Ajanta Pharma Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI Trading As ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP

Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI trading as ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP. COTTON GREEN RLY. STN. MUMBAI-400033. MANUFACTURE & MERCHANT INDIAN NATIONAL Used Since :31/01/2001 MUMBAI MEDICINAL PREPARATIONS. 537 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SEPTIGARD 1741718 08/10/2008 INDERJIT SINGH trading as ;INDERJIT SINGH B-104 , SWASTHYA SINGH , NEW DELHI -92 MERCHANTS & MANUFACTUERERS Address for service in India/Agents address: MAHTTA & CO. 43 - B/3, MAHTTA HOUSE,UDHAM SINGH NAGAR, LUDHIANA - 141 001, (PUNJAB). Proposed to be Used DELHI MEDICINAL & PHARMACEUTICAL PREPARATIONS. 538 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 FAIR & BEAUTY 1803779 08/04/2009 GALPHA LABORATORIES LIMITED 221, Kanakia Zillion, E Wing Bandra Kurla Complex Annex LBS Marg & CST Road Junction Kurla West MUMBAI 400070 MANUFACTURERS AND MERCHANTS INDIAN NATIONAL Used Since :15/11/2007 MUMBAI PHARMACEUTICAL AND MEDICINAL PREPARATIONS AND SUBSTANCES 539 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 O-BAMA 1815900 08/05/2009 KREMOINT PHARMA PVT. LTD. 151/5, SHRI KRISHNA DARSHAN, GARODIA NAGAR, GHATKOPAR (E), BOMBAY-400 077. MANUFACTURERS AND MERCHANTS. A CORPORATE ENTITY INCORPORATED IN INDIA UNDER THE COMPANIES ACT 1956. Address for service in India/Attorney address: KRISLAW CONSULTANTS BUILDING NO.4, C/104, SHANKESHWAR PALMS, BEHIND MODEL SCHOOL, KUMBHARKHANPADA, SUBHASH ROAD, DOMBIVILI(W) 421202 Used Since :02/05/2009 MUMBAI PHARMACETICAL AND MEDICINAL PREPARATIONS. 540 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 AYUSHAKTI D-VYRO 1815928 08/05/2009 SMITA NARAM BUNGALOW NO.31, NEXT TO M. -

Inner 25 India Pharma & Healthcare Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata India Pharma & Healthcare Fund o i L g (An open ended equity scheme investing in Pharma and Healthcare Services Sector) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Pharma & Healthcare sectors in India. Equity & Equity Related Total 55184.24 97.88 Glenmark Pharmaceuticals Ltd. 167000 1089.76 1.93 INVESTMENT OBJECTIVE Healthcare Services Sanofi India Ltd. 13000 997.39 1.77 The investment objective of the scheme is to seek long Apollo Hospitals Enterprise Ltd. 70500 2551.99 4.53 Gland Pharma Ltd. 19662 673.29 1.19 term capital appreciation by investing atleast 80% of its Fortis Healthcare Ltd. 795000 1935.03 3.43 Laurus Labs Ltd. 90000 619.79 1.10 net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in Syngene International Ltd. 265000 1545.75 2.74 India.However, there is no assurance or guarantee that the investment objective of the Scheme will be Narayana Hrudayalaya Ltd. 301420 1483.74 2.63 Other Equities^ 1186.14 2.10 achieved.The Scheme does not assure or guarantee any Metropolis Healthcare Ltd. -

MF 35 Fund One Pager

BR“BuyS RightT : BSit TightR” ST BRSnowT Bin fourRS differentTBRS colorsTBRS BRSTBRSTBRSTBR Motilal Oswal MOSt Focused Invests in enduring B25 RFund STBRSTBwRealth creaStors T Motilal Oswal MOSt Focused Invests in emerging BMidcapR 30 Fund TBRwealth creators T BRSTBSRSTBRSTBSRS Motilal Oswal MOSt Focused Invests in emerging and BMulticapRS 35 FundT BRSTBRenduringST wealthB creatorRs Lock in fund that invests Motilal Oswal MOSt Focused in wealth creators BLongR Term SFund TBRSTBplusR Saves TSax T BR TBR T BRSTBSRSTBRSTBSRS Focused Low Churn QGLP No load BRSTBPortfolioRSTBPortfolioRSTStocksBR BRSInvesTt nowB to addR colorSs Tto yourB porRolioST BRSCall:T 1800-200-6626B | SMS:R FOCUSS to 575753T BRSTBRS Website: www.motilaloswalmf.com Our Investment Philosophy The recommended way to create Wealth from equity- 'Buy Right : Sit Tight' At Molal Oswal Asset Management Company (MOAMC), our investment philosophy and invesng style is centered on 'Buy Right: Sit Tight‘ principal. ‘Buy Right' means buying quality companies at a reasonable price and 'Sit Tight' means staying invested in them for a longer me to realise the full growth potenal of the stocks. Buy Right Stock Characteristics Sit Tight Approach QGLP ‘Q’uality denotes quality of the business and Buy and Hold: We are strictly buy and hold management investors and believe that picking the right ‘G’rowth denotes growth in earnings and business needs skill and holding onto these sustained RoE businesses to enable our investors to benefit from the entire growth cycle needs even more ‘L’ongevity denotes longevity of the skill. competitive advantage or economic moat of the business Focus: Our portfolios are high conviction portfolios with 20 to 25 stocks being our ideal ‘P’rice denotes our approach of buying a good n u m b e r. -

CARE Ratings Ltd

CARE/HO/RL/2020-21/2749 Mr. Arvind Agrawal Chief Financial Officer Ajanta Pharma Limited Ajanta House, Charkop, Kandivali (W), Mumbai-400067 October 1, 2020 Confidential Dear Sir, Credit rating for bank facilities On the basis of recent developments including operational and financial performance of your company for FY20 (audited) and Q1FY21 (provisional), our Rating Committee has reviewed the following ratings: Facilities Amount Rating1 Rating (Rs. crore) Action Long-term/Short-term Bank 55.00 CARE AA; Stable/CARE A1+ Facilities (reduced from 87.50) (Double A; Outlook: Stable/A Reaffirmed One Plus) Total 55.00 (Rs. Fifty Five crore only) 2. Refer Annexure 1 for details of rated facilities. 3. The rationale for the rating will be communicated to you separately. A write-up (press release) on the above rating is proposed to be issued to the press shortly, a draft of which is enclosed for your perusal as Annexure-2. We request you to peruse the annexed document and offer your comments if any. We are doing this as a matter of courtesy to our clients and with a view to ensure that no factual inaccuracies have inadvertently crept in. Kindly revert as early as possible. In any case, if we do not hear from you by October 5, 2020 we will proceed on the basis that you have no any comments to offer. 4. CARE reserves the right to undertake a surveillance/review of the rating from time to time, based on circumstances warranting such review, subject to at least one such review/surveillance every year. 5. -

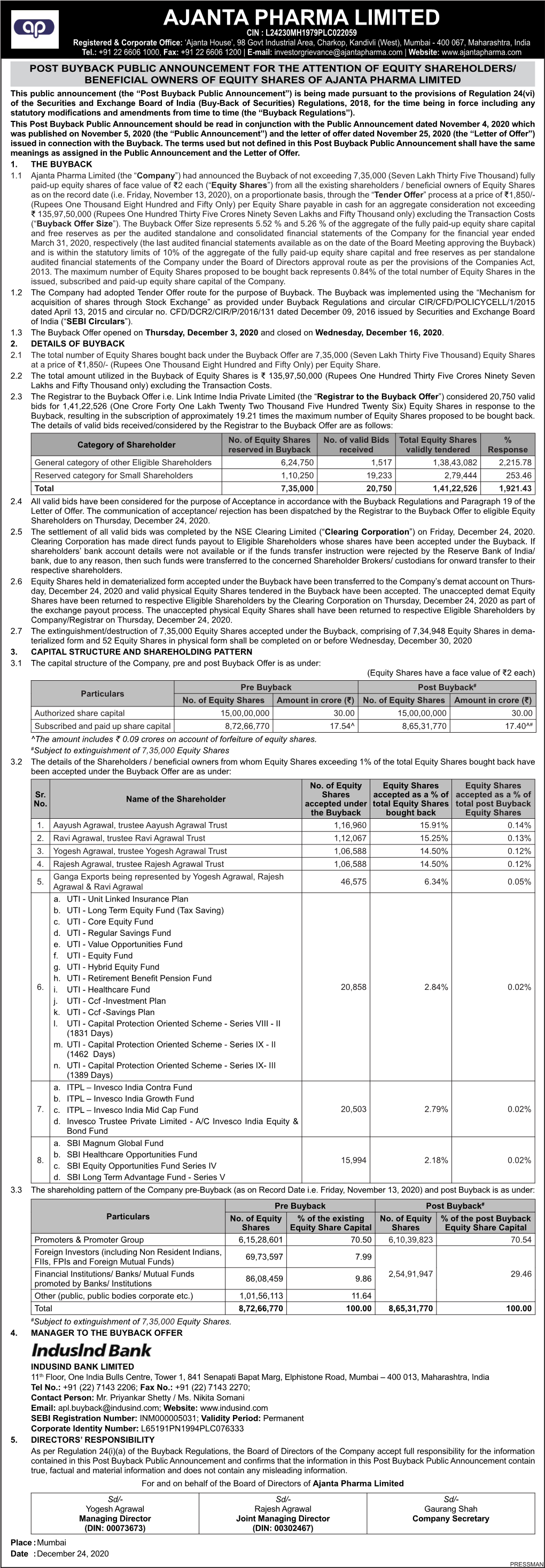

PUBLIC ANNOUNCEMENT for the ATTENTION of EQUITY SHAREHOLDERS/ BENEFICIAL OWNERS of As Partner of Ganga Exports, Where the Partner’S Share Being 37.5%

ii. Shareholding of directors of the Promoters and Promoter Group entity (i.e. Gabs Investment Private Limited ii. the amount of permissible capital payment (including premium) as stated in Annexure A for the proposed (“GIPL”)) in the Company: buy-back of equity shares has been properly determined considering the audited standalone financial statements and audited consolidated financial statements in accordance with Section 68(2) of the Act; and Sr. Designation No. of Equity Shares held Percentage (%) of issued Name iii. the Board of Directors of the Company in their meeting dated 3 November 2020, have formed the opinion No. in GIPL in the Company Equity Share capital as specified in clause (x) of Schedule I to the SEBI Buy-back Regulations on reasonable grounds and 1. Yogesh Agrawal Director 1,35,36,523(1) 15.51 that the Company will not, having regard to its state of affairs, be rendered insolvent within a period AJANTA PHARMA LIMITED 2. Rajesh Agrawal Director 1,35,36,522(2) 15.51 of one year from that date. CIN : L24230MH1979PLC022059 3. Ravi Agrawal Director 1,33,32,906(3) 15.28 Auditors’ Responsibility (Continued) Registered & Corporate Office: ‘Ajanta House’, 98 Govt Industrial Area, Charkop, 4. Aayush Agrawal Director 1,25,60,389(4) 14.39 5. The audited standalone financial statements and audited consolidated financial statements referred to in Kandivli (West), Mumbai - 400 067, Maharashtra, India Total 5,29,66,340 60.69 paragraph 5 above, which we have considered for the purpose of this report, have been audited by us, on Tel.: +91 22 6606 1000, Fax: +91 22 6606 1200 | E-mail: [email protected] which we have issued an unmodified audit opinion vide our reports dated 20 May 2020. -

Defying Challenges Achieving Growth

Annual Report 2019-20 Resilience Defying Achieving Challenges Growth What’s Inside Corporate Overview Statutory Reports Financial Statements 0 2 Letter to Shareholder 15 Management Discussion and 56 Consolidated Analysis 0 4 Business Overview 124 Standalone 20 Directors’ Report 0 6 Resilience: Defying Challenges 190 Notice / Achieving Growth 40 Report on Corporate Governance 10 Resilient Infrastructure 12 Financial Overview 14 Corporate Information For additional information scan the QR CODE For more details, please visit: www.ajantapharma.com Resilienceliterally means ‘capacity to recover quickly from difficulties’. We at Ajanta Pharma, have shown this ability time and again: Defying Challenges faced on the way and Achieving Growth. Each challenge brings associated risks with it, but our proactive approach allows us to defy it so that we continue the growth even during that time. New manufacturing facility for oral solid inaugurated at Pithampur The following pages detail such efforts, which allow us to de-risk the business in a way that insulates it from macro concerns to the extent possible. It is these efforts that make us resilient. Letter to Shareholder DESPITE THE CAPEX OF K 240 CR. IN FY 2020 WE GENERATED OPERATING FREE CASH FLOW OF K 235 CR. IN THE YEAR. Yogesh M. Agrawal Managing Director Dear Shareholder, We hope and wish that all of you have been safe and differentiated products along with seamless execution healthy during this unprecedented challenge faced by allow us to delight our customers, which in turn the humanity. The uncertainty around the course of generates superior quality business for us. This year the COVID-19 pandemic started in March leading to was no exception as it reconfirmed our capability to governments across the world initiating lockdowns. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Systematix Institutional Equities

Systematix Institutional Equities Ajanta Pharma 19 July 2021 Diversified branded generics play; US region to add to operating leverage INITIATING COVERAGE Ajanta Pharma (AJP)’s business model offers a distinct mix of consistency and fast Sector: Rating: BUY growth with strong operating metrics (debt-free balance sheet, RoE >20%). The Pharmaceuticals company derives 68% of its revenues from the branded generic markets of India, CMP: Rs 2,145 Target Price: Rs 2,481 Africa and Asia, which lend long term earnings visibility, while its US business is scaling up fast, driving operating leverage benefits. The culmination of a large Stock Info capex (Rs 13bn over FY17-21) should further aid growth and drive a 21% EPS CAGR Sensex/Nifty 53,140/15,923 over FY20-23E. Given its strong earnings visibility, best-in-class operating and Bloomberg AJP IN returns metrics, AJP deserves to trade at a premium to its long term average and in Equity shares 87mn 52-wk High/Low Rs 2,195/1,330 line with the Nifty Pharmaceutical Index. We initiate coverage on the stock with a Face value Rs 2 BUY rating and a target price of Rs 2,481 based on 26x (PE) FY23E EPS. M-Cap Rs 187bn/ USD 2.5bn Interesting brand play: AJP derives 68% of its revenues from the branded generics 3-m Avg value USD 3.5mn markets of India, Africa and Asia. This provides consistency and visibility of strong Financial Snapshot (Rs mn) profitability and returns. Its strategy of focusing on niche/first-to-market products in Y/E March FY21 FY22E FY23E India and customized portfolios in emerging markets should lead to continued strong Sales 28,897 31,870 35,549 outperformance. -

Media Release

Media Release Review of S&P BSE indices Index Committee of S&P BSE Indices has decided to revise the composition of S&P BSE indices as detailed below, w. e. f. June 24, 2013: 1. S&P BSE 200 Index: Exclusions: Inclusions: Code Name Code Name FFF NEYVELI LIGNITE 513683 534816 BHARTI INFRATEL LIMITED CORPORATION LTD. 0.15 531500 RAJESH EXPORTS LTD. 531162 EMAMI LTD 0.30 500840 EIH LTD 533398 MUTHOOT FINANCE LIMITED 0.20 GUJARAT FLUOROCHEMICALS 500173 505200 EICHER MOTORS LTD. LTD. 0.45 532778 LANCO INFRATECH LTD. 532209 JAMMU AND KASHMIR BANK LTD. 0.50 CHAMBAL FERTILISERS & 500085 509480 BERGER PAINTS INDIA LTD CHEMICALS LTD 0.25 532524 PTC INDIA LTD 500034 BAJAJ FINANCE LIMITED 0.35 532670 SHREE RENUKA SUGARS LTD. 500260 MADRAS CEMENTS LTD., 0.55 502742 SINTEX INDUSTRIES LTD 532800 TV18 BROADCAST LTD. 0.45 532391 OPTO CIRCUITS (INDIA) LTD. 500008 AMARA RAJA BATTERIES LTD 0.50 532693 PUNJ LLOYD LTD 532218 SOUTH INDIAN BANK LTD. 1.00 530773 IVRCL LTD 532652 KARNATAKA BANK LTD. 1.00 2. S&P BSE 500 Index: Exclusions: Inclusions: Code Name Code Name FFF 531900 CCL INTERNATIONAL LTD 531465 NOUVEAU GLOBAL VENTURES 0.65 LIMITED 531426 TAMILNADU NEWSPRINT & 526045 LUMINAIRE TECHNOLOGIES LTD 0.75 PAPERS 523838 SIMPLEX INFRASTRUCTURES LTD 534690 LAKSHMI VILAS BANK LTD. 0.95 509631 HEG LTD 531522 RASOYA PROTEIBO LTD 0.70 524051 POLYPLEX CORP. LTD. 502420 ORIENT PAPER & INDUSTRIES LTD. 0.55 532481 NOIDA TOLL BRIDGE CO. LTD. 512105 SHREE NATH COMMERCIAL & 0.85 FINANCE LTD 509550 GAMMON INDIA LTD 512355 ANUKARAN COMMERCIAL 0.90 ENTERPRISES LT 512463 SHREE GLOBAL TRADEFIN LTD 530557 NCL RESEARCH & FINANCIAL 0.80 SERVICES LTD 513250 JYOTI STRUCTURES LTD 500027 ATUL LTD. -

Draft Letter of Offer This Document Is Important and Requires Your Immediate Attention

DRAFT LETTER OF OFFER THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Letter of Offer is being sent to you, being an Eligible Shareholder of Ajanta Pharma Limited (the “Company”) as on the Record Date (as defined hereunder) in accordance with Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018. If you require any clarifications about the action to be taken, you may consult your stockbroker or investment consultant or the Manager to the Buyback Offer i.e. IndusInd Bank Limited or the Registrar to the Buyback Offer i.e. Link Intime India Private Limited. Please refer to the section on ‘Definitions’ for the definition of the capitalized terms used herein. AJANTA PHARMA LIMITED Registered & Corporate Office: ‘Ajanta House’, 98 Govt Industrial Area, Charkop, Kandivli (West), Mumbai - 400 067, Maharashtra, India CIN: L24230MH1979PLC022059 Contact Person: Mr. Gaurang Shah, Company Secretary Tel: +91 22 6606 1000 | Fax: +91 22 6606 1200 Email: [email protected] | Website: www.ajantapharma.com CASH OFFER FOR BUYBACK OF NOT EXCEEDING 7,69,230 (SEVEN LAKH SIXTY NINE THOUSAND TWO HUNDRED THIRTY) FULLY PAID-UP EQUITY SHARES OF FACE VALUE ` 2 EACH, REPRESENTING 0.87% OF THE TOTAL NUMBER OF EQUITY SHARES IN THE ISSUED, SUBSCRIBED AND PAID-UP EQUITY SHARE CAPITAL OF THE COMPANY, FROM ALL THE EXISTING SHAREHOLDERS/ BENEFICIAL OWNERS OF EQUITY SHARES OF THE COMPANY AS ON THE RECORD DATE i.e. TUESDAY, FEBRUARY 12, 2019 ON A PROPORTIONATE BASIS, THROUGH THE “TENDER OFFER” PROCESS AT A PRICE -

Placement Report 2015-16.Pdf

Jayawant Shikshan Prasarak Mandal’s Charak College of Pharmacy and Research Gat No.720/1&2, Wagholi, Pune-Nagar Road, Pune-412 207 ANNUAL PLACEMENT REPORT 2015-16 The placement cell constituted for the academic year 2015-2016 is as follows, Sr. No. Name Designation 1. Dr. S. D. Ambawade Chairman 2. Prof. S. A Waghmare Training and Placement Officer 3. Prof. S. S Jangam Member 4. Prof. N. B. Londhe Member The activities performed by the Training and Placement cell in the academic year 2015- 2016 are as follows, 1. Organization of campus interviews (On-campus & Off-campus) for Placement for Final Year Students (Pass out and appearing students) 2. Assisting students for one month industrial training 3. Organization of Industrial Visits 4. Special guidance for higher studies in India and abroad 5. Industry expert and students interaction with regard to career avenues and work culture in Pharmaceutical Industry. 6. Organization of Personality development Workshop 7. Organization of Guest lectures on soft skill development 8. Organization of Seminar on Entrepreneurship Skills 9. Training on: English Language Skills, Resume Building, GD Sessions, Aptitude tests, Demo interviews. 1 Details of the Activities Performed under Training and Placements SUMMARY OF STUDENTS PLACED (2015-2016) Total No of Student = 61 Particulars of Students Percentage Number (Higher Education/Placement/Entrepreneurship) (%) Bachelor of Pharmacy Total No of Students = 59 Student Placed 48 81.36 Student Opted for Higher Education 07 11.86 Students Started entrepreneurship 03 5.08 Total 58 98.31 Master of Pharmacy Total No of Students = 02 Student Placed 02 100 Total No of Students (59+02=61) 60 98.36 Placement Details (B. -

Booked Profit/Loss Table Name of the Stock Sector Reco Date Wgt% No

Booked Profit/Loss Table Name of the Stock Sector Reco Date Wgt% No of shares Reco Price Booked Price Charges Nett Profit Exit Date SHRIRAM TRANSPORT BFSI 15-May-19 5.0% 49 1019 1127 500 4817 21-May-19 AMBUJA CEMENT CEMENT 15-May-19 5.0% 235 213 237 500 5117 04-Jun-19 LICHSGFIN BFSI 24-Apr-19 5.0% 100 502 559 500 5200 04-Jun-19 HDFCLIFE BFSI 24-Apr-19 5.0% 125 400 459 500 6813 14-Jun-19 TORRENT POWER* POWER 24-Apr-19 5.0% 199 251 284 500 6067 27-Jun-19 BANK OF BARODA BANKS 20-Jun-19 5.0% 427 117 130 500 5051 04-Jul-19 HINDALCO* METALS 24-Apr-19 5.0% 249.0 200 198 500 -874 24-Jul-19 MFSL BFSI 16-Jul-19 5.0% 120 417 452 500 3700 22-Aug-19 AJANTA PHARMA PHARMA 24-Apr-19 5.0% 49 1023 1021 500 -615 03-Sep-19 CROMPTON* CONSUMER 24-Apr-19 5.0% 214 232 231 500 -714 03-Sep-19 TITAN CONSUMER 16-Jul-19 5.0% 45 1106 1292 500 7870 20-Sep-19 AXISBANK CONSUMER 20-Sep-19 7.5% 115 650 706 500 5940 24-Oct-19 TATAELXSI** IT 25-Jun-19 10.0% 136 732 809 500 9972 30-Oct-19 MFSL NBFC 31-Oct-19 5.0% 122 411 458 500 5234 07-Nov-19 HDFC NBFC 31-Oct-19 7.5% 36 2107 2301 500 6484 26-Nov-19 GODREJCP* FMCG 24-Apr-19 7.5% 111 668 734 500 6782 10-Jan-20 BHARATFORGE* AUTO 23-May-19 5.0% 105 471 519 500 4540 10-Jan-20 M&MFIN NBFC 27-Dec-19 7.5% 153 326 357 500 4243 16-Jan-20 CADILAHC PHARMA 13-Jan-20 7.5% 290 256 344 500 25165 10-Apr-20 HEROMOTOCORP* AUTO 24-Apr-19 7.5% 30 2515 2426 500 -3170 08-Jun-20 JKTYRES* TYRES 04-Jun-19 7.5% 613 82 63 500 -11841 08-Jun-20 AMBUJACEM* CEMENT 20-Jun-19 7.5% 241 208 195 500 -3513 08-Jun-20 ENGINEERS INDIA* ENGG 24-Apr-19 10.0% 1212