Inner 25 India Pharma & Healthcare Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Healthcare Sector in India Flanders Investment & Trade Market Survey

HEALTHCARE SECTOR IN INDIA FLANDERS INVESTMENT & TRADE MARKET SURVEY Healthcare Sector in India Flanders Investment & Trade Economic Representation of Flanders c/o Embassy of Belgium 50 - N, Shantipath, Chanakyapuri New Delhi - 110 021 India [email protected] T: +91 11 42 42 81 00 F: +91 11 42 42 81 10 Studie Healthcare Sector in India | juni 2015 1 2 TABLE OF CONTENTS ICT in Healthcare Services in India ................................................................................................. 8 Introduction ......................................................................................................................................... 8 Healthcare Information & Communication Technology (HICT) ...................................................... 9 Patient Monitoring & Tracking ........................................................................................................ 9 Healthcare Information Technology (HIT) ..................................................................................... 10 National Health Policy ................................................................................................................... 10 Health Information Management Systems (HIMS) ....................................................................... 10 Grading of Indian States for the use of ICT in Hospitals ................................................................ 12 Telemedicine .................................................................................................................................... -

Emerging Markets Equity Fund Q3 Portfolio Holdings

Putnam Emerging Markets Equity Fund The fund's portfolio 5/31/21 (Unaudited) COMMON STOCKS (98.8%)(a) Shares Value Airlines (0.9%) Copa Holdings SA Class A (Panama)(NON) 70,700 $5,815,782 5,815,782 Banks (5.7%) HDFC Bank, Ltd. (India)(NON) 889,339 18,568,792 Sberbank of Russia PJSC ADR (Russia) 548,845 9,261,759 TCS Group Holding PLC GDR 144A (Cyprus) 107,200 8,040,000 35,870,551 Capital markets (2.4%) B3 SA - Brasil Bolsa Balcao (Brazil) 3,151,700 10,607,061 Hong Kong Exchanges and Clearing, Ltd. (Hong Kong) 73,200 4,582,015 15,189,076 Chemicals (2.5%) Asian Paints, Ltd. (India) 184,575 7,592,754 LG Chem, Ltd. (South Korea) 11,537 8,471,983 16,064,737 Entertainment (1.7%) Sea, Ltd. ADR (Thailand)(NON) 42,300 10,712,052 10,712,052 Food and staples retail (3.0%) Dino Polska SA (Poland)(NON) 84,264 6,522,925 Wal-Mart de Mexico SAB de CV (Mexico) 3,834,400 12,620,909 19,143,834 Health-care equipment and supplies (1.4%) Shenzhen Mindray Bio-Medical Electronics Co., Ltd. Class A (China) 120,200 9,120,222 9,120,222 Health-care providers and services (3.0%) Apollo Hospitals Enterprise, Ltd. (India)(NON) 289,662 12,728,054 Universal Vision Biotechnology Co., Ltd. (Taiwan) 540,000 5,917,702 18,645,756 Hotels, restaurants, and leisure (2.7%) Jubilant Foodworks, Ltd. (India)(NON) 127,363 5,470,363 Yum China Holdings, Inc. -

FHL Annual Report 2020-21

ANNUAL REPORT 2020-2021 COMPANY INFORMATION CONTENTS BOARD OF DIRECTORS CORPORATE OVERVIEW CLINICAL EXCELLENCE Chairman 02 Introduction 66 Dedicated to Serve Responsibly Ravi Rajagopal (Independent Director) 04 Vision and Mission AWARDS AND ACCOLADES 06 Values Vice-Chairman 74 Inspired By Recognitions Shirish Moreshwar Apte (Non-Executive Director) 08 Key Performance Highlights 2020-21 HUMAN RESOURCES Managing Director and CEO BOARD OF DIRECTORS 78 Inspiring Trust Through the People Power Dr. Ashutosh Raghuvanshi 10 Fortis Healthcare Limited 12 SRL Limited Non-Executive Directors STATUTORY REPORTS Dilip Kadambi MANAGEMENT COMMUNIQUE 84 Director’s Report Dr. Farid Bin Mohamed Sani 136 Report on Corporate Governance 14 From the Chairman’s Desk Heng Joo Joe Sim 164 Business Responsibility Report Joerg Ayrle 18 MD & CEO’s Message (FHL) 175 Management Discussion and Analysis Report Dr. Kelvin Loh Chi-Keon 22 CEO’s Message (SRL) Takeshi Saito FINANCIAL STATEMENTS COVID-19 AND OUR RESPONSE Independent Directors 26 A Clear and Compelling Purpose 191 Standalone Financials Indrajit Banerjee 283 Consolidated Financials Shailaja Chandra FORTIS HEALTHCARE LIMITED Suvalaxmi Chakraborty 32 Inspiring Trust Across the Nation Chief Financial Officer OUR TRANSFORMATION Vivek Kumar Goyal 38 The New Journey Company Secretary and Compliance Officer FINANCIAL HIGHLIGHTS Sumit Goel 40 Performance Snapshot Auditors CLINICAL FOCUS B S R & Co. LLP Chartered Accountants 44 New Clinical Offerings Fortis Healthcare Limited 46 Speciality Mix CIN: L85110PB1996PLC045933 -

SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI Trading As ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP

Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI trading as ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP. COTTON GREEN RLY. STN. MUMBAI-400033. MANUFACTURE & MERCHANT INDIAN NATIONAL Used Since :31/01/2001 MUMBAI MEDICINAL PREPARATIONS. 537 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SEPTIGARD 1741718 08/10/2008 INDERJIT SINGH trading as ;INDERJIT SINGH B-104 , SWASTHYA SINGH , NEW DELHI -92 MERCHANTS & MANUFACTUERERS Address for service in India/Agents address: MAHTTA & CO. 43 - B/3, MAHTTA HOUSE,UDHAM SINGH NAGAR, LUDHIANA - 141 001, (PUNJAB). Proposed to be Used DELHI MEDICINAL & PHARMACEUTICAL PREPARATIONS. 538 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 FAIR & BEAUTY 1803779 08/04/2009 GALPHA LABORATORIES LIMITED 221, Kanakia Zillion, E Wing Bandra Kurla Complex Annex LBS Marg & CST Road Junction Kurla West MUMBAI 400070 MANUFACTURERS AND MERCHANTS INDIAN NATIONAL Used Since :15/11/2007 MUMBAI PHARMACEUTICAL AND MEDICINAL PREPARATIONS AND SUBSTANCES 539 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 O-BAMA 1815900 08/05/2009 KREMOINT PHARMA PVT. LTD. 151/5, SHRI KRISHNA DARSHAN, GARODIA NAGAR, GHATKOPAR (E), BOMBAY-400 077. MANUFACTURERS AND MERCHANTS. A CORPORATE ENTITY INCORPORATED IN INDIA UNDER THE COMPANIES ACT 1956. Address for service in India/Attorney address: KRISLAW CONSULTANTS BUILDING NO.4, C/104, SHANKESHWAR PALMS, BEHIND MODEL SCHOOL, KUMBHARKHANPADA, SUBHASH ROAD, DOMBIVILI(W) 421202 Used Since :02/05/2009 MUMBAI PHARMACETICAL AND MEDICINAL PREPARATIONS. 540 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 AYUSHAKTI D-VYRO 1815928 08/05/2009 SMITA NARAM BUNGALOW NO.31, NEXT TO M. -

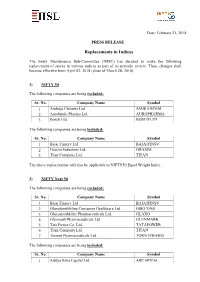

Replacements in Indices

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

Fortis Healthcare Limited

FORTIS HEALTHCARE LIMITED Earnings Presentation – Q2FY21 November 12, 2020 Disclaimer This presentation may not be copied, published, distributed or transmitted. The presentation has been prepared solely by the company. Any reference in this presentation to “Fortis Healthcare Limited” shall mean, collectively, the Company and its subsidiaries. This presentation has been prepared for informational purposes only. This presentation does not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form the basis of, or be relied on in connection with, any contract or investment decision in relation to any securities. Furthermore, this presentation is not and should not be construed as an offer or a solicitation of an offer to buy securities of the company for sale in the United States, India or any other jurisdiction. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering in the United States may be made only by means of an offering document that may be obtained from the Company and that will contain detailed information about the Company and its management, as well as financial statements. Any offer or sale of securities in a given jurisdiction is subject to the applicable laws of that jurisdiction. This presentation contains forward-looking statements based on the currently held beliefs and assumptions of the management of the Company, which are expressed in good faith and, in their opinion, reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, financial condition, performance, or achievements of the Company or industry results, to differ materially from the results, financial condition, performance or achievements expressed or implied by such forward-looking statements. -

50 KW Offer Solar Copy 2

21st Century Enviro Engineers Pvt.Ltd. Plot No. 120(10 Marla), COMPANY Industrial Area Phase II Chandigarh - 160002, India PROFILE www.21stcenturyenviro.com INTRODUCTION 21st CENTURY ENVIRO ENGINEERS PVT. LTD. is a Company dealing in the field of Environmental Engineering related activities. We are Registered Environmental Consultants of Pollution Control Board to Supply ETP’s, STP’s, APCD’s, Incinerators, Water Treatment Plants, Reverse Osmosis, Evaporators, Solid Waste Management and Rain Water Harvesting and to carry out EIA Studies . The Directors of the company are young Technocrats having versatile experience in this field. We have a back up of highly qualified and experienced technical team having versatile experience in Designing, Erection, Commissioning and Operation of different types of Effluent Treatment Plants. Our Managing Director himself is a Chemical Engineer with almost 25 Years Experience in this line and Technical Director is PhD. in Environmental Science with almost 30 Years working experience on various types of effluent treatment Technologies. Our team comprises of almost 150 people from different backgrounds e.g. Chemical, Environmental, Mechanical, Instrumentation, Civil, Accounts, Purchase, Marketing etc. We have our Marketing/ Design Office in Chandigarh and regional offices in Dhaka, Mumbai, New Delhi, Sikkim etc. and have our own testing Laboratory for Effluent/Water Testing and to study treatability of effluent on pilot scale. We have our own full-fledged manufacturing unit of Pollution Control Equipments in Village Kunjhal Baddi (HP). We also undertake annual operation and maintenance contracts and liasining services for the systems supplied by us. We are also Registered with CREST (Chandigarh Renewable Energy & Technology Promotion Society) and SECI (Solar Energy Corporation of India) for supplying Online/Offline Solar systems in Chandigarh, Himachal Pradesh, Uttarakhand, J&K, Punjab, Haryana, Delhi, Bihar etc. -

09-06-2015 Brochure.Cdr

If IndiGo Ran Your Hospital Ratan Jalan Thanks to Aditya Ghosh, IndiGo's President & Executive Director, I was able to look under the hood and get a peep into this widely acclaimed airline's secret sauce. This article is not aimed at providing a ready-to-implement toolkit of 'things you can do'. It is meant to provoke and facilitate a different way of thinking. If it helps you feel somewhat disturbed, but with a tinge of optimism and possibilities, I would have achieved my objective. I am grateful to Rohini Duvvuri for her painstaking editorial inputs and Rajesh Nambiar for the excellent design. Pictures relating to various facets of IndiGo are used to illustrate the point being made. I am constantly amazed by IndiGo’s trailblazing performance in an industry, which is notorious for its loss making capabilities and has witnessed many corporate casualties. In India alone, the cumulative losses for airlines over the last seven years have crossed ` 65,000 crore. IndiGo, on the other hand, has been the lone profit-maker and has posted six straight years of profits against the backdrop of vicious fare fights. The airline is reportedly expecting to record a net profit of up to ` 2,200 crore in 2014-15 partly on account of Profit in ` crore Frankly, you'll have 1000 nothing to complain 0 2011-12 2012-13 2013-14 2010-11 if IndiGo ran your -1000 hospital. It would -2000 -3000 procure state-of-the-art -4000 -5000 equipment, offer Indigo Spicejet Jet consistently superior low crude oil prices and is targeting for ` 2,500 clinical outcome crore IPO in the next couple of quarters to fund at relatively lower prices expansion. -

Fortis Healthcare Limited Investor Presentation – Q3 FY2013

Fortis Healthcare Limited Earnings Presentation – FY20 and Q4 FY20 June 17, 2020 Disclaimer This presentation may not be copied, published, distributed or transmitted. The presentation has been prepared solely by the company. Any reference in this presentation to “Fortis Healthcare Limited” shall mean, collectively, the Company and its subsidiaries. This presentation has been prepared for informational purposes only. This presentation does not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form the basis of, or be relied on in connection with, any contract or investment decision in relation to any securities. Furthermore, this presentation is not and should not be construed as an offer or a solicitation of an offer to buy securities of the company for sale in the United States, India or any other jurisdiction. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering in the United States may be made only by means of an offering document that may be obtained from the Company and that will contain detailed information about the Company and its management, as well as financial statements. Any offer or sale of securities in a given jurisdiction is subject to the applicable laws of that jurisdiction. This presentation contains forward-looking statements based on the currently held beliefs and assumptions of the management of the Company, which are expressed in good faith and, in their opinion, reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, financial condition, performance, or achievements of the Company or industry results, to differ materially from the results, financial condition, performance or achievements expressed or implied by such forward-looking statements. -

A Showcase of Apollo's Achievements in 2019

Milestones of2019 DEC APR MAY NOV JUN MAR OCT JUL FEB AUG SEP A showcase of Apollo’s achievements in 2019 JAN My heart swells with pride whenever I think of all that each and 1700 solid organ transplants were performed. In this calendar year every one of you contribute as members of our pioneering family alone we have performed over 68,000 successful surgeries for the betterment of India. Another momentous year in our including high-end organ transplants, thus providing a new lease of journey of healing came to a close and now we have a fresh life to thousands of families. beginning ahead of us, another 365 days of new opportunities and prospects towards a newer horizon. I believe that path breaking partnerships & collective efforts will shape the future of healthcare. Apollo has emerged shining bright in It is also a matter of pride that yet again, all through 2019, this too. Over the year, Apollo partnered with Samsung, Reckitt Apollo was at the forefront, championing change & guiding the Benkiser, Zipline, Abbott, Siemens Healthineers, Uber, Magzter, Bajaj nation towards a healthy tomorrow. This year, Apollo Hospitals Finserv, Maastricht University and many Government and was conferred with over 90 prestigious awards & recognition Non-Government entities to launch various healthcare and from leading organizations and authorities in India and around academic initiatives for the benefit of humanity. the world. I am looking forward to 2020 with great optimism and enthusiasm A momentous launch at the start of 2019 was South Asia’s very as I am well aware that you will leave no stone unturned to make it first Proton Therapy at the Apollo Proton Cancer Centre (APCC). -

Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock

Visit us at www.sharekhan.com November 04, 2015 Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock Update >> Ipca Laboratories Stock Update >> Skipper Viewpoint >> Lloyd Electric & Engineering For Private Circulation only REGISTRATION DETAILS Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE - INB/ INF231073330 ; CD-INE231073330 ; MSEI - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS- INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX- 00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at [email protected] ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Do’s & Don’ts by MCX & NCDEX and the T & C on www.sharekhan.com before investing. investor’s eye stock update Marico Reco: Buy Stock Update Enhanced focus to improve volume growth; maintain Buy CMP: Rs399 Company details Key points Price target: Rs460 Mixed operating performance: During Q2FY2016, Marico’s revenue grew by 4% to Rs1,485.4 crore, entirely driven by a 4% volume growth (domestic business’ volume Market cap: Rs25,735 cr growth stood at 5.5%). The gross profit margin (GPM) improved by almost 500BPS to 52 week high/low: Rs466/299 49.3% on the back of ~30% decline in the copra prices and 33% decline in the prices of liquid paraffin. -

State City Hospital Name Address Pin Code Phone K.M

STATE CITY HOSPITAL NAME ADDRESS PIN CODE PHONE K.M. Memorial Hospital And Research Center, Bye Pass Jharkhand Bokaro NEPHROPLUS DIALYSIS CENTER - BOKARO 827013 9234342627 Road, Bokaro, National Highway23, Chas D.No.29-14-45, Sri Guru Residency, Prakasam Road, Andhra Pradesh Achanta AMARAVATI EYE HOSPITAL 520002 0866-2437111 Suryaraopet, Pushpa Hotel Centre, Vijayawada Telangana Adilabad SRI SAI MATERNITY & GENERAL HOSPITAL Near Railway Gate, Gunj Road, Bhoktapur 504002 08732-230777 Uttar Pradesh Agra AMIT JAGGI MEMORIAL HOSPITAL Sector-1, Vibhav Nagar 282001 0562-2330600 Uttar Pradesh Agra UPADHYAY HOSPITAL Shaheed Nagar Crossing 282001 0562-2230344 Uttar Pradesh Agra RAVI HOSPITAL No.1/55, Delhi Gate 282002 0562-2521511 Uttar Pradesh Agra PUSHPANJALI HOSPTIAL & RESEARCH CENTRE Pushpanjali Palace, Delhi Gate 282002 0562-2527566 Uttar Pradesh Agra VOHRA NURSING HOME #4, Laxman Nagar, Kheria Road 282001 0562-2303221 Ashoka Plaza, 1St & 2Nd Floor, Jawahar Nagar, Nh – 2, Uttar Pradesh Agra CENTRE FOR SIGHT (AGRA) 282002 011-26513723 Bypass Road, Near Omax Srk Mall Uttar Pradesh Agra IIMT HOSPITAL & RESEARCH CENTRE Ganesh Nagar Lawyers Colony, Bye Pass Road 282005 9927818000 Uttar Pradesh Agra JEEVAN JYOTHI HOSPITAL & RESEARCH CENTER Sector-1, Awas Vikas, Bodla 282007 0562-2275030 Uttar Pradesh Agra DR.KAMLESH TANDON HOSPITALS & TEST TUBE BABY CENTRE 4/48, Lajpat Kunj, Agra 282002 0562-2525369 Uttar Pradesh Agra JAVITRI DEVI MEMORIAL HOSPITAL 51/10-J /19, West Arjun Nagar 282001 0562-2400069 Pushpanjali Hospital, 2Nd Floor, Pushpanjali Palace,