FORM 10-K/A Dell Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

Case 3:14-cv-03264-JD Document 1709 Filed 06/26/17 Page 1 of 17 1 2 3 4 5 6 7 8 9 10 11 UNITED STATES DISTRICT COURT 12 NORTHERN DISTRICT OF CALIFORNIA 13 SAN FRANCISCO DIVISION 14 IN RE: CAPACITORS ANTITRUST MASTER FILE NO. 3:14-cv-03264-JD LITIGATION 15 [PROPOSED] FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO 16 THIS DOCUMENT RELATES TO: DEFENDANT OKAYA ELECTRIC INDUSTRIES CO., LTD. 17 ALL INDIRECT PURCHASER ACTIONS 18 19 20 21 22 23 24 25 26 27 28 Law Offices Final Judgment of Dismissal with Prejudice as to Approval of Settlements with Defendant Okaya Electric Industries Co., Ltd.; COTCHETT, PITRE & Case No. 3:14-cv-03264-JD MCCARTHY, LLP Case 3:14-cv-03264-JD Document 1709 Filed 06/26/17 Page 2 of 17 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not enter Final Judgment as to Defendant Okaya Electric Industries Co., Ltd. 3 (“Okaya”). The Court, having reviewed the settlement agreement between Plaintiffs Michael 4 Brooks, CAE Sound, Steve Wong, Toy-Knowlogy Inc., AGS Devices, Ltd., J&O Electronics, 5 Nebraska Dynamics, Inc., Angstrom, Inc., MakersLED, In Home Tech Solutions, Inc., 6 individually and on behalf of the Indirect Purchaser Class they seek to represent, on the one hand, 7 and Okaya, on the other, dated April 14, 2016 (the “Settlement Agreement”); Indirect Purchasers’ 8 Motion for Final Approval of Settlements with Defendants NEC TOKIN, Nitsuko and Okaya; the 9 pleadings and other papers on file in this action; and the statements of counsel and the parties, 10 including at the July 6, 2017 Fairness Hearing, hereby finds no just reason to delay the entry of 11 Final Judgment under Federal Rule of Civil Procedure 54(b). -

Dell Inc (4331) 10-K

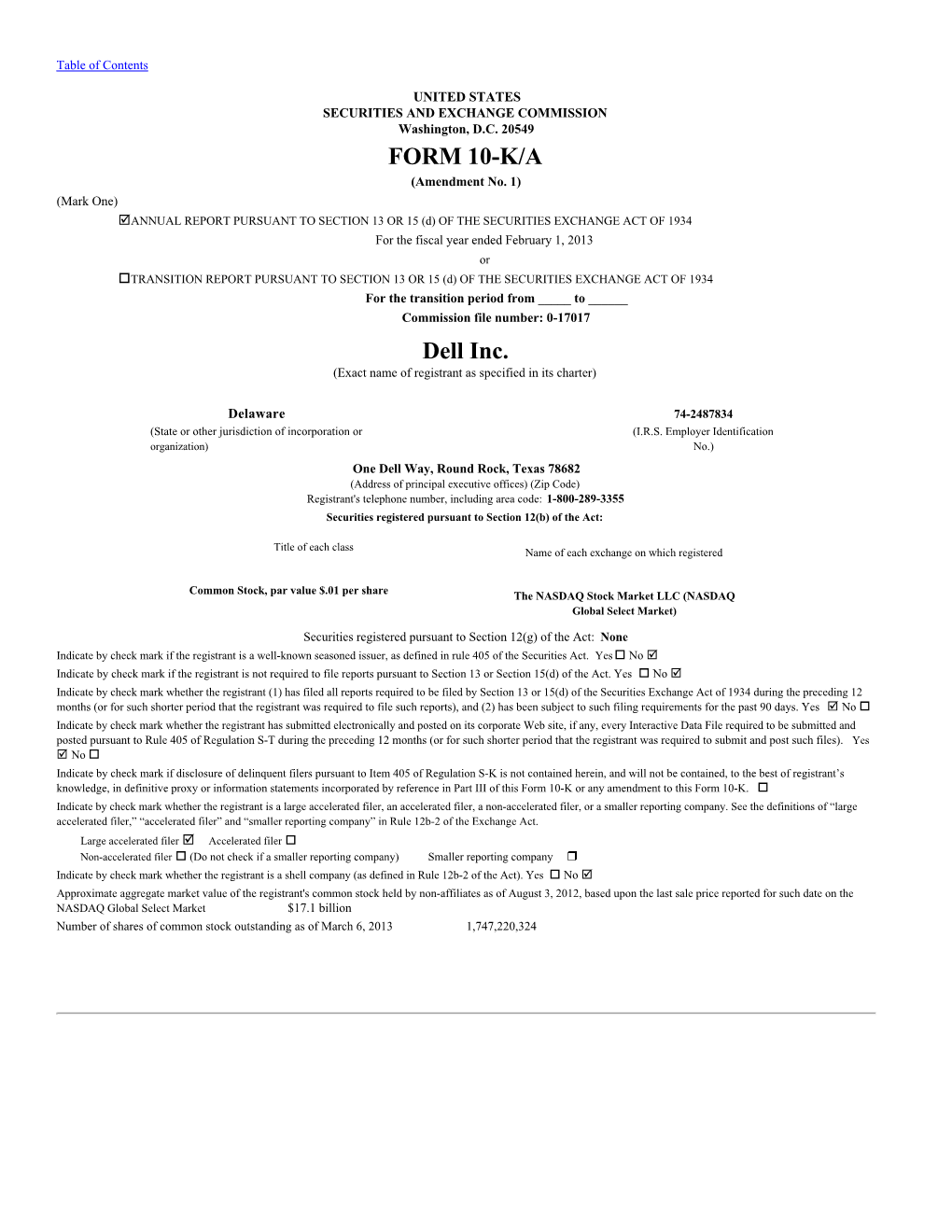

DELL INC (4331) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/13/2012 Filed Period 02/03/2012 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 3, 2012 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 0-17017 Dell Inc. (Exact name of registrant as specified in its charter) Delaware 74-2487834 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) One Dell Way, Round Rock, Texas 78682 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: 1-800-BUY-DELL Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $.01 per share The NASDAQ Stock Market LLC (NASDAQ Global Select Market) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No R Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No R Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 1 of 74 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 OAKLAND DIVISION 11 IN RE: LITHIUM ION BATTERIES Case No. 13-md-02420-YGR ANTITRUST LITIGATION 12 MDL No. 2420 13 FINAL JUDGMENT OF DISMISSAL This Document Relates To: WITH PREJUDICE AS TO LG CHEM 14 DEFENDANTS ALL DIRECT PURCHASER ACTIONS 15 AS MODIFIED BY THE COURT 16 17 18 19 20 21 22 23 24 25 26 27 28 FINAL JUDGMENT OF DISMISSAL WITH PREJUDICE AS TO LG CHEM DEFENDANTS— Case No. 13-md-02420-YGR Case 4:13-md-02420-YGR Document 2321 Filed 05/16/18 Page 2 of 74 1 This matter has come before the Court to determine whether there is any cause why this 2 Court should not approve the settlement between Direct Purchaser Plaintiffs (“Plaintiffs”) and 3 Defendants LG Chem, Ltd. and LG Chem America, Inc. (together “LG Chem”), set forth in the 4 parties’ settlement agreement dated October 2, 2017, in the above-captioned litigation. The Court, 5 after carefully considering all papers filed and proceedings held herein and otherwise being fully 6 informed, has determined (1) that the settlement agreement should be approved, and (2) that there 7 is no just reason for delay of the entry of this Judgment approving the settlement agreement. 8 Accordingly, the Court directs entry of Judgment which shall constitute a final adjudication of this 9 case on the merits as to the parties to the settlement agreement. -

Capacitors Exclusions 2017-06-06.Xlsx

Case 3:14-cv-03264-JD Document 1705-4 Filed 06/26/17 Page 1 of 13 EXHIBIT D Case 3:14-cv-03264-JD Document 1705-4 Filed 06/26/17 Page 2 of 13 In re Capacitors Antitrust Litigation Exclusion Report Name Exclusion ID # Postmark Date 1 Acer, Inc. 41778552-1 2/10/2017 2 Acer America Corporation 41778552-2 2/10/2017 3 Gateway, Inc. 41778552-3 2/10/2017 4 Gateway U.S. Retail, Inc (f/k/a eMachines, Inc) 41778552-4 2/10/2017 5 Packard Bell B.V. 41778552-5 2/10/2017 6 BlackBerry Limited (f/k/a Research in Motion Limited) 41778553-1 2/15/2017 7 BlackBerry Corporation (f/k/a Research in Motion Corporation) 41778553-2 2/15/2017 8 BlackBerry Singapore Pte. Limited (f/k/a Research in Motion Singapore Pte. Limited) 41778553-3 2/15/2017 9 BlackBerry UK Limited (f/k/a Research in Motion UK Limited 41778553-4 2/15/2017 10 Plexus Corp. 41778554-1 2/14/2017 11 Plexus Asia, Ltd. 41778554-2 2/14/2017 12 Plexus Corp. Limited 41778554-3 2/14/2017 13 Plexus Corporation (UK) Limited 41778554-4 2/14/2017 14 Plexus Deutschland GmbH 41778554-5 2/14/2017 15 Plexus Electronica S. de R.L. de C.V. 41778554-6 2/14/2017 16 Plexus (Hangzhou) Co., Ltd. 41778554-7 2/14/2017 17 Plexus International Services, Inc. 41778554-8 2/14/2017 18 Plexus Intl. Sales & Logistics, LLC 41778554-9 2/14/2017 19 Plexus Manufacturing Sdn. -

Why the Dell / EMC Combination Makes Sense for Customers

Why the Dell / EMC Combination Makes Sense for Customers Synergistic product portfolio and go-to-market strategies have potential to set IT customers up for success in the digital economy Executive Summary One of the biggest technology deals in history at over $60 billion is about to unfold as Dell prepares to buy EMC. At EMC World in May 2016, Michael Dell made this acquisition more real than ever when he announced the new entity’s name, Dell Technologies, which will be an umbrella brand for the collection of companies that will include enterprise and client solutions and services, and other strategic assets including VMware, Pivotal, RSA, Virtustream, and SecureWorks. With just a few major milestones to go, it appears that all is on track for the companies to merge the enterprise organizations as Dell EMC under the umbrella brand and to begin operating as one by around mid-year. Dell and EMC are positioning themselves as the path to the cloud for IT customers. Moor Insights & Strategy (MI&S) believes Dell’s leadership in compute and EMC’s leadership in storage and converged infrastructure have the potential to become building blocks for a one-stop shop for enterprise datacenter customers. Other assets such as security, virtualization software, and cloud solutions can help round out the portfolio. Moreover, Dell’s client computing business and IoT practices can bring insight into client computing and IoT models that will be key drivers for future datacenter requirements. Dell EMC should focus on continuing to build up their networking business and making it a more cohesive part of their end-to-end datacenter story. -

In the Court of Chancery of the State of Delaware City

EFiled: Feb 19 2013 09:26AM EST Transaction ID 49611480 Case No. 8329 IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE CITY OF ROSEVILLE EMPLOYEES RETIREMENT SYSTEM, Plaintiff, Civil Action No. v. DELL, INC., MICHAEL DELL, JAMES W. BREYER, DONALD J. CARTY, JANET F. CLARK, LAURA CONIGLIARO, KENNETH M. DUBERSTEIN, WILLIAM H. GRAY, III, GERARD J. KLEISTERLEE, KLAUS S. LUFT, ALEX J. MANDL, SHANTANU NARAYEN, ROSS PEROT, JR., DENALI HOLDING INC., DENALI INTERMEDIATE INC., DENALI ACQUIROR INC., SILVER LAKE PARTNERS, L.P., SILVER LAKE PARTNERS III, L.P., SILVER LAKE PARTNERS IV, L.P., SILVER LAKE TECHNOLOGY INVESTORS III, L.P., and MSDC MANAGEMENT, L.P., Defendants. VERIFIED CLASS ACTION COMPLAINT City of Roseville Employees’ Retirement System (“Plaintiff”), by and through its undersigned counsel, upon knowledge as to itself and upon information and belief as to all other matters, alleges as follows: NATURE OF THE ACTION 1. This action challenges Michael Dell’s attempt to take Dell, Inc. (“Dell” or the “Company”) private in a transaction (the “Going Private Transaction”) that offers Dell’s public shareholders an egregiously unfair price and threatens to foreclose them from sharing in any of the benefits to be obtained by the Company’s unfolding turnaround plan. The Going Private Transaction offers Dell’s public shareholders $13.65 per share – a price so patently unfair that it prompted one shareholder to question whether company insiders are “trying to steal the company because of current market conditions.” The $13.65 per share purchase price is approximately 3% less than the price at which the stock was trading just days prior to the Transaction’s announcement, represents only a 25% premium over the stock’s trading price before news of a potential transaction was reported, and amounts to a 34% discount from the prices at which Dell was trading a year ago. -

Notice of Annual Meeting and Proxy Statement 2011

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT 2011 May 26, 2011 Dear Fellow Stockholders: On behalf of the Board of Directors, it is my pleasure to invite you to Dell’s 2011 Annual Meeting of Stockholders. The meeting will be held on Friday, July 15, 2011, at 8:00 a.m., Central Daylight Time, at the Dell Round Rock Campus, 501 Dell Way, Building 2-East, Houston/Dallas conference rooms, Round Rock, Texas 78682. For your convenience, we are also offering a live Webcast of the meeting. You may attend and participate in the meeting via the Internet at www.dell.com/investor, where you will be able to vote electronically and submit questions during the meeting. If you choose to view the Webcast, go to www.dell.com/investor shortly before the meeting time and follow the instructions provided. If you miss the meeting, you can view a replay of the Webcast on that site. You will find information regarding the matters to be voted on in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. We are sending many of our stockholders a notice regarding the availability of this proxy statement, our Annual Report on Form 10-K for Fiscal 2011 and other proxy materials via the Internet. This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. A paper copy of these materials may be requested using one of the methods described in the materials. You may visit www.dell.com/investor to access an interactive Fiscal 2011 Year-in-Review, as well as various web-based reports, executive messages and timely information on Dell’s global business. -

90'S 10'S 00'S 80'S

Dell Canada 25 years of celebrates it’s 20’s Dell in Canada 25 anniversary 2013 on May 26. Since its founding 25 years ago Dell Canada has listened to its customers and delivered innovative • Dell among the first to introduce touch enabled technology and services that give Windows 8 devices. them the power to do more. • Dell named among Greater Toronto Area’s top 95 employers by Canada’s top employers. • Dell named Polycultural Immigration and dell.ca Community Services (PICS) employer of the year. • Dell announces its first Canadian Powering the Possible partnership – recipient is Boys and 2012 Girls Club Canada. 10’s • Acquisitions include AppAssure, SonicWALL, Clerity, Make Technologies, Wyse, Quest, Gale Technologies and Credant. • Named on the Maclean's/Jantzi-Sustainalytics list 2011 of the Top 50 socially responsible corporations in Canada for 2011, 2012 and 2013. • Dell Canada recognized by the Progressive Employers of Canada for its contribution to leading change in the workplace for working parents and their families. • Dell makes several key acquisitions including Boomi®, 2010 • Dell acquires Perot Systems and launches Dell™ Exanet, InSite One®, KACE™, Ocarina™ Networks, Services, giving customers end-to-end IT services Scalent™ and Dell Compellent®. to help lower total cost of IT ownership. 2009 • First retail engagement in Canada. 2008 • Channel partner program introduced in Canada. • Dell ramps up its social media • Dell acquires storage leader EqualLogic™. 2007 eorts – joins Twitter and creates IdeaStorm.com • Dell Canada ranked No. five on the list of • Dell tops the list of "America’s most admired “Most admired corporate cultures” in Canada. -

USCIS - H-1B Approved Petitioners Fis…

5/4/2010 USCIS - H-1B Approved Petitioners Fis… H-1B Approved Petitioners Fiscal Year 2009 The file below is a list of petitioners who received an approval in fiscal year 2009 (October 1, 2008 through September 30, 2009) of Form I-129, Petition for a Nonimmigrant Worker, requesting initial H- 1B status for the beneficiary, regardless of when the petition was filed with USCIS. Please note that approximately 3,000 initial H- 1B petitions are not accounted for on this list due to missing petitioner tax ID numbers. Related Files H-1B Approved Petitioners FY 2009 (1KB CSV) Last updated:01/22/2010 AILA InfoNet Doc. No. 10042060. (Posted 04/20/10) uscis.gov/…/menuitem.5af9bb95919f3… 1/1 5/4/2010 http://www.uscis.gov/USCIS/Resource… NUMBER OF H-1B PETITIONS APPROVED BY USCIS IN FY 2009 FOR INITIAL BENEFICIARIES, EMPLOYER,INITIAL BENEFICIARIES WIPRO LIMITED,"1,964" MICROSOFT CORP,"1,318" INTEL CORP,723 IBM INDIA PRIVATE LIMITED,695 PATNI AMERICAS INC,609 LARSEN & TOUBRO INFOTECH LIMITED,602 ERNST & YOUNG LLP,481 INFOSYS TECHNOLOGIES LIMITED,440 UST GLOBAL INC,344 DELOITTE CONSULTING LLP,328 QUALCOMM INCORPORATED,320 CISCO SYSTEMS INC,308 ACCENTURE TECHNOLOGY SOLUTIONS,287 KPMG LLP,287 ORACLE USA INC,272 POLARIS SOFTWARE LAB INDIA LTD,254 RITE AID CORPORATION,240 GOLDMAN SACHS & CO,236 DELOITTE & TOUCHE LLP,235 COGNIZANT TECH SOLUTIONS US CORP,233 MPHASIS CORPORATION,229 SATYAM COMPUTER SERVICES LIMITED,219 BLOOMBERG,217 MOTOROLA INC,213 GOOGLE INC,211 BALTIMORE CITY PUBLIC SCH SYSTEM,187 UNIVERSITY OF MARYLAND,185 UNIV OF MICHIGAN,183 YAHOO INC,183 -

Dell's $3.9 Billion Perot Gamble

Sept. 25, 2009 InformationWeekanalytics.com Analytics Alerts Dell’s $3.9 Billion Perot Gamble Contents Dell faces numerous obstacles, including integration 2 Dell’s Perot Bid A $3.9 Billion challenges and wary customers, as it looks Gamble to become a player in the tech services market. 5 Dell’s Acquisition Of Perot Helps Healthcare Push But it’s on the right track. 6 Dell Buys Perot: Told You So! 7 Dell-Perot Cash-Outs And The Media’s ‘Windfall’ Idiocy Dell’s Perot Gamble InformationWeekanalytics.com Analytics Alerts Sept. 22, 2009 Dell’s Perot Bid A $3.9 Billion Gamble By Paul McDougall DELL’S $3.9 BILLION DEAL TO ACQUIRE PEROT SYSTEMS could be a boon to its own sagging fortunes and to business customers looking to implement new architectures like virtu- alization and cloud computing. But the PC and server maker will have to manage thorny inte- gration issues as it absorbs a company known for its rigid, by-the-book culture and reliance on a market-healthcare-where Dell has little experience. On top of these issues, Dell is a relative neophyte when it comes to IT services and M&As. Not that there isn’t a plan. Dell wants to marry its hardware and automation software with Perot’s integration and out- sourcing services so it can offer end-to-end “solutions,” mirror- ing earlier moves by rivals Hewlett-Packard and IBM. The parts are all there-in theory at least. Dell has the iron and applica- tions needed for advanced data centers. It bundles VMware’s View virtual desktop offering Does Perot give Dell with its Latitude and Optiplex [a winning hand? PCs and PowerEdge servers to create an off-the-shelf virtualization package. -

Dell Inc(Dell) 10-K

DELL INC (DELL) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/15/2011 Filed Period 01/28/2011 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended January 28, 2011 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 0-17017 Dell Inc. (Exact name of registrant as specified in its charter) Delaware 74-2487834 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) One Dell Way, Round Rock, Texas 78682 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: 1-800-BUY-DELL Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $.01 per share The NASDAQ Stock Market LLC (NASDAQ Global Select Market) Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

This Document Is a Confidential Filing. Access Is Prohibited Except As Authorized by Court Order. in the Court of Chancery of Th

EFiled: Jun 09 2020 05:25PM EDT Transaction ID 65687317 Case No. 2020-0440-KSJM IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE KENIA LOPEZ, Plaintiff, C.A. No. 2020-0440-KSJM v. PUBLIC [REDACTED] DELL TECHNOLOGIES INC., VERSION AS FILED VMWARE, INC., MICHAEL S. ON JUNE 9, 2020 DELL, ROBERT C. MEE, and CYNTHIA GAYLOR, Defendants. VERIFIED CLASS ACTION COMPLAINT Plaintiff Kenia Lopez, on behalf of herself and similarly situated former public stockholders of Pivotal Software, Inc. (“Pivotal” or the “Company”), brings this Verified Class Action Complaint asserting breach of fiduciary duty claims stemming from VMware, Inc.’s (“VMware”) 2019 acquisition of Pivotal (the “Acquisition”) against (i) Pivotal’s controlling stockholders Michael S. Dell (“M. Dell”), Dell Technologies Inc. (“Dell”), and VMware, (ii) M. Dell and Pivotal’s CEO Robert Mee in their capacity as former members of Pivotal’s board of directors (the “Board”), and (iii) Mee and former Pivotal CFO Cynthia Gaylor in their capacity as former Pivotal officers; as well as (iv) a claim against VMware for aiding and abetting the foregoing breaches. THIS DOCUMENT IS A CONFIDENTIAL FILING. ACCESS IS PROHIBITED EXCEPT AS AUTHORIZED BY COURT ORDER. The allegations are based on Plaintiff’s knowledge as to herself, and on information and belief, including counsel’s investigation, review of publicly available information, and review of books and records produced by the Company in response to Plaintiff’s demand made under 8 Del. C. § 220 (the “220 Production”), as to all other matters. NATURE OF THE ACTION 1. M. Dell, Dell, and VMware (together, the “Controller Defendants”) exploited their fiduciary positions as Pivotal’s controlling stockholders by orchestrating an opportunistic “take private” transaction to serve their self-interest at the expense of Pivotal’s Class A stockholders.