Stmicroelectronics Nv (Stm) 20-F

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enel Green Power, Sharp and Stmicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy

Enel Green Power, Sharp and STMicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy January 4, 2010 3:04 AM ET Enel Green Power, Sharp and STMicroelectronics join forces to produce innovative thin-film photovoltaic panels. The plant, located in Catania, Italy, is expected to have initial production capacity of 160 MW per year and is targeted to grow to 480 MW over the next years. In addition, Enel Green Power and Sharp will jointly develop solar farms focusing on the Mediterranean area, with a total installed capacity at a level of 500 MW, by the end of 2016. Geneva, January 4, 2010 – Today, Enel Green Power, Sharp and STMicroelectronics signed an agreement for the manufacture of triple-junction thin-film photovoltaic panels in Italy. At the same time, Enel Green Power and Sharp signed a further agreement to jointly develop solar farms. Today's agreement regarding the photovoltaic panel factory follows the Memorandum of Understanding signed in May 2008 by Enel Green Power and Sharp. STMicroelectronics has joined this strategic partnership. This agreement marks the first time that three global technology and industrial powerhouses have joined together in an equal partnership to contribute their unique value-add to the solar industry. It brings together Enel Green Power, with its international market development and project management know-how; Sharp, and its exclusive triple-junction thin-film technology, which will be operational in the mother plant in Sakai, Japan as of spring 2010; and STMicroelectronics, with its manufacturing capacity, skills and resources in highly advanced, hi-tech sectors such as microelectronics. -

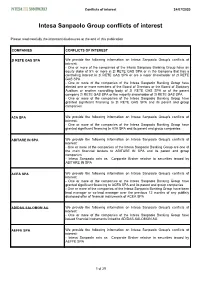

Intesa Sanpaolo Group Conflicts of Interest

Conflicts of interest 24/07/2020 Intesa Sanpaolo Group conflicts of interest Please read carefully the important disclosures at the end of this publication COMPANIES CONFLICTS OF INTEREST 2I RETE GAS SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have an equity stake of 5% or more in 2I RETE GAS SPA or in the Company that has a controlling interest in 2I RETE GAS SPA or are a major shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have elected one or more members of the Board of Directors or the Board of Statutory Auditors or another controlling body of 2I RETE GAS SPA or of the parent company 2I RETE GAS SPA or the majority shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to 2I RETE GAS SPA and its parent and group companies A2A SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to A2A SPA and its parent and group companies ABITARE IN SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group are one of the main financial lenders to ABITARE IN SPA and its parent and group companies - Intesa Sanpaolo acts as Corporate Broker relative to securities issued -

IEEE Spectrum: 25 Microchip

IEEE Spectrum: 25 Microchips That Shook the World http://www.spectrum.ieee.org/print/8747 Sponsored By Select Font Size: A A A 25 Microchips That Shook the World By Brian R. Santo This is part of IEEE Spectrum 's Special Report: 25 Microchips That Shook the World . In microchip design, as in life, small things sometimes add up to big things. Dream up a clever microcircuit, get it sculpted in a sliver of silicon, and your little creation may unleash a technological revolution. It happened with the Intel 8088 microprocessor. And the Mostek MK4096 4-kilobit DRAM. And the Texas Instruments TMS32010 digital signal processor. Among the many great chips that have emerged from fabs during the half-century reign of the integrated circuit, a small group stands out. Their designs proved so cutting-edge, so out of the box, so ahead of their time, that we are left groping for more technology clichés to describe them. Suffice it to say that they gave us the technology that made our brief, otherwise tedious existence in this universe worth living. We’ve compiled here a list of 25 ICs that we think deserve the best spot on the mantelpiece of the house that Jack Kilby and Robert Noyce built. Some have become enduring objects of worship among the chiperati: the Signetics 555 timer, for example. Others, such as the Fairchild 741 operational amplifier, became textbook design examples. Some, like Microchip Technology’s PIC microcontrollers, have sold billions, and are still doing so. A precious few, like Toshiba’s flash memory, created whole new markets. -

MOSTEK 1980 CIRCUITS and SYSTEMS PRODUCT GUIDE Mostek Reserves the Right to Make Changes in Specifications at Any Time and Without Notice

MOSTEK 1980 CIRCUITS AND SYSTEMS PRODUCT GUIDE Mostek reserves the right to make changes in specifications at any time and without notice. The information furnished by Mostek in this publication is believedto be accurate and reliable. However, no responsibility is assumed by Mostek for its use; nor for any infringements of patents or other rights of third parties resulting from its use. No license is granted under any patents or patent rights of Mostek. The "PRELIMINARY" designation on a Mostek data sheet indicates that the product is not characterized. The specifications are subject to change, are based on design goals or preliminary part evaluation, and are not guaranteed. Mostek Corporation or an authorized sales representative should be consulted for current information before using this product. No responsibility is assumed by Mostek for its use; nor for any infringements of patents and trademarks or other rights ofthird parties resulting from its use. No license is granted under any patents, patent rights, or trademarks of Mostek. Mostek reserves the right to make changes in specifications at anytime and without notice. PRINTED IN USA April 1980 Publication Number Trade Marks Registered® STD No 01009 Copyright © 1980 Mostek Corporation (All rights reserved) II ~~~~~~~;;;;' Table of Contents '~~~~~~;;;;; Table of Contents ................................................... 111 Numerical Index ...................................................VIII Alphabetical Index . ................................................. x Mostek Profile -

TEA6422 TEA6422D TEA6422DT Stmicroelectronics Datasheet

TEA6422 BUS-CONTROLLED AUDIO MATRIX ■ 6 Stereo Inputs ■ 3 Stereo Ouputs ■ Gain Control 0 dB/Mute for each Output ■ Cascadable (2 different addresses) ■ Serial Bus Controlled ■ Very Low Noise ■ Very Low Distorsion SHRINK DIP24 ■ Fully ESD Protected (Shrink Plastic Package) ■ Wide Audio Dynamic Range ( 3 V ) RMS ORDER CODE: TEA6422 DESCRIPTION The TEA6422 switches 6 stereo audio inputs on 3 stereo outputs. All the switching possibilities are changed through the I2C BUS. SO28 (Plastic Monopackage) ORDER CODE: TEA6422D Figure 1. PIN CONNECTIONS SO28 SDIP24 GND 1 28 SDA GND 1 24 SDA CAPACITANCE 2 27 SCL 2 23 CAPACITANCE SCL VS 3 26 ADDR VS 3 22 ADDR L1 4 25 R1 L1 4 21 R1 L2 5 24 R2 L2 5 20 R2 L3 6 23 R3 L3 6 19 R3 NC 7 22 NC L4 7 18 R4 NC 8 21 NC L5 8 17 R5 L4 9 20 R4 L6 9 16 R6 L5 10 19 R5 LOUT1 10 15 ROUT3 L6 11 18 R6 ROUT1 11 14 LOUT3 LOUT1 12 17 ROUT3 LOUT2 12 13 ROUT2 ROUT1 13 16 LOUT3 LOUT2 14 15 ROUT2 September 2003 1/10 1 TEA6422 BLOCK DIAGRAM RIGHT INPUTS GAIN = 0 dB RIGHT OUTPUTS VS SDA C SUPPLY BUS DECODER SCL GND ADDR LEFT OUTPUTS GAIN = 0 dB LEFT INPUTS ABSOLUTE MAXIMUM RATINGS Symbol Parameter Value Unit VCC Supply Voltage 12 V o Toper Operating Temperature 0, + 70 C o Tstg Storage Temperature - 20, + 150 C THERMAL DATA Symbol Parameter Value Unit SDIP24 75 oC/W R (j-a) Junction - ambient Thermal Resistance th SO28 75 oC/W 2/10 1 TEA6422 ELECTRICAL CHARACTERISTICS o Ω Ω TA = 25 C, VS = 9 V, RL = 10 k , RG = 600 , f = 1 kHz (unless otherwise specified) Symbol Parameter Test Conditions Min. -

4133-6266-6020.6 EMTN PROGRAMME PROSPECTUS This

EMTN PROGRAMME PROSPECTUS This document constitutes two base prospectuses: (i) the base prospectus of TIM S.p.A. and (ii) the base prospectus of Telecom Italia Finance S.A. (together, the EMTN Programme Prospectus). TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) TELECOM ITALIA FINANCE S.A. (incorporated with limited liability under the laws of the Grand-Duchy of Luxembourg) €20,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed in respect of Notes issued by Telecom Italia Finance S.A. by TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) Under this €20,000,000,000 Euro Medium Term Note Programme (the Programme), TIM S.p.A. (TIM) and Telecom Italia Finance S.A. (TI Finance and, together with TIM in its capacity as an issuer, the Issuers and each an Issuer) may from time to time issue notes (the Notes) denominated in any currency agreed with the relevant Dealer (as defined below). Payment of all amounts owing in respect of the Notes issued by TI Finance will be unconditionally and irrevocably guaranteed by TIM (in such capacity, the Guarantor). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuers (each a Dealer and, together, the Dealers), which appointment may be for a specific issue or on an ongoing basis. -

World's Smallest Micro-Mirror Scanning Technology From

Press release Communiqué de presse Comunicato stampa 新闻稿 / 新聞稿 プレスリリース 보도자료 T4264D World’s Smallest Micro-Mirror Scanning Technology from STMicroelectronics Chosen for Intel® RealSense™ High-Resolution LiDAR Depth Camera L515 Power-efficient, hi-res LiDAR camera capturing millions of depth points per second suits a wide range of Industrial and Computing use cases Geneva, March 8, 2021 – STMicroelectronics (NYSE: STM), a global semiconductor leader serving customers across the spectrum of electronics applications, has developed a tiny MEMS mirror with Intel enabling spatial scanning of an environment. Intel developed a LiDAR system based on this micro-mirror, providing high-resolution scanning for industrial applications such as robotic arms for bin picking, volumetric measurements, logistics, and 3D scanning. Built into the Intel RealSense LiDAR1 Camera L515, the small dimensions of the ST micro-mirror contribute to the LiDAR camera’s hockey-puck size (61mm diameter x 26mm height). The micro-mirror enables continuous laser scanning across the entire field of view. In combination with a custom photodiode sensor, the RealSense LiDAR Camera L515 renders a 3D depth map of the entire scene. “With 30 frames per second and a field-of-view of 70° by 55°, ST’s 2nd-generation micro-mirror continues to set the bar for 3D scanning and detection applications,” said Benedetto Vigna, President Analog, MEMS and Sensors Group, STMicroelectronics. “Continuing the long-term supply relationship for micro-mirrors with Intel demonstrates our never-ending efforts to leverage our long-lasting leadership in MEMS to meet the demanding technical and supply needs of our customers.” The L515 leverages the scanning capabilities of ST’s MEMS to deliver high-resolution depth with no interpolated pixels, the ability to control the field of view, and provides close to zero pixel blur driven by the low 50nS exposure time. -

Microcomputers: NQS PUBLICATIONS Introduction to Features and Uses

of Commerce Computer Science National Bureau and Technology of Standards NBS Special Publication 500-110 Microcomputers: NQS PUBLICATIONS Introduction to Features and Uses QO IGf) .U57 500-110 NATIONAL BUREAU OF STANDARDS The National Bureau of Standards' was established by an act ot Congress on March 3, 1901. The Bureau's overall goal is to strengthen and advance the Nation's science and technology and facilitate their effective application for public benefit. To this end, the Bureau conducts research and provides; (1) a basis for the Nation's physical measurement system, (2) scientific and technological services for industry and government, (3) a technical basis for equity in trade, and (4) technical services to promote public safety. The Bureau's technical work is per- formed by the National Measurement Laboratory, the National Engineering Laboratory, and the Institute for Computer Sciences and Technology. THE NATIONAL MEASUREMENT LABORATORY provides the national system of physical and chemical and materials measurement; coordinates the system with measurement systems of other nations and furnishes essential services leading to accurate and uniform physical and chemical measurement throughout the Nation's scientific community, industry, and commerce; conducts materials research leading to improved methods of measurement, standards, and data on the properties of materials needed by industry, commerce, educational institutions, and Government; provides advisory and research services to other Government agencies; develops, produces, and -

A User-Oriented Family of Minicomputers

)BER 1974 iI © Copr. 1949-1998 Hewlett-Packard Co. A User-Oriented Family of Minicomputers HP's minicomputer section manager discusses the philosophy behind the design of this new computer series. by John M. Stedman WHAT DO MINICOMPUTER USERS want? In system application may require 128K words of main setting design objectives for HP's new 21 MX memory today, with the capability of expanding as Series minicomputers, we tried to make the objec additional needs arise. And it shouldn't be necessary tives conform as closely as possible to the answers to to trade off physical memory space for I/O controller this question, as we saw them. space. Minicomputer applications have broadened tre mendously in the last few years. One finds minicom puters today solving problems that only a few years Cover: The HP 21 MX Series ago would have required a large expensive computer is a family of advanced system or a dedicated system designed to solve one minicomputers featuring particular problem. In more and more cases a mini modular design, a choice of computer turns out to be the best solution to a problem. semiconductor memory systems, user-micropro- What Do Users Want? grammable processors, and In general, a minicomputer user wants the most customized instruction sets, cost-effective solution to his problem. He would like and a power system that has to have the solution as quickly as possible, and not be unusual immunity to substandard electrical con required to design special hardware to do the job. In ditions. The memory systems use the new 4K addition, he wants a solution closely matched to his RAMs, a few of which are shown here. -

John Hancock Disciplined Value International Fund A: JDIBX C: JDICX I: JDVIX R2: JDISX R4: JDITX R6: JDIUX

All data is as of June 30, 2021 Q2 - 2021 International equity fund Quarterly commentary John Hancock Disciplined Value International Fund A: JDIBX C: JDICX I: JDVIX R2: JDISX R4: JDITX R6: JDIUX Objective Use for Morningstar category Long-term growth of capital Core international holding Foreign Large Value Quarterly commentary Highlights The fund beneited from strong stock selection in the communication International equities rallied in the second quarter, helping the fund’s services sector, where SK Telecom Co., Ltd. was a top performer ater its benchmark—the MSCI EAFE Index—achieve a series of all-time highs management announced a plan to split the company in two to recognize before it peaked in mid-June. value. The fund also outperformed in energy, due largely to a rally in shares The fund delivered a positive return, but it trailed the index. of Cenovus Energy, Inc., IMI PLC, and Hitachi Corp. All three companies Given the underperformance of the value style relative to growth, the were top contributors for the quarter, as was a zero weighting in the fund’s value-driven strategy was a headwind to results compared with the Japanese company Sotbank Group Corp. broad-based benchmark. Market review and outlook Portfolio changes International stocks performed well in the past three months as economic We increased the fund’s weightings in industrials and healthcare while data continued to improve as the gradual rollout of vaccines fostered a reducing its allocation to information technology. The changes were all resumption of normal business conditions. Broad measures of consumer stock speciic, and the structure of the portfolio didn’t change materially. -

Euro Stoxx® Residual Momentum Premium Index

EURO STOXX® RESIDUAL MOMENTUM PREMIUM INDEX Components1 Company Supersector Country Weight (%) EUROFINS SCIENTIFIC null null 3.37 SARTORIUS STEDIM BIOTECH null null 3.20 EDP RENOVAVEIS null null 2.97 HELLOFRESH AG null null 2.21 SIEMENS GAMESA null null 2.21 SARTORIUS PREF. null null 2.16 KESKO null null 2.07 DEUTSCHE POST null null 1.89 CORBION null null 1.81 BRENNTAG null null 1.80 SIGNIFY null null 1.75 ZALANDO null null 1.68 SEB null null 1.56 LVMH MOET HENNESSY null null 1.52 BOLLORE null null 1.48 INTERPUMP GRP null null 1.45 SIEMENS null null 1.44 CAP GEMINI null null 1.41 RATIONAL null null 1.41 BMW null null 1.40 BANCO BPM null null 1.37 FUCHS PETROLUB PREF null null 1.30 SOITEC null null 1.27 SAINT GOBAIN null null 1.25 PUBLICIS GRP null null 1.23 MICHELIN null null 1.22 UNIBAIL-RODAMCO-WESTFIELD null null 1.20 WARTSILA null null 1.15 CAIXABANK null null 1.13 STELLANTIS null null 1.12 CNH Industrial NV null null 1.12 SOLVAY null null 1.11 BCO BILBAO VIZCAYA ARGENTARIA null null 1.09 PROSIEBENSAT.1 MEDIA null null 1.08 NOKIAN RENKAAT null null 1.08 COVESTRO null null 1.06 DEUTSCHE BANK null null 1.02 INFINEON TECHNOLOGIES null null 1.02 DAIMLER null null 1.02 STMICROELECTRONICS null null 1.02 CONTINENTAL null null 1.01 REXEL null null 0.99 FLUTTER ENTERTAINMENT null null 0.99 AALBERTS null null 0.99 COMMERZBANK null null 0.95 RYANAIR null null 0.94 HEIDELBERGCEMENT null null 0.93 BASF null null 0.93 ASML HLDG null null 0.93 SPIE null null 0.90 ING GRP null null 0.90 ELIS null null 0.89 HERMES INTERNATIONAL null null 0.88 ASM -

Semiconductors & Semiconductor Equipment

Semiconductors & Semiconductor Equipment Driving forces Highlighted criteria & The application of advanced semiconductors has progressed dimension weights beyond traditional computing products to include the Internet Environmental Dimension..34% of Things, Artificial Intelligence, automotive applications, 5G, – Climate Strategy and high-performance computing. Cybersecurity is a strategic – Environmental Policy & priority that is increasing in importance, since security should Management Systems be included by design during chip R&D. The rate at which the – Operational Eco-Efficiency number of transistors on a chip doubles (i.e., Moore’s Law) is – Product Stewardship slowing as integrated circuits become smaller. The semiconductor industry must, therefore, investigate new architectures, materials, Social Dimension ............. 23% and packaging to go beyond current scaling and performance – Human Capital Development constraints, while also addressing the demand for low energy- – Talent Attraction & Retention consumption products. To sustain a rapid pace of innovation, the industry will need to increase R&D investment that, in turn, Governance & Economic will necessitate attracting and retaining a skilled workforce and Dimension ........................ 43% developing talent. The industry must continue to improve its – Innovation Management ultra-pure water usage, energy and waste management, and – Product Quality and Recall pollution prevention. It must also increase promotion of projects Management to substitute hazardous materials and