QUEST Integration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redemption Centers County: out of STATE Unit Can Company 1000 N

Redemption Centers County: OUT OF STATE Unit Can Company 1000 N. Phillips Ave. Operating Status: Operating Hrs Of Operation: Sioux Falls, SD 57104 Hrs Per Week: Name: Ron Nedved, Address: 1000 N. Phillips Ave. Sioux Falls, SD 57104 Phone: 605-332-1222 Ext.: Fax: 605-336-1222 Mobile: Other Phone: Email: County: ADAIR Approved Redemption Center for a Twin Oaks Redemption Center Dealer 419 Washington Street Operating Status: Operating Hrs Of Operation: W, TH, F-10:00-4:3 Approved For: Fontanelle, IA 50846 Hrs Per Week: 27.5 Casey's General Store (Fontanelle) - 0.25 miles Nodaway Valley Market (Fontanelle) - 0.25 miles Name: , Address: , Phone: Ext.: Fax: Mobile: Other Phone: Email: County: ADAMS Approved Redemption Center for a Country Peddler, LLC Dealer 800 Quincy Street Operating Status: Operating Redemption Center for a Dealer Hrs Of Operation: M - W 8-4, Thurs-F Approved For: Corning, IA 50841 Hrs Per Week: 43 Corning Mini Mart (Corning) - 1.2 miles The Pub (Corning) - 0 miles Boz's Kitchen (Corning) - 0 miles Casey's - Corning (Corning) - 0 miles Lake Binder Campsite Park (Corning) - 0 miles Lake Icaria (Corning) - 0 miles The Red Bull (Corning) - 0 miles Text2: Page 1 of 36 Name: Gayle Houk, Address: 800 Quincy Street Corning, IA 50841 Phone: 641-322-5030 Ext.: Fax: Mobile: Other Phone: Email: [email protected] County: ALLAMAKEE Spice N Ice Redemption Center 123 N Lawler Operating Status: Operating PO Box 607 Hrs Of Operation: Postville, IA 52162 Hrs Per Week: Name: Margery Lange, Owner Address: 123 N Lawler PO Box 607 Postville, IA 52162 Phone: 563-864-3518 Ext.: Fax: Mobile: Other Phone: Email: Waukon Ice & Redemption 707 W Main Operating Status: Operating Hrs Of Operation: Waukon, IA 52172 Hrs Per Week: Name: Dennis Blocker, Address: 707 W Main Waukon, IA 52172 Phone: 563-568-6975 Ext.: Fax: Mobile: Other Phone: Email: County: APPANOOSE Moravia's Cash for Cans Registered/Unapproved 303 W. -

Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814

FOR LEASE > FOOD COURT SPACE Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814 Food Court Space for lease The food court is situated in the premier hub of commerce in the The space is located in the Don Quijote food court, which includes a Ala Moana area, just 5 minutes delightful array of local and Asian cuisines. The foot court provides walking distance to Ala Moana strong co-tenant synergies and ample outdoor seating for customers. Center, Ross Dress for Less, Walmart and Sam’s Club. Property Information Available Space: Space 14 (430 SF) Kapiolani Blvd Base Rent: Negotiable Kalakaua Ave Operating Expenses: $1.83 PSF/Mo Term: 3 - 5 years Features & Benefits: > Great visibility > Excellent foot traffic > The largest Asian grocery store on Oahu WAIKIKI MARIA SU (S) COLLIERS INTERNATIONAL | Hawaii Retail Services Division 220 S. King Street, Suite 1800 808 524 2666 Honolulu, Hawaii 96813 www.colliers.com/hawaii [email protected] This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers International and/or its licensor(s). ©2020. All rights reserved.. -

Die Antwort Auf Das Discountmodell

R Die Antwort auf das Discountmodell Ein neues Geschäftsmodell für den Lebensmitteleinzelhandel? Projekt XI August 2005 Eine Studie im Auftrag von The Coca-Cola Retailing Research Council Europe durchgeführt von McKinsey & Company Der Auftraggeber / Die Verfasser The Coca-Cola Retailing Research Council, Europe The Coca-Cola Retailing Research Council, Europe (CCRRCE) hat sich zur Aufgabe gemacht, den Lebensmitteleinzelhandel und das damit verbundene System der Warenverteilung in Europa besser zu verstehen. Er konzentriert sich darauf, wichtige Themen und Probleme zu erkennen und gezielt zu untersuchen. Die gewonnenen Erkenntnisse werden ggf. in einem geeigneten Forum präsentiert, damit die Informationen voll dazu genutzt werden können, die Warenverteilung des Lebensmitteleinzelhandels weiterzuentwickeln und effektiver zu gestalten. McKinsey & Company McKinsey & Company ist eine Managementberatung, die führenden Unternehmen und Organisationen hilft, ihre Performance durch entscheidende, nachhaltige und substanzielle Verbesserungen zu steigern. Über die letzten sieben Jahrzehnte hat die Firma stets an ihrem Hauptziel festgehalten: Unternehmen als vertrauenswürdigster, externer Berater zur Seite zu stehen, wenn die Unternehmensführung vor kritischen Entscheidungen steht. Mit etwa 7.800 Beratern, die sich auf 85 Niederlassungen in 44 Ländern verteilen, berät McKinsey Unternehmen über Strategie, operatives Geschäft, Organisation und Technologie. Die Firma verfügt nicht nur über umfassende Erfahrung in allen großen Branchen und Hauptfunktionsbereichen, -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

NGA Retailer Membership List October 2013

NGA Retailer Membership List October 2013 Company Name City State 159-MP Corp. dba Foodtown Brooklyn NY 2945 Meat & Produce, Inc. dba Foodtown Bronx NY 5th Street IGA Minden NE 8772 Meat Corporation dba Key Food #1160 Brooklyn NY A & R Supermarkets, Inc. dba Sav-Mor Calera AL A.J.C.Food Market Corp. dba Foodtown Bronx NY ADAMCO, Inc. Coeur D Alene ID Adams & Lindsey Lakeway IGA dba Lakeway IGA Paris TN Adrian's Market Inc. dba Adrian's Market Hopwood PA Akins Foods, Inc. Spokane Vly WA Akins Harvest Foods- Quincy Quincy WA Akins Harvest Foods-Bonners Ferry Bonner's Ferry ID Alaska Growth Business Corp. dba Howser's IGA Supermarket Haines AK Albert E. Lees, Inc. dba Lees Supermarket Westport Pt MA Alex Lee, Inc. dba Lowe's Food Stores Inc. Hickory NC Allegiance Retail Services, LLC Iselin NJ Alpena Supermarket, Inc. dba Neimans Family Market Alpena MI American Consumers, Inc. dba Shop-Rite Supermarkets Rossville GA Americana Grocery of MD Silver Spring MD Anderson's Market Glen Arbor MI Angeli Foods Company dba Angeli's Iron River MI Angelo & Joe Market Inc. Little Neck NY Antonico Food Corp. dba La Bella Marketplace Staten Island NY Asker's Thrift Inc., dba Asker's Harvest Foods Grangeville ID Autry Greer & Sons, Inc. Mobile AL B & K Enterprises Inc. dba Alexandria County Market Alexandria KY B & R Stores, Inc. dba Russ' Market; Super Saver, Best Apple Market Lincoln NE B & S Inc. - Windham IGA Willimantic CT B. Green & Company, Inc. Baltimore MD B.W. Bishop & Sons, Inc. dba Bishops Orchards Guilford CT Baesler's, Inc. -

Recent Revisions to Japanese Tender Offer Rules: Toward Transparency and Fairness

JUNE 2007 JONES DAY COMMENTARY Recent REvisions to JApanesE Tender Offer RulEs: TOward Transparency and Fairness DEvElOpments iN ThE JApanesE economy in 1991, Japanese businesses underwent significant corporate restructuring for more than a M&A Market decade, and the number of tender offers gradually Japanese tender offer regulations were substantially increased as part of the effort to recover from the amended in December 2006 in the wake of recent deflationary economy in the late 1990s. Tender offers hostile-takeover activities in Japan. The tender offer in Japan in 2005 and 2006 numbered 50 and 68, regulations, which were first introduced in Japan in respectively. However, after the collapse of the eco- 1971, were substantially revised in 1990. These revised nomic bubble, hostile offers were almost nonexistent regulations form the basis of the current legal frame- in Japan until 2000, when a Japanese activist fund work. The additional revisions made in 2006 (the managed by Mr. Yoshiaki Murakami engaged in a “Revisions”) are intended to increase the transparency hostile offer for Shoei Co., Ltd., a real estate com- and fairness of tender offers by, for example, enhanc- pany. This was followed by hostile tender offers made ing the disclosure requirements and expanding the simultaneously for two mid-sized companies, Sotoh scope of application of the tender offer rules. Corporation and Yushiro Chemical Industry Co., Ltd., by Steel Partners Japan, a U.S.-based activist fund, in Historically, the pace of M&A activity, particularly take- December 2003. While the level of hostile offers is still overs, in Japan has been relatively slow. -

Global Powers of Retailing 2019 Contents

Global Powers of Retailing 2019 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Global Powers of Retailing Top 250 11 Geographic analysis 19 Product sector analysis 23 New entrants 27 Fastest 50 30 Study methodology and data sources 35 Endnotes 39 Contacts 41 Welcome to the 22nd edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2017 (fiscal years ended through June 2018), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2017 Minimum retail US$4.53 US$18.1 revenue required to be trillion billion among Top 250 Aggregate Average size US$3.7 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 5.7% revenue growth net profit margin 5.0% Composite (CAGR from Composite year-over-year retail FY2012-201 2.3% return on assets revenue growth 3.3% Top 250 retailers with foreign 23.6% 10 operations Share of Top 250 Average number aggregate retail revenue of countries where 65.6% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2019. Analysis of financial performance and operations for fiscal years ended through June 2018 using company annual reports, Supermarket News, Forbes America’s largest private companies and other sources. 4 Global economic outlook 5 Global Powers of Retailing 2019 | Global economic outlook The global economy is currently at a turning point. -

Deloitte Studie

Global Powers of Retailing 2018 Transformative change, reinvigorated commerce Contents Top 250 quick statistics 4 Retail trends: Transformative change, reinvigorated commerce 5 Retailing through the lens of young consumers 8 A retrospective: Then and now 10 Global economic outlook 12 Top 10 highlights 16 Global Powers of Retailing Top 250 18 Geographic analysis 26 Product sector analysis 30 New entrants 33 Fastest 50 34 Study methodology and data sources 39 Endnotes 43 Contacts 47 Global Powers of Retailing identifies the 250 largest retailers around the world based on publicly available data for FY2016 (fiscal years ended through June 2017), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook and looks at the 50 fastest-growing retailers and new entrants to the Top 250. This year’s report will focus on the theme of “Transformative change, reinvigorated commerce”, which looks at the latest retail trends and the future of retailing through the lens of young consumers. To mark this 21st edition, there will be a retrospective which looks at how the Top 250 has changed over the last 15 years. 3 Top 250 quick statistics, FY2016 5 year retail Composite revenue growth US$4.4 net profit margin (Compound annual growth rate CAGR trillion 3.2% from FY2011-2016) Aggregate retail revenue 4.8% of Top 250 Minimum retail Top 250 US$17.6 revenue required to be retailers with foreign billion among Top 250 operations Average size US$3.6 66.8% of Top 250 (retail revenue) billion Composite year-over-year retail 3.3% 22.5% 10 revenue growth Composite Share of Top 250 Average number return on assets aggregate retail revenue of countries with 4.1% from foreign retail operations operations per company Source: Deloitte Touche Tohmatsu Limited. -

Placeholder Title Here

IGA and Nestle Discussion Agenda • US Market Insights - Shopper - Channels • Acosta Corporate Overview • Discussion Market Insights Times Aren’t Changing, They’ve Changed. 4 Industry Change Driver: Demographic Shifts Boomers Millennials Multicultural Income Divide • Fastest Growing • Spending Power • Hispanic majority • Median Income Segment increased of Growth down $5k since • • Changing Needs Highly Multicultural • Larger households 2000 • Technology Dependent • More meals at • Transparency is important home • Soon to be heavy buying HH’s 2014 There are more mobile devices than people in the world 67% Increase in use of mobile devices to access the internet in the last 12 months eCommerce Is More Than Just A Place to Shop • 30% of product searches start on Amazon, 16% on Google • 70% of consumers research online before buying Industry Change Driver: Health & Wellness Fresh / Perimeter Growth Healthy Snacking vs. Meals Natural/Organic/Gluten Free Retailer H&W Emphasis $39 Billion Organic Food Sales1 (Doubled since 2008) Going Forward, There Are Ten Macro Trends That Will Impact Your Future in Industry Focus on value Personalized pricing • Price sensitivity post recession • Prices tailored to the individual customer through • Price transparency loyalty programs • Willingness to cherry pick • Increased price transparency Convenience redefined Proprietary brands • Smaller stores • Increasing range of categories • Convenient location • Different tiers: value, premium, “exclusive” products • Fast & easy in-store experience Digital connectivity Localization • Personalized marketing and offers through web and • Assortment tailored to reflect trade area customer mobile preferences • Higher acceptance of e-commerce • Locally sourced products Premium models Health & wellness • Premium players have cult followings • Consumer attention for health • Consumer willing to pay for specialty products (e.g. -

OAHU WIC VENDORS (72 Stores)

Koolauloa (2) Foodland (Laie) Waialua (2) Tamura’s (Hauula) Koolaupoko (11) Foodland (Pupukea) Foodland (Kaneohe) Malama Market (Haleiwa) Foodland (Kailua) Kaneohe Bay Commissary Safeway (Aikahi Park) Wahiawa (6) Safeway (Enchanted Lakes) Foodland (Mililani) WAIALUA KOOLAULOA Safeway (Kailua) Foodland (Wahiawa) Safeway (Kaneohe) Safeway (Mililani) Shima’s Market (Waimanalo) Schofield Commissary Times Super Market (Kailua) Times Market (Mililani) Times Super Market (Kaneohe) Tamura’s Wahiawa Times Super Market (Temple Valley) WAHIAWA KOOLAUPOKO AIANAE Waianae (4) W EWA Nanakuli Super (Nanakuli) WEST Sack ‘N Save (Nanakuli) Tamura Super Market HONOLULU Waianae Store (Waianae) EAST HONOLULU Ewa (22) West Honolulu (10) East Honolulu (15) Don Quijote (Pearl City) Foodland (Dillingham) Don Quijote (Kaheka) Don Quijote (Waipahu) Foodland (School Street) Food Pantry (Kuhio Ave) Foodland (Ewa Beach) Kmart (Salt Lake) Food Pantry (Eaton Square) Foodland (Pearl City) Sack ‘N Save (Salt Lake) Foodland Farms Aina Haina Foodland (Kapolei) Safeway (Pali) Foodland (Beretania) Foodland (Waipio Gentry) Safeway (Salt Lake) Foodland (Market City) Hickam Commissary Target (Salt Lake) Safeway (Beretania) Kmart –(Kapolei) Times Market (Kam Shopping Cntr) Safeway (Hawaii Kai) Kmart (Waikele) Times Super Market (Liliha) Safeway (Kapahulu)) Malama Market Makakilo (Kapolei) Walmart (Pearl City) Safeway (Manoa) Pacific Supermarket (Waipahu) Times Super Market (Beretania) Pearl Harbor Commissary Times Super Market (Kahala) Safeway (Ewa Beach) Times Super Market (Kaimuki) Safeway (Kapolei) Times Super Market (McCully) Tamura’s Kalaeloa Walmart (Keeaumoku) Target (Kapolei) Safeway (Aiea) Times Super Market (Aiea) Times Super Market (RoyalKunia) Times Super Market (Waimalu) Times Super Market (Waipahu) Walmart (Kapolei) OAHU WIC VENDORS (72 Stores) 05/04/2015 . -

Food and Beverage Industry Insight February 2019

www.peakstone.com Food and Beverage Industry Insight February 2019 0 Food and Beverage Industry Insight | February 2019 Food and Beverage M&A Update Food and Beverage categories continue to be active in M&A activity, but less than 2017 levels For 2018, total U.S. F&B announced transactions of 440, slightly less than 2017 levels of 453 deals. Both 2018 and 2017 exceeded 2016 levels of 453 deals. Select Recent Notable Publicly Announced U.S. M&A Transactions Transaction Date Status Target Buyer Size 2/12/2019 Dec-2018 Closed Undisclosed Nov-2018 Announced $750 million Nov-2018 Announced $1,800 million Nov-2018 Announced $494 million 2018 Closed Gourmet Gift Concepts Undisclosed www.peakstone.com 1 Food and Beverage Industry Insight | February 2019 Industry Insight: A Focus In-Store Bakery Industry Trends Bakery Industry Revenues ($ in billions) ▪ In-store bakeries drive consumers into stores ─ Aldi, for example, is now adopting in-store bakeries into their store plan after successful testing in select stores $60.9 $61.6 $59.4 $60.4 ▪ Most in-store bakeries are no longer baking in the store itself $55.9 due to high store labor costs, but average bakery department $53.6 square footage has grown since 2014 $49.5 $45.9 ▪ The $15+ billion U.S. in-store bakery market is projected to grow 3.8% annually through from 2017 to 2022 ▪ To satisfy any consumer, offerings range from good for you to indulgent products 2010 2011 2012 2013 2014 2015 2016 2017 ▪ Key market drivers for in-store bakery purchases at grocery stores and food markets: Bakery Industry at a Glance ─ Small Format Portion Control ─ Grab & Go Convenience Revenue Net Profit Wages $61.6 billion $2.4 billion $2.6 billion ─ Premium Indulgence ─ Better-for-You ─ Hosting & Entertaining The Wholesale Bakery industry remains very fragmented ─ Fully-Baked Products with many small companies and no clear industry leader. -

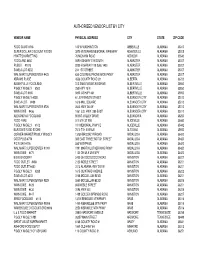

Alabama Vendor List.Xlsx

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE