Preliminary Results for the Year Ended 31St March 2020 Confident in the Strength of Our Business

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Batteries for Electric Cars

Batteries for Electric Cars A case study in industrial strategy Sir Geoffrey Owen Batteries for Electric Cars A case study in industrial strategy Sir Geoffrey Owen Policy Exchange is the UK’s leading think tank. We are an independent, non-partisan educational charity whose mission is to develop and promote new policy ideas that will deliver better public services, a stronger society and a more dynamic economy. Policy Exchange is committed to an evidence-based approach to policy development and retains copyright and full editorial control over all its written research. We work in partnership with academics and other experts and commission major studies involving thor- ough empirical research of alternative policy outcomes. We believe that the policy experience of other countries offers important lessons for government in the UK. We also believe that government has much to learn from business and the voluntary sector. Registered charity no: 1096300. Trustees Diana Berry, Andrew Feldman, Candida Gertler, Greta Jones, Edward Lee, Charlotte Metcalf, Roger Orf, Krishna Rao, Andrew Roberts, George Robinson, Robert Rosenkranz, Peter Wall. About the Author About the Author Sir Geoffrey Owen is Head of Industrial Policy at Policy Exchange. The larger part of his career has been spent at the Financial Times, where he was Deputy Editor from 1973 to 1980 and Editor from 1981 to 1990. He was knighted in 1989. Among his other achievements, he is a Visiting Professor of Practice at the LSE, and he is the author of three books - The rise and fall of great companies: Courtaulds and the reshaping of the man-made fibres industry, Industry in the USA and From Empire to Europe: the decline and revival of British industry since the second world war. -

REV Entry List

Entry List - Public Goodwood Revival 2018 Race(s): 1 Kinrara Trophy - Race Status: National A Car Shelter Year Make and Model Entrant Confirmed Driver(s) No. No. 3 1963 AC Cobra Hunt, Martin Blakeney-Edwards, Patrick/Hunt, Martin 4 1960 Maserati 3500GT Rosina, Stefano Rosina, Stefano/TBC, 5 1960 Aston Martin DB4GT Alexander, Tom Alexander, Tom/Wilmott, Adrian 6 1960 Aston Martin DB4GT Friedrichs, Wolfgang Friedrichs, Wolfgang/Hadfield, Simon 7 1960 Ferrari 250 GT SWB/C Werner, Max Werner, Max/Werner, Moritz 8 1960 Ferrari 250 GT SWB/C Allemann, Benno Dowd, Mike/Gnani, Michael 9 1960 Aston Martin DB4GT Mosler, Mathias Gillian, G.C./Woodgate, Chris 10 1960 Ferrari 250 GT SWB/C Gaye, Vincent Gaye, Vincent/Reid, Anthony 11 1961 Jaguar E-type Ian Dalglish Dalglish, Ian/Turner, James 12 1961 Jaguar E-type FHC Meins, Richard Huff, Rob/Meins, Richard 14 1961 Ferrari 250 GT SWB/C Racing Team Holland Hugenholtz, John/van Oranje, Bernhard 15 1961 Austin Healey 3000 Mk1 Darcey, Michael Woolmer, Paul/Woolmer, Richard 16 1961 Ferrari 250 GT SWB 'Breadvan' Halusa, Niklas Halusa, Niklas/Pirro, Emanuele 17 1962 Jaguar E-type FHC Hayden, Andrew Hayden, Andrew/Hibberd, Andrew 18 1962 Jaguar E-type FHC Corrie, John Minshaw, Jason/Stretton, Martin 19 1960 Ferrari 250 GT SWB Scuderia del Viadotto Vögele, Alain/Vögele, Yves 20 1960 Ferrari 250 GT SWB/C Devis, Marc Devis, Marc/O'Connell, Martin 21 1960 Austin Healey 3000 Mk1 Le Blanc, Karsten Le Blanc, Karsten/van Lanschot, Christiaen 23 1961 Ferrari 250 GT SWB/C Lanzante Ltd. Ellerbrock, Olivier/Glaesel, Christian -

View PDF Version

ChemComm View Article Online FEATURE ARTICLE View Journal | View Issue Covalent non-fused tetrathiafulvalene–acceptor systems Cite this: Chem. Commun., 2016, 52, 7906 Flavia Pop†* and Narcis Avarvari* Covalent donor–acceptor (D–A) systems have significantly contributed to the development of many organic materials and to molecular electronics. Tetrathiafulvalene (TTF) represents one of the most widely studied donor precursors and has been incorporated into the structure of many D–A derivatives with the objective of obtaining redox control and modulation of the intramolecular charge transfer (ICT), in order to address switchable emissive systems and to take advantage of its propensity to form regular stacks in the solid state. In this review, we focus on the main families of non-fused TTF–acceptors, which are classified according to the nature of the acceptor: nitrogen-containing heterocycles, BODIPY, Received 29th February 2016, perylenes and electron poor unsaturated hydrocarbons, as well as radical acceptors. We describe herein the Accepted 25th April 2016 most representative members of each family with a brief mention of their synthesis and a special focus on Creative Commons Attribution 3.0 Unported Licence. DOI: 10.1039/c6cc01827k their D–A characteristics. Special attention is given to ICT and its modulation, fluorescence quenching and switching, photoconductivity, bistability and spin distribution by discussing and comparing spectroscopic www.rsc.org/chemcomm and electrochemical features, photophysical properties, solid-state properties -

Platinum Metals Review

PLATINUM METALS REVIEW A quarterly survey of research on the platinum metals and of developments in their application in industry VOL. 10 APRIL 1966 NO. 2 Contents Recent Advances in Industrial Platinum Resistance Thermometry 42 Petrochemicals by Platinum Reforming 47 Prevention of Corrosion in Paper Making Machines 48 Expansion in Platinum Production 52 Platinum-wound Furnaces in the Manufacture of Semiconductors 53 The Wetting of Platinum and its Alloys by Glass 54 Electrodeposition of Iridium 59 The Reaction between Hydrogen and Oxygen on Platinum 60 Catalysis of Olefin-to-Olefin Addition 65 Abstracts 66 New Patents 73 Communications should be addressed to The Editor, Platinum Metals Review Johnson, Matthey & Co Limited, Hatton Garden, London ECI Recent Advances in Industrial Platinum Resistance Thermometry By J. S. Johnston, B.s~.,A.R.C.S. Rosemount Engineering Company Limited, Bognor Regis The modern platinum resistance thermometer provides the most accurate and versatile method of industrial temperature measurement and control. This article gives details of a new design of platinum resistance thermo- meter element of small dimensions and good stability. It also describes a range of complete thermometers based on these elements together with a resistance-bridge system used for signal conditioning when the thermo- meters are used in data-logging or computer controlled systems. Two principal factors have contributed to a thermometer confers the advantages of better recent large increase in the use of platinum reproducibility and larger output signal resistance thermometers in industry. On the coupled with the ability to scale the output one hand new techniques of manufxture to fit the requirements of the instrumentation. -

September 2020

TB Saracen UK Alpha Fund September 2020 Fund Overview FOR PROFESSIONAL INVESTORS ONLY • Objective: to achieve a higher rate of return than the MSCI UK All Cap Index by investing in a portfolio of primarily UK equity securities with the potential for long Retail investors should consult their term growth. financial advisers • The portfolio has a bias towards small and medium sized companies and a high active share compared to the benchmark. FUND DETAILS th (as at 30 September 2020) • The fund has significant capacity and liquidity at a competitive annual charge. • The Fund has, since launch in March 1999, outperformed its benchmark in 17 out Fund size: £10.3m of 21 years and in 8 out of the last 10 calendar years. Launch date: 05/03/99 • A concentrated portfolio of 25-35 holdings, with a focus on capital growth, backed by the Saracen research process. No. of holdings: 33 Active share: 93% Source: Bloomberg Performance Chart* TB Saracen UK Alpha Fund B Acc Denomination: GBP 5 Year Performance (%) MSCI UK All Cap Index (TR) Valuation point: 12 noon 170 160 Fund prices: A Accumulation: 395.73p 150 B Accumulation: 651.65p 140 Policy is not to charge a dilution levy except in exceptional circumstances. 130 120 ACD: 110 T. Bailey Fund Services Limited 100 90 80 Scott McKenzie David Clark Fund Manager Fund Manager 09/15 03/16 09/16 03/17 09/17 03/18 09/18 03/19 09/19 03/20 09/20 *Source: Bloomberg, as at 30th September 2020 Total Return, Bid to Bid, GBP terms. -

Presentation to Analysts / Investors Johnson Matthey in China

Presentation to Analysts / Investors Johnson Matthey in China London Stock Exchange 27th / 28th January 2010 Cautionary Statement This presentation contains forward looking statements that are subject to risk factors associated with, amongst other things, the economic and business circumstances occurring from time to time in the countries and sectors in which Johnson Matthey operates. It is believed that the expectations reflected in these statements are reasonable but they may be affected by a wide range of variables which could cause actual results to differ materially from those currently anticipated. Overview and Trading Update Neil Carson Chief Executive JM Executive Board • Neil Carson - Chief Executive • Robert MacLeod - Group Finance Director • Larry Pentz - Executive Director, Environmental Technologies • Bill Sandford - Executive Director, Precious Metal Products 4 Other Senior Management • John Walker Division Director, Emission Control Technologies • Neil Whitley Division Director, Process Technologies • Nick Garner Division Director, Fine Chemicals • Geoff Otterman Division Director, Catalysts, Chemicals and Refining • Linky Lai General Manager, Emission Control Technologies, China • Henry Liu Commercial Director, Emission Control Technologies, China • Peng Zhang Sales Director, Power Plant Industries, China • Wolfgang Schuettenhelm Director, Worldwide Power Plant Industries • Andrew Wright Managing Director, Syngas and Gas to Products • David Tomlinson President, Davy Process Technology • Vikram Singh Country Head (AMOG) -

Introduction to Batteries at Johnson Matthey

http://dx.doi.org/10.1595/205651315X686723 Johnson Matthey Technol. Rev., 2015, 59, (1), 2–3 JOHNSON MATTHEY TECHNOLOGY REVIEW www.technology.matthey.com Guest Editorial Introduction to Batteries at Johnson Matthey It may surprise some readers to see an edition of this generation batteries and operates at two points in the journal dedicated largely to lithium-ion batteries, but value chain for lithium-ion batteries (Figure 1). this is a technology that Johnson Matthey considers Through a combination of in-house R&D and a major new business area for the company. acquisition the company is establishing itself as a Johnson Matthey has been involved in research and signifi cant player in the sector. From an initial position development (R&D) in the battery materials space for in lithium iron phosphate materials, further investments several years and launched its commercial business in the coming years will expand the product range, operations in the sector in 2012. Since then, the working with cell developers to commercialise improved company has made a series of acquisitions to establish and next generation materials. itself both as a global supplier of cathode materials and There are big challenges to deliver the performance of advanced battery systems. Complemented by its required for advanced lithium-ion cells, not just initial lithium-ion battery research group at the Technology performance but durability and long term safety, as well Centres in Sonning Common, UK, and in Singapore, as cost. Good cell design and effi cient manufacture are the Battery Technology business of Johnson Matthey critical elements but the functional materials used are sits within its New Business Division. -

Studentthesis-Michele Blagg 2013

This electronic thesis or dissertation has been downloaded from the King’s Research Portal at https://kclpure.kcl.ac.uk/portal/ The Royal Mint Refinery, a Business Adapting to Change, 1919-1968 Blagg, Michele Awarding institution: King's College London The copyright of this thesis rests with the author and no quotation from it or information derived from it may be published without proper acknowledgement. END USER LICENCE AGREEMENT Unless another licence is stated on the immediately following page this work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International licence. https://creativecommons.org/licenses/by-nc-nd/4.0/ You are free to copy, distribute and transmit the work Under the following conditions: Attribution: You must attribute the work in the manner specified by the author (but not in any way that suggests that they endorse you or your use of the work). Non Commercial: You may not use this work for commercial purposes. No Derivative Works - You may not alter, transform, or build upon this work. Any of these conditions can be waived if you receive permission from the author. Your fair dealings and other rights are in no way affected by the above. Take down policy If you believe that this document breaches copyright please contact [email protected] providing details, and we will remove access to the work immediately and investigate your claim. Download date: 07. Oct. 2021 This electronic theses or dissertation has been downloaded from the King’s Research Portal at https://kclpure.kcl.ac.uk/portal/ The Royal Mint Refinery, a Business Adapting to Change, 1919-1968 Title: Author: Michele Blagg The copyright of this thesis rests with the author and no quotation from it or information derived from it may be published without proper acknowledgement. -

Description Holding Book Cost Market Price Market Value £000'S £000'S

DORSET COUNTY PENSION FUND VALUATION OF PORTFOLIO AT CLOSE OF BUSINESS 31 March 2017 Book Market Description Holding Market Value Cost Price £000's £000's UK EQUITIES MINING ACACIA MINING 33,000 147.93 4.502 148.57 ANGLO AMERICAN ORD USD0.54 270,390 2,804.18 12.27 3,317.69 ANTOFAGASTA ORD GBP0.05 74,500 151.50 8.355 622.45 BHP BILLITON ORD USD0.50 436,926 2,401.54 12.395 5,415.70 CENTAMIN EGYPT LTD 226,000 349.07 1.732 391.43 FRESNILLO 35,500 88.20 15.52 550.96 GLENCORE XSTRATA 2,412,543 5,662.91 3.141 7,577.80 HOCHSCHILD MINING ORD GBP0.25 49,000 108.90 2.765 135.49 KAZ MINERALS 53,600 89.80 4.551 243.93 PETRA DIAMONDS 106,900 169.67 1.329 142.07 POLYMETAL INT'L 53,800 514.30 9.945 535.04 RANDGOLD RESOURCES ORD USD0.05 19,250 485.32 69.7 1,341.73 RIO TINTO ORD GBP0.10 (REG) 250,150 2,876.49 32.185 8,051.08 VEDANTA RESOURCES ORD USD0.10 18,500 75.07 8.11 150.04 Total MINING 15,924.89 28,524.69 OIL & GAS PRODUCERS AFREN PLC 218,000 215.93 0 0.00 BP ORD USD0.25 3,948,100 13,177.95 4.5885 18,115.86 CAIRN ENERGY ORD GBP0.06153846153 119,207 236.32 2.048 244.14 NOSTRUM OIL & GAS 17,700 84.36 4.796 84.89 ROYAL DUTCH 'B' ORD EUR0.07 1,642,961 20,190.09 21.945 36,054.78 TULLOW OIL ORD GBP 0.10 188,500 789.92 1.99026 375.16 Total OIL & GAS PRODUCERS 34,694.58 54,658.45 CHEMICALS CRODA INTL ORD GBP0.10 26,995 211.15 35.77 965.61 ELEMENTIS 99,000 130.23 2.899 287.00 JOHNSON MATTHEY ORD GBP1.00 40,357 446.31 30.82 1,243.80 SYNTHOMER 57,665 118.87 4.751 273.97 VICTREX ORD GBP0.01 17,000 111.61 19.02 323.34 Total CHEMICALS 1,018.16 3,087.91 CONSTRUCTION -

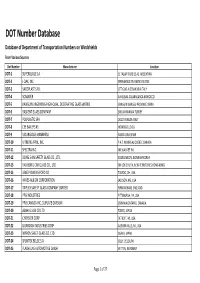

DOT Number Database Database of Department of Transportation Numbers on Windshields from Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A

DOT Number Database Database of Department of Transportation Numbers on Windshields From Various Sources Dot Number Manufacturer Location DOT‐1 SUPERGLASS S.A. EL TALAR TIGRE BS.AS. ARGENTINA DOT‐2 J‐DAK, INC. SPRINGFIELD TN UNITED STATES DOT‐3 SACOPLAST S.R.L. OTTIGLIO ALESSANDRIA ITALY DOT‐4 SOMAVER AIN SEBAA CASABNLANCA MOROCCO DOT‐5 JIANGUIN JINGEHENG HIGH‐QUAL. DECORATING GLASS WORKS JIANGUIN JIANGSU PROVINCE CHINA DOT‐6 BASKENT GLASS COMPANY SINCAN ANKARA TURKEY DOT‐7 POLPLASTIC SPA DOLO VENEZIA ITALY DOT‐8 CEE BAILEYS #1 MONTEBELLO CA DOT‐9 VIDURGLASS MANBRESA BARCELONA SPAIN DOT‐10 VITRERIE APRIL, INC. P.A.T. MONREAL QUEBEC CANADA DOT‐11 SPECTRA INC. MILWAUKEE WI DOT‐12 DONG SHIN SAFETY GLASS CO., LTD. BOOKILMEON, JEONNAM KOREA DOT‐13 YAU BONG CAR GLASS CO., LTD. ON LOK CHUEN, NEW TERRITORIES HONG KONG DOT‐15 LIBBEY‐OWENS‐FORD CO TOLEDO, OH, USA DOT‐16 HAYES‐ALBION CORPORATION JACKSON, MS, USA DOT‐17 TRIPLEX SAFETY GLASS COMPANY LIMITED BIRMINGHAM, ENGLAND DOT‐18 PPG INDUSTRIES PITTSBURGH, PA, USA DOT‐19 PPG CANADA INC.,DUPLATE DIVISION OSHAWA,ONTARIO, CANADA DOT‐20 ASAHI GLASS CO LTD TOKYO, JAPAN DOT‐21 CHRYSLER CORP DETROIT, MI, USA DOT‐22 GUARDIAN INDUSTRIES CORP AUBURN HILLS, MI, USA DOT‐23 NIPPON SHEET GLASS CO. LTD OSAKA, JAPAN DOT‐24 SPLINTEX BELGE S.A. GILLY, BELGIUM DOT‐25 FLACHGLAS AUTOMOTIVE GmbH WITTEN, GERMANY Page 1 of 27 Dot Number Manufacturer Location DOT‐26 CORNING GLASS WORKS CORNING, NY, USA DOT‐27 SEKURIT SAINT‐GOBAIN DEUTSCHLAND GMBH GERMANY DOT‐32 GLACERIES REUNIES S.A. BELGIUM DOT‐33 LAMINATED GLASS CORPORATION DETROIT, MI, USA DOT‐35 PREMIER AUTOGLASS CORPORATION LANCASTER, OH, USA DOT‐36 SOCIETA ITALIANA VETRO S.P.A. -

1 Information Memorandum Unsecured, Subordinated Perpetual, Listed, Rated Hybrid Securities in the Form of Non Convertible Deben

INFORMATION MEMORANDUM UNSECURED, SUBORDINATED PERPETUAL, LISTED, RATED HYBRID SECURITIES IN THE FORM OF NON CONVERTIBLE DEBENTURES ON A PRIVATE PLACEMENT BASIS Issue Opening Date: 10 May 2011 Issue Closing Date: 11 May 2011 1 Tata Steel Limited A Public Company incorporated under the Indian Companies Act, VI of 1882 Date of Incorporation: 26 August 1907 Registered Office: 3rd floor, Bombay House, 24 Homi Mody Street, Fort, Mumbai 400-001, India Phone No.: 91 22 6665 7279 Fax No.: 91 22 6665 8113 Email: [email protected] Website: www.tatasteel.com INFORMATION MEMORANDUM FOR ISSUE OF UNSECURED, SUBORDINATED, PERPETUAL, LISTED, RATED HYBRID SECURITIES IN THE FORM OF NON CONVERTIBLE DEBENTURES ON A PRIVATE PLACEMENT BASIS INFORMATION MEMORANDUM FOR PRIVATE PLACEMENT OF UNSECURED, SUBORDINATED PERPETUAL, LISTED, RATED HYBRID SECURITIES IN THE FORM OF NON CONVERTIBLE DEBENTURES OF FACE VALUE OF RS.10,00,000/- EACH FOR CASH AT PAR AGGREGATING TO AN AMOUNT OF RS.525 CRORES, WITH GREEN SHOE OPTION (the “SECURITIES”) TO BE ISSUED IN FINANCIAL YEAR 2011-12 GENERAL RISKS General Risks: Investors are advised to read the risk factors carefully before taking an Investment decision in this issue. For taking an investment decision, investors must rely on their own examination of the issuer and the Information Memorandum including the risks involved. The securities have not been recommended or approved by Securities and Exchange Board of India (SEBI) nor does SEBI guarantee the accuracy or adequacy of this Information Memorandum. Special attention -

Volume 64, Issue 3, July 2020 Published by Johnson Matthey © Copyright 2020 Johnson Matthey

ISSN 2056-5135 Johnson Matthey’s international journal of research exploring science and technology in industrial applications Volume 64, Issue 3, July 2020 Published by Johnson Matthey www.technology.matthey.com © Copyright 2020 Johnson Matthey Johnson Matthey Technology Review is published by Johnson Matthey Plc. This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. You may share, copy and redistribute the material in any medium or format for any lawful purpose. You must give appropriate credit to the author and publisher. You may not use the material for commercial purposes without prior permission. You may not distribute modifi ed material without prior permission. The rights of users under exceptions and limitations, such as fair use and fair dealing, are not aff ected by the CC licenses. www.technology.matthey.com www.technology.matthey.com Johnson Matthey’s international journal of research exploring science and technology in industrial applications Contents Volume 64, Issue 3, July 2020 234 Guest Editorial: Johnson Matthey Technology Review Special Edition on Clean Mobility By Andy Walker 236 Powering the Future through Hydrogen and Polymer Electrolyte Membrane Fuel Cells By Bo Ki Hong, Sae Hoon Kim and Chi Myung Kim 252 Exploring the Impact of Policy on Road Transport in 2050 By Huw Davies 263 Sustainable Aviation Fuels By Ausilio Bauen, Niccolò Bitossi, Lizzie German, Anisha Harris and Khangzhen Leow 279 Hydrogen Fuel Cell Vehicle Drivers and Future Station Planning By Scott Kelley, Michael Kuby, Oscar Lopez Jaramillo, Rhian Stotts, Aimee Krafft and Darren Ruddell 287 Battery Materials Technology Trends and Market Drivers for Automotive Applications By Sarah Ball, Joanna Clark and James Cookson 298 Adaptable Reactors for Resource- and Energy-Efficient Methane Valorisation (ADREM) By Emmanouela Korkakaki, Stéphane Walspurger, Koos Overwater, Hakan Nigar, Ignacio Julian, Georgios D.