INTELSAT S.A. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DOC-367662A1.Pdf

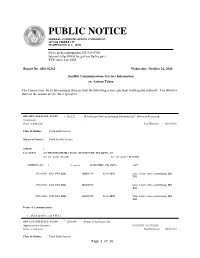

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12th STREET S.W. WASHINGTON D.C. 20554 News media information 202-418-0500 Internet: http://www.fcc.gov (or ftp.fcc.gov) TTY (202) 418-2555 Report No. SES-02311 Wednesday October 21, 2020 Satellite Communications Services Information re: Actions Taken The Commission, by its International Bureau, took the following actions pursuant to delegated authority. The effective dates of the actions are the dates specified. SES-AFS-20181108-03150 E KA322 Global Eagle Telecom Licensing Subsidiary LLC, Debtor-in-Possession Amendment Grant of Authority Date Effective: 10/15/2020 Class of Station: Fixed Earth Stations Nature of Service: Fixed Satellite Service SITE ID: 1 LOCATION: 200 TELEGRAPH HILL ROAD, MONMOUTH, HOLMDEL, NJ 40 ° 23 ' 40.00 " N LAT. 74 ° 10 ' 26.00 " W LONG. ANTENNA ID: 1 11 meters SCIENTIFIC ATLANTA 8007 5925.0000 - 6425.0000 MHz 36M0G7W 81.40 dBW Data, Voice, video conferencing, IBS, IDR 3700.0000 - 4200.0000 MHz 36M0G7W Data, Voice, video conferencing, IBS, IDR 5850.0000 - 5925.0000 MHz 36M0G7W 81.40 dBW Data, Voice, video conferencing, IBS, IDR Points of Communication: 1 - SES-6 (S2870) - (40.5 W.L.) SES-LIC-20191022-01364 E E190858 Swarm Technologies, Inc. Application for Authority 10/19/2020 - 10/19/2035 Grant of Authority Date Effective: 10/19/2020 Class of Station: Fixed Earth Stations Page 1 of 36 Nature of Service: Mobile Satellite Service SITE ID: Sussex NJ Gateway LOCATION: 11 Edsall Drive, Sussex, Sussex, NJ 41 ° 12 ' 6.30 " N LAT. 74 ° 31 ' 34.60 " W LONG. ANTENNA ID: -

Intelsat S.A. (Exact Name of Registrant As Specified in Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): August 1, 2012 Intelsat S.A. (Exact Name of Registrant as Specified in Charter) Luxembourg 000-50262 98-0346003 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File Number) Identification Number) 4 rue Albert Borschette Luxembourg Grand-Duchy of Luxembourg L-1246 (Address of Principal Executive Offices) (Zip Code) +(352) 27 84 1600 (Registrant’s Telephone Number, Including Area Code) n/a (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 2.02 Results of Operations and Financial Condition On August 1, 2012, Intelsat S.A. issued a press release entitled “Intelsat Reports Second Quarter 2012 Results.” A copy of such press release is furnished as an exhibit to this Current Report on Form 8-K. Item 9.01 Financial Statements and Exhibits (d) Exhibits 99.1 Press Release dated August 1, 2012 entitled “Intelsat Reports Second Quarter 2012 Results” SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. -

Intelsat S.A. (Translation of Registrant’S Name Into English)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of October, 2018 001-35878 (Commission File Number) Intelsat S.A. (Translation of registrant’s name into English) 4 rue Albert Borschette Luxembourg Grand-Duchy of Luxembourg L-1246 (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. INTELSAT S.A. Date: October 30, 2018 By: /s/ Jacques Kerrest Name: Jacques Kerrest Title: Executive Vice President and Chief Financial Officer EXHIBIT INDEX Exhibit Number Description 99.1 Press Release, dated October 30, 2018, entitled “Intelsat Announces Third Quarter 2018 Results” 99.2 Quarterly Commentary by Stephen Spengler, Chief Executive Officer, and Jacques Kerrest, Executive Vice President and Chief Financial Officer, made available on Intelsat’s public website on October 30, 2018 Exhibit 99.1 News Release 2018-52 Contact Dianne VanBeber Vice President, Investor Relations [email protected] +1 703 559 7406 (o) +1 703 627 5100 (m) Intelsat Announces Third Quarter 2018 Results • Third quarter revenue of $536.9 million; $511.9 million excluding effects of revenue recognition rules (ASC 606) • Third quarter net loss attributable to Intelsat S.A. -

Intelsat S.A. (Translation of Registrant’S Name Into English)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of April, 2019 001-35878 (Commission File Number) Intelsat S.A. (Translation of registrant’s name into English) 4 rue Albert Borschette Luxembourg Grand Duchy of Luxembourg L-1246 (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ INTELSAT S.A. Quarterly Report for the three months ended March 31, 2019 1 TABLE OF CONTENTS PART I. FINANCIAL INFORMATION Item 1. Financial Statements: Condensed Consolidated Balance Sheets as of December 31, 2018 and March 31, 2019 (Unaudited) 5 Unaudited Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2018 and 2019 6 Unaudited Condensed Consolidated Statements of Comprehensive Loss for the Three Months Ended March 31, 2018 and 2019 7 Unaudited Condensed Consolidated Statements of Changes in Shareholders' Deficit for the Three Months Ended March 31, 2018 and 2019 8 Unaudited Condensed Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2018 and 2019 9 Notes to the Condensed Consolidated Financial Statements (Unaudited) 10 Item 2. -

Space Business Review International Mobile Telecommunications Services, Including Wimax

December 2007 - SPECIAL EDITION: THE TOP-10 SPACE BUSINESS STORIES OF 2007 - #1 - M&A Transactions Keep Pace #5 - 50th Anniversary of Sputnik Despite challenging credit markets, merger, As we celebrate the 50th anniversary of the acquisition and investment activity kept pace in satellite that introduced the “space age”, 2007. Abertis & Caisse des Dépôts et approximately 1,000 satellites now orbit the consignations purchase 32% (€1.07B) and Earth and the space business has grown to 25.5% (€862.7M) stakes, respectively, in more than $100 billion in annual revenues. Eutelsat (Jan.). GE Capital sells back its 19.5% #6 - Satellite Manufacturers Remain Busy interest in SES Global for €588 million in cash 18 commercial satellite orders announced in and assets including stakes in AsiaSat, Star 2007. Ball Aerospace & Technologies: One and Orbcomm (Feb.). JSAT & SKY WorldView-2. EADS Astrium: YahSat 1A Perfect Communications merge (March). BC and 1B, Arabsat 5A, BADR-5 (the foregoing Partners to acquire Intelsat Ltd. for $16.4 billion, in cooperation with Thales Alenia Space) including debt (June). Carlyle Group to acquire and Alphasat 1-XL. Israel Aerospace ARINC (July). Apax Partners France Industries: Amos-4. Lockheed Martin purchases Telenor Satellite Services for $400 Commercial Space Systems: JCSAT-12. million (Sept.). Loral Space & Orbital Sciences Corporation: Optus-D3, Communications and PSP Canada conclude AMC-5R. Space Systems/Loral: Nimiq 5, C$3.25 billion acquisition of Telesat Canada ProtoStar I, Intelsat 14, SIRIUS FM-6, Abertis to acquire 28.4% stake in Hispasat EchoStar XIV, NSS-12. Thales Alenia (Nov.). CIP Canada Investment, indirectly Space: THOR 6, Palapa-D. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

2010 Commercial Space Transportation Forecasts

2010 Commercial Space Transportation Forecasts May 2010 FAA Commercial Space Transportation (AST) and the Commercial Space Transportation Advisory Committee (COMSTAC) HQ-101151.INDD 2010 Commercial Space Transportation Forecasts About the Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA/AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 49 United States Code, Subtitle IX, Chapter 701 (formerly the Commercial Space Launch Act). FAA/AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA/AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA/AST’s web site at http://ast.faa.gov. Cover: Art by John Sloan (2010) NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. • i • Federal Aviation Administration / Commercial Space Transportation Table of Contents Executive Summary . 1 Introduction . 4 About the CoMStAC GSo Forecast . .4 About the FAA NGSo Forecast . .4 ChAracteriStics oF the CommerCiAl Space transportAtioN MArket . .5 Demand ForecastS . .5 COMSTAC 2010 Commercial Geosynchronous Orbit (GSO) Launch Demand Forecast . 7 exeCutive Summary . .7 BackGround . .9 Forecast MethoDoloGy . .9 CoMStAC CommerCiAl GSo Launch Demand Forecast reSultS . -

Update of the Space and Launch Insurance Industry

Commercial Space Transportation QUARTERLY LAUNCH REPORT Special Report: Update of the Space and Launch Insurance Industry 4th Quarter 1998 United States Department of Transportation • Federal Aviation Administration Associate Administrator for Commercial Space Transportation 800 Independence Ave. SW Room 331 Washington, D.C. 20591 Special Report SR-1 Update of the Space and Launch Insurance Industry INTRODUCTION at risk, insurance is essential to mitigate the high cost of a failure. Insurance is a basic requirement for the maintenance of a commercial space industry. Certain types of space insurance, such as Space activity mishaps can result in hundreds third party liability insurance, protect the of millions of dollars of expenses. Two general public from the hazards of space recent launch vehicles that failed (a Titan 4A activity. The U.S. Federal Aviation and the initial Delta 3) were valued at $1.3 Administration, through the Commercial billion and $225 million respectively Space Launch Act Amendments of 1988, (inclusive of payload). The replacement cost requires third party liability insurance as a of the recently failed Galaxy 4 satellite, for condition for the issuance of a commercial example, was in the range of $200 to $250 launch license. Under the 1972 United million. In addition, consequences of Nations Convention on International Liability mishaps will typically extend beyond the cost for Damage Caused by Space Objects, of a satellite and launch vehicle. Business governments are liable for injury or damage operations can be delayed, possibly resulting to third parties, caused by launch vehicles or in the deferral of a satellite venture’s vital payloads launched under their jurisdiction. -

Spotlight on Asia-Pacific

Worldwide Satellite Magazine June 2008 SatMagazine Spotlight On Asia-Pacific * The Asia-Pacific Satellite Market Segment * Expert analysis: Tara Giunta, Chris Forrester, Futron, Euroconsult, NSR and more... * Satellite Imagery — The Second Look * Diving Into the Beijing Olympics * Executive Spotlight, Andrew Jordan * The Pros Speak — Mark Dankburg, Bob Potter, Adrian Ballintine... * Checking Out CommunicAsia + O&GC3 * Thuraya-3 In Focus SATMAGAZINE JUNE 2008 CONTENTS COVER FEATURE EXE C UTIVE SPOTLIGHT The Asia-Pacific Satellite Market Andrew Jordan by Hartley & Pattie Lesser President & CEO The opportunities, and challenges, SAT-GE facing the Asia-Pacific satellite market 12 are enormous 42 FEATURES INSIGHT Let The Games Begin... High Stakes Patent Litigation by Silvano Payne, Hartley & Pattie by Tara Giunta, Robert M. Masters, Lesser, and Kevin and Michael Fleck and Erin Sears The Beijing Olympic Games are ex- Like it or not, high stakes patent pected to find some 800,000 visitors wars are waging in the global satel- 47 arriving in town for the 17-day event. 04 lite sector, and it is safe to assume that they are here to stay. Transforming Satel- TBS: Looking At Further Diversification lite Broadband by Chris Forrester by Mark Dankberg Internationally, Turner Broadcasting The first time the “radical” concept has always walked hand-in-hand with 54 of a 100 Gbps satellite was intro- the growth of satellite and cable – duced was four years ago, 07 and now IPTV. Here’s Looking At Everything — Part II by Hartley & Pattie Lesser The Key To DTH Success In Asia by Jose del Rosario The Geostationary Operational Envi- Some are eyeing Asia as a haven for ronmental Satellites (GOES) continu- economic safety or even economic ously track evolution of weather over growth amidst the current global almost a hemisphere. -

59864 Federal Register/Vol. 85, No. 185/Wednesday, September 23

59864 Federal Register / Vol. 85, No. 185 / Wednesday, September 23, 2020 / Rules and Regulations FEDERAL COMMUNICATIONS C. Congressional Review Act II. Report and Order COMMISSION 2. The Commission has determined, A. Allocating FTEs 47 CFR Part 1 and the Administrator of the Office of 5. In the FY 2020 NPRM, the Information and Regulatory Affairs, Commission proposed that non-auctions [MD Docket No. 20–105; FCC 20–120; FRS Office of Management and Budget, funded FTEs will be classified as direct 17050] concurs that these rules are non-major only if in one of the four core bureaus, under the Congressional Review Act, 5 i.e., in the Wireline Competition Assessment and Collection of U.S.C. 804(2). The Commission will Bureau, the Wireless Regulatory Fees for Fiscal Year 2020 send a copy of this Report & Order to Telecommunications Bureau, the Media Congress and the Government Bureau, or the International Bureau. The AGENCY: Federal Communications indirect FTEs are from the following Commission. Accountability Office pursuant to 5 U.S.C. 801(a)(1)(A). bureaus and offices: Enforcement ACTION: Final rule. Bureau, Consumer and Governmental 3. In this Report and Order, we adopt Affairs Bureau, Public Safety and SUMMARY: In this document, the a schedule to collect the $339,000,000 Homeland Security Bureau, Chairman Commission revises its Schedule of in congressionally required regulatory and Commissioners’ offices, Office of Regulatory Fees to recover an amount of fees for fiscal year (FY) 2020. The the Managing Director, Office of General $339,000,000 that Congress has required regulatory fees for all payors are due in Counsel, Office of the Inspector General, the Commission to collect for fiscal year September 2020. -

Classification of Geosynchronous Objects

esoc European Space Operations Centre Robert-Bosch-Strasse 5 D-64293 Darmstadt Germany T +49 (0)6151 900 www.esa.int CLASSIFICATION OF GEOSYNCHRONOUS OBJECTS Produced with the DISCOS Database Prepared by ESA’s Space Debris Office Reference GEN-DB-LOG-00211-OPS-GR Issue 20 Revision 0 Date of Issue 28 May 2018 Status Issued Document Type Technical Note Distribution ESA UNCLASSIFIED - Limited Distribution European Space Agency Agence spatiale europeenne´ Abstract This is a status report on geosynchronous objects as of 1 January 2018. Based on orbital data in ESA’s DISCOS database and on orbital data provided by KIAM the situation near the geostationary ring is analysed. From 1523 objects for which orbital data are available (of which 0 are outdated, i.e. the last available state dates back to 180 or more days before the reference date), 519 are actively controlled, 795 are drifting above, below or through GEO, 189 are in a libration orbit and 19 are in a highly inclined orbit. For 1 object the status could not be determined. Furthermore, there are 59 uncontrolled objects without orbital data (of which 54 have not been cata- logued). Thus the total number of known objects in the geostationary region is 1582. If you detect any error or if you have any comment or question please contact: Stijn Lemmens European Space Agency European Space Operations Center Space Debris Office (OPS-GR) Robert-Bosch-Str. 5 64293 Darmstadt, Germany Tel.: +49-6151-902634 E-mail: [email protected] Page 1 / 187 European Space Agency CLASSIFICATION OF GEOSYNCHRONOUS OBJECTS Agence spatiale europeenne´ Date 28 May 2018 Issue 20 Rev 0 Table of contents 1 Introduction 3 2 Sources 4 2.1 USSTRATCOM Two-Line Elements (TLEs) . -

The Annual Compendium of Commercial Space Transportation: 2017

Federal Aviation Administration The Annual Compendium of Commercial Space Transportation: 2017 January 2017 Annual Compendium of Commercial Space Transportation: 2017 i Contents About the FAA Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 51 United States Code, Subtitle V, Chapter 509 (formerly the Commercial Space Launch Act). FAA AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA AST’s website: http://www.faa.gov/go/ast Cover art: Phil Smith, The Tauri Group (2017) Publication produced for FAA AST by The Tauri Group under contract. NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. ii Annual Compendium of Commercial Space Transportation: 2017 GENERAL CONTENTS Executive Summary 1 Introduction 5 Launch Vehicles 9 Launch and Reentry Sites 21 Payloads 35 2016 Launch Events 39 2017 Annual Commercial Space Transportation Forecast 45 Space Transportation Law and Policy 83 Appendices 89 Orbital Launch Vehicle Fact Sheets 100 iii Contents DETAILED CONTENTS EXECUTIVE SUMMARY .