Board of Directors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View of These Submission He Has Prayed for Allowing the Listed Application

IN THE HIGH COURT OF SINDH AT KARACHI Suit No. 1404 of 2019 Plaintiff: Abdul Rashid Shaikh Through Dr. Shah Nawaz, Advocate. Defendants: M/s. National Refinery Ltd. & another Through Mr. Javed Ashgar Awan, Advocate. For hearing of CMA No. 11475/2019. Dates of hearing: 29.10.2019, 12.11.2019, 17.12.2019 & 20.12.2019. Date of order: 20.12.2019 O R D E R Muhammad Junaid Ghaffar, J. Through this Suit for Declaration, Injunction and Damages, the Plaintiff seeks reinstatement in service with Defendant No.1 by impugning Letter dated 11.06.2019, whereby, the Plaintiff has been retired pre-maturely. 2. Learned Counsel for the Plaintiff submits that the Plaintiff was initially employed vide Appointment Letter dated 01.09.1992 with State Petroleum Refining & Petrochemical Corporation (Pvt.) Ltd. (“PERAC”) and was thereafter transferred / absorbed in Defendant No.1 vide Letter dated 12.11.1994; that the Plaintiff has worked for 29 years of service, whereas, time and again his services have been appreciated and there is no allegation of any misconduct; that four years of his service were left when he was retired prematurely through impugned letter; that in the terms of appointment as well as the governing rules of service relationship, there is no provision for an early retirement; that neither any notice was ever issued to the Plaintiff nor an opportunity was provided; that the conduct of the Defendants is in violation of the principles of natural justice 2 including violation of Article 10-A of the Constitution; that the Defendants ought to have exercised discretion within certain parameters, and procedure should have been followed like issuance of a Show Cause Notice and conducting some inquiry; that it is a matter of exploitation employed by the Defendants to the very detriment of the Plaintiff and in view of these submission he has prayed for allowing the listed application. -

List of Acronyms

List of Acronyms A ABL Allied Bank Limited AC Air Conditioner ACP Annual Credit Plan ACAC Agriculture Credit Advisory Committee ACD Agriculture Credit Department ADs Authorized Dealers ADB Asian Development Bank ADF Asian Development Fund ADP Annual Development Plan AFS Available For Sale AIDS Acquired Immune Deficiency Syndrome APCMA All Pakistan Cement Manufacturers Association APL Attock Petroleum Limited ARPU Average Revenue per User ASEAN Association of South East Asian Nations B BAFL Bank AlFalah Limited BHU Basic Health Unit BISP Benazir Income Support Programme BMR Balancing Modernization and Replacing BOC Bank of China BOP Balance of Payment BP British Petroleum BPO Business Process Outsourcing BPRD Banking Policy Regulation Department BPS Basis Points BSC Bahbood Saving certificates, Benazir Smart Cards BSD Banking Surveillance Department BSE Bombay Stock Exchange Bt Bacillus thuringiensis C CAD Current Account Deficit CAB Current Account Balance CAGR Compound Annual Growth Rate CAR Capital Adequacy Ratio CBR Central Board of Revenue, Crude Birth Rate CBD Conventions on Biodiversity CBU Completely Built Unit CCC Climate Change Convention CDA Capital Development Authority CDR Crude Death Rate CDC Central Depository Company CDNS Central Directorate of National Saving CDs Certificate of Deposits CDS Credit Default Swap CDWA Clean drinking Water for All CDWI Clean Drinking Water Initiative CFC Common Facilities Centers CFS Continuous Funding System CFSMK-II Continuous Funding System Mark II CIA Central intelligence Agency CIB Credit -

Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: a Panel Data Analysis

European Online Journal of Natural and Social Sciences 2019; www.european-science.com Vol.8, No 1 pp. 109-117 ISSN 1805-3602 Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: A Panel Data Analysis Samara Haroon, Dong Hui Zhang* School of Economics, Shandong University, Jinan, PR China *Email. [email protected] Tel.: +8613708926062 Received for publication: 24 July 2018. Accepted for publication: 19 November 2018. Abstract This research article investigates how explanatory variables are responsible for change in to- tal factor productivity in manufacturing sector of Pakistan. Panel data of selected fifteen manufac- turing firms of Pakistan from 2005 to 2013 are used to capture time and space affects. Considering data set of fifteen selected manufacturing firms consistently, it was found that explanatory variables (like size of firm, leverage, cash flows and Ownership) were responsible for changed in TFP growth. Empirical results suggest that explanatory variables appear to be most dominating factors in order to influence the TFP growth over a period of time and over a firm also. Research study further will provide a guide for Pakistan policy makers to set priorities to improve TFP growth for their manu- facturing firms especially in Punjab. Keywords: Total Factor Productivity, Manufacturing Sector, Punjab, Pakistan Introduction TFP growth sets opportunity towards society to increase the welfare of people by increasing the production of manufacturing sector. Further productive efficiency plays an important role in economic planning and development. It is core objectives of any government to enhance the overall growth and development of the economy in order to enhance the GDP. -

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY from : 09:15 AM to 05:15 PM Pageno: 1 Friday August 09,2019 Flu No:152/2019 P

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY From : 09:15_AM_TO_05:15_PM PageNo: 1 Friday August 09,2019 Flu No:152/2019 P. Vol.: 109097620 P.KSE100 Ind: 29737.98 P.KSE 30 Ind: 13993.91 Plus : 170 C. Vol.: 76410570 C.KSE100 Ind: 29429.07 C.KSE 30 Ind: 13793.17 Minus: 134 Total 321 Net Change : -308.91 Net Change : -200.74 Equal: 17 Company Name Turnover Prv.Rate Open Rate Highest Lowest Last Rate Diff. ***CLOSE - END MUTUAL FUND*** HIFA HBL Invest Fund 500 3.01 3.00 3.00 3.00 3.00 -0.01 TSMF Tri-Star Mutual 25500 3.01 2.16 2.16 2.01 2.04 -0.97 ***MODARABAS*** AWWAL Awwal Modaraba 1000 11.60 11.40 11.40 11.40 11.40 -0.20 BRR B.R.R.Guardian 1000 6.81 7.00 7.00 7.00 7.00 0.19 FECM Elite Cap.Mod 500 1.33 1.60 1.60 1.60 1.60 0.27 FHAM Habib Modaraba 21000 9.00 8.77 8.77 8.50 8.51 -0.49 FPJM Punjab Mod 6000 1.88 1.97 1.97 1.90 1.93 0.05 FUDLM U.D.L.Modaraba 1500 5.23 6.00 6.00 5.90 5.90 0.67 ORIXM Orix Modaraba 500 14.25 14.50 14.50 14.50 14.50 0.25 PMI Prud Mod.1st 2000 0.80 0.99 0.99 0.66 0.99 0.19 ***LEASING COMPANIES*** OLPL Orix Leasing 5000 21.30 21.75 22.36 21.75 22.34 1.04 ***INV. -

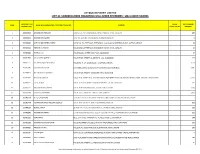

List of Unclaimed Shares and Dividend

ATTOCK REFINERY LIMITED LIST OF SHAREHOLDERS REGARDING UNCLAIMED DIVIDENDS / UNCLAIMED SHARES FOLIO NO / CDC SHARE NET DIVIDEND S/NO. NAME OF SHAREHOLDER / CERTIFICATE HOLDER ADDRESS ACCOUNT NO. CERTIFICATES AMOUNT 1 208020582 MUHAMMAD HAROON DASKBZ COLLEGE, KHAYABAN-E-RAHAT, PHASE-VI, D.H.A., KARACHI 450 2 208020632 MUHAMMAD SALEEM SHOP NO.22, RUBY CENTRE,BOULTON MARKETKARACHI 8 3 307000046 IGI FINEX SECURITIES LIMITED SUIT # 701-713, 7TH FLOOR, THE FORUM, G-20, BLOCK 9, KHAYABAN-E-JAMI, CLIFTON, KARACHI 15 4 307013023 REHMAT ALI HASNIE HOUSE # 96/2, STREET # 19, KHAYABAN-E-RAHAT, DHA-6, KARACHI. 15 5 307020846 FARRUKH ALI HOUSE # 246-A, STREET # 39, F-11/3, ISLAMABAD 67 6 307022966 SALAHUDDIN QURESHI HOUSE # 785, STREET # 11, SECTOR G-11/1, ISLAMABAD. 174 7 307025555 ALI IMRAN IQBAL MOTIWALA HOUSE NO. H-1, F-48-49, BLOCK - 4, CLIFTON, KARACHI. 2,550 8 307026496 MUHAMMAD QASIM C/O HABIB AUTOS, ADAM KHAN, PANHWAR ROAD, JACOBABAD. 2,085 9 307028922 NAEEM AHMED SIDDIQUI HOUSE # 429, STREET # 4, SECTOR # G-9/3, ISLAMABAD. 7 10 307032411 KHALID MEHMOOD HOUSE # 10 , STREET # 13 , SHAHEEN TOWN, POST OFFICE FIZAI, C/O MADINA GERNEL STORE, CHAKLALA, RAWALPINDI. 6,950 11 307034797 FAZAL AHMED HOUSE # A-121,BLOCK # 15,RAILWAY COLONY , F.B AREA, KARACHI 225 12 307037535 NASEEM AKHTAR AWAN HOUSE # 183/3 MUNIR ROAD , LAHORE CANTT LAHORE . 1,390 13 307039564 TEHSEEN UR REHMAN HOUSE # S-5, JAMI STAFE LANE # 2, DHA, KARACHI. 3,475 14 307041594 ATTIQ-UR-REHMAN C/O HAFIZ SHIFATULLAH,BADAR GENERALSTORE,SHAMA COLONY,BEGUM KOT,LAHORE 7 15 307042774 MUHAMMAD NASIR HUSSAIN SIDDIQUI HOUSE-A-659,BLOCK-H, NORTH NAZIMABAD, KARACHI. -

United Engineering Services

United Engineering Services Electrical Consultant, Technical Training, Instrumentation, Energy Audit, Maintenance Management System 2-C, Mezzanine Floor, 15th Commercial Street, Phase II (Ext.) DHA Karachi. 75500. Tel: (021)-35805163, 36010208, 35405495 Fax: (021)-35313968 Mobile: 0300-9232276 UES E-mail: [email protected], Web: www.ues-electrical.com All About Us… UES is consultancy firm providing services to Oil & Gas , Refinery and Industrial Sector. It started its work in 1999 & in a short time grew into major design, energy audit & maintenance consultancy concern. The industrial sector responded well to our work & services. The development is speeded up further when we organized ourselves to execute & monitor project with reputable background. UES has a complete team of Engineers & highly qualified, motivated members who provide quality work. UES Services • Electrical & Instrumentation Design Services • Energy Audit • Quality System Requirement Instrumentation & Calibration • Maintenance Management • Plant Maintenance • Auto CAD Services • Field Installation • Trouble Shooting • Detailed Engineering • Documentation & Printing • Programmable Logic Control (PLC) • Power Quality Analysis • Load Flow Analysis • Instruments Calibration • Inspection Services UES • Machinery Risk Assessment Different Disciplines • Maintenance Consultancy • Electrical Design Consultancy • Detailed Engineering • Process Instruments Design Consultancy • Process Instrument Calibration • Maintenance Management System • Energy Conservation Consultancy • -

Attock Petroleum Limited Financial Highlights

ATTOCK PETROLEUM LIMITED FINANCIAL HIGHLIGHTS EARNINGS PER SHARE Rs. 39.79 PROFIT AFTER TAX Rs. 3,961 Million OPERATING PROFIT Rs. 5,708 Million GROSS PROFIT Rs. 8,221 Million NET SALES REVENUE Rs. 223,054 Million 212 ANNUAL REPORT 2019 TABLE OF CONTENTS Introduction (2-23) Calendar of Major Events (112) Our Vision, Our Mission (2) Information Technology Governance (114) Corporate Strategy (3) Organizational Chart (116) Core Values (4) Review Report on Statement of Compliance Management’s Objectives & Strategies (6) with the Code of Corporate Governance (118) Code of Conduct (8) Statement of Compliance with the Code of Geographical Presence of APL Business Unit (14) Corporate Governance (119) APL Group Structure (15) Value Chain (16) Financial Analysis (121-135) Brief Company Profile (18) DuPont Analysis (122) Product Portfolio (19) Key Operating and Financial Data for Six Years (123) Chairman’s Review (24-25) Vertical Analysis (126) Chairman’s Review (24) Horizontal Analysis (127) Graphical Presentation (128) Governance (26-120) Comments on Financial Analysis (131) Board of Directors (28) Statement of Economic Value Added (133) Profile of Board of Directors (30) Analysis of Variation in Results of Board Committees and Corporate Interim Reports (134) Information (34) Statement of Charity Account (134) Whistle Blower Protection Statement of Value Added (135) Mechanism Policy (35) Board Committees and their Terms Financial Statements (137-206) of Reference (36) Independent Auditor’s Report to the Management Committees (39) Members (139) -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

Dai Ly Quotati

D A I LY Q U O TAT I O N S No. 161/2021 Wednesday, Sep 1, 2021 LISTED COMPANIES - 531 MARKET REPORT UPTO 04:15 LISTED CAPITAL 1,458,220.972 M TRADING VOLUME TRADING VALUE MARKET CAPITALIZATION COS. TOTAL Pre. 378,832,096 Pre. 14,023,728,426 Pre: Rs.8,290,427,669,434 P LUS. 307 Cur. 536,640,545 Cur. 14,368,773,492 Cur: Rs. 8,307,132,366,059 MINUS. 207 N.Change: 16,704,696,625 E QUA L. 20 TOTA L. 534 TRADING VOLUME (B&B) TRADING VALUE (B&B) REMARKS Pre. 0 Pre. 0 For further details, please see debt instrument segments hereunder Cur. 0 Cur. 0 PSX INDICES Index Code Previous Current High Low Change %age Change K S E-100 47,419.74 47,413.46 47,629.20 47,352.54 -6.28 -0.01 K S E-A LL-Shares 32,394.47 32,460.77 32,590.08 32,394.47 66.30 0.20 K S E-30 19,027.87 19,029.27 19,129.16 19,011.66 1.40 0.01 K MI-30 77,641.73 77,663.99 78,115.66 77,574.99 22.26 0.03 B K Ti 12,936.20 12,886.42 13,009.69 12,866.71 -49.78 -0.38 OGTi 12,244.10 12,239.90 12,345.54 12,223.88 -4.20 -0.03 P S X-K MI-All-Shares 23,461.71 23,525.33 23,613.54 23,461.71 63.62 0.27 UP P9 13,056.93 13,065.87 13,129.56 13,048.09 8.94 0.07 NITP GI 9,744.65 9,746.77 9,793.90 9,738.20 2.12 0.02 NB P P GI 11,757.52 11,770.22 11,830.08 11,757.52 12.70 0.11 MZNP I 10,854.55 10,861.58 10,918.47 10,850.82 7.03 0.06 APPLIED FOR LISTING PROSPECTUS/OFFER FOR SALE APPROVED BY THE EXCHANGE COMPANY Sr. -

National Refinery Limited 2

The Pakistan Credit Rating Agency Limited Rating Report Report Contents 1. Rating Analysis National Refinery Limited 2. Financial Information 3. Rating Scale 4. Regulatory and Supplementary Disclosure Rating History Dissemination Date Long Term Rating Short Term Rating Outlook Action Rating Watch 28-May-2021 AA+ A1+ Negative Maintain - 30-May-2020 AA+ A1+ Negative Maintain - 29-Nov-2019 AA+ A1+ Stable Maintain - 31-May-2019 AA+ A1+ Stable Maintain - Rating Rationale and Key Rating Drivers The ratings reflect National Refinery Limited's (NRL) association with the integrated oil group – Attock Group (AG). The strength of the Company is its base oil business wherein NRL possesses a notable share in meeting the economy's demand for lubricants. NRL's core business remains exposed to the vicissitudes in international crude and petroleum products’ (POL) prices, which in turn, steer the gross refining margins (GRMs) of the Company. The Country’s refinery sector is going through some significant challenges for an extended period, majorly pertaining to up-gradation of the refining complexes. The global oil market was further struck by widespread uncertainty due to outbreak of COVID-19 pandemic. This had severely weakened the International Oil dynamics, creating a manifold impact on the domestic economy as well as the local refinery industry. In order to cater the issues, Working Group constituted by the Government, comprising of the Government officials and representative of refineries, had finalised a draft Refining Policy which envisages certain fiscal and tariff concessions to the refining sector which are likely to improve financial condition of the refineries enabling up-gradation of plants. -

LIST of MEMBERS - ELEGIBLE for VOTING in ELECTION 2020 29-Nov-19

LIST OF MEMBERS - ELEGIBLE FOR VOTING IN ELECTION 2020 29-Nov-19 SL.NO. OM # ALPHA COMPANY CEO NAME NTN # SALES TAX REGISTRATION NO. 1 OM-551 3 3M PAKISTAN (PRIVATE) LIMITED NAZAR UR REHMAN 0817125-4 02--16-6805-001-73 2 OM-616 A ABB POWER & AUTOMATION (PRIVATE) LIMITED NAJEEB AHMAD 4233180-3 03-00-4233-180-17 3 OM-383 A ABBOTT LABORATORIES (PAKISTAN) LIMITED SYED ANIS AHMED 1347561-4 02-04-3302-002-91 4 OM-661 A ABUDAWOOD TRADING COMPANY PAKISTAN (PRIVATE) LIMITED AGHA TARIQUE 3039736-7 17-00-9998-007-19 5 OM-680 A AISHA STEEL MILLS LIMITED MUNIR AHMED (DR.) 2486644-0 17-50-7210-001-91 6 OM-676 A AKZO NOBEL PAKISTAN LIMITED SAAD MAHMOOD RASHID 3804142-1 S3804142-1 7 OM-584 A AL BARAKA BANK (PAKISTAN) LIMITED AHMED SHUJA KIDWAI 2554922-7 17-00-9813-031-46 8 OM-640 A AL-HAJ PAKISTAN EXPLORATION LIMITED TAJ MOHAMMAD AFRIDI 0657090-9 07-01-2711-034-73 9 OM-693 A ALLIANZ EFU HEALTH INSURANCE LIMITED KAMRAN ANSARI 1163080-9 17-50-9805-057-82 10 OM-613 A ARABIAN SEA ENTERPRISES LIMITED SIKANDER MEHMOOD 0700949-6 02-10-9801-002-46 11 OM-579 A ARCHROMA PAKISTAN LIMITED MUJTABA RAHIM 0816040-6 12-00-2900-783-46 12 OM-672 A ARYSTA LIFESCIENCE PAKISTAN (PRIVATE) LIMITED MUHAMMAD ALI NAEEM 1126945-6 12-00-2800-297-64 13 OM-696 A ASIA PETROLEUM LIMITED MIR SHAHZAD KHAN TALPUR 0709724-7 32-77-8761-358-7 14 OM-699 A ASIAN CONSUMER CARE PAKISTAN (PVT) LIMITED NAUMAN KHAN 2631418-5 17-00-2100-037-82 15 OM-470 A ASPIN PHARMA (PVT) LTD TAREK M. -

About This Report

SUSTAINABILITY REPORT| 2019 12 About this Report Prioritization Validation Identification Review Process for Defining Report Content and Aspect Boundaries Scope This report covers all operations of Attock (SA-8000), UNGC indices, ISO Management Refinery Limited at Morgah, Rawalpindi consid- Standards (ISO 14001, ISO 9001, ISO 50001 and ering its Social, Environmental and Economic OHSAS 18001) for reporting Social, Environmen- aspects. ARL is keen and committed to share tal and Economic performance. This report also information about its sustainability endeavors, contains our commitment to the Ten Guiding targets, goals, initiatives and performance with Principles of UNGC. To accomplish the Agenda all stakeholders. This report is a consolidated 2030, we have mapped our Reporting tool with and concise document on ARL’s economic , the 17 Sustainable Development Goals. social and environmental performance. The Differences from the Sustainability report also demonstrates ARL commitment to Report 2018 good governance, transparency and highlights This year's report compilation is based on GRI the methodology for recognition and evaluation Standards, published by the Global Reporting of stakeholder's needs/expectations and its Initiatives (GRI), and is supplemented with ten transformation into actionable items. We guiding principles of UNGC. The GRI Standard consider Sustainability Report as a tool for com- has been mapped with 17 SDGs as well to municating ARL’s performance to all stakehold- achieve the targets of National Initiative for ers. SDGs. The material aspects identified in 2018 Reporting Period report, re-evaluated by considering comments ARL is publishing Sustainability Report annually from internal and external parties. The defined since 2005. The Report presents social & envi- prioritized material aspects are categorized ronmental performance data for the calendar again by changing their category from high to year 2019, economic and financial data for the moderate and vice versa.