I·,;T:A.Chuti-5 S Istutin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Single-Use Duodenoscopes and Duodenoscopes with Disposable End Caps

REPORT ON EMERGING TECHNOLOGY Single-use duodenoscopes and duodenoscopes with disposable end caps Prepared by: ASGE TECHNOLOGY COMMITTEE Arvind J. Trindade, MD,1,* Andrew Copland, MD,2,* Amit Bhatt, MD,3 Juan Carlos Bucobo, MD, FASGE,4 Vinay Chandrasekhara, MD, FASGE,5 Kumar Krishnan, MD,6 Mansour A. Parsi, MD, MPH, FASGE,7 Nikhil Kumta, MD, MS,8 Ryan Law, DO,9 Rahul Pannala, MD, MPH, FASGE,10 Erik F. Rahimi, MD,11 Monica Saumoy, MD, MS,12 Guru Trikudanathan, MBBS,13 Julie Yang, MD, FASGE,14 David R. Lichtenstein, MD, FASGE, (Chair, Technology Committee)15 This document was reviewed and approved by the Governing Board of the American Society for Gastrointestinal Endoscopy. Background and Aims: Multidrug-resistant infectious outbreaks associated with duodenoscopes have been documented internationally. Single-use duodenoscopes, disposable distal ends, or distal end cap sealants could eliminate or reduce exogenous patient-to-patient infection associated with ERCP. Methods: This document reviews technologies that have been developed to help reduce or eliminate exogenous infections because of duodenoscopes. Results: Four duodenoscopes with disposable end caps, 1 end sheath, and 2 disposable duodenoscopes are re- viewed in this document. The evidence regarding their efficacy in procedural success rates, reduction of duode- noscope bacterial contamination, clinical outcomes associated with these devices, safety, and the financial considerations are discussed. Conclusions: Several technologies discussed in this document are anticipated to eliminate or reduce exogenous infections during endoscopy requiring a duodenoscope. Although disposable duodenoscopes can eliminate exog- enous ERCP-related risk of infection, data regarding effectiveness are needed outside of expert centers. Addition- ally, with more widespread adoption of these new technologies, more data regarding functionality, medical economics, and environmental impact will accrue. -

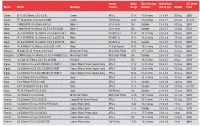

Sensor Zoom Min. Focusing Dimensions Est. Street Brand Model Mount(S) Format Range Distance (D X L) (In.) Weight Price

Sensor Zoom Min. Focusing Dimensions Est. Street Brand Model Mount(s) Format Range Distance (D x L) (in.) Weight Price Canon EF-S 18-200mm ƒ/3.5-5.6 IS Canon APS-C 11.1x 17.8 inches 3.1 x 6.4 20.9 oz. $699 Canon EF 28-300mm ƒ/3.5-5.6L IS USM Canon Full-Frame 10.7x 27.6 inches 3.6 x 7.2 59.2 oz. $2,449 Nikon 1 NIKKOR VR 10-100mm ƒ/4-5.6 Nikon 1 CX (1-inch) 10x Variable 2.4 x 2.8 10.5 oz. $549 Nikon 1 NIKKOR VR 10-100mm ƒ/4.5-5.6 PD-ZOOM Nikon 1 CX (1-inch) 10x Variable 3.0 x 3.7 18.2 oz. $749 Nikon AF-S DX NIKKOR 18-200mm ƒ/3.5-5.6G ED VR II Nikon DX (APS-C ) 11.1x 19.2 inches 3.0 x 3.8 19.8 oz. $649 Nikon AF-S DX NIKKOR 18-300mm ƒ/3.5-6.3G ED VR Nikon DX (APS-C) 16.7x 19.2 inches 3.0 x 3.8 19.4 oz. $699 Nikon AF-S DX NIKKOR 18-300mm ƒ/3.5-5.6G ED VR Nikon DX (APS-C) 16.7x Variable 3.3 x 4.7 29.3 oz. $999 Nikon AF-S NIKKOR 28-300mm ƒ/3.5-5.6G ED VR Nikon FX (Full-Frame) 10.7x 19.2 inches 3.3 x 4.5 28.2 oz. $949 Olympus M.Zuiko ED 14-150mm ƒ/4.0-5.6 II Micro Four Thirds Micro Four Thirds 10.7x 19.7 inches 2.5 x 3.3 10.0 oz. -

The Mineral Industry of Japan in 1998

THE MINERAL INDUSTRY OF JAPAN By John C. Wu Japan’s reserves of limestone, pyrophyllite, and silica are important role in supplying the ferrous and nonferrous metals, quite large. Japan has considerable reserves of coal and iodine, fabricated metal products, and industrial mineral products to but its reserves of natural gas and crude petroleum are very the construction and manufacturing industries of China, small. As a result of exploration conducted in the past 5 years including Hong Kong, Indonesia, the Republic of Korea, by the Metal Mining Agency of Japan (MMAJ), a Malaysia, Singapore, Thailand, and Taiwan. semigovernment agency under the Ministry of International For the first time since the end of World War II, the Japanese Trade and Industry (MITI), reserves of gold, lead, and zinc had economy went into a severe recession in 1998 after 5 years of been extended (Metal Mining Agency of Japan, 1998a), but slow growth in the 1990’s. According to the Economic Japan’s reserves of ferrous and nonferrous minerals are small. Planning Agency and MITI, Japan’s economy, as measured by Japan relied on imports to meet more than 95% of its raw GDP in 1990 constant yen, contracted 2.8% in 1998. material requirements for energy, ferrous metals, and Restructuring in the financial, manufacturing, and other sectors nonferrous metals for its mineral-processing and mineral- had resulted in a substantial increase in unemployment, which related manufacturing sectors. Japan also relied on imports to reached a record rate of 4.1% in 1998. The depressed real meet between 10% and 25% of its requirements for refined estate and stock markets had caused the major banks to carry a nonferrous metal products, industrial mineral products, and heavy load of bad loans, with limited funds available for refined petroleum products. -

Annual Report 2019 Year Ended March 31, 2019

Annual Report 2019 Year ended March 31, 2019 Contributing to the Construction of Social Infrastructure Contents Editorial Policy This “Annual Report” is a publication for the Furukawa Company Group’s About the Furukawa Company Group 1 shareholders and other investors. It is an integrated report that includes financial information from the Group’s “Annual Securities Report” and Furukawa Company Group’s Value Creation Process 2 environmental, social, and governance (ESG)-related information from its “Corporate Governance Report” and “CSR Report.” The intention of this Message from the President 4 Annual Report is to foster a more accurate understanding of the integrated Interview with President Miyakawa 6 thinking, strategies, and actions of the Group while covering the informa- tion necessary for shareholders and other investors. Special Feature ~Improving ROE~ 10 In addition to these report, we disclose financial statements, financial Review of Operations 12 results briefing materials, and post various other information on our corpo- rate website in a timely and appropriate manner. Topics 16 https://www.furukawakk.co.jp/ir/library/ ESG Information The Furukawa Company Group’s ESG Activities 17 Target Period: April 2018–March 2019 CSR Goals 18 (Some activities before and after this period are also included.) Corporate Governance 19 Message from an Outside Independent Director 21 Directors and Audit & Supervisory Board Members 22 Risk Management 23 Annual Report Compliance 24 Environmental Initiatives 25 Environmental Management 26 Annual Securities Corporate Governance CSR Social Initiatives 28 Report Report Report (Financial information) (ESG information) (ESG information) Financial Information Consolidated Six-Year Financial Summary 30 Forward-Looking Statements This Annual Report contains information about the Furukawa Company Group’s Financial Review 31 plans, strategies, and future prospects. -

Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?

IRLE IRLE WORKING PAPER #188-09 September 2009 Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln, Masahiro Shimotani Cite as: James R. Lincoln, Masahiro Shimotani. (2009). “Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?” IRLE Working Paper No. 188-09. http://irle.berkeley.edu/workingpapers/188-09.pdf irle.berkeley.edu/workingpapers Institute for Research on Labor and Employment Institute for Research on Labor and Employment Working Paper Series (University of California, Berkeley) Year Paper iirwps-- Whither the Keiretsu, Japan’s Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln Masahiro Shimotani University of California, Berkeley Fukui Prefectural University This paper is posted at the eScholarship Repository, University of California. http://repositories.cdlib.org/iir/iirwps/iirwps-188-09 Copyright c 2009 by the authors. WHITHER THE KEIRETSU, JAPAN’S BUSINESS NETWORKS? How were they structured? What did they do? Why are they gone? James R. Lincoln Walter A. Haas School of Business University of California, Berkeley Berkeley, CA 94720 USA ([email protected]) Masahiro Shimotani Faculty of Economics Fukui Prefectural University Fukui City, Japan ([email protected]) 1 INTRODUCTION The title of this volume and the papers that fill it concern business “groups,” a term suggesting an identifiable collection of actors (here, firms) within a clear-cut boundary. The Japanese keiretsu have been described in similar terms, yet compared to business groups in other countries the postwar keiretsu warrant the “group” label least. -

User Manual 0.6 MB

L IR-M Note: The 2S button will start shooting video on compatible Canon DSLR A cameras when in video mode, the T and W buttons will not work with INFRARED U Olympus E-system cameras, and the W/T button will not work with Pentax REMOTE N CONTROL A camera. WIRELESS SHUTTER ACTIVATION M Using Your IR-M as a Remote Trigger R E S away. To use your IR-M as a remote trigger, turn on your camera and follow U these steps: 1. Remove the plastic separator from the battery. Introduction 2. Set up your shot and make sure your camera is in focus. Thank you for choosing Vello. 3. Set your camera for remote triggering. For more information about the remote triggering feature, consult your camera’s manual. Congratulations on the purchase of your Vello IR-M infrared remote control. 4. Aim the remote at the camera’s infrared sensor and press the S button to This versatile remote control lets you wirelessly take photos, zoom, and release the shutter. is especially useful for preventing camera shake during long exposures and for Depending on your camera’s manufacturer and model, you may be able to taking self-portraits. It can also be used to trigger a remote camera when trigger the shutter with a two-second delay by pressing the 2S button. You shooting events. may also be able to zoom in and out by pressing the T and W buttons. For manual. from Canon, Nikon, Olympus, Sony, and Pentax. Precautions Note: Please see your camera’s user manual for complete instructions and supported features. -

HONEYWELL PENTAX Cameras and Accessories

H O N E Y WELL PHOTOGRAPHIC PROD U C T S -J HONEYWELL PENTAX cameras and accessories HONEYWELL PENTAX SPOTMATIC with behind-the-Iens exposure systeJll The world's first single-lens-reflex camera with a behind-the-Iens exposure system, the Spotmatic is the crowning achievement of the Honeywell Pentax line. Absolute correct exposures are simple with the Spotmatic. Its two CdS sensors read light from the image focused on the ground glass the same amount of light that strikes the film plane. With any focal length lens, or with bellows, extension Honeywell Pentax Spotmatic, chrome finish, tubes, or filters proper exposure is automatic and extremely with filA Super-Takumar lens. accurate. The Spotmatic's metering system can be operated with one hand without taking the eye from the viewfinder by simply pushing a switch and centering a needle. And, for special effects, it's simple to change shutter speed or aperture for over- or under exposures. The same size and classic design as the famous Pentax H3v, the Spotmatic also features: eye-level pentaprism finder with Fresnel lens; central microprism and positive grid focusing; instant-return mirror; focal plane shutter; speeds from 1 to 1/ 1000 sec., plus Bulb on single non-rotating knob; ASA-Range from 20 to 1600; self timer; auto-reset counter; ratchet film-advance lever cocks shutter and advances counter; FP and X flash terminals, and threaded lens mount. With very fast Super-Takumar 50mm f/ 1.4 lens or 55mm f/ 1.8 Super-Takumar lens. Both lenses have instant-open fully automatic diaphragm, and manual depth-of-field preview In addition, the Super-Takumar 50mm f/ 1.4 lens is a 7-element lens, with a 46° angle of view, a minimum aperture of f/ 16 and uses 49mm filters. -

Hugostudio List of Available Camera Covers

Exakta VX 1000 W/ P4 Finder Hugostudio List of Exakta VX 500 W/ H3.3 Finder Available Camera Covers Exakta VX IIa V1-V4 W/ P2.2 Finder Exakta VX IIa V5-V7-V8 _P3.3 Finder (1960) Exakta VX IIa V6 W/ H3 SLR Exakta VX IIb W/ P3 Asahiflex IIb Exakta VX IIb W/ P4 Finder Canon A-1 Exakta Varex VX V1 - V2 Canon AE-1 Exakta-Varex VX IIa V1-V4 Canon AE-1 Program Exakta Varex VX V4 V5 Canon AV-1 Exakta Varex VX W/ Finder P1 Canon EF Fujica AX-3 Canon EX Auto Fujica AZ-1 Canon F-1 Pic Req* Fujica ST 601 Canon F-1n (New) pic Req* Fujica ST 701 Canon FT QL Fujica ST 801 Canon FTb QL Fujica ST 901 Canon FTb n QL Kodak Reflex III Canon Power Winder A Kodak Reflex IV Canon TL-QL Kodak REflex S Canon TX Konica FT-1 Canonflex Konica Autoreflex T3 Chinon Memotron Konica Autoreflex T4 Contax 137 MA Konica Autoreflex TC Contax 137 MD Leica R3 Contax 139 Quartz Leica R4 Contax Motor Drive W6 Leica Motor Winder R4 Contax RTS Leicaflex SL Contax RTS II Mamiya ZE-2 Quartz Contax139 Quartz Winder Minolta Auto Winder D Edixa Reflex D Minolta Auto Winder G Exa 500 Minolta Motor Drive 1 Exa I, Ia, Ib Minolta SR 7 Exa II Minolta SRT 100 Exa IIa Minolta SRT 101 Exa Type 6 Minolta SRT 202 Exa VX 200 Minolta X370 Exa Version 2 to 5 Minolta X370s Exa Version 6 Minolta X570 Exa Version I Minolta X700 Exakta 500 Minolta XD 11, XD 5, XD 7, XD Exakta Finder H3 Minolta XE-7 XE-5 Exakta Finder: prism P2 Minolta XG-1 Exakta Finder: prism P3 Minolta XG 9 Exakta Finder: prism P4 Minolta XG-M Exakta Kine Minolta XG7, XG-E Exakta Meter Finder Minolta XM Exakta RTL1000 Miranda AII -

Japan- Tokyo- Office

M A R K E T B E AT TOKYO Office Q4 2020 YoY 12-Mo. Economy Indicates Only Gradual Recovery Chg Forecast The Bank of Japan‘s outlook for real GDP growth rate for FY2020 has been revised downward to -5.6%, 0.1 pp lower than the previous forecast. Total exports value in 2020 declined by 11% y-o-y, the third-largest drop after the GFC in 2009 (-33.1%) and the Plaza Accord in 1986 (-15.9%). -0.14% Exports to China were strong, and total export value in December was up y-o-y for the first time in 25 months. However, global economic recovery is Rental Growth, YoY now expected to be slower due to the re-emergence of COVID-19. In Japan, Capex spending has stopped falling overall in recent month, although 4.22% with variations among industries, and consumer spending has been under increasing downward pressure to face-to-face services. Vacancy Rate Vacancy Rate Trending Up Average Grade A office asking rent in Q4 2020 was JPY37,684, down 1.95% q-o-q. The overall vacancy rate rose 1.13 pp q-o-q to 4.22%, exceeding -1.71% the 4.06% mark of September 2008. Minato Ward, with a concentration of office developments, saw the highest vacancy rise among the five wards of Absorption, QoQ central Tokyo, up 3.49 pp y-o-y to 6%. The vacancy rate in Shinjuku Ward, a hub of SMEs and sales offices, rose 2.88 pp y-o-y to 4.53%, with the ward suspectable to economic shifts. -

This Issue of Pdf File

Thoughts on the New Year .....1 MMC Activities...................2 Study, Research and Dissemination Activities ..3 Project Update ...................4 Column............................5 Overseas Trends.................6 Member’s Profiles ..............8 Thoughts on the New Year As we greet the year 2009, I would like to wish everyone a Happy New Year, and to share some thoughts at the beginning of this new year. The past year was a turbulent one for the Japanese economy. Increases in the price of crude oil and rare materials, which had been a concern for the past few years, continued apace. This put pressure on company operations and people’s daily lives, and highlighted the all too well known fragility of the industrial infrastructure and lifeline of Japan, a country with a dearth of energy resources and raw materials. Then financial instability on a worldwide scale occurred, caused by the long-feared collapse of subprime loans in the United States. The resulting turbulence seems unlikely to be resolved easily. Viewing these trends, what I feel anew is the peril posed by an economy that is not tethered to reality. As an industry, Japan must have creative products with an appeal unrivaled by those of other countries, constituting an economic foundation that is based on actual circumstances. Tamotsu Nomakuchi The Micromachine Center (MMC) conducts a variety of activities aimed at establishing key Director, technologies relating to micromachines, MEMS and other micro/nano fields and providing support for Micromachine Center the continued growth of the MEMS industry, as well as strengthening the international competitiveness of Japan’s domestic industry and contributing to the creation of the abundant society of the future. -

Corporate Profile (PDF 4.8MB)

Corporate profile 1 Message from the President We will promote ESG management as a unified group and contribute to the realization of a sustainable society. “Drawing on more than a century of expertise in the development and fabrication of advanced materials, we will contribute to the realization of a sustainable society through continuous technological innovation.” This is the Corporate Philosophy of the Furukawa Electric Group. From our founding in 1884 through to the present day, the conveying, connecting, and storage of energy, information, and heat have been the pillars of our business, and through the four core technologies of metals, polymers, photonics, and high- frequency, we are developing a wide range of products around the world in fields of infrastructure such as telecommunications and energy, as well as in the fields of automotive components and electronics. The DNA of the Furukawa Electric Group comes from the words of our founder, Ichibei Furukawa: “value employees, value customers, value new technology, and contribute to society”. These ideas are linked to the SDGs (Sustainable Development Goals) adopted by the United Nations, and I believe that it is ESG management itself, which gives care and consideration for the environment, society, and governance. Our daily operations are guided by the “three valuables” spoken of by Ichibei Furukawa. Last year, we experienced a grave and unprecedented situation in which economic activity stagnated around the world due to the impact of the COVID-19 epidemic. For us, fiscal 2021 will be “the year of building a powerful company”, during which we will further enhance our ability to respond to changes and prepare to achieve the targets of the next medium-term management plan, which will start in fiscal 2022. -

Characteristics of Japanese Industrial Groups and Their Potential Impact on U

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Empirical Studies of Commercial Policy Volume Author/Editor: Robert E. Baldwin, editor Volume Publisher: University of Chicago Press, 1991 Volume ISBN: 0-226-03569-7 Volume URL: http://www.nber.org/books/bald91-1 Conference Date: March 16-17, 1990 Publication Date: January 1991 Chapter Title: Characteristics of Japanese Industrial Groups and Their Potential Impact on U. S . - Japanese Trade Chapter Author: K.C. Fung Chapter URL: http://www.nber.org/chapters/c6712 Chapter pages in book: (p. 137 - 168) 5 Characteristics of Japanese Industrial Groups and Their Potential Impact on U. S .- Japanese Trade K. C. Fung 5.1 Introduction Given the economic importance of the two nations, the economic relation- ship between the United States and Japan is perhaps the most significant bilat- eral economic linkage in the world economy today. Unfortunately, the domi- nant feature of the relationship in recent years has been disputes about trade. The core of the problem is undoubtedly the persistent trade imbalance be- tween the two nations. The magnitude of the trade imbalance remains large, The United States ran a merchandise trade deficit of over $1 18.5 billion in 1988, and $109 billion in 1989. Japan had a global trade surplus of $78.3 billion in 1988 and $65 billion in 1989. On a bilateral level, the trade imbalance between the United States and Japan was $5 1.8 billion in 1988 and $49 billions in 1989.