Business Opportunities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russian M&A Review 2017

Russian M&A review 2017 March 2018 KPMG in Russia and the CIS kpmg.ru 2 Russian M&A review 2017 Contents page 3 page 6 page 10 page 13 page 28 page 29 KEY M&A 2017 OUTLOOK DRIVERS OVERVIEW IN REVIEW FOR 2018 IN 2017 METHODOLOGY APPENDICES — Oil and gas — Macro trends and medium-term — Financing – forecasts sanctions-related implications — Appetite and capacity for M&A — Debt sales market — Cross-border M&A highlights — Sector highlights © 2018 KPMG. All rights reserved. Russian M&A review 2017 3 Overview Although deal activity increased by 13% in 2017, the value of Russian M&A Deal was 12% lower than the previous activity 13% year, at USD66.9 billion, mainly due to an absence of larger deals. This was in particular reflected in the oil and gas sector, which in 2016 was characterised by three large deals with a combined value exceeding USD28 billion. The good news is that investors have adjusted to the realities of sanctions and lower oil prices, and sought opportunities brought by both the economic recovery and governmental efforts to create a new industrial strategy. 2017 saw a significant rise in the number and value of deals outside the Deal more traditional extractive industries value 37% and utility sectors, which have historically driven Russian M&A. Oil and gas sector is excluded If the oil and gas sector is excluded, then the value of deals rose by 37%, from USD35.5 billion in 2016 to USD48.5 billion in 2017. USD48.5bln USD35.5bln 2016 2017 © 2018 KPMG. -

Russian Withholding Tax Refund

Russian withholding tax refund Tax & Legal If you or your clients invested in Russian securities and are entitled to a substantial dividend or interest income, there is a chance that you overpaid your taxes and may qualify for a tax refund © 2018 Deloitte Consulting LLC Background Investors may apply a According to the The Russian The tax refund reduced tax rate for Russian tax withholding tax rate is practice in Russia is their interest and/or authorities, they are set at 15% on not well-developed: dividend income, ready to reimburse dividends and 20 the tax legislation depending on the overpaid taxes, if a percent on interest. does not provide for a conditions set by the full package of Effective from 1 specific list of Russian Tax Code or documents confirming January 2014, the documents to be applicable Double Tax the income payment duties of the tax collected and Treaties. Calculations chain and the agent for WHT requirements to be of a standard Russian investor’s rights to purposes were met. For these rate or the standard the income is transferred to the reasons, the process reduced Double Tax submitted. local Russian can be lengthy and Treaty rate, as well as custodian or, in a sometimes fruitless. submission of claims limited number of However, the trend is on tax can be cases, to the reassuring: the refunded, should be fiduciary, broker or number of successful made by investors issuer. refund claims and themselves within positive court three calendar years, decisions is growing. following the year in which it was withheld. -

Net Profit) in 1Q’21

TCS Group Holding PLC reports record quarterly profit for the period (net profit) in 1Q’21 Total revenues grew 21% to RUB 56.8 bn in 1Q’21 (1Q’20: RUB 46.9 bn) Net profit rose 57% to RUB 14.2 bn in 1Q’21 (1Q’20: RUB 9.0 bn) Tinkoff Investments assets under custody exceeded RUB 415 bn Non-credit business lines accounted for 43% of revenues and 24% of net profit Total customers reached 14.8 mn in 1Q’21 (1Q’20: 10.8 mn) LIMASSOL, CYPRUS — 11 May 2021. TCS Group Holding PLC (LI: TCS, MOEX: TCSG) (“Tinkoff”, “We”, the "Group", the “Company”), Russia's leading provider of online financial and lifestyle services via its Tinkoff ecosystem, today announces its consolidated IFRS results for the three months ended 31 March 2021. Oliver Hughes, CEO of Tinkoff Group, commented: “We continued to demonstrate profitable growth in the first quarter of 2021 with net profit reaching a new quarterly record of RUB 14.2 bn, as we charged full steam ahead, acquiring new customers and launching cool new features across our product lines. We continue to strengthen Tinkoff Investments by diversifying our investment offering. I am pleased to welcome Anton Malkov on board as the new Head of the Capital Markets Transactions Management Team at Tinkoff Investments to lead our new DCM and ECM effort with a focus on new-economy companies. In April we announced Tinkoff Group’s acquisition of a majority stake in Beskontakt LLC, the developer of the Koshelek app. A digital wallet and Russia’s only mobile app for aggregating bank cards, loyalty cards and coupons, the Koshelek app has a user base that exceeds 20 million and works with the country’s largest retailers. -

Emerging Index - QSR

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

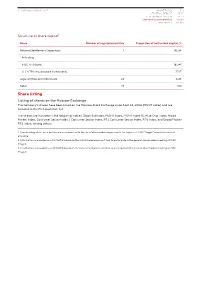

Share Listing

Annual Report 2018 | MAGNIT MAGNIT TODAY 3-11 99 STRATEGIC REPORT 13-27 PERFORMANCE REVIEW 29-53 CORPORATE GOVERNANCE 55-113 APPENDICES 115-189 Structure of share capital1 Name Number of registered entities Proportion of authorized capital, % National Settlement Depositary 1 95.54 Including: PJSC VTB Bank 18.342 LLC VTB Infrastructure Investments 7.723 Legal entities and individuals 24 4.46 Total: 25 100 Share listing Listing of shares on the Moscow Exchange The Company’s shares have been listed on the Moscow Stock Exchange since April 24, 2006 (MGNT ticker) and are included in the first quotation list. The shares are included in the following indices: Stock Subindex, MOEX Index, MOEX Index 10, Blue Chip Index, Broad Market Index, Consumer Sector Index / Consumer Sector Index, RTS Consumer Sector Index, RTS Index, and Broad Market RTS Index, among others. 1. Shareholding structure is provided in accordance with the list of shareholders registered in the register of PJSC “Magnit” shareholders as of 31.12.2018 2. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 3. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 100 101 Weight of shares in indices Ticker Index name Weight in index, % RDXUSD Russian Depositary Index USD 2.85 RDX Russian Depositary Index EUR 2.85 NU137529 MSCI EM IMI (VRS Taxes) Net Return USD Index 0.09 RIOB FTSE Russia IOB -

ESG-Digest №3 by Mikhailov & Partners Monthly Issue

ESG-Digest №3 by Mikhailov & Partners monthly issue Some of the hyperlinks lead to the full version of the article only in Russian July 2021 KEY EVENTS #ESG_global_agenda European Green Deal: Commission proposes transformation of EU economy and society to meet climate ambitions The European Commission adopted a package of proposals to make the EU's climate, energy, land use, transport and taxation policies fit for reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. A new Carbon Border Adjustment Mechanism will put a carbon price on imports of a targeted selection of products to ensure that ambitious climate action in Europe does not lead to "carbon leakage" More Vladimir Putin and John Kerry had a telephone conversation on climate issues Vladimir Putin claimed that Russia attaches great importance to achieving the goals of the Paris Agreement and stands for a depoliticized and professional dialogue in this area. Putin and Kerry exchanged their views on the prospects of bilateral environmental cooperation in the Arctic. Putin came up with a number of initiatives, including a proposal to establish Russian- American cooperation on collecting climate data using satellites. More Blockchain can help us beat climate change Smart contracts – fully traceable, transparent and irreversible self- executing contracts, running on blockchains – can contribute to the fight against climate change. They allow us to design globally accessible and fully automated incentive systems that can directly reward individuals, companies and governments for taking part in sustainable practices – such as regenerative agriculture, carbon offsets, crop insurance and more. More ESG-Digest, No. -

Dmitri V. Kovalenko

Dmitri V. Kovalenko Partner, Moscow Mergers and Acquisitions; Private Equity; Capital Markets Dmitri Kovalenko is co-head of the Moscow office and represents international and Russian clients on a broad range of mergers and acquisitions, private equity and joint venture transac- tions in Russia and other countries covering various industries and sectors. Mr. Kovalenko has practiced law in Skadden’s Moscow, Chicago and Paris offices since 1994. He is ranked in the top tier for Russia M&A and Russia capital markets work by Chambers Global and Chambers Europe, as well as for private equity in Russia by Chambers Europe. Mr. Kovalenko also was named as the 2021 Mergers and Acquisitions Lawyer of the Year and the 2020 Capital Markets Lawyer of the Year by The Best Lawyers in Russia, and was listed in the publication’s Global Business Edition. Additionally, he is listed as a leading individual in IFLR1000 and Who’s Who Legal, as well as repeatedly in The Legal 500 EMEA as a member of its Commercial, Corporate and M&A: Moscow Hall of Fame. T: 7.495.797.4600 F: 7.495.797.4601 His M&A and private equity experience has included advising: [email protected] - Mercury Retail Group in its US$1.2 billion sale of JSC Dixy Group to PJSC Magnit; - Horvik Limited in relation to its preconditional mandatory offer to acquire Trans-Siberian Gold Education plc, an AIM-quoted gold producer; LL.M. (with honors), Northwestern - Kismet Acquisition One, a special purpose acquisition company, in its US$1.9 billion initial University School of Law, Chicago, merger with Nexters Global Limited, the first-ever de-SPAC transaction involving a Russian USA, 1996 company. -

Annual Report 2018 ABOUT THIS REPORT 02

AnnuAl RepoRt 2018 ABOUT THIS REPORT 02 1 / 2 ABOUT THIS REPORT Approach to the Report Boundaries of the Report Approval of the Report This Annual Report of Sberbank of Russia ¹ for 2018 (the “Report”) The financial data are presented in the Report Information on sustainable development is consoli- This Report received preliminary approv- in accordance with the IFRS consolidated financial dated by the major participants of the Group, which al by the Supervisory Board of Sberbank includes the performance results of Sberbank and its subsidiaries ² statements, unless otherwise specified in the text of have a significant impact on their regions of pres- (Minutes No. 11 of April 16, 2019). for the reporting period from January 1, 2018, to December 31, 2018. the Report. ence, and Sberbank Corporate University. The reliability of the data in the Report was con- Operational data are presented for PJSC Sberbank firmed by the Audit Committee of Sberbank. unless otherwise specified in the text of the Report. The Report has been prepared in accordance with In addition, the contents of the Report The Report was approved by the Annual General the legislation of the Russian Federation, including: comply with the following documents: Shareholder Meeting of Sberbank as of May 24, 2019 (Minutes No 32 as of May 29, 2019). ♦ Federal Law No. 39-FZ “On the Securities ♦ Requirements of the Moscow Stock The term “Group” as used in the sections “People: Nurturing New Skills in Effective Teams” Market” dated April 22,1996; Exchange on the preparation of annu- and “Impact on Society” includes Sberbank Corporate University and the following: al reports by joint stock companies; ♦ Federal Law No. -

Identifying Russia's Structural Leaders

June 7, 2011 GS SUSTAIN Equity Research Identifying Russia’s structural leaders Identifying long-term winners with SUSTAIN Russia Structural Leaders List We have applied the GS SUSTAIN framework to We have identified eight companies that have RUSSIA STRUCTURAL LEADERS 75 companies across our Russian coverage to delivered and in our view will continue to deliver y identify those well positioned to deliver long-term industry leading cash returns: Mechel, EDCL, Company Sector quality quartile position quartile Management CROCI CROCI average 2011- % 13E, CROCI change 2006-10, % quartile CROCI outperformance through sustained high cash Alliance Oil, Rosneft and Novatek in the natural Novatek Energy 32.1% 0.3% 1 1 1 Oil Serv & Pipe Eurasia Drilling Co 28.2% -2.1% 2 1 1 returns. The framework combines forecast cash resources space and Magnit, Cherkizovo and M- producers Mechel Steel 21.9% -0.6% 2 1 1 returns with objective measures of industry Video in the consumer segment. Investing in this Alliance Oil CompaEnergy 17.4% 0.8% 2 1 1 Magnit (GDR) Consumer 17.1% -0.2% 2 1 1 positioning and management quality, which in a list of companies would have generated over Cherkizovo Group Consumer 16.1% 1.2% 2 1 2 M-VIDEO Consumer 15.0% 1.4% 2 1 2 Russian context focus predominantly on 300% outperformance vs. the MSCI Russia since Rosneft Energy 13.9% 1.0% 2 1 2 ownership and corporate governance issues. January 2006. RUSSIA STRUCTURAL LEADERS WATCH LIST Russia at the intersection of global structural Russia Structural Leaders Watch List Company Sector dust y CROCI average 2011-13E, % CROCI change 2006-10, % quartile CROCI position quartile Management quality quartile trends Disclosure remains sub par in many Russian Uralkali Mining 38.3% 2.4% 1 1 3 Globaltrans Transport 20.3% 2.3% 1 1 3 Oil Serv & Pipe Russia’s economy and equity market are corporates and is the main reason why a number ChelPipe 18.0% -1.3% 2 1 3 producers undergoing a dramatic transformation through of companies that are forecast to generate Mail.ru Group Ltd. -

Factsheet: DWS Russia

Marketing Material Factsheet: DWS Russia Equity Funds - Emerging Markets August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class LC (in %) Equities of selected small, medium-sized and large Russian companies that we believe have a strong market position and good growth prospects; see the sales prospectus for details of the risks of focusing on a certain geographical area. Fund Benchmark* *Benchmark: MSCI Russia 10/40 (RI) ab 1.4.07 (vorher MSCI Russia Capped) Fund Management's Comment Calculation of performance is based on the time-weighted return and excludes front-end fees. Individual costs such as fees, commissions and other charges have not been included in this presentation and would have an adverse impact on returns if they were included. Past performance is not a reliable indicator of future returns. While Inflation surprised to the lower side lately, President Vladimir Putin announcement of two one-off payments to pensioners and military service personnel, which are to be Cumulative performance (in %) - share class LC dispensed in the coming quarters, are going 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 to slightly boost inflation and GDP at the same time, and are coming right ahead of the parliamentary elections. The majority of EUR 3.1 32.4 69.9 90.7 248.5 25.5 19.3 13.8 -10.0 -0.5 43.3 -6.7 Russian listed companies posted their BM IN EUR 2.0 31.5 64.6 89.5 531.0 23.3 18.1 13.6 -11.6 4.4 47.6 -11.2 earnings releases, resulting in positive sentiment on the market, and although an accident at a Gazprom facility was a short term headwind, the impact on production was considered limited. -

Market News Politics Company News SECURITIES MARKET NEWS

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody September 24, 2020 Issue No. 2020/37 Market News Moscow Exchange to restart trade in RUSAL’s shares on September 28, 2020 On September 22, 2020 a spokesperson for the Moscow Exchange stated that the bourse suspended trade in shares of Russian aluminum giant UC RUSAL on September 22 and would restart it on September 28 after the company finishes the registration in the country. The suspension is connected to re-registration of the company from the Jersey Island into Russia. RUSAL said in a statement that the central bank had already registered the issue and a prospectus of securities under the re-registration process, and the company expects to obtain registration as an international company with the Federal Tax Service on Friday. In April 2018, the U.S. imposed sanctions against 38 Russian tycoons, officials and companies, including Oleg Deripaska and his companies – En+ Group, carmaker GAZ Group, holding Basic Element, and RUSAL – among others. In December, the shareholders of En+ Group unilaterally voted for reregistration of the business in Russia and for Deripaska’s ownership reduction below 50% and an end to his influence on the board of directors. RUSAL and En+ Group were decided to be reregistered in a special administrative zone in Kaliningrad. Moscow Exchange to suspend trading in Mostotrest shares from September 24, 2020 On September 23, 2020 it was announced that the Moscow Exchange would suspend trading in the shares of construction company Mostotrest from September 24 due to reorganization of the company. Ruble falls 82.35 kopecks to RUB 77.18 per US dollar On September 24, 2020 it was reported that the weighted average rate of the Russian ruble with tomorrow settlement fell by 82.35 kopecks against the U.S.