Second Questions on Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Excellence Awards

2020 EXCELLENCE AWARDS Advertising :: Photographic :: Journalism :: Newspapers QUEENSLAND COUNTRY PRESS ASSOCIATION INC. E: [email protected] :: Secretary Phone 0408 165 509 2020 EXCELLENCE MESSAGE FROM OUR PRESIDENT AWARDS Congratulations … Despite the challenges of Covid-19 impacting at the end of March when entries were due, this year’s Excellence Awards again highlighted the tremendous talent which abounds in regional publishing across Queensland. We received over 400 entries across the Advertising, Photography, Journalism and Newspaper categories. The judges were united in compliments about the professionalism and vital contribution our publications are making to our regional communities. It was unfortunate we were unable to fully celebrate our achievements with our highlight presentation night dinner this year, but we have been able to at least recognise the success of our teams and individual winners from the Southern Regions on Queensland, with a presentation luncheon at Toowoomba on Friday, November 6. Congratulations to all who entered, and deserving acknowledgment for the winners, place-getters and highly commended recipients. Maybe we can have an extra celebration at next year’s Awards dinner scheduled to be held at Mercure Brisbane Hotel on May 28. And these Awards herald in a new era for QCPA – with almost 20 new print publications launched recently, and our Association expanding its Online Publisher Membership, providing us over 60 members covering the State. Kind regards, Phill Le Petit President QUEENSLAND COUNTRY PRESS ASSOCIATION INC PO Box 3212, Victoria Point West, Qld., 4165 E: [email protected] :: Phone 0408 165 509 2020 EXCELLENCE AWARDS Advertising Awards JUDGE: RON REEDMAN QUEENSLAND COUNTRY PRESS ASSOCIATION INC. -

Chronology of Recent Events

View metadata, citation and similar papers at core.ac.uk brought to COREyou by provided by University of Queensland eSpace AUSTRALIAN NEWSPAPER HISTORY GROUP NEWSLETTER ISSN 1443-4962 No. 20 December 2002 Compiled for the ANHG by Rod Kirkpatrick, 13 Sumac Street, Middle Park, Qld, 4074, 07-3279 2279, [email protected] 20.1 COPY DEADLINE AND WEBSITE ADDRESS Deadline for next Newsletter: 31 January 2003. Subscription details appear at end of Newsletter. [Number 1 appeared in October 1999.] See separate file for Australian Newspaper Press Bicentenary Symposium registration form The Newsletter is online through the “Publications” link from the University of Queensland’s School of Journalism & Communication Website at www.sjc.uq.edu.au/ Current Developments: Metro (20.2-27), and Provincial (20.28-38); Newspaper History (20.39-49); Recently Published Books and Articles (20.50-51); and Chronology, 1890-1899 (20.52). CURRENT DEVELOPMENTS: METRO 20.2 CENTRAL COAST DAILY NEWSPAPER BATTLE It’s Fairfax versus News in a daily newspaper battle on the Central Coast of New South Wales: Fairfax, through Newcastle Newspapers, has invaded traditional News turf, serviced by the Cumberland title, the Express Advocate (a merger of the old Central Coast Express and the Wyong Advocate). Fairfax had been working toward the daily for nearly two years and made its first move in July 2001, buying the Sun, a weekly Central Coast free founded in 1987. It launched the Central Coast Sun Weekly in August 2001. Fairfax announced on 25 September that it would launch the daily Central Coast Herald on Saturday, 28 September. -

Business Wire Catalog

Asia-Pacific Media Pan regional print and television media coverage in Asia. Includes full-text translations into simplified-PRC Chinese, traditional Chinese, Japanese and Korean based on your English language news release. Additional translation services are available. Asia-Pacific Media Balonne Beacon Byron Shire News Clifton Courier Afghanistan Barossa & Light Herald Caboolture Herald Coast Community News News Services Barraba Gazette Caboolture News Coastal Leader Associated Press/Kabul Barrier Daily Truth Cairns Post Coastal Views American Samoa Baw Baw Shire & West Cairns Sun CoastCity Weekly Newspapers Gippsland Trader Caloundra Weekly Cockburn City Herald Samoa News Bay News of the Area Camden Haven Courier Cockburn Gazette Armenia Bay Post/Moruya Examiner Camden-Narellan Advertiser Coffs Coast Advocate Television Bayside Leader Campaspe News Collie Mail Shant TV Beaudesert Times Camperdown Chronicle Coly Point Observer Australia Bega District News Canberra City News Comment News Newspapers Bellarine Times Canning Times Condobolin Argus Albany Advertiser Benalla Ensign Canowindra News Coober Pedy Regional Times Albany Extra Bendigo Advertiser Canowindra Phoenix Cooktown Local News Albert & Logan News Bendigo Weekly Cape York News Cool Rambler Albury Wodonga News Weekly Berwick News Capricorn Coast Mirror Cooloola Advertiser Allora Advertiser Bharat Times Cassowary Coast Independent Coolum & North Shore News Ararat Advertiser Birdee News Coonamble Times Armadale Examiner Blacktown Advocate Casterton News Cooroy Rag Auburn Review -

APN Shaannual Report APN News & Media Annual Report 2010 Report Annual & Media News APN 2010

APN SHAAnnUAL REPORT APN News & Media Annual Report 2010 2010 90.0 FM 89.4 FM 1503 AM 91.0 FM 97.4 FM 89.4 FM 774 AM 96.8 FM 90.5 FM 90.9 FM 93.8 FM 1584 AM 93.3FM 95.6 FM APN OUTDooR & ADSHEL / BALLIna SHIRE ADVOCATE / BALonnE BEACon / BAY NEWS / BAY OF PLENTY TIMES / BEST OF TIMES / BIG RIGS / BLACKWATER HERALD / BRIBIE WEEKLY / BUDERIM CHRonICLE / BUSH TELEGRapH / BUSpaK (HonG KonG) / BYRon SHIRE NEWS / CabooLTURE NEWS / CaLOUNDRA WEEKLY / CapRICORN CoaST MIRROR / CENTRAL & NORTH BURNETT TIMES / CENTRAL QUEENSLanD NEWS / CENTRAL TELEGRapH / CHB MaIL / CHINCHILLA NEWS anD MURILLA ADVERTISER / CITYLIFE / CLASSIC HITS / CoaSTAL NEWS / CoaSTAL VIEWS / CoDY (HonG KonG) / CooK STRAIT NEWS / CooLooLA ADVERTISER / CooLUM & NORTH SHORE NEWS / CoUNTRY NEWS / CREME / CRUISE / DaILY MERCURY / DaILY POST / DaILY POST WEEKENDER / DaLBY HERALD / DannEVIRKE EVENING NEWS / EaSTERN BAY NEWS / EaSYMIX / FINDA / FLAVA / FRASER CoaST CHRonICLE / GaTTon, LoCKYER anD BRISbanE VaLLEY STAR / GIRLFRIEND / GISboRNE HERALD / GoLD CoaST MaIL / GRabONE / GUARDIan / GUARDIan PALMERSTon NORTH / HaMILTon THIS WEEK / HaSTINGS LEADER / HaWKE’S BAY ToDAY / HERVEY BAY OBSERVER / HoROWHENUA CHRonICLE / InDEPENDENT HERALD / InSITE / ISIS ToWN & CoUNTRY / ISLanD & MaINLanD NEWS / JET MaGAZINE / KapITI NEWS / KaTIKATI ADVERTISER / KaWana WEEKLY / MaCKAY & SaRIna MIDWEEK / MaRooCHY WEEKLY / MINERS MIDWEEK / MIX / NAMboUR WEEKLY / NapIER CoURIER RETUrn TO GROWTH / NEW IDEA / NEW ZEALanD LISTENER / NEW ZEALanD WoMan’S WEEKLY / NEWS ADVERTISER / NEWS-MaIL / NEWSTALKZB / NooSA -

Question on Notice No 923 Asked on 26 May 2006 MR QUINN Asked The

Question on Notice No 923 Asked on 26 May 2006 MR QUINN asked the Minister for Transport and Main Roads (MR LUCAS) – QUESTION: For 2001-02, 2002-03, 2003-04, 2004-05 and 2005-06 (year to date) will he detail all Department of Transport and Main Roads advertising campaigns and promotional material broken down by (a) the name of the advertising campaign/promotional material, (b) media publications in which is appears, (c) the dates that the advertising campaign/promotional material appeared in the media and (d) total cost of the advertising campaign/promotional material? ANSWER: I thank the Honourable Member for his question. The portfolio undertakes advertising and promotional activity to provide key information to the community, such as information on its products and services including marine and road safety, public transport initiatives to name a few. The departments advise that when planning an advertising campaign, robust research findings are used to determine the audiences being targeted for the specific message (product/service), and liaison is undertaken with the media agency to provide a media strategy to best deliver this message to key audiences. The publications selected for any advertising campaigns are to inform or educate the public or generate positive attitudinal or behavioural changes in the public, in relation to the services, activities, projects, laws or policies of the department. For those messages requiring exposure to a larger audience a wider range of regional papers and city dailies are selected in addition to targeted publications. Campaign advertising does not include public notices, tender advertisements, road closure advice, or other one-off operational advertisements. -

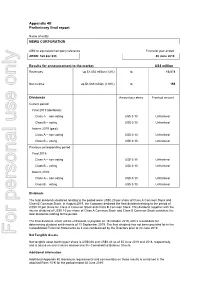

Printmgr File

Appendix 4E Preliminary final report Name of entity NEWS CORPORATION ABN or equivalent company reference Financial year ended ARBN: 163 882 933 30 June 2019 Results for announcement to the market US$ million Revenues up $1,050 million (12%) to 10,074 Net income up $1,669 million (110%) to 155 Dividends Amount per share Franked amount Current period Final 2019 (declared): Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2019 (paid): Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Previous corresponding period Final 2018: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2018: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Dividends The total dividends declared relating to the period were US$0.20 per share of Class A Common Stock and Class B Common Stock. In August 2019, the Company declared the final dividend relating to the period of US$0.10 per share for Class A Common Stock and Class B Common Stock. This dividend, together with the interim dividend of US$0.10 per share of Class A Common Stock and Class B Common Stock constitute the total dividends relating to the period. The final dividend, which will be unfranked, is payable on 16 October 2019, with a record date for determining dividend entitlements of 11 September 2019. The final dividend has not been provided for in the Consolidated Financial Statements as it was not declared by the Directors prior to 30 June 2019. -

News Corp Australia Specifications. Select Your State

News Corp Australia specifications. Select your state.... NT QLD WA SA NSW VIC TAS News Corp Australia Advertising Specifications 2018 NSW - PUBLICATIONS. Select your publication.... NSW - Metro NSW - Community NSW - Liftouts NSW - Real Estate Publications Special Executions. Sunday Telegraph Blacktown Advocate Body + Soul Central Coast Real Estate South Tabloid Ribbons & Ribbon Wraps The Daily Telegraph Canterbury Bankstown Express Carsguide Peninsula Real Estate Gloss Creative Options The Sportsman Central The Review Northern District Times Real Estate A4 Mag Manly Daily Gloss Real Estate Central Coast Express Travel & Indulgence A4 Mag Sealed Sections Fairfield Advance Best Weekend Central Coast Real Estate North NSW - National A4 Mag 6pp Gatefold The Australian - Main Hills Shire Times Escape Hills Shire Times Real Estate Hornsby Advocate Homes A4 Mag 8pp Gatefold The Australian - Recruitment Rouse Hill Times Real Estate Liverpool Leader The Deal Magazine Penrith Press Real Estate 310 Mag The Australian -Notices & Tenders 310 Mag 4pp Gatefold Manly Daily Stellar Magazine The Daily Telegraph - Real Esate Gloss The Australian - Realestate 310 Mag 8pp Gatefold Macarthur Chronicle TWAM - Weekend Aust’ Mag Mt Druitt - St Marys Standard Coffs Coast Real Estate 350 Mag Newsprint STL TV Guide Grafton Real Estate NSW - Regional Northern District Times 350 Mag Gloss Ballina Shire Advocate Parramatta Advertiser Lismore TV Guide Lismore Real Estate Quarto Mag Coffs Coast TV Guide Tweed Realestate Byron Shire News Penrith Press Quarto Mag 8pp Gatefold Coastal Views Rouse Hill Times Quartofold Newsprint mag Coffs Coast Advocate Inner West Courier - City Daily Examiner Inner West Courier - West Gloss Posters Lismore Echo North Shore Times Northern Star Southern Courier Richmond River Express The Mosman Daily Rural Weekly N NSW Wentworth Courier Seniors Central Coast Seniors Coffs Coast Seniors N NSW Tweed Daily News RETURN TO MAP News Corp Australia Advertising Specifications 2018 QLD - PUBLICATIONS. -

Dent Island Golf Course Resort, the Whitsundays

COORDINATOR-GENERAL’S EVALUATION REPORT on the ENVIRONMENTAL IMPACT STATEMENT for the DENT ISLAND GOLF COURSE RESORT, THE WHITSUNDAYS August 2004 CONTENTS 1 INTRODUCTION...................................................................................... 1 2 PROJECT DETAILS................................................................................ 2 2.1 The Proponent ..................................................................................................................2 2.2 Project Description ..........................................................................................................2 2.1.1 Golf Course ....................................................................................................................2 2.2.2 Accommodation .............................................................................................................3 2.2.3 Maintenance Facility ......................................................................................................3 2.2.4 Irrigation Pump Shed .....................................................................................................3 2.2.5 Transport & Jetty Facilities ............................................................................................3 2.2.6 Domestic Refuse Collection ..........................................................................................4 2.2.7 Liquid Petroleum Gas ....................................................................................................4 2.2.8 Electrical Power .............................................................................................................4 -

NEWS CORPORATION (Exact Name of Registrant As Specified in Its Charter) ______Delaware 46-2950970 (State Or Other Jurisdiction of (I.R.S

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ________________________________ FORM 10-K ________________________________ (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2020 Or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-35769 ________________________________ NEWS CORPORATION (Exact name of registrant as specified in its charter) ________________________________ Delaware 46-2950970 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 1211 Avenue of the Americas, New York, New York 10036 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (212) 416-3400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Class A Common Stock, par value $0.01 per share NWSA The Nasdaq Global Select Market Class B Common Stock, par value $0.01 per share NWS The Nasdaq Global Select Market Class A Preferred Stock Purchase Rights N/A The Nasdaq Global Select Market Class B Preferred Stock Purchase Rights N/A The Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None (Title of class) ________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Appendix 4E Preliminary Final Report

Appendix 4E Preliminary final report Name of entity NEWS CORPORATION ABN or equivalent company reference Financial year ended ARBN: 163 882 933 30 June 2021 Results for announcement to the market US$ million Revenues up $350 million (4%) to 9,358 Net income up $1,599 million (126%) to 330 Dividends Amount per share Franked amount Current period Final 2021 (declared): Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2021: US$ 0.10 Unfranked Class A – non-voting US$ 0.10 Unfranked Class B – voting Previous corresponding period Final 2020: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2020: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Dividends The total dividends declared relating to the period were US$0.20 per share of Class A Common Stock and Class B Common Stock. In August 2021, the Company declared the final dividend relating to the period of US$0.10 per share for Class A Common Stock and Class B Common Stock. This dividend, together with the interim dividend of US$0.10 per share of Class A Common Stock and Class B Common Stock constitute the total dividends relating to the period. The final dividend, which will be unfranked, is payable on 13 October 2021, with a record date for determining dividend entitlements of 15 September 2021. The final dividend has not been provided for in the Consolidated Financial Statements as it was not declared by the Directors prior to 30 June 2021. -

Downloadable Audio Books for Tablets, E-Book Readers and Mobile Devices

Appendix 4E Preliminary final report Name of entity NEWS CORPORATION ABN or equivalent company reference Financial year ended ARBN: 163 882 933 30 June 2019 Results for announcement to the market US$ million Revenues up $1,050 million (12%) to 10,074 Net income up $1,669 million (110%) to 155 Dividends Amount per share Franked amount Current period Final 2019 (declared): Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2019 (paid): Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Previous corresponding period Final 2018: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Interim 2018: Class A – non-voting US$ 0.10 Unfranked Class B – voting US$ 0.10 Unfranked Dividends The total dividends declared relating to the period were US$0.20 per share of Class A Common Stock and Class B Common Stock. In August 2019, the Company declared the final dividend relating to the period of US$0.10 per share for Class A Common Stock and Class B Common Stock. This dividend, together with the interim dividend of US$0.10 per share of Class A Common Stock and Class B Common Stock constitute the total dividends relating to the period. The final dividend, which will be unfranked, is payable on 16 October 2019, with a record date for determining dividend entitlements of 11 September 2019. The final dividend has not been provided for in the Consolidated Financial Statements as it was not declared by the Directors prior to 30 June 2019. -

Australia Media Directory

Australia Media Directory Australia Newswire 1st Headlines 2GB 2UE 3AW 4BC 5AA 6PR AAP ABC ABC Adelaide ABC Alice Springs ABC BrisBane ABC Broken Hill ABC CanBerra ABC Capricornia ABC Central Victoria ABC Central West NSW ABC Darwin ABC Esperance ABC Eyre Peninsula and West Coast ABC Far North Queensland ABC Gippsland ABC Gold and Tweed Coasts Queensland ABC Goldfields Esperance WA ABC GoulBurn Murray ABC Great Southern WA ABC HoBart ABC Illawarra NSW ABC Katherine ABC Kimberley WA ABC MelBourne ABC Mid North Coast NSW ABC Mid West and Wheatbelt WA ABC Mildura Swan Hill ABC New England North West NSW ABC Newcastle ABC Newsradio ABC North Coast NSW ABC North Queensland ABC North West Queensland ABC North West WA ABC North and West SA ABC Northern Tasmania ABC Perth ABC Queensland ABC Riverina NSW ABC Riverland SA ABC Rural ABC South East NSW ABC South East SA ABC South West WA ABC Southern Queensland ABC Sunshine and Cooloola Coasts Queensland ABC Sydney ABC Tropical North Queensland ABC Upper Hunter NSW ABC Western Plains NSW ABC Western Queensland ABC Western Victoria ABC Wide Bay Queensland Adelaidean Advertiser Advertiser Advocate Advocate Age Age Al Ankabout AlBany Advertiser AlBany and Great Southern Weekender AlBert and Logan News AlBury Wodonga News Weekly Alice Springs News Allora Advertiser Along the Grapevine Alpine OBserver Ararat Advertiser Area News Armidale Express Armidale Independent Asset Augusta Margaret River Mail Australia Plus Australian Australian Australian Financial Review Australian Financial Review Australian