Italy's Largest Photovoltaic Panel Plant Starts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enel Green Power, Sharp and Stmicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy

Enel Green Power, Sharp and STMicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy January 4, 2010 3:04 AM ET Enel Green Power, Sharp and STMicroelectronics join forces to produce innovative thin-film photovoltaic panels. The plant, located in Catania, Italy, is expected to have initial production capacity of 160 MW per year and is targeted to grow to 480 MW over the next years. In addition, Enel Green Power and Sharp will jointly develop solar farms focusing on the Mediterranean area, with a total installed capacity at a level of 500 MW, by the end of 2016. Geneva, January 4, 2010 – Today, Enel Green Power, Sharp and STMicroelectronics signed an agreement for the manufacture of triple-junction thin-film photovoltaic panels in Italy. At the same time, Enel Green Power and Sharp signed a further agreement to jointly develop solar farms. Today's agreement regarding the photovoltaic panel factory follows the Memorandum of Understanding signed in May 2008 by Enel Green Power and Sharp. STMicroelectronics has joined this strategic partnership. This agreement marks the first time that three global technology and industrial powerhouses have joined together in an equal partnership to contribute their unique value-add to the solar industry. It brings together Enel Green Power, with its international market development and project management know-how; Sharp, and its exclusive triple-junction thin-film technology, which will be operational in the mother plant in Sakai, Japan as of spring 2010; and STMicroelectronics, with its manufacturing capacity, skills and resources in highly advanced, hi-tech sectors such as microelectronics. -

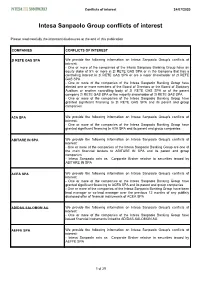

Intesa Sanpaolo Group Conflicts of Interest

Conflicts of interest 24/07/2020 Intesa Sanpaolo Group conflicts of interest Please read carefully the important disclosures at the end of this publication COMPANIES CONFLICTS OF INTEREST 2I RETE GAS SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have an equity stake of 5% or more in 2I RETE GAS SPA or in the Company that has a controlling interest in 2I RETE GAS SPA or are a major shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have elected one or more members of the Board of Directors or the Board of Statutory Auditors or another controlling body of 2I RETE GAS SPA or of the parent company 2I RETE GAS SPA or the majority shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to 2I RETE GAS SPA and its parent and group companies A2A SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to A2A SPA and its parent and group companies ABITARE IN SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group are one of the main financial lenders to ABITARE IN SPA and its parent and group companies - Intesa Sanpaolo acts as Corporate Broker relative to securities issued -

Sustainability-Linked Bond Sterling

Media Relations Investor Relations T +39 06 8305 5699 T +39 06 8305 7975 [email protected] [email protected] enel.com enel.com THIS ANNOUNCEMENT CANNOT BE DISTRIBUTED IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED, RESIDENT OR DOMICILED IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE US VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT. ENEL SUCCESSFULLY LAUNCHES A 500 MILLION POUNDS STERLING “SUSTAINABILITY-LINKED BOND”, THE FIRST OF ITS KIND ON THE STERLING MARKET • Enel Finance International N.V. has placed the sterling market’s first “Sustainability-Linked bond”, which is linked to the achievement of Enel’s sustainable objective related to the percentage of consolidated renewable installed capacity on total consolidated installed capacity, in line with the commitment to achieving the United Nations Sustainable Development Goals • The issue was almost six times oversubscribed, with orders of about 3 billion pounds sterling. The strong demand from investors for the “Sustainability-Linked bond” once again confirms the appreciation and confidence of the financial markets in the soundness of the Enel Group’s sustainable strategy and the consequent impact on the economic and financial results Rome, October 13 th , 2020 - Enel Finance International N.V. (“EFI”), the Dutch-registered finance company controlled by Enel S.p.A. (“Enel”) 1, launched today a single-tranche “Sustainability-Linked bond” for institutional investors on the sterling market totaling 500 million pounds sterling, equivalent to about 550 million euros. -

Wells Fargo/Causeway International Value CIT Fact Sheet

As of June 30, 2021 Collective Fund fact sheet wellsfargoassetmanagement.com/collective Wells Fargo/Causeway International Value CIT Asset class: International Equity Class CUSIP Ticker Sector allocation (%) TR 94987Q342 CWINTTR 25 20 FUND OBJECTIVE 15 This Collective Investment Trust ("CIT", "the 10 Fund", or "collective fund") seeks long-term growth of capital. 5 0 FUND STRATEGY The Fund invests primarily in common stocks of -5 companies located in developed countries -10 outside the U.S. Normally, the Fund invests at Communication Consumer Consumer Information services discretionary staples Energy Financials Health care Industria ls technolo gy Materials Real estate Utilities least 80% of its total assets in stocks of companies located in at least ten foreign Fund 0.0 5.4 7.5 5.0 20.6 14.7 20.6 15.7 5.5 0.0 5.2 countries and invests the majority of its total Index 5.0 13.0 10.5 3.2 16.9 12.4 15.5 9.1 7.9 3.0 3.4 assets in companies that pay dividends or Allocation -5.0 -7.6 -3.0 1.8 3.7 2.3 5.1 6.6 -2.4 -3.0 1.8 repurchase their shares. The Fund may invest variance up to 10% of its total assets in companies in Sector allocations are as of the date specified above and subject to change without notice. Due to rounding, fund and index sums may not add up emerging (less developed) markets. to exactly 100%. Excludes any cash or cash equivalents that may be held by the fund. -

Euro Stoxx® Quality Dividend 50 Index

STRATEGY INDICES 1 EURO STOXX® QUALITY DIVIDEND 50 INDEX Index description Key facts The EURO STOXX Quality Dividend 50 Index systematically aims at » Ideal to achieve a balanced exposure between a dividend paying selecting the top 50 stocks in terms of quality and dividend yield and a high quality strategy from the EURO STOXX index, whilst minimizing overall volatility of the derived index. » Liquid universe ensured by the use of the ADTR screening » Balanced approach between the different screenings » Diversification though capping of component weights to 4% and number of companies per industry to 15 Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months EURO STOXX Quality Dividend 50 Index 1,088.9 872.4 17.1 13.0 41.2 2.3 4.8 0.3 68.4 EURO STOXX Index 5,888.0 4,364.9 14.5 6.8 119.7 1.5 2.7 0.0 2.8 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y EURO STOXX Quality Dividend 50 Index 3.1 17.7 24.4 41.2 82.3 N/A N/A 24.6 12.3 12.9 EURO STOXX Index 2.3 16.8 24.6 39.4 88.1 N/A N/A 24.8 11.9 13.7 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 EURO STOXX Quality Dividend 50 Index 7.3 9.0 9.4 17.6 16.0 N/A N/A 2.3 0.7 0.8 EURO STOXX Index 6.3 9.9 10.2 18.7 17.1 N/A N/A N/A 0.7 0.8 Index to benchmark Correlation Tracking error (%) EURO STOXX Quality Dividend 50 Index 0.9 0.9 0.9 1.0 1.0 2.8 3.9 4.0 3.5 3.5 Index to benchmark Beta Annualized information ratio EURO STOXX Quality Dividend 50 Index 1.1 0.8 0.9 0.9 0.9 3.0 0.2 -0.1 0.0 -0.3 1 For information on data calculation, please refer to STOXX calculation reference guide. -

TEA6422 TEA6422D TEA6422DT Stmicroelectronics Datasheet

TEA6422 BUS-CONTROLLED AUDIO MATRIX ■ 6 Stereo Inputs ■ 3 Stereo Ouputs ■ Gain Control 0 dB/Mute for each Output ■ Cascadable (2 different addresses) ■ Serial Bus Controlled ■ Very Low Noise ■ Very Low Distorsion SHRINK DIP24 ■ Fully ESD Protected (Shrink Plastic Package) ■ Wide Audio Dynamic Range ( 3 V ) RMS ORDER CODE: TEA6422 DESCRIPTION The TEA6422 switches 6 stereo audio inputs on 3 stereo outputs. All the switching possibilities are changed through the I2C BUS. SO28 (Plastic Monopackage) ORDER CODE: TEA6422D Figure 1. PIN CONNECTIONS SO28 SDIP24 GND 1 28 SDA GND 1 24 SDA CAPACITANCE 2 27 SCL 2 23 CAPACITANCE SCL VS 3 26 ADDR VS 3 22 ADDR L1 4 25 R1 L1 4 21 R1 L2 5 24 R2 L2 5 20 R2 L3 6 23 R3 L3 6 19 R3 NC 7 22 NC L4 7 18 R4 NC 8 21 NC L5 8 17 R5 L4 9 20 R4 L6 9 16 R6 L5 10 19 R5 LOUT1 10 15 ROUT3 L6 11 18 R6 ROUT1 11 14 LOUT3 LOUT1 12 17 ROUT3 LOUT2 12 13 ROUT2 ROUT1 13 16 LOUT3 LOUT2 14 15 ROUT2 September 2003 1/10 1 TEA6422 BLOCK DIAGRAM RIGHT INPUTS GAIN = 0 dB RIGHT OUTPUTS VS SDA C SUPPLY BUS DECODER SCL GND ADDR LEFT OUTPUTS GAIN = 0 dB LEFT INPUTS ABSOLUTE MAXIMUM RATINGS Symbol Parameter Value Unit VCC Supply Voltage 12 V o Toper Operating Temperature 0, + 70 C o Tstg Storage Temperature - 20, + 150 C THERMAL DATA Symbol Parameter Value Unit SDIP24 75 oC/W R (j-a) Junction - ambient Thermal Resistance th SO28 75 oC/W 2/10 1 TEA6422 ELECTRICAL CHARACTERISTICS o Ω Ω TA = 25 C, VS = 9 V, RL = 10 k , RG = 600 , f = 1 kHz (unless otherwise specified) Symbol Parameter Test Conditions Min. -

4133-6266-6020.6 EMTN PROGRAMME PROSPECTUS This

EMTN PROGRAMME PROSPECTUS This document constitutes two base prospectuses: (i) the base prospectus of TIM S.p.A. and (ii) the base prospectus of Telecom Italia Finance S.A. (together, the EMTN Programme Prospectus). TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) TELECOM ITALIA FINANCE S.A. (incorporated with limited liability under the laws of the Grand-Duchy of Luxembourg) €20,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed in respect of Notes issued by Telecom Italia Finance S.A. by TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) Under this €20,000,000,000 Euro Medium Term Note Programme (the Programme), TIM S.p.A. (TIM) and Telecom Italia Finance S.A. (TI Finance and, together with TIM in its capacity as an issuer, the Issuers and each an Issuer) may from time to time issue notes (the Notes) denominated in any currency agreed with the relevant Dealer (as defined below). Payment of all amounts owing in respect of the Notes issued by TI Finance will be unconditionally and irrevocably guaranteed by TIM (in such capacity, the Guarantor). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuers (each a Dealer and, together, the Dealers), which appointment may be for a specific issue or on an ongoing basis. -

World's Smallest Micro-Mirror Scanning Technology From

Press release Communiqué de presse Comunicato stampa 新闻稿 / 新聞稿 プレスリリース 보도자료 T4264D World’s Smallest Micro-Mirror Scanning Technology from STMicroelectronics Chosen for Intel® RealSense™ High-Resolution LiDAR Depth Camera L515 Power-efficient, hi-res LiDAR camera capturing millions of depth points per second suits a wide range of Industrial and Computing use cases Geneva, March 8, 2021 – STMicroelectronics (NYSE: STM), a global semiconductor leader serving customers across the spectrum of electronics applications, has developed a tiny MEMS mirror with Intel enabling spatial scanning of an environment. Intel developed a LiDAR system based on this micro-mirror, providing high-resolution scanning for industrial applications such as robotic arms for bin picking, volumetric measurements, logistics, and 3D scanning. Built into the Intel RealSense LiDAR1 Camera L515, the small dimensions of the ST micro-mirror contribute to the LiDAR camera’s hockey-puck size (61mm diameter x 26mm height). The micro-mirror enables continuous laser scanning across the entire field of view. In combination with a custom photodiode sensor, the RealSense LiDAR Camera L515 renders a 3D depth map of the entire scene. “With 30 frames per second and a field-of-view of 70° by 55°, ST’s 2nd-generation micro-mirror continues to set the bar for 3D scanning and detection applications,” said Benedetto Vigna, President Analog, MEMS and Sensors Group, STMicroelectronics. “Continuing the long-term supply relationship for micro-mirrors with Intel demonstrates our never-ending efforts to leverage our long-lasting leadership in MEMS to meet the demanding technical and supply needs of our customers.” The L515 leverages the scanning capabilities of ST’s MEMS to deliver high-resolution depth with no interpolated pixels, the ability to control the field of view, and provides close to zero pixel blur driven by the low 50nS exposure time. -

Explaining Incumbent Internationalization of the Public Utilities: Cases from Telecommunications and Electricity

Explaining incumbent internationalization of the public utilities: Cases from telecommunications and electricity Judith Clifton, Daniel Díaz-Fuentes, Marcos Gutiérrez and Julio Revuelta ∗ One major consequence of the reform of public service utilities in the European Union since the 1980s - particularly privatization, liberalization, deregulation and unbundling - was that a number of formerly inward-looking incumbents in telecommunications and electricity transformed themselves into some of the world’s leading multinationals. Now, reform was a prerequisite for their internationalization, substantially changing the business options available to incumbents. However, the precise relationship between reform and incumbent internationalization is contested. In this paper, three dominant political economy arguments on this relationship are tested. The first claims that incumbents most exposed to domestic reform (liberalization and privatization) would internationalize most. The second asserts that incumbents operating where reform was limited or slower-than-average would exploit monopolistic rents to finance aggressive internationalization. The third argument claims that a diversity of paths would be adopted by countries and incumbents vis-à-vis reform and internationalization, differences being explained by institutional features. After compiling an original database on extent of incumbent internationalization, alongside OECD data on ownership and liberalization, we deploy correlation and cluster analysis to seek explanations for internationalization. Evidence is found in favor of the third hypothesis. Internationalization as a response to reform took diverse forms in terms of timing and extent. This can therefore be best explained using a country, sector and firm logic. Key words: Utilities, European Union, internationalization, liberalization, privatization. ∗ Department of Economics, Universidad de Cantabria, Av de los Castros s.n., Cantabria D39005, Spain. -

Common Stocks — 104.5%

Eaton Vance Tax-Advantaged Global Dividend Income Fund January 31, 2021 PORTFOLIO OF INVESTMENTS (Unaudited) Common Stocks — 104.5% Security Shares Value Aerospace & Defense — 0.8% Safran S.A.(1) 98,721 $ 12,409,977 $ 12,409,977 Banks — 6.7% Bank of New York Mellon Corp. (The) 518,654 $ 20,657,989 Citigroup, Inc. 301,884 17,506,253 HDFC Bank, Ltd.(1) 512,073 9,775,702 ING Groep NV(1) 1,676,061 14,902,461 Japan Post Bank Co., Ltd. 445,438 3,851,696 Mitsubishi UFJ Financial Group, Inc. 2,506,237 11,317,609 Mizuho Financial Group, Inc. 292,522 3,856,120 Sumitomo Mitsui Financial Group, Inc. 186,747 5,801,916 Wells Fargo & Co. 341,979 10,218,332 $ 97,888,078 Beverages — 1.0% Diageo PLC 378,117 $ 15,180,328 $ 15,180,328 Biotechnology — 1.2% CSL, Ltd. 82,845 $ 17,175,550 $ 17,175,550 Building Products — 0.9% Assa Abloy AB, Class B 509,607 $ 12,603,485 $ 12,603,485 Chemicals — 0.7% Sika AG 38,393 $ 10,447,185 $ 10,447,185 Construction & Engineering — 0.0% Abengoa S.A., Class A(1)(2) 311,491 $ 0 Abengoa S.A., Class B(1)(2) 3,220,895 0 $0 Construction Materials — 0.9% CRH PLC 332,889 $ 13,660,033 $ 13,660,033 Consumer Finance — 0.6% Capital One Financial Corp. 79,722 $ 8,311,816 $ 8,311,816 1 Security Shares Value Diversified Financial Services — 2.5% Berkshire Hathaway, Inc., Class B(1) 101,853 $ 23,209,243 ORIX Corp. -

Diapositiva 1

M&A and Investment Banking Enel Acquisition of Endesa – Case Study 1 Table of Contents Introduction Transaction Description Strategic Rationale Financial Impact on Enel Accounts Focus on Equity Swap Contracts 2 Enel Acquisition of Endesa Introduction 3 Transaction Highlights World’s largest utility deal ever given an offer price of €41.3 per share, equivalent to a total EV of €63.6bn Largest cross-border cash offer ever launched by an Italian company and largest PTO ever launched in Spain Rapidly designed and executed, understood to be launched within 2 months from the presentation of the opportunity to Enel The deal represented a transforming transaction for Enel, consolidating its presence in the European and Latin American electricity market 4 Global M&A in the Energy and Power Industry 5 Source: Thomson Financial, Institute of Mergers, Acquisitions and Alliances (IMAA) analysis. Key Parties Involved in the Transaction Enel is Italy's largest power company and Europe's third largest listed utility by market capitalization Listed on the Milan and New York stock exchanges since 1999 Enel has the largest number of shareholders of any Italian company, at some 2.3m It has a market capitalization of about €50bn (as of April 2007) Total Installed Capacity: 40,475MW 2006A Revenues: €38,513m 2006A EBITDA: €8,019m 2006A EBIT: €5,819m 2006A Net Debt: €11,690m Acciona is one of the main Spanish corporations with activities in more than 30 countries throughout the five Continents Its activities span from infrastructures, renewable -

Thursday 24Th March Technical Sessions

Thursday 24th March Technical Sessions DRILLING & COMPLETION : FIELD CASE HISTORIES ROOM A CHAIRMEN : NASR AGIZA , TIBA – LAURENS VAN DER PEET, TOTAL 09.00 DRILL/FCH/01 Managed Pressure Drilling as a Tool to Reduce Risks and Non-Productive Time: an Update on Field Experience J. Chopty, A. Sardo, Weatherford International Ltd 09.25 DRILL/FCH/02 Marginal shallow water gas fields development through subsea vertical tree with jack- up drilling operations. Analysis of the first successful experience in the Adriatic Sea: Bonaccia Est gas field R. Carrara, M. La Rovere, A. Malkowski, G. Baccon, A. Laghi, S. Masi, L. Pellicciotta, eni e&p 09.50 DRILL/FCH/03 Well placement using borehole images and bed boundary mapping in an underground gas storage project in Italy M. Borghi, D. Loi, S. Cagneschi, S. Mazzoni, E. Donà, eni e&p - A. Zanchi, D. Baiocchi, STOGIT - J. Gremillion, F. Chinellato, N. Lebnane, R. Lepp, S. Chow, S. Squaranti, Schlumberger 10.15 DRILL/FCH/04 Electromagnetic telemetry MWD (Measurement-While-Drilling) system allows directional control while drilling through total loss circulation zones on high enthalpy geothermal field L. Serniotti, Enel Green Power – M. Troiano, D. Di Tommaso, Weatherford Alternate DRILL/FCH/05A1 New Class of Microsphere Improves Economics and Allows Circulation Where Previous Designs Suffered Losses: A Case History D. Kulakofsky, C. Faulkner, S. Williams, Halliburton – C. Seidel Debrick, Devon Energy HEALTH , SAFETY AND ENVIRONMENT : MONITORING ROOM F CHAIRMEN : ROBERTO PAVESI , WEATHERFORD – IACOPO RAINALDI , TECNOMARE 09.00 HSE/M01 Third party interference and leak detection on buried Pipelines for reliable transportation of fluids G.