Ishares FTSE MIB UCITS ETF EUR (Acc)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enel Green Power, Sharp and Stmicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy

Enel Green Power, Sharp and STMicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy January 4, 2010 3:04 AM ET Enel Green Power, Sharp and STMicroelectronics join forces to produce innovative thin-film photovoltaic panels. The plant, located in Catania, Italy, is expected to have initial production capacity of 160 MW per year and is targeted to grow to 480 MW over the next years. In addition, Enel Green Power and Sharp will jointly develop solar farms focusing on the Mediterranean area, with a total installed capacity at a level of 500 MW, by the end of 2016. Geneva, January 4, 2010 – Today, Enel Green Power, Sharp and STMicroelectronics signed an agreement for the manufacture of triple-junction thin-film photovoltaic panels in Italy. At the same time, Enel Green Power and Sharp signed a further agreement to jointly develop solar farms. Today's agreement regarding the photovoltaic panel factory follows the Memorandum of Understanding signed in May 2008 by Enel Green Power and Sharp. STMicroelectronics has joined this strategic partnership. This agreement marks the first time that three global technology and industrial powerhouses have joined together in an equal partnership to contribute their unique value-add to the solar industry. It brings together Enel Green Power, with its international market development and project management know-how; Sharp, and its exclusive triple-junction thin-film technology, which will be operational in the mother plant in Sakai, Japan as of spring 2010; and STMicroelectronics, with its manufacturing capacity, skills and resources in highly advanced, hi-tech sectors such as microelectronics. -

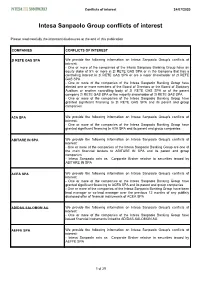

Intesa Sanpaolo Group Conflicts of Interest

Conflicts of interest 24/07/2020 Intesa Sanpaolo Group conflicts of interest Please read carefully the important disclosures at the end of this publication COMPANIES CONFLICTS OF INTEREST 2I RETE GAS SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have an equity stake of 5% or more in 2I RETE GAS SPA or in the Company that has a controlling interest in 2I RETE GAS SPA or are a major shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have elected one or more members of the Board of Directors or the Board of Statutory Auditors or another controlling body of 2I RETE GAS SPA or of the parent company 2I RETE GAS SPA or the majority shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to 2I RETE GAS SPA and its parent and group companies A2A SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to A2A SPA and its parent and group companies ABITARE IN SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group are one of the main financial lenders to ABITARE IN SPA and its parent and group companies - Intesa Sanpaolo acts as Corporate Broker relative to securities issued -

Business Strategies of the Companies Listed on the FTSE MIB Index of Borsa Italiana Stock Exchange

Acta Europeana Systemica n°3 Business Strategies of the Companies listed on the FTSE MIB index of Borsa Italiana Stock Exchange Riccardo Profumo CSE-Crescendo, Milan, Italy www.cse-crescendo.com ABSTRACT The aim of the research is to provide a gross evaluation of the entrepreneurial system’s ability to create new industries. The research focuses on the most important Italian firms: the companies listed on the FTSE MIB index of Borsa Italiana. The way to comprehend the entrepreneurial system’s capability to create new industries, is by understanding the innovation level they are able to generate by the strategic planning activity. The model used for this research is the “Value Life Cycle Model” developed by Mr Francesco Zanotti. The overall result shows that the FTSE MIB Companies don’t have a strategic goal of creating new industries. The innovation level inside the business strategies designed by the FTSE MIB companies is generally very low. KEYWORDS Industry, Attractiveness, Innovation, Industry Attractiveness, Entrepreneurial Strategy, Entrepreneurial innovation, FTSE MIB, Value Life Cycle Model THE CONTEXT The necessity of the construction of a new economic and social system is absolutely shared by a lot of contemporary observers. Without doubt, the entrepreneurial system plays a key role for the economic growth and social development. The creation of new industries is crucial: radically new products (or services) are the only way to create new industries and developing markets. The aim of the research is to provide a gross evaluation of the entrepreneurial system’s ability to create new industries. The way to comprehend the entrepreneurial system’s capability to create new industries, is by understanding the innovation level they are able to generate by the strategic planning activity. -

Ishares FTSE MIB UCITS ETF EUR (Dist)

iShares FTSE MIB UCITS ETF EUR (Dist) IMIB August Factsheet Unless otherwise stated, Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021 All other data as at 07-Sep-2021 This document is marketing material. For Investors in Switzerland. Investors should read the Key Capital at risk. All financial investments Investor Information Document and Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 40 of the largest and most liquid vary and your initial investment amount cannot Italian companies be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency EUR Exposure to broadly diversified Italian companies 1 Share Class Currency EUR 2 Direct investment into 40 Italian companies Fund Launch Date 06-Jul-2007 Share Class Launch Date 06-Jul-2007 3 Single country and large market capitalisation companies exposure Benchmark FTSE MIB Index Valor 3246482 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN IE00B1XNH568 Total Expense Ratio 0.35% This means the Fund is more sensitive to any localised economic, market, political or regulatory Distribution Frequency Semi-Annual events. The value of equities and equity-related securities can be affected by daily stock market Domicile Ireland movements. Other influential factors include political, economic news, company earnings and Methodology Replicated significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss. -

TEA6422 TEA6422D TEA6422DT Stmicroelectronics Datasheet

TEA6422 BUS-CONTROLLED AUDIO MATRIX ■ 6 Stereo Inputs ■ 3 Stereo Ouputs ■ Gain Control 0 dB/Mute for each Output ■ Cascadable (2 different addresses) ■ Serial Bus Controlled ■ Very Low Noise ■ Very Low Distorsion SHRINK DIP24 ■ Fully ESD Protected (Shrink Plastic Package) ■ Wide Audio Dynamic Range ( 3 V ) RMS ORDER CODE: TEA6422 DESCRIPTION The TEA6422 switches 6 stereo audio inputs on 3 stereo outputs. All the switching possibilities are changed through the I2C BUS. SO28 (Plastic Monopackage) ORDER CODE: TEA6422D Figure 1. PIN CONNECTIONS SO28 SDIP24 GND 1 28 SDA GND 1 24 SDA CAPACITANCE 2 27 SCL 2 23 CAPACITANCE SCL VS 3 26 ADDR VS 3 22 ADDR L1 4 25 R1 L1 4 21 R1 L2 5 24 R2 L2 5 20 R2 L3 6 23 R3 L3 6 19 R3 NC 7 22 NC L4 7 18 R4 NC 8 21 NC L5 8 17 R5 L4 9 20 R4 L6 9 16 R6 L5 10 19 R5 LOUT1 10 15 ROUT3 L6 11 18 R6 ROUT1 11 14 LOUT3 LOUT1 12 17 ROUT3 LOUT2 12 13 ROUT2 ROUT1 13 16 LOUT3 LOUT2 14 15 ROUT2 September 2003 1/10 1 TEA6422 BLOCK DIAGRAM RIGHT INPUTS GAIN = 0 dB RIGHT OUTPUTS VS SDA C SUPPLY BUS DECODER SCL GND ADDR LEFT OUTPUTS GAIN = 0 dB LEFT INPUTS ABSOLUTE MAXIMUM RATINGS Symbol Parameter Value Unit VCC Supply Voltage 12 V o Toper Operating Temperature 0, + 70 C o Tstg Storage Temperature - 20, + 150 C THERMAL DATA Symbol Parameter Value Unit SDIP24 75 oC/W R (j-a) Junction - ambient Thermal Resistance th SO28 75 oC/W 2/10 1 TEA6422 ELECTRICAL CHARACTERISTICS o Ω Ω TA = 25 C, VS = 9 V, RL = 10 k , RG = 600 , f = 1 kHz (unless otherwise specified) Symbol Parameter Test Conditions Min. -

An Analysis of the Level of Qualitative Efficiency for the Equity Research Reports in the Italian Financial Market

http://ijba.sciedupress.com International Journal of Business Administration Vol. 9, No. 2; 2018 An Analysis of the Level of Qualitative Efficiency for the Equity Research Reports in the Italian Financial Market Paola Fandella1 1 Università Cattolica del Sacro Cuore, Italy Correspondence: Paola Fandella, Università Cattolica del Sacro Cuore, Italy. Received: January 15, 2018 Accepted: February 6, 2018 Online Published: February 8, 2018 doi:10.5430/ijba.v9n2p21 URL: https://doi.org/10.5430/ijba.v9n2p21 Abstract Corporate reports issued by various financial intermediaries play a major role in investment decisions. For this reason, it is particularly interesting to understand the accuracy of the forecasts, by carrying out an empirical analysis of the "equity research" system in Italy, identifying structural features, degree of reliability and incidence in the market. The choice of the analysis of the efficiency level information on the Italian market proposes to assess the interest of equity research of a niche market (339 listed companies in 2017) but with characteristics of potential growth such as having been acquired by LSEGroup in 2007, the 6th stock-exchange group at international level for the number of listed companies and the 4th for capitalization. The analysis was carried out on the reports issued on companies belonging to the Ftse Mib stock index during a period of 5 years. It aims to analyse the composition of the equity research system in Italy as well as the analysts' ability to properly evaluate the stocks' fair price, so as to test their degree of reliability and detect possible anomalies in recommendations to the investors. -

FTSE MIB Quarterly Rebalancing Changes 12 March 2018

FTSE MIB Quarterly Rebalancing Changes 12 March 2018 FTSE announces the new shares number and Investability Weighting Factors for the FTSE MIB Index effective after the close of business on Friday, 16 March 2018, i.e. on Monday, 19 March 2018. According to the FTSE MIB Ground Rules art. 7.4 and Appendix C, FTSE publishes share in issue & IWF figures updated at the cut-off date, where needed adjusted for capping based on capitalisation calculated with closing prices of five trading days before the rebalancing. The share in issue figure excludes all treasury shares and the Investability Weighting is computed with reference to shares in issue net of treasury shares. The new index divisor will be published after close of business on Friday, 16 March 2018. FTSE comunica il nuovo numero di azioni e i pesi di investibilità per l'Indice FTSE MIB che saranno effettivi dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018 (vale a dire da lunedì 19 marzo 2018). Secondo le Regole di base del FTSE MIB art. 7.4 e l'Appendice C, sono indicati i valori del numero di azioni e peso di investibilità aggiornati alla data del cut-off, eventualmente soggetti alla correzione del capping applicata con riferimento alle capitalizzazioni calcolate con i prezzi di chiusura di cinque giorni di negoziazione prima della data di ribilanciamento. Il numero di azioni esclude tutte le azioni proprie e la percentuale di flottante è calcolata con riferimento al numero di azioni al netto delle azioni proprie. Il nuovo divisor per il FTSE MIB sarà reso disponibile dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018. -

4133-6266-6020.6 EMTN PROGRAMME PROSPECTUS This

EMTN PROGRAMME PROSPECTUS This document constitutes two base prospectuses: (i) the base prospectus of TIM S.p.A. and (ii) the base prospectus of Telecom Italia Finance S.A. (together, the EMTN Programme Prospectus). TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) TELECOM ITALIA FINANCE S.A. (incorporated with limited liability under the laws of the Grand-Duchy of Luxembourg) €20,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed in respect of Notes issued by Telecom Italia Finance S.A. by TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) Under this €20,000,000,000 Euro Medium Term Note Programme (the Programme), TIM S.p.A. (TIM) and Telecom Italia Finance S.A. (TI Finance and, together with TIM in its capacity as an issuer, the Issuers and each an Issuer) may from time to time issue notes (the Notes) denominated in any currency agreed with the relevant Dealer (as defined below). Payment of all amounts owing in respect of the Notes issued by TI Finance will be unconditionally and irrevocably guaranteed by TIM (in such capacity, the Guarantor). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuers (each a Dealer and, together, the Dealers), which appointment may be for a specific issue or on an ongoing basis. -

World's Smallest Micro-Mirror Scanning Technology From

Press release Communiqué de presse Comunicato stampa 新闻稿 / 新聞稿 プレスリリース 보도자료 T4264D World’s Smallest Micro-Mirror Scanning Technology from STMicroelectronics Chosen for Intel® RealSense™ High-Resolution LiDAR Depth Camera L515 Power-efficient, hi-res LiDAR camera capturing millions of depth points per second suits a wide range of Industrial and Computing use cases Geneva, March 8, 2021 – STMicroelectronics (NYSE: STM), a global semiconductor leader serving customers across the spectrum of electronics applications, has developed a tiny MEMS mirror with Intel enabling spatial scanning of an environment. Intel developed a LiDAR system based on this micro-mirror, providing high-resolution scanning for industrial applications such as robotic arms for bin picking, volumetric measurements, logistics, and 3D scanning. Built into the Intel RealSense LiDAR1 Camera L515, the small dimensions of the ST micro-mirror contribute to the LiDAR camera’s hockey-puck size (61mm diameter x 26mm height). The micro-mirror enables continuous laser scanning across the entire field of view. In combination with a custom photodiode sensor, the RealSense LiDAR Camera L515 renders a 3D depth map of the entire scene. “With 30 frames per second and a field-of-view of 70° by 55°, ST’s 2nd-generation micro-mirror continues to set the bar for 3D scanning and detection applications,” said Benedetto Vigna, President Analog, MEMS and Sensors Group, STMicroelectronics. “Continuing the long-term supply relationship for micro-mirrors with Intel demonstrates our never-ending efforts to leverage our long-lasting leadership in MEMS to meet the demanding technical and supply needs of our customers.” The L515 leverages the scanning capabilities of ST’s MEMS to deliver high-resolution depth with no interpolated pixels, the ability to control the field of view, and provides close to zero pixel blur driven by the low 50nS exposure time. -

Technical Analysis FTSE MIB Basket

Technical Analysis Equity 10 August 2020: 7:14 CET Date and time of production FTSE MIB Basket Daily Report Technical Indicators FTSE MIB Constituents in EUR/share Strong uptrends Amplifon Davide Campari Interpump Italgas Prysmian Strong uptrends are when M/L and short trend arrows are both up. Trading signals New In New Out Trading signals are the new short-term indication (IN) and exit (OUT) from the column "Position" in the basket. Sample Intesa Sanpaolo Research Dept Corrado Binda – Technical Analyst +39 02 7265 0983 [email protected] Sergio Mingolla – Technical Analyst Source: Intesa Sanpaolo elaborations on Thomson Reuters data +39 02 7265 0538 Report priced at market close on day prior to issue (except where otherwise indicated) [email protected] Equity Derivatives Sales +39 02 7261 2806 See page 3 for full disclosure and analyst certification 10 August 2020: 07:17 CET Date and time of first circulation FTSE MIB Basket 10 August 2020 FTSE MIB Index Source: Thomson Reuters – Metastock Sample 2 Intesa Sanpaolo Research Department FTSE MIB Basket 10 August 2020 Disclaimer Analyst certification The financial analysts who prepared this report, and whose names and roles appear within the document, certify that: 1. The views expressed on the company mentioned herein accurately reflect independent, fair and balanced personal views; 2. No direct or indirect compensation has been or will be received in exchange for any views expressed. Specific disclosures Neither the analysts nor any persons closely associated with the analysts have a financial interest in the securities of the Company. Neither the analysts nor any persons closely associated with the analysts serve as an officer, director or advisory board member of the Companies cited in the report. -

John Hancock Disciplined Value International Fund A: JDIBX C: JDICX I: JDVIX R2: JDISX R4: JDITX R6: JDIUX

All data is as of June 30, 2021 Q2 - 2021 International equity fund Quarterly commentary John Hancock Disciplined Value International Fund A: JDIBX C: JDICX I: JDVIX R2: JDISX R4: JDITX R6: JDIUX Objective Use for Morningstar category Long-term growth of capital Core international holding Foreign Large Value Quarterly commentary Highlights The fund beneited from strong stock selection in the communication International equities rallied in the second quarter, helping the fund’s services sector, where SK Telecom Co., Ltd. was a top performer ater its benchmark—the MSCI EAFE Index—achieve a series of all-time highs management announced a plan to split the company in two to recognize before it peaked in mid-June. value. The fund also outperformed in energy, due largely to a rally in shares The fund delivered a positive return, but it trailed the index. of Cenovus Energy, Inc., IMI PLC, and Hitachi Corp. All three companies Given the underperformance of the value style relative to growth, the were top contributors for the quarter, as was a zero weighting in the fund’s value-driven strategy was a headwind to results compared with the Japanese company Sotbank Group Corp. broad-based benchmark. Market review and outlook Portfolio changes International stocks performed well in the past three months as economic We increased the fund’s weightings in industrials and healthcare while data continued to improve as the gradual rollout of vaccines fostered a reducing its allocation to information technology. The changes were all resumption of normal business conditions. Broad measures of consumer stock speciic, and the structure of the portfolio didn’t change materially. -

Euro Stoxx® Residual Momentum Premium Index

EURO STOXX® RESIDUAL MOMENTUM PREMIUM INDEX Components1 Company Supersector Country Weight (%) EUROFINS SCIENTIFIC null null 3.37 SARTORIUS STEDIM BIOTECH null null 3.20 EDP RENOVAVEIS null null 2.97 HELLOFRESH AG null null 2.21 SIEMENS GAMESA null null 2.21 SARTORIUS PREF. null null 2.16 KESKO null null 2.07 DEUTSCHE POST null null 1.89 CORBION null null 1.81 BRENNTAG null null 1.80 SIGNIFY null null 1.75 ZALANDO null null 1.68 SEB null null 1.56 LVMH MOET HENNESSY null null 1.52 BOLLORE null null 1.48 INTERPUMP GRP null null 1.45 SIEMENS null null 1.44 CAP GEMINI null null 1.41 RATIONAL null null 1.41 BMW null null 1.40 BANCO BPM null null 1.37 FUCHS PETROLUB PREF null null 1.30 SOITEC null null 1.27 SAINT GOBAIN null null 1.25 PUBLICIS GRP null null 1.23 MICHELIN null null 1.22 UNIBAIL-RODAMCO-WESTFIELD null null 1.20 WARTSILA null null 1.15 CAIXABANK null null 1.13 STELLANTIS null null 1.12 CNH Industrial NV null null 1.12 SOLVAY null null 1.11 BCO BILBAO VIZCAYA ARGENTARIA null null 1.09 PROSIEBENSAT.1 MEDIA null null 1.08 NOKIAN RENKAAT null null 1.08 COVESTRO null null 1.06 DEUTSCHE BANK null null 1.02 INFINEON TECHNOLOGIES null null 1.02 DAIMLER null null 1.02 STMICROELECTRONICS null null 1.02 CONTINENTAL null null 1.01 REXEL null null 0.99 FLUTTER ENTERTAINMENT null null 0.99 AALBERTS null null 0.99 COMMERZBANK null null 0.95 RYANAIR null null 0.94 HEIDELBERGCEMENT null null 0.93 BASF null null 0.93 ASML HLDG null null 0.93 SPIE null null 0.90 ING GRP null null 0.90 ELIS null null 0.89 HERMES INTERNATIONAL null null 0.88 ASM