Hedge Fund in Today's Changing Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

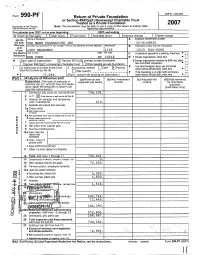

Return of Private Foundation

OMB No 1545.0052 Form 990 P F Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation 2007 Department of the Treasury Note : The foundation may be able to use a copy of this return to satisfy state Internal Revenue Service For calendar year 2007, or tax year be ginnin g , 2007 , and endin g I G Check all that apply Initial return Final return Amended return Address change Name change Name of foundation A Employer identification number Use the IRS label THE MANN FOUNDATION INC 32-0149835 Otherwise , Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see the instructions) print or type 1385 BROADWAY 1 1102 (212) 840-6266 See Specific City or town State ZIP code C If exemption application is pending, check here Instructions. ► NEW YORK NY 1 0 0 1 8 D 1 Foreign organizations , check here ► H Check type of organization Section 501 (c)(3exempt private foundation 2 Foreign organizations meeting the 85% test, check q here and attach computation Section 4947(a ) (1) nonexem p t charitable trust Other taxable p rivate foundation ► foundation status was terminated Accrual E If private ► Fair market value of all assets at end of year J Accounting method Cash X under section 507(b)(1 XA), check here (from Part ll, column (c), line 16) Other (s pecify) _ _ _ _ _ _ _ _ _ _ _ _ F If the foundation is in a 60-month termination (d) on cash basis) under section 507(b)(1)(B), check here ► $ -2,064. -

Seagram Building, First Floor Interior

I.andmarks Preservation Commission october 3, 1989; Designation List 221 IP-1665 SEAGRAM BUIIDING, FIRST FLOOR INTERIOR consisting of the lobby and passenger elevator cabs and the fixtures and interior components of these spaces including but not limited to, interior piers, wall surfaces, ceiling surfaces, floor surfaces, doors, railings, elevator doors, elevator indicators, and signs; 375 Park Avenue, Manhattan. Designed by Ludwig Mies van der Rohe with Philip Johnson; Kahn & Jacobs, associate architects. Built 1956-58. Landmark Site: Borough of Manhattan Tax Map Block 1307, Lot 1. On May 17, 1988, the landmarks Preservation Commission held a public hearing on the proposed designation as a Landmark of the Seagram Building, first floor interior, consisting of the lobby and passenger elevator cabs and the fixtures and interior components of these spaces including but not limited to, interior piers, wall surfaces, ceiling surfaces, floor surfaces, doors, railings, elevator doors, elevator indicators, and signs; and the proposed designation of the related I.and.mark Site (Item No. 2). The hearing had been duly advertised in accordance with the provisions of law. Twenty witnesses, including a representative of the building's owner, spoke in favor of designation. No witnesses spoke in opposition to designation. The Commission has received many letters in favor of designation. DFSCRIPI'ION AND ANALYSIS Summary The Seagram Building, erected in 1956-58, is the only building in New York City designed by architectural master Iudwig Mies van der Rohe. Constructed on Park Avenue at a time when it was changing from an exclusive residential thoroughfare to a prestigious business address, the Seagram Building embodies the quest of a successful corporation to establish further its public image through architectural patronage. -

CFTC Rule 1.55(K) and 1.55(O): FCM-Specific Disclosure Document

COMMODITY FUTURES TRADING COMMISSION RULE 1.55(K) AND 1.55(O): FCM-SPECIFIC DISCLOSURE DOCUMENT The Commodity Futures Trading Commission (“Commission” or “CFTC”) requires each futures commission merchant (“FCM”), including J.P. Morgan Securities LLC (“JPMS LLC”), to provide the following information to a customer prior to the time the customer first enters into an account agreement with the FCM or deposits money or securities (funds) with the FCM. Except as otherwise noted below, the information set out is as of September 24th, 2021 J.P. Morgan Securities LLC will update this information annually and as necessary to take account of any material change to its business operations, financial condition or other factors that J.P. Morgan Securities LLC believes may be material to a customer’s decision to do business with it. Nonetheless, the business and financial data of J.P. Morgan Securities LLC is not static and will change in non-material ways frequently throughout any 12-month period. NOTE: J.P. Morgan Securities LLC (“JPMorgan”) is a subsidiary of JPMorgan Chase & Co. Information that may be material with respect to J.P. Morgan Securities LLC for purposes of the Commission’s disclosure requirements may not be material to JPMorgan Chase & Co. for purposes of applicable securities laws. FIRM AND ITS PRINCIPALS 1.55(k)(1) FCM’s name, address of its principal place of business, phone number, fax number and email address. • J.P. Morgan Securities LLC o Name – J.P. Morgan Securities LLC o Address – 383 Madison Avenue, New York, NY 10179 o Phone number – 212-834-6271 or 212-270-6000 o Fax number – 212-622-0076 o Email – [email protected] 1.55(k)(6) FCM’s DSRO and DSRO’s website address • J.P. -

Leseprobe 9783791384900.Pdf

NYC Walks — Guide to New Architecture JOHN HILL PHOTOGRAPHY BY PAVEL BENDOV Prestel Munich — London — New York BRONX 7 Columbia University and Barnard College 6 Columbus Circle QUEENS to Lincoln Center 5 57th Street, 10 River to River East River MANHATTAN by Ferry 3 High Line and Its Environs 4 Bowery Changing 2 West Side Living 8 Brooklyn 9 1 Bridge Park Car-free G Train Tour Lower Manhattan of Brooklyn BROOKLYN Contents 16 Introduction 21 1. Car-free Lower Manhattan 49 2. West Side Living 69 3. High Line and Its Environs 91 4. Bowery Changing 109 5. 57th Street, River to River QUEENS 125 6. Columbus Circle to Lincoln Center 143 7. Columbia University and Barnard College 161 8. Brooklyn Bridge Park 177 9. G Train Tour of Brooklyn 195 10. East River by Ferry 211 20 More Places to See 217 Acknowledgments BROOKLYN 2 West Side Living 2.75 MILES / 4.4 KM This tour starts at the southwest corner of Leonard and Church Streets in Tribeca and ends in the West Village overlooking a remnant of the elevated railway that was transformed into the High Line. Early last century, industrial piers stretched up the Hudson River from the Battery to the Upper West Side. Most respectable New Yorkers shied away from the working waterfront and therefore lived toward the middle of the island. But in today’s postindustrial Manhattan, the West Side is a highly desirable—and expensive— place, home to residential developments catering to the well-to-do who want to live close to the waterfront and its now recreational piers. -

May 5, 2016 Game-Changing Real Estate Puts Rapaport in The

May 5, 2016 http://rew-online.com/2016/05/05/game-changing-real-estate-puts-rapaport-in-the-winners-circle/ Game-changing real estate puts Rapaport in the winners circle BY DAN ORLANDO Laura Rapaport, senior vice president at L&L Holding Company, will be taking part in the Real Estate Weekly Women’s Forum next week. Once in pursuit of a career in medicine, Rapaport’s path to her current role was not devoid of twists and turns. “When I was 18, I took an unpaid internship with Earle Altman at Helmsley Spear. After doing what seemed like two weeks of work in just one morning, I was told that if I got my license and closed a deal, they would pay me,” Rapaport recalled. “I got my license and managed to nail a lease on a small property in Queens. That’s when I got the real estate bug.” A University of Pennsylvania graduate, Rapaport said that entering the competitive field was made easier because of the excellent mentorships she has been the beneficiary of. At the forum, she hopes that she’ll be able to positively influence other young real estate professionals, male and female, in a similar manner. “I have been fortunate to work with and learn from some of the industry greats. First there was Earle, and then my mentor Tara Stacom. Each taught me and showed me how exciting and dynamic the real estate industry was and have helped to cultivate my knowledge and experience going forward.” While her past has certainly molded her, Rapaport’s current role has allowed her to truly blossom. -

Q1 2016 New York Office Outlook

Office Outlook New York | Q1 2016 Vacancy moves higher as large blocks are added to the market • The Manhattan office market showed signs of caution in the first quarter of 2016 as vacancy moved higher and renewal activity increased. • While there have been concerns about slower expansion in the tech sector—as a result of a potential pullback in venture capital—the TAMI sector remained strong in Midtown South. • Investment sales activity slowed in the first quarter of the year after a strong 2015 with 120 sales totaling $12.3 billion, down nearly 20 percent year-over-year. JLL • Office Outlook • New York • Q1 2016 2 New York overview The Manhattan office market showed signs of caution in the first comprised the majority of leasing activity. McGraw Hill Financial Inc. quarter of 2016 as vacancy moved higher and renewal activity—rather renewed at 55 Water Street in Lower Manhattan for 900,027 square feet than relocations and expansions—captured the bulk of top in the largest lease of the quarter. Salesforce.com subleased 202,678 transactions. Manhattan Class A vacancy rose as several large blocks square feet at 1095 Avenue of the Americas in a transaction that were returned to the market. The vacancy rate for Midtown Class A included a provision to replace MetLife’s name atop the building with its space increased to 11.6 percent, up from 10.4 percent at year-end own, in full view of highly-trafficked Bryant Park. In Midtown South, 2015. Average asking rents were also higher as a result of newer and Facebook continued its massive expansion in a 200,668-square-foot higher quality product becoming available. -

Fall Hospitality Report Manhattan 2015

FALL HOSPITALITY REPORT (2015) MANHATTAN FALL HOSPITALITY REPORT MANHATTAN 2015 1 | P a g e FALL HOSPITALITY REPORT (2015) MANHATTAN EXECUTIVE SUMMARY According to the Starr report, Manhattan’s hotel sector has been growing by over 4.0 % since 2010 both by ADR and number of rooms. The demand still far exceeds supply especially for 5 star brands. Early in the hotel recovery in 2011, three star brands grew in number of rooms and ADR initially. As the recovery went into full swing by late 2013, four and five star hotel development continued to outpace three star hotel growth. Global investors are seeking five star hotel product in Manhattan and at $1.0 million up to $2.0 million per key. For instance, Chinese investors bought the Waldorf Astoria and the Baccarat Hotels both at substantially above $1.0 million per key. Manhattan is one of the best hotel markets in the world between growing tourism and inexpensive accommodations compared to other global gateway cities like London, Paris, Moscow, Hong Kong, etc. Any established global hotel brand also requires a presence in Manhattan. In 2014 alone, 4,348 keys were added to Manhattan’s existing 108,592 rooms. Currently, another 14,272 rooms are under construction in the city and about 4000 keys (1/3) are for boutique hotels. As of July 2015, the Manhattan market has approximately 118,000 keys. They are segmented as follows: Currently, there is a 4.0% annual compounded growth rate. Despite this growth, demand for hotel rooms from tourism, conventions, cultural events, and corporate use continues to grow as Manhattan is one of the most desirable locations for all of the above uses especially tourism from Asia and Europe. -

DOCOMOMO 2012 No 2 Newsletter

NEW YORK | TRI-STATE 2012 no. 2 Contents MODERN LANDMARKS AT VASSAR DEAR FRIENDS 3 The Vassar College campus in Poughkeepsie, NY, was indirect lighting bounced off severe white ceiling CHATHAM GREEN AT FIFTY 4 launched with a massive all-purpose Main Building in planes. Glass block inserts in interior partitions echo the French Second Empire mode (James Renwick, Jr., the grid pattern of the ample Gothic Revival windows. VILLA TUGENDHAT CELEBRATED 6 1865), which remains the iconic center of its campus. The interior-exterior split here apparently contrasts THE MARGINS: GUERON, LEPP But styles of subsequent buildings include Collegiate the progressive interests of the arts faculty with the & ASSOCIATES REHAB CENTER 7 Gothic, Jacobean, Georgian Revival—you name it. And college's demand for consistency on the exterior. among these stylistically varied specimens are some After this library, Vassar added hardly any new ROCHESTER’S TUBE TOWERS 8 scattered gems of mid-century Modernism. facilities until the 1951 completion of a landmark of MIDTOWN MODERN: CONTEXT, Vassar's earliest example of Modernism is strictly an Modernism, the Dexter Ferry Cooperative House by FILMS AND THE FUTURE 10 interior, but it is notable for its purity and for its com- Marcel Breuer. The donor chose Breuer, providing one pletion date of 1937. This suite of rooms, the school's of his earliest commissions for other than single-family MODERN LIBRARY 12 art history library, looks as if it were retrofitted in an houses. The building housed 26 students (all female, DISAPPEARING INTERIORS 14 older structure, but was in fact created simultaneously as Vassar didn't become coed until 1969) who carried with its Collegiate Gothic exterior. -

Sonny Bazbaz (MBA ’04) Enjoys the Views at Real Estate Giant Fisher Brothers

FALL/WINTER 2005 the Alumni Magazine of NYU Stern STERNbusiness HIGH RISE Sonny Bazbaz (MBA ’04) enjoys the views at real estate giant Fisher Brothers Jack Welch Headlines Stellar CEO Lineup ■ Stern Entrepreneurs Make Business Plans Pay ■ Is Your 401(k) OK? ■ Why Soap Costs $1.99 Digital Rights and Wrongs ■ Hollywood’s Boffo Foreign Box Office a letter fro m the dean Welcome to the new and companies to manage digital rights? Why does a six- improved STERNbusiness. pack of cola priced at $3.99 strike consumers as being For many years, the maga- a lot cheaper than a $4.00 six-pack? zine has functioned as a As you read through the magazine, it will be clear highly effective – and visu- that Stern regards New York City as not just its home, ally appealing – showcase but as a classroom and laboratory. Because of our for the prodigious and var- location, our students and faculty have the rare abili- ied research of our faculty. ty to see and experience things first-hand, to learn With this issue, the maga- directly from practitioners at the highest levels in cru- zine has been redesigned and re-imagined. Its vision, cial fields. In an “only in New York” story (p. 10), scope, and circulation have all been expanded. Sonny Bazbaz (MBA ’04), within two years of arriving Why change a good thing? in the city, became a teaching assistant and then a col- NYU Stern may be a group of buildings in league to Richard Fisher of the real estate firm Fisher Greenwich Village. -

Analysis of Technical Problems in Modern Super-Slim High-Rise Residential Buildings

Budownictwo i Architektura 20(1) 2021, 83-116 DOI: 10.35784/bud-arch.2141 Received: 09.07.2020; Revised: 19.11.2020; Accepted: 15.12.2020; Avaliable online: 09.02.2020 © 2020 Budownictwo i Architektura Orginal Article This is an open-access article distributed under the terms of the CC-BY-SA 4.0 Analysis of technical problems in modern super-slim high-rise residential buildings Jerzy Szołomicki1, Hanna Golasz-Szołomicka2 1 Faculty of Civil Engineering; Wrocław University of Science and Technology; 27 Wybrzeże Wyspiańskiego st., 50-370 Wrocław; Poland, [email protected] 0000-0002-1339-4470 2 Faculty of Architecture; Wrocław University of Science and Technology; 27 Wybrzeże Wyspiańskiego St., 50-370 Wrocław; Poland [email protected] 0000-0002-1125-6162 Abstract: The purpose of this paper is to present a new skyscraper typology which has developed over the recent years – super-tall and slender, needle-like residential towers. This trend appeared on the construction market along with the progress of advanced struc- tural solutions and the high demand for luxury apartments with spectacular views. Two types of constructions can be distinguished within this typology: ultra-luxury super-slim towers with the exclusivity of one or two apartments per floor (e.g. located in Manhattan, New York) and other slender high-rise towers, built in Dubai, Abu Dhabi, Hong Kong, Bangkok, and Melbourne, among others, which have multiple apartments on each floor. This paper presents a survey of selected slender high-rise buildings, where structural improvements in tall buildings developed over the recent decade are considered from the architectural and structural view. -

Chapter 7: Urban Design and Visual Resources

Chapter 7: Urban Design and Visual Resources 7.1 Introduction This chapter assesses the Proposed Action’s potential effects on urban design and visual resources. Per the 2014 City Environmental Quality Review (CEQR) Technical Manual, the urban design and visual resources assessment is undertaken to determine whether and how a project or action may change the visual experience of a pedestrian, focusing on the components of the project or action that may have the potential to affect the arrangement, appearance, and functionality of the built and natural environment. According to the CEQR Technical Manual, urban design is defined as the totality of components—including streets, buildings, open spaces, wind, natural resources, and visual resources—that may affect a pedestrian’s experience of public space. A visual resource is defined as the connection from the public realm to significant natural or built features, including views of the waterfront, public parks, landmark structures or districts, otherwise distinct buildings or groups of buildings, and natural resources. As described in Chapter 1, “Project Description,” the New York City Department of City Planning (DCP) is proposing zoning map and zoning text amendments that would collectively affect approximately 78 blocks in Greater East Midtown, in Manhattan Community Districts 5 and 6 (collectively, the “Proposed Action”). The Proposed Action is intended to reinforce the area’s standing as a one of the City’s premiere business districts, support the preservation of landmarks, and provide for above- and below-grade public realm improvements as contained in the Public Realm Improvement Concept Plan (the “Concept Plan”) described in Chapter 1, “Project Description.” Many aspects of urban design are controlled by zoning, and because the Proposed Action would entail changes to zoning and related development-control mechanisms, the Proposed Action therefore may have the potential to result in changes to urban design. -

New York Branch Other Regulatory Disclosures

New York Branch Other Regulatory Disclosures April 2019 CIP (Customer Identification Program) Notice In order to comply with existing regulations to combat terrorist financing and money laundering activities, the regulations require all financial institutions to obtain, verify and record information that identifies each person who establishes an account or any other financial relationship with such institution. What this means for you: When you open an account or any other financial relationship with BRADESCO S.A. NEW YORK BRANCH, when an individual request to open an account, we will ask the name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your national ID, Passport, Driver’s License or other valid government issued ID that allow us to perform a verification of the identity of the person. For entities we will request documentation to prove the legal existence, ownership structure, information about the persons authorized to represent the entity as account-holder, the entity’s registration number, tax identity number (TIN) and/or registration number assigned by the registrar of companies or similar government agency where the incorporation documents were filed. We will also ask you for the names of all authorized signatories, attorneys-in- fact, officers and directors of the legal entity opening accounts and for significant beneficial owners of the legal entity account-holders (generally, all those with direct or indirect ownership interest of at least 10%). In some cases, we may request identification documents of persons or legal entities that are already customers of BRADESCO S.A.