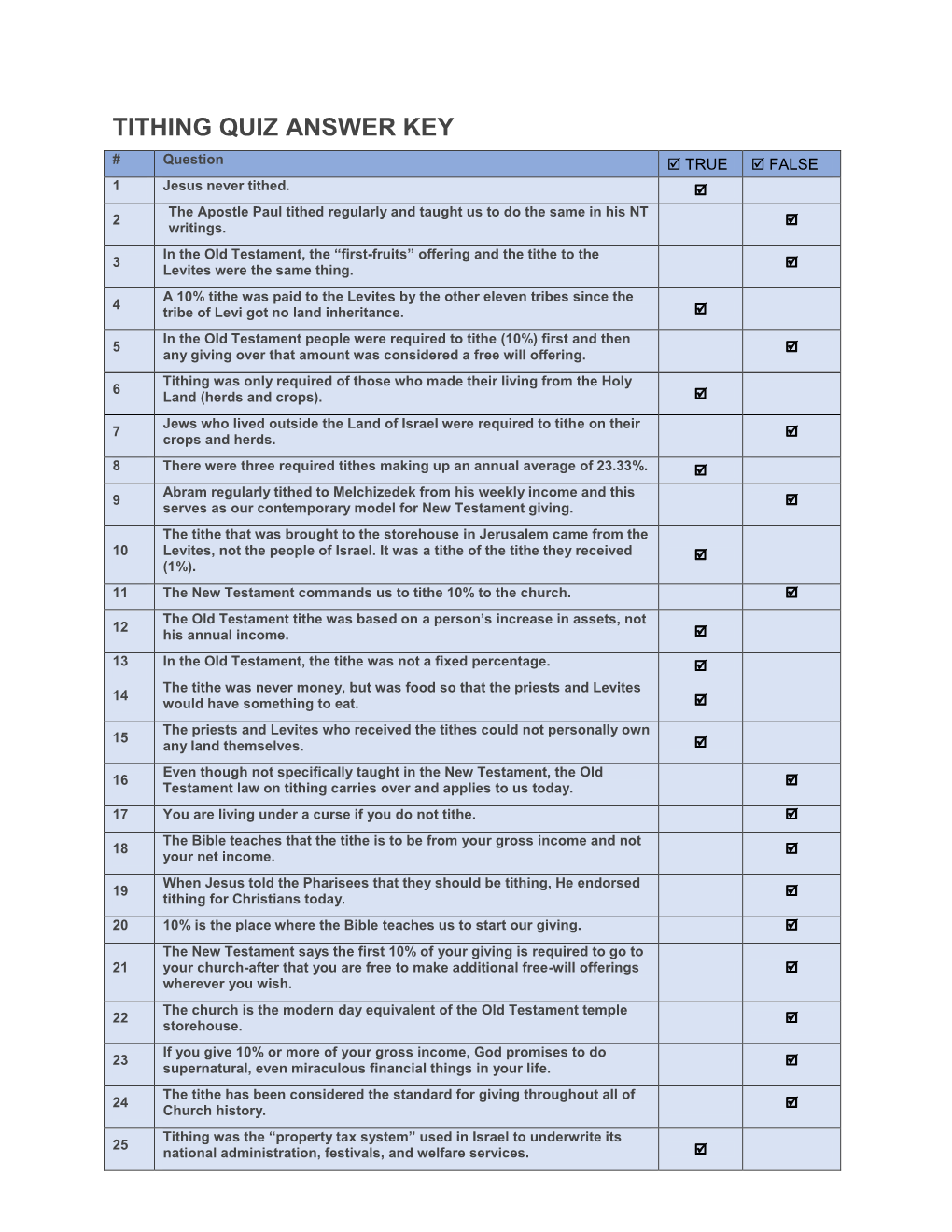

Tithing Quiz Answer Key

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

History of the Jews Vol. V

History of the Jews Vol. V By Heinrich Graetz HISTORY OF THE JEWS CHAPTER I CHMIELNICKI AND THE PERSECUTION OF THE JEWS OF POLAND BY THE COSSACKS Condition of the Jews in Poland before the Outbreak of Persecution— Influence of the Jesuits—Characteristics of Poles and Jews—The Home of the Cossacks—Repression of the Cossacks by the Government—Jews appointed as Tax Farmers—Jurisdiction of the Synods—The Study of the Talmud in Poland—Hebrew Literature in that Country becomes entirely Rabbinical—Character of Polish Judaism—Jews and Cossacks— Chmielnicki—Sufferings of the Jews in consequence of his Successes—The Tartar Haidamaks—Fearful Massacres in Nemirov, Tulczyn, and Homel— Prince Vishnioviecki—Massacres at Polonnoie, Lemberg, Narol, and in other Towns—John Casimir—Lipmann Heller and Sabbataï Cohen—Renewal of the War between Cossacks and Poles—Russians join Cossacks in attacking the Jews—Charles X of Sweden—The Polish Fugitives—"Polonization" of Judaism. 1648–1656 C. E. Poland ceased to be a haven for the sons of Judah, when its short-sighted kings summoned the Jesuits to supervise the training of the young nobles and the clergy and crush the spirit of the Polish dissidents. These originators of disunion, to whom the frequent partition of Poland must be attributed, sought to undermine the unobtrusive power which the Jews, through their money and prudence, exercised over the nobles, and they combined with their other foes, German workmen and trades-people, members of the guilds, to restrict and oppress them. After that time there were repeated persecutions of Jews in Poland; sometimes the German guild members, sometimes the disciples of the Jesuits, raised a hue and cry against them. -

Common Law and Jewish Law. the Diasporic Principle of Dina De-Malkhuta Dina

Behemoth. A Journal on Civilisation 2008, 2 (39–53) Common Law and Jewish Law. The Diasporic Principle of dina de-malkhuta dina Sylvie Anne Goldberg Abstract Medieval rabbis conceived of a legal framework for the relations between Jews and non-Jews according to a principle: dina de-malkhuta dina , ‘the Law of the Kingdom is Law.’ This framework depended on the fact that Jews were living in Galut, Diaspora. Thus, the notion of Diaspora, which in the last century came to be used to refer to the fate of migrants in general, bears a dual legal connotation in Judaism. This article tries first, by tracing back the origin of the word “galut” or “golah” (translated as “exile”) in An- tiquity, to demonstrate how it is related to the core of Jewish definitions of the “present” as construed by Rabbinic Judaism. It then ventures across the boundaries of time and place to question the purely theolog- ical and particularly Jewish evolution of this concept. It is an attempt to apprehend the ways in which the evolution of the notion of Diaspora bears witness to the transformation of the history of the Jews. Keywords: Jerusalem; Diaspora; Exile; Jewishness; Law; dina de-malkhuta dina “And I spoke […] saying: ‘Bring your necks under the yoke of the king of Babylon, and serve him and his people, and live. Why will ye die, thou and thy people, by the sword, by the famine, and by the pestilence, as the LORD hath spoken concerning the nation that will not serve the king of Babylon? And hearken not unto the words of the prophets that speak unto you, saying: Ye shall not serve the king of Babylon, for they prophesy a lie unto you. -

Tithing in 10 Baby Steps

Tithing in 10 Baby Steps A Users Guide to The Great Tithe Experiment Mike McGuire 1 This is written for you. You wanted to tithe. Now is the time. 2 The Ten Baby Steps Preface 4 1 Ask “Why?” 5 2 Ask “Why Not?” 12 3 Commit 16 4 Calculate 19 5 Count the Cost 21 6 Develop a Plan 24 7 Determine the Method 27 8 Give Now 29 9 Persevere Through Challenges 31 10 Enjoy the Benefits 33 About the Author 36 The Great Tithe Experiment 37 Notes 38 3 Preface Dear Reader, I want to help you to fulfill your desire to give. This short book takes a big step of faith and breaks it into small baby steps. I have found tithing to be one of the most fruitful spiritual disciplines resulting in a closer relationship to God and a further separation from material pursuits. Our church recently conducted an experiment to measure the effects of tithing. In total, 52 individuals participated, which included 13 households, who started tithing for the first time. You’ll receive highlights of their story in this ebook. A richer spiritual life is only 10 baby steps away. I hope you will join us. Mike McGuire 4 1 Ask “Why?” Tithing is a simple concept. It means donating 10% of your income to your local church. It’s simple, but for many Americans, not easy. One couple who took the experiment remarked, “I wrote my first check and said, ‘Oh, my gosh, that is a lot of money!’ ” The first question to ask is, “Why?” Why in the world would one give away their hard-earned income? And, why 10%? Baby Step #1 – Ask “Why?” Why should you give 10% of your income to a local church? Those are fair and appropriate questions. -

The Crucifiable Jesus

The Crucifiable Jesus Steven Brian Pounds Peterhouse Faculty of Divinity University of Cambridge This dissertation is submitted for the degree of Doctor of Philosophy February 2019 This thesis is the result of my own work and includes nothing which is the outcome of work done in collaboration except as declared in the Preface and specified in the text. It is not substantially the same as any that I have submitted, or, is being concurrently submitted for a degree or diploma or other qualification at the University of Cambridge or any other University or similar institution except as declared in the Preface and specified in the text. I further state that no substantial part of my thesis has already been submitted, or, is being concurrently submitted for any such degree, diploma or other qualification at the University of Cambridge or any other University or similar institution except as declared in the Preface and specified in the text. It does not exceed the prescribed word limit for the relevant Degree Committee Steven Brian Pounds “The Crucifiable Jesus” Abstract: In recent decades, scholars have both used Jesus’ crucifixion as a criterion of historicity and employed the rhetoric of a “crucifiable Jesus”– suggesting that some historical reconstructions of Jesus more plausibly explain his crucifixion than others. This dissertation tests the grounds of these proposals, whilst offering its own reconstruction of a crucifiable Jesus. It first investigates primary source depictions of Roman crucifixion and focuses upon the offences for which crucifixions were carried out. As a first level conclusion, it determines that, in a formal sense, a bare appeal to crucifiability or to a criterion of crucifixion does not yield what it purports to deliver because a wide range of offences were punishable by crucifixion. -

An Analysis of the Graded Property Tax Robert M

TaxingTaxing Simply Simply District of Columbia Tax Revision Commission TaxingTaxing FairlyFairly Full Report District of Columbia Tax Revision Commission 1755 Massachusetts Avenue, NW, Suite 550 Washington, DC 20036 Tel: (202) 518-7275 Fax: (202) 466-7967 www.dctrc.org The Authors Robert M. Schwab Professor, Department of Economics University of Maryland College Park, Md. Amy Rehder Harris Graduate Assistant, Department of Economics University of Maryland College Park, Md. Authors’ Acknowledgments We thank Kim Coleman for providing us with the assessment data discussed in the section “The Incidence of a Graded Property Tax in the District of Columbia.” We also thank Joan Youngman and Rick Rybeck for their help with this project. CHAPTER G An Analysis of the Graded Property Tax Robert M. Schwab and Amy Rehder Harris Introduction In most jurisdictions, land and improvements are taxed at the same rate. The District of Columbia is no exception to this general rule. Consider two homes in the District, each valued at $100,000. Home A is a modest home on a large lot; suppose the land and structures are each worth $50,000. Home B is a more sub- stantial home on a smaller lot; in this case, suppose the land is valued at $20,000 and the improvements at $80,000. Under current District law, both homes would be taxed at a rate of 0.96 percent on the total value and thus, as Figure 1 shows, the owners of both homes would face property taxes of $960.1 But property can be taxed in many ways. Under a graded, or split-rate, tax, land is taxed more heavily than structures. -

Addendum General Information1

ADDENDUM GENERAL INFORMATION1 TABLE OF CONTENTS Pennsylvania ......................................................... A-43 Addendum – General Information ......................... A-1 Puerto Rico ........................................................... A-44 United States ......................................................... A-2 Rhode Island ......................................................... A-45 Alabama ................................................................. A-2 South Carolina ...................................................... A-45 Alaska ..................................................................... A-2 South Dakota ........................................................ A-46 Arizona ................................................................... A-3 Tennessee ............................................................. A-47 Arkansas ................................................................. A-5 Texas ..................................................................... A-47 California ................................................................ A-6 Utah ...................................................................... A-48 Colorado ................................................................. A-8 Vermont................................................................ A-49 Connecticut ............................................................ A-9 Virginia ................................................................. A-50 Delaware ............................................................. -

Halacha a Crash Course in Teruma and Maaser 1. Mishna Rosh Hashana 1:1 אַרְבָּעָּהרָּ אשֵׁ ישָּ נִיםהֵׁם

Why Tu Bishvat Matters: Halacha A Crash Course in Teruma and Maaser 1. Mishna Rosh Hashana 1:1 ַאְרָּבָּעה ָּראֵׁשי ָּשִנים ֵׁהם. ְבֶאָּחד ְבִניָּסן רֹאש ַהָּשָּנה ַלְמָּלִכים ְוָּלְרָּגִלים. ְבֶאָּחד ֶבֱאלּול רֹאש ַהָּשָּנה לְמַעְשַ רבְ הֵׁמָּ ה . ַרִבי ֶאְלָּעָּזר ְוַרִבי ִשְמעֹון אֹוְמִרים, ְבֶאָּחד ְבִתְשֵׁר י. ְבֶאָּחד ְבִתְשֵׁרי רֹאש ַהָּשָּנה ַלָּשִנים ְוַלְשִמִטין ְוַלּיֹוְבלֹות, ַלְנִטיָּעה ְוַלְיָּרקֹות. ְבֶאָּחד ִבְשָּבט, רֹאש ַהָּשָּנה ָּלִאיָּלן, ְכִדְבֵׁרי ֵׁבית ַשַמאי. בֵׁית הִ לֵׁל אֹוְמִרים, ַבֲחִמָּשה ָּעָּשר בֹו: There are four New Years: On the first of Nisan is the New Year for kings; And for the Festivals. On the first of Elul is the New Year for animal tithes; Rabbi Elazar and Rabbi Shimon say: on the first of Tishrei. On the first of Tishrei is the New Year for years, for Sabbatical Years and Jubilee Years, for planting and for vegetables. On the first of Shevat is the New Year for the tree, in accordance with the statement of Beit Shammai. But Beit Hillel say: on the fifteenth. 2. Terumah and Maaser I have assigned to you as your share, you Terumah Gedola – Bemidbar 18:8-12 shall set aside from them one-tenth of the tithe as a gift to the LORD. This shall be ַוְיַדֵׁבר ה׳ ֶאלַ־אֲהֹרן ַוֲאִני ִהֵׁנה ָּנַתִתי ְלָך ֶאת־ִמְשֶמֶרת accounted to you as your gift. As with the ְתרּוֹמָּתי ְלָּכל־ָּקְדֵׁשי ְבֵׁני־ִיְשָּרֵׁאל ְלָך ְנַתִתים ְלָּמְשָּחה new grain from the threshing floor or the flow ּוְלָּבֶניָך ְלָּחק־עֹוָּל ם... ֹכל ֵׁחֶלב ִיְצָּהר ְוָּכֵׁל־חֶלב ִתירֹוש ְוָּדָּגן from the vat, so shall you on your part set ֵׁראִשָּיתֲם אֶשר־ִיְתנּו ַליהָּוה ְלָך ְנַתִתים׃ The LORD spoke to Aaron: I hereby give you aside a gift for the LORD from all the tithes charge of My gifts, all the sacred donations that you receive from the Israelites; and from of the Israelites; I grant them to you and to them you shall bring the gift for the LORD to your sons as a perquisite, a due for all time… Aaron the priest. -

It Is Advisable to Study the Pertinent Torah Laws Prior to the Performance of a Mitzvah in Order to Perform the Mitzvah Flawlessly

Rabbi Pinches Friedman Parshas Re'eh 5774 Translation by Dr. Baruch Fox “עשר תעשר“ “הענק תעניק“ “נתון תתן“ It Is Advisable to Study the Pertinent Torah Laws Prior to the Performance of a Mitzvah in order to Perform the Mitzvah Flawlessly In this week’s parsha, parshas Re’eh, we read (Devarim 14, “taryag mitzvos” of the Torah? Furthermore, while “milah and tithe, you — “עשר תעשר את כל תבואת זרעך היוצא השדה שנה שנה“ :(22 “הענק :shall tithe the entire crop of your planting, the produce of the Midrash compare these pairs to the words in the Torah priah” and “tzitzis and tefillin” are pairs of mitzvos, how does the The language is double, but ?תעניק, נתון תתן, פתוח תפתח, עשר תעשר“ .field, year by year following elucidation from Chazal: each pair of words only refers to a single mitzvah. In the Midrash Tanchuma (13), we find the “עשר תעשר, הדא הוא דכתיב )משלי לא-כא( לא תירא לביתה משלג כי כל ביתה to our passuk in the Midrash Tanchuma (Ki Savo 11). There the לבוש שנים, חזקיה אמר משפט רשעים בגיהנם י“ב חדשים, ששה חדשים בחמה וששה Additionally, we find another enigmatic statement related :(Midrash is elucidating the passuk (ibid. 26, 11 חדשים בצינה... יכול אף לישראל, תלמוד לומר כי כל ביתה לבוש שנים, שנים שנים, מילה ופריעה, ציצית תפילין, הענק תעניק, נתון תתן, פתוח תפתח, עשר תעשר, לפיכך “ושמחת בכל הטוב אשר נתן לך ה’ אלקיך, ואין טוב אלא תורה, שנאמר )משלי משה מזהיר את ישראל עשר תעשר“. ד-ב( כי לקח טוב נתתי לכם וגו’, לפיכך משה מזהיר את ישראל עשר תעשר“. -

Bulletin No. 13 (Motor Vehicle Excise Tax & Personal Property Tax)

MAINE REVENUE SERVICES PROPERTY TAX DIVISION PROPERTY TAX BULLETIN NO. 13 MOTOR VEHICLE EXCISE TAX & PERSONAL PROPERTY TAX REFERENCE: 36 M.R.S. §§ 1481 through 1491 December 9, 2019; replaces November 21, 2017 revision 1. General The motor vehicle excise tax is an annual tax imposed for the privilege of operating a motor vehicle on public roads. This bulletin discusses the applicability of motor vehicle excise tax to automobiles, buses, trucks, truck tractors, motorcycles, and special mobile equipment. Mobile homes, camper trailers, and aircraft are also subject to excise tax, but are not covered by this bulletin. Detailed information about the excise tax as applied to mobile homes and camper trailers may be found in Property Tax Bulletin No. 6 – Taxation of Mobile Homes and Camper Trailers. For information about the excise tax as applied to aircraft, contact the Property Tax Division using the contact information at the end of this bulletin. As a rule, a registered motor vehicle owned by a person on April 1 and on which an excise tax was paid is exempt from property taxes. A motor vehicle, for which an excise tax has not been paid before property taxes are committed is subject to property tax. The Secretary of State provides municipal excise tax collectors with standard vehicle registration forms for the collection of excise tax. 2. The Motor Vehicle Excise Tax A. When applicable. The excise tax on motor vehicles applies where the owner of the motor vehicle intends to use it on public roads during the year. B. Where excise tax is payable. -

Worldwide Estate and Inheritance Tax Guide

Worldwide Estate and Inheritance Tax Guide 2021 Preface he Worldwide Estate and Inheritance trusts and foundations, settlements, Tax Guide 2021 (WEITG) is succession, statutory and forced heirship, published by the EY Private Client matrimonial regimes, testamentary Services network, which comprises documents and intestacy rules, and estate Tprofessionals from EY member tax treaty partners. The “Inheritance and firms. gift taxes at a glance” table on page 490 The 2021 edition summarizes the gift, highlights inheritance and gift taxes in all estate and inheritance tax systems 44 jurisdictions and territories. and describes wealth transfer planning For the reader’s reference, the names and considerations in 44 jurisdictions and symbols of the foreign currencies that are territories. It is relevant to the owners of mentioned in the guide are listed at the end family businesses and private companies, of the publication. managers of private capital enterprises, This publication should not be regarded executives of multinational companies and as offering a complete explanation of the other entrepreneurial and internationally tax matters referred to and is subject to mobile high-net-worth individuals. changes in the law and other applicable The content is based on information current rules. Local publications of a more detailed as of February 2021, unless otherwise nature are frequently available. Readers indicated in the text of the chapter. are advised to consult their local EY professionals for further information. Tax information The WEITG is published alongside three The chapters in the WEITG provide companion guides on broad-based taxes: information on the taxation of the the Worldwide Corporate Tax Guide, the accumulation and transfer of wealth (e.g., Worldwide Personal Tax and Immigration by gift, trust, bequest or inheritance) in Guide and the Worldwide VAT, GST and each jurisdiction, including sections on Sales Tax Guide. -

Tzedakah As the Defining Social Marker of Jewish Identity

Tzedakah as the Defining Social Marker of Jewish Identity A. The Test of a True Jew: Check the Pocketbook B. Maimonides: Appealing to Jewish Genes – The Perfect “Pitch” “[God] has told you, human being, what is good and what Adonai requires of you: Nothing but to do justice (mishpat), to love kindness (hesed), and to walk humbly with your God.” (Micah 6:8) הִ גִיד לְָך ָאדָ ם מַ ה-ּטוֹב ּומָ ה-יְהוָה ּדוֹרֵ ׁש מִמְ ָך כִ י אִ ם- עֲׂשוֹתמִׁשְ טפָ וְַאהֲבַת חֶסֶ ד וְהַצְ נֵעַ לֶכֶת עִ ם- אֱֹלהֶ יָך. Noam Zion, Hartman Institute, [email protected] – excerpted form from Jewish Giving in Comparative Perspectives: History and Story, Law and Theology, Anthropology and Psychology. Book One: From Each According to One’s Ability: Duties to Poor People from the Bible to the Welfare State and Tikkun Olam Previous Books: A DIFFERENT NIGHT: The Family Participation Haggadah By Noam Zion and David Dishon LEADER'S GUIDE to "A DIFFERENT NIGHT" By Noam Zion and David Dishon A DIFFERENT LIGHT: Hanukkah Seder and Anthology including Profiles in Contemporary Jewish Courage By Noam Zion A Day Apart: Shabbat at Home By Noam Zion and Shawn Fields-Meyer A Night to Remember: Haggadah of Contemporary Voices Mishael and Noam Zion www.haggadahsrus.com 1 Our teachers have said: "If all troubles were assembled on one side and poverty on the other, poverty would outweigh them all." - Midrash Shemot Rabbah 31:14 "The sea of a mighty population, held in galling fetters, heaves uneasily in the tenements.... The gap between the classes in which it surges, unseen, unsuspected by the thoughtless, is widening day by day. -

To Tithe Or Not to Tithe?

To tithe or not to tithe? Considering proportional giving: A guide for everyone © The United Reformed Church 2016 Scripture taken from the Holy Bible, NEW INTERNATIONAL VERSION®, NIV® Copyright © 1973, 1978, 1984, 2011 by Biblica, Inc.® Used by permission. All rights reserved worldwide. How much should we give? Christians often ask: how much money should I give to the work of the church? And this is often answered by the church treasurer who, on presenting a budget which shows the expenditure as being greater than the income, then appeals to congregation to increase their giving so as to balance the budget. But perhaps a different approach should be taken. God is not calling on us to simply meet a specific need; he is calling on us to give of our resources willingly and cheerfully as a response to his generosity to, and love for, us. What does the Bible say? The Bible has a great deal to say about money! The Old Testament introduces the idea of tithing. This is giving the first tenth of your income to God and living on the rest. Some biblical scholars have calculated that, if people gave according to the original Old Testament laws on tithing, including the special tithes, then each person would be giving 23% of their annual income to God in tithes. Tithing and the Old Testament In the Old Testament there are a number of passages that specifically call on God’s people to give a tithe. Here are some of them which we invite you to read, consider and perhaps discuss in small groups.