05/2018 Equity Security -

Amazon to Buy Whole Foods for $13.4 Billion by NICK WINGFIELD and MICHAEL J

Amazon to Buy Whole Foods for $13.4 Billion By NICK WINGFIELD and MICHAEL J. de la MERCED, NYT, June 17, 2017, on Page A1 Amazon agreed to buy the upscale grocery chain Whole Foods for $13.4 billion, in a deal that will instantly transform the company that pioneered online shopping into a merchant with physical outposts in hundreds of neighborhoods across the country. The acquisition, announced Friday, is a reflection of both the sheer magnitude of the grocery business — about $800 billion in annual spending in the United States — and a desire to turn Amazon into a more frequent shopping habit by becoming a bigger player in food and beverages. After almost a decade selling groceries online, Amazon has failed to make a major dent on its own as consumers have shown a stubborn urge to buy items like fruits, vegetables and meat in person. Buying Whole Foods also represents a major escalation in the company’s long-running battle with Walmart, the largest grocery retailer in the United States, which has been struggling to play catch-up in internet shopping. On Friday, Walmart announced a $310 million deal to acquire the internet apparel retailer Bonobos, and last year it agreed to pay $3.3 billion for Jet.com and put Jet’s chief executive, Marc Lore, in charge of Walmart’s overall e-commerce business. “Make no mistake, Walmart under no circumstances can lose the grocery wars to Amazon,” said Brittain Ladd, a strategy and supply chain consultant who formerly worked with Amazon on its grocery business. -

Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814

FOR LEASE > FOOD COURT SPACE Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814 Food Court Space for lease The food court is situated in the premier hub of commerce in the The space is located in the Don Quijote food court, which includes a Ala Moana area, just 5 minutes delightful array of local and Asian cuisines. The foot court provides walking distance to Ala Moana strong co-tenant synergies and ample outdoor seating for customers. Center, Ross Dress for Less, Walmart and Sam’s Club. Property Information Available Space: Space 14 (430 SF) Kapiolani Blvd Base Rent: Negotiable Kalakaua Ave Operating Expenses: $1.83 PSF/Mo Term: 3 - 5 years Features & Benefits: > Great visibility > Excellent foot traffic > The largest Asian grocery store on Oahu WAIKIKI MARIA SU (S) COLLIERS INTERNATIONAL | Hawaii Retail Services Division 220 S. King Street, Suite 1800 808 524 2666 Honolulu, Hawaii 96813 www.colliers.com/hawaii [email protected] This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers International and/or its licensor(s). ©2020. All rights reserved.. -

Global Vs. Local-The Hungarian Retail Wars

Journal of Business and Retail Management Research (JBRMR) October 2015 Global Vs. Local-The Hungarian Retail Wars Charles S. Mayer Reza M. Bakhshandeh Central European University, Budapest, Hungary Key Words MNE’s, SME’s, Hungary, FMCG Retailing, Cooperatives, Rivalry Abstract In this paper we explore the impact of the ivasion of large global retailers into the Hungarian FMCG space. As well as giving the historical evolution of the market, we also show a recipe on how the local SME’s can cope with the foreign competition. “If you can’t beat them, at least emulate them well.” 1. Introduction Our research started with a casual observation. There seemed to be too many FMCG (Fast Moving Consumer Goods) stores in Hungary, compared to the population size, and the purchasing power. What was the reason for this proliferation, and what outcomes could be expected from it? Would the winners necessarily be the MNE’s, and the losers the local SME’S? These were the questions that focused our research for this paper. With the opening of the CEE to the West, large multinational retailers moved quickly into the region. This was particularly true for the extended food retailing sector (FMCG’s). Hungary, being very central, and having had good economic relations with the West in the past, was one of the more attractive markets to enter. We will follow the entry of one such multinational, Delhaize (Match), in detail. At the same time, we will note how two independent local chains, CBA and COOP were able to respond to the threat of the invasion of the multinationals. -

Closeby Deborah Patton

OPINIONATED • OUTSPOKEN • UNBIASED THE FALL 2015 GLOBAL REPORTS FROM BRAZIL, CUBA, ITALY AND MEXICO PAGES 17,18,23,32,42 MILLENNIALS: TALKING LUXURY AND THE WORKPLACE OF THE FUTURE PAGES 8, 40 COSTCOHOLICS 75 MILLION ADDICTS AND COUNTING PAGE 3 / 1 TOC Featured Contributors: RANDY BURT VISHWA CHANDRA NADIA SHOURABOURA Randy Burt is a Partner in the Consumer Goods Vishwa Chandra is a Partner in Dr. Nadia Shouraboura is a retail and Retail Practice at A.T. Kearney, a global A.T. Kearney's Consumer Goods and revolutionary. She holds a Ph.D. in strategy and management consulting firm. Retail Practice, where he partners Mathematics from Princeton University, He has over 16 years of experience in consumer with food, mass, drug and value has extensive retail and technology products and Food Retailing with focus on retail retailers to drive merchandising experience, and was former head of strategy, Fresh and Center Store merchandising, effectiveness and supply chain Supply Chain and Fulfillment Technolo- ecommerce, and supply chain. He also spent efficiency. He is also a leader in the gies for Amazon.com. Nadia also served five years at the Nielsen Company in a variety firm's Consumer institute, where he on Jeff Bezos's senior leadership team, of market research and data operations roles. leads primary research on the ever which was responsible for overall He is a regular speaker and author on online evolving consumer landscape and direction and operations of Amazon. grocery and other food retail topics. its implications for retailers. CEO, EDITORIAL -

Amazon Case Study

Last updated: August 2002 Amazon.com Case Update Amazon.com Inc. (stock: AMZN) is undoubtedly the poster child for Internet retail businesses. It is the No. 1 Internet retailer of books, music, DVDs and videos, and has 26 million active customers in more than 220 countries as of first quarter 2002. In 2001, Interbrand's annual World's Most Valuable Brands survey ranked Amazon.com as the 76th most valuable brand in the world, ahead of Burger King and Shell, among others. According to MMXI Europe Audience Ratings Report, the Amazon.co.uk, Amazon.de and parent Amazon.com site are the top three online retail sites in Europe, based on reach. Amazon's founder and chairman, Jeff Bezos, was Time magazine's "Man of the Year" in 1999. Amazon.com has evolved from an online bookseller to a general merchant, and today is the largest online retailer. It claims that it has “the Earth’s biggest selection” of products in categories such as books, music, DVDs, videos, toys, electronics, software, video games, lawn and patio, kitchen and home improvement. The company has also created Web-based marketplaces, including Amazon Marketplace, Amazon.com Auctions and zShops, where businesses or individuals can sell virtually anything. The Amazon.com family of websites also includes Internet Movie Database (www.imdb.com), a comprehensive source of information on more than 300,000 movies and entertainment programs and 1 million cast and crew members dating from 1892 to the present. Amazon Anywhere (www.amazon.com/anywhere) marks the company's entrance into mobile e-commerce.