The Role of Third Party Vendors in Asset Management September 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

10 Year Capital Market Assumptions for 2021

10-Year Capital Market Assumptions Calendar Year 2021 2 10-Year Capital Market Assumptions Overview On an annual basis, BNY Mellon Investor Solutions, LLC develops capital market return assumptions for approximately 50 asset classes around the world. The assumptions are based on a 10-year investment time horizon and are intended to guide investors in developing their long-term strategic asset allocations. Historically, the initial baseline assumptions were derived using consensus views, adjusted to reflect insights regarding global market imbalances based on research from across BNY Mellon. This year we have incorporated the macroeconomic forecasts generated by BNY Mellon Investment Management Global Economic and Investment Analysis Group, led by Chief Economist Shamik Dhar. Given the global pandemic and unprecedented amount of global monetary and fiscal stimulus deployed to support the economic recovery, we believe the incorporation of these probability-weighted forecasts will prove particularly useful given the high degree of coronavirus-related economic uncertainty. Overall, the results of our 2021 10-year capital market assumptions are mixed depending on the asset class when compared to last year’s assumptions (see Exhibit 1). We see stronger equity market returns due to higher growth rates as the economy recovers from the pandemic. Fixed income asset class returns will be extremely limited given how low global bond yields are today. Alternative asset class returns are mixed, with generally lower returns in absolute return or hedged strategies and amplified returns in private markets. Exhibit 1: Snapshot of Risk and Return for the 2021 Capital Market Assumptions 9% U.S. Private Equity US Private Equity EM Equity Equity 2021 Equity 2020 EM Equity 8% Fixed Income 2021 Fixed Income 2020 Alternatives 2021 Alternatives 2020 Int'lIntl Developed Equity Equity USU.S. -

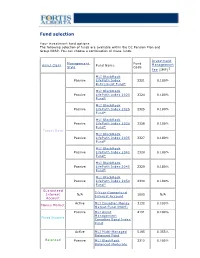

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

Brokerage Transfer

Brokerage Transfer ✓ Use this form to: Mail to: Express delivery only: • Transfer assets to T. Rowe Price Brokerage from another T. Rowe Price T. Rowe Price Mail Code 17150 institution. P.O. Box 17150 4515 Painters Mill Road ✗ Do not use this form to: Baltimore, MD 21297-1150 Owings Mills, MD 21117-4903 • Exchange between T. Rowe Price funds. This stamp indicates a signature guarantee is required. • Change ownership. Use the Change Ownership form. This paper clip indicates you may need to attach documentation. Trust, Estate, Corporation, or Other Entity Name (if applicable) TIN 1 T. Rowe Price Account A separate form is required for each account type or delivering institution. Delivering Firm Name Phone Check One Account Type: ¨ Individual ¨ Traditional or Rollover IRA ¨ Profit Sharing Plan (PSP) ¨ Joint ¨ Roth or Roth Rollover IRA ¨ Money Purchase Delivering Firm Address ¨ Trust ¨ Inherited IRA Pension Plan (MPP) ¨ Estate ¨ Roth Inherited IRA ¨ Individual 401(k) ¨ UGMA/UTMA ¨ SIMPLE IRA ¨ SEP-IRA City State ZIP Code ¨ Corporate or Other Entity For a new account, visit troweprice.com/newaccount to get an account ¨ For more owners, check this box and attach a separate page. number or write “new” and enclose one of these forms: • Brokerage New Account • Brokerage IRA New Account 3 Transfer Instructions • Brokerage Employer-Sponsored Retirement Plan New Account T. Rowe Price Brokerage Account Number Phone NOTE: Your current firm may charge a fee for transferring assets. Check one: ¨ Full transfer. Transfer all identically registered assets in kind. Owner Name (as it appears on statement) Social Security Number (SSN) Assets are moved as is and not sold. -

2005 Market St. Philadelphia, PA 19103-7094 for IMMEDIATE RELEASE DELAWARE

2005 Market St. Philadelphia, PA 19103-7094 FOR IMMEDIATE RELEASE DELAWARE INVESTMENTS GLOBAL DIVIDEND AND INCOME FUND, INC. AND DELAWARE ENHANCED GLOBAL DIVIDEND AND INCOME FUND ANNOUNCE APPROVAL OF PLAN OF REORGANIZATION PHILADELPHIA, September 21, 2011 — The Board of Directors of Delaware Investments Global Dividend and Income Fund, Inc. (NYSE: DGF) (“DGF”) and the Board of Trustees of Delaware Enhanced Global Dividend and Income Fund (NYSE: DEX) (“DEX”) today announced the final results of voting at the Joint Special Meeting of Shareholders (the “Special Meeting”) held on September 21, 2011. Shareholders of each Fund approved an Agreement and Plan of Reorganization (the “Plan of Reorganization”) providing for (i) the acquisition by DEX of substantially all of the assets and certain of the liabilities of DGF, in exchange for newly issued common shares of DEX; (ii) the distribution of such newly issued common shares of DEX to holders of common shares of DGF; and (iii) the dissolution of DGF thereafter. Common shares of DGF would be exchanged for common shares of DEX on a pro rata basis based on the relative net asset values of each Fund’s common shares. This transaction, which is expected to be tax-free, is currently anticipated to close at the close of business on October 21, 2011. In connection with this transaction, shareholders of DGF holding share certificates must send in such certificates before becoming eligible to receive distributions as DEX shareholders. DGF shareholders will be mailed specific instructions on how to send in their certificates. The Fund’s transfer agent, BNY Mellon Shareowner Services, can assist DGF shareholders in this process. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint. -

Blackrock International Limited Annual Best Execution Disclosure

BlackRock International Limited Annual Best Execution Disclosure 2019 June 2020 Contents Introduction Quantitative Analysis Top five entity reports for the transmission of orders Top five entity report for the execution of orders Securities Finance Transactions o Top five entity reports for the execution of orders Qualitative Analysis Equities Shares & Depository Receipts Equity derivatives: Futures & Options admitted to trading on a trading venue Interest rate derivatives: Futures & Options admitted to trading on a trading venue Currency derivatives: Futures & Options admitted to trading on a trading venue Commodities derivatives: Futures & Options admitted to trading on a trading venue Credit derivatives: Futures & Options admitted to trading on a trading venue Securitized derivatives: Warrants and certificate derivatives Equity derivatives: Swaps & other equity derivatives Contracts For Difference Debt instruments: Bonds Debt instruments: Money Market Instruments Interest rate derivatives: Swaps, forwards & other interest rates derivatives Credit derivatives: Other credit derivatives Currency derivatives: Swaps, forwards & other currency derivatives Commodities derivatives: Swaps and other commodities derivatives Structured Finance Instruments Exchange Traded Products Other Instruments Securities Finance Transactions BLACKROCK Annual Best Execution Disclosure 2019 | 2 Introduction The publication of this report is required under the Markets in Financial Instruments Directive 2014/65/EU (“MIFID II”) and it is designed to provide information on the top five execution venues* utilised by BlackRock to execute its clients’ orders, as well as the top five entities to which BlackRock transmitted its clients’ orders for execution. It also includes information on how BlackRock monitors the quality of its clients’ trades’ execution, on BlackRock’s conflicts of interest and other matters, as they relate to the execution by BlackRock of its clients’ trades. -

Now Live Rule

NOW LIVE RULE COLLATERAL SCHEDULES MADE EASY With RULE you can easily manage your collateral schedules so that you can be free to concentrate on driving performance for your business. RULE creates a flexible, collaborative and intelligent environment for the management of your collateral schedules. Negotiate schedules with your counterparties and receive feedback in real-time. So enhance the efficiency of your workflow and take full control of your collateral schedules with our new platform, designed to better integrate your needs – and our services. How It Works R R 1. Set up your criteria 2. Negotiate your schedules 3. Counterparty confirms 4. Schedule approved The Benefits of Digital Simplified, Streamlined Workflow Reduced Time-to-Market Transformation • Dedicated workflows and user • Self service workflow profiles (edit, approve, view) • Ready to use downloadable schedules As a result of our investment in • Easy access to all counterparty this technology, you’ll be able to • Electronic approval schedules streamline your end-to-end collateral schedule workflow. That doesn’t just • Increased visibility via a Risk Reduction dashboard on pending and active mean improved operational efficiency; • Allows for timely handling of changes collateral schedules it may also reduce your time-to-market in schedules during market stress as well as enhance your risk profile. • Collaborative tool scenarios Here’s how. • Full schedule visibility Through RULE, To learn more, contact us at: You’ll be able to … US APAC [email protected] [email protected] 1. Define your collateral eligibility criteria +1 212 815 6336 +81 3 6756 4326 2. Agree to your collateral schedules [email protected] electronically EMEA +61 2 92606663 3. -

Closed-End Strategy: Select Opportunity Portfolio 2021-2

Invesco Unit Trusts Closed-End Strategy: Select Opportunity Portfolio 2021-2 A specialty unit trust Trust specifi cs Objective Deposit information The Portfolio seeks to provide current income and the potential for capital appreciation. The Portfolio seeks Public offering price per unit1 $10.00 to achieve its objective by investing in a portfolio consisting of common stocks of closed-end investment 2 companies (known as “closed-end funds”) that invest in various global fixed income and equity securities. Minimum investment ($250 for IRAs) $1,000.00 As indicated by the information publicly available at the time of selection, none of the Portfolio’s closed-end Deposit date 04/07/21 funds employed “structured leverage”4. Termination date 04/05/23 † Distribution dates 25th day of each month Portfolio composition (As of the business day before deposit date) Record dates† 10th day of each month Covered Call High Yield Estimated initial distribution month† 05/21 BlackRock Enhanced Capital and Western Asset High Income Opportunity Term of trust Approximately 24 months Income Fund, Inc. CII Fund, Inc. HIO Historical 12 month distributions† $0.5793 BlackRock Enhanced Equity Dividend Trust BDJ Western Asset High Yield Defi ned Opportunity NLEV212 Sales charge and CUSIPs Columbia Seligman Premium Technology Fund, Inc. HYI Brokerage Growth Fund, Inc. STK Investment Grade Sales charge3 Eaton Vance Tax-Managed Global Diversifi ed Invesco Bond Fund VBF Deferred sales charge 2.25% Equity Income Fund EXG Sector Equity Creation and development fee 0.50% First Trust Enhanced Equity Income Fund FFA Blackrock Health Sciences Trust II BMEZ Total sales charge 2.75% Nuveen Dow 30sm Dynamic Overwrite Fund DIAX Last deferred sales charge payment date 04/10/22 BlackRock Science & Technology Trust II BSTZ Emerging Market Equity CUSIPs BlackRock Utilities, Infrastructure & Power Voya Emerging Markets High Dividend Cash 46148V-26-3 Opportunities Trust BUI Equity Fund IHD Reinvest 46148V-27-1 Tekla Healthcare Investors HQH Historical 12 month distribution rate† 5.79% Global Equity U.S. -

Stfx Enrolment Guide

my money @ work Start saving guide it’s time to save Welcome to my money @ work Millions of Canadians participate in workplace retirement and savings plans. Now, it’s your turn because it’s your money and your future. Saving at work helps you meet your financial goals whether you’re just starting your career, midway through it or close to retirement. And this guide has what you need to get started: practical savings information to help you save and enrol in the Improved Retirement Plan for Teaching, Administration & Other Employees of St. Francis Xavier University. Being part of the Sun Life Financial community has its advantages. From making the most of your workplace plan to helping you plan for your financial future, my money @ work and Sun Life Financial are here for you. To take advantage of your dedicated Sun Life Financial Customer Care Centre representative, call 1-866-733-8612 from 8 a.m. to 8 p.m. ET any business day. Service is available in more than 190 languages. Group Retirement Services are provided by Sun Life Assurance Company of Canada, 2 aSun member Life Financial of the Sun Life Financial group of companies. Three easy steps… 1 READ 4 my money @ work Why save now? My plan What’s in it for me? 2 INVEST 9 my investments A choice of investment approaches Diverse selection of investment options Investment risk profiler 3 ENROL 15 mysunlife.ca It’s action time! We’re with you World of information & tools FORMS 18 my money @ work 3 READ 4 Sun Life Financial my money @ work There is no better way to save for your future than through your plan @ work. -

Pursuing Long-Term Value for Our Clients

Pursuing long-term value for our clients BlackRock Investment Stewardship A look into the 2020-2021 proxy voting year Executive Contents summary 03 By the Voting outcomes numbers Board quality and effectiveness Incentives aligned with value creation 18 Climate and natural capital Strategy, purpose, and financial resilience Company impacts on people Appendix 71 21 This report covers BlackRock Investment Stewardship’s (BIS) stewardship activities — focusing on proxy voting — covering the period from July 1, 2020 to June 30, 2021, representing the U.S. Securities and Exchange Commission’s 12-month reporting period for U.S. mutual funds, including iShares. Throughout the report we commonly refer to this reporting period as “the 2020-21 proxy year.” While we believe the information in this report is accurate as of June 30, 2021, it is subject to change without notice for a variety of reasons. As a result, subsequent reports and publications distributed may therefore include additional information, updates and modifications, as appropriate. The information herein must not be relied upon as a forecast, research, or investment advice. BlackRock is not making any recommendation or soliciting any action based upon this information and nothing in this document should be construed as constituting an offer to sell, or a solicitation of any offer to buy, securities in any jurisdiction to any person. References to individual companies are for illustrative purposes only. BlackRock Investment Stewardship 2 SUMMARY NUMBERS OUTCOMES APPENDIX Executive summary BlackRock Investment Stewardship Our Investment Stewardship (BIS) advocates for sound corporate toolkit governance and sustainable business Engaging with companies models that can help drive the long- How we build our term financial returns that enable our understanding of a clients to meet their investing goals. -

Blackrock UK Income Fund

Annual report BlackRock UK Income Fund For the year ended 28 February 2019 Contents General Information Manager & Registrar General Information 2 BlackRock Fund Managers Limited About the Fund 3 12 Throgmorton Avenue, London EC2N 2DL Investment Objective & Policy 3 Member of The Investment Association and authorised and regulated by the Financial Conduct Authority (“FCA”). Fund Managers 3 Directors of the Manager G D Bamping* C L Carter M B Cook (appointed 2 May 2018) W I Cullen* Significant Events 3 R A Damm (resigned 31 December 2018) R A R Hayes A M Lawrence Risk and Reward Profile 4 L E Watkins (appointed 16 May 2018, resigned 1 March 2019) M T Zemek* Performance Table 5 * Non-executive Director. Classification of Investments 6 Trustee* & Custodian The Bank of New York Mellon (International) Limited Investment Report 8 One Canada Square, London E14 5AL Performance Record 10 Authorised by the Prudential Regulation Authority and regulated by the FCA and the Prudential Distribution Tables 14 Regulation Authority. * On 18 June 2018 the Trustee changed from BNY Mellon Trust & Depositary (UK) Limited to The Bank of New York Mellon (International) Limited. Report on Remuneration 16 Portfolio Statement 22 Investment Manager BlackRock Investment Management (UK) Limited Statement of Total Return 25 12 Throgmorton Avenue, London EC2N 2DL Statement of Change in Net Assets Attributable to Unitholders 25 Authorised and regulated by the FCA. Balance Sheet 26 Securities Lending Agent Notes to Financial Statements 27 BlackRock Advisors (UK) Limited 12 Throgmorton Avenue, London EC2N 2DL Statement of Manager’s Responsibilities 44 Authorised and regulated by the FCA.