Consolidated Accounting Reports with Independent Auditor's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Testimony: the Russian Economy: More Than Just Energy?

The Russian Economy: More than Just Energy? Anders Åslund, Peterson Institute for International Economics Testimony for the Committee on Foreign Affairs of the European Parliament April 2009 1 Introduction Russia has enjoyed a decade of high economic growth because of the eventually successful market reforms of the 1990s as well as an oil boom. For the last six years, however, the Russian economy has become increasingly dysfunctional because the authorities have done nothing to impede corruption. The energy sector has been a generator of corrupt revenues, and its renationalization has concentrated these corrupt incomes in the hands of the security police elite. Russia depends on the European Union for most of its exports and imports, but no free trade agreement is even on the horizon. Investments, by contrast, are relatively well secured through international conventions. In global governance, Russia has changed its attitude from being a joiner to becoming a spoiler. The disruption of supplies of Russian gas to Europe in January 2009 displayed all the shortfalls both of the Russian and Ukrainian gas sectors and of EU policy. The European Union needs to play a more active role. It should monitor gas supplies, production, and storage. It should demand the exclusion of corrupt intermediaries in its gas trade. It should demand that Russia and Ukraine conclude a long- term transit and supply agreement. The European Union should form a proper energy policy, with energy conservation, diversification, unbundling, and increased storage. This is a good time to persuade Russia to ratify the Energy Charter. The European Union should also demand that Ukraine undertake a market-oriented and transparent energy-sector reform. -

Privatization in Russia: Catalyst for the Elite

PRIVATIZATION IN RUSSIA: CATALYST FOR THE ELITE VIRGINIE COULLOUDON During the fall of 1997, the Russian press exposed a corruption scandal in- volving First Deputy Prime Minister Anatoli Chubais, and several other high- ranking officials of the Russian government.' In a familiar scenario, news organizations run by several bankers involved in the privatization process published compromising material that prompted the dismissal of the politi- 2 cians on bribery charges. The main significance of the so-called "Chubais affair" is not that it pro- vides further evidence of corruption in Russia. Rather, it underscores the im- portance of the scandal's timing in light of the prevailing economic environment and privatization policy. It shows how deliberate this political campaign was in removing a rival on the eve of the privatization of Rosneft, Russia's only remaining state-owned oil and gas company. The history of privatization in Russia is riddled with scandals, revealing the critical nature of the struggle for state funding in Russia today. At stake is influence over defining the rules of the political game. The aim of this article is to demonstrate how privatization in Russia gave birth to an oligarchic re- gime and how, paradoxically, it would eventually destroy that very oligar- chy. This article intends to study how privatization influenced the creation of the present elite structure and how it may further transform Russian decision making in the foreseeable future. Privatization is generally seen as a prerequisite to a market economy, which in turn is considered a sine qua non to establishing a democratic regime. But some Russian analysts and political leaders disagree with this approach. -

Russia Intelligence

N°70 - January 31 2008 Published every two weeks / International Edition CONTENTS SPOTLIGHT P. 1-3 Politics & Government c Medvedev’s Last Battle Before Kremlin Debut SPOTLIGHT c Medvedev’s Last Battle The arrest of Semyon Mogilevich in Moscow on Jan. 23 is a considerable development on Russia’s cur- Before Kremlin Debut rent political landscape. His profile is altogether singular: linked to a crime gang known as “solntsevo” and PRESIDENTIAL ELECTIONS sought in the United States for money-laundering and fraud, Mogilevich lived an apparently peaceful exis- c Final Stretch for tence in Moscow in the renowned Rublyovka road residential neighborhood in which government figures « Operation Succession » and businessmen rub shoulders. In truth, however, he was involved in at least two types of business. One c Kirillov, Shestakov, was the sale of perfume and cosmetic goods through the firm Arbat Prestige, whose manager and leading Potekhin: the New St. “official” shareholder is Vladimir Nekrasov who was arrested at the same time as Mogilevich as the two left Petersburg Crew in Moscow a restaurant at which they had lunched. The charge that led to their incarceration was evading taxes worth DIPLOMACY around 1.5 million euros and involving companies linked to Arbat Prestige. c Balkans : Putin’s Gets His Revenge The other business to which Mogilevich’s name has been linked since at least 2003 concerns trading in P. 4-7 Business & Networks gas. As Russia Intelligence regularly reported in previous issues, Mogilevich was reportedly the driving force behind the creation of two commercial entities that played a leading role in gas relations between Russia, BEHIND THE SCENE Turkmenistan and Ukraine: EuralTransGaz first and then RosUkrEnergo later. -

M. Korostikov / Russian State and Economy

’Ifri ’Ifri _____________________________________________________________________ Leaving to Come Back: Russian Senior Officials and the State-Owned Companies _____________________________________________________________________ Mikhail Korostikov August 2015 . Russia/NIS Center Ifri is a research center and a forum for debate on major international political and economic issues. Headed by Thierry de Montbrial since its founding in 1979, Ifri is a non-governmental and a non-profit organization. As an independent think tank, Ifri sets its own research agenda, publishing its findings regularly for a global audience. With offices in Paris and Brussels, Ifri stands out as one of the rare French think tanks to have positioned itself at the very heart of European debate. Using an interdisciplinary approach, Ifri brings together political and economic decision-makers, researchers and internationally renowned experts to animate its debates and research activities. The opinions expressed in this article are the authors’ alone and do not reflect the official views of their institutions. ISBN: 978-2-36567-435-5 © All rights reserved, Ifri, 2015 Ifri Ifri-Bruxelles 27, rue de la Procession Rue Marie-Thérèse, 21 75740 Paris Cedex 15 – FRANCE 1000 – Bruxelles – BELGIQUE Tél. : +33 (0)1 40 61 60 00 Tél. : +32 (0)2 238 51 10 Fax : +33 (0)1 40 61 60 60 Fax : +32 (0)2 238 51 15 Email : [email protected] Email : [email protected] Website : Ifri.org Russie.Nei.Visions Russie.Nei.Visions is an online collection dedicated to Russia and the other new independent states (Belarus, Ukraine, Moldova, Armenia, Georgia, Azerbaijan, Kazakhstan, Uzbekistan, Turkmenistan, Tajikistan and Kyrgyzstan). Written by leading experts, these policy- oriented papers deal with strategic, political and economic issues. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

Argus Russian Coal

Argus Russian Coal Issue 17-36 | Monday 9 October 2017 MARKET COmmENTARY PRICES Turkey lifts coal imports from Russia Russian coal prices $/t Turkey increased receipts of Russian thermal coal by 9pc on Delivery basis NAR kcal/kg Delivery period 6 Oct ± 29 Sep the year in January-August, to 7.79mn t, according to data fob Baltic ports 6,000 Nov-Dec 17 86.97 -0.20 from statistics agency Tuik, amid higher demand from utili- fob Black Sea ports 6,000 Nov-Dec 17 90.63 -0.25 ties and households. Russian material replaced supplies from cif Marmara* 6,000 Nov 17 100.33 0.33 South Africa, which redirected part of shipments to more fob Vostochny 6,000 Nov-Dec 17 100.00 1.00 profitable markets in Asia-Pacific this year. fob Vostochny 5,500 Nov-Dec 17 87.0 0 1.75 *assessment of Russian and non-Russian coal In August Russian coal receipts rose to over 1.26mn t, up by 15pc on the year and by around 19pc on the month. Russian coal prices $/t This year demand for sized Russian coal is higher com- Delivery basis NAR kcal/kg Delivery period Low High pared with last year because of colder winter weather in 2016-2017, a Russian supplier says. Demand for coal fines fob Baltic ports 6,000 Nov-Dec 17 85.25 88.00 fob Black Sea ports 6,000 Nov-Dec 17 89.50 91.00 from utilities has also risen amid the launch of new coal- fob Vostochny 6,000 Nov-Dec 17 100.00 100.00 fired capacity, the source adds. -

Progress and Obstacles

MULTI-DIMENSIONAL SECURITY COOPERATION BETWEEN RUSSIA AND SOUTH KOREA: PROGRESS AND OBSTACLES Se Hyun Ahn London School of Economics and Political Science Department of International Relations A thesis submitted to the University of London for the Degree of Doctor of Philosophy in International Relations 2006 UMI Number: U213461 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U213461 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 F £5 ibU I o S ’ 3 3 q. Abstract This thesis explores the progress in, and the obstacles obstructing, the building of comprehensive security between Russia and South Korea since diplomatic relations were established in 1991. It focuses on oil and natural gas projects, linking the Trans-Siberian and Trans-Korean Railroads, industrial development in the Nakhodka Free Economic Zone, fishery cooperation, and the arms trade, and examines whether these five aspects of cooperation serve to contribute to building Russian-South Korean bilateral and regional economic security. The study pays particular attention to three aspects of security: definitions of economic, comprehensive and regional economic security, the security building process between states, and security threats. -

SSI Changes 2014 (PDF)

OFFICE OF FOREIGN ASSETS CONTROL CHANGES TO THE Sectoral Sanctions Identifications List SINCE JANUARY 1, 2014 This publication of Treasury's Office of Foreign [email protected]; BIK (RU) 044525060 [UKRAINE- OTKRYTOE AKTSIONERNOE Assets Control ("OFAC") is a reference tool EO13662]. OBSHCHESTVO; a.k.a. GPB, OAO; a.k.a. GPB, providing actual notice of actions by OFAC with BANK RAZVITIYA I OJSC), 16, Building 1, Nametkina St., Moscow respect to persons that are identified pursuant to VNESHNEEKONOMICHESKOI 117420, Russia; 63, Novocheremushkinskaya Executive Order 13662 and are listed on the DEYATELNOSTI (VNESHEKONOMBANK) St., Moscow 117418, Russia; SWIFT/BIC Sectoral Sanctions Identifications List (SSI List). GOSUDARSTVENNAYA KORPORATSIYA GAZPRUMM; Website www.gazprombank.ru; The latest changes may appear here prior to their (a.k.a. BANK FOR DEVELOPMENT AND Email Address [email protected]; publication in the Federal Register, and it is FOREIGN ECONOMIC AFFAIRS Registration ID 1027700167110; Tax ID No. intended that users rely on changes indicated in (VNESHECONOMBANK) STATE 7744001497; Government Gazette Number this document. Such changes reflect official CORPORATION; a.k.a. VNESHECONOMBANK; 09807684 [UKRAINE-EO13662]. actions of OFAC, and will be reflected as soon as a.k.a. "VEB"), 9 Akademika Sakharova prospekt, GAZPROMBANK OPEN JOINT STOCK practicable in the Federal Register under the Moscow 107996, Russia; SWIFT/BIC BFEA RU COMPANY (a.k.a. GAZPROMBANK GAS index heading "Foreign Assets Control." New MM; Website http://www.veb.ru; Email Address INDUSTRY OJSC; a.k.a. GAZPROMBANK Federal Register notices with regard to [email protected]; BIK (RU) 044525060 [UKRAINE- OAO; a.k.a. GAZPROMBANK OJSC; a.k.a. -

A Survey of Corporate Governance in Russia

Centre for Economic and Financial Research at New Economic School June 2007 A Survey of Corporate Governance in Russia Olga Lazareva Andrei Rachinsky Sergey Stepanov Working Paper No 103 CEFIR / NES Working Paper series A Survey of Corporate Governance in Russia Olga Lazareva, Andrei Rachinsky, and Sergey Stepanov* June 2007 Abstract In this survey, we describe the current state of corporate governance in Russia and discuss its dynamics and prospects. We review the main mechanisms of corporate governance in the country and relate them to firms’ ownership structures, financial market development and government influence. Finally, we discuss the current trends in Russian corporate governance and its prospects. Keywords: corporate governance, ownership, expropriation, predatory state, property rights JEL Classifications: G32, G34, G38 * Olga Lazareva: Centre for Economic and Financial Research (CEFIR) and Stockholm School of Economics, [email protected]; Andrei Rachinsky: CEFIR, [email protected]; Sergey Stepanov: New Economic School and CEFIR, [email protected] We thank Sergei Guriev for very valuable comments 1. Introduction In this survey we describe the current state of corporate governance in Russia and discuss its dynamics and prospects. Corporate governance has become an important topic in Russia once again, and there is a clear trend among the largest Russian companies to adhere to good corporate governance standards by increasing disclosure, complying with international accounting standards, placing “independent directors” on boards, and adopting corporate governance codes, for example. There have also been initiatives to improve corporate governance from the government, regulators and various private agencies. The government is adopting new laws and amendments to the existing laws. -

Royal Dutch Shell and Its Sustainability Troubles

Royal Dutch Shell and its sustainability troubles Background report to the Erratum of Shell's Annual Report 2010 Albert ten Kate May 2011 1 Colophon Title: Royal Dutch Shell and its sustainability troubles Background report to the Erratum of Shell's Annual Report 2010 May 2011. This report is made on behalf of Milieudefensie (Friends of the Earth Netherlands) Author: Albert ten Kate, free-lance researcher corporate social responsibility Pesthuislaan 61 1054 RH Amsterdam phone: (+31)(0)20 489 29 88 mobile: (+31)(0)6 185 68 354 e-mail: [email protected] 2 Contents Introduction 4 Methodology 5 Cases: 1. Muddling through in Nigeria 6 1a) oil spills 1b) primitive gas flaring 1c) conflict and corruption 2. Denial of Brazilian pesticide diseases 14 3. Mining the Canadian tar sands 17 4. The bitter taste of Brazil's sugarcane 20 4a) sourcing sugarcane from occupiers of indigenous land 4b) bad labour conditions sugarcane harvesters 4c) massive monoculture land use 5. Fracking unconventional gas 29 6. Climate change, a business case? 35 7. Interfering with politics 38 8. Drilling plans Alaska’s Arctic Ocean 42 9. Sakhalin: the last 130 Western Gray Whales 45 10. The risky Kashagan oil field 47 11. A toxic legacy in Curaçao 49 12. Philippines: an oil depot amidst a crowd of people 52 3 Introduction Measured in revenue, Royal Dutch Shell is one of the biggest companies in the world. According to its annual report of 2010, its revenue amounted to USD 368 billion in 2010. Shell produces oil and gas in 30 countries, spread over the world. -

2005 Annual Report on Form 20-F

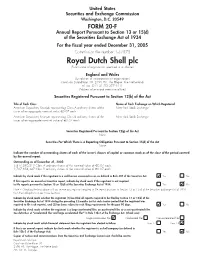

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

2016 Shell Sustainability Report, Which Covers Our Performance in 2016 and Significant Changes and Events During the Year

SUSTAINABILITY REPORT Royal Dutch Shell plc Sustainability Report 2016 03 39 CONTENTS INTRODUCTION OUR PERFORMANCE 04 Introduction from the CEO 40 Safety 06 Topic selection for 2016 43 Security 08 About Shell 43 Environment 10 How sustainability works at Shell 48 Social performance 14 Sustainability governance 53 Embedding sustainability into projects COVER IMAGE The cover shows how collaborations and discussions with communities, 15 55 customers and partners worldwide ENERGY TRANSITION WORKING TOGETHER help Shell provide more and cleaner 16 Towards a low-carbon future 56 Living by our principles energy solutions. 18 Our work to address climate change 57 Environmental and social partners DIGITAL 24 Natural gas 60 Collaborations The Sustainability Report has moved to 25 Liquefied natural gas 61 Shell Foundation an online digital report 26 Research and development 62 Contractors and suppliers reports.shell.com. The digital version 28 Lower-carbon alternatives 63 Our people includes further information such as an interactive GRI index to enhance 64 Our business partners usability for and the experience of the 65 Tax and transparency readers of the report. In the event of 32 any conflict, discrepancy or MANAGING OPERATIONS inconsistency between the digital 33 Our activities in Nigeria 66 report and this hardcopy report of the 35 Oil sands DATA AND REPORTING Sustainability Report then the 36 Shales 67 Abour our reporting information contained in the digital report will prevail. This hardcopy 37 Decommissioning and restoration 68 Environmental data report is provided for the readers’ 38 Measuring the impact of earthquakes in 69 Social and safety data convenience only. Groningen 70 External Review Committee NEW LENS SCENARIOS CAUTIONARY NOTE (a) price fluctuations in crude oil and natural gas; (b) changes in This publication contains data from The companies in which Royal Dutch Shell plc directly and demand for Shell’s products; (c) currency fluctuations; (d) drilling Shell’s New Lens Scenarios.