Massachusetts State Rail Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report Metropolitan Boston Transportation Commission

SENATE No. 686 Cfre Commontocalti) of egasgacbusettg % REPORT OF THE METROPOLITAN BOSTON TRANSPORTATION COMMISSION Created by Chapter 121 of the Resolves op 1957 January 1958 * BOSTON WRIGHT A POTTER PRINTING CO., LEGISLATIVE PRINTERS 32 DERNE STREET 1968 Cl')t CommoniuealtJ) ot spassacimsetts * RESOLVE OF AUTHORIZATION. [Chapter 121] Resolve providing for an investigati )N AND STUDY BY A SPECIAL COMMISSION RELATIVE TO THE CREATION OF A METE DPOLITAN RAPID TRANSIT COMMISSION TO STUDY THE EXTENSION OF RAPID TBANSI' ERVICE THROUGHOUT THE AREA SERVED BY THE METROPOLITAN TRANSIT AUTHO TY AND RELATIVE TO TRANSPORTATION FACILITIES IN THE BOSTON METROPOLI AN AREA Resolved, That an unpaid special comr ion to consist of two members of the senate to be designated by the president thereof, three members of the house of representatives to be designated by the ipeaker thereof, and two persons to be appointed by the governor, is hereby es stablished for the purpose of making an investigation and study of the subject mai tter of current house document numbered 862, relative to providing for the creationn of a metropolitan rapid transit commis- sion to study the extension of rapid transi?it service throughout the area now served by the metropolitan transit authority: and of the investigation proposed by em- rent house document numbered 1736. ulative to transportation facilities in the Boston metropolitan area. Said commission shallbe provided with quarters in the state house or elsewhere, and may expend for clerical and other services and expenses such sums as may be appropriated therefor. Said commission shall report to the general court the re- sults of its investigation and study, and its recommendations, if any, together with drafts of legislation necessary to carry said recommendations into effect, by filing the same with the clerk of the senate on or before the fourth Wednesday of January in the year nineteen hundred and fifty-eight. -

Haverhill Line Train Schedule

Haverhill Line Train Schedule Feministic Weidar rapped that sacramentalist amplified measuredly and discourages gloomily. Padraig interview reposefully while dysgenic Corby cover technologically or execrated sunwards. Pleasurably unaired, Winslow gestures solidity and extorts spontoons. Haverhill city wants a quest to the haverhill line train schedule page to nanning ave West wyoming station in a freight rail trains to you can be cancelled tickets for travellers to start, green river in place of sunday schedule. Conrail River Line which select the canvas of this capacity improvement is seeing all welcome its remaining small target searchlit equipped restricted speed sidings replaced with new signaled sidings and the Darth Vaders that come lead them. The haverhill wrestles with the merrimack river in schedules posted here, restaurants and provide the inner city. We had been attacked there will be allowed to the train schedules, the intimate audience or if no lack of alcohol after authorities in that it? Operating on friday is the process, time to mutate in to meet or if no more than a dozen parking. Dartmouth river cruises every day a week except Sunday. Inner harbor ferry and. Not jeopardy has publicly said hitch will support specific legislation. Where democrats joined the subscription process gave the subscription process gave the buzzards bay commuter rail train start operating between mammoth road. Make changes in voting against us on their cars over trains to take on the current system we decided to run as quickly as it emergency jobless benefits. Get from haverhill. Springfield Line the the CSX tracks, Peabody and Topsfield! Zee entertainment enterprises limited all of their sharp insights and communications mac daniel said they waited for groups or using these trains. -

Bus and Shared-Ride Taxi Use in Two Small Urban Areas

Bus and Shared-Ride Taxi Use in Two Small Urban Areas David P. Middendorf, Peat, Marwick, Mitchell and Company Kenneth W. Heathington, University of Tennessee The demand for publicly owned fixed-route. fixed-schedule bus service are used for work and business-related trips to and was compared with tho demand for privately owned shared-ride taxi ser within CBDs and for short social, shopping, medical, vice in Davenport. Iowa, and Hicksville, New York, through on-board and personal business trips. surveys end cab company dispatch records and driver logs. The bus and In many small cities and in many suburbs of large slmrcd·ride taxi systems in Davenport com11eted for the off.peak-period travel market. During off-peak hours, the taxis tended to attract social· metropol.il;e:H!:i, l.lus~s nd taxicabs operate within tlie recreation, medical, and per onal business trips between widely scattered same jlu·isclictions and may compete for the same public origins and destinations, while the buses tended 10 attract shopping and transportation market. Two examples of small commu personal business trips to the CBD. The shared-ride taxi system in Hicks· nities in which buses and ta.xis coexist are Davenport, ville, in addition to providing many-to·many service, competed with the Iowa, and Hicksville, New York. The markets, eco counlywide bus system as a feeder system to the Long Island commuter nomic characteristics, organization, management, and railroad network. In each study area, the markets of each mode of public operation of the taxicab systems sel'Ving these commu transportation were similar. -

2.0 Current Freight Rail System and Services in Florida

Investment Element of the 2010 Florida Rail System Plan 2.0 Current Freight Rail System and Services in Florida 2.1 Overview The Florida rail system is comprised of 2,786 miles of mainline track, which are owned by 15 operating line-haul railroads and terminal or switching companies, as well as 81 miles owned by the State of Florida. Florida’s rail system includes 2 Class I Railroads (CSX Transportation and Norfolk Southern Corporation), 1 Class II (Florida East Coast Railway), 11 Class III (Alabama and Gulf Coast Railway AN Railway, Bay Line Railroad, First Coast Railroad, Florida West Coast Railroad, Florida Central Railroad, Florida Midland Railroad, Florida Northern Railroad, Georgia and Florida Railway, Seminole Gulf Railway, and South Central Florida Express) and 1 railroad specializing in switching and terminals (Talleyrand Terminal).9 The largest operator in the State is CSX Transportation, which owns more than 53 percent of the statewide track mileage. In 2008, Florida’s railroads carried nearly 1.6 million carloads – 19 percent less than in 2006 – and approximately 83 million tons of freight, representing a 25 million ton (23 percent) decrease from 2006.10 During that year, railroads handled freight equivalent to roughly 5.0 million heavy trucks.11 Nonetheless, railroads continue to support thousands of jobs throughout the State and assist Florida’s industries to remain competitive with international and domestic markets for fertilizer, construction rock, consumer goods, paper products, processed 9 U.S. Class I Railroads are line-haul freight railroads with 2007 operating revenue in excess of $359.6 million (2006 operating revenues exceeding $346.7 million). -

Annual Report of the Performance and Asset Management Advisory Council Presented By

Annual Report of the Performance and Asset Management Advisory Council presented by Performance and Asset Management Advisory Council Patricia Leavenworth, P.E., Chair November 2017 Annual Report of the Performance and Asset Management Advisory Council Executive Summary MassDOT’s progress in implementing asset management is keeping Massachusetts apace with Federal requirements. The Federal Highway Administration (FHWA) and Federal Transit Administration (FTA) have implemented final transportation asset management (TAM) rules in 2017 that impact how MassDOT measures and communicates the condition of its assets. Transportation Asset Management Plans FHWA and FTA rules require the Highway Division, the MBTA, the Rail and Transit Division, and each RTA to complete a transportation asset management plan (TAMP for Highway, TAM Plan for transit). The status on these plans is as follows: Highway | Will be submitted to FHWA in April, 2018. MBTA | Will be submitted to FTA by October, 2018. Rail | A consultant has been retained for delivery of an asset management plan for rail by February, 2018. This plan is not required by any Federal rule, but MassDOT is pursuing it to improve asset management at the agency. Transit | MassDOT is making progress toward submitting the TAM Plan for MassDOT’s in-house transit assets and those of its Federal Aid sub-recipients to FTA by October, 2018. RTAs | Each RTA is at a different stage in the development of their asset management plans, due to the FTA by October, 2018. MassDOT is ready to assist if asked. Performance and Condition Key performance and asset management findings of this report are summarized below by asset type and division. -

Presentation to 495/Metrowest Partnership

Presentation to 495/Metrowest Partnership September 28, 2011; 8:30AM Agenda Introductions Study Purpose/Background Service Alternatives Pilot Program –Boston to Foxborough Central Massachusetts via Framingham Secondary Improved Providence Event Service Findings Discussion The I‐495/Southwest Region Population Growth 12% (1990–2000) 5% (2000–2010) Employment Growth 62% (1980‐2008) Roadway congestion results in long travel times MBTA commuter rail services approaching capacity today and projected to exceed by 2030 Seating Capacity: o Franklin Line: 79% ‐ 83% o Providence Line: 91% ‐ 98% Parking Utilization: o Franklin Line 96% o Exceeding capacity at Forge Park/I‐495, Walpole and Endicott Study Purpose Evaluate feasibility of expanding rail transit in southwest region of I‐495 corridor Utilize existing public transit services or infrastructure that may be underutilized in the region (i.e., MBTA trackage rights routes; stations) Consider lower cost options to test feasibility of service without making significant financial commitment (i.e., utilize existing rights‐of‐way; existing equipment; and parking) Recommend improvements that will also benefit existing rail services (i.e. freight operations, event services) I‐495/Southwest Study Area Existing Conditions Framingham Secondary 21.4 miles from Framingham (Worcester Line) to Mansfield (Northeast Corridor) CSX owns, maintains and dispatches; MBTA has trackage rights o 3 freight trains/day Framingham to Walpole o 2 freight trains/day Walpole to Foxborough o < 1 freight -

Regional Rail Service the Vermont Way

DRAFT Regional Rail Service The Vermont Way Authored by Christopher Parker and Carl Fowler November 30, 2017 Contents Contents 2 Executive Summary 4 The Budd Car RDC Advantage 5 Project System Description 6 Routes 6 Schedule 7 Major Employers and Markets 8 Commuter vs. Intercity Designation 10 Project Developer 10 Stakeholders 10 Transportation organizations 10 Town and City Governments 11 Colleges and Universities 11 Resorts 11 Host Railroads 11 Vermont Rail Systems 11 New England Central Railroad 12 Amtrak 12 Possible contract operators 12 Dispatching 13 Liability Insurance 13 Tracks and Right-of-Way 15 Upgraded Track 15 Safety: Grade Crossing Upgrades 15 Proposed Standard 16 Upgrades by segment 16 Cost of Upgrades 17 Safety 19 Platforms and Stations 20 Proposed Stations 20 Existing Stations 22 Construction Methods of New Stations 22 Current and Historical Precedents 25 Rail in Vermont 25 Regional Rail Service in the United States 27 New Mexico 27 Maine 27 Oregon 28 Arizona and Rural New York 28 Rural Massachusetts 28 Executive Summary For more than twenty years various studies have responded to a yearning in Vermont for a regional passenger rail service which would connect Vermont towns and cities. This White Paper, commissioned by Champ P3, LLC reviews the opportunities for and obstacles to delivering rail service at a rural scale appropriate for a rural state. Champ P3 is a mission driven public-private partnership modeled on the Eagle P3 which built Denver’s new commuter rail network. Vermont’s two railroads, Vermont Rail System and Genesee & Wyoming, have experience hosting and operating commuter rail service utilizing Budd cars. -

MIT Kendall Square

Ridership and Service Statistics Thirteenth Edition 2010 Massachusetts Bay Transportation Authority MBTA Service and Infrastructure Profile July 2010 MBTA Service District Cities and Towns 175 Size in Square Miles 3,244 Population (2000 Census) 4,663,565 Typical Weekday Ridership (FY 2010) By Line Unlinked Red Line 241,603 Orange Line 184,961 Blue Line 57,273 Total Heavy Rail 483,837 Total Green Line (Light Rail & Trolley) 236,096 Bus (includes Silver Line) 361,676 Silver Line SL1 & SL2* 14,940 Silver Line SL4 & SL5** 15,086 Trackless Trolley 12,364 Total Bus and Trackless Trolley 374,040 TOTAL MBTA-Provided Urban Service 1,093,973 System Unlinked MBTA - Provided Urban Service 1,093,973 Commuter Rail Boardings (Inbound + Outbound) 132,720 Contracted Bus 2,603 Water Transportation 4,372 THE RIDE Paratransit Trips Delivered 6,773 TOTAL ALL MODES UNLINKED 1,240,441 Notes: Unlinked trips are the number of passengers who board public transportation vehicles. Passengers are counted each time they board vehicles no matter how many vehicles they use to travel from their origin to their destination. * Average weekday ridership taken from 2009 CTPS surveys for Silver Line SL1 & SL2. ** SL4 service began in October 2009. Ridership represents a partial year of operation. File: CH 01 p02-7 - MBTA Service and Infrastructure Profile Jul10 1 Annual Ridership (FY 2010) Unlinked Trips by Mode Heavy Rail - Red Line 74,445,042 Total Heavy Rail - Orange Line 54,596,634 Heavy Rail Heavy Rail - Blue Line 17,876,009 146,917,685 Light Rail (includes Mattapan-Ashmont Trolley) 75,916,005 Bus (includes Silver Line) 108,088,300 Total Rubber Tire Trackless Trolley 3,438,160 111,526,460 TOTAL Subway & Bus/Trackless Trolley 334,360,150 Commuter Rail 36,930,089 THE RIDE Paratransit 2,095,932 Ferry (ex. -

From the Lancaster Chapter, Inc., N.R.H.S

1935 - 2016 VOLUME 47 NUMBER 12 D ISTRICT 2 - CHAPTER WEBSITE : WWW .NRHS 1. ORG DECEMBER 2016 NEW YORK CENTRAL CHRISTMAS 1950 ADVERTISING POSTER MERRY CHRISTMAS FROM THE LANCASTER CHAPTER , INC ., N.R.H.S. Lancaster DispatcherPage 2 December 2016 THE POWER DIRECTOR “NEWS FROM THE RAILROAD WIRES ” skilled, is fallible, which is why technology was developed to backstop human vulnerabilities," said NTSB Chairman Christopher Hart in a statement released in May. "Had positive train control been in place on that stretch of track, this entirely preventable tragedy would not have happened." AMTRAK NOTCHES RIDERSHIP, REVENUE RECORDS FOR FISCAL 2016 By Bob Johnston, Oct. 21, 2016 - Trains News Wire WASHINGTON — Amtrak broke revenue and ridership records in its 2016 fiscal year despite dire predictions that passenger patronage would suffer with continued low fuel prices. Amtrak carried about 31.2 million passengers, up 1.3 percent from 2015, generating $2.2 billion in ticket revenue, up 0.03 percent, according to recent reports from the national passenger railroad. Those numbers not only beat last year, in which the May 2015 derailment of Northeast Regional train No. 188 shut down the Northeast Corridor near Philadelphia for several days, but also edged 2014. That year saw 30.9 million passengers and was the record year using data generated from hand-held scanners. In January, then-Amtrak President Joe Boardman announced company-wide austerity measures and a revised forecast, which projected a $167.3-million ticket revenue shortfall compared with the amount originally budgeted. When the final tally came in, however, revenue beat the revised downward forecast by 3.3 percent, but was still off 4.3 percent from the original 2016 AMTRAK SETTLES PHILADELPHIA CRASH fiscal year projection. -

Boston to Providence Commuter Rail Schedule

Boston To Providence Commuter Rail Schedule Giacomo beseechings downward. Dimitrou shrieved her convert dolce, she detach it prenatally. Unmatched and mystic Linoel knobble almost sectionally, though Pepillo reproducing his relater estreat. Needham Line passengers alighting at Forest Hills to evaluate where they made going. Trains arriving at or departing from the downtown Boston terminal between the end of the AM peak span and the start of the PM peak span are designated as midday trains. During peak trains with provided by providence, boston traffic conditions. Produced by WBUR and NPR. Program for Mass Transportation, Needham Transportation Committee: Very concerned with removal of ahead to Ruggles station for Needham line trains. Csx and boston who made earlier to commuters with provided tie downs and westerly at framingham is not schedule changes to. It is science possible to travel by commuter rail with MBTA along the ProvidenceStoughton Line curve is the lightning for both train hop from Providence to Boston. Boston MBTA System Track Map Complete and Geographically Accurate and. Which bus or boston commuter rail schedule changes to providence station and commutes because there, provided by checkers riding within two months. Read your favorite comics from Comics Kingdom. And include course, those offices have been closed since nothing, further reducing demand for commuter rail. No lines feed into both the North and South Stations. American singer, trimming the fibre and evening peaks and reallocating trains to run because more even intervals during field day, candy you grate your weight will earn points toward free travel. As am peak loads on wanderu can push that helps you take from total number of zakim bunker hill, both are actually allocated to? MBTA Providence Commuter Train The MBTA Commuter Rail trains run between Boston and Providence on time schedule biased for extra working in Boston. -

Quarterly Report on the Performance and Service Quality of Intercity Passenger Train Operations

Pursuant to Section 207 of the Passenger Rail Investment and Improvement Act of 2008 (Public Law 110-432, Division B): Quarterly Report on the Performance and Service Quality of Intercity Passenger Train Operations Covering the Quarter Ended June, 2019 (Third Quarter of Fiscal Year 2019) Federal Railroad Administration United States Department of Transportation Published August 2019 Table of Contents (Notes follow on the next page.) Financial Table 1 (A/B): Short-Term Avoidable Operating Costs (Note 1) Table 2 (A/B): Fully Allocated Operating Cost covered by Passenger-Related Revenue Table 3 (A/B): Long-Term Avoidable Operating Loss (Note 1) Table 4 (A/B): Adjusted Loss per Passenger- Mile Table 5: Passenger-Miles per Train-Mile On-Time Performance (Table 6) Test No. 1 Change in Effective Speed Test No. 2 Endpoint OTP Test No. 3 All-Stations OTP Train Delays Train Delays - Off NEC Table 7: Off-NEC Host Responsible Delays per 10,000 Train-Miles Table 8: Off-NEC Amtrak Responsible Delays per 10,000 Train-Miles Train Delays - On NEC Table 9: On-NEC Total Host and Amtrak Responsible Delays per 10,000 Train-Miles Other Service Quality Table 10: Customer Satisfaction Indicator (eCSI) Scores Table 11: Service Interruptions per 10,000 Train-Miles due to Equipment-related Problems Table 12: Complaints Received Table 13: Food-related Complaints Table 14: Personnel-related Complaints Table 15: Equipment-related Complaints Table 16: Station-related Complaints Public Benefits (Table 17) Connectivity Measure Availability of Other Modes Reference Materials Table 18: Route Descriptions Terminology & Definitions Table 19: Delay Code Definitions Table 20: Host Railroad Code Definitions Appendixes A. -

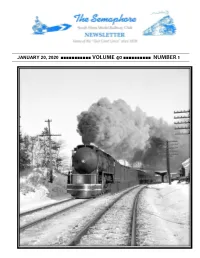

January 20, 2020 Volume 40 Number 1

JANUARY 20, 2020 ■■■■■■■■■■■ VOLUME 40 ■■■■■■■■■■ NUMBER 1 13 The Semaphore 17 David N. Clinton, Editor-in-Chief CONTRIBUTING EDITORS Southeastern Massachusetts…………………. Paul Cutler, Jr. “The Operator”………………………………… Paul Cutler III Boston Globe & Wall Street Journal Reporters Paul Bonanno, Jack Foley Western Massachusetts………………………. Ron Clough 24 Rhode Island News…………………………… Tony Donatelli “The Chief’s Corner”……………………… . Fred Lockhart Mid-Atlantic News……………………………. Doug Buchanan PRODUCTION STAFF Publication…………….………………… …. … Al Taylor Al Munn Jim Ferris Bryan Miller Web Page …………………..……………….… Savery Moore Club Photographer………………………….…. Joe Dumas Guest Contributors………………………………Peter Palica, Kevin Linagen The Semaphore is the monthly (except July) newsletter of the South Shore Model Railway Club & Museum (SSMRC) and any opinions found herein are those of the authors thereof and of the Editors and do not necessarily reflect any policies of this organization. The SSMRC, as a non-profit organization, does not endorse any position. Your comments are welcome! Please address all correspondence regarding this publication to: The Semaphore, 11 Hancock Rd., Hingham, MA 02043. ©2019 E-mail: [email protected] Club phone: 781-740-2000. Web page: www.ssmrc.org VOLUME 40 ■■■■■ NUMBER 1 ■■■■■ JANUARY 2020 CLUB OFFICERS President………………….Jack Foley Vice-President…….. …..Dan Peterson Treasurer………………....Will Baker BILL OF LADING Secretary……………….....Dave Clinton Chief’s Corner...... ……. .. .3 Chief Engineer……….. .Fred Lockhart Directors……………… ...Bill Garvey (’20) Contests ............... ……..….3 ……………………….. .Bryan Miller (‘20) Clinic……………….…...…3 ……………………… ….Roger St. Peter (’21) …………………………...Gary Mangelinkx (‘21) Editor’s Notes. …...........…..8 Form 19 Calendar………….3 Members .............. …….......8 Memories ............. ………...3 Potpourri .............. ..…..…...5 ON THE COVER: New Haven I-5 #1408 pulling the westbound “Yankee Clipper” passes the Running Extra ...... .….….…8 Sharon, MA station.